Interview with Shadow's Chinese Promotion Lead: x(3,3) Reinvents Liquidity Incentives, MEV-Driven Stronger LP Protection + Fee Capture

TechFlow Selected TechFlow Selected

Interview with Shadow's Chinese Promotion Lead: x(3,3) Reinvents Liquidity Incentives, MEV-Driven Stronger LP Protection + Fee Capture

Step into the core mechanism of Shadow Exchange that embodies the vision of "maximizing LP protection + superior fee capture."

Written by: TechFlow

The market is harsh. While many are caught in the anxiety of "the more they operate, the more they lose," some have noticed:

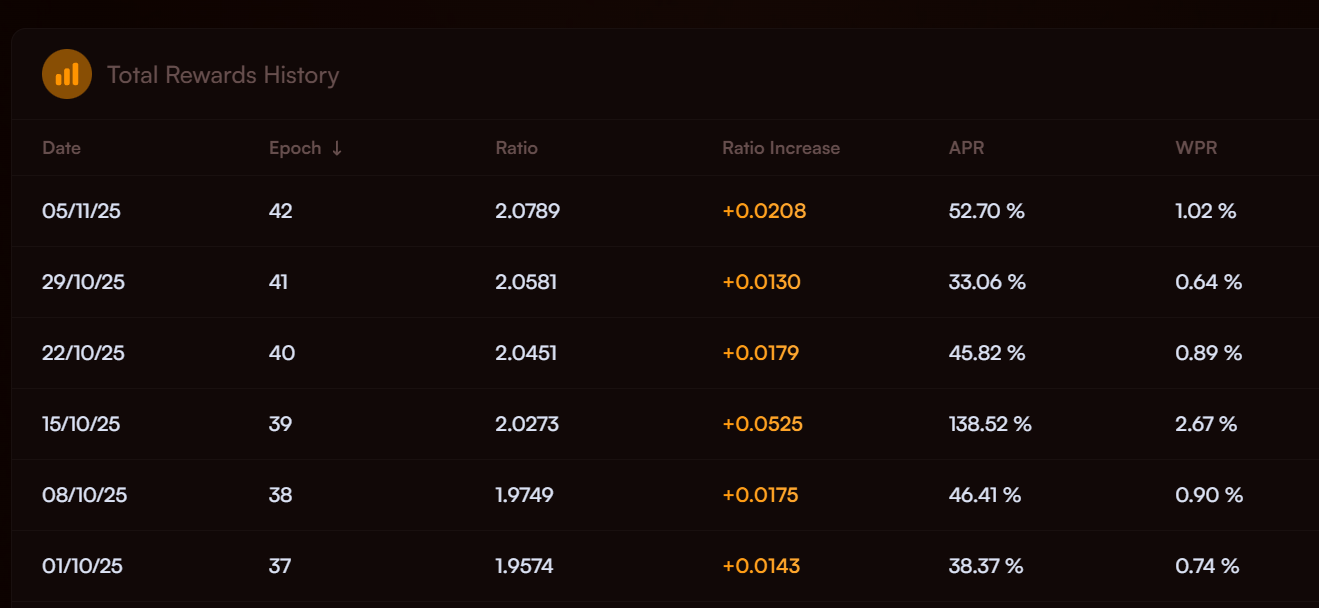

Shadow Exchange's $x33 offers automatic weekly compounding, with weekly returns exceeding 30% APR for the past six weeks.

Meanwhile, when high volatility strikes, Shadow’s dynamic fee mechanism better protects LPs from significant impermanent loss, while comprehensively capturing fees and returns, enabling stronger user rebates, higher protocol revenue, and enhanced trader rewards.

This has sparked widespread curiosity and created an opportunity for a deep conversation with Dr. Koala, the Chinese community lead for Shadow Exchange.

As the top DEX in the Sonic ecosystem in both trading volume and revenue, Shadow Exchange's core innovation lies in its x(3,3) model. This model features three tokens: native token $SHADOW, governance token $xSHADOW, and the liquid version of $xSHADOW called $x33. It aims to better align incentives among traders, LPs, and token holders, setting a benchmark for DeFi liquidity incentives.

On the fundamental value proposition of $x33, Dr. Koala stated:

Firstly, users can mint $x33 from $xSHADOW at a 1:1 ratio. Since Shadow allows users to exit their $xSHADOW lock-up anytime—but with up to a 50% penalty for early withdrawal—and these penalties are fully redistributed back to holders via the PVP Rebase mechanism, $x33 enjoys a price floor that never falls below half the price of $SHADOW.

Secondly, because $x33 automatically compounds once per week, the underlying $xSHADOW balance only increases over time, forming the intrinsic value base of $x33. The investment appreciates rapidly due to frequent compounding, making long-term holding the optimal strategy to maximize compound returns.

As the flagship DeFi platform of the Sonic ecosystem, when discussing current market downturns and declining discussions around the Sonic ecosystem, Dr. Koala expressed confidence:

A decline in Sonic’s ecosystem activity naturally leads to reduced earnings for Shadow—this is an unavoidable reality. However, recently there have been frequent developments on Sonic, including team changes, the launch of new project Flying Tulip (FT), and ongoing support from the Sonic Foundation for emerging projects. Any on-chain activity will positively impact Shadow.

Beyond ecosystem support, the Shadow team continues advancing product development and technical innovation, with recent updates including integration with Circle CCTP, launching Limit Orders and Time-Weighted Average Price (TWAP) functionality. Regarding future priorities, Dr. Koala revealed:

The team is concentrating resources on developing a new MEV solution, aiming to deliver greater platform value and superior user experience for Shadow users. We believe these foundational improvements will generate longer-term, sustainable returns for users and help Shadow build a solid foundation to better embrace future market opportunities and challenges.

In this article, let’s follow Dr. Koala’s insights to explore the core mechanisms behind Shadow Exchange’s vision of “maximizing LP protection + superior fee capture,” and understand Shadow Exchange’s future competitive strategy through its upcoming multi-functional MEV module matrix.

Largest DeFi Protocol in the Sonic Ecosystem: Exploring Shadow’s Core Competitive Advantages

TechFlow: Thank you for your time. Could you please introduce yourself (including educational background, how you entered the crypto industry, and your entrepreneurial or professional experience in crypto)?

Dr. Koala:

Hello everyone, I’m Dr. Koala, the Chinese community lead for Shadow Exchange. Great to be here with you all.

I come from a computer engineering background, specializing in network systems, and occasionally return to universities to give lectures. Currently, my focus is primarily on the crypto industry.

In 2025, I joined Shadow Exchange and initially worked on creating Chinese-language content, including beginner tutorials. As the Chinese-speaking community began gaining traction, and in alignment with Sonic’s new Asia-Pacific promotion initiative, I officially took over Shadow’s Chinese outreach efforts.

TechFlow: What attracted you and your team to the Sonic ecosystem? And why choose to build a DEX on Sonic?

Dr. Koala:

Sonic blockchain’s sub-second finality, low gas fees, and FeeM reward system were key reasons Shadow chose to build on Sonic. Sub-second finality enables fast transaction settlement, low gas fees allow users to trade affordably, and the FeeM rewards provide additional incentives for projects, allowing teams to dedicate more resources to optimization and delivering a better user experience.

TechFlow: The market already has plenty of DEXs, and competition this year has been especially fierce. As the largest DEX protocol in the Sonic ecosystem, what are Shadow Exchange’s key differentiating advantages?

Dr. Koala:

Our team has been focused on the (3,3) model since Solidly V1, accumulating deep expertise. Additionally, we’ve operated multiple ve(3,3) projects across six other blockchains, further broadening our practical experience and understanding.

To advance the evolution of the ve(3,3) economic model, our team innovatively introduced the x(3,3) design, successfully deploying it on the Sonic chain. We’re honored to be the leading DEX in the Sonic ecosystem and are satisfied with our achievements so far.

Moreover, we continue to deeply invest in the project. Since launching in January, we’ve consistently rolled out new features and content updates every month, continuously improving product experience and driving protocol growth.

Comprehensive Value Capture + Maximum LP Protection

TechFlow: Economic models are the lifeline of DeFi. As an evolution of the ve(3,3) model, what breakthrough innovations does Shadow Exchange’s x(3,3) model bring? How does the value loop formed by the three tokens—$SHADOW, $xSHADOW, and $x33—better balance interests among traders, LPs, and token holders?

Dr. Koala:

The x(3,3) model consists of three token mechanisms:

-

$SHADOW: Native token of the Shadow ecosystem, used for trading and liquidity mining. Initial supply is 3 million, with emissions adjusted based on protocol revenue each cycle. Maximum supply capped at 10 million. Users can stake $SHADOW to obtain $xSHADOW;

-

$xSHADOW: Governance token of the Shadow ecosystem. Users can use $xSHADOW to obtain $x33;

-

$x33: Liquid version of $xSHADOW. Users can mint $x33 using $xSHADOW, retaining governance rights and yield while gaining liquidity. $x33 can also be directly purchased on the open market.

The x(3,3) model re-packages the originally non-tradable governance token into a freely tradable token known as $x33.

$x33 auto-compounds weekly, and its underlying $xSHADOW holdings only increase over time, forming the intrinsic value foundation of $x33. Due to the high compounding frequency (once per week), the investment grows quickly, making long-term holding the best strategy to realize compounding gains.

Additionally, $x33 supports instant exit—users can buy or sell directly on the market. $x33 has relatively low selling pressure because it includes a price floor: users can mint $x33 1:1 from $xSHADOW, but early unlocking of $xSHADOW incurs up to a 50% penalty, which is fully redistributed to existing holders via the PVP Rebase mechanism. Thus, $x33 always maintains a minimum price no lower than half the price of $SHADOW.

As long as there is trading volume on the Sonic chain, the value of $x33 will continue to grow. Even during periods of low volume, Shadow’s Rebase mechanism still distributes returns to $x33 holders.

TechFlow: The x(3,3) model empowers Shadow Exchange with stronger “ecosystem value capture + reinvestment” capabilities. Could you elaborate on how this enhanced capability manifests compared to other DeFi protocols?

Dr. Koala:

Since launch, we’ve remained committed to returning value to users. For example, all transaction fees and Gems rewards received from the Sonic network are 100% fully returned to users.

Shadow currently achieves extremely high “Bribe Efficiency”—for instance, when a project spends $1 in bribes on Shadow, they receive approximately $1.5 in return. More importantly, 100% of all bribes received are distributed directly to users. We believe that staying user-centric is the truly effective and sustainable way to grow and strengthen Shadow.

Since launch, Shadow’s unique MEV bots have captured and recaptured value across multiple dimensions. For example, our Anti-JIT system monitors in real-time, blocks invalid and malicious wallets, and automatically redirects their profits to $x33. Outside the normal redemption range of $x33 to $SHADOW (50%-100%), the bot automatically captures arbitrage profits and injects them into $x33.

TechFlow: On the topic of enhanced “ecosystem value capture + reinvestment,” could you share key metrics Shadow Exchange has achieved so far?

Dr. Koala:

I can start with Shadow Exchange’s MEV module to illustrate our current achievements.

Recently, Shadow Exchange in the Sonic ecosystem launched the $x33 AMO and Anti-JIT protection features as core components of its MEV module, aiming to further improve trading efficiency and fairness.

The $x33 AMO system maximizes participant value through system-level arbitrage when $x33 hits its redemption floor, generating additional returns for voters and $x33 holders, strengthening LP protection, reducing interference from external bots, and preventing value leakage. So far, this function has captured over $151,236.52 in value, 100% returned to users.

The Anti-JIT protection proactively monitors Just-In-Time (JIT) liquidity maneuvers, automatically redirecting related rewards to $x33 and banning wallets involved in JIT behavior. Since launch, the Anti-JIT mechanism has generated over $151,000 in returns for $x33 holders. When combined with all returns Shadow receives from the Sonic chain—including two Gems campaign rewards and full FeeM rebates—the current composite annual percentage rate (APR) for $x33 reaches 134%.

TechFlow: Recent features like $x33 AMO and Anti-JIT protection have drawn significant attention, and upcoming functions such as buyback arbitrage and delayed rewards are widely discussed. As the core of the MEV module, how do these functionalities further enhance LP protection and fee capture, thereby safeguarding and amplifying user权益?

Dr. Koala:

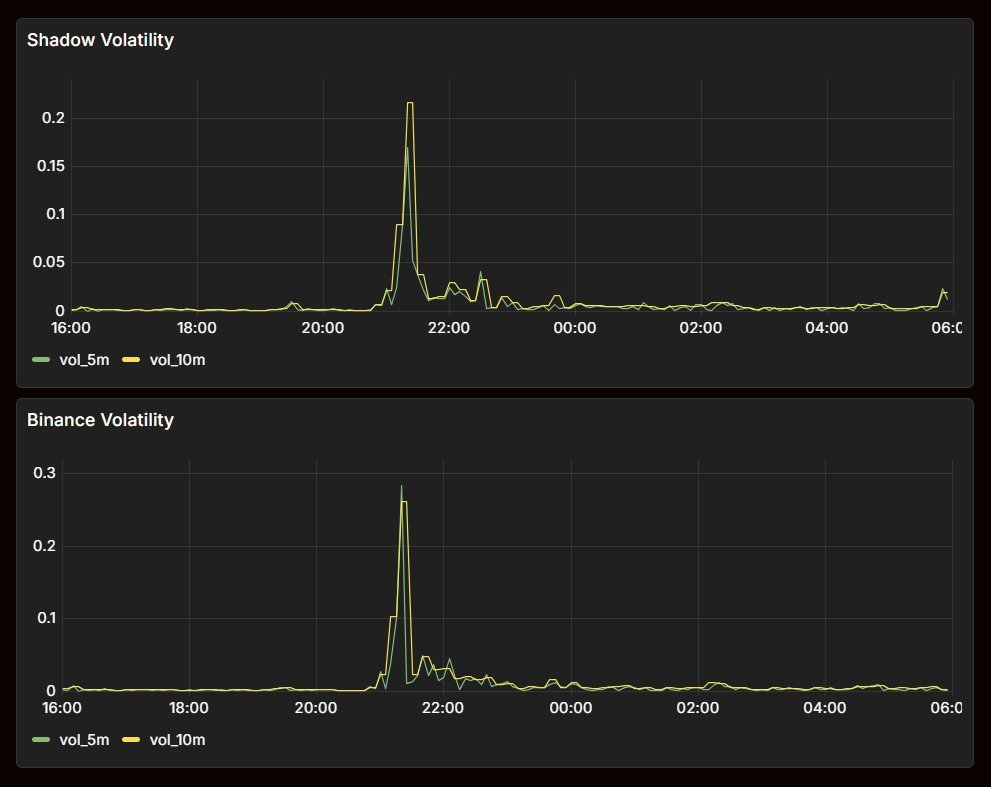

You may recall the extreme volatility in the crypto market last October, during which Shadow clearly demonstrated its ability to protect liquidity providers (LPs).

During the market crash, Shadow quickly activated its protection mechanism to ensure user fund safety. While other DEXs maintained fixed fees, Shadow’s dynamic fee mechanism immediately increased pool fees, successfully blocking harmful trades and generating $172,243 in fee revenue during the volatile period.

Shadow’s dynamic fee algorithm responds in real-time to market conditions, effectively shielding LPs from severe impermanent loss while maximizing fee income. Once potentially harmful liquidity is detected, the system actively raises fees to protect capital. No other exchange in the Sonic ecosystem responded similarly during that period.

At the same time, thanks to Shadow’s algorithm effectively maintaining $S / $USDC liquidity, lending protocols like Silo Finance and Aave were able to complete liquidation processes smoothly.

Despite the market crash causing a sharp contraction in overall liquidity across Sonic, Shadow ensured smooth cross-platform transactions thanks to sufficient liquidity reserves. This resilient performance stems from the team’s pre-deployed strategic liquidity support and coordinated defense between real-time risk control algorithms.

Additionally, Shadow remained highly synchronized with Binance during extreme market fluctuations, demonstrating strong market responsiveness.

Furthermore, our upcoming MEV bots will further capture value across trading pools in both centralized and decentralized exchanges, with all profits returned to Shadow token holders.

TechFlow: For current users, what is the most efficient way to participate in Shadow Exchange?

Dr. Koala:

My recommendation is to become an LP and consider buying $x33 to achieve automatic compounding growth.

Shadow remains one of the top-performing projects on the Sonic chain in terms of actual returns. Even amid recent market downturns, simply holding $x33 alone has delivered weekly returns exceeding 30% APR over the past six weeks.

Next Phase Focus: The MEV Module

TechFlow: Shadow Exchange is deeply integrated with the Sonic ecosystem. Some users believe this deep integration creates strong synergies and mutual growth, while others worry that declining attention toward the Sonic ecosystem may limit Shadow’s development. How do you view this divergence?

Dr. Koala:

It's true that as Sonic’s ecosystem activity declines, Shadow’s revenues also decrease accordingly—this is an unavoidable reality.

However, it's worth noting that Andre Cronje, widely celebrated as the father of DeFi, remains a core architect of the Sonic chain, and his new project Flying Tulip continues to attract significant market attention. Any on-chain activity will positively impact Shadow.

Moreover, the Shadow team continues to push forward product development and technological innovation. For example, the recently launched cctp.to integrates CCTP developed by Circle, the issuer of $USDC, providing users with completely free cross-chain services, supporting not only operations within the Sonic chain but also asset transfers across other blockchains.

TechFlow: Previously, Shadow Exchange joined the Circle Alliance Directory and integrated CCTP versions v1 and v2, offering users seamless cross-chain experiences. Does Shadow Exchange have additional plans for multi-chain expansion in the future?

Dr. Koala:

The Shadow team closely monitors both project developments and public chain ecosystem trends. We’ve noticed recent personnel changes on the Sonic chain, the launch of new project Flying Tulip (FT), and continued support from the Sonic Foundation for new initiatives. Amid these dynamics, Shadow remains optimistic about its future development.

TechFlow: What do you see as the core reasons behind the increasingly fierce DEX competition this year? And where do you think the next phase of DEX competition will ultimately converge?

Dr. Koala:

Each DEX has its own unique philosophy and positioning, and healthy market competition often drives industry-wide progress and innovation. Such competition motivates projects to continuously improve and delivers better services and features to users.

Shadow itself is a great example. In August this year, Shadow launched Limit Orders and TWAP functionality, enriching trading strategies and enhancing user experience. These new features are helping Shadow evolve into a more comprehensive and convenient one-stop DeFi trading platform.

TechFlow: What key initiatives does Shadow Exchange have planned to better compete in the next stage of DEX competition?

Dr. Koala:

The team is focusing resources on developing a new MEV solution, aiming to deliver richer platform value and a superior user experience for Shadow users. We believe that enhancing these foundational capabilities will bring users longer-term, sustainable returns and help Shadow solidify its foundation to better meet future market opportunities and challenges.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News