Infrastructure interest remains strong: A detailed look at Shadow, the new project funded with $9 million by Paradigm

TechFlow Selected TechFlow Selected

Infrastructure interest remains strong: A detailed look at Shadow, the new project funded with $9 million by Paradigm

Shadow is dedicated to simplifying and reducing the engineering time and cost of on-chain data indexing and analysis.

Written by: TechFlow

Retail investors in the secondary market are actively chasing inscriptions, while VCs in the primary market continue to focus on investing in infrastructure.

Recently, an infrastructure project named Shadow publicly announced that it raised a $9 million seed round led by Paradigm.

Infrastructure is indeed important in the crypto space, but the prevailing sentiment remains that there’s an oversaturation of infrastructure projects and a lack of compelling applications.

This naturally leads us to wonder: why do venture capitalists favor large investments in infrastructure? What critical problems—often invisible to most users—do these projects solve for the broader crypto industry?

Infrastructure projects often involve complex technical designs that present a learning curve. After reviewing materials related to Shadow, this impression becomes even stronger.

The project's official website is filled with code and data, making it difficult for average users to grasp exactly what problem it solves.

At a high level, Shadow is an innovative blockchain infrastructure project aiming to simplify and reduce the engineering time and cost associated with on-chain data indexing and analysis; however, the specifics of how and why remain less clear.

As a new rising star backed by top-tier VC Paradigm, Shadow naturally has its unique strengths.

Therefore, after conducting some research, I will attempt to unpack the pain points Shadow addresses, its distinctive solutions, and delve into its core value and potential impact within the crypto ecosystem.

On-chain data analysis is important, but expensive to use

First, Shadow targets the field of on-chain data analysis.

On-chain data analysis is crucial in the cryptocurrency space. It not only provides deep insights into market dynamics but also plays a key role in optimizing trading strategies, enhancing security measures, and driving technological innovation.

However, note that the "on-chain data analysis" referred to by Shadow should not be equated with familiar tools like Dune, Nansen, or Arkham.

On-chain analytics tools essentially provide “pre-processed data ready for use,” whereas on-chain analysis itself refers to the process of “processing the data.”

This distinction is similar to the difference between dishes served at a restaurant and raw ingredients.

You can access on-chain data tools quickly and for free because the restaurant has already prepared the meal; behind the scenes, processing the ingredients (raw on-chain data) can be time-consuming and labor-intensive.

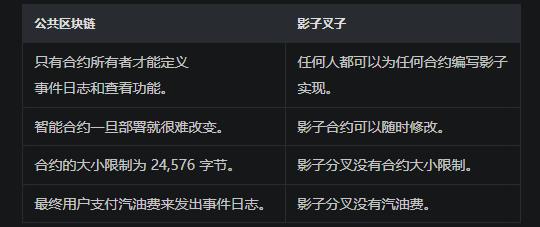

How so? Existing on-chain data analysis faces two major challenges: high costs and technical complexity:

-

Generating event logs from smart contracts requires paying high gas fees

-

Real-time tracking and analysis demand substantial computing resources

-

Although on-chain data is public and transparent, their structure and format make parsing and effective utilization challenging

As a result, existing data analysis solutions often fall short in meeting demands for real-time performance, cost efficiency, and flexibility—highlighting the urgent need for a more efficient and economical method of data processing.

This need may not stem from end users. As suggested by the restaurant analogy above, it’s more akin to the kitchen’s requirement for handling raw ingredients. Therefore, Shadow primarily serves project teams, developers, and professional data analysts rather than end users.

Shadow: Creating a "shadow" for expensive on-chain entities

Given the high cost of organizing and utilizing on-chain data, a viable solution would be:

Create a forked version of on-chain data and freely analyze or modify it within this copy.

This concept is subtly reflected in the name “Shadow.” Instead of directly consuming resources on the main chain for analysis, Shadow generates an identical “shadow” version for processing.

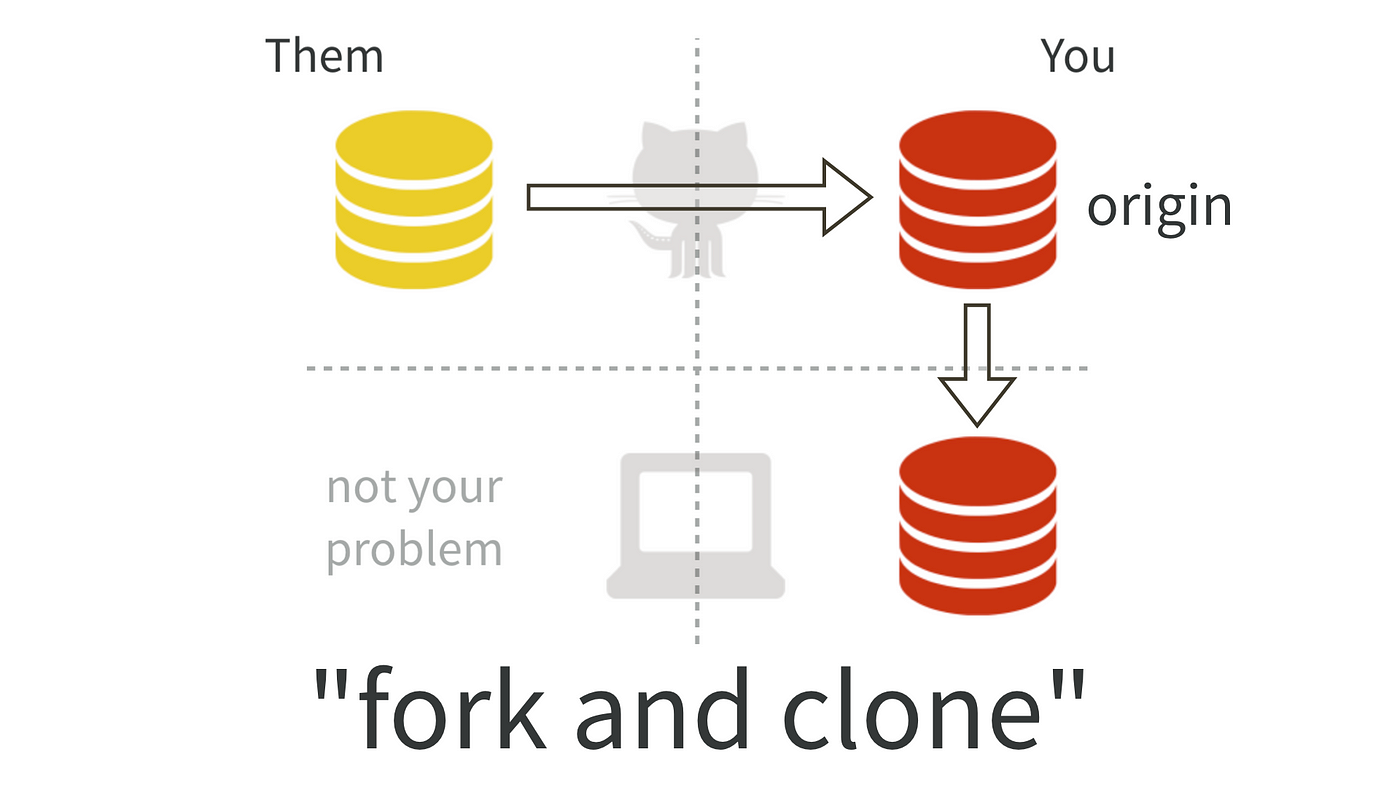

This approach resembles the Fork button on GitHub.

When someone else has a code repository you find useful, instead of cluttering their original workspace, the best practice is to fork it and clone it locally for unrestricted modifications.

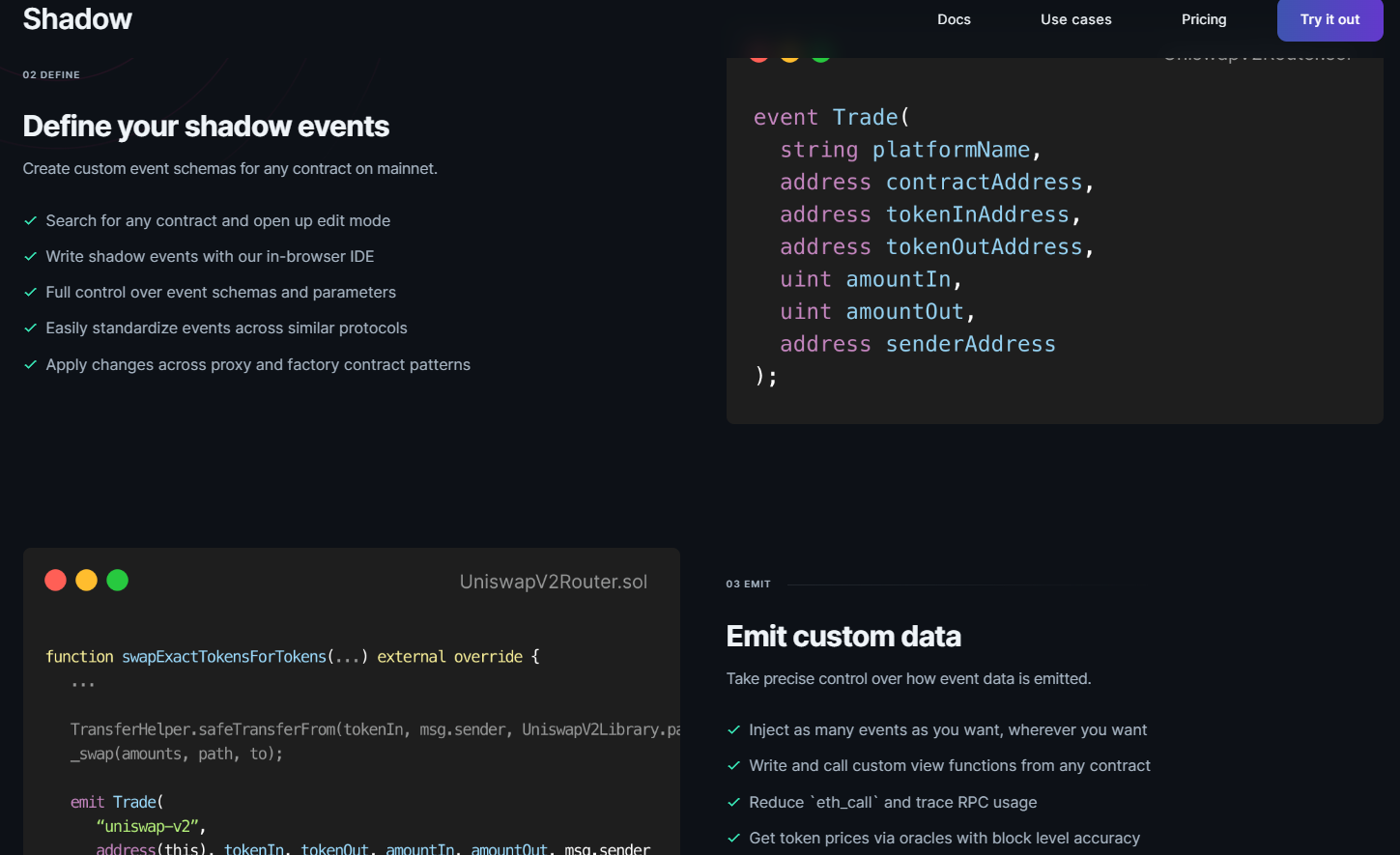

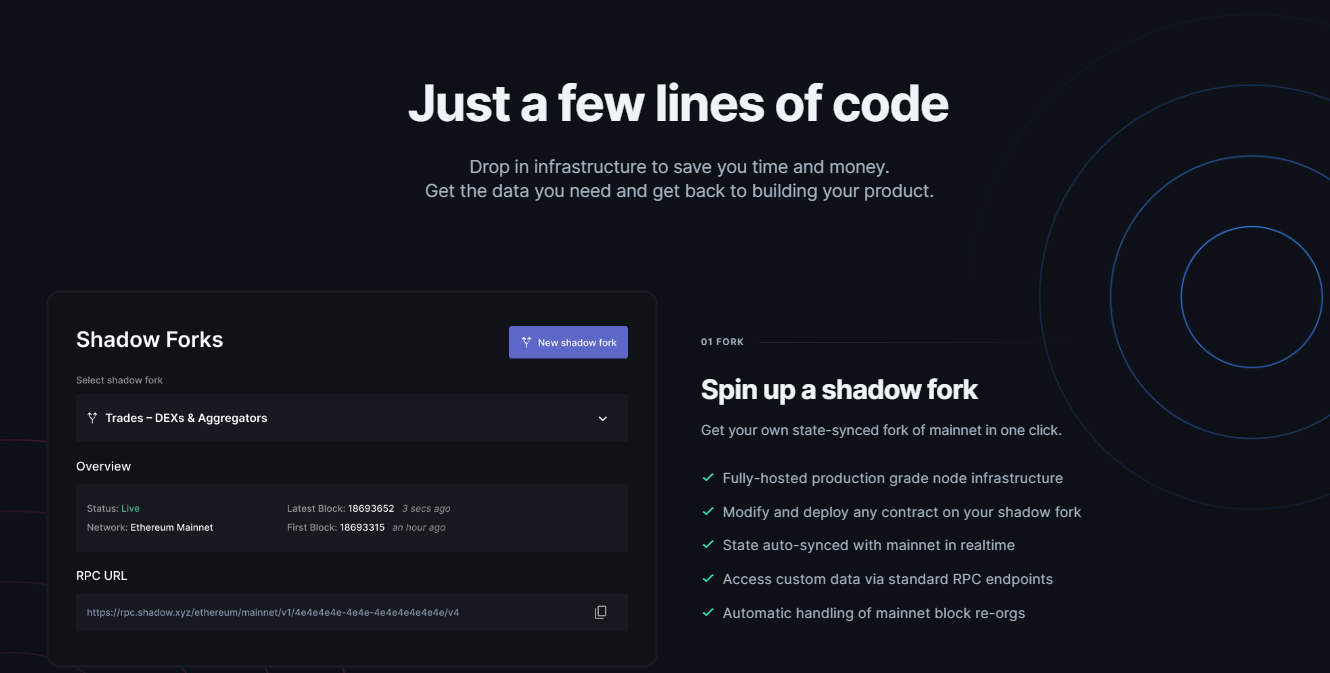

Similarly, think of Shadow’s shadow forks as analogous to forking repositories on GitHub. On Shadow, you can create a mirrored version of the main chain to perform data analysis and add custom event logs—operations that have no effect on the actual main chain.

Thus, shadow forks are off-chain read-only execution environments designed to mirror the state of public blockchains in real time and highly optimized for data access.

Through its unique shadow fork technology, Shadow offers a novel solution for accessing and indexing on-chain data.

This technology is comparable to creating a perfect simulation environment in the real world. Within this virtual setting, users can freely add or modify smart contract event logs without incurring gas fees.

It’s like building freely within a sandbox city, unbound by the constraints of real-world costs and regulations. In doing so, Shadow dramatically reduces data processing costs while increasing flexibility and efficiency.

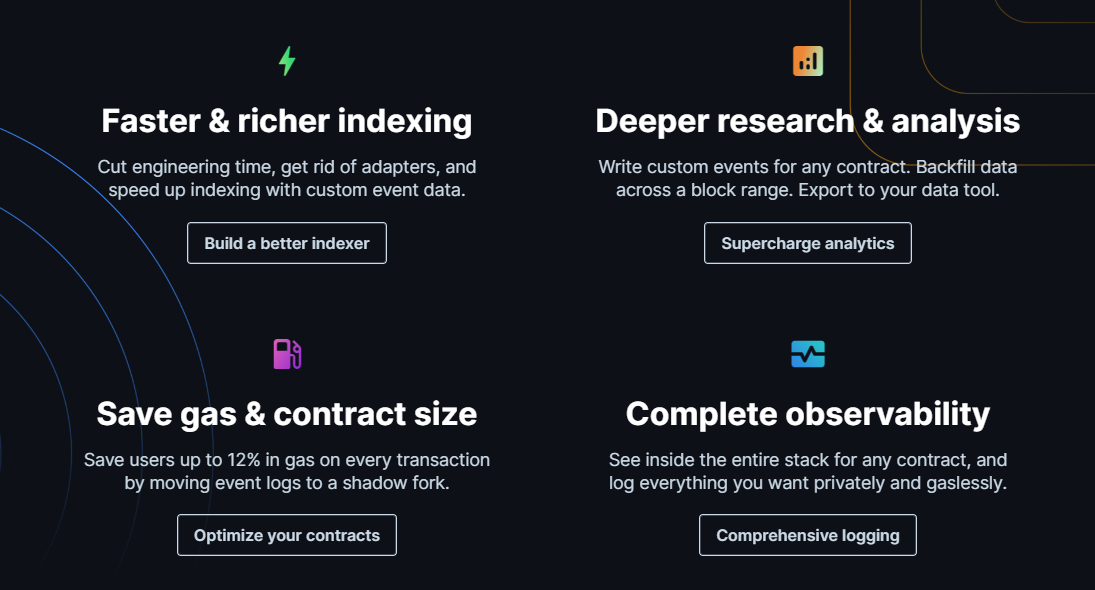

Not only does it enable faster and richer data indexing, but it also makes in-depth data analysis simple and accessible. Furthermore, Shadow’s approach opens up new possibilities for smart contract development and testing, allowing developers to experiment and optimize contracts without affecting the mainnet.

What can it actually do?

Currently, Shadow’s official documentation outlines four potential use cases enabled by the protocol:

-

Save gas fees and reduce contract size: By placing event logs in shadow forks instead of on the mainnet, contracts can be significantly optimized to meet diverse data needs. This approach can reduce gas costs per transaction by up to 12% while improving contract visibility.

-

Enhance protocol analytics: Shadow allows users to define custom events for any contract, even when events on the mainnet are missing or incomplete. Users gain direct access to mainnet state data for subsequent analysis.

-

Build fast indexers: By emitting rich data via shadow events, RPC calls, tracking, and complex data merging can be reduced, accelerating the data indexing process.

-

Complete logging suite: Shadow enables users to emit private logs in any contract for monitoring, testing, debugging, and analyzing contract execution based on real mainnet transactions.

These features may seem too technical for average users. But who might benefit from them?

Shadow’s primary user base includes blockchain developers, data analysts, and researchers who require efficient and low-cost tools for accessing and analyzing on-chain data.

Using Shadow is straightforward. Developers can create and test new event logs and smart contracts within their own shadow fork using just a few lines of code. The setup is simple, and users can easily create shadow forks through Shadow’s intuitive interface and add custom event logs.

This ease of use means even non-experts in blockchain can quickly begin leveraging Shadow’s capabilities.

Opportunities and Challenges

As cryptocurrencies and Web3 technologies continue evolving, Shadow faces significant opportunities and challenges.

From an opportunity standpoint, growing blockchain adoption, increasing participation from external organizations, and rising trading volumes during bull markets all contribute to greater demand for efficient and affordable on-chain data processing. Shadow’s technology has the potential to become a leader in this domain.

However, challenges remain—including competition with other technical solutions, maintaining technological advancement and security (especially given its open-source nature), and scalability across multiple blockchain platforms.

Overall, the main issue such projects face is their distance from end users, making them hard to perceive and unlikely to generate FOMO.

From the perspective of industry observers and practitioners, having more tools like Shadow enriches the ecosystem with powerful instruments for deeper analysis. But from retail investors’ and users’ viewpoints, such tools may seem irrelevant—they care more about airdrops, participation mechanisms, and reward-seeking interactions.

Amid the divergent focuses and sentiments between primary and secondary markets, I believe Paradigm’s investment in Shadow is not just support for a single project, but a vote of confidence in the development of crypto infrastructure.

VCs build infrastructure, retail chases applications. Today’s crypto market resembles an open bazaar, where participants of different scales focus on their respective stalls and transactions.

But ultimately, the more vibrant and active the market becomes, the better it is for everyone.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News