Breaking the ve(3,3) Limitation: Shadow Exchange's x(3,3) Mechanism and the Innovative Application of $x33

TechFlow Selected TechFlow Selected

Breaking the ve(3,3) Limitation: Shadow Exchange's x(3,3) Mechanism and the Innovative Application of $x33

Shadow Exchange has revolutionized the ve(3,3) model by introducing the x(3,3) mechanism, with its token $x33 becoming the new North Star among ve(3,3) projects.

The Vote Escrow (ve(3,3)) model is nothing new: stake, vote, claim rewards, and repeat. Shadow Exchange has reinvented the ve(3,3) model by introducing the x(3,3) mechanism, making its token $x33 the new North Star among ve(3,3) projects.

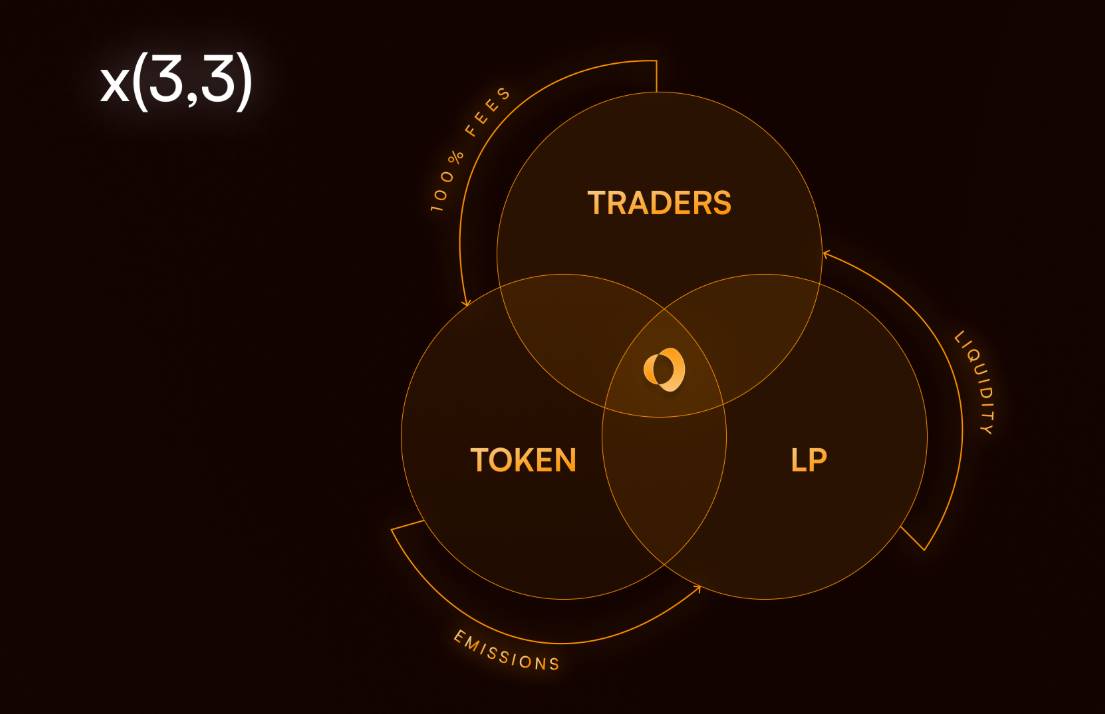

Basics of VE(3,3)

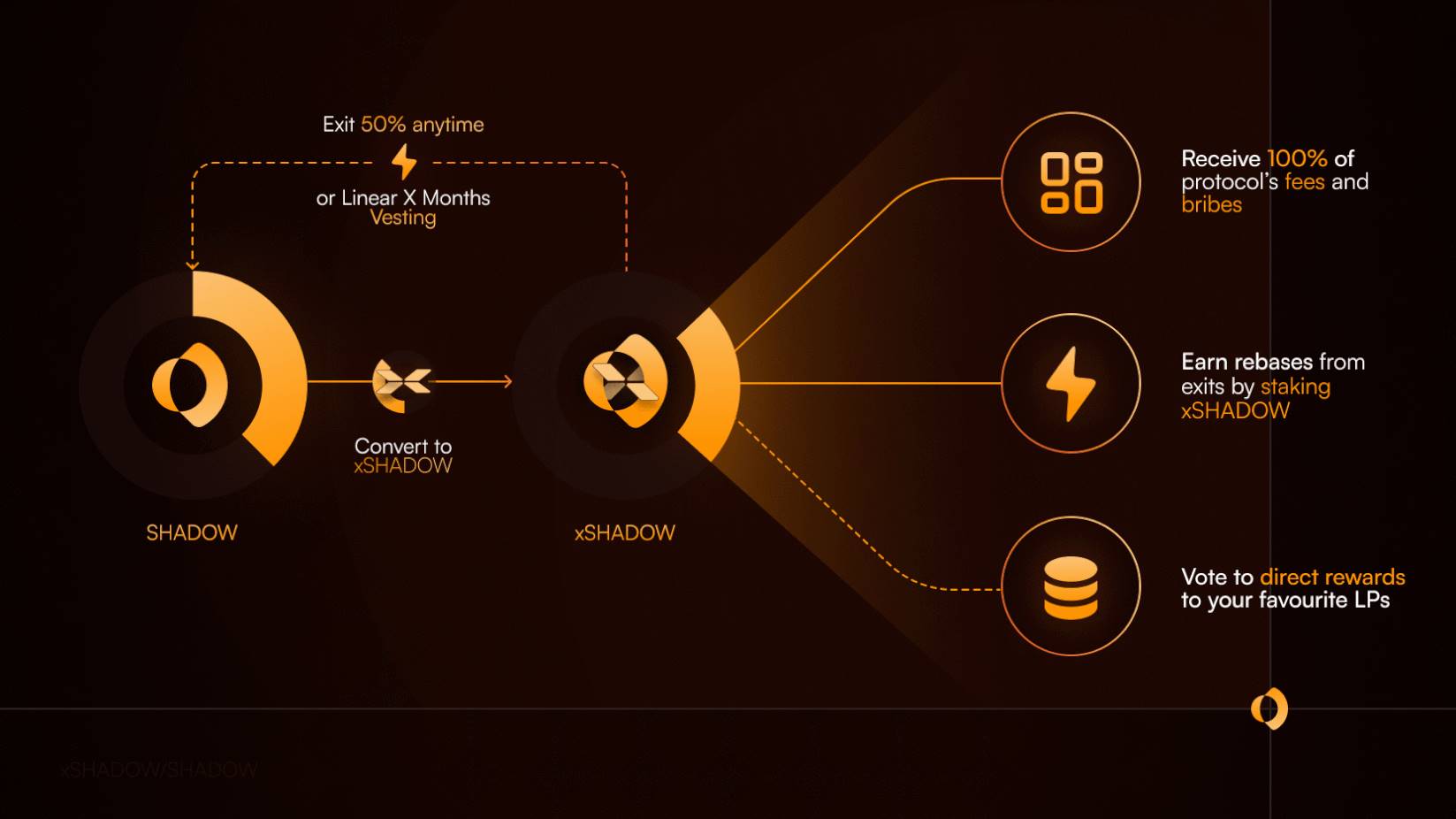

Stake Shadow's native token $Shadow to receive xShadow, which grants voting rights. Holders then vote weekly to earn Voting Rewards and Rebase rewards. Voting Rewards come from platform fees and bribes, while Rebase rewards are sourced from xShadow tokens forfeited by early exits.

Drawbacks of Traditional VE(3,3)

Legacy systems typically require a 4-year lock-up period with no direct sell option. xShadow includes two exit mechanisms: Instant Exit and Vested Exit. The former redeems $Shadow at a 1:0.5 ratio, while the latter allows full 1:1 redemption after 180 days. Although this involves some loss, it remains far more reasonable than a 4-year commitment.

To enhance user experience—especially regarding the liquidity of staked tokens—Shadow has launched a new x(3,3) model.

$x33 as a Liquid Staking Token (LST)

$x33 wraps non-liquid xShadow tokens into a tradable form, minting $x33 as a Liquid Staking Token (LST). Once packaged, $x33 becomes a fully liquid asset that can be freely bought and sold on the open market. Beyond tradability, the underlying xShadow continues to generate value through voting power and growth over time.

Once recognized, $x33 can serve as usable collateral in lending markets or be leveraged by other protocols to create novel financial instruments. Examples include Silo, Aave, Euler, and Pendle—all typical use cases for $x33 as an LST.

Market Value Perspective of $x33

Since $x33 trades freely on the market, its value fluctuates with demand. While the price of $x33 may rise or fall, it’s important to note that the 50% instant exit mechanism of xShadow sets a floor price for $x33—at 0.5 times the value of $Shadow. The upper limit is determined by the conversion rate between $x33 and xShadow.

xShadow Backing of $x33

The intrinsic value of $x33 is rooted in xShadow, which retains full voting rights. Through periodic compounding and auto-compounding, the amount of underlying xShadow grows each week, increasing its fundamental value. As a result, the updated $x33 to xShadow ratio only rises over time—never decreases.

What Sets $x33 Apart

Thanks to the x(3,3) module’s liquidity wrapping and automatic compounding features, $x33 goes beyond being just a liquid staking token (LST). It combines asset liquidity with growing underlying value and cross-dApp utility beyond Shadow itself. The periodic increase in the $x33/xShadow exchange ratio makes it easier for liquidity providers (LPs) in the $x33/$Shadow pool to set optimal position ranges.

With its multifaceted utility, high flexibility, diverse applications, and built-in price support, $x33 stands out uniquely within the ve(3,3) ecosystem, setting a new direction for innovation in the industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News