Circle, Tether, and Stripe race to launch stablecoin L1—who will prevail?

TechFlow Selected TechFlow Selected

Circle, Tether, and Stripe race to launch stablecoin L1—who will prevail?

What is the endgame for stablecoin-driven Layer 1?

Author: Terry Lee

Translation: TechFlow

Meme depicting Tether, Stripe, and Circle launching their own versions of L1

Introduction

In less than 12 years, stablecoins have evolved from a niche crypto experiment into a rapidly growing asset class—and as of September 2025, growth continues to accelerate. Notably, this expansion is driven not only by market demand but also by regulatory clarity—the U.S. GENIUS Act and the EU's MiCA regulation have both provided legitimacy for stablecoins. Today, stablecoins are recognized by major Western governments as a foundational component of future finance. More interestingly, stablecoin issuers are not just "stable," they're highly profitable. Fueled by high interest rates in the U.S., Circle, the issuer of USDC, reported $658 million in revenue during Q2 2025, mostly from reserve interest. Circle has been profitable since 2023, with a net income of $271 million.

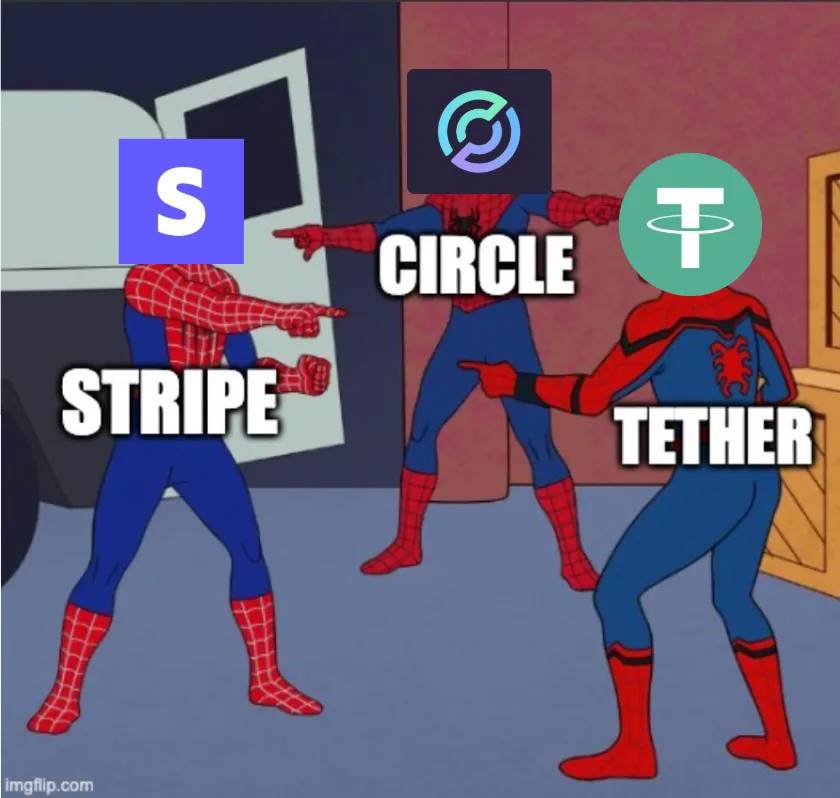

Source: tokenterminal.com, current stablecoin outstanding supply

This profitability naturally fuels competition. From Ethena’s algorithmic stablecoin USDe to Sky’s USDS, challengers continue to emerge, attempting to disrupt the market dominance of Circle and Tether. As competition intensifies, leading issuers like Circle and Tether are turning to developing their own Layer 1 blockchains, aiming to control the future financial infrastructure. These financial infrastructures aim to deepen moats, capture more fees, and potentially reshape how programmable money flows across the internet.

A trillion-dollar question arises: Can giants like Circle and Tether withstand the impact of non-stablecoin-native players such as Tempo?

Why Layer 1? Background and Differentiation Analysis

A Layer 1 blockchain is the base protocol of an ecosystem, responsible for transaction processing, settlement, consensus, and security. For technical audiences, think of it as the operating system of the crypto world (like Ethereum or Solana), upon which all other functions are built.

For stablecoin issuers, entering Layer 1 represents a vertical integration strategy. Instead of relying on third-party chains (such as Ethereum, Solana, Tron) or Layer 2 solutions, they are actively building their own infrastructure to capture more value, strengthen control, and comply with regulations.

To understand this battle for control, we can examine the common characteristics and unique distinctions among Circle, Tether, and Stripe’s Layer 1 blockchains:

Common Characteristics:

-

Use their respective stablecoins as native currencies, eliminating the need to hold ETH or SOL for gas fees. For example, fees on Circle’s Arc will be paid in USDC, while others like Plasma completely waive gas fees.

-

High throughput and fast settlement: Each Layer 1 promises sub-second finality and thousands of TPS (e.g., over 1,000 TPS for Plasma, over 100,000 TPS for Stripe’s Tempo).

-

Optional privacy within regulated environments: These are privacy-enhanced yet compliant crypto ecosystems, achieved at the cost of centralization.

-

EVM compatibility, ensuring familiar development standards for developers.

Unique Distinctions:

-

Circle’s Arc is designed for both retail and institutional users. Its internal foreign exchange engine (Malachite) makes it highly attractive in capital markets trading and payments, potentially positioning Arc as the preferred crypto infrastructure for “Wall Street.”

-

Tether’s Stable and Plasma focus on accessibility, offering zero transaction fees to enable frictionless transactions for retail and P2P users.

-

Stripe’s Tempo takes a different approach, maintaining stablecoin neutrality. Because Tempo relies on its internal AMM mechanism to support various USD tokens, it may strongly appeal to developers seeking flexibility and users indifferent to which USD token they use.

Layer 1 Adoption Trends

From my analysis, three main trends emerge:

Trend 1: Bridging Traditional Finance—Trust and Regulation

For stablecoin issuers, building their own Layer 1 is key to earning trust. By controlling the infrastructure or ecosystem rather than relying solely on Ethereum, Solana, or Tron, Circle and Tether can easily provide compliant infrastructure aligned with frameworks like the U.S. GENIUS Act and the EU’s MiCA.

Circle has positioned USDC as a regulated product, requiring entities that redeem USDC for USD to comply with “Know Your Customer” (KYC) and anti-money laundering (AML) frameworks. Its newly launched Layer 1 protocol, Arc, goes further by combining auditable transparency with privacy features, making it a reliable candidate for institutional adoption. Tether adopts a similar strategy through its Stable and Plasma chains, aiming to become the infrastructure backbone for banks, brokers, and asset managers.

The potential “ideal” use case here is foreign exchange trading. Circle’s Arc offers sub-second finality, over 1,000 transactions per second (TPS), and FX capabilities. Arc could allow market makers and banks to settle FX trades instantly, opening access to the daily $7+ trillion forex market and creating strong network effects. Stablecoins like USDC and EURC could become native settlement assets, locking developers firmly into its ecosystem. This could also open doors for DeFi applications supporting institutional-grade Request-for-Quote (RFQ) systems, leveraging smart contracts to reduce counterparty risk and ensure rapid settlement.

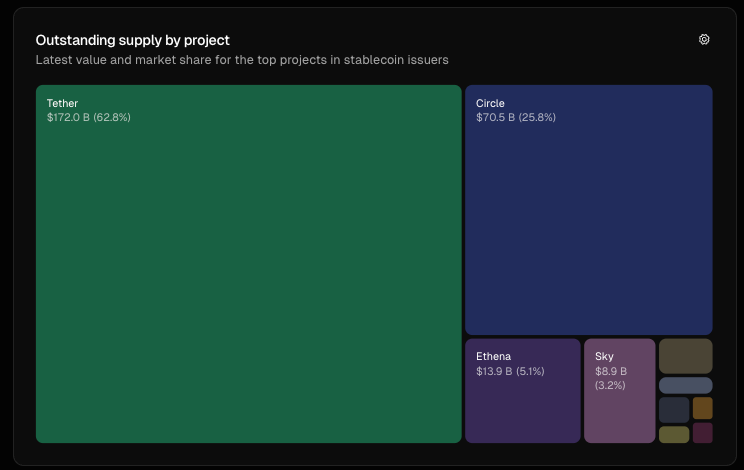

This scenario assumes the use of Chainlink oracles, for illustrative purposes only.

Diagram illustrating transaction flow via Circle’s Layer 1

Imagine a scenario where a forex trader based in Paris executes a $10 million USD-to-EUR trade directly on Arc using the USDC/EURC pair via Malachite. Assuming real-time exchange rates (e.g., 1 USD = 0.85 EUR) are fetched via Chainlink oracles, the $10 million conversion from USDC to EURC could be executed in under one second, reducing traditional FX settlement delays from T+2 to T+0. Done!

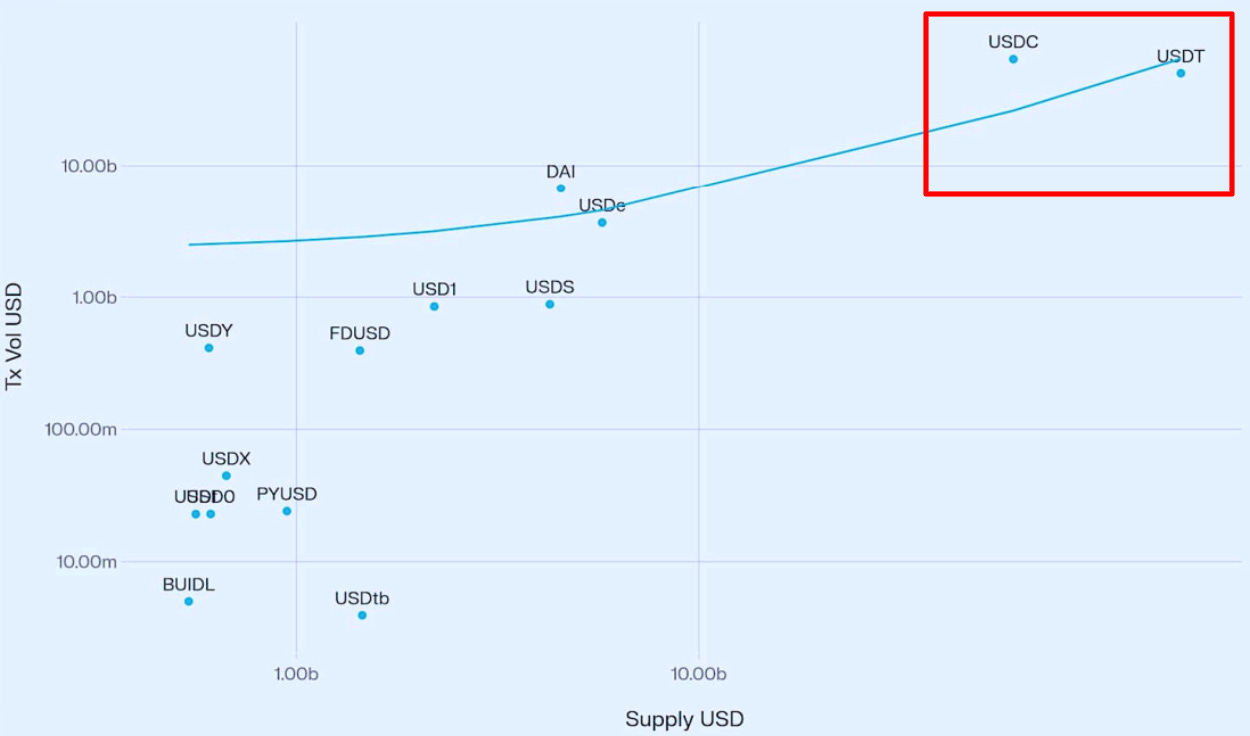

Source: Vedang Ratan Vatsa, “Stablecoin Growth and Market Dynamics”

Research supports this direction. According to Vedang Ratan Vatsa’s study, there is a strong positive correlation between stablecoin supply and trading volume, meaning greater supply leads to deeper liquidity and higher adoption. As the two largest issuers, Tether and Circle are well-positioned to capture this institutional liquidity.

However, integrating traditional finance with blockchain infrastructure still faces significant challenges. Coordinating regulators, central banks, and regional laws involves navigating complex landscapes (e.g., interfacing with national central banks could take years). Issuing stablecoins for different currencies (e.g., XYZ tokens pegged to emerging market currencies) adds further complexity, and adoption in developing economies may be extremely slow or even nonexistent due to limited product-market fit. Even if these hurdles are overcome, banks and market makers may remain reluctant to migrate critical infrastructure to new chains. Such a shift could incur additional costs, as not all currencies are chain-compatible, forcing institutions to maintain both crypto and legacy systems simultaneously. Moreover, as multiple issuers (including Circle, Tether, Stripe, and potentially banks) launch their own blockchains, the risk of liquidity silos intensifies. Fragmentation could prevent any single chain from achieving the scale or liquidity needed to dominate the daily $7 trillion forex market.

Trend 2: Do Stablecoin Chains Threaten Traditional Payment Infrastructure?

As Layer 1s attract traditional finance with their programmability, their rise may also disrupt traditional payment giants like Mastercard, Visa, and PayPal by offering instant, low-cost settlement across a wide range of decentralized applications. Unlike closed, proprietary platform systems, these are open and programmable, providing developers and fintech companies with flexible foundations—similar to renting AWS cloud infrastructure instead of hosting payment infrastructure. This shift enables developers to deploy products for cross-border remittances, agent-based (AI-driven) payments, and tokenized assets, all while enjoying near-zero fees and sub-second finality.

For example, developers could build a payment dApp on a stablecoin chain enabling instant settlement. Merchants and consumers benefit from fast, low-cost transactions, while Layer 1 platforms like Circle, Tether, and Tempo capture value as essential infrastructure. The key difference from traditional systems is the elimination of intermediaries like Visa and Mastercard, directly creating more value for developers and users.

Yet risks abound. As more issuers and payment companies launch their own Layer 1s, the ecosystem faces fragmentation. Merchants might encounter confusion from different “USD” tokens originating from separate chains that aren’t easily interchangeable. Circle’s Cross-Chain Transfer Protocol (CCTP) attempts to solve this by creating a single liquid version of USDC across multiple chains, but its scope is limited to Circle’s tokens. In an oligopolistic market, interoperability may become a critical bottleneck.

The landscape has shifted further with Stripe’s recent announcement of Tempo, a stablecoin-neutral Layer 1 co-developed with Paradigm. Unlike Circle and Tether, Stripe has not launched its own token, instead supporting multiple stablecoins for gas and payments via a built-in AMM. This neutrality could attract developers and merchants seeking flexibility without being locked in, potentially allowing Stripe to carve out a space in a domain long dominated by crypto-native firms.

Trend 3: Duopoly Dynamics—Circle vs. Tether

As these Layer 1s challenge traditional players, they are also reshaping market structure. Currently, Circle and Tether dominate the stablecoin space with nearly 89% of issuance—Tether at 62.8% and Circle at 25.8% as of September 2025. By launching their own Layer 1s (Arc and Stable/Plasma), they reinforce their dominance by setting high barriers to entry. For instance, Plasma raised $1 billion in treasury deposits for its token sale cap, establishing a significant entry barrier.

Yet a subtle threat emerges: stablecoin-neutral Layer 1s. Stripe’s Tempo reduces merchant onboarding friction and mitigates centralized regulatory risk. If neutrality becomes the standard, Circle and Tether’s closed moats could turn into weaknesses. Should neutrality prevail, Circle and Tether may lose network effects and market share. The current duopoly could evolve into an oligopoly, with multiple chains competing for dominance.

Conclusion

In summary, as stablecoins have become a powerful asset class exceeding $280 billion in size and generating massive profits for issuers, the rise of stablecoin-backed Layer 1s reveals three key trends:

(1) Connecting traditional finance with crypto-native infrastructure to enter the growing foreign exchange market;

(2) Transforming payments by eliminating intermediaries like Mastercard and Visa;

(3) Redefining the market structure from a duopoly to an oligopoly.

Together, these shifts point toward a broader vision: stablecoin issuers like Circle and Tether, along with new entrants like Stripe’s Tempo, are no longer merely bridges between crypto and fiat—they are positioning themselves as foundational pillars of future financial infrastructure.

Ultimately, this raises a question for my readers: How will these chains achieve product-market fit? Which will lead in transaction volume or institutional adoption—Circle’s Arc, Tether’s Stable/Plasma, or stablecoin-neutral challengers like Tempo? Despite opportunities, barriers including liquidity fragmentation remain. Readers are welcome to share your thoughts!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News