A 10,000-Word Analysis of Gaming Blockchain Ronin: Can Pixels, with 100K Daily Active Users, Revive Axie's Parent Chain After a $600M+ Hack?

TechFlow Selected TechFlow Selected

A 10,000-Word Analysis of Gaming Blockchain Ronin: Can Pixels, with 100K Daily Active Users, Revive Axie's Parent Chain After a $600M+ Hack?

Ronin is a custom-built long-term scaling solution designed specifically for Axie Infinity.

Author: JUMPENG, Senior Researcher at Shilian Investment

Project Overview

Ronin is an Ethereum sidechain built by Sky Mavis, the developer of Axie Infinity. It supports EVM-compatible smart contracts and protocols, enabling developers to build high-performance, feature-rich blockchain projects. Ronin is specifically customized as a long-term scaling solution for Axie Infinity, meaning it's optimized for viral growth and providing global access to the blockchain gaming revolution. These features make Ronin highly suitable for collectibles, art, and of course, gaming.

1. Research Highlights

1.1 Core Investment Thesis

Backed by popular game Axie Infinity with large user base: As a pioneer in blockchain gaming, Ronin’s greatest competitive advantage lies in its flagship blockchain game Axie Infinity, which currently has millions of active players—providing Ronin with a solid user foundation. The greatest value of any public chain comes from the applications and user scale it hosts. Axie’s success has attracted a massive existing user base to Ronin, delivering stable transaction volume and establishing Ronin’s leadership position in the blockchain gaming sector. Compared to competitors, Ronin boasts a mature flagship application like Axie Infinity, whose user scale and commercial value far exceed those of other on-chain games. This has accumulated invaluable operational experience and created network effects that are difficult for others to replicate. As Ronin further enriches its ecosystem and attracts more high-quality games, the user base and traffic advantages from Axie Infinity will amplify further. Ronin has the potential to become the preferred infrastructure for blockchain game developers and dominate the blockchain gaming space. Axie Infinity’s success laid a strong foundation for Ronin.

Large ecosystem, technological edge, and rich management experience: After recently integrating Pixels, daily active users exceeded 100,000—again proving its ability to convert significant traffic. This provides Ronin with a substantial user pool to draw from when absorbing additional games in the future. Following Axie’s historic success, market confidence in Sky Mavis remains strong, leading multiple top-tier games to join Ronin and expand their ecosystems on this platform—laying a critical foundation for Ronin’s future development and affirming its leadership in technology and service quality. Technologically, Ronin holds clear advantages, offering superior performance and enhanced user experience. Using DPoS consensus, Ronin achieves TPS in the thousands with extremely low gas fees—far surpassing peers—and attracting more games while delivering seamless gameplay. As technology continues to optimize, these advantages will grow even more pronounced. From a team perspective, Sky Mavis has accumulated extensive experience in blockchain game R&D and operations through its success with Axie. Although the asset theft incident damaged its reputation, it also provided the team with valuable lessons. If Ronin can achieve new milestones, it will add another legendary chapter to its story.

1.2 Valuation

Comparing Ronin’s valuation with other gaming blockchains: Immutable X (IMX): current circulating market cap is approximately $1.5 billion. WAX: A blockchain targeting digital collectibles and assets, with a current market cap of about $230 million. Ronin: currently valued at around $217 million—lower than both IMX and WAX. This valuation gap stems from several key factors:

A. Ecosystem and user scale: IMX, powered by well-known games like Gods Unchained, has a significantly larger user base than Ronin. WAX, as an established project, also exceeds Ronin in user numbers—directly impacting market cap.

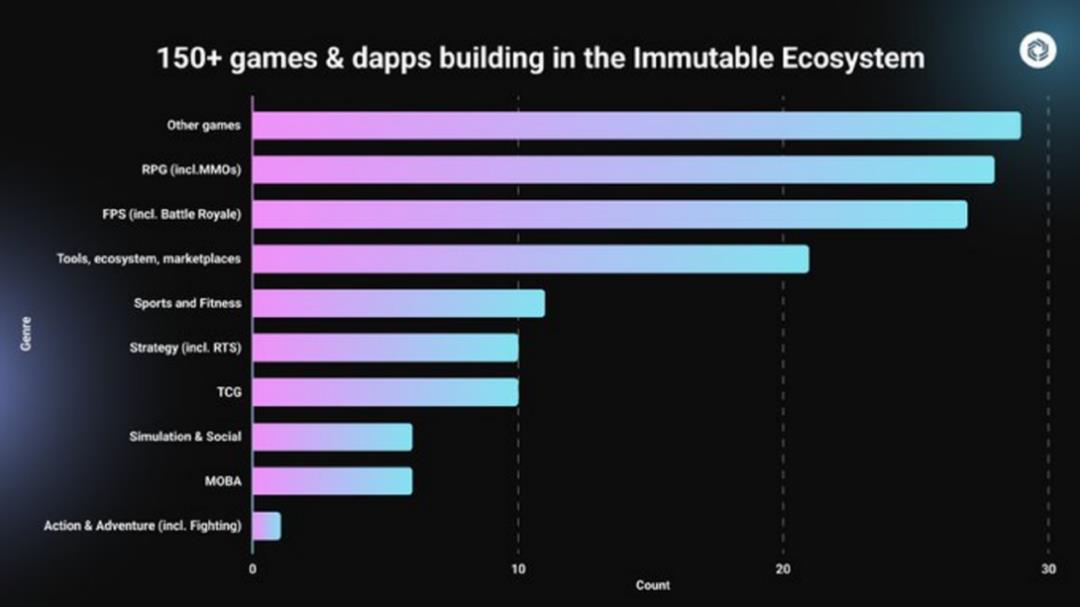

B. Number of applications: IMX and WAX host more on-chain games than Ronin, demonstrating stronger ecosystem appeal—a dimension where Ronin needs improvement.

C. Technological advantages: IMX uses zkRollup technology, resulting in lower interaction costs and clear technical superiority. However, Ronin is specifically optimized for gaming, giving it long-term potential.

D. Project reputation: Neither IMX nor WAX has suffered major security incidents, leading to higher community trust. Ronin must rebuild market confidence over time.

E. Future growth potential: All three benefit from the Web3 boom, but IMX and WAX already have established foundations, whereas Ronin must work harder to close the gap.

F. Funding: IMX has received greater resource support for development, while Ronin relies primarily on Axie’s closed-loop ecosystem, leaving it relatively underfunded.

Overall, despite the asset theft incident temporarily undermining Ronin—even bringing it near collapse—the team never abandoned its goals. With issues being resolved and the ecosystem rebuilt, Ronin’s valuation is poised to rise further, continuing to catch up with its public chain rivals. Its powerful network effects remain the key to overtaking competitors.

1.3 Project Risks

Ronin’s main risks stem from high dependency, an underdeveloped ecosystem, security vulnerabilities, limited decentralization, and intense competition among public chains—which challenge its technological standing. See Section 5.2 SWOT analysis for details.

2. Project Overview

2.1 Project Introduction

Ronin is an EVM-compatible chain designed specifically for gaming, using a sidechain architecture to deliver smooth, seamless gameplay experiences—especially supporting the renowned NFT game Axie Infinity. Ronin was created to solve Ethereum’s problems of high fees, slow speeds, and poor user experience, all of which hindered NFT gaming projects. In contrast, Ronin offers fast, low-cost transactions along with a rich suite of developer and user tools. Launched by Sky Mavis, the creator of Axie Infinity, Ronin has generated over $1.33 billion in revenue and proven capable of handling hundreds of thousands of daily active users, processing over $4 billion in NFT transactions—highlighting its strengths. By optimizing instant transactions and negligible gas fees, Ronin enables millions of in-ecosystem transactions to proceed smoothly, cementing its pioneering status in Web3 gaming. Additionally, Ronin’s native token RON plays a triple role in transactions, governance, and utility within the platform.

2.2 Team Background

2.2.1 Overall Situation

Ronin was initiated and overseen by Sky Mavis, a Vietnam-based blockchain gaming studio co-founded in 2018 by Trung Nguyen and Jeffrey Zirlin. Sky Mavis successfully developed and operated the popular blockchain game Axie Infinity, accumulating rich experience in blockchain and game development. Ronin is a dedicated application-specific chain designed by Sky Mavis based on the Axie ecosystem. The Ronin team is highly international, with core R&D teams located across multiple Sky Mavis research centers. Management includes not only Sky Mavis founders but also experts from industry leaders such as Ubisoft and Binance. The team is sizable, with over 100 employees at Sky Mavis alone, distributed across Vietnam, the United States, and the Philippines. Overall, Ronin benefits from Sky Mavis’ seasoned leadership and the convergence of diverse resources and talent, forming a comprehensive, well-structured R&D and operations team.

2.2.2 Key Members

Trung Nguyen: Co-founder and CEO of Sky Mavis. A Vietnamese programmer with a PhD in Computer Science from the National University of Singapore. Passionate about gaming and programming since childhood, he founded a gaming company in Singapore in 2012. In 2018, he co-founded Sky Mavis with Jeffrey Zirlin. At Sky Mavis, Trung leads overall strategic direction and major technical decisions. After the success of Axie Infinity, he guided Sky Mavis toward building a full blockchain gaming ecosystem. Beyond technical expertise, Trung excels in product thinking and business model validation. He conducted extensive research to define Axie’s gameplay, helping the game gain rapid user adoption. It was Trung who proposed creating a dedicated underlying support system during Ronin’s inception phase. He personally oversees Ronin’s technical planning and resolves complex challenges, leveraging his deep coding skills and extensive project management experience to remain Sky Mavis’ core decision-maker and technical leader.

Jeffrey Zirlin: Co-founder and Chief Product Officer at Sky Mavis. Holds a degree in Computer Science and Human-Computer Interaction from MIT. Previously worked on Google Play’s development team, managing game product operations. Gradually drawn to blockchain, he joined Trung Nguyen to establish Sky Mavis. At Sky Mavis, Jeffrey leads product design and operations, ensuring project success. Many of Axie’s product optimizations originated from his insights. Beyond work, Jeffrey actively contributes to blockchain community building, speaking at various summits to share Sky Mavis’ experience and supporting collaborations with other projects. After Ronin’s launch, Jeffrey led Sky Mavis’ partnerships with other game studios, attracting more DApps into the Ronin ecosystem. Skilled in product strategy and community operations, his continuous improvements helped transition Axie from niche to mainstream, ensuring sustained growth. With exceptional product design and promotional abilities, Jeffrey plays a vital role in driving the flourishing of the Ronin ecosystem.

2.3 Funding History

November 8, 2019: Sky Mavis announced raising $1.465 million in a new funding round led by Animoca Brands, with participation from Hashed, Pangea Blockchain Fund, ConsenSys, and 500 Startups.

October 5, 2021: Sky Mavis raised approximately $150 million in Series B funding at a nearly $3 billion valuation, led by a16z with Paradigm participating.

April 6, 2022: Sky Mavis completed a $150 million fundraising round led by Binance, with Animoca Brands, a16z, Dialectic, Paradigm, and Accel participating. The funds were intended to compensate users affected by the Ronin attack. However, subsequent reports revealed that Sky Mavis only raised $11 million in this round. According to VentureCap Insights, which tracks Singapore regulatory filings, this reduced the company’s valuation from $3 billion to $1.95 billion.

2.4 Development History and Roadmap

2.4.1 Historical Development

2.4.2 Development Plan and Roadmap

Based on current information, Ronin’s future development may include the following aspects:

A. Expand the ecosystem: Ronin will continue partnering with more game developers to attract high-quality games. Recently added titles include Zoids Wild Arena and Pixels, with more to come.

B. Enhance network performance: Ronin plans performance optimization in late 2023, upgrading technology to improve transaction speed and throughput, supporting higher daily active user counts.

C. Strengthen cybersecurity: Following the 2022 security incident, Ronin will reinforce network security with stricter internal controls and enhanced oversight of validators and bridges.

D. Host developer conferences: Ronin plans to hold its own developer conference in 2023 to deepen engagement with the global developer community and attract more contributors to the ecosystem.

E. Rebuild brand image: Ronin will continue efforts to reshape its brand, rebuilding user trust through community events and media outreach, enhancing its reputation and influence in the industry.

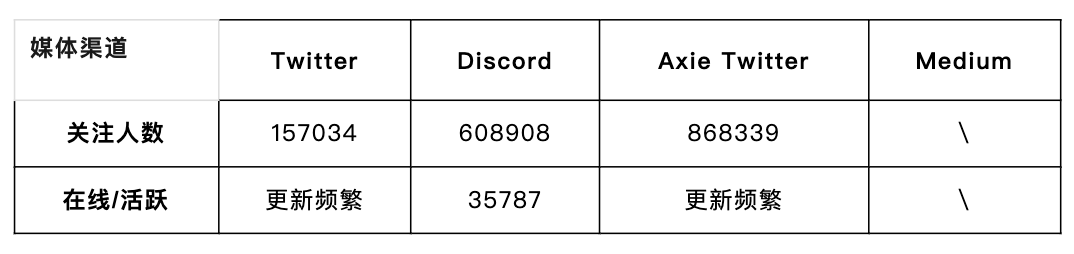

2.5 Social Media Metrics

As of November 15, 2023, Ronin maintains active social media presence and widespread attention. Its primary channels include Twitter and Discord. Ronin has over 157,000 followers on Twitter, frequently posting updates and promotional content. The shared Discord server with parent company Sky Mavis and Axie Infinity is even larger, hosting over 600,000 fans with up to 35,000 users online simultaneously, fostering frequent interaction. Axie Infinity’s Twitter account has an even larger following of 868,000, serving as Ronin’s most influential channel. Overall, Ronin effectively leverages mainstream platforms to ensure timely information dissemination, maintain tight community connections, and accelerate outreach using Axie’s existing user base. Below are detailed metrics from each platform:

3. Project Analysis

3.1 Project Background

Ronin was developed as a sidechain to address the on-chain limitations faced by the popular NFT game Axie Infinity. Axie Infinity is an Ethereum-based NFT card game; as its user base grew rapidly, Ethereum network congestion caused slow transaction speeds and high gas fees, severely degrading user experience. To resolve Ethereum’s bottlenecks, Axie Infinity’s developer Sky Mavis decided to build a custom gaming-optimized sidechain—Ronin. Officially launched in November 2020 and live on mainnet in April 2021, Sky Mavis used Ronin to build Axie’s ecosystem, launching services such as the Katana exchange, liquidity mining, and staking. Ronin aims to provide fast, low-cost on-chain gaming experiences. Compared to Ethereum, Ronin achieves 3,000 transactions per second with fees of just a few cents, dramatically improving gameplay fluidity.

Sky Mavis aims to use Ronin to create a fully functional on-chain gaming ecosystem. Beyond Axie Infinity, Ronin has attracted multiple third-party games and plans to introduce NFT markets, lending protocols, metaverse platforms, and more. As the blockchain gaming market grows, Ronin—with its superior gameplay experience and ecosystem development—is poised to become the go-to infrastructure for blockchain game development, helping Web3 gaming reach the mainstream.

3.2 Project Mechanics

Ronin uses a sidechain architecture with a bridge enabling two-way asset flow between itself and the Ethereum mainnet. It employs a hybrid consensus mechanism combining Proof-of-Authority (PoA) and Delegated Proof-of-Stake (DPoS). Details below:

3.2.1 Sidechain Architecture

A sidechain is an independent blockchain operating parallel to the main chain. Through bidirectional pegging, it enables interoperability of assets and data with the main chain. Its goal is to offload traffic from the main chain, increasing overall transaction capacity. Users can conduct fast transactions on the sidechain while maintaining asset links to the main chain. Sidechains are easier to develop and can be optimized for specific use cases. Asset transfers between chains rely on anchoring mechanisms, typically supervised by trusted third parties. Simply put, a sidechain moves general computation from Ethereum’s mainnet to a separate sub-chain for scalability. Think of the main chain as a “highway”—when traffic jams occur, sidechains act as “off-ramps” to分流 traffic.

As an Ethereum sidechain, Ronin has its own block generation and consensus mechanisms but connects to Ethereum via a bridge for asset interoperability. This architecture allows Ronin to focus on optimizing for gaming while retaining integration with Ethereum’s ecosystem. Using the Ronin bridge, users can transfer ETH and ERC20 assets from Ethereum to Ronin, and native tokens and NFTs on Ronin can be moved back to Ethereum. This interoperable design enables free asset movement between chains.

3.2.2 Hybrid Consensus Mechanism

Ronin uses a hybrid PoA + DPoS consensus model. In PoA, trusted validator nodes designated by Sky Mavis produce blocks, ensuring network integrity due to their verified identities. DPoS opens participation to users—those holding sufficient RON can become validators or delegate stake to earn rewards, enhancing decentralization.

1) Proof-of-Authority (PoA)

Initially, Ronin used PoA, selecting reputable professional validators to verify and package transactions, maintaining network operations. Validators are chosen by Sky Mavis and the community based on expertise and reputation. They bundle transactions into new blocks and append them to the blockchain. Adding or removing validators requires approval from the majority of current validators, incentivizing honest behavior.

A. Compared to PoW, PoA is energy-efficient since it doesn’t require massive computational power. With only a small group of validators confirming blocks, PoA delivers faster transactions and lower fees—enhancing gaming experience.

B. However, PoA faces criticism for relying on a small number of validators, creating potential single points of failure—if validators malfunction, detection and correction are difficult.

Overall, PoA improves efficiency and performance but needs further decentralization.

2) Delegated Proof-of-Stake (DPoS)

To enhance decentralization, Ronin introduced DPoS to complement PoA. In DPoS, token holders delegate voting rights to candidate validators. Candidates receiving more delegations have higher chances of selection. One becomes a candidate validator by staking a required amount of RON.

A. Selected validators confirm transactions and produce blocks, distributing rewards proportionally based on delegation contributions. This greatly lowers entry barriers, making validator roles accessible. Ronin also implements slashing penalties—for inactivity or fraudulent behavior—to deter misconduct.

B. Compared to pure PoA, DPoS significantly increases decentralization through open elections and penalty mechanisms, while maintaining high transaction throughput.

Combining both mechanisms allows Ronin to achieve high security and decentralization. The hybrid consensus enables 3,000 TPS, a technical design perfectly aligned with Ronin’s role as a gaming infrastructure, delivering efficient, secure, and convenient on-chain gaming experiences.

3.2.3 Bridge

The bridge plays a crucial role in Ronin, connecting it with other EVM-compatible chains to enable seamless asset transfers.

Specifically, the Ronin bridge is maintained by multiple bridge operator nodes. Each validator must run both a validator node and a bridge operator node; otherwise, they lose eligibility for rewards. Bridge operators confirm deposit and withdrawal events across chains:

A. When a user withdraws from Ethereum to Ronin, they submit a transfer proof to bridge operators. Once verified, equivalent assets are minted on Ronin.

B. Conversely, users can withdraw assets from Ronin to other EVM chains by submitting transaction proofs. Bridge operators then lock the corresponding assets on Ronin and release equivalent assets on the target chain.

This mechanism ensures secure cross-chain asset transfers. To incentivize efficiency and honesty, Ronin implements reward and penalty systems—operators causing accidents face disqualification. Through the Ronin bridge, assets can move freely between EVM-compatible chains, greatly enhancing internal and external connectivity.

3.3 Nodes

3.3.1 Ronin Nodes

Ronin nodes form the core infrastructure of the Ronin network and fall into three main categories:

① Non-validator nodes: Do not participate in consensus. They only synchronize ledger state and observe the network, supporting DApps with query capabilities.

② Validator nodes: Responsible for producing new blocks and validating transactions—core to the network. Validators must stake a certain amount of RON to gain block production rights. Block production follows a round-robin schedule, with different nodes taking turns. When a node produces a block, it collects pending transactions into a candidate block, which other validators vote to confirm. If over two-thirds approve, the block is finalized and added to the chain. Validators can also modify certain chain parameters (e.g., transaction fees, adding/removing validators), requiring over two-thirds approval from governance participants.

③ Archive nodes: Permanently store full historical ledger data, traceable back to genesis. Support backend services like explorers with long-term query capabilities.

Validator and non-validator nodes regularly compress recent data, while archive nodes retain all historical information. All nodes are deployed and managed openly via open-source tools. Beyond consensus, validators can compete for block production through RON staking. Ronin operates as a distributed network, with nodes working together seamlessly to ensure stability and efficiency. Among them, validators—producing blocks and confirming transactions—are central to the Ronin ecosystem. The node mechanism is essential to Ronin’s successful operation.

3.3.2 Bridge Nodes

Bridge nodes serve as the link between Ronin and Ethereum networks for asset conversion. When a user withdraws from Ethereum to Ronin, they initiate a transfer on Ethereum and provide a transaction proof. After bridge nodes verify it, corresponding tokens are released on Ronin. Conversely, withdrawing from Ronin to Ethereum requires providing a Ronin transaction proof. Upon confirmation, bridge nodes lock the user’s tokens on Ronin and release equivalent tokens on Ethereum. Bridge nodes are jointly supervised to ensure the security of asset conversion.

3.4 Project Roles

The Ronin network primarily consists of three roles: delegators, validators, and bridge node operators.

1) Delegators

Delegators are participants who stake their Ronin tokens to validators and earn rewards in return. Any RON holder can become a delegator. They don’t need to run nodes—just delegate tokens to validators to receive a share of block rewards. Delegators can choose validators based on reward-sharing ratios and other criteria. Becoming a delegator offers stable token returns and participation in Ronin governance, lowering barriers so ordinary investors can get involved.

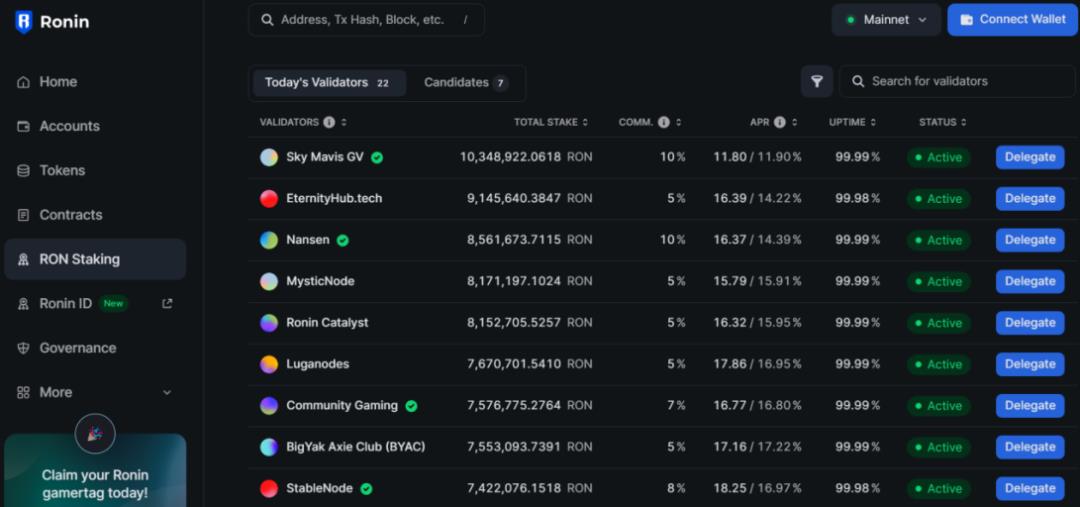

2) Validators

Validators maintain the Ronin network by producing and verifying blocks. They must stake a large amount of RON and operate nodes. The chance to produce blocks depends on the amount of staked RON—either self-staked or supported by delegators. Their income comes from block rewards and transaction fees. Validators must fulfill their duties responsibly or face penalties.

3) Bridge Node Operators

Bridge node operators manage asset conversions between Ronin and Ethereum. They monitor asset movements on both chains and respond to deposit/withdrawal requests by executing token swaps to complete transfers. Bridge operators must also stake RON and keep nodes running stably—failure to respond promptly results in penalties.

Through mutual checks and cooperation among these three roles, Ronin builds an efficient blockchain gaming infrastructure. Clear responsibilities and mutual oversight create a closed-loop ecosystem.

3.5 Project Ecosystem

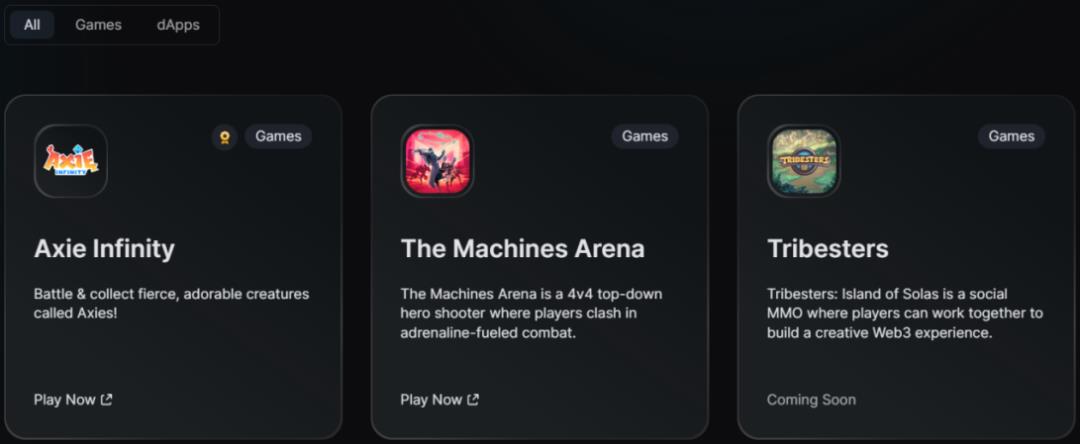

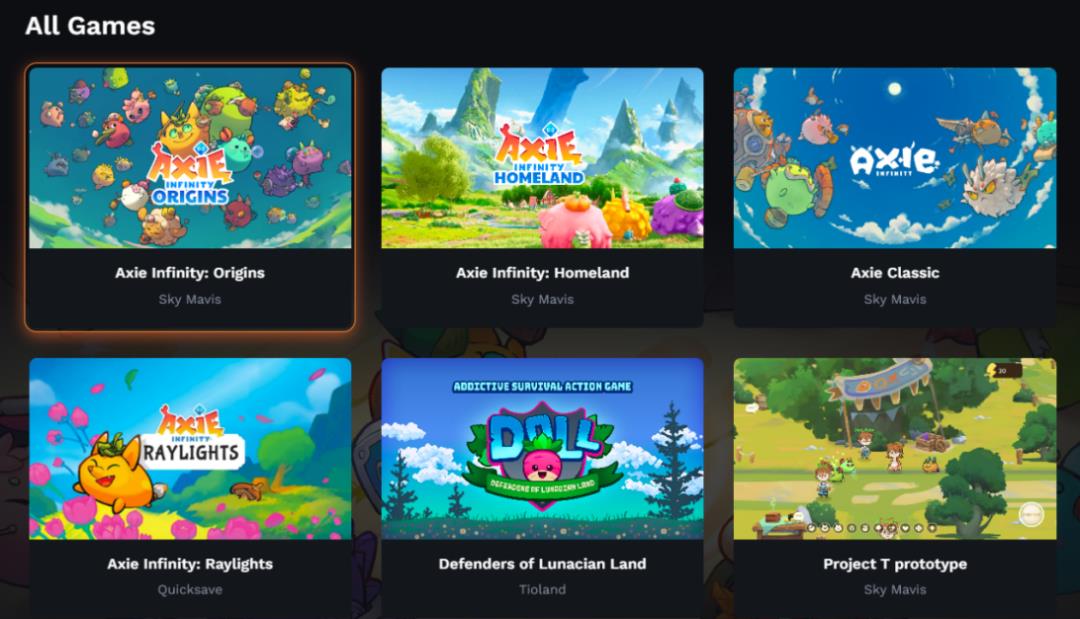

According to official information, the Ronin ecosystem includes games and DApps.

3.5.1 Games

On the gaming front, the Ronin ecosystem currently hosts prominent titles such as Axie Infinity, The Machines Arena, and Pixels.

1) Axie Infinity

Axie Infinity is the largest game on Ronin, where players collect and raise “Axies” for PvP battles. Let’s briefly review Axie Infinity: a turn-based tactical card battle game where players compete using teams of creatures called Axies.

· Axie Classic was the first official version, running 21 seasons from December 2019 to June 2022.

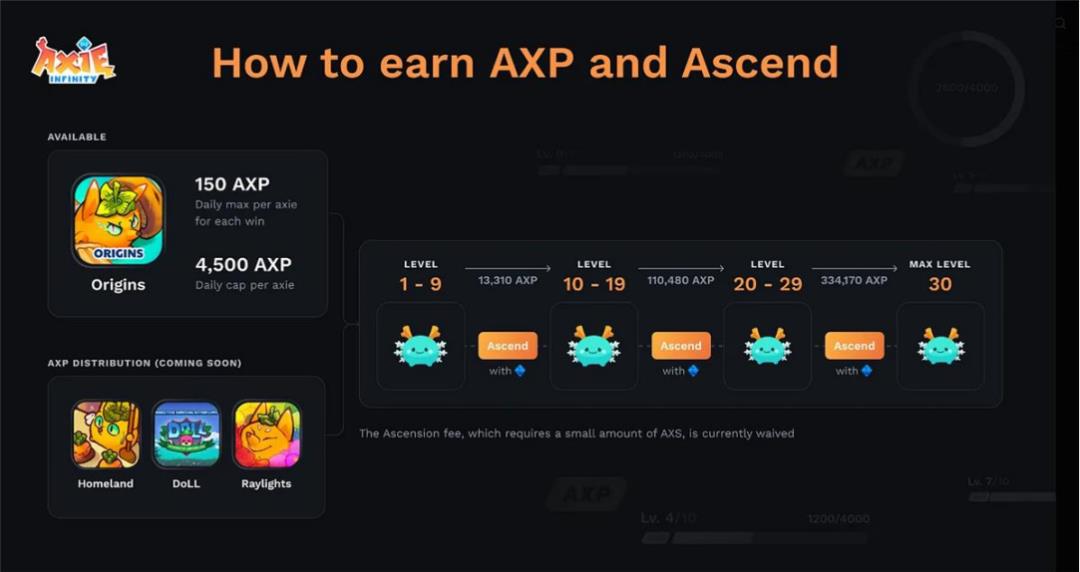

· Building on Axie Classic, the upgraded Origins version launched in 2022, offering new adventure and arena modes. Origins paved the way for Axie’s on-chain evolution and laid the foundation for new mechanics like free starter Axies and equipable items. Origins is now in its fifth season. Featuring digital pets that can form teams and battle, players level up their Axies by earning AXP through gameplay—transforming Axies from passive NFTs into dynamic, personalized NFTs shaped by game participation.

Regarding Axie, readers likely know enough—we’ll just briefly cover the latest AXP mechanic. AXP (Axie Experience Points) is Axie Infinity’s newest on-chain upgrade system, allowing players to win victories in Origins and earn points to advance and level up their Axies.

· Players earn up to 150 AXP per match across Origins game modes like ranked battles and dungeon adventures, with a daily maximum of 4,500 AXP per Axie. These AXP points are non-transferable and bound directly to the respective Axie.

· Axies can activate upgrades on the Ronin sidechain upon reaching levels 9, 19, and 29, requiring 13,310, 110,480, and 334,170 total AXP respectively.

The introduction of the AXP system is significant: 1) It transforms Axies from passive NFT assets into personalized, evolving digital beings shaped by gameplay; 2) It adds depth to the Axie Infinity ecosystem; 3) It sets a design precedent for other NFT games, inspiring similar on-chain upgrade systems.

This marks Axie’s transformation from a static character to an organic entity that grows through accumulated experience—and signals that similar on-chain upgrade mechanisms may soon spread widely across the NFT and gaming landscape. AXP realizes the Axie Core vision, injecting new momentum into Axie Infinity and the broader NFT ecosystem.

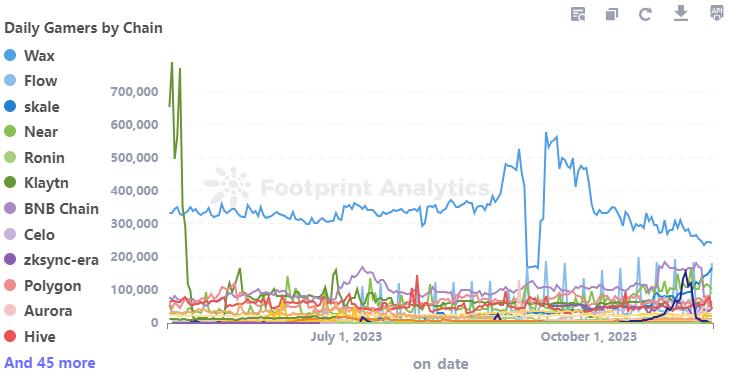

2) Pixels

On November 17, 2023, Jeff Zirlin, co-founder of Ronin and Axie Infinity, announced on X that Pixels had surpassed 100,000 daily active addresses. Additionally, Blur data shows the floor price of Farm Land by Pixels NFTs is now 0.74 ETH, up 85.93% over seven days.

Pixels is a P2E farm game built on metaverse principles. As the first blockchain game integrating NFT avatars, Pixels launched in 2021, allowing players to farm and play in a virtual world using their NFT personas.

Pixels uses a three-part asset system: land, resources, and tokens. Players can operate on free, rented, or purchased land, harvesting resources to earn Berry, the in-game currency.

In February 2022, Pixels raised $2.4 million in seed funding led by Animoca Brands and PKO Investments, with OpenSea participating. On October 31, 2023, Pixels migrated to Ronin. The Pixels team stated they chose Ronin because it hosts the largest Web3 user base and strongest community.

A. Since migrating to Ronin, Pixels has exceeded 55,000 daily active users and plans to launch its PIXEL governance token in Q4.

B. Pixels has received strong support from Jihoz, founder of Ronin and Axie Infinity, who even appears as an NPC in the game and promotes Pixels on social media.

C. Currently, Pixels integrates over 50 well-known NFT brands, achieving deep GameFi interoperability. In the future, Pixels will introduce a governance token for decentralized management. With a team experienced in game development, Pixels has grown steadily, exceeding 55,000 daily active players.

As a key ecosystem project supported by Ronin, Pixels is highly favored by Axie players. With ongoing product iteration and ecosystem revitalization, Pixels could become another flagship project in the Ronin ecosystem, joining Axie in driving Ronin’s growth.

3) ACT Games

ACT Games is a renowned South Korean game company focused on promoting TCG and other card games. Its flagship title, Zoids Wild Arena, originally launched on Polygon. Zoids Wild Arena is an Android and PC-based collectible card game where players collect mechanical creature cards from the Zoids series and battle 1v1 or 3v3. Cards have different attributes and talents, with gameplay similar to Hearthstone. In November 2023, ACT Games partnered with Sky Mavis to bring Zoids Wild Arena and all future games to the Ronin ecosystem. ACT Games stated this collaboration will leverage Ronin’s technological strengths to meet the high-expectation gameplay standards desired by gamers and IP fans. After migration, Zoids Wild Arena players will use Ronin wallets for various activities, including in-game trading, benefiting from Ronin’s seamless asset exchange capabilities.

This is another significant step by Ronin to strengthen its gaming ecosystem. ACT Games’ decision reflects their trust in the Ronin system and willingness to co-build a more robust GameFi ecosystem. For Ronin, ACT Games’ involvement brings renewed credibility.

4) Other Game Ecosystems

Beyond the three main games above, Sky Mavis continues collaborating with multiple game studios to enrich the Ronin ecosystem. Early partners include Directive Games, Bali Games, and Tribes Studio, each developing their own games on Ronin. Directive Games’ The Machines Arena was one of the first Ronin games to lead the way.

A. The Machines Arena is a 4v4 multiplayer shooter where players battle in sci-fi arenas as tanks or support heroes.

B. The game features third-person perspective and offers both single-player and multiplayer modes. Currently in PC testing, it plans to launch on the Epic Games Store, with mobile versions for iOS and Android to follow—delivering a truly cross-platform experience.

Additionally, Sky Mavis partnered with NFT project CyberKongz. In July, CyberKongz launched a new NFT series "Phantom Sea," with 4,000 pieces available on Mavis Market on Ronin. Sky Mavis also plans to reward Axie players with "Phantom Sea" NFTs. Furthermore, CyberKongz will collaborate with Ronin to develop a new game themed around "Phantom Sea."

By continuously introducing high-quality game projects, Ronin’s ecosystem grows richer, offering users diverse and mature gaming experiences—further solidifying Ronin’s status as a leading blockchain gaming platform.

5) Summary

As the first notable blockchain gaming project, Axie has driven rapid expansion of the Ronin ecosystem. Sky Mavis views Axie as just the beginning, aiming to evolve it into a globally recognized IP. Despite past setbacks, Sky Mavis remains persistent, committed to providing developers with high-quality, low-cost services—understanding that fast response times and low-cost interactions are key to long-term success in blockchain gaming. Leveraging Axie’s early success, more and more projects trust Sky Mavis and join the Ronin ecosystem. The ecosystem is maturing and diversifying, further strengthening Ronin’s position as a mainstream blockchain gaming platform. Sky Mavis’ challenge lies in maintaining Ronin’s appeal and competitive edge. The management team states they will uphold open and shared values, continuously optimizing technical architecture and user experience to deliver greater value. By attracting more top-tier games, as long as Sky Mavis persists in exploration and strengthens user loyalty among developers, Ronin could emerge as a winner in the Web3 ecosystem.

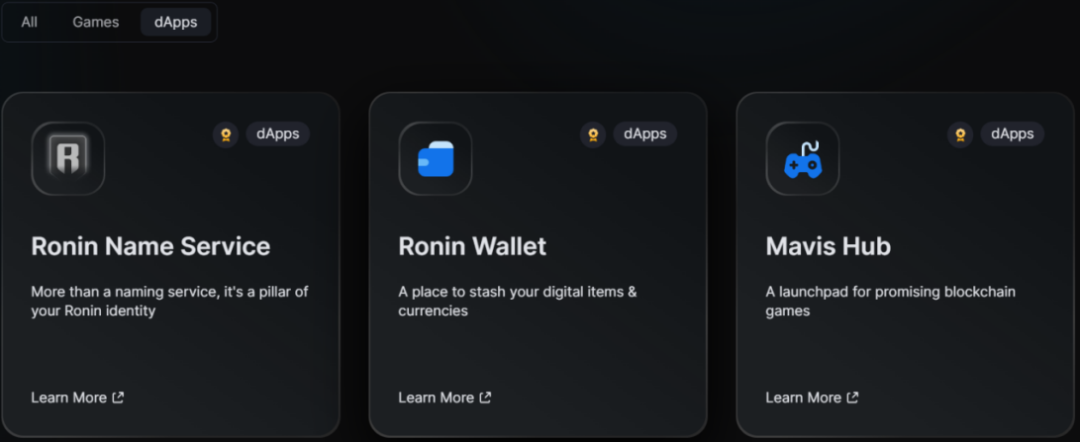

3.5.2 DApps

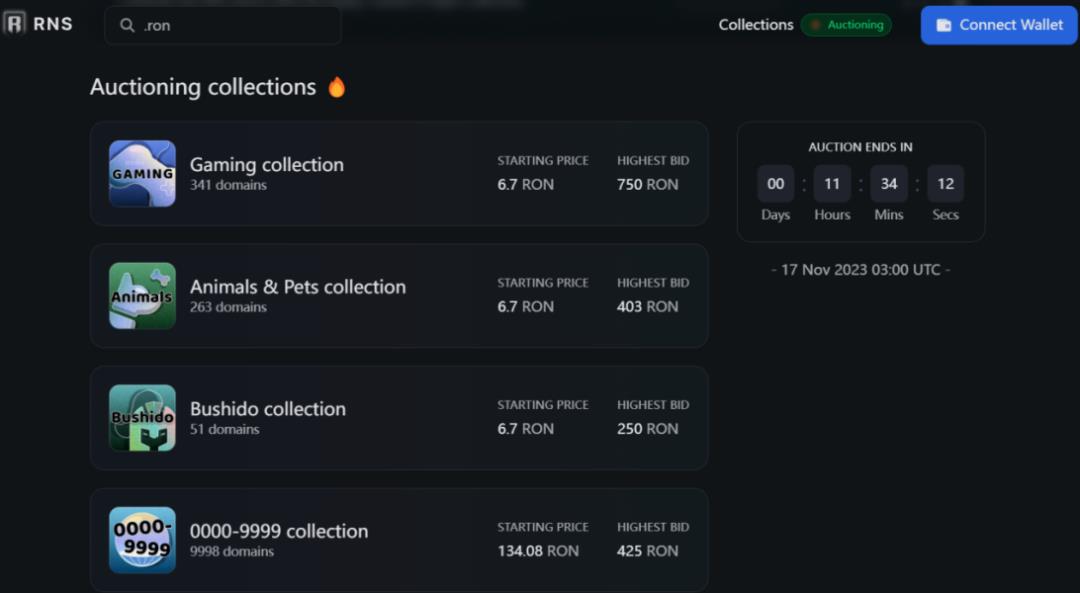

1) RNS

According to official Twitter, on November 16, Ronin Name Service (RNS) opened public sales, hosting an auction for premium .ron domains that lasted 48 hours. RNS has integrated with Ronin Wallet, Ronin Explorer, Mavis Market, App.Axie, and Sky Mavis Account Service.

Ronin Name Service (RNS) is a decentralized naming system on the Ronin blockchain that allows users to assign human-readable ".ron" domain names to long hexadecimal wallet addresses.

A. Domain Categories: RNS domains are classified as regular, auction, and protected domains. Regular domains are first-come-first-served; auction domains are sold via bidding; protected domains are reserved for partners and major brands.

B. Pricing: Domain pricing includes annual fees and reserve prices for auction domains. Annual fees vary by domain length; reserve fees are 15% of the auction price and fluctuate with market activity.

C. Domain Tiers: Based on character count and market value, RNS classifies domains into Tier 1, 2, and 3. Shorter, rarer domains are higher tier, indicated by color codes.

D. Management: Users can set a primary domain, renew registrations, and trade domains on Mavis Market. Domains can only be renewed by the original owner within 90 days before expiration.

E. Use Cases: Users can replace long wallet addresses with RNS for sending and receiving assets. RNS also serves as a unique identifier within the Ronin ecosystem.

Overall, RNS makes Ronin addresses simpler and more readable, enhancing user experience and asset usability. Its tiered domain system also creates branding opportunities.

2) Staking

Ronin staking (RON Stake) is a dApp allowing RON holders to stake their tokens with validator nodes to participate in network governance and earn rewards.

A. Staking Targets: RON holders can stake with any validator, receiving varying reward shares depending on the node.

B. Equity Management: Users can increase or decrease staked amounts and freely redelegate stakes to other validators.

C. Reward Withdrawal: Stakers earn a portion of validator block rewards, credited directly to their wallet balances.

D. Governance Participation: The amount of staked RON determines a user’s voting weight in Ronin governance.

RON staking enables ordinary holders to contribute to Ronin’s network and earn economic returns. This helps attract more users to support the ecosystem and enhances Ronin’s decentralization.

In summary, Ronin is not only a high-performance, secure oracle product but, more importantly, a decentralized infrastructure that solves real-world Web3.0 challenges—better serving broad sectors like CBDC, DeFi, GameFi, and NFTs—giving Ronin significant market relevance.

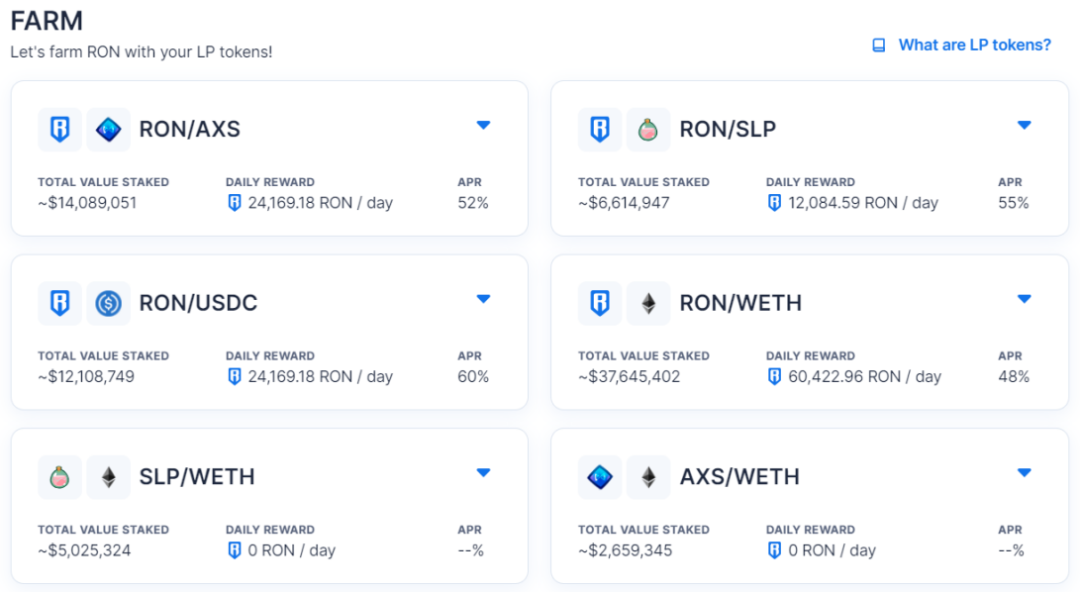

3) Katana

Katana is Ronin’s decentralized exchange, enabling users to trade digital assets within the Ronin ecosystem.

A. Swap: Katana supports trading pairs between different ERC20 tokens on Ronin, enabling easy exchanges.

B. Liquidity Mining: Users can provide liquidity to trading pairs, becoming liquidity providers and earning trading fees plus RON rewards.

C. Staking Mining: Users can stake their liquidity provider tokens to earn additional RON mining rewards.

D. Data Analytics: Katana provides users with detailed statistics and analysis on trades and earnings.

Katana brings Uniswap-like decentralized trading functionality to the Ronin ecosystem, reducing reliance on cross-chain swaps and offering users new ways to earn—helping attract more users to the Ronin network.

4. Market Space and Potential

4.1 Sector Overview

4.1.1 Sector Positioning

Ronin is positioned as a gaming-dedicated chain—specifically, a game-focused public chain—aiming to provide high-performance, low-cost infrastructure for blockchain games.

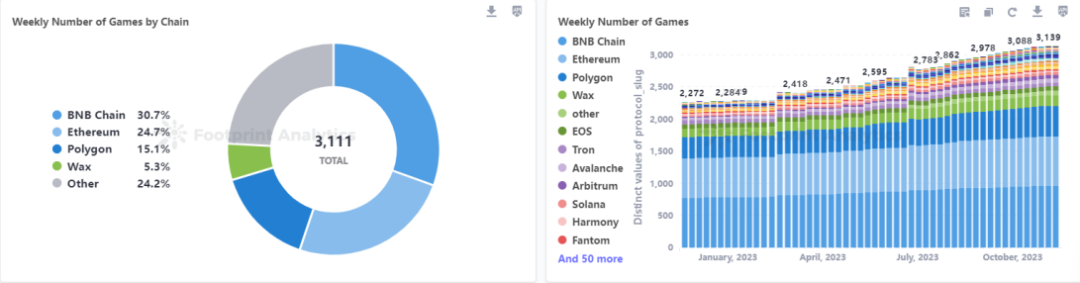

4.1.2 Market Size

With the rise of Web2.5 gaming, the importance of gaming platforms and ecosystems is growing. Compared to standalone games, platforms and ecosystems offer longer lifespans and better resilience against individual game obsolescence. Moreover, platforms aggregate capital, communities, and incubation capabilities—providing crucial user acquisition channels and lowering customer acquisition costs for new games. They can also capture partial value from individual game projects through token economics. For players, platforms offer navigation and blockchain infrastructure, helping them discover favorite games more easily and smoothing the transition from Web2 to Web3. Therefore, future gaming platforms could use specialized operations and game-agnostic token economies to reduce customer acquisition costs, partially decoupling game creation from user acquisition. This platform-enabled model is one of the most promising directions in blockchain gaming. Recently, some game projects have begun transitioning from standalone games to platforms offering broader capabilities—indicating a clear trend. Overall, gaming platforms and ecosystems offer greater longevity, helping drive the entire blockchain gaming sector toward more professional and sustainable development.

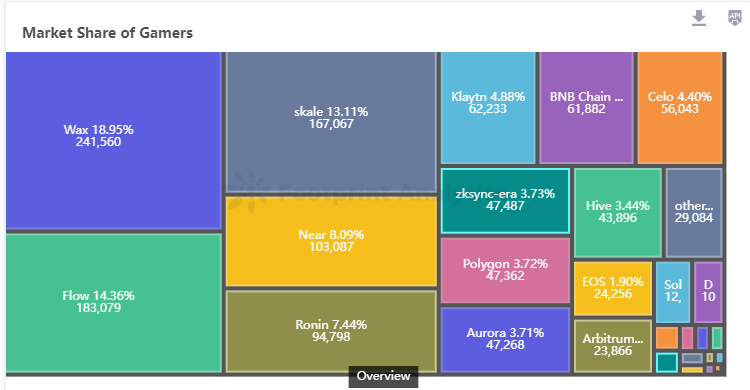

4.1.3 Competitive Landscape

With the rapid growth of the gaming chain industry, Ronin—as the sidechain hosting Axie Infinity, the first major blockchain game—has drawn significant attention. Currently, Ronin faces competition from multi-functional public chains and other gaming chains. The competitive landscape includes the following aspects:

1) Established Multi-Functional Public Chains

A. BSC Chain: As of November 2023, BSC hosts 963 blockchain games, dominating in quantity. This advantage stems from several strengths:

· Performance: BSC achieves thousands of TPS daily with extremely low transaction costs, meeting GameFi’s demands for high concurrency and low cost.

· Ecosystem Resources: BSC has a strong tokenomic foundation, with Binance Labs consistently investing in GameFi incubation, greatly expanding the ecosystem.

· User Base: Binance serves as a gateway, providing BSC with a vast Web3 user base and early traffic advantages for GameFi projects.

· Clear Roadmap: BSC clearly executes a “low gas, high speed” strategy, offering reliable long-term support for GameFi.

Although BSC lacks a flagship project like Axie, its diversified ecosystem gives it a leading edge in GameFi project count. As technology and ecosystem evolve, BSC will continue solidifying its position in GameFi, indicating a bright future.

B. Polygon: As a key Ethereum Layer 2 solution, Polygon performs strongly in GameFi. As of November 2023, Polygon hosts 473 games, a 74.28% year-on-year increase—demonstrating its strength in attracting GameFi projects.

· Solid Ecosystem Support: Over 65% monthly active users indicate high engagement; top projects like The Sandbox reinforce confidence.

· Clear Technical Edge: Thousands of TPS and low gas fees solve Ethereum’s performance issues; deep Ethereum interoperability expands ecosystem reach.

· Successful Ecosystem Collaboration: Polygon Studios actively incubates quality projects and explores partnership models to boost ecosystem vitality.

· Strong User Base: Thanks to Ethereum’s community, every project on Polygon gains access to abundant early adopters.

Overall, Polygon leads the GameFi sector and is likely to maintain this edge through technology and ecosystem development, becoming a mainstream GameFi public chain.

C. Ethereum: As of November 2023, Ethereum hosts the second-highest number of GameFi projects—770 in total. Ethereum has the richest ecosystem, with vast developer and user bases. But as the first smart contract platform, it suffers from performance bottlenecks—only 15 TPS and high fees—limiting the growth of high-frequency applications like GameFi.

2) Gaming-Focused Specialized Chains

A. WAX: Positioned as an NFT and GameFi chain, WAX ranks second in user count after BSC, with early and mature ecosystem development. Home to flagship projects like Alien Worlds, it sees high daily trading volumes. As of November 2023, WAX hosts 166 games.

· Strong Technical Foundation: WAX achieves over 2,700 TPS—faster than Visa—with free transactions via staking, meeting GameFi’s low-cost, high-concurrency needs.

· Effective Business Model: Leveraging resources like OPSkins, WAX has deeply cultivated NFT and gaming business models, forming a complete industrial chain.

· Massive Impact from Alien Worlds: As a flagship project, Alien Worlds drives WAX’s daily trading volume to the top, fueling ongoing ecosystem vitality.

· Expanding User Base: WAX ranks second in active users after BSC, with a growing developer community enhancing ecosystem impact.

· Improving Cross-Chain Capabilities: WAX strengthens interoperability with major chains, expanding into games, NFTs, and other business models.

As a veteran GameFi-focused public chain, WAX has become a leader thanks to its excellent technology and ecosystem.

B. Hive: Focused on social and gaming, Hive’s ecosystem centers on Splinterlands. Though hosting only 16 games, Hive maintains high daily active user counts, indicating strong ecosystem quality.

· Major Role of Splinterlands: As Hive’s flagship game, Splinterlands performs exceptionally, acting as the ecosystem’s “first moat.”

· Clear Technical Advantages: Hive meets GameFi needs with “fast, stable, low-cost” features, earning praise for user experience.

· Strong Active User Base: Despite few projects, Hive maintains over 35,000 daily active users, with Splinterlands sustaining high traffic.

· Need for More Games: Beyond Splinterlands, Hive must attract and nurture more GameFi projects to broaden ecosystem depth.

· Need for Better Mainnet Integration: Strengthening connections with major public chains will help scale Hive’s GameFi ambitions.

Overall, Hive maintains influence through technology and its flagship game, but ecosystem expansion and project discovery need further effort—determining its future prospects.

3) Other Gaming-Specific Sidechains

A. ImmutableX: Recently, ImmutableX’s game count surged past 150, with rapid growth in daily transactions and users. Star games like Gods Unchained, Guild of Guardians, and Illuvium drive platform growth and attract more high-quality games.

· Clear Technical Edge: Technologies like zkRollup solve gas issues, offering games high-performance, low-cost environments.

· Growing User Base: ImmutableX has surpassed 100,000 daily active users, achieving meaningful scale.

· Partnerships with Major Platforms: Collaborations with mainstream platforms like GameStop bring in more users.

· Established Gateway Status: In the NFT gaming space, ImmutableX has become a key entry point, poised to strengthen its influence.

· Focus on Ecosystem Depth: Needs more flagship games to enrich content and boost user engagement.

· Need for Ongoing Innovation: Continued performance optimization, lower barriers, and improved UX are critical.

Overall, ImmutableX is rapidly rising as a key NFT gaming infrastructure, with strengths in technical innovation and ecosystem expansion. Sustained ecosystem development and technological leadership will be key to winning the gaming chain race.

4) Competitive Landscape Analysis

In recent years, GameFi has grown rapidly. Ethereum once dominated, but as network congestion and gas fees became apparent, GameFi projects migrated to next-generation public chains.

A. Among traditional chains, BSC leads in GameFi project count due to strong tech and broad adoption; Polygon has maintained active protocols throughout the bear market—both increasingly becoming mainstream choices in the new GameFi era.

B. Among gaming chains

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News