The Future Engine of FinTech: Ant International Reshapes Global Fund Management with "Blockchain + AI"

TechFlow Selected TechFlow Selected

The Future Engine of FinTech: Ant International Reshapes Global Fund Management with "Blockchain + AI"

Blockchain and AI technologies are fundamentally transforming how capital, information, and businesses connect within the economy.

By TechFlow

Since 2025, the digital asset sector has witnessed a series of landmark developments: In March, the U.S. Senate passed the GENIUS Act by a wide margin; in May and June, Hong Kong released its Stablecoin Ordinance and Digital Asset Declaration. Multiple tech giants have announced major stablecoin initiatives, with Circle’s IPO surging ahead, fueling a wave of market optimism.

Yet, as the rise and fall of internet companies in the 2000s revealed, only digital innovations that move beyond concepts and declarations to achieve large-scale adoption across real-world scenarios can truly endure across cycles.

In fact, the answer for stablecoins is already emerging. In early 2024, SpaceX revealed on a podcast that to overcome cross-border settlement challenges, its Starlink division had begun using the stablecoin payment platform Bridge for global fund settlements. The news sent shockwaves through the industry and ultimately led to U.S. payments giant Stripe acquiring Bridge for over $1 billion.

Corporate global clearing and treasury operations represent the anchor for sustainable growth in the stablecoin and broader digital asset industry. In June, media reports indicated that Ant International plans to apply for stablecoin issuance licenses in Hong Kong, Singapore, and Europe. In response, Ant International stated: “We are accelerating investments and expanding partnerships in global treasury management, bringing AI, blockchain, and stablecoin innovations into reliable, large-scale real-world applications.”

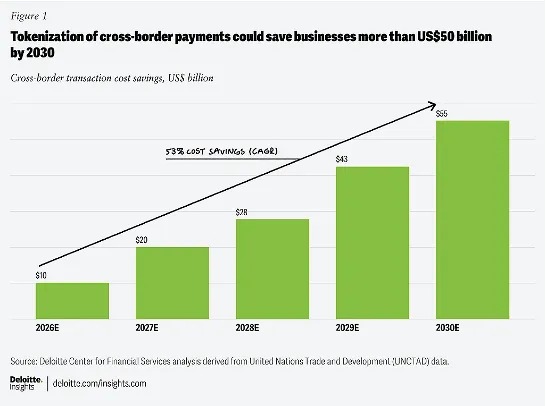

On July 3, under the Monetary Authority of Singapore’s (MAS) Project Guardian innovation initiative, Ant International—co-leading the foreign exchange working group—jointly released the industry framework *Tokenized Deposits in Transactional Banking* with the International Swaps and Derivatives Association (ISDA). According to estimates, this framework could reduce cross-border transaction costs by 12.5%, saving businesses over $50 billion cumulatively by 2030.

These moves by industry and regulators show that the future of stablecoins and blockchain finance will not be shaped by speculative capital, but by an ongoing revolution in enterprise treasury management. The vast market for Treasury Technology (“Treasury Tech”) is set to become the decisive battleground in global FinTech.

FinTech: The Rise of Treasury Tech

For decades, treasury management has been a persistent challenge for every multinational business. Despite massive demand, it has remained a “digital island” due to outdated systems, rigid processes, and complex risk management—like a hidden gold mine waiting to be unearthed.

The difficulties are twofold. First, cross-border payments involve complex processes, high transaction costs, and settlement delays that lead to financial risks and losses. Infrastructure remains highly centralized, with lengthy procedures and layered compliance costs passed down the chain. Each intermediary in a cross-border settlement—be it banks, agents, or currency providers—charges fees for transactions, settlements, and foreign exchange. Disconnected compliance checks, uneven risk controls, and time-zone mismatches further exacerbate delays.

Second, there's currency volatility. Exchange rates fluctuate wildly amid shifting geopolitical dynamics, yet companies must still operate in weaker, less stable emerging markets. Businesses must manage cash flows across global counterparties, ensure smooth multi-currency transactions, and accurately assess and monitor working capital needs worldwide.

For multinational enterprises, predicting and managing foreign exchange needs is the cornerstone of cash flow management. Finance teams typically rely on historical data and basic trend analysis, which struggle to respond to market swings, seasonal shifts, or sudden disruptions. This forces companies to either hold excessive buffer funds—leading to idle capital and lost returns—or conduct frequent emergency fund transfers. Industry data shows suboptimal FX strategies cost businesses an average of 1.5%-3% in additional expenses.

Trapped in this system are not just multinational platforms, but especially small and medium-sized enterprises (SMEs) in emerging markets. A Mexican company sourcing raw materials from Vietnam may go through four or more financial intermediaries: local Mexican bank → local FX provider → international agent bank A → international agent bank B → Vietnamese FX provider → local Vietnamese bank. Specific B2B payments can take 3–7 days to clear, costing $14–$150 per $1,000 transacted.

An analysis by Deloitte Financial Services Center, citing data from the United Nations Conference on Trade and Development (UNCTAD), projects that tokenization of cross-border payments could save businesses over $50 billion in transaction costs by 2030. This vast, deep landscape of corporate cross-border payments is precisely the market Ant International is targeting.

Ant International: Forging a New Frontier in Global Enterprise Financial Services

In 2024, Ant Group underwent restructuring, with Ant International officially becoming an independent operating entity. As described on its website, headquartered in Singapore, Ant International provides cross-border digital payments, financial, and digital services to global merchants and financial institutions. Its four core business units are: Alipay+, Antom, WorldFirst, and Bettr.

In 2018, Alipay launched a "global lucky draw" campaign—back when Ant’s international focus was mainly helping Chinese tourists abroad and supporting Chinese e-commerce platforms going global. By 2024, these four business lines had evolved to leverage fintech in enabling seamless travel experiences, and empowering both online and offline global operations and growth for enterprises. The target clients are now primarily businesses and institutions with cross-border payment and settlement needs, spanning industries such as e-commerce, digital entertainment, and online travel agencies (OTAs). It supports digital payments in over 70 offline markets, e-commerce payments in 200 markets, offers more than 100 settlement currencies, and supports over 300 payment methods.

For instance, WorldFirst (Wanli Hui), Ant International’s global business account service widely used by overseas e-commerce sellers, serves over 1.2 million SMEs and became last year the world’s largest digital account provider for e-commerce SMEs. Antom, its merchant payment service, supports leading global and Chinese e-commerce platforms, airlines, and digital entertainment firms, and is the largest payment provider in the Asia-Pacific region for several international digital platforms.

From Chinese cross-border sellers to overseas ones, WorldFirst has become an essential payment tool for businesses engaged in global trade

Qualitative change follows quantitative expansion. Rapid growth in business scenarios has driven a surge in the scale of funds under management. According to media reports, Ant International processed over $1 trillion in total transaction volume in 2024 alone.

With this massive flow of funds comes its behind-the-scenes manager—the previously little-known Platform Technology department (Platform Tech)—now stepping into the spotlight. Between 2020 and 2025, they quietly built a “secret garden” integrating blockchain and AI, transitioning from internal treasury use to external customer-facing services. In 2024, Ant International launched its new scenario finance business line, with the Platform Tech unit emerging as a fast-growing pillar of the business.

Blockchain and AI: The GPT Moment for Global Treasury Management

Over recent years, blockchain technology has gone through ups and downs, finally finding its most mature and ideal commercial application in global fund settlement. Shared ledger systems offer a revolutionary solution to traditional pain points like time-zone differences, settlement delays, and fragmented liquidity, ushering in a new era of low-cost, scalable, instant cross-border payments.

Take Alipay+ under Ant International: it provides cross-border payment technology services to digital wallets in multiple countries and regions. When a Malaysian tourist uses their local wallet via Alipay+ to pay a merchant in Singapore, the blockchain-powered real-time settlement system eliminates the delays and extra costs associated with traditional banking channels for all parties—the tourist, the merchant, the wallet provider, and the linked bank.

Alipay+'s cross-border service allows more global travelers to use their home wallets abroad, creating new business opportunities for merchants worldwide

This is why stablecoin-based settlement using blockchain technology has attracted significant attention from global giants like SpaceX, Walmart, and Amazon. Leading digital asset investor a16z (Andreessen Horowitz) even published an investment memo detailing the industries most suited for stablecoin adoption—from e-commerce to logistics.

According to Deloitte research, this innovative payment method could reduce cross-border transaction costs by 12.5% by 2030, saving corporate clients over $50 billion cumulatively. The transparency and immutability of blockchain ledgers also meet mainstream financial institutions’ stringent security and compliance requirements.

In 2018, Ant International completed its first cross-border blockchain remittance in Hong Kong. Since 2020, several international banks have disclosed partnerships with Ant International’s blockchain cross-border settlement platform, Whale, to offer real-time treasury management services to corporate clients.

Whale supports interoperability with multiple tokenized assets issued by leading global banks and financial institutions, enabling businesses to seamlessly transfer and manage funds across different institutions—without relying on traditional interbank settlement processes—while ensuring compliance across jurisdictions. Settlement times have been reduced from days to seconds, with true 24/7 operation, allowing enterprises to execute fund transfers at any time, dramatically improving capital efficiency.

Lei Yue, Head of Platform Technology at Ant International, revealed to media that in 2024, one-third of Ant International’s global transactions—over $300 billion in funds—were processed on-chain using blockchain technology.

If the Whale platform is the 'highway' for enterprise cross-border treasury management—offering 24/7, real-time, secure fund transfer channels—then this highway requires a special 'intelligent navigation system' to guide businesses on when, where, and how to allocate foreign exchange funds globally for optimal efficiency.

Ant International developed an AI-driven foreign exchange demand forecasting model internally named Falcon. Built on the Transformer architecture, Falcon contains nearly 2 billion specialized industry parameters. By integrating advanced time-series forecasting algorithms, the Time-Series Transformer (TST) model can predict corporate cash flows and FX exposures hourly, daily, and weekly, covering hourly and daily forecasts for over 100 currencies, with accuracy exceeding 90%.

With these high-precision forecasts, finance teams can quickly identify potential funding needs and determine appropriate actions. For example, in the airline industry—where fuel prices, travel demand, and exchange rates are highly volatile—this system can reduce foreign exchange costs by up to 60%.

The Whale blockchain infrastructure and the TST AI prediction model complement and reinforce each other, forming an efficient, transparent, and intelligent global treasury management ecosystem. “With blockchain and AI, the daily workflow of corporate finance teams has undergone a revolutionary transformation. Decision-making is shifting from experience-based to truly data-driven—this is the GPT moment for global treasury management,” said Lei Yue.

"Ecosystem, Ecosystem, Ecosystem"

From blockchain to AI, while new technologies excite the market, they also face rigorous scrutiny from regulators and mainstream financial institutions. Ant International has actively participated in innovation pilots in Singapore and Hong Kong, including two flagship regulatory sandboxes: MAS’s Project Guardian and HKMA’s Project Ensemble. In 2023, Ant Group became one of the first participants in the Hong Kong Monetary Authority’s “Digital Hong Kong Dollar” pilot program, with AlipayHK serving as a retail use case for the digital currency.

To maintain trust in the ecosystem, robust compliance and security technologies are essential. Lei Yue emphasized that the integration of the Whale blockchain platform and the TST AI model has created a comprehensive, real-time enterprise treasury security system. Homomorphic encryption ensures secure data transmission, while privacy-preserving computation allows transaction parties to verify transaction occurrences without accessing detailed information. “Fund security, data privacy, and regulatory compliance are the lifeline of treasury services. Investment in AI security must stay ahead of the curve.”

By actively engaging in regulatory innovation, Ant International leverages Singapore and Hong Kong as strategic hubs to build a globally connected enterprise treasury network. Since 2020, its two core treasury technology products have gained increasing recognition from international financial institutions and are now widely deployed in global commercial services. Banks including Citibank, HSBC, Standard Chartered, Deutsche Bank, and BNP Paribas have begun extensively using the Whale blockchain platform in their global client services. The AI foreign exchange forecasting model is now applied across diverse sectors including banking, aviation, online travel, and e-commerce platforms.

In its newly released 2025 vision and mission, Ant International defines itself as a “Digital Partner” within the evolving financial system—not a disruptor like Stripe or Wise.

“We aim to be a tech connector within the constantly evolving financial ecosystem—a builder that makes the system more resilient and inclusive,” explained Douglas Feagin, President of Ant International, in a media interview.

Beneath the surface of everyday commerce, in the vast domain of corporate treasuries, blockchain and AI are fundamentally transforming how capital, information, and business connect across economies.

That may well be where the next wave begins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News