Ronin: The Winner in Web3 Gaming

TechFlow Selected TechFlow Selected

Ronin: The Winner in Web3 Gaming

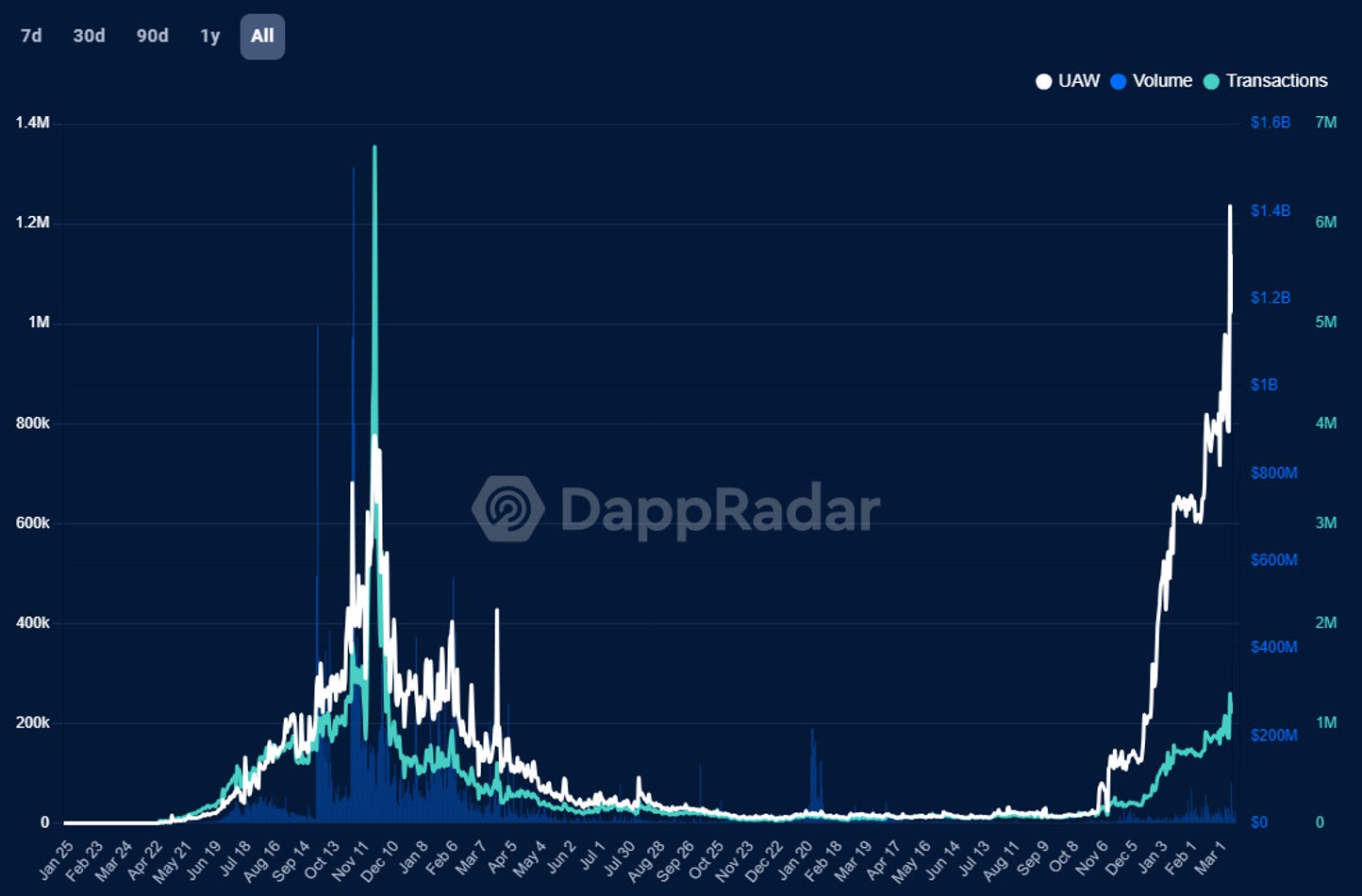

The chain is witnessing strong and sustained growth in UAW metrics, with even greater growth potential as more games are integrated.

Authors: 0XYARO, 0XRAMEN, OUROBOROS CAPITAL

Translation: Mars Finance, MK

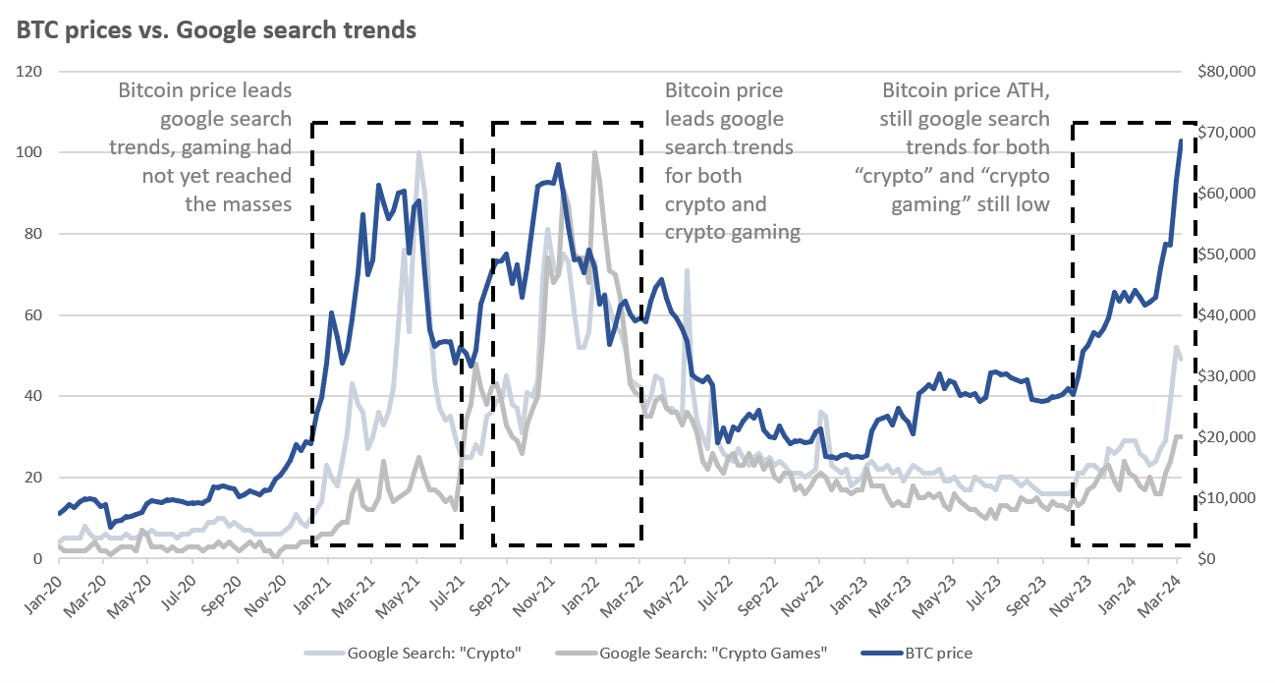

Retail is gradually making a comeback. While Bitcoin's price approaches all-time highs, a full retail recovery has yet to materialize. We believe there’s a good reason for this—mainstream media coverage and retail attraction take time. This creates an empirical lag of approximately 2–3 months between Bitcoin’s price and Google search volume for crypto (which we view as a proxy for retail interest).

Source: CoinGecko, Google, Ouroboros Research

We have a soft spot for gaming. We’ve been digging into which investment thesis fits long-term trends and aligns closely with retail—and gaming stands out as our top choice (meme coins have their place too, but that’s for another article).

Choosing the right strategy is crucial. While advocating for a Web3 gaming revival is relatively straightforward, historically it's been extremely challenging to pick winners in a winner-takes-all market. We could theoretically hand-pick a basket of game tokens, but we believe infrastructure projects offer superior risk-reward due to less idiosyncratic exposure and broader exposure across multiple games.

Our conviction in RON continues to grow, as it stands out across several dimensions:

-

Ronin exhibits the strongest network effects among peers, with metrics exceeding competing chains by 50x to 1,000x. Despite this, RON remains relatively undervalued.

-

The chain is witnessing strong and sustained growth in unique active wallets (UAW), with even greater potential as more games go live.

-

RON has several catalysts that could drive revaluation, including: 1) enhanced launchpad appeal and airdrops, 2) tokenomics changes, 3) CEX listings, and 4) the rollout of its ZK L2.

Investment Thesis

#1 Top-tier Gaming Chain at a Reasonable Price

Gaming platforms are inherently two-sided markets. New platforms often struggle to attract both gamers and developers simultaneously, as each side wants to see the other already active before joining. Game developers want immediate access to large user bases, while gamers expect high-quality games (and/or incentives).

Ronin has already established network effects. Built by Sky Mavis, the creators of Axie Infinity, Ronin cleverly bypassed this chicken-and-egg problem by onboarding Axie’s massive user base directly onto the chain. This created instant scale and network effects unmatched by any other crypto platform.

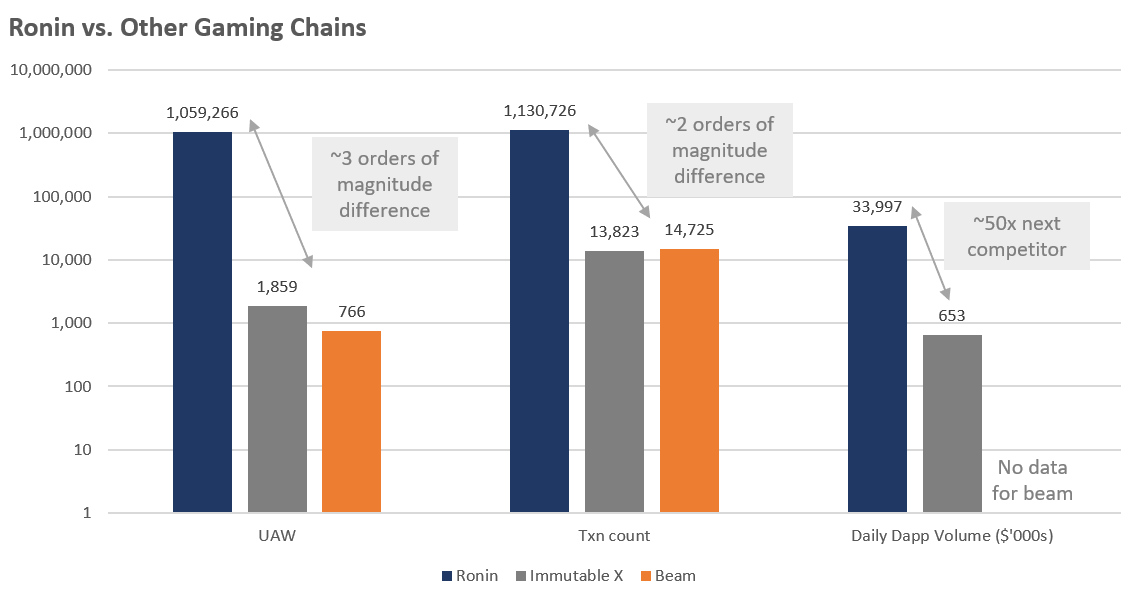

Source: DappRadar, Avax Subnet Stats, Ouroboros Research

Ronin’s unique metrics exceed those of other gaming networks by 50x to 1,000x. It has 1,000x more active wallets, 80x more transactions, and 50x higher dapp transaction volume than its peers. We believe this alone justifies a higher valuation for RON. Yet, BEAM currently trades at a 60% market cap premium, and IMX at a staggering 260% premium.

#2 User Numbers at All-Time Highs, With Growth Expected to Continue

Ronin hosts the largest Web3 games. Though the Web3 gaming space is still nascent, a few games have already achieved over 1–10k daily active users (DAUs). Here are some notable games hosted on Ronin:

-

Axie Infinity (AXS): Peaked at 2 million users in 2021 and now maintains over 350k active users across Axie Classic and Axie Origins.

-

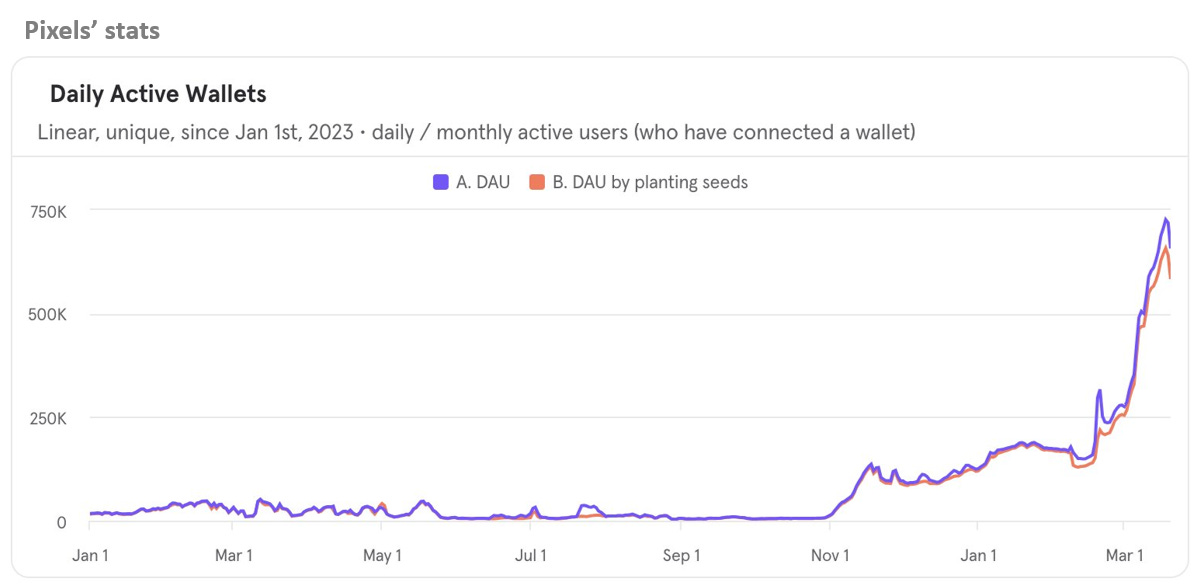

Pixels (PIXEL): Recently launched, already had 260k DAUs pre-token launch and has since grown to around 700k, with further growth expected from Chapter Two.

-

Wild Forest (WF): This real-time strategy (RTS) game had over 10k DAUs pre-token launch.

-

Apeiron (APRS): An upcoming game that recently completed a $3M token sale, with over $75M worth of RON allocated.

-

Kaidro: Another upcoming title that saw over 346k mints during its first NFT drop (1 NFT per wallet max).

The symbiotic relationship between Pixels and Ronin will attract more game partners. Historically, Ronin’s user base came largely from Axie. The exponential growth in daily active wallets (DAWs) after Pixels migrated from Polygon shows that non-Axie games can thrive on Ronin too. In fact, this suggests Ronin not only benefits from a game’s existing user base but actively grows it—a win-win dynamic.

Source: Jiho’s tweet

Source: DappRadar

The Ronin flywheel effect. We believe other game developers have noticed this “Ronin effect” (user growth post-onboarding) and will be eager to migrate to benefit from larger audiences. This could trigger a powerful flywheel:

Great games move to Ronin → Grow user base → Validate the “Ronin effect” → Attract more games

As the pipeline of upcoming games expands, we wouldn’t be surprised to see top-tier AAA games join Ronin to revitalize their player bases. Upcoming titles include The Machine’s Arena, Axie Champions, Tribesters World, CyberKongz, PlayFightLeague, and others.

#3 Multiple Catalysts: Launchpad, Tokenomics Changes, CEX Listings, L2 ZK Rollout

Ronin is fundamentally stronger than its competitors, and we expect continued growth. Additionally, we identify four key catalysts that could boost RON’s value:

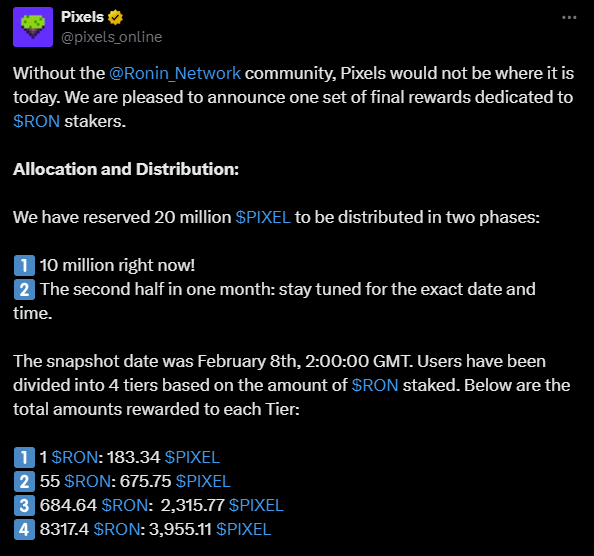

Ronin Launchpad: Staking rewards = demand for RON + airdrops to stakers. Ronin has partnered with Impossible Finance to launch an on-chain gaming launchpad. To qualify for new game tokens, RON holders must stake their tokens—naturally increasing demand. Pixels set a precedent by airdropping to RON stakers, generating returns of 10% to 3,700% in RON value (based on current RON and PIXEL prices).

Given the growing list of upcoming games, we anticipate increased buying pressure on RON as users seek early access.

-

Value accrual / tokenomics changes. Currently, Ronin collects fees from various dapps, including Katana DEX (0.05% trading fee), Mavis Marketplace (NFT marketplace, 0.5% fee), and Ronin Name Service (30% fee). These fees are collected in RON and deposited into Ronin’s treasury. While RON holders do not yet directly benefit from this revenue, co-founder Jiho has indicated that value accrual via staking rewards and/or buybacks is possible—potentially leading to revaluation.

-

Centralized exchange listings. Ronin recently listed on Binance and completed its Coinbase listing. We expect the Coinbase listing to significantly expand Ronin’s reach in Western markets (where exposure has so far been Asia-centric). We also see potential for listings on Korean CEXs—AXS and IMX are already on Upbit, while RON is not.

-

More than a chain—a gaming ecosystem. Ronin’s lead researcher Phuc Thai has hinted at a Layer-2 ZK implementation, R2, which would enhance performance and capacity while enabling more blockchain-customized games (similar to Maplestory on Avalanche subnets).

Valuation + Conclusion

Base Case Target: Given its superior metrics, we expect RON’s market cap to reach at least BEAM/IMX levels—representing 60%/260% upside, or price targets of $6.00/$13.50 respectively.

Bull Case Target: If catalysts fully materialize, Ronin could become the leading platform driving Web3 gaming adoption, competing directly with major publishers like Valve and Epic Games. Given Web3 games’ significantly higher user monetization potential, we expect RON’s valuation to surpass these incumbents (Valve valued at $7.7B, Epic Games at $22.5B per Bloomberg).

We conclude this investment thesis by emphasizing the following key points:

-

Ronin significantly outperforms peers on metrics, yet remains materially undervalued.

-

Ronin’s flywheel—great games → users → momentum—is just beginning.

-

Despite being fundamentally undervalued, multiple catalysts could drive revaluation, including launchpad enhancements, tokenomics upgrades, CEX listings, and ZK L2 deployment.

-

We believe Ronin has ignited a powerful flywheel attracting both players and developers, and the next generation of industry-disrupting Web3 games will emerge from this "kingmaker" ecosystem.

Appendix #1: References & Acknowledgments

We especially thank the Sky Mavis team (particularly @bottomd0g) for their support in our research, as well as fellow contributors who provided valuable insights and feedback: @s4msies (Ronin: A New Era), @DarkForestCap, @JavierAng_, @ahboyash, @NotSoAnonJoo, @isaac_mung, @0xMize.

Appendix #2: Mythbusting

Rumor #1: Ronin suffered a massive bridge hack in 2022. Is the Ronin chain still sound?

Yes. Although validators’ private keys were compromised, resulting in a $600M theft from the bridge, partial losses have been recovered, and Sky Mavis fully reimbursed users through its balance sheet.

Since then, Ronin has transitioned to a delegated proof-of-stake model, with Sky Mavis controlling only one of 22 reputable validators—demonstrating its commitment to decentralization.

Rumor #2: Ronin’s inflation is concerning.

In reality, ~500M RON will be released over a 7-year vesting period—longer than most other projects, which typically have under 4 years.

Rumor #3: FTX Estate still holds RON and may cause further selling pressure.

Since Ronin’s Binance listing, FTX Estate has completed RON sales via Binance. As of this writing, they have sold 10.2M RON total and transferred the final batch of 1.2M tokens just one day ago.

Appendix #3: What is Ronin?

A sidechain built for gaming. Ronin is a blockchain platform developed by Sky Mavis between 2020–2021 to address scalability and cost issues of traditional blockchains. Focused on blockchain gaming and NFT markets, it operates as an EVM-compatible chain optimized for high-volume, low-cost transactions, making it an ideal home for flagship projects like Axie Infinity and other Web3 games.

Ronin is more than a gaming platform—it’s a hub for player communities and guilds. Thanks to the early success of play-to-earn (P2E) gaming in 2021, the Ronin ecosystem gained strong foothold in emerging market gaming communities. This was amplified by strong partnerships with P2E guilds, notably Yield Guild Games (YGG), whose extensive networks and localized content helped onboard users at scale.

Ronin also offers a mobile wallet designed for mass adoption. One of the key factors enabling Ronin’s penetration into mainstream markets is the integration of the Ronin Wallet into mobile devices, making it accessible and intuitive. This experience is particularly critical in emerging markets with high mobile penetration, offering users seamless entry into the ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News