Ten Years of Breakthrough in Enterprise Blockchain

TechFlow Selected TechFlow Selected

Ten Years of Breakthrough in Enterprise Blockchain

This is not a revolution, but perhaps real adoption.

Author: Jill, Chief Strategy Officer at Espresso

Translation: Luffy, Foresight News

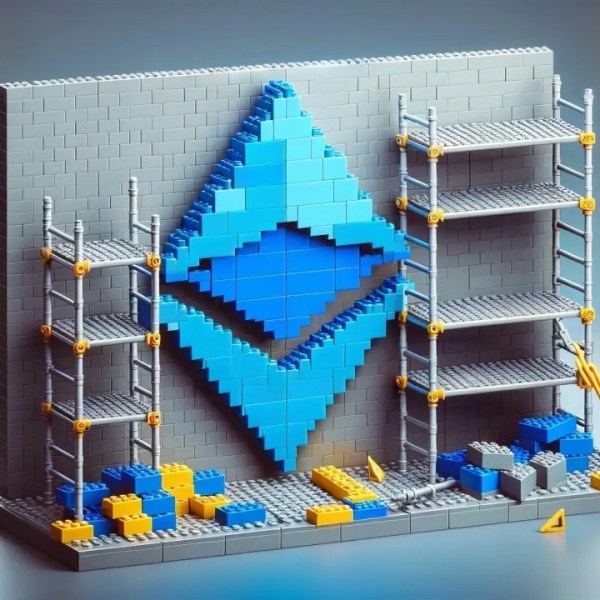

A crypto Twitter user recently opened LinkedIn and stumbled upon a post by Google’s Web3 lead (Wait—Google has such a role!?).

The post revealed some details about Google's Layer 1 blockchain product (Wait—what?), leaving the entire industry baffled.

Unlike others, I’m not surprised that Google is building a Layer 1 blockchain. Partly because I remember the "crazy years" from 2015 to 2020 when nearly every major company—from Microsoft and Alibaba to JPMorgan and LVMH—launched their own blockchains.

To be honest, objectively speaking, most of those early corporate blockchain experiments went nowhere. These blockchains became symbolic art installations in corporate lobbies: clients and institutional investors could catch a glimpse of “innovation” and feel a touch of “modernity” as they walked by—but that was it; don’t stop, don’t ask questions.

By 2018 or 2019, corporate blockchains seemed destined to fade away—until Facebook launched its Libra project. Sigh, five years too early. Held back by the Biden administration’s regulatory stance and general caution toward crypto, the project never materialized. But when Zuckerberg announced it in 2019, it sparked a new wave of FOMO, prompting tech companies from Silicon Valley to Seoul to jump on the bandwagon, reigniting corporate blockchain efforts.

The Innovation Lab Dilemma

It’s been ten years now since “blockchain” and “distributed ledger technology” first appeared in Fortune 500 boardroom memos and meetings (Yes, ten years!). Most of these projects remain trapped in “proof-of-concept purgatory,” never making it to production. There are a few successful deployments (Kakao’s Layer 1 blockchain Kaia deserves mention), but overall, most never left the lab.

“The Innovator’s Dilemma” refers to how large, established companies often lose market share to more agile, unburdened startups when facing disruptive technologies. The book introducing this concept was published in 1997, just before the dot-com bubble, and advised big firms to create startup-like units (often called “innovation labs”) to guard against such risks.

For the past decade, corporate executives have believed innovation labs would protect them from disruption. These labs busied themselves rebranding open-source blockchain code, running tests in sandbox environments, and producing mostly press releases.

In recent years, many executives may have scrutinized these resource investments, wondering whether to keep “playing innovator,” questioning if blockchain is just another tech bubble (like the one that burst shortly after “The Innovator’s Dilemma” became a CEO bestseller). Should they shut down the lab and admit failure? Pause experiments, keeping only a skeleton crew tinkering quietly? Or double down, continuing to search for innovations with real business applications? This is the innovation lab dilemma.

Apple Chain

I don’t know if Google’s Layer 1 is a leftover from the previous era or a brand-new initiative; nor whether it’s already live or still under development (though the LinkedIn post mentioned a “private testnet”). Beyond press releases with enterprise partners like CME Group, there’s almost no information available. I actually know nothing about Google’s blockchain operations.

But I do know another tech giant is indeed running its own Layer 1 (using a loose definition of “Layer 1”—which, frankly, is the only way it makes sense in an enterprise context): Apple.

Apple has never announced a “blockchain innovation lab,” released a Web3 strategy, or issued related press releases. In fact, searching “Apple Chain” mostly yields news about Apple removing blockchain-related apps from its App Store—not about Apple building its own blockchain.

And yet, it did exactly that.

Here’s the story: Within Apple Intelligence, a particularly innovative component emerged in recent years—Private Cloud Compute (PCC), a system designed for private AI processing. In related technical blogs, Apple described an architecture providing verifiable privacy and security guarantees for security researchers: “Apple publishes measurements of all code running on PCC into a tamper-proof, cryptographically secured, append-only transparency log.”

That sounds exactly like a blockchain. It’s not programmable, doesn’t support your favorite DeFi apps, won’t be used by major financial institutions for settlement innovation, but Apple’s blockchain might just have achieved the elusive holy grail of “practicality.”

Side note: Is it surprising that @cathieyun, a key contributor to this Apple project, has a background in blockchain protocol development?

Fulfilling the Web3 Dream

If you’ve spent a few years in crypto, you might recall the grand, beautiful vision from the early days.

Before yield farming and “hot air” mining, before airdrop mania and infrastructure booms, there was just one dream: Blockchain would become the “machine of trust.”

-

Instead of Web2 platform capitalism, we’d have decentralized social media, decentralized sharing economies, and decentralized creator markets—owned collectively by everyone, yet belonging to no one;

-

We wouldn’t rely on corporate media’s “Fourth Estate,” but instead use decentralized prediction markets and oracles, with free-market incentive systems to determine and disseminate truth;

-

We’d have an open, verifiable global payment and transaction system, rather than centralized, opaque, extractive financial firms.

On these use cases, the industry has actually done fairly well. While not quite the chrome-and-green-grass, flying-cars future we imagined, tangible products now exist across all these areas, many reaching mainstream users—perhaps a sign of impending adoption!

Most of these products were built by startups on public chains like Ethereum and Solana. Some startups (like Circle and Coinbase) have even grown into major companies.

Despite setbacks in mainstream acceptance and adoption, despite complaints about “lack of use cases,” the industry has held up reasonably well. And while the sector gained notoriety for criminals (again, SBF), making cynicism easy, a closer look shows the Web3 dream remains as grand and beautiful as ever.

I believe adoption of stablecoins, DEXs, and prediction markets on Ethereum will continue growing. But I also think blockchain adoption is about to undergo a significant shift. Unfortunately for dreamers, this shift may be far less glamorous—more practical, more like “Apple Chain.”

Web2.5: The “Unexciting” Practicality

It’s time to grow up. Idealists should embrace pragmatism. We must accept that the “machines of trust” we built are essentially ledgers, distributed databases, middleware.

To be clear: I think this is great. It benefits the industry and represents the best chance for the past decade’s real innovations to achieve scalable impact. It’s through this path that processes securing global asset and data flows will transform, and our technologies will change lives.

Unlike past corporate experiments, I believe the corporate blockchain moment has arrived. Corporations will become the primary channel pushing this technology into the world. This is happening not only because regulation has eased, but because the technology, use cases, and talent are mature enough for real production deployment.

But I predict large-scale corporate blockchain adoption won’t unfold as innovation labs envisioned, nor resemble the Enterprise Ethereum Alliance’s 2017 hype. I also doubt corporations will position blockchain as “neutral infrastructure.” Consider @gwartygwart’s take:

“The funniest part is ‘Tether won’t use Circle’s blockchain,’ acting like Google is some neutral arbiter. This is the same company that rigged its ad auctions to screw over merchants, now somehow the last hope for fairness.”

Listen to @ethereumJoseph, who’s been fighting on the front lines:

“Permissioned enterprise chains were tried years ago and failed. Why? Because no one sufficiently trusted the central controllers to build on them. For decades, the ‘delisting’ drama has repeated itself.”

Indeed, enterprise blockchains are unlikely to be the fully open, permissionless systems demanded by purists. Unsurprisingly, they’re also unlikely to protect civil liberties or empower dissidents as cypherpunks hoped.

I suspect Apple’s “append-only, cryptographically tamper-proof transparency log” used to prove commitments to security researchers might be as “cypherpunk” as corporate blockchain applications get.

Rather, corporations will develop and adopt blockchain solely for its “practicality”—to solve the only problem that matters to them: increasing profits. This is Web2.5.

Several areas already show this trend:

-

Robinhood is using tokenization as a financial engineering tool to bring U.S. stocks to European retail investors. Vlad Tenev talks about it in visionary terms that easily seduce us dreamers, but make no mistake: this is essentially replacing backend databases with blockchain (plus some geographic arbitrage), far removed from Satoshi’s vision. And that’s okay.

-

Stripe is acquiring and developing stablecoin technology (including its own blockchain!) likely aiming for lower-cost global distribution than existing systems. Corporate motivation, corporate tech, yet capable of massive impact and scale. I welcome this approach.

I believe corporations will adopt blockchain for these additional goals:

-

Enterprise blockchains serving as payment infrastructure tailored for AI agents—a capability existing financial rails cannot retrofit;

-

In the deepfake-saturated “post-truth era,” using hashes to link data in tamper-proof, append-only ledgers for verifiable timestamps on images and videos offers enterprises a valuable solution;

-

As @diogomonica noted, a public company’s Layer 1 might become the new standard for developer platforms, enabling businesses to build open ecosystems composed of composable applications.

Given these reasons, Google developing a blockchain platform makes perfect sense. Even more logical is that it’s led by Google Cloud, which naturally handles foundational, transformative, yet deeply technical infrastructure. That’s what these blockchains ultimately are.

This isn’t revolution, but perhaps genuine adoption. To the new corporate “overlords” of crypto, I say: Welcome.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News