October DeFi On-Chain Activity Report: Market Recovers Across the Board, Solana, Sui, and Injective Shine

TechFlow Selected TechFlow Selected

October DeFi On-Chain Activity Report: Market Recovers Across the Board, Solana, Sui, and Injective Shine

Compared to September, the market saw a broad recovery in October, especially in the Solana and Sui ecosystems. In terms of DeFi protocols, Injective stood out.

This is the second issue of the DeFi on-chain bulletin jointly released by TechFlow and Pyth Network. DeFi data has always been a key reference in various analyses and research. As oracle infrastructure for DeFi, Pyth not only supplies data to numerous DeFi products but also offers us direct insights into the current state of DeFi and user activity through its first-hand data.

Pyth Network is an oracle built specifically for DeFi and holds a leading position in the high-throughput DeFi ecosystem. Key users include Synthetix, Venus, Ribbon Finance, Arbitrum, Cap Finance, Solend, Zeta, Wombat, and OpenBB. Pyth uses a Pull Mode pricing model, where protocols pull price data as needed, better reflecting real-time on-chain conditions.

Currently, Pyth supports over 300 low-latency price feeds for digital assets, stocks, ETFs, forex pairs, and commodities. It is the largest first-party financial oracle network, delivering secure and transparent real-time market data to more than 30 blockchains.

However, it should be noted that the data in this report is primarily provided by Pyth. While Pyth ranks second in terms of the number of supported protocols within the oracle market, some top-tier platforms like Curve use their own proprietary oracles. Therefore, the conclusions drawn here may slightly deviate from the complete market picture. The goal of this bulletin is to offer readers an additional perspective backed by primary data sources.

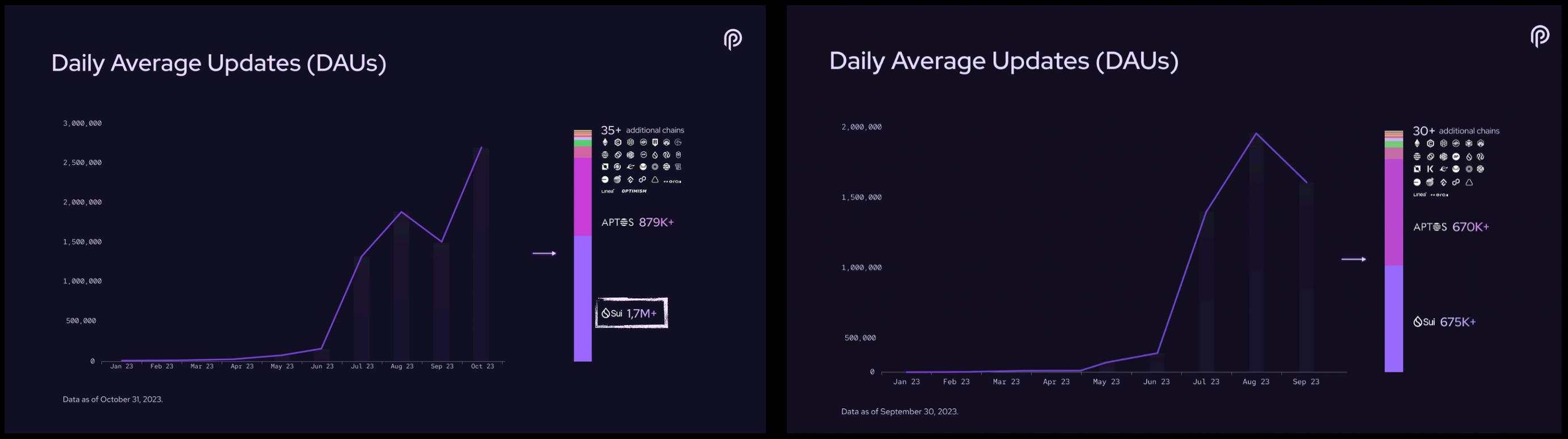

1. DAU – Daily Average Updates

DAU, or Daily Average Updates, reflects the average number of daily price updates delivered by Pyth across different blockchains during the month. This metric indirectly indicates the on-chain activity levels of #PoweredByPyth applications. A higher daily update count suggests more frequent on-chain contract interactions—and thus more transactions—occurring within DeFi protocols on that chain.

Below is the overall price update activity across chains in October:

It's evident that the total number of price updates in October increased by over 50% compared to September, driven by market recovery that led to more active on-chain trading.

Additionally, Sui’s price update frequency surged to over 250% of its September level. Since September, Sui’s TVL has consistently grown and now exceeds $150 million.

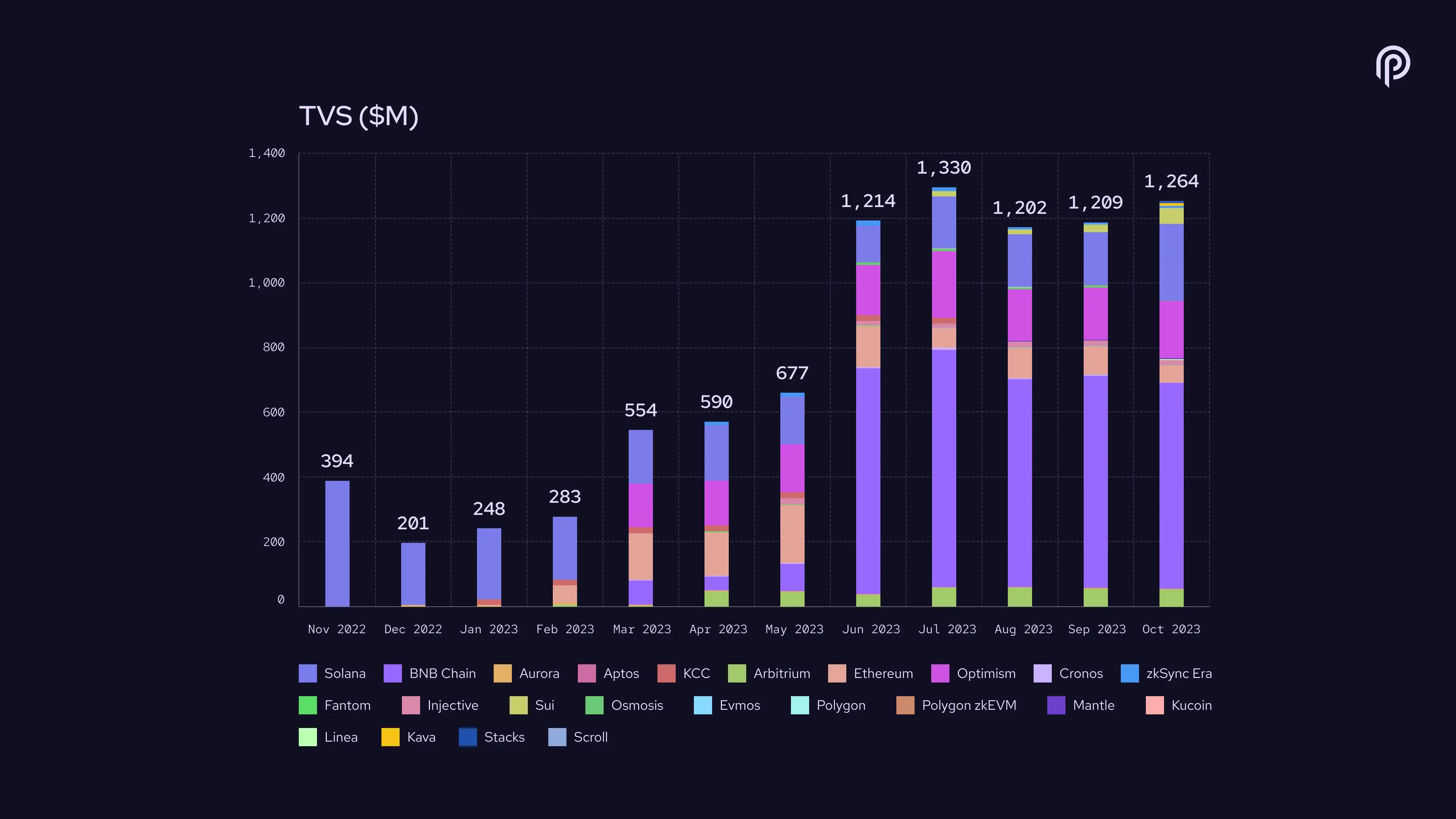

2. TVS – Total Value Secured

TVS, or Total Value Secured, is one of the most important performance metrics for oracles. TVS represents the total value locked (TVL) generated by dApps using a given oracle—in other words, the "total TVL of oracle-supported applications." This metric directly reflects the oracle’s market scale and adoption level.

Below is the TVS summary as of October:

The top three are BNB Chain, Solana, and Optimism.

Notably, Solana’s TVS showed significant growth compared to September, coinciding with repeated all-time highs in $SOL’s price. Fueled by the Solana Breakpoint conference at the end of October, both developer and user activity across the Solana ecosystem demonstrated a clear rebound trend.

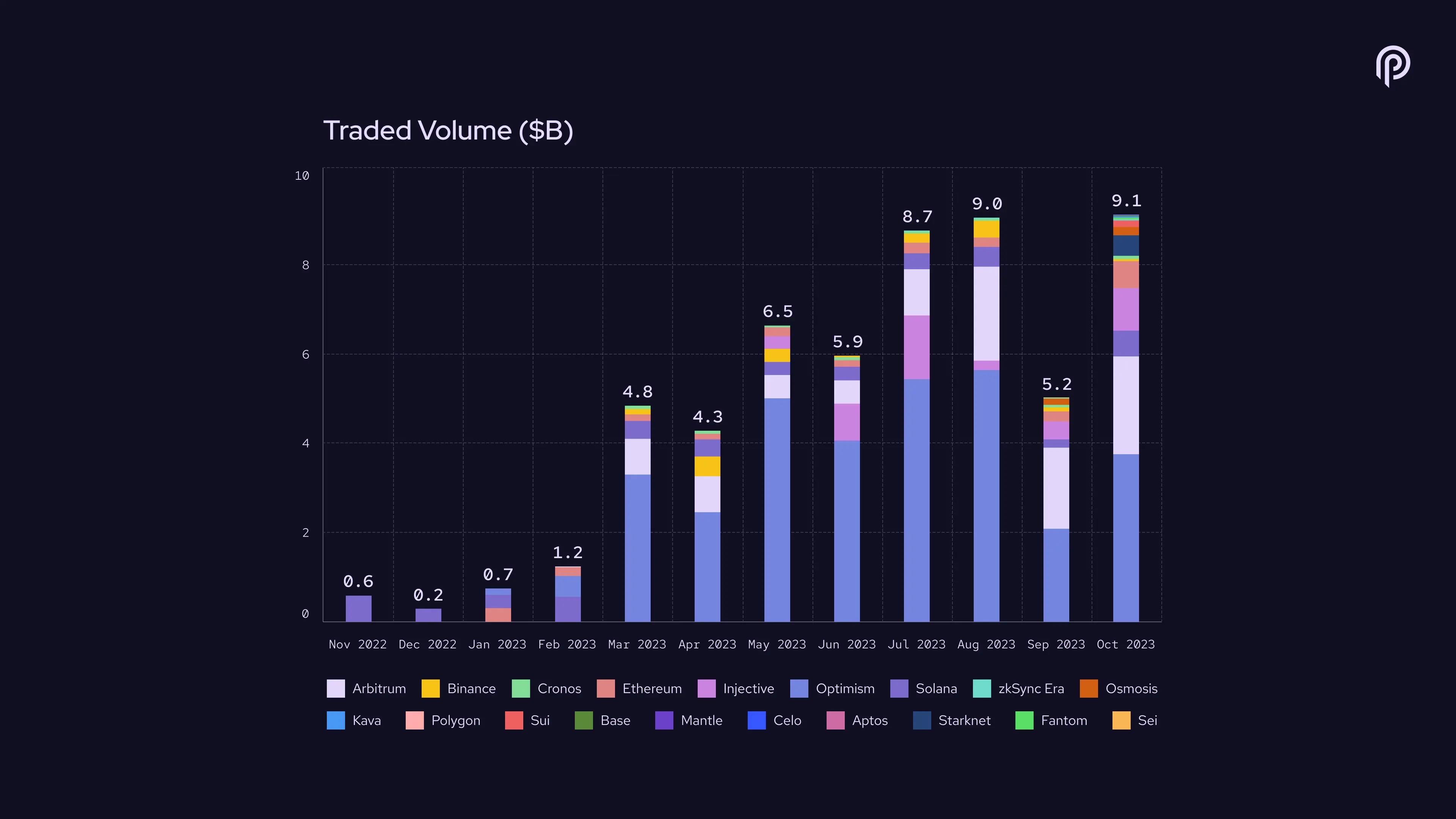

3. Traded Volume – Total Trading Volume Supported by the Oracle

Traded Volume is a common industry metric, referring here to the total trading volume on chains supported by Pyth.

Below is the data as of October:

In October, Pyth added support for StarkNet. Additionally, increased trading volumes on Solana and Injective were major contributors to the overall rise. From a price standpoint, October was also the pivotal month when $INJ began its upward trajectory.

The above includes first-hand data and brief analysis provided by Pyth. Overall, October saw broad market recovery compared to September, with particularly strong momentum in the Solana and Sui ecosystems. Among DeFi protocols, Injective stood out with exceptional performance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News