Sonic DeFi leader Shadow: Better "LP protection + fee capture" during sharp declines

TechFlow Selected TechFlow Selected

Sonic DeFi leader Shadow: Better "LP protection + fee capture" during sharp declines

With the x(3,3) model as its core innovation, Shadow Exchange is building a powerful DeFi ecosystem centered on liquidity incentives, with self-driving and self-evolving capabilities.

Written by: TechFlow

The market is undergoing post-disaster reconstruction after the October 11 crash, but many have noticed an interesting contrast.

Analyst @0xyukiyuki stated:

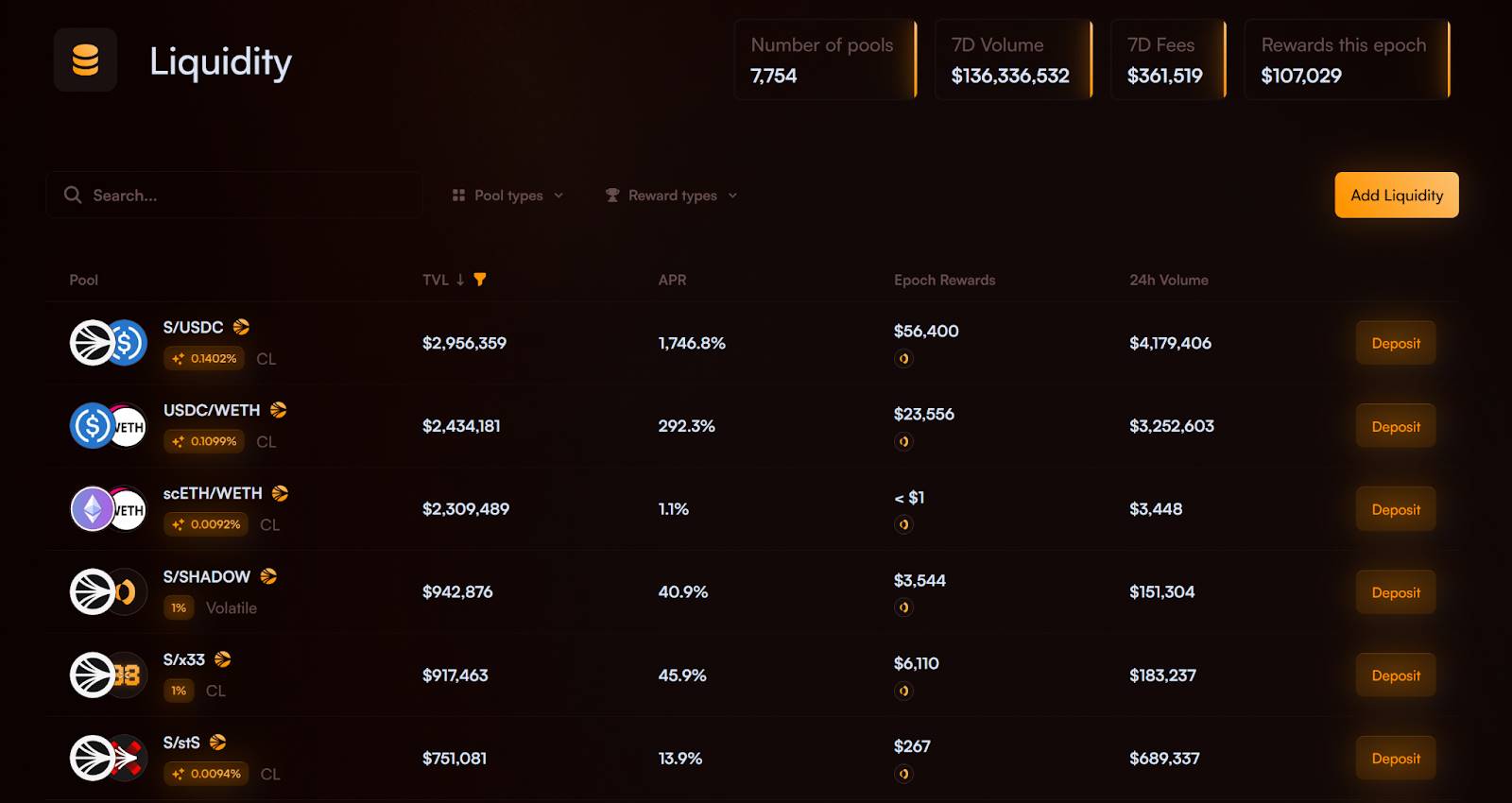

One benefit of high volatility is that regardless of direction, DeFi can capture some solid additional APR. Shadow Exchange in the Sonic ecosystem is a prime example. Due to a surge in trading volume, their weekly rewards doubled last week.

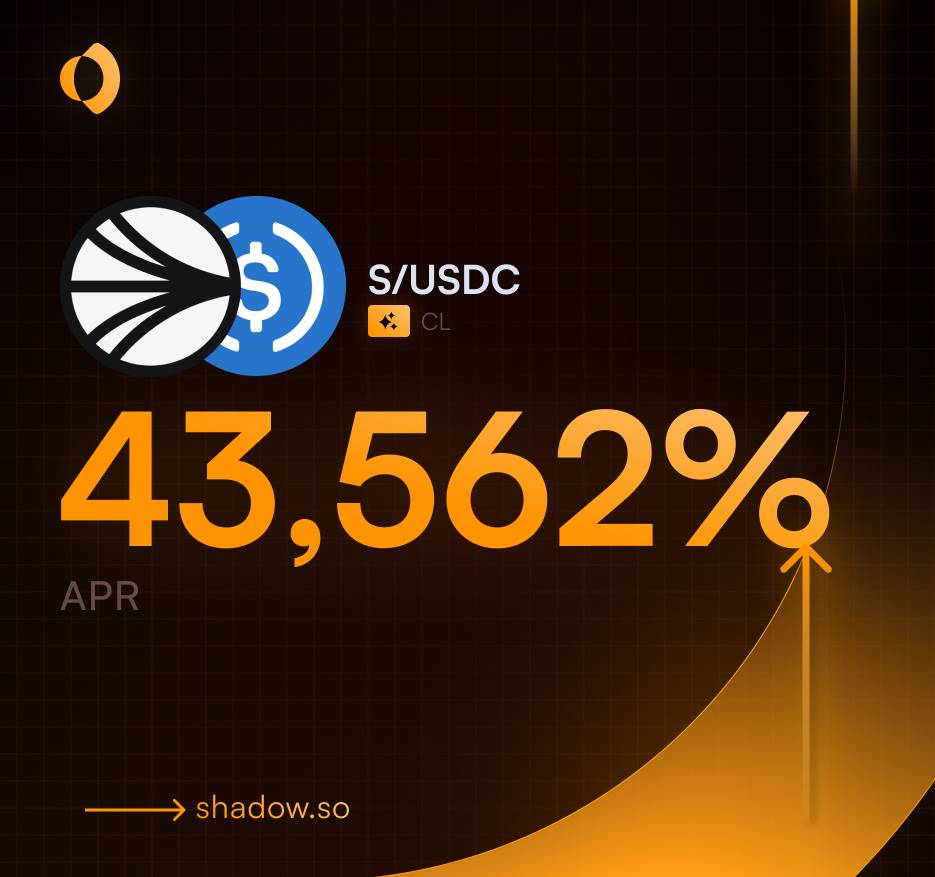

Further investigation reveals: On October 11, amid extreme price fluctuations, the $S / $USDC liquidity pool on Shadow Exchange—the leading DEX in the Sonic ecosystem—achieved an APR of 43,562%, with over $12.8 million in 24-hour trading volume and more than $45,000 in rewards.

During the crash, Shadow’s revenue increased, participant rewards rose, and overall ecosystem engagement intensified.

Such figures naturally spark curiosity.

In crypto, "crisis means opportunity." At a time when DEX competition intensifies and on-chain attention is siphoned by Hyperliquid, Shadow Exchange—Sonic's highest-volume and highest-revenue DeFi project—effortlessly demonstrated its differentiated competitive edge through this crisis:

Centered on the x(3,3) model, Shadow Exchange is not merely a stable, high-performance trading platform, but is building a powerful DeFi ecosystem driven by liquidity incentives, capable of self-sustaining and self-evolution.

Decoding High APR: Shadow's Comprehensive Value Capture and Reinvestment

Shadow Exchange builds a highly efficient and resilient liquidity infrastructure centered on two core goals: "maximizing LP protection" and "superior fee capture."

Unlike traditional DEXs with static models, Shadow emphasizes active intervention and value recycling, ensuring sustainable returns for LPs under any market condition.

Now let's take the $S / $USDC liquidity pool as an example to dissect how Shadow’s multi-layered incentive design transforms simple liquidity provision into a compound growth engine behind its high APR:

First, 100% of trading fees from the liquidity pool are reinvested into the ecosystem, forming the foundational pillar of returns. Notably, Shadow supports two liquidity frameworks: traditional and concentrated liquidity. Under the concentrated model, LPs can precisely allocate capital within specific price ranges ("precision sniping"), dramatically increasing capital efficiency and exponentially amplifying fee earnings. However, higher efficiency often entails greater risk; LPs must closely monitor impermanent loss and leverage Shadow’s dynamic fee adjustment mechanism to buffer potential shocks.

Rewards in $S tokens from the Sonic ecosystem further enhance Shadow’s yield base. Sonic Labs distributes $S token rewards weekly to high-performing projects within the ecosystem. As the undisputed top-tier DeFi project in Sonic, Shadow pools with higher liquidity receive richer incentives, adding an extra yield boost for LPs.

Additionally, $SHADOW token rewards from Shadow Exchange reflect the protocol’s internal incentive resilience. Shadow dynamically adjusts $SHADOW emissions per cycle based on protocol revenue, ensuring rewards align with ecosystem health.

Meanwhile, integration with various DeFi products opens leveraged amplification channels, such as using lending protocols to recycle principal, enabling higher returns with smaller initial capital.

This comprehensive, all-encompassing value capture and reinvestment model benefits not only from Sonic’s underlying advantages but also from Shadow Exchange’s own x(3,3) model—a sophisticated evolution of the ve(3,3) framework integrating triple-token design, PVP Rebase, auto-compounding, and more. This makes Shadow Exchange the core engine of liquidity yields within the Sonic ecosystem.

Sonic Foundation, x(3,3) Innovation: Building Shadow’s Liquidity Incentive Flywheel

Shadow Exchange is built on the Sonic blockchain, crafted by Andre Cronje. Sonic inherits Fantom’s high-performance DNA while introducing cutting-edge innovations that accelerate Shadow’s development.

On one hand, Sonic’s enhanced performance enables Shadow to better support high-frequency DeFi scenarios. Through technological advances like SonicVM, SonicDB, Sonic Gateway, and SonicCS 2.0, Sonic achieves over 2000 TPS throughput, 0.7-second transaction finality, and ultra-low fees of just $0.0001 per transaction—all while maintaining full EVM compatibility. This empowers Shadow to deliver fast, secure, convenient, and low-cost trading experiences.

When the October 11 crash hit, Sonic and Shadow faced the test of extreme volatility: while other networks collapsed due to congestion and failed transactions, Sonic remained fully functional with zero downtime. The combination of Sonic’s robust infrastructure and Shadow’s efficiency ensured users could earn more from liquidity while facing lower risks.

On the other hand, Sonic’s FeeM model injects sustainable economic incentives into Shadow Exchange. Sonic’s FeeM model allows up to 90% of on-chain fees to be directly returned to developers and dApps, rewarding high-traffic projects and attracting innovative builders to the ecosystem.

As the leading DeFi project, Shadow receives 90% of these fees, which are entirely reinvested into traders. This allows users—whether adjusting positions or executing arbitrage strategies—to maximize gains without friction, thereby boosting overall trading volume.

Additionally, the ecosystem application rewards from Sonic Labs further propel Shadow Exchange’s growth. Sonic Labs distributes $S tokens based on key metrics like trading volume and user count. This isn’t just short-term traffic stimulation—it’s a cornerstone of long-term ecosystem governance. As the flagship DeFi project, Shadow receives substantial $S rewards, which it redistributes to users, fueling continuous expansion.

Another often-overlooked point is that whether due to Andre Cronje’s direct involvement or the continuation of Fantom’s strengths, Sonic undeniably possesses strong DeFi roots. With diverse DeFi infrastructure and innovative projects flourishing across the ecosystem, Shadow delivers richer trading experiences through deep integration with the Sonic DeFi network.

For more technical details and reward mechanisms of Sonic, interested readers may refer to our previous in-depth article: Same Soup, Different Medicine: How Is the Restructured Sonic Doing Now?

Beyond the series of advantages derived from being built on Sonic, the x(3,3) model—as a core innovation—is crucial to Shadow Exchange achieving "comprehensive, all-around value capture and reinvestment."

As a trading platform, balancing the interests of three key stakeholders is essential: low-cost execution and incentives for traders, risk mitigation and high returns for LPs, and governance rights and long-term appreciation for token holders—thus creating a self-reinforcing ecosystem.

The x(3,3) model establishes a tightly-linked "incentive chain" through three tokens, enabling a positive feedback loop from value creation, capture, distribution, and reinvestment back to participants.

$SHADOW is the entry point to the ecosystem:

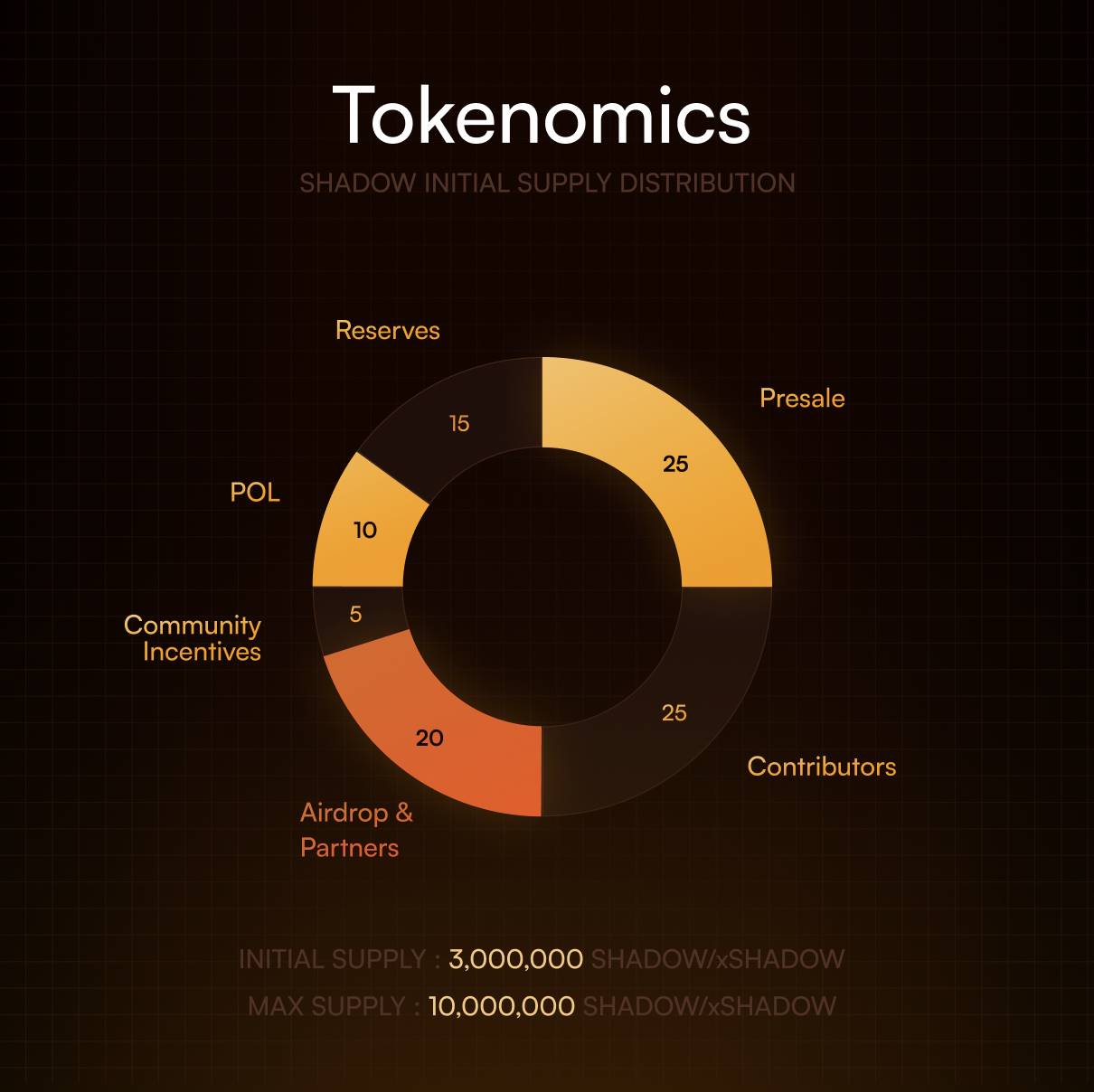

$SHADOW is Shadow’s native token, used for trading, liquidity mining, and ecosystem incentives. Its initial supply is 3 million, with a maximum cap of 10 million.

$SHADOW is emitted per cycle, with emission levels flexibly adjusted based on protocol revenue to align with developmental stages. When protocol revenue consistently exceeds emissions over multiple cycles, it strongly signals an upcoming period of rapid growth.

$xSHADOW is the core of ecosystem governance:

Users can stake $SHADOW to obtain $xSHADOW.

Shadow allows users to exit $xSHADOW lockups at any time, but early withdrawal incurs a penalty fee. These penalties are 100% redistributed to existing holders via the PVP Rebase mechanism, protecting long-term stakeholders.

Each week, $xSHADOW holders vote during Epochs to determine which liquidity pools receive token rewards. Projects can also offer additional incentives to attract $xSHADOW holder votes.

Under Sonic’s FeeM model, the 90% fee rebate received by Shadow is fully distributed to $xSHADOW and $x33 holders.

$x33 is the core vehicle for liquidity release andcompounding growth:

Since $xSHADOW is solely for governance and not freely tradable, users can mint $x33 at a 1:1 ratio using $xSHADOW.

As the liquid version of $xSHADOW, $x33 can be freely traded and utilized in lending or derivative DeFi protocols, allowing users to unlock liquidity while retaining governance rights and earning yields—thereby generating greater value.

Simultaneously, $x33 features auto-compounding functionality: $xSHADOW grows continuously through $x33, steadily increasing the exchange rate between $xSHADOW and $x33, attracting arbitrage bots to participate.

For more detailed information and technical insights about Shadow’s x(3,3) model, interested readers can revisit our earlier in-depth piece: Top Trading Volume and Revenue in the Sonic Ecosystem: Is Shadow’s x(3,3) Model the Ultimate Evolution of DeFi Liquidity Incentives?

Thus, Shadow Exchange has forged a precise positive cycle via the x(3,3) model:

Ecosystem incentives attract participation → More active trading generates higher protocol revenue → Higher revenue fuels stronger incentives → Stronger incentives draw broader user adoption.

Within this loop, traders benefit from low-cost, high-frequency execution, LPs gain dynamic protection and amplified returns, and holders lock in long-term appreciation through governance and Rebase. By maximizing balanced benefits for all three roles, Shadow acquires the foundational momentum for true long-term sustainability.

Data Performance: Undisputed DeFi Leader in the Sonic Ecosystem

Currently, Shadow Exchange supports a wide range of liquidity pools—including core stablecoin pairs, high-volatility Meme coin pools, and cross-ecosystem assets—covering diverse use cases from traditional DeFi to emerging narratives.

Yet data beyond product features best illustrate Shadow’s dominant position as Sonic’s premier DeFi protocol.

According to DeFi Llama, Shadow Exchange has surpassed $12.517 billion in cumulative DEX trading volume. On February 21, 2025, Shadow achieved a record-breaking 24-hour trading volume of $252,856,099—surpassing Hyperliquid.

On the user side, Messari reports show a daily active user (DAU) count of 73,071—far exceeding most other protocols on Sonic—demonstrating strong community stickiness.

Protocol revenue and reward distributions are equally noteworthy. Official data indicates Shadow has generated over $38 million in fee revenue and more than $25 million in platform revenue to date.

During the October 11 crash week, Shadow’s dynamic fees effectively shielded LPs from massive impermanent losses while prioritizing maximum fee capture, generating $172,243 in fees—excellently fulfilling its mission of "maximizing LP protection + superior fee capture" even during a market collapse.

Official data shows that on October 16, 2025, Shadow distributed over $353,737 in rewards, including more than $194,000 worth of $SHADOW emissions in Cycle 38.

In terms of penetration and coverage within the Sonic ecosystem, Shadow Exchange delivers even more impressive metrics:

In trading volume, according to Messari, Shadow captured 53.0% of Sonic’s ecosystem volume in Q2 2025, 47.3% since launch, and peaked at 69%.

In revenue, Shadow is the #1 income-generating protocol in the Sonic ecosystem, contributing up to 86% of Sonic’s total revenue at its peak.

In user reach, 80% of active Sonic users utilize Shadow.

Market Focus Turns to DEX: Multi-Dimensional Initiatives Fuel Shadow’s Future Growth

As the DeFi leader in the Sonic ecosystem, Shadow Exchange has built a self-reinforcing liquidity incentive flywheel through its innovative x(3,3) model. From $12.5 billion in cumulative trading volume, to capturing 53% of Sonic’s market share, to reaching 80% of ecosystem users, Shadow has proven its role as Sonic’s key liquidity hub.

With on-chain trading activity continuing to heat up and multiple favorable market trends converging, Shadow’s future growth potential is accelerating.

On one hand, led by the popularity of Hyperliquid and Aster, on-chain trading activity in 2025 continues to rise, drawing increasing attention to DEX competition. In the search for the next Hyperliquid or Aster, Shadow—with its uniquely reimagined liquidity incentives via the x(3,3) model—may emerge as a serious contender at the DEX battleground table.

On the other hand, signs of recovery are emerging in the Sonic ecosystem. While TVL growth remains modest, data from major platforms indicate rising DEX trading volumes and increasing stablecoin wallet addresses—early signals of ecosystem revival. As Sonic’s core DeFi player, Shadow stands to benefit directly.

Notably, due to market volatility, Shadow is currently in a "low starting point, high rebound potential" phase across TVL, trading volume, and token price. For investors bullish on Sonic and Shadow, this may represent an even larger growth foundation.

Over recent months, Shadow has been quietly accumulating strength through continuous product refinement and ecosystem development.

First, ongoing optimization of incentive programs:

Shadow’s 3 million $S token incentive program continues rolling out. Since Sonic’s second-season airdrop will no longer support GEM tokenization, Shadow has advanced 50% of the expected second-season airdrop rewards to boost liquidity incentives and active market-making strategies, further driving user participation and ecosystem growth.

Meanwhile, Shadow revised its issuance framework to distribute $SHADOW directly to LPs—replacing the prior model of issuing rewards as xSHADOW—enhancing capital flexibility.

Second, continuous product iteration and expanding ecosystem partnerships:

On the product front, Shadow introduced Limit Orders and Time-Weighted Average Price (TWAP) functionality, expanding trading capabilities.

In ecosystem development, Shadow actively collaborates with more projects, launching diverse trading pairs spanning stablecoins to high-volatility assets.

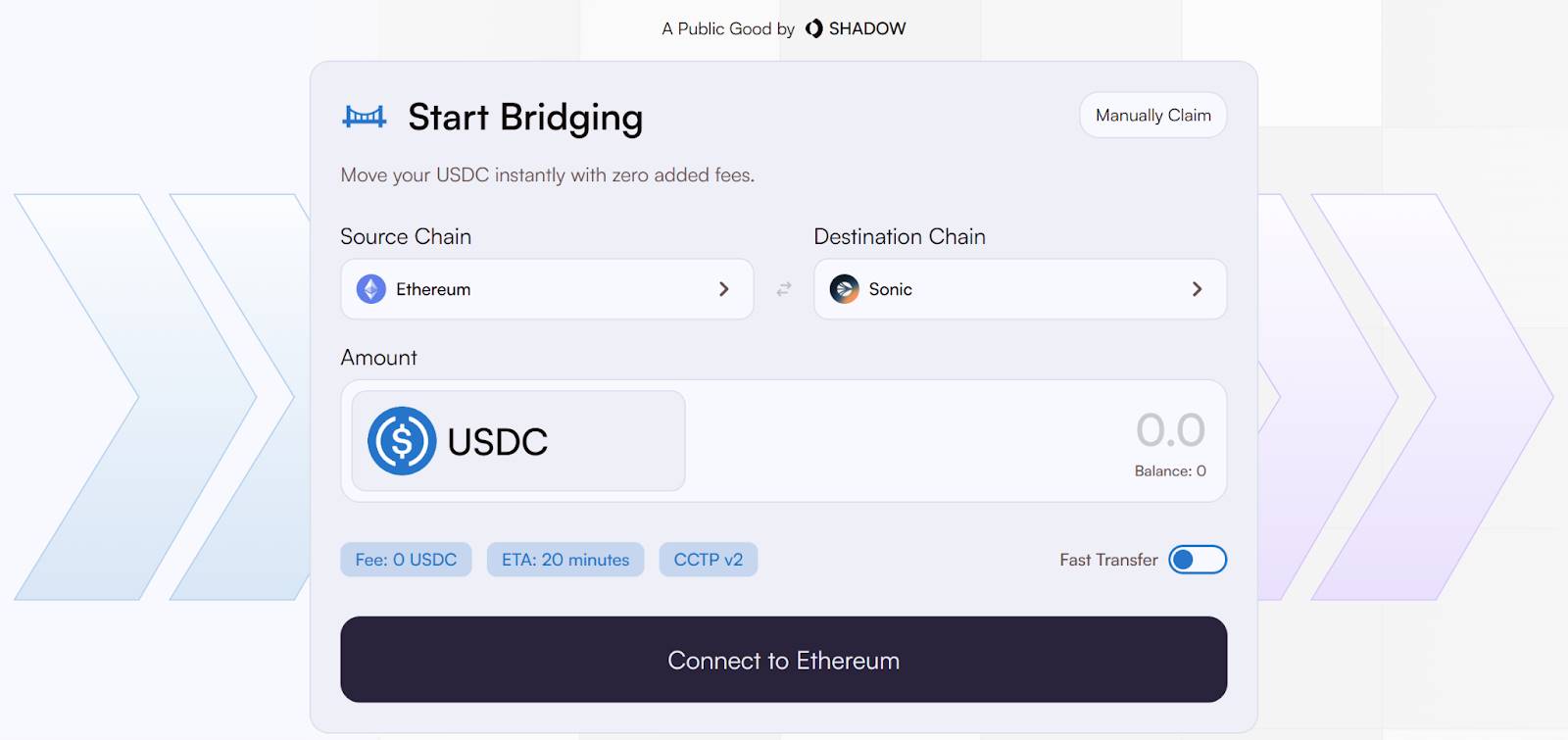

Moreover, by joining the Circle Alliance Directory and integrating both v1 and v2 versions of CCTP, Shadow offers users seamless cross-chain experiences.

In the near future, a series of key products and features will officially launch:

First, a buyback arbitrage system and delayed reward mechanism will go live, further protecting LPs and strengthening the x(3,3) flywheel effect.

Second, and more disruptively, a lending market based on $x33 will debut—positioning $x33 as a collateralizable asset supporting leveraged borrowing and derivative strategies, unlocking its full potential.

Just as DeFi’s essence is to make finance more efficient and democratic, Shadow Exchange embodies this principle through technological innovation and incentive design—and has already passed the test of a crashing market.

As the crown jewel of the Sonic DeFi ecosystem, with continuous product improvements and deepening ecosystem integration, the community witnesses and anticipates Shadow accumulating strength for its comeback—poised to once again become a leading force in DeFi liquidity innovation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News