Sonic ecosystem ranks first in both trading volume and revenue: Can Shadow's x(3,3) represent the ultimate evolution of DeFi liquidity incentives?

TechFlow Selected TechFlow Selected

Sonic ecosystem ranks first in both trading volume and revenue: Can Shadow's x(3,3) represent the ultimate evolution of DeFi liquidity incentives?

Shadow announced a 3 million $S token incentive program, advancing the release of 50% of Season 2's anticipated airdrop rewards for liquidity incentives and active market making strategies, further incentivizing user participation to drive ecosystem growth.

By: TechFlow

Amid countless laments about the lack of innovation in this current cycle, lies a deep nostalgia for the DeFi Summer that began in 2020.

This nostalgia has drawn significant attention to Shadow Exchange, the leading DEX in the Sonic ecosystem.

In this cycle, Sonic blockchain—powered by comprehensive performance upgrades and deep involvement from Andre Cronje, the "father of DeFi"—has reignited market anticipation and enthusiasm for DeFi under the banner of "purer DeFi DNA." As the highest-volume and highest-revenue DeFi project in the Sonic ecosystem, Shadow Exchange is undoubtedly the main driving force behind this resurgence.

According to Messari’s latest report, since its launch in December 2024, Shadow has averaged 46% of Sonic’s total daily trading volume, peaking at 69%. In terms of revenue, Shadow distributed $2.04 million to xSHADOW stakers and voters over the past 30 days—ranking first in the Sonic ecosystem and placing among the top ten highest-earning DeFi protocols globally.

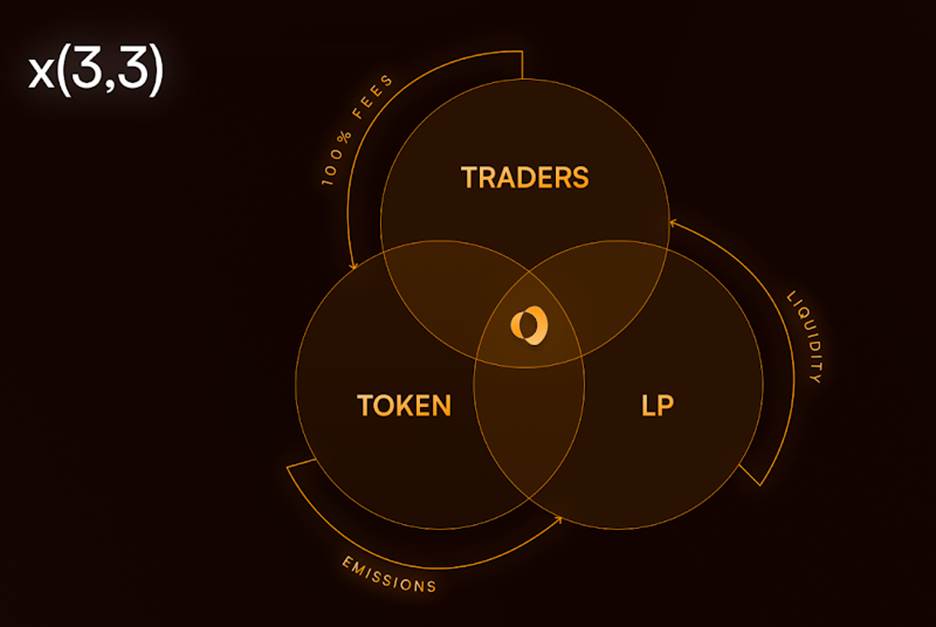

At the heart of the project is the x(3,3) model, evolved from the renowned ve(3,3). Mining, staking, and voting may sound like standard mechanics, but how has Shadow managed to “reinvent the wheel” with meaningful innovations in balancing the interests of traders, liquidity providers, and token holders to attract massive user adoption?

In Shadow’s recently announced roadmap, features such as a lending market based on x33 are already live, while upcoming developments including a Memecoin ecosystem and infrastructure upgrades—will these catalyze another wave of explosive growth?

This article aims to find out.

Sonic's Double Champion: Trading Volume Surpasses $10 Billion, Revenue Leads the Pack

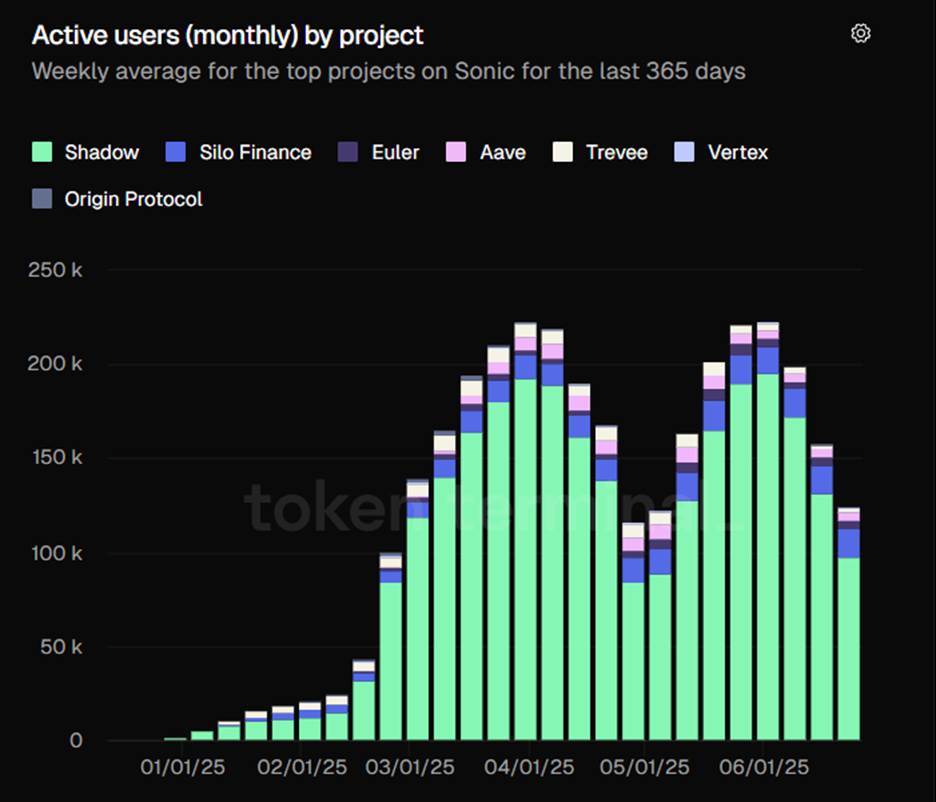

We can better appreciate Shadow’s absolute dominance as the leading DeFi protocol in the Sonic ecosystem through more objective, data-driven metrics.

For any trading platform, trading volume is the most critical indicator—it directly reflects market vitality and user engagement. From this perspective, Shadow Exchange demonstrates strong competitiveness and sustained growth momentum:

According to the latest data released in July: Shadow’s total trading volume has surpassed $10 billion. While this scale still lags behind established DeFi DEXs, it clearly underscores Shadow’s pivotal role as a key liquidity hub within the Sonic ecosystem.

Alongside soaring trading volume, Shadow’s on-chain activity is equally impressive: Behind every transaction are users, and a broad base of highly active DeFi users forms another crucial driver of Shadow’s rapid growth.

In the past 30 days, Shadow has had over 200,000 active addresses.

On-chain data shows that on February 21, 2025, Shadow achieved a 24-hour trading volume of $252,856,099—a record high—and briefly surpassed Hyperliquid, a platform currently at the center of market attention in this cycle.

Since its December 2024 launch, Shadow has averaged 46% of Sonic’s daily trading volume, peaking at 69%, with up to 80% of Sonic’s active users utilizing Shadow. This long-term, stable leadership further solidifies Shadow’s central position within the Sonic ecosystem.

Driven by both high user activity and rapidly growing trading volume, Shadow becoming the highest-earning protocol in the Sonic ecosystem was almost inevitable.

According to official data from Shadow, the protocol has generated over $38 million in fee revenue and over $18 million in platform revenue to date—accounting for 86% of all income on the Sonic platform.

When measured by 30-day project revenue to market cap ratio, Shadow leads the rankings thanks to its higher revenue relative to its smaller market cap—surpassing Pharaoh by approximately 10.22%, and even exceeding well-known protocols such as Raydium, PancakeSwap, and Aerodrome, positioning itself alongside mature networks like Ethereum, Solana, Tron, and Hyperliquid.

Shadow’s team has stated that 95–100% of protocol revenue will be reinvested into the ecosystem, accelerating progress toward a healthier, more sustainable future.

In this cycle—where on-chain liquidity is drying up and user attention is increasingly fragmented—why has Shadow still succeeded?

The answer emerges in the form of x(3,3), an important innovation built upon ve(3,3), now drawing increasing attention.

x(3,3) Model: Evolved from ve(3,3), the Ultimate Evolution in DeFi Liquidity Incentives

To date, many believe that competition among crypto projects ultimately comes down to the quality of their economic models—especially in DeFi.

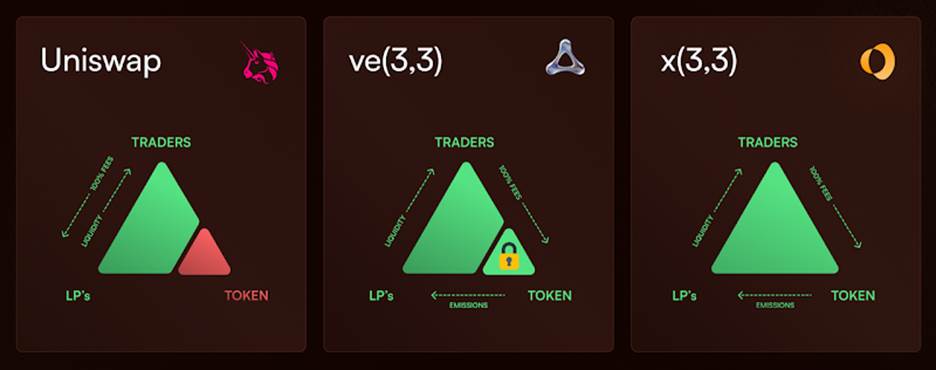

For DEXs, achieving optimal incentive alignment among three core roles—traders, liquidity providers (LPs), and token holders—is fundamental to sustainable, positive growth.

Since the DeFi Summer began, the DeFi space has undergone multiple iterations in addressing the DEX “impossible triangle.”

The initial 1.0 version was typified by Uniswap, which rose rapidly during DeFi’s early days using AMM. However, by prioritizing traders and LPs while neglecting token holder rights, Uniswap became vulnerable to vampire attacks—including one from SushiSwap.

The 2.0 version is represented by Andre Cronje’s ve(3,3) model, which combines Curve’s veCRV with Olympus’ (3,3) mechanism. It features several distinct characteristics: token emissions adjusted based on locked amounts; longer lockup durations yield higher APRs, incentivizing long-term commitment; ve token ownership ratios dynamically adjust with supply changes; and locked positions can be converted into NFTs for secondary market trading.

Theoretically, ve(3,3) better protects token holder interests, creating a more balanced triangle among traders, LPs, and holders. However, in practice, the model’s limitations have become increasingly apparent:

First, it lacks exit flexibility—users must lock tokens for extended periods (up to four years). Second, rewards are primarily based on lockup duration and voting power, relying heavily on rebase mechanisms to adjust stakes, which fails to effectively shield long-term holders from inflation. Additionally, veTokens are non-transferable governance tokens, limiting capital efficiency.

Overall, the ve(3,3) model disproportionately benefits protocol insiders or long-term lockers, placing ordinary users at a disadvantage in reward distribution.

As a pioneering protocol ushering in the 3.0 era, Shadow’s x(3,3) model directly addresses the limitations of ve(3,3), offering a more flexible, balanced, and user-centric approach to maximizing returns.

To quickly grasp how the Shadow x(3,3) model works, we first need to understand its three-token mechanism:

-

Shadow: The native token of the Shadow ecosystem, used for trading and liquidity mining. Initial supply is 3 million, with maximum supply capped at 10 million. Emissions are adjusted per cycle based on protocol revenue. Users can stake Shadow to receive $xShadow;

-

xShadow: Governance token of the Shadow ecosystem. Users can use xShadow to obtain $x33;

-

x33: The liquid version of xShadow. Users can mint $x33 from $xShadow, retaining governance rights and earning yields while gaining liquidity for their tokens.

These three tokens interlock to form a robust incentive flywheel: “create more value → capture value more fully → distribute value more fairly.”

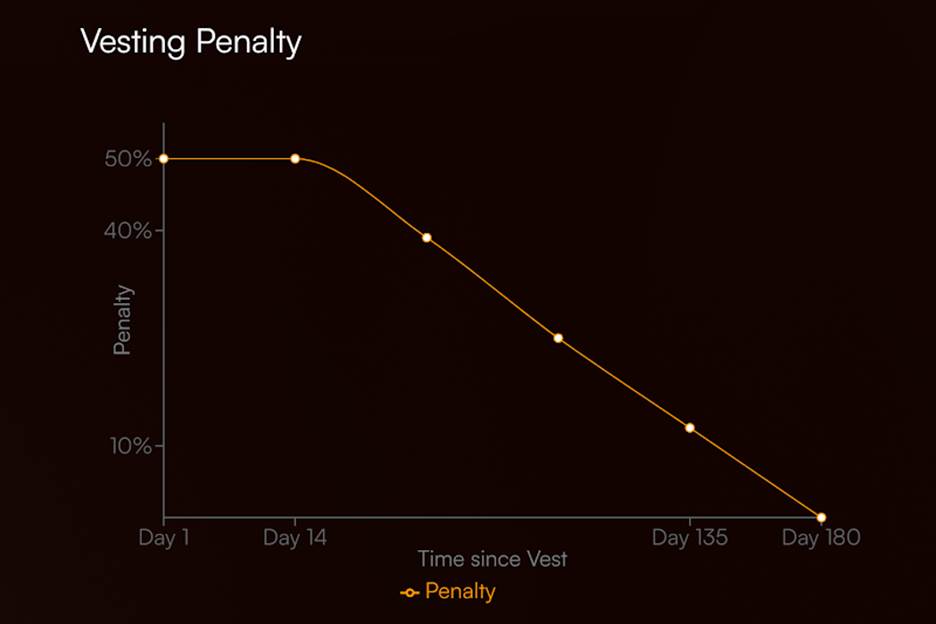

Problem: inflexible exits in ve(3,3)? Solution: x(3,3) supports anytime exit, dramatically enhancing user flexibility.

While users can exit $xShadow staking at any time, different exit timelines incur penalties: immediate exit forfeits 50%; 90-day phased exit converts at 1:0.73; 180-day exit allows 1:1 lossless conversion. This design preserves long-term incentives while offering flexible exit options, allowing users to adapt strategies based on market conditions.

What happens to early-exit penalties? x(3,3) introduces the PVP Rebase mechanism—value captured by the protocol flows 100% back to holders.

Penalties from early exits are proportionally distributed to other $xShadow stakers, creating an anti-dilution mechanism that protects long-term holders from inflation while providing them extra yield. This encourages active participation over passive holding.

From a governance standpoint, Shadow also implements voting and bribery mechanisms to further empower $xShadow holders and ensure rewards flow to high-quality liquidity pools.

$xShadow stakers vote weekly during each Epoch to determine which liquidity pools receive token rewards. Projects can offer additional incentives to attract votes, generating extra income for $xShadow holders.

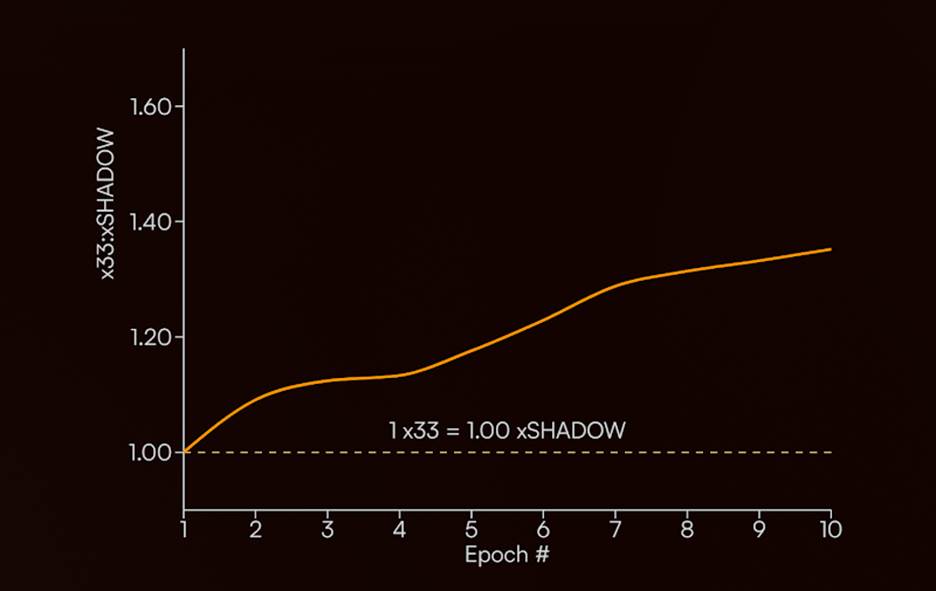

Additionally, to solve the non-transferability of veTokens in the ve(3,3) model, Shadow innovatively introduced $x33—the liquid staking version of $xShadow—to unlock liquidity.

$x33 can be freely traded on Shadow Exchange or other Sonic DEXs. Once $x33 gains market recognition as an LST (Liquid Staking Token), it becomes a usable asset—for example, as collateral in lending markets or leveraged by other projects to create new financial instruments. Silo, Aave, Euler, and Pendle are notable examples of $x33 integration.

Meanwhile, $x33 features automatic compounding: weekly $xShadow rewards are automatically reflected in the $x33 balance. Although $xShadow and $x33 are minted at a 1:1 ratio, over time and with accumulated rewards, the exchange rate of $x33 to $xShadow only increases. This not only simplifies LP position management but also attracts arbitrage bots, forming a self-reinforcing liquidity network.

Thus, while protecting trader and LP interests, $xShadow holders enjoy multiple layers of value protection:

-

100% Fee Distribution: Shadow receives the highest fees (FeeM) on Sonic, all of which are returned to $xShadow and $x33 holders.

-

PvP Rebase Rewards: Users exiting $xShadow early pay penalties, which are redistributed to token holders to incentivize long-term holding.

-

Bribery Rewards: Projects seeking more votes offer richer incentives, directly benefiting $xShadow holders.

-

x33 Value: As the underlying asset of $x33, $xShadow accumulates value through fees and rewards. The market price of $x33 will never fall below its redemption value.

As a superior solution for balancing incentives among traders, LPs, and token holders, the x(3,3) model is foundational to Shadow’s rapid growth. But as a trading platform built on Sonic, how does Shadow perform in actual trading experience?

DEX Fundamentals: A Paradigm Shift in Speed, Liquidity, Experience, and Security

Being built on Sonic gives Shadow the confidence to grow into a world-class trading platform.

From a performance standpoint, Sonic rebuilds the virtual machine, storage engine, and consensus mechanism, forming a core technical architecture based on SonicVM, SonicDB, and SonicCS 2.0. While fully EVM-compatible, it achieves over 2000 TPS throughput, 0.7-second finality, and transaction costs as low as $0.0001 per tx.

With such leading-edge performance, as the market places high hopes on Sonic to “make DeFi great again,” Shadow, built atop Sonic, is positioned to deliver faster, safer, more convenient, and lower-cost trading experiences.

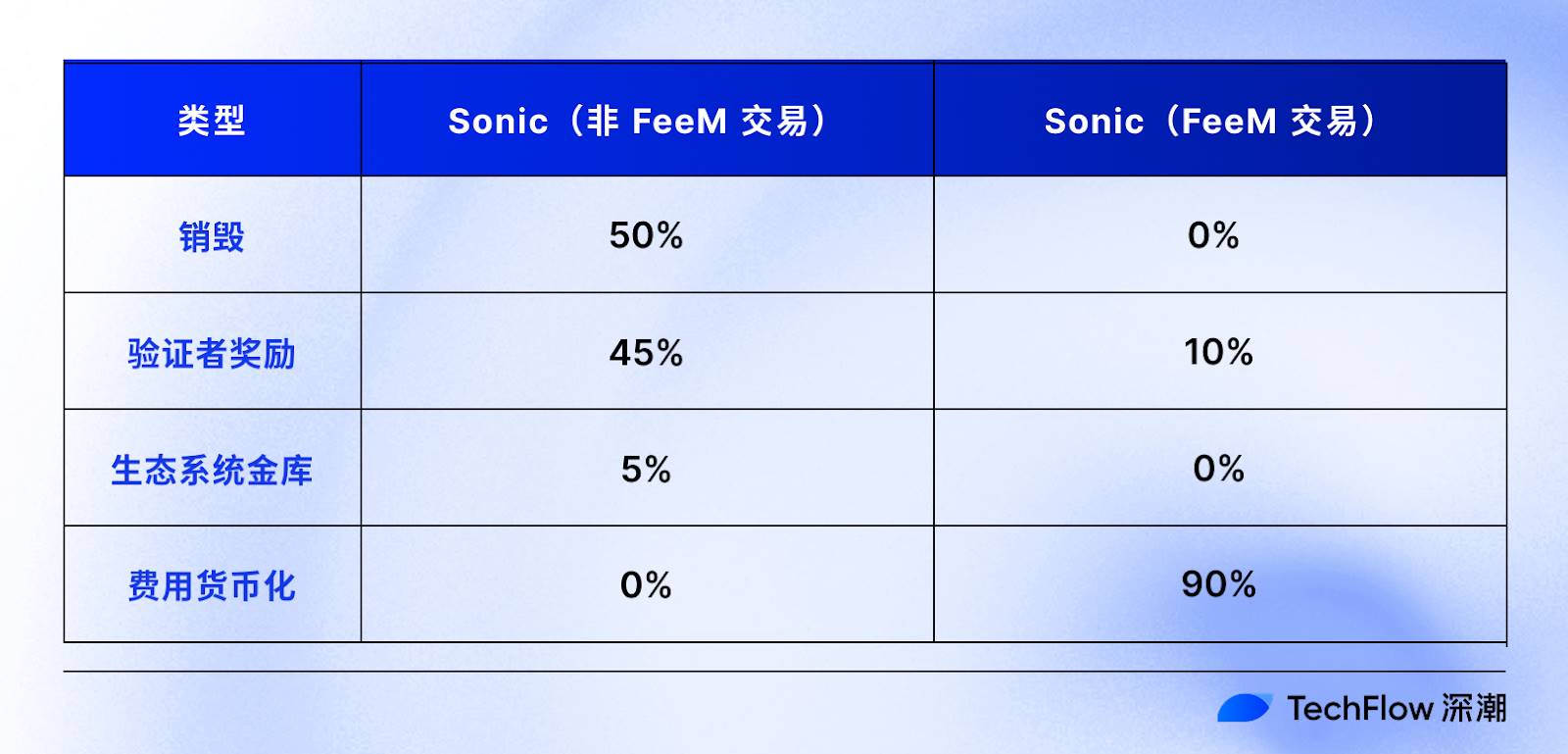

Beyond technology, Sonic is particularly praised for its generous FeeM ecosystem incentive model: developers deploying apps on Sonic can earn up to 90% of trading fee revenue, with the remainder going to validators.

This mechanism—where more users and more active trading directly generate higher earnings—not only motivates developers to build high-traffic applications but also enables ecosystem projects to better reward users and explore more innovative trading mechanisms: Shadow can return up to 90% of gas fees to users or developers, eliminating cost barriers for high-frequency trading and position adjustments, enabling efficient concentrated liquidity deployment and arbitrage, thereby driving overall volume growth.

Although Shadow benefits significantly from being built on Sonic, it also brings substantial independent strengths in trading experience, capital efficiency, and intelligent fee structures.

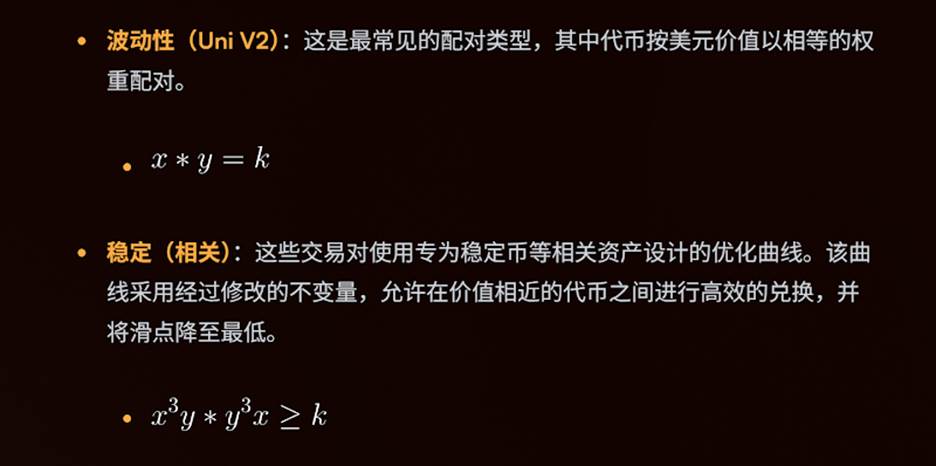

Shadow supports two liquidity frameworks: traditional and concentrated liquidity.

If you’re familiar with Uniswap, understanding these two frameworks will come easily.

Shadow’s traditional liquidity framework is based on Uniswap v2, using constant product pools (x * y = k) to support both volatile and stable asset pairs. Volatile pairs are paired at equal USD value (e.g., $50 Token A + $50 Token B), while stable pairs follow specially optimized price curves to better suit highly correlated assets, reducing slippage and improving swap efficiency. Liquidity covers the entire price range and is managed by arbitrage bots, with 95% of trading fees (typically 0.3%) going to LPs.

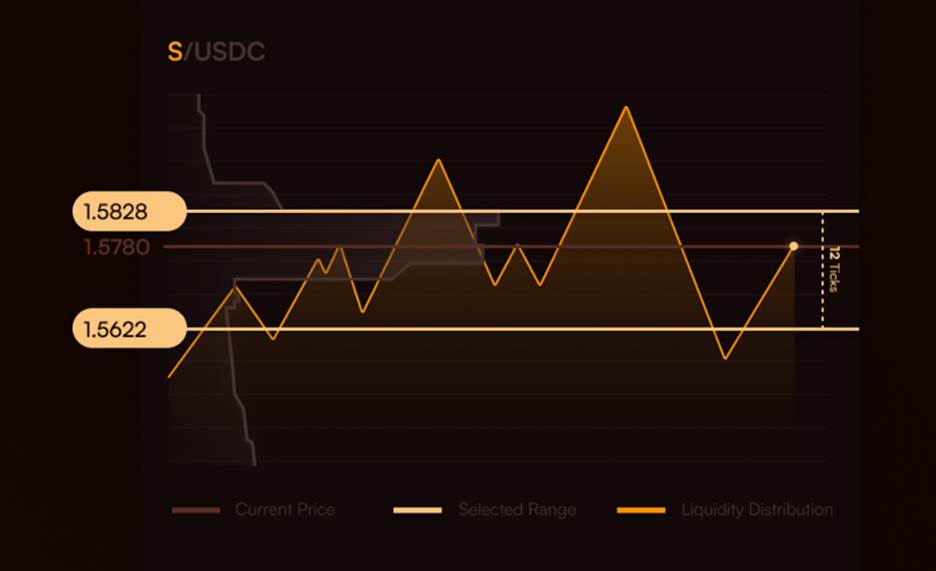

Shadow’s concentrated liquidity framework is built on Ramses V3 Core—an evolution of Uniswap V3— allowing users to concentrate liquidity within specified price ranges. For example, in the ETH-USDC pair, users can focus liquidity between $2,000 and $2,500. The narrower the range, the higher the potential rewards, greatly improving capital efficiency and amplifying fee generation within active price bands.

By concentrating capital in the most effective price ranges, Shadow delivers better returns for LPs and tighter spreads and price stability for traders.

However, narrower ranges increase impermanent loss risk, requiring frequent monitoring. Shadow tracks positions as NFTs, and combined with Sonic’s high-speed blockchain, allows LPs to quickly adjust positions and respond flexibly to market shifts.

Additionally, Shadow enjoys advantages from its smart fee architecture:

Shadow’s algorithm automatically adjusts fees based on market conditions and trading volume. Under the FeeM mechanism, fees can change as frequently as every 30 seconds. Shadow’s system monitors trading volume across other DEXs and CEXs, ensuring superior performance and price stability even during volatility—delivering a better trading experience.

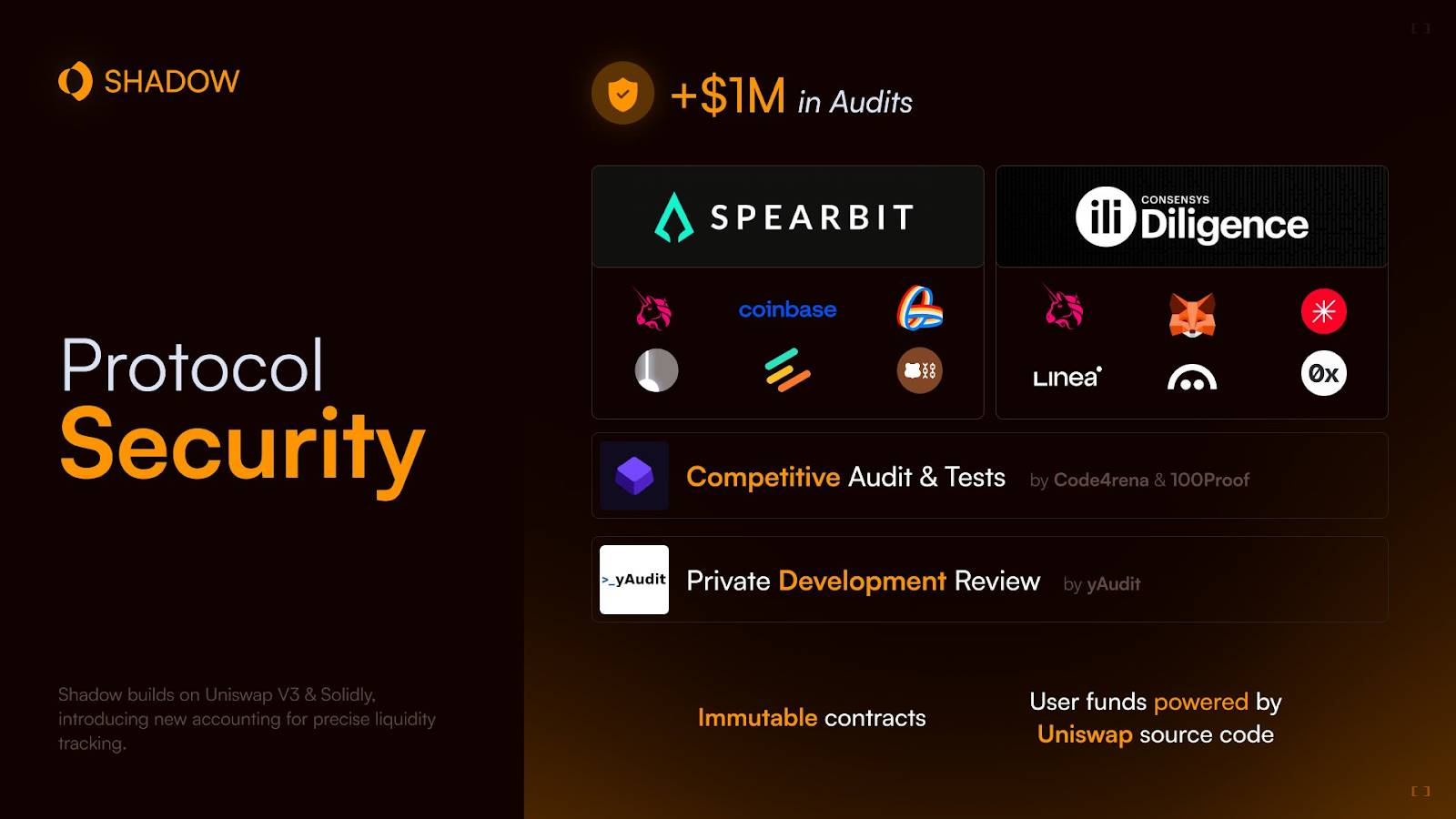

Finally, security underpins all platform functions and advantages. Through Shadow’s layered security defenses, we see its commitment to “security first” in action.

First, Shadow is built on a robust security foundation: Its core architecture draws from Uniswap V3 and Andre Cronje’s Solidly model, enhanced with dynamic systems and optimized fee mechanisms to provide more precise liquidity tracking. Moreover, Shadow’s immutable smart contract design further strengthens platform security.

Second, Shadow has invested $1 million in security audits, conducting rigorous multi-module, multi-stage evaluations to achieve comprehensive protection: Shadow has passed audits by Spearbit, Consensys Diligence, Code4rena, Zenith Mitigation, yAudit, and others, covering core architecture security, professional testing, and privacy development audits—building a robust, reliable trading ecosystem from every angle.

Earn Multiple Yields, With Key Roadmap Items Coming Soon

Of course, beyond theory, real insight comes from practice—especially when Shadow is known for generous yields.

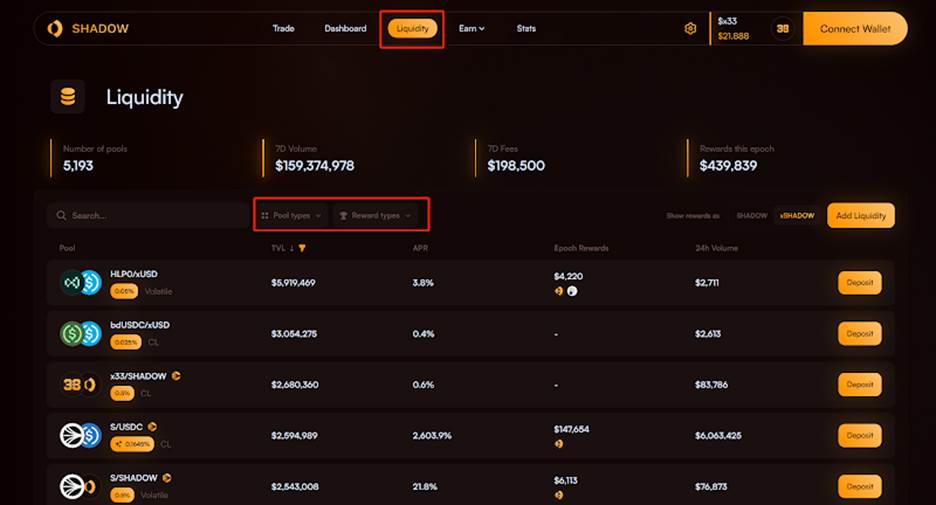

Currently, the most direct way to participate is liquidity mining. Shadow’s Liquidity page offers various pools for users to choose from based on risk tolerance.

Based on liquidity mechanisms, users have four options:

-

Stable Pools: Stablecoin pairs with low impermanent loss, ideal for conservative traders;

-

Airdrop Pools: Designed for users aiming to earn Sonic airdrop points;

-

Legacy Pools: Uniswap V2-style pools, suitable for steady returns;

-

CL Pools: Concentrated liquidity pools in the style of Uniswap V3, ideal for high-risk, high-reward traders.

Based on reward types, users have two choices:

-

Swap Fees Only: Earn trading fees—stable but lower returns.

-

Emissions & Incentives: Earn $SHADOW / $xShadow or other token rewards from liquidity pools—higher returns but greater volatility.

Liquidity mining rewards can be received as either $Shadow or $xShadow, then further leveraged—such as by minting $x33—to capture multidimensional ecosystem value and diversify yield streams.

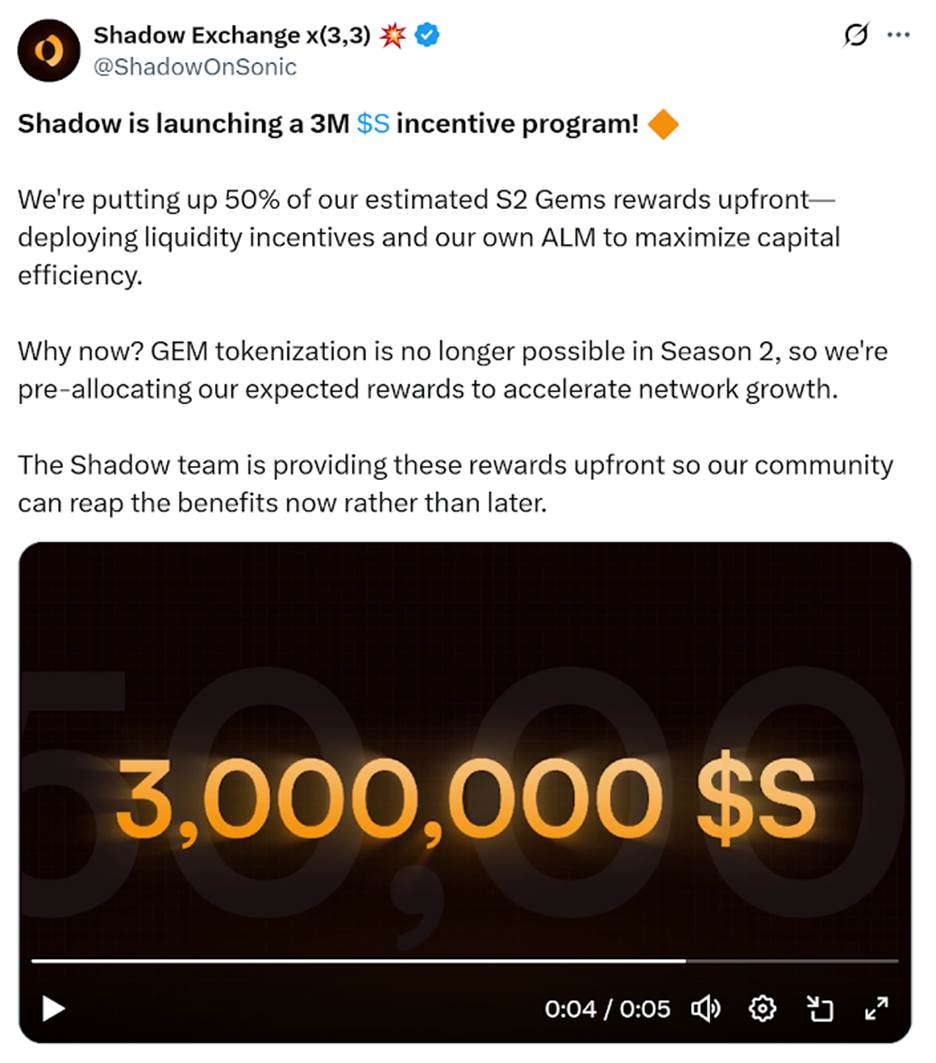

Notably, with Sonic’s second airdrop season now officially launched, users trading whitelisted assets on Shadow earn points and enjoy dual boosts via loyalty multipliers and yield scoring. Holding $Shadow and $x33 grants a 10x acceleration in $S airdrop points.

Moreover, since the second airdrop no longer supports GEM tokenization, Shadow has announced a 3-million-$S token incentive program, releasing 50% of expected second-season rewards upfront to fuel liquidity incentives and active market-making strategies (ALM), further driving user participation and ecosystem growth.

Beyond rapid ecosystem expansion, Shadow’s team remains committed to product refinement. According to the official roadmap, Shadow will continue upgrading its technical infrastructure—introducing features like MEV protection via buyback arbitrage systems and delayed reward mechanisms to ensure rewards reach genuine market makers, along with new fee-tracking systems that only reward efficient liquidity.

Meanwhile, several innovative features have recently launched on Shadow, the most notable being the $x33-based lending market, further expanding Shadow’s DeFi utility.

Looking ahead, with plans for Memecoin ecosystem development, Shadow will establish a safer, better-incentivized launch process to enable fair, free distribution of trading fees among xSHADOW holders, token creators, and liquidity providers.

As the core engine of the Sonic ecosystem, Shadow Exchange is redefining the trajectory of DeFi through its unique x(3,3) model, powerful trading performance, and comprehensive reward distribution mechanisms.

With full-spectrum ecosystem deployment and gradual rollout of innovative features, we look forward to Shadow Exchange—the rising star of DeFi—entering its next phase of explosive growth and emerging as a key force in making DeFi great once again.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News