The single-use debate in blockchain: Is Tempo truly a blockchain?

TechFlow Selected TechFlow Selected

The single-use debate in blockchain: Is Tempo truly a blockchain?

Stripe's Tempo, developed in collaboration with Paradigm, may ultimately test how much people are willing to pay for "decentralization."

Author: Byron Gilliam

Translation: Saoirse, Foresight News

"No one goes out of their way to buy a Swiss Army knife—it’s usually a Christmas gift." — Jensen Huang

Great companies start more like a "scalpel" than a "Swiss Army knife." Businesses focused on a single domain are more likely to excel in that area and enable users to clearly remember their core value.

Take internet companies in 1999 as an example: Yahoo's homepage included search, auctions, news, email, instant messaging, and more, yet performed mediocrely in each category. Google, by contrast, focused solely on search—making its purpose instantly clear to users—and went on to dominate the search space. Today, "Google" has become synonymous with "search," while Yahoo is left hosting niche services like fantasy baseball leagues. This validates the business principle that mastering one thing beats being average at many.

So, does this logic apply equally to blockchain?

Status Quo: The Parallel Development of Two Blockchain Models

Bitcoin is a blockchain dedicated to a single use case—transferring Bitcoin—and its simplicity may be precisely why it has achieved such massive success.

Ethereum and Solana, however, are general-purpose blockchains, and they have also achieved notable success.

Yet these two models don’t seem to erode each other: Bitcoin has yet to break through in DeFi, and Ethereum has never become a mainstream currency.

Does this mean both models can coexist peacefully?

It might be too early to conclude, because general-purpose blockchains are about to face a new, single-use competitor.

The New Variable: Tempo

Last week, payments giant Stripe and investment firm Paradigm jointly announced the development of Tempo, a new blockchain focused exclusively on stablecoins. Upon its reveal, Tempo was immediately seen within the industry as a "potential winner in crypto payments," directly addressing key pain points of general-purpose blockchains:

-

Predictable fees: Settlements in stablecoins, no need to hold native tokens

-

Fast confirmations: Achieves "near-instant" transaction finality

-

Balanced privacy and compliance: Supports "opt-in" privacy and compliance features

-

Dedicated payment lanes: Separate "channels" to avoid congestion from other applications

-

High throughput: Optimized specifically for payments, far surpassing general-purpose chains in efficiency

Matt Huang, leading Tempo’s development, stated: "Focusing on a single domain enables faster iteration. We urgently need to meet upcoming market demand while reducing reliance on other ecosystems (like Ethereum L1)."

This indirect challenge to Ethereum raises speculation that Tempo’s ambitions may extend beyond just 'payments.'

More notably, Matt Huang mentioned: "While Tempo starts with permissioned validators, it will be permissionless from day one and gradually advance decentralization."

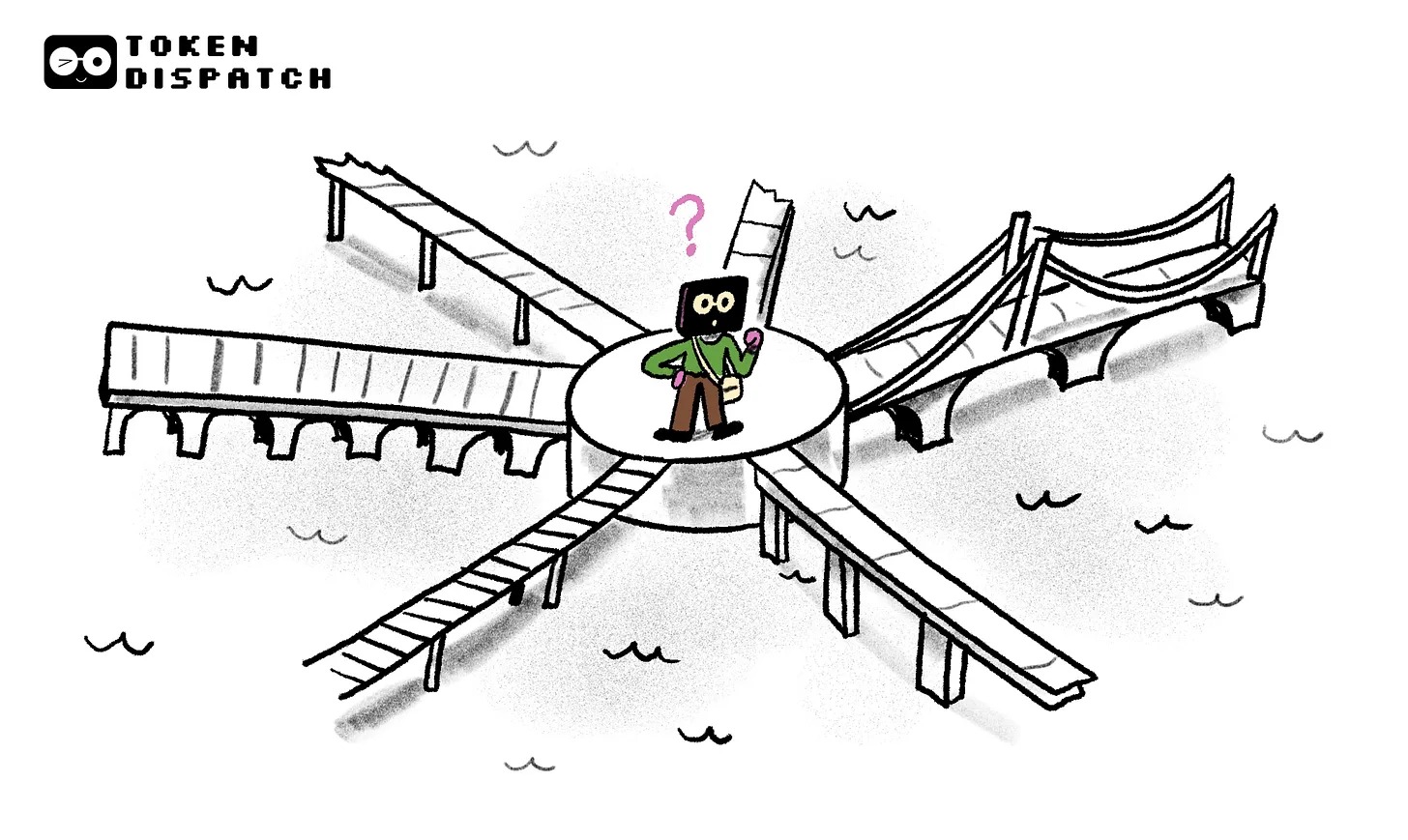

A blockchain that is both decentralized and highly specialized in payments sounds strikingly similar to the ideal version of a general-purpose blockchain. Could Tempo become a full-stack rival to Ethereum and Solana?

Controversy: The Expansion Paradox of Single-Use Blockchains

From a business perspective, there are plenty of successful examples of "master one thing first, then expand": Microsoft began with the BASIC programming language and expanded into operating systems, office software, and cloud computing; Amazon started as an online bookstore and grew into an e-commerce giant covering all categories; Apple entered via personal computers and now dominates an ecosystem of smartphones, computers, and wearables. If Tempo establishes itself in payments, it might replicate this horizontal expansion and become a more comprehensive blockchain than Ethereum.

But counterexamples exist too: In the past, dedicated calculators vastly outperformed general computers in arithmetic speed—yet who buys a standalone calculator today? More people keep a Swiss Army knife in their drawer than a Texas Instruments calculator. This suggests that if general-purpose technologies keep improving, single-use tools may eventually become obsolete. Then again, will general-purpose blockchains eventually render "payment-specific chains" irrelevant?

Industry opinions are sharply divided:

Max Resnick favors general-purpose blockchains: "Decentralized blockchains will ultimately surpass centralized systems—including single-use chains—in speed, scale, reliability, and even compliance."

Mert Mumtaz questions Tempo’s positioning: "It’s not even a real blockchain, let alone a general-purpose one—since when does a blockchain exist just for payments?" In his view, "decentralization" is blockchain’s core trait, and any truly decentralized blockchain must inherently support general-purpose functionality. If Tempo pushes toward full decentralization, it will inevitably attract meaningless projects like "shitcoins," clogging up the network and degrading payment performance.

Mert Mumtaz further argues that a "payment-specific chain" has only two viable paths: either be non-Turing complete like Bitcoin (supporting only transfers, no complex code), or adopt a permissioned model (centrally controlled nodes). If so, Ethereum and Solana have little to fear from being replaced by Tempo—after all, Tempo is either functionally limited or insufficiently decentralized.

But the crucial question remains: If Tempo delivers faster, cheaper payments without full decentralization, and becomes the primary circulation layer for stablecoins, will users still care whether it qualifies as a "real blockchain"?

Conclusion: A Test of the Value of Decentralization

Rather than merely a race between single-use and general-purpose blockchains, this is a test of the value of decentralization: How much are users willing to pay for decentralization? Are they willing to accept slower speeds and higher fees for the sake of blockchain’s decentralized nature? Or do they prefer efficient, low-cost services—even if they’re less decentralized?

Tempo’s emergence may just be the litmus test for this very question.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News