Web3 Wallet Competition Intensifies: How to Find New Opportunities in a Saturated Market?

TechFlow Selected TechFlow Selected

Web3 Wallet Competition Intensifies: How to Find New Opportunities in a Saturated Market?

This article proposes three frameworks to understand the business and strategic positioning of Web3 wallets.

Written by: MICHAELLWY

Compiled by: TechFlow

Introduction

Web3 wallets serve as the primary gateway to on-chain services, enabling users to interact with dapps and store their digital assets. With over 350 wallets listed on the WalletConnect website, it's clear that this space has become one of the most saturated sectors in crypto. The reason for this saturation is obvious: wallets represent the initial touchpoint for everything on-chain, and as distribution goes, so too does power.

In this article, I won't dive into technical details categorizing wallets into EOA, AA, MPC, or ERC-4337. While these technical classifications are important, they often only reflect distinctions within a specific layer of wallet architecture. Instead, my focus is on proposing three frameworks to understand the business and strategic positioning of Web3 wallets. These frameworks aim to provide builders and investors with a clearer understanding of the wallet ecosystem, answering questions such as: How do existing projects capture additional value in this crowded market? What strategies can newcomers adopt to carve out space among established giants? Which areas of the wallet market still present opportunities? These are the considerations guiding our discussion.

Part One: "General-Purpose Wallets" vs. "Specialized Wallets"

For this analysis, I map major wallets along two distinct axes: functional specificity and blockchain ecosystem coverage. While this classification isn't strictly quantitative or scientific, it draws from my firsthand experience with these products. Rather than focusing on each wallet’s exact position on the grid, it's more useful to observe the general quadrant they occupy. For example, wallets targeting Move-based chains and the Bitcoin Ordinals ecosystem sit toward the bottom of the chart due to their narrow ecosystem focus. Conversely, wallets designed for specific use cases like trading, staking, or social features tend toward the right side, indicating higher specialization.

This framework divides the landscape into four distinct categories:

Top-left corner: This is a fiercely competitive zone where wallets strive to be all-encompassing—offering nearly every major function, utility, and chain support. Typical players in this quadrant include CEX-affiliated apps such as Trust (Binance), Coinbase Wallet, OKX Wallet, Bitget Wallet, and others.

Top-right corner: Although these wallets maintain broad cross-chain ecosystem coverage, they don’t pursue every available feature. Instead, they focus on use cases serving their most active user segments. For instance, Zerion and Zapper offer integrated DeFi portfolio tracking. Rainbow leans heavily into NFTs, featuring native minting capabilities.

Bottom-left corner: Wallets here show clear bias toward specific ecosystems. While they may support multiple chains, their loyalty skews toward particular ones—for example, Phantom favoring Solana, or Core Wallet aligning with Avalanche and its subnets, despite supporting other EVM chains. Their goal is to gain early traction on emerging chains and build a loyal user base from day one.

Bottom-right corner: These wallets focus on specific features with a well-defined purpose, such as staking or swapping. They selectively support chains, directing resources toward those with the highest activity or liquidity, potentially offering promising investment returns.

Part Two: The Wallet Stack

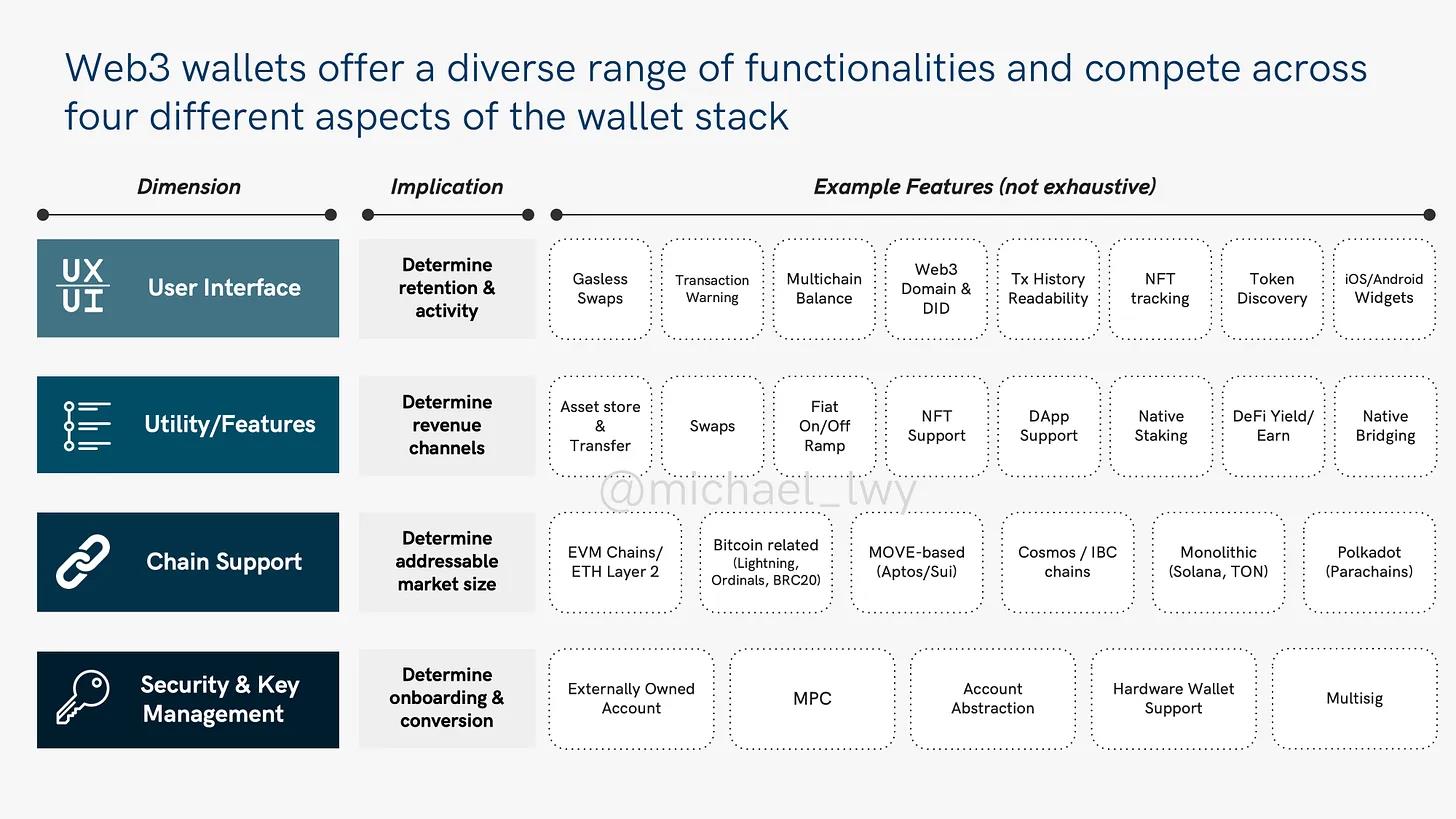

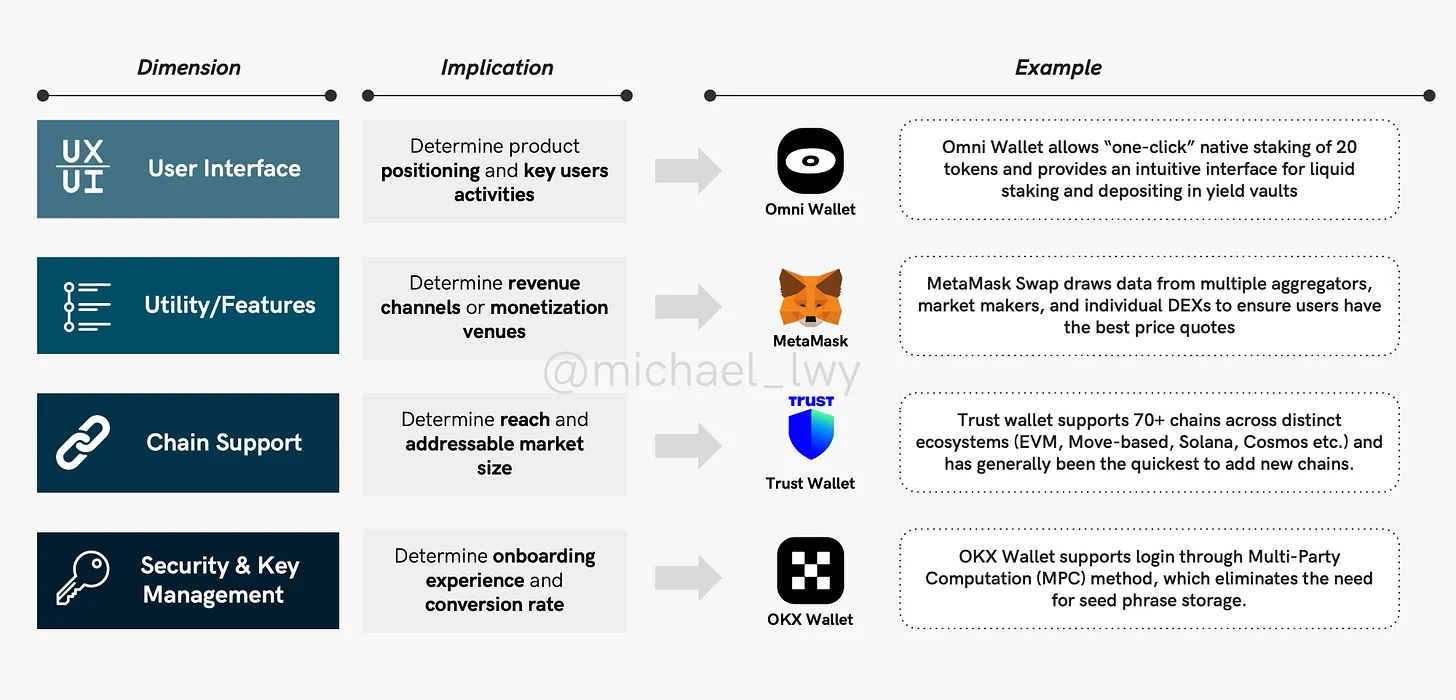

In the second framework, I build upon an idea from Messari’s Kel, who breaks down the wallet stack into four components: 1) key management, 2) blockchain connectivity, 3) user interface, and 4) application logic. Building on this foundation, I explore the strategic implications of different stack configurations. In Kel’s analysis, these four dimensions are described as separate elements that collectively determine a wallet’s accessibility, specialization, and business focus.

In my version, the wallet stack resembles a layered cake, with security and key management forming the most critical base layer. On top of a solid foundation, wallets can then focus on refining more cosmetic UI adjustments aimed at user retention. Features within each layer have specific impacts on product strategy across onboarding, conversion, monetization, and retention.

-

Security & Key Management: Self-custody is Web3’s most defining characteristic. This dimension focuses on how wallets manage private keys and ensure security. Features here include Multi-Party Computation (MPC), hardware wallet integration, multisig capabilities, and social login powered by account abstraction. Elements around key management shape the wallet’s onboarding journey and its ability to successfully convert new users.

-

Chain Support: Wallets differentiate themselves through supported blockchains. Some focus on the Ethereum ecosystem (L2s and EVM-compatible chains), while others serve Bitcoin-related protocols (BRC-20 and Ordinals), Cosmos chains, or single-chain environments like Solana and TON. In practice, a wallet’s chain compatibility defines its potential market reach.

-

Utility: This dimension highlights core functionalities that set a wallet apart. Examples include facilitating basic asset transfers, supporting dApps, native staking, and NFT management. A wallet’s utility scope establishes its revenue streams. Most wallets now offer basic services like swaps and fiat on-ramps. Therefore, differentiation increasingly depends on improvements in the next layer.

-

User Interface / User Experience: As the initial interface, UI/UX governs how users interact with the wallet. This layer includes gasless swaps, transaction alerts, multi-chain balance display logic, and integrating Web3 domains into decentralized identities (DID). This dimension shapes the primary in-app user activities.

Now let’s look at two examples: one from the top-left quadrant—Trust Wallet—and another from the bottom-right—Uniswap Wallet.

Trust Wallet epitomizes the “fat wallet.” It boasts a feature suite covering nearly all four layers of the stack. Notably, it offers robust support across almost every blockchain ecosystem. In contrast, Uniswap Wallet adopts a “lean” approach. Its design and functionality are clearly optimized for the trading experience, making it a more specialized tool.

Here are more examples illustrating how different wallets uniquely position themselves within specific dimensions.

Omni Wallet, formerly known as Steakwallet, emphasizes native staking. It provides a simple UX for staking over 20 tokens natively. From the outset, Omni’s mission has been clear: highlight DeFi yield opportunities in staking, liquid staking, and yield vaults, thereby carving out a unique niche.

Metamask operates its swap feature as an aggregator-of-aggregators, sourcing liquidity from DEXs, DEX aggregators, and market makers. This strategy ensures users get the best quotes. In return, users pay Metamask a 0.875% swap fee for this aggregation service.

Trust Wallet stands out due to its extensive chain support. It supports chains across more than 70 distinct ecosystems, including EVM, Move-based chains, Cosmos, and standalone chains like Solana and TON.

OKX Wallet has focused heavily on improving user onboarding and conversion. They introduced MPC-based social login, allowing users to create wallets using just an email. This bypasses the need to write down a 12-word recovery phrase—a common barrier for beginners.

Part Three: Monetization and Interchangeability

Another useful framework for evaluating wallet products is examining the monetization potential and interchangeability of their features.

Monetization refers to the potential for internal wallet features to generate revenue. For example, certain features such as fiat on-ramps, token swaps, and bridging can easily generate income by introducing additional platform fees. Features related to staking and DeFi yields can allocate a portion of rewards as platform fees. Beyond asset management, dapp-related features like dapp discovery or marketplaces open another revenue stream: platforms can charge advertising fees to boost visibility for certain dapps.

Interchangeability emphasizes competitive differentiation of features. It measures how distinctly a product or service differs from competitors and how replaceable it is. Basic utility features like token transfers, transaction history, and swaps are table stakes present in most wallets. However, specialized features like staking and gas fee subsidies offer stronger moats—when users choose a specific wallet to stake their assets, they’re more likely to reuse that same wallet for subsequent on-chain fund management. Social features are another example: social capabilities such as community feeds and Web3 profiles seen in Halo Wallet and Easy Wallet foster user connections. Once users establish social ties within a platform, they become locked in by network effects.

Based on the above three frameworks, we can see that it is crucial for developers and investors in the wallet space to ask the following questions:

1. Where does the wallet sit in terms of ecosystem coverage and functional specificity? Roughly which quadrant does it occupy in the first framework? Does it focus on a particular blockchain or use case? Who are the key competitors nearby on the map?

2. Which layer of the wallet stack does the project emphasize? Does it introduce meaningful differentiation and superior functionality, expanding the scope at each level? Among factors like user conversion, market reach, revenue generation, and user retention, which are prioritized?

3. Finally, how does the wallet’s feature set perform when weighed against profitability and interchangeability? How strong is the moat around this feature?

Two Trends to Watch

Finally, I’d like to highlight two key trends that could significantly reshape the wallet landscape in the future.

1. Embedded Wallets

One notable development to watch is the rise of embedded wallets—many decentralized applications (dapps) are increasingly opting to vertically integrate wallet functionality. Take the recent emergence of Friend.Tech and its forks as an example. Traditionally, they would require users to connect via Metamask or WalletConnect. But to eliminate seed phrase requirements for new users, Friend.Tech integrated an embedded wallet leveraging Privy’s infrastructure.

This shifts the paradigm from “one wallet for all dapps” to “one wallet per dapp.” Users may no longer manage assets through a single app but instead hold multiple addresses and balances across various dapps they use—challenging the “fat wallet” theory and suggesting a more fragmented wallet ecosystem. If we consider Friend.Tech as a wallet, it would fall somewhere in the far bottom-right of the first framework: its use case is specific to managing Friend.Tech keys, and its chain focus is solely on Base.

Thus, with the emergence of “Wallet-as-a-Service” (WaaS) providers such as Privy, Coinbase WaaS, Web3Auth, Magic Link, Ramper, Unipass, Dynamic, Sequence, Particle, ZeroDev, and Biconomy, the value proposition of traditional standalone wallets may weaken. Instead, dapps may encroach on the territory of wallet apps, treating wallet functions as auxiliary features and capturing market share once dominated by independent wallets.

2. Wallets’ Role in the MEV Supply Chain

This article primarily treats the wallet sector as a standalone domain, but it’s essential to also consider wallets’ role within the broader MEV supply chain. Wallets act as powerful gatekeepers in this ecosystem, translating user intent into on-chain actions. They determine how transactions are routed—whether through public mempools or private channels such as MEV-Blocker (used by Uniswap Wallet), Flashbots Protect (used by OKX Wallet), and Blink—which enforce search strategies like anti-frontrunning and anti-sandwiching.

Do not underestimate the value of user order flow within the MEV supply chain. While attention has often focused on the substantial transaction fees accumulated by Metamask Swap, a frequently overlooked detail is that Metamask’s default RPC endpoint is Infura. And you guessed it—both Metamask and Infura belong to the same parent company, ConsenSys. In short:

-

Who controls the wallet, controls the RPC endpoint.

-

Who controls the RPC endpoint, controls the order flow.

-

Who controls the order flow, controls MEV.

This hierarchical control relationship underscores the strategic importance of wallets far beyond their user interface or asset management capabilities. Their central role in the MEV supply chain influences users’ transaction experiences. Consequently, competition among searchers for valuable trades will enable wallets to monetize via Payment for Order Flow (PFOF).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News