Deep Dive Interview with Paradigm Co-Founder Matt Huang: The Departure That Left Sequoia Regretful, Now Fully Committed to the Crypto World

TechFlow Selected TechFlow Selected

Deep Dive Interview with Paradigm Co-Founder Matt Huang: The Departure That Left Sequoia Regretful, Now Fully Committed to the Crypto World

Huang and his team are not only investing in the future, but writing it line by line.

Author: Dom Cooke

Translation: TechFlow

Photography: Carolyn Fong

"Sometimes I feel like I'm running an 'X-Men School,'" says Matt Huang, co-founder and managing partner of Paradigm, the $12 billion crypto investment firm that has assembled a team of extraordinary "mutant geniuses."

Take Charlie Noyes, the firm’s first employee—a 19-year-old MIT dropout who didn’t even know how to use a calendar. He showed up five hours late, unapologetically, to his first 10 a.m. meeting.

Today, he is a general partner at Paradigm.

Or Georgios Konstantopoulos, Paradigm’s CTO, who evolved from a World of Warcraft-obsessed gamer into one of crypto’s most influential engineers. And transmissions11, the anonymous prodigy discovered by Paradigm through a Discord server while still in high school, now a key member of the team.

"They sometimes create maddening chaos—you want to pull your hair out," Huang says. "But when you see what they produce, you think: Wow, no one else on Earth could have done this."

On a cold morning during my visit to Paradigm’s San Francisco office, two members of Huang’s team were working on a mechanism that could reshape how hundreds of billions of dollars in digital currencies flow through financial systems.

In the top-floor conference room—an arc-shaped space reminiscent of a cathedral's echo chamber—partner Dan Robinson, wearing Paradigm-green Nike Air Force 1s, rapidly explained their latest breakthrough in a voice as fast as high-frequency trading.

Research partner Dave White, sporting hexagonal glasses and a slightly unkempt beard, focused intently on his laptop, occasionally pausing to discuss the mathematical foundations behind the concept he invented. Huang listened attentively, dressed in a minimalist black Japanese sweater, his athletic build and calm demeanor embodying the presence of a leader perpetually ahead of his time.

"Everything he does is exceptional," says Doug Leone, former head of Sequoia Capital, where Huang worked from 2014 to 2018. "He’s incredibly smart, yet profoundly humble. It’s hard not to walk away from a conversation with Matt thinking he’s someone truly special."

Through two massive arched windows above Union Square, eastward lies the concrete skyline of traditional finance; to the south, SoMa (South of Market) brims with startups. The view perfectly captures Paradigm’s role as a bridge between legacy finance and cutting-edge technology—and mirrors Matt Huang’s career-long ability to spot disruptive potential.

In 2012, during a weeklong vacation in Beijing, Huang visited a startup operating out of two apartments. Founder Zhang Yiming was building a personalized news app—an idea Huang initially thought was doomed to fail. Yet sitting at an old IKEA table beside a dusty refrigerator, watching Zhang communicate through a translator, Huang sensed something beyond language.

"I remember having a very strong feeling: This person is extremely capable, driven, ambitious, yet balanced—not someone who would burn out. He had an incredibly clear vision of what he wanted to build and a conquer-the-world ambition."

Zhang was the most impressive person Huang had ever met—so impressive that he decided to invest. That company became ByteDance, the creator of TikTok. Huang’s stake is now worth billions—though he doesn’t know the exact figure, as he never bothers to update the spreadsheet.

This instinct for spotting talent became central to Paradigm. In 2018, Coinbase co-founder Fred Ehrsam approached Huang while he was at Sequoia with a vision for a new investment firm. They founded Paradigm as equal partners, but over time, Ehrsam shifted focus to other ventures, including a brain-computer interface startup, realizing Huang was the natural leader for Paradigm. In Ehrsam’s words, Huang was “born for Paradigm.”

The son of one of the world’s top financial theorists and a pioneering computer science professor, Matt Huang grew up at the intersection of math, economics, and technology. In just six years, his firm Paradigm has grown from managing $400 million to over $12 billion in assets—a feat fueled by early, concentrated bets on foundational crypto projects and critical contributions to core infrastructure.

Paradigm’s researchers are more than investors—they actively develop foundational innovations and open-source them for the entire industry. This is rare among financial firms, because Paradigm isn’t a traditional investment firm. It’s more like a hybrid of a research lab and engineering team, fused with the sophistication and forward-thinking ethos of a West Coast “Wall Street.”

"He’s super smart and deeply humble. It’s hard not to come away from any interaction with Matt thinking he’s someone extraordinary." —Doug Leone, Sequoia Capital

In the top-floor meeting room, partner Dan Robinson and research partner Dave White are deep in work on a breakthrough called “bullseye liquidity.” This innovation could transform how stablecoins—digital tokens pegged to the dollar—are traded. Stablecoins are now essential to crypto finance, but their trading infrastructure remains primitive, requiring separate pools for each trading pair. Their research aims to unify these fragmented markets through an efficient system.

Though this innovation could give companies Paradigm has invested in—like Uniswap and Noble—a major edge, they plan to publish the findings on their blog. "If others implement it and make the crypto industry better overall, we’re completely fine with that," Robinson says.

White pauses from his work on OpenAI’s o1 Pro—verifying mathematical proofs—then refines a point about n-dimensional space. On screen, Dan Robinson displays a mathematical visualization resembling a quarter-slice of Captain America’s shield. Matt Huang spends most of his time listening—he usually prefers to listen—but when he speaks, it’s clear he has fully absorbed the complex material.

Recalling childhood, Robinson notes their friend group would argue endlessly until Matt spoke. "He doesn’t say much," Robinson says, "but we always ended up doing what he suggested." Those closest to Huang describe him as someone whose quiet exterior masks extraordinary abilities. Stripe co-founder Patrick Collison observes: "Matt’s ‘insight per minute’ is incredibly high, even in minutes when he says nothing." Collison added Huang to his board in 2021. Huang’s attention to detail is everywhere—from Paradigm’s website load speed to his taste in obscure Japanese streetwear to the people he hires. "He demands excellence," says Coinbase CEO Brian Armstrong. "He will not tolerate mediocrity."

Yet beneath this pursuit of excellence lies a disarming humility. As Doug Leone puts it: "He has a great sense of humor, but it’s overshadowed by his kindness, making you want to take him seriously." Perhaps most telling, nearly all praise comes from others—Huang is the kind of person whose greatness is whispered rather than proclaimed, whose influence is felt rather than boasted.

Collison adds: "Not every great investor or leader is a great human being. But on every test of integrity—like whether someone could be your child’s godfather—Matt passes with flying colors."

Paradigm is not a traditional investment firm. It’s more like a fusion of a research laboratory and engineering team, infused with the polished, forward-looking sensibility of a West Coast version of “Wall Street.”

This blend of technical excellence and quiet integrity has made Paradigm one of the most important institutions in crypto. In an industry that grew from zero to a $3 trillion market cap amid waves of speculation and crashes, Paradigm’s open-source tools now support 90% of smart contract development. Its innovations have made the movement of hundreds of billions in digital assets more efficient and earned the trust of the world’s top investors—including Harvard, Stanford, Sequoia, and Yale.

CAROLYN FONG

Awakening

One of Matt Huang’s earliest memories is navigating Tokyo’s streets alone at age nine. As an explorer in one of the world’s largest cities, he walked an hour each way to school every morning through narrow alleys and busy avenues. This early independence shaped his worldview. "Once you have an N=2—the comparison between Tokyo and New York—your perspective on everything changes," Huang says.

In 1997, Matt’s family moved to Japan due to his father Chi-fu Huang’s job. Chi-fu was tasked with launching Long-Term Capital Management’s (LTCM) Asian office. Previously, he managed LTCM’s Asia trades remotely from Greenwich, working daily from 4 p.m. to 3 a.m. to match market hours. Born in Taiwan as the only son among four sisters, his parents used their modest savings to send him to the U.S., where he rose from MIT economics professor to head of Goldman Sachs’ fixed-income derivatives research, then to LTCM—a Nobel Prize-laden firm that perfectly merged academic theory with market practice.

Matt’s mother, Marina Chen, also had an impressive academic journey. After immigrating from Taiwan, she studied under tech legend Carver Mead at Caltech, pioneering parallel computing research—technology still widely used in modern processors. Though she became one of Yale’s first female computer science professors and seemed destined for academic stardom, Chen chose to leave academia to raise her three sons, channeling her intellect and focus into their education.

At the Huang household, dinner each night resembled an investment committee meeting. As the garage door opened, the brothers rushed to finish their father’s reading assignments—carefully curated, age-appropriate articles ranging from economic principles to Scientific American. At dinner, they answered questions on these topics. Facing high expectations, each brother developed different coping strategies. As the eldest, Matt chose direct rebellion.

In 1998, Russia’s financial crisis caused LTCM’s model to collapse, wiping out the family’s savings and abruptly ending life in Tokyo. Yet Chi-fu Huang rebuilt from the wreckage, co-founding Platinum Grove Asset Management in 1999 with LTCM colleague and Nobel laureate Myron Scholes. Within less than nine years, the firm grew from $45 million to managing $6 billion—one of the world’s largest fixed-income hedge funds—until the 2008 crisis. This pattern of finding opportunity in chaos and rebuilding from systemic collapse deeply influenced his son.

Scarsdale, a New York suburb, became Matt Huang’s fourth home in 11 years. At a school dominated by Jewish students, he was one of only three Asian kids. Frequent moves and cultural adaptation honed his ability to read social dynamics and connect with diverse personalities.

In class, Huang struggled to sit still. His restlessness led to expulsion from weekend Chinese school for repeatedly disturbing others. "Hard to control," his parents later described him at his wedding. Yet when engaged on his own terms, he displayed remarkable focus. With his “uncool but academically oriented” friend group, Huang directed amateur films, debated liberal philosophy, and mastered games. His performance in StarCraft—as a semi-pro competing on international servers—foreshadowed the detail-oriented mindset that now extends to his obsession with handstands.

Though Yiming communicated with Matt Huang through a translator, Huang was deeply drawn to the founder’s nonverbal signals—his gestures, expressions, and intensity forming a picture that needed no words.

Huang’s turning point came when he discovered mathematics. Math club revealed his natural aptitude. Though not a national competition standout, it showed his parents that their “hard-to-control” son could excel academically given the right challenge. Poker and chess then became outlets for his analytical mind.

This gradually “reformed” student eventually enrolled at MIT. In 2006, he found himself among “one of the strangest groups of people on Earth.” He majored in math and once took a semester off to focus on online poker, playing eight tables simultaneously. But the real transformative moment (besides meeting his future wife) was when his friend Albert Ni dropped out to join a small startup called Dropbox as its sixth employee. For someone raised to become a PhD, dropping out without even a bachelor’s degree seemed unthinkable. Yet Ni wasn’t a failure—he was one of the most capable people Huang knew, making a deliberate choice to build something new. This prompted Huang to read all of Paul Graham’s essays, discovering Silicon Valley and the ultimate rebellious temptation: forging your own path.

In his final year at MIT, Huang and his roommate applied to startup accelerator Y Combinator (YC), but were rejected. Graham told them: "We like you, but we hate your idea." Six months later, they reapplied with a viable prototype and got in. A few MIT grads spent six days driving cross-country to San Francisco. At YC, they built what Huang now calls a “bad idea”—a TV guide website for the streaming era named Hotspots. This two-year “failed startup” ultimately ended in acquisition by Twitter. Working at Twitter, he witnessed the company’s “poor management” before its IPO, further shaping his professional outlook.

By 2012, Matt Huang was ready for a new path. To him, Silicon Valley had become too obvious, consumer innovation too dull to offer exciting work or returns. During a week off from Twitter, he considered starting a tech company in China and visited six founders in Beijing. One was Zhang Yiming, building what seemed like a doomed consumer app. Though Zhang communicated through a translator, Huang was captivated by the founder’s nonverbal cues—his gestures, expressions, and intensity forming a wordless narrative. Leaving Zhang’s apartment, Huang had one thought: “I need to find a way to back this person.”

Huang later invested in ByteDance at valuations of $20 million and $30 million—his largest personal investments at the time. Today, ByteDance is valued at $300 billion, making his stake roughly 10,000 times larger—turning a hypothetical $50,000 into $500 million. He still holds most of his shares, though he admits to feeling “increasingly peaceful” about it, adding: “It does complicate things emotionally, because it might be the best investment of my life.” That same year, he also made seed investments in YC-backed companies Instacart, Benchling, PlanGrid, and Amplitude in San Francisco—all now unicorns valued over $1 billion.

In 2014, an email from Sequoia Capital landed in Huang’s inbox while he was still at Twitter. Despite an impressive investment track record, he had no interest in becoming a professional investor and initially treated the message as spam. But curiosity won, and he accepted the interview task—writing a one-page report on which company Sequoia should invest in. He chose Coinbase, then with only seven employees, launching his deep connection with crypto.

At Sequoia, Matt Huang found what he calls “the highest standard place I’ve ever experienced.” The day after he joined, Facebook acquired WhatsApp for $19 billion. Partners briefly gathered in the lobby to celebrate. Champagne was poured, but no one drank; within five minutes, everyone returned to work. This billion-dollar exit barely rippled through a portfolio that included Apple, Google, and Nvidia—each now worth over a trillion. This culture of relentless excellence further ignited Huang’s already formidable ambitions.

Reflecting on his four years at Sequoia, Huang says: “You begin to see how far the axes can stretch—what kinds of people qualify as truly great founders. Without exposure to that, your perception of possibility lacks the top end of dynamic range.” Sequoia also taught him that excellence takes many forms. Working alongside investors with vastly different styles but consistent excellence gave him confidence to develop his own methodology: “Realizing I could do things my way—that sense of freedom was incredibly liberating.”

And Sequoia gained unexpected value from Huang. Doug Leone, managing partner of Sequoia U.S., recalls: “Every year, Sequoia U.S. got crushed by Sequoia China in the poker tournament. Then Matt joined and won it for us. Thanks to him, we got Don Valentine’s colorful jacket back.” You won’t hear this story from Huang himself—he never boasts about his achievements. Like so many of his traits, you either hear it from others or know exactly what to ask.

Leaving Home

In 2010, Matt Huang first encountered Bitcoin at MIT, immediately captivated by its elegant fusion of math, economics, computer science, and game theory.

“I internalized it as a very beautiful idea,” Huang recalls. Yet in those early days, Bitcoin felt more like an intellectual curiosity than a real investment. Not until 2012 did he buy his first Bitcoin on Mt. Gox, the dominant exchange at the time, experiencing his first crypto bubble. “You almost need to lose money the first time,” he reflects. “Then you might abandon it, thinking it’s dead. But when you see it come back and it’s not dead, you start taking it seriously.”

Multiple reports cite legendary investor Michael Moritz calling Huang “the only departure from Sequoia that anyone regrets.” Doug Leone adds: “He was the first person in my career who voluntarily left Sequoia.”

During his time at Sequoia, Huang found few colleagues who shared his growing conviction about crypto’s importance. Though the firm supported his interests—he led several crypto investments on their behalf—he increasingly sought like-minded thinkers outside the firm. He began attending monthly dinners in San Francisco with six to eight investors passionate about crypto, exploring the frontier of this emerging technology.

In 2017, Fred Ehrsam, recently stepped down as Coinbase president, published a blog post arguing that cryptocurrency is the metaverse. Matt Huang, still at Sequoia, reached out to discuss the idea. Ehrsam recalls: “I knew I wouldn’t start a company around this concept, but pitching it to Sequoia sounded fun.”

What began as an intellectual exchange evolved into 40 emails of deep dialogue between the two, exploring the infinite possibilities of crypto. Their backgrounds were perfectly complementary: Ehrsam co-founded and ran one of crypto’s most important companies; Huang brought elite investment experience.

“Until I met Matt, I didn’t feel anyone was the right partner,” Ehrsam says. He’d discussed launching a crypto-focused fund with other potential co-founders but never found the ideal match. Over the next six months, they systematically explored partnership viability—investment philosophy, fund structure—testing alignment on every level. They especially focused on achieving true equality—splitting everything 50/50. While this principle drove some “crazy,” for them it was a non-negotiable foundation.

For Huang, leaving Sequoia was painful. It was the first place he truly felt he belonged: “If they’d let me stay, I think I could’ve retired there.” Multiple sources report that legendary investor Michael Moritz called Huang “the only departure from Sequoia that anyone regrets.” Sequoia’s managing partner Leone says: “He was the first person in my career who voluntarily left Sequoia.”

Yet Huang firmly believed crypto would be one of the most important technological trends of the coming decades. “When he told me this might be the opportunity of his lifetime, my answer was simple: Follow your dream, go for it,” Leone says, with a hint of regret. “I’m mad at myself—he kept talking to me about Bitcoin, and I’m usually good at spotting these opportunities. If I’d been smart enough, I should’ve followed his lead and created a fund for him within Sequoia.”

CAROLYN FONG

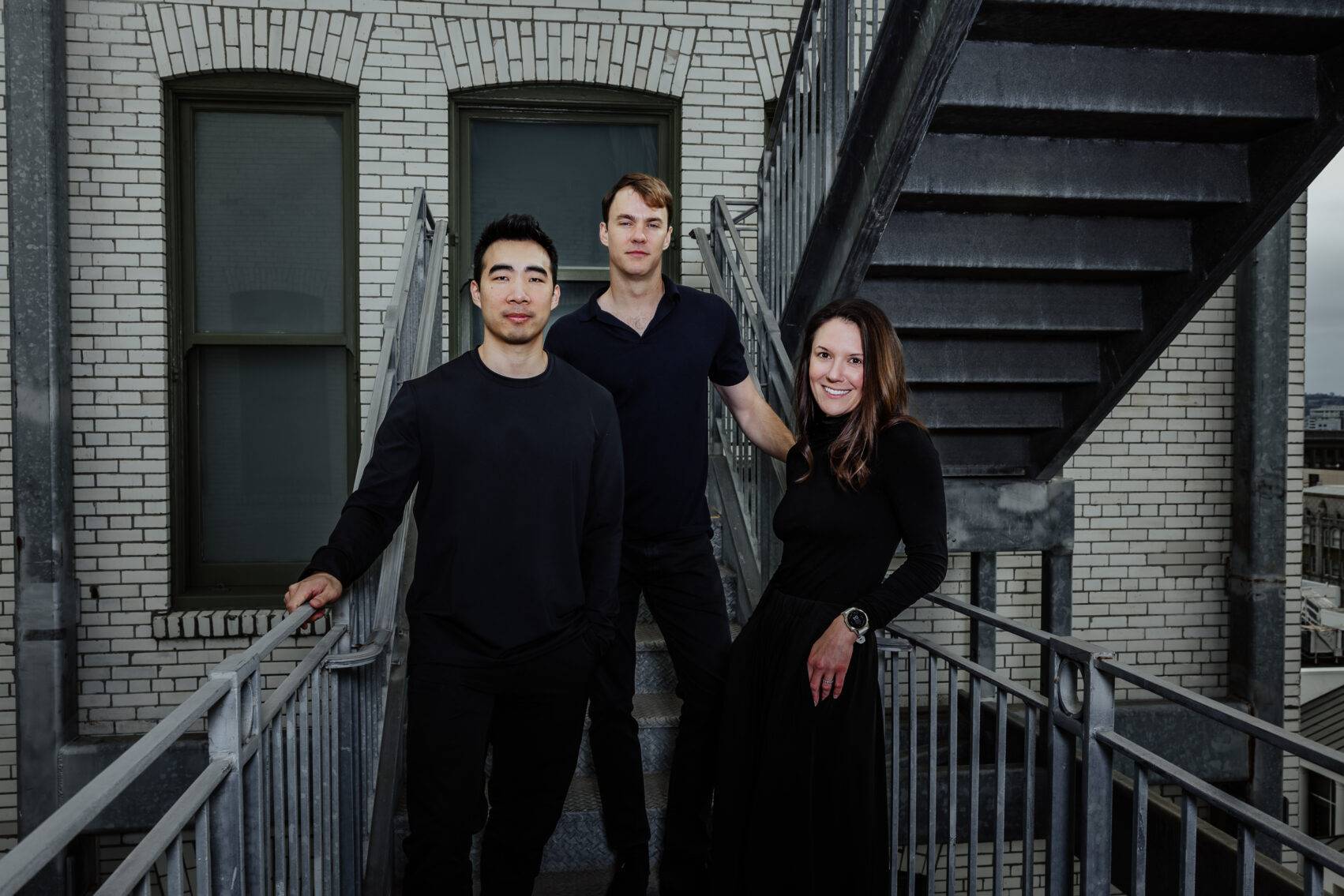

In June 2018, Matt Huang and Fred Ehrsam co-founded Paradigm on two core beliefs: first, that cryptocurrency would be one of the most important technological and economic shifts of the coming decades; second, that crypto lacked the kind of investor founders like them wished existed—genuinely “crypto-native” investors.

Graham Duncan, founder of East Rock Capital and an early advisor to Paradigm, was deeply impressed by Huang and Ehrsam’s vision. “They were planning for scale in a way that almost seemed absurd to me at first,” Duncan says. “It opened my eyes—but it wasn’t arrogance. Their time horizon was simply different, and what they envisioned actually came to pass.”

By the end of 2018, Paradigm raised its first fund—$400 million from top-tier institutions including Harvard, Stanford, and Yale—the first major crypto investments by these universities—as well as Sequoia. The fund structure was novel: it was open-ended, with no fixed capital return schedule, allowing holdings in both public crypto assets and private investments. Then they made a bold move: unlike most VCs who draw capital gradually, they demanded the full $400 million upfront and began dollar-cost averaging into Bitcoin and Ethereum. These positions initially made up about 90% of the fund, with Bitcoin bought at an average price of roughly $4,000–$5,000—massive bets during the 2018 “crypto winter,” when prices had crashed over 70%.

Paradigm’s first three hires reflected different dimensions of their vision. Charlie Noyes became the first hire—Huang met him in a Telegram chat about a Bitcoin Cash fork. “From his messages, I assumed he was a 40-year-old, bearded, grizzled, cynical guy,” Huang recalls. “But when he showed up to dinner, I realized he was only 19—that shocked me.”

Noyes had been immersed in crypto since age 12, introduced via gaming. He published research papers on crypto applications and twice won Intel Science Competitions. He attended MIT, then dropped out to join Paradigm. His transition to office life was rocky—he assumed “commenting on project proposals via email and coming to the office once a week” was normal. After his first tardy arrival, Huang sat down to explain basic professional norms—a patience that paid off.

Now 25, Noyes is a general partner at Paradigm. Huang compares him to an artist, able to intuitively synthesize fragmented information into clear investment theses. In 2020, for example, he identified MEV (Maximal Extractable Value) as a critical blockchain issue and became a key investor in Flashbots. Flashbots’ infrastructure now handles nearly all Ethereum transactions, establishing vital market rules for the $450 billion ecosystem.

Dan Robinson embodies the technical depth needed to push crypto’s frontier. A childhood friend of Huang’s and “the smartest person I’ve known since I was young,” Robinson grew disillusioned with Harvard Law and turned to programming, diving into crypto while working at blockchain company Stellar. Huang and Ehrsam designed a unique role for him—blending investing, research, and helping portfolio companies build. This initial compromise became the template for Paradigm’s research-driven investing approach. Robinson later invented key mechanisms for Uniswap—the leading decentralized exchange in crypto—further cementing Paradigm’s industry standing.

“She’s been the third partner to Matt and Fred, fully involved in building the company.”

——Graham Duncan, East Rock Capital

CAROLYN FONG

Paradigm’s managing partners: Huang and Palmedo

Alana Palmedo joined Paradigm just four weeks after founding, when the company was still leasing office space week-by-week. She brought the institutional rigor needed to bridge crypto and traditional finance. Though not “deep in crypto,” her experience managing complex operations at Boston University’s endowment and Bill Gates’ investment office during the 2008 financial crisis proved invaluable. Initially skeptical, she was ultimately won over by Huang and Ehrsam’s thoughtful approach to building an institution, plus a value investor’s intuition: “Bitcoin’s price dropped so low—it must be the bottom.”

Graham Duncan of East Rock Capital says: “She’s become the third partner to Matt and Fred, fully embedded in building the company.” Early on, Palmedo handled everything from trade settlement to finance to compliance, later recruiting specialists so the investment team could focus on deals. Now a managing partner, she’s cultivated Paradigm’s high-performance culture—where everyone, regardless of title, practices daily self-reflection and works with “radical transparency.” Palmedo insists: “Everyone must be in the top 1% of their field.”

By mid-2019, crypto prices began recovering, but most investors remained cautious. Paradigm re-entered the market as initial LPs committed an additional $360 million. This timing exemplifies Huang’s approach: raising capital when others doubt, partnering only with those who believe crypto will fundamentally reshape finance.

Though crypto hasn’t fully delivered on its transformative promise, Paradigm’s investments have yielded extraordinary returns. Public filings show its flagship fund grew from $760 million to $8.3 billion by end-2024. Sources say Paradigm has already returned all LPs’ initial capital and distributed over $1 billion in profits from the fund.

Insight

Despite Paradigm’s early success, one wonders why Huang—a man long free from financial worry, with a “perfect job” at Sequoia—would venture into the uncertain, volatile world of crypto?

Coinbase CEO and co-founder Brian Armstrong has pondered this too: “Who leaves a job at Sequoia, right?” But he offers an answer: “He’s a silent killer. Our industry needs more people like him—high integrity, focused on long-term goals, doing it for the right reasons. He has extraordinary conviction, willing to take the road less traveled.”

For Huang, the answer is simple: “I’ve always had a certain skepticism toward authority, so whenever I see authority exerting influence, I wonder: Is this really how we want the world to function?”

He continues: “Everyone in the U.S. looks at China and says, that looks dystopian. But I don’t think they fully realize the same thing is happening in the West.”

Take the Obama-era “Operation Choke Point,” where the U.S. Department of Justice tried to restrict banking access for certain industries. Phase one (2013–2017) targeted so-called “high-risk” sectors like payday lenders and gun dealers. Under Biden, “Choke Point 2.0” has targeted crypto, using “debanking” to suppress the industry. Even individuals like Uniswap founder Hayden Adams and Gemini co-founder Tyler Winklevoss have had bank accounts suddenly closed without explanation.

Huang divides crypto’s evolution into three key phases: first as money, then as a financial system, finally as an internet platform. Each phase builds on the last. He explains: “Money is the origin of the crypto ecosystem. Buying your first Bitcoin or setting up your first wallet is often the gateway to other crypto apps. It’s like getting your AOL account and connecting to the internet for the first time.”

In the money phase, crypto has achieved astonishing results. From a 2008 white paper to nearly $2 trillion in value today, Bitcoin has become the most successful “startup project” since its inception. Remarkably, even countries—including the U.S.—are beginning to accept Bitcoin.

Institutions that mocked crypto in 2018, like BlackRock CEO Larry Fink (who called Bitcoin a “money laundering index”), now embrace the technology. In 2024, BlackRock’s Bitcoin ETF attracted $50 billion in just 11 months—the fastest-growing ETF in history. Traditional portfolios are shifting too—Fidelity now recommends allocating 1–3% of assets to crypto. The classic “60/40” portfolio is evolving into “59/39/2,” with institutions carving out dedicated allocations for crypto assets.

The second phase—building a new financial system—is accelerating. Unlike traditional finance’s layers of intermediaries, crypto enables near-instant transactions, 24/7 markets, and innovative financial instruments—all built on permissionless foundations. The rise of stablecoins illustrates this potential: blockchain-based digital currencies pegged to stable assets like the dollar, growing from $500 million to over $200 billion since Paradigm’s founding.

The third phase—as an internet platform—remains nascent, not yet fully formed. Unlike today’s internet, crypto promises true digital ownership and peer-to-peer interactions without middlemen. Currently, high transaction costs limit everyday applications like social media and gaming, but Huang believes new scaling technologies will drastically reduce costs. Infrastructure supporting NFTs and meme coins today will power more serious, significant applications tomorrow—just as YouTube evolved from cat videos into one of the world’s most important platforms.

CAROLYN FONG

Huang, Ehrsam, and Palmedo outside their top-floor office in San Francisco.

Of course, like any new technology, crypto has a dark side. Scams and hacks are common. Meme coins encourage short-term thinking over real building. Token prices swing wildly. Projects collapse frequently. The industry often feels more like a casino than the future of finance.

Yet Huang chooses a long-term perspective. Just as the early internet attracted brilliant researchers alongside scammers and fraudsters, crypto’s open borders foster both innovation and abuse. Each new wave—even seemingly irrational speculative bubbles—brings fresh talent and capital to build critical infrastructure.

Stablecoins are a perfect example. The 2017 ICO (Initial Coin Offering) bubble brought crypto into the mainstream and created a generation of crypto millionaires. Some of that capital flowed into stablecoin development, significantly improving infrastructure. On Ethereum, sending USDC (a popular dollar-pegged stablecoin) cost $12 in 2021; today it’s $1. On Coinbase’s popular Layer 2 network Base, the same transaction costs less than a penny. This cost reduction has fueled explosive growth in circulation—up 400x since the bubble burst—and enabled real-world use cases.

For instance, SpaceX uses stablecoins to repatriate revenue from emerging markets, converting local currency into digital dollars for instant transfers. Scale AI pays its global data labeling network via stablecoins, eliminating friction and cost in cross-border payments. Companies like Ramp have discovered another advantage: when savings accounts yield mere basis points, Treasury-backed stablecoins capture most of the yield banks typically keep for themselves.

Data confirms the trend. Over the past five years, stablecoin transaction volume has grown 120% annually. In 2024 alone, stablecoins processed $5.6 trillion in payments—nearly half of Visa’s $13.2 trillion. This momentum led Stripe to acquire stablecoin payments platform Bridge in October 2024. Stripe co-founder Patrick Collison says: “Stablecoins are the room-temperature superconductor of financial services. Thanks to stablecoins, global businesses will enjoy dramatic improvements in speed, reach, and cost efficiency in the coming years.”

Matt’s personality traits stand out. He’s calm, rigorous, and patient—qualities perfectly suited to complex technologies like crypto, whose impact accumulates over time.

–Patrick Collison, Stripe

This adoption curve mirrors crypto’s broader evolution: Bitcoin launched in 2009, reaching one million users by 2011; Ethereum followed in 2015, hitting the same milestone in 2017. Then came stablecoins in 2019, DeFi (Decentralized Finance) in 2021, NFTs in 2022, and social apps in 2023.

Critics often note crypto’s limited impact on everyday commerce. Huang sees stablecoins as the next “killer app,” but distinguishes between “single-player” technologies (like AI) and “multiplayer” ones (like crypto). The former deliver immediate utility; the latter require coordinated adoption. He explains: “It’s like learning a new language or building a new city. If you’re the only one doing it, it’s meaningless.” He draws an analogy to email—early critics called it “technically interesting but economically naive,” echoing today’s skepticism toward crypto.

Conversations with Huang reveal a notably calm demeanor toward crypto’s trajectory. Patrick Collison brought Huang onto Stripe’s board not just for his crypto expertise, but for his broad business acumen. Collison says: “Matt’s personality traits are exceptional. He’s calm, rigorous, and patient—ideal for complex technologies like crypto, whose impact unfolds over time.”

What sets Huang apart is his ability to hold both sides of investment logic. “He can engage with the typically more concrete ‘bear arguments,’ while also understanding the technology’s potential—seeing how tiny, nascent things can grow into something monumental,” says Stripe co-founder Patrick Collison.

Recently, artificial intelligence (AI) has captured global attention with its clear, immediate applications. Huang and his team at Paradigm even considered expanding into AI. Yet they ultimately stayed committed to crypto. Huang explains: “AI will thrive with or without us. But crypto is a crucial technology that needs to coexist with AI—and currently lacks strong advocates. We believe advancing crypto’s success is our responsibility.”

Innovation

Paradigm’s commitment to crypto’s success drives an unconventional investment strategy. Unlike most VC firms that wait for “winners” to emerge, Paradigm focuses on creating the conditions for victory. This goes beyond analyzing trends or writing checks—it means solving fundamental technical problems that expand the entire industry’s capabilities.

This research-driven approach emerged almost by accident. When Huang hired his childhood friend and best man Dan Robinson, it wasn’t clear how this self-taught programmer-turned-lawyer would fit into an investment firm. “We wanted Dan on the team because he’s the smartest person I know,” Huang says, “but he wasn’t the most commercial, and we weren’t sure how he’d contribute to investing.” To bring him aboard, they created a novel role letting him spend time on open-source projects—what they call “exploratory research.”

“It turns out this type of research is incredibly valuable in crypto,” Robinson explains. “Most investment research involves gathering and analyzing existing information. We’re trying to invent new things.” Breakthroughs from Paradigm’s research team often stem from theoretical exploration, delivering solutions before companies even realize they need them—like “bullseye liquidity.”

Crypto’s uniqueness lies in how its mathematical mechanisms create massive leverage. Traditional exchanges may need thousands of servers and hundreds of employees to match buyers and sellers. But when Vitalik Buterin proposed a simple formula (x*y=k) on Reddit in 2016, he laid the foundation for autonomous markets on blockchains worth trillions.

Yet this elegant solution, while computationally efficient, wastes enormous capital by spreading liquidity across all possible prices. Paradigm’s research team advances the industry precisely by solving such foundational issues.

Robinson met Hayden Adams in early Ethereum research circles. Adams turned Buterin’s formula into Uniswap. Weeks after joining Paradigm, Robinson wrote a memo on Uniswap, leading to Paradigm’s seed investment and active involvement in protocol improvements. His contribution to Uniswap v2 enabled trading between any Ethereum-based tokens, helping the protocol’s volume surge from $2 billion to over $1 trillion.

Yet throughout 2019, Robinson and Adams worked on a more fundamental breakthrough. Through mathematical exploration, the team discovered a method to concentrate liquidity efficiently within specific price ranges, enabling traders to focus capital where it’s most needed. This innovation birthed Uniswap v3, boosting capital efficiency by 4,000x. $5 million in capital could now provide the same depth as $2 billion spread across all prices. By October 2022, Uniswap was valued at $1.7 billion.

In competing with other firms, Paradigm isn’t just an investor—they’re builders. Coinbase founder Brian Armstrong says: “Paradigm can actually help you build a crypto company. Their team includes experts in protocol design, security, law, even policy.”

–Brian Armstrong, Coinbase

This pattern—research driving breakthrough products—repeats across Paradigm’s portfolio. Last year, when Blur approached Paradigm for help adding margin trading, the team faced a fundamental challenge: How to safely lend against illiquid NFTs with hard-to-determine values? The research team spent four months developing a new lending protocol—Blend. “If you can solve lending for NFTs,” Robinson says, “you can potentially solve lending for any illiquid asset.” Within months of launch, Blend not only created a new lending category but quickly dominated it.

Unlike traditional VCs that separate technical resources from investment decisions, Paradigm’s researchers are central to every investment. They attend every pitch meeting and jointly make all decisions. This deep integration allows Paradigm to spot opportunities others miss—because they’ve already solved similar technical problems. For example, when algorithmic stablecoins (like Terra) gained popularity, Paradigm avoided the space—years of trying to design better stablecoin mechanisms taught them these projects hadn’t addressed core issues.

This deep technical foundation gives Paradigm a powerful edge in deal sourcing and execution, and makes them highly attractive to top talent. As Coinbase founder Brian Armstrong puts it: “When competing with other firms, Paradigm isn’t just an investor—they can genuinely help you build a crypto company. Their team has experts in protocol design, security, law, even policy.”

“The most important part of our process is identifying what the truly critical problems are,” explains Paradigm researcher Robinson. This requires staying close to crypto’s rapidly shifting frontier. Huang adds: “Internet cycles are incredibly short.” He compares this rapid change to Sherlock Holmes’ “street urchin network,” collecting vital intelligence from London’s streets. “Even a two-year gap can alter your understanding of crypto culture.”

This insight led to the Paradigm Fellowship program, aimed at discovering exceptional young developers still in school. The program partly grew from the team’s experience with developer transmissions11. Discovered on Discord while still in high school, he once dialed into a Paradigm pitch meeting during a school assembly—a moment that highlighted both the challenges and opportunities of collaborating with the next generation of crypto innovators.

Through such initiatives, Paradigm not only leads in technical research and investment decisions but plays a pivotal role in shaping the future of the crypto industry.

CAROLYN FONG

Mapping their next breakthrough: Konstantopoulos, Noyes, and Robinson

Crypto, Crypto, Crypto

On the last Thursday of May 2023, crypto news outlet The Block made a discovery that sent shockwaves through the industry. Using the Internet Archive’s Wayback Machine, they noticed Paradigm had quietly removed all mentions of “crypto” from its website and social media, rebranding as a “research-driven technology investment firm.” This seemingly “explosive” revelation—though a month old—sparked immediate backlash. In an industry demanding loyalty and zero tolerance for betrayal, this was seen as a “betrayal.”

“We don’t want to work with you anymore,” a portfolio company tweeted directly at Paradigm, referencing both the rebrand and its investment in FTX—which had become “a scar on the entire industry.” The criticism, though sharp, fit crypto’s usual “no-holds-barred” culture. Under pressure, Paradigm not only restored the word “crypto” but added flashing neon text to its homepage, scrolling “crypto crypto crypto” repeatedly.

Yet the original intent wasn’t complicated. Two researchers complained that potential AI partners stopped replying to emails after seeing “crypto” on Paradigm’s site. “We thought, okay, everyone in crypto already knows us—they won’t look at our website anyway. They read our blog, and every blog post and portfolio company is crypto-related. What’s the big deal?” Huang explains. “But in hindsight, that was clearly a mistake. People see the website as a collective statement of pride.” (Stripe co-founder Patrick Collison even joked that Paradigm’s site “might be the fastest website you’ve used this year.”)

Still, the incident revealed deeper industry tensions. By November 2022, Bitcoin had plunged 75% from its 2021 peak, below $16,000; Ethereum fell 80%. That same month, ChatGPT launched, igniting the AI boom, making crypto seem like “yesterday’s news” to many. Some major VC firms had already begun shifting focus and capital toward AI.

Paradigm’s branding controversy wasn’t just a communications misstep—it reflected crypto’s self-reflection amid a new tech wave. Despite AI’s rise dimming crypto’s spotlight, Paradigm’s loud “crypto crypto crypto” declaration sent a signal: they remain firmly on crypto’s front lines, pushing toward the next breakthrough.

For Paradigm, the website controversy was a microcosm of a humbling period. Just 18 months earlier, the firm seemed unstoppable. Its Bitcoin holdings had grown 15x, early investment Coinbase went public at an $85 billion valuation, and it raised a $2.5 billion venture fund. Yet even the most disciplined crypto investors couldn’t resist the 2021 frenzy.

Fred Ehrsam spotted danger early. In March 2021, he sent portfolio companies a letter titled “Surviving Crypto Cycles.” Prices doubled in two months, Bitcoin’s market cap surpassed $1 trillion, “pixelated crypto art sold for millions.” He warned: “Even senators are using laser eyes! Mania is everywhere.” Drawing from Coinbase’s 2014–2017 slump—when a third of staff quit—he offered practical advice: stress-test systems for 10–100x usage spikes, consider fundraising during capital abundance, and remind new hires of crypto’s brutal cycles.

Paradigm co-founder Matt Huang has a calmer view of crypto cycles: “Bear markets are actually easier than bull markets. The signal-to-noise ratio is high. Prices fall, but from a long-term view, it doesn’t bother us.”

Yet despite timely warnings, Paradigm still made mistakes. “We made a lot of errors during that period,” Huang admits. “When you focus too much on competitors, you start to resemble them.” He recalls seeing rival firm a16z raise huge funds and wondering if Paradigm should match that scale. The firm grew from 18 to 62 people. “We did lower our quality bar,” he concedes. “I remember making compromises, thinking if we didn’t do it—if we didn’t hire that person—we’d fall behind. In hindsight, those were bad decisions.”

Matt Huang may not keep careful accounts or recall the exact peak-to-trough drawdown of Paradigm’s portfolio, but one moment is seared into memory: FTX’s collapse. Paradigm had invested $278 million in the exchange—its largest investment ever. By 2022, FTX had become crypto’s public face, its founder Sam Bankman-Fried appearing at conferences, congressional hearings, and magazine covers. Just the previous October, he gave the keynote at Paradigm’s limited partner (LP) meeting. Weeks later, FTX imploded amid fraud allegations and revelations of customer fund misuse.

The investment failed completely, but the deeper wound was betrayal of trust. During due diligence, Paradigm had flagged a key risk: FTX’s relationship with Bankman-Fried’s trading firm Alameda Research. They asked direct questions but received false assurances. When Huang later testified at Bankman-Fried’s criminal trial, the experience reinforced his belief in founder-vision alignment.

“Clearly, even then, he didn’t share our vision of improving crypto,” Huang says. “To him, crypto was just a tool to make vast wealth and donate it away.” This divergence was stark in policy debates—Bankman-Fried advocated compromises that Paradigm believed undermined crypto’s core promises.

FTX wasn’t Paradigm’s only setback. At the peak of the NFT boom, Paradigm co-led a $300 million Series C round for OpenSea, valuing the NFT marketplace at $13.3 billion. Since then, the platform’s trading volume has plummeted 98%. Another portfolio company, BlockFi, collapsed due to deep ties with FTX.

“In venture capital, some investments won’t pan out,” Matt Huang acknowledges. “It’s always a chance to reflect, and we’ve reflected deeply.” He insists bear markets actually offer clearer signals than bull markets. “Bear markets are easier than manic ones. The signal-to-noise ratio is high. Prices fall, but from a long-term view, it doesn’t trouble us.”

After these trials, Paradigm emerged smaller but sharper. The investment and research team shrank from 20 in 2021 to 11, with stricter standards. The firm set clear filters for new investments: founders must align with Paradigm’s mission of advancing crypto’s frontier.

The website incident offered another lesson: the crypto community’s swift negative reaction showed Paradigm was no longer seen as just another investment firm, but as a flagbearer and benchmark for the entire industry.

Writing the Future

Behind Georgios Konstantopoulos’s desk sits a mini electric guitar, occasionally strummed during impromptu meetings. The CTO’s spontaneous playing during blockchain architecture discussions perfectly captures his approach—technical mastery blended with intuitive grasp of practical feasibility.

In 2019, Konstantopoulos was a sought-after researcher and software engineer, renowned in crypto circles for his development skills. His technical work was so rigorous that companies in Paradigm’s portfolio kept mentioning his name.

When Huang first met him at a conference, Konstantopoulos was weighing whether to expand his consulting business or join a startup. But Huang, with his distinctive vision, offered a third path: designing a role like Robinson’s, blending technical research with investment evaluation.

This role evolved in unexpected directions. In 2020, while helping portfolio company Optimism implement research, Konstantopoulos noticed many projects struggled with the same foundational issues. These weren’t conceptual problems—they lacked the tools to build. Rather than support each company individually, Konstantopoulos had an idea: Could they build open-source infrastructure to advance the entire industry?

“People say certain things are hard, but they’re not. They’re hard because you don’t control your tools.”

——Georgios Konstantopoulos, Paradigm

This philosophy gave birth to Foundry—Konstantopoulos’s first major contribution. He built a tool in one weekend that dramatically simplified secure smart contract development. Think of it as a “spell-checker” for blockchain code—but instead of catching typos, it prevents million-dollar vulnerabilities. Within months, Foundry became the industry standard, now boasting 90% market penetration and protecting over $100 billion in smart contracts.

Yet Foundry’s success revealed deeper challenges in crypto. Ethereum, the core platform driving innovation, was hampered by inefficient software severely limiting scalability. Like trying to stream 4K video over dial-up, it simply couldn’t meet demand. Konstantopoulos proposed a radical solution: rebuild Ethereum’s core node software from scratch.

“You’re crazy—this will take five years,” team members responded. But Konstantopoulos, backed by earned trust and deep understanding of team capability, pushed forward. His unique hiring approach helped too—instead of traditional interviews, he looked for engineers through open-source contributions. “Code doesn’t lie,” Konstantopoulos says. “I want to see how people solve real problems.”

The project, named Reth, was completed in just 18 months. Though its function seems simple—download transactions, execute locally, write to database—its impact is profound. By optimizing this core process, Reth reduced size by 80% and increased speed tenfold. Since its June 2024 release, major platforms including Coinbase’s Base, WorldCoin, and Optimism (valued at $1.65 billion in 2022) have adopted its superior performance.

Paradigm’s technical contributions form a virtuous cycle: research teams identify problems while evaluating investments, then build open-source solutions that become industry standards. These tools attract top developers—some join portfolio companies, others become founders, and in some cases, join Paradigm itself.

This strategy reached a new peak last October—Paradigm incubated Ithaca, funding it with $20 million. Georgios Konstantopoulos serves as Paradigm’s CTO and Ithaca’s CEO, aiming to commercialize the team’s developed technologies. “Things that would take other teams 20 to 30 engineers, seed funding, and two years,” he says, “we can do in weeks.”

Konstantopoulos’s confidence stems from his deep understanding of every layer of the tech stack—from cryptography to user interfaces to core tools like Reth and Foundry. He insists: “People say certain things are hard, but they’re not. They’re hard because you don’t control your tools.” This philosophy of “tool sovereignty,” combined with acute awareness of industry needs, has fundamentally transformed Paradigm’s role in crypto.

Reflecting on his growth, Konstantopoulos sums it up in typical Greek fashion: “Matt is the only mentor I can never surpass.” Most mentors are eventually outgrown, but in Huang, Konstantopoulos found a leader who evolves with the team. For engineers at his level, the usual path is to leave and start a company—but he and others choose to stay at Paradigm because Huang grows alongside them. “They push me every day to be better,” Huang says. “And I don’t want to be surpassed either.”

On the back of Matt Huang’s MacBook, there’s a telling detail: three stickers neatly arranged—Foundry, Reth, and Paradigm. It reflects his obsessive attention to detail and reveals his evolving thinking about venture capital. “What if Sequoia didn’t just back Google—but actually founded Google?” This is a question Huang finds himself asking more often. It points to a future where the line between investor and creator blurs.

From a game-obsessed teenager to architect of crypto’s core infrastructure, Konstantopoulos embodies Huang and Ehrsam’s original thesis: crypto needs a new kind of investor. One who doesn’t just assess technology but can build it—shaping the future of finance line by line. In an industry instinctively resistant to centralized authority, Paradigm focuses on building, not controlling, becoming one of crypto’s most trusted institutions. Huang and his team aren’t just investing in the future—they’re writing it, one line at a time.

CAROLYN FONG

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News