Decoding Ethereum's ERC-4337 Revolution: What Opportunities Can We See?

TechFlow Selected TechFlow Selected

Decoding Ethereum's ERC-4337 Revolution: What Opportunities Can We See?

ERC4337 remains the optimal solution for implementing account abstraction at this stage.

Author: Jerry Luo

TLDR

Currently, the two mainstream wallet types on Ethereum are EOA and SCW, but each faces its own challenges—low execution efficiency for EOAs and inability to initiate transactions autonomously for SCWs. After years of exploration, Ethereum developers have identified account abstraction via ERC4337 as the optimal solution at this stage.

-

ERC4337 wallets separate private keys from the account entity through Bundlers, enabling batch transaction processing and allowing users to proactively initiate transactions. Additionally, built-in smart contract logic enables automated transaction handling based on external data.

-

However, this proposal still faces competition from alternative approaches such as protocol-layer account abstraction and native account abstraction wallets. Moreover, the Entry Point contract for ERC4337 only launched on Ethereum's mainnet in March, meaning many issues remain unresolved and the final design is still uncertain. Finally, due to the singleton nature of the Entry Point contract, ERC4337 faces significant limitations in terms of upgradability.

-

To address these issues, ERC4337 developers have proposed supplementary EIPs to optimize the standard without modifying the Entry Point contract. To resolve incompatibility between ERC4337 and existing DApps designed for EOA accounts, supporters have launched numerous ERC4337-native wallet projects and DApps focused on interacting with ERC4337 wallets. These provide similar interaction capabilities as traditional DeFi and SocialFi applications while improving usability.

Overall, ERC4337 remains the best available approach for achieving account abstraction today. Through Paymaster contracts that cover gas fees, it lowers the barrier for user participation in DeFi—projects can offer zero-gas or low-gas transactions to attract more users. By batching and processing transactions collectively, it significantly improves user experience in SocialFi and GameFi, offering richer interaction options.

1. Background

The trade-off between decentralization and convenience has long been a major challenge for crypto participants. Embracing decentralization means giving up the simple web2-style interactions, replacing button clicks with complex processes like managing seed phrases, signing with private keys, and manually setting nonce values. Conversely, pursuing convenience risks reliance on centralized entities like FTX and JPEX, whose collapses highlight the importance of self-custody. To solve this dilemma, Ethereum developers have explored ways to make web3 accounts as convenient as web2—this concept is known as account abstraction. At this year’s ETHCC conference, Ethereum co-founder Vitalik Buterin summarized these efforts, identifying ERC4337 as the standard receiving the broadest developer consensus.

2. How ERC4337 Account Abstraction Works

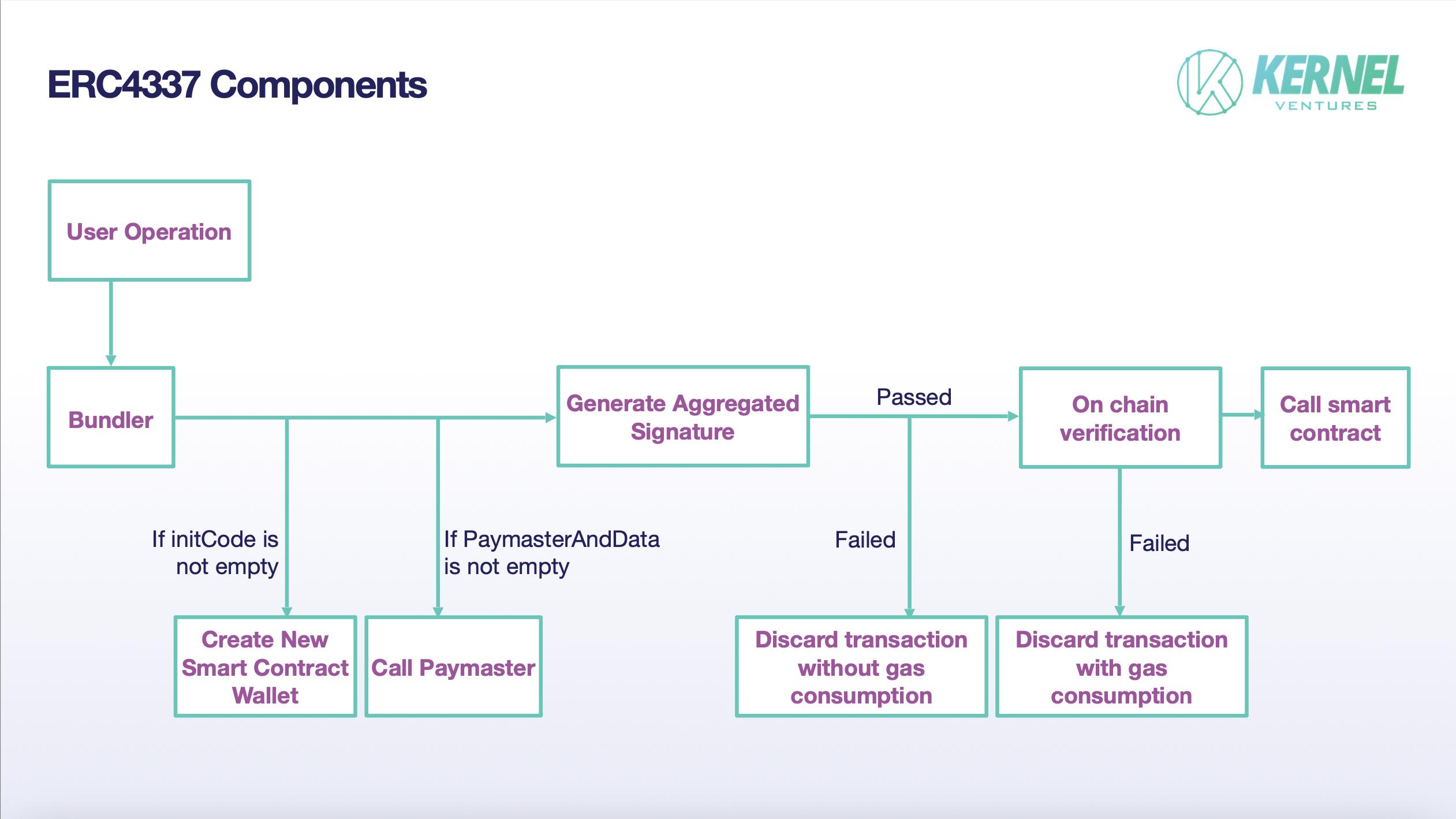

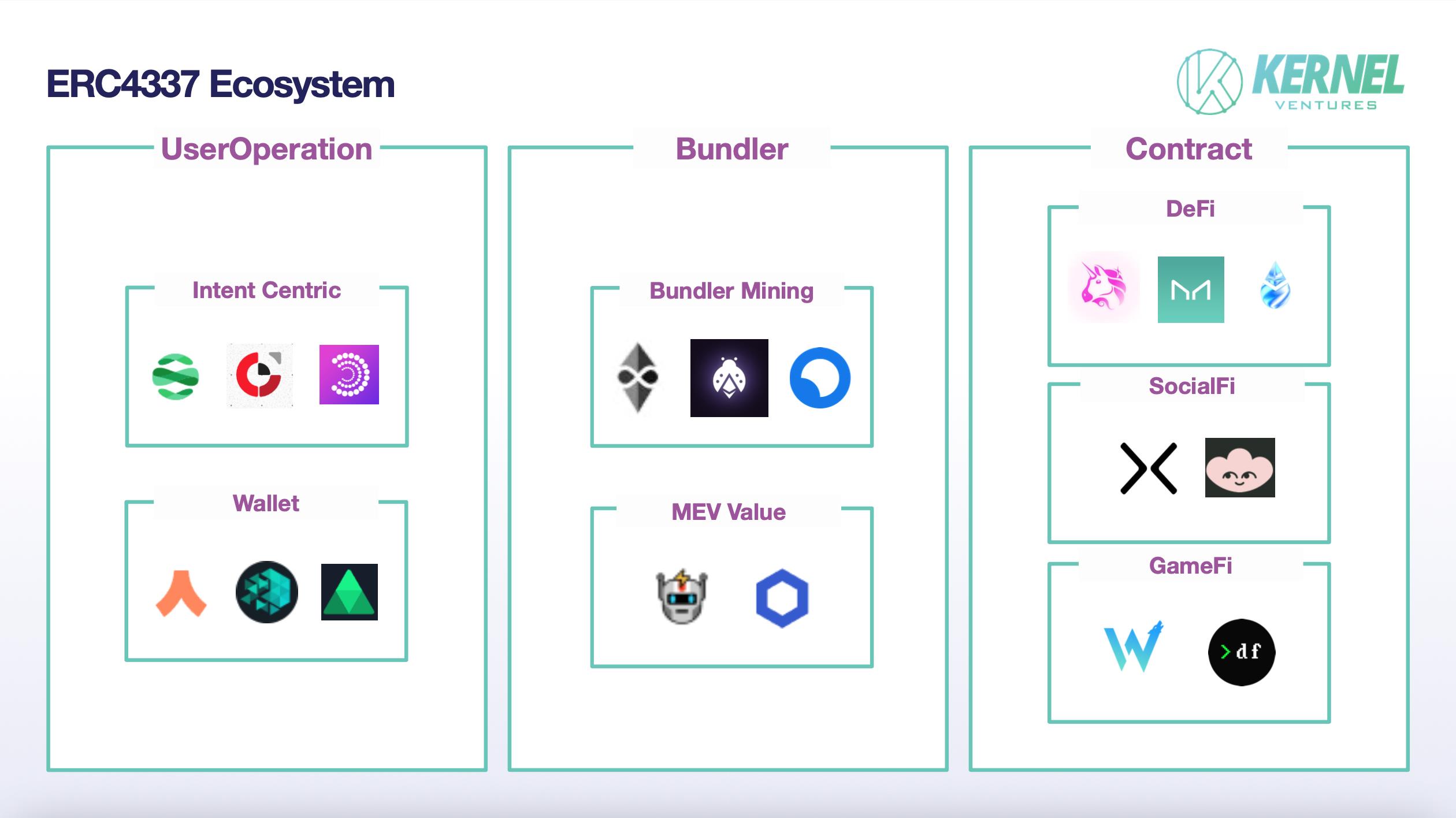

ERC4337 achieves separation of control/ownership from the account entity by involving three key components: UserOperation, Bundler, and on-chain contracts. The UserOperation contains all user-submitted transaction details; the Bundler handles packaging and triggering transactions; and the on-chain contracts—comprising Entry Point, Paymaster Contract, and Wallet Contract—implement complex validation and execution logic.

-

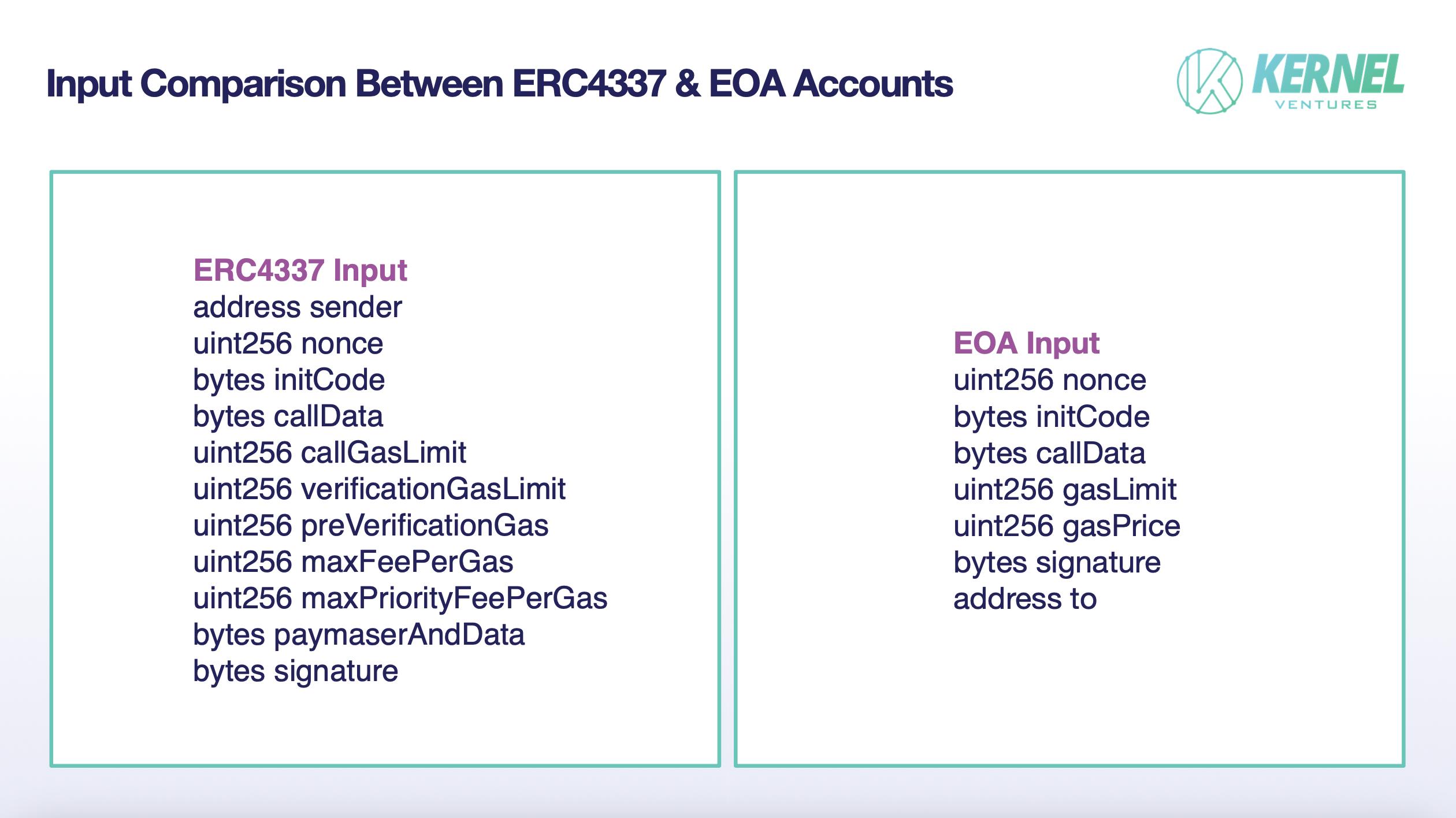

UserOperation: A UserOperation includes all transaction-related information submitted by the user. The image below compares parameters required in an ERC4337 wallet versus those needed when an EOA initiates a transaction.

The biggest difference lies in the ability of ERC4337 wallets to specify the sender explicitly, unlike EOAs where the ECDSA signature address is automatically treated as the transaction initiator. This allows ERC4337 to decouple the account entity from ownership. Additionally, ERC4337 introduces the paymasterAndData parameter to define specific details about a gas-paying proxy contract, which we will explain later.

-

Bundler: A Bundler is essentially an EOA account. Upon receiving UserOperations, it first simulates the validateOp function call within the Wallet Contract’s calldata. If the code contains TIMESTAMP, BLOCKHASH checks, or accesses outside the wallet storage, the Bundler rejects the operation to prevent malicious simulation attacks. Once validated, the Bundler batches multiple UserOperations and broadcasts them to public or private mempools. Since smart contracts on Ethereum must be triggered by an EOA, the Bundler subsequently interacts with the Entry Point contract to execute the UserOperation. During this process, the Bundler earns profits from the difference between maximum priority fee and actual gas cost, along with MEV gains from transaction ordering. Thus, the rise of ERC4337 may introduce a new form of mining on Ethereum—Bundler mining.

-

Entry Point: The Entry Point is a smart contract responsible for validating and executing UserOperations, triggered by the Bundler, thereby separating the Bundler from the smart contract wallet. It is implemented as a singleton contract under ERC4337. Each Wallet Contract, upon creation, grants special permissions to the Entry Point contract address. When the Bundler calls the Entry Point, it triggers the handleOps function, which first checks whether the wallet holds sufficient funds to compensate the Bundler. If not, the transaction reverts. Alternatively, a Paymaster contract can cover the gas cost—more on this later. Upon successful validation, the internal _executeUserOp function executes the calldata step-by-step, invoking corresponding functions in the Wallet Contract. Any leftover gas is refunded to the Bundler.

-

Wallet Contract: A Wallet Contract is essentially a smart contract wallet. It features a multiCall function capable of batching and processing calldata from UserOperations, greatly reducing gas consumption. Crucially, during execution, operations are split into validateOp and executeOp phases. If validation fails in validateOp, execution halts immediately, and any incurred gas costs are borne solely by the Bundler. However, once execution enters executeOp, any failure—even if caused externally—results in gas costs being charged to the Wallet Contract. This mechanism ensures Bundlers are fairly rewarded for honest behavior while protecting against DoS attacks by malicious actors exploiting empty wallet balances.

-

Paymaster: Paymasters are optional in ERC4337. When the paymasterAndData field in a UserOperation is non-empty, the designated Paymaster contract pays gas fees on behalf of the user. The Bundler invokes the Paymaster’s validatePaymasterOp function, which verifies whether the Paymaster has enough balance before approving gas payment per user-defined conditions. Notably, ERC4337 does not define a standard ranking system for Paymasters. Instead, Bundlers must use off-chain records of past performance to select high-quality Paymasters and filter out unreliable ones—a competitive process that enhances network efficiency.

-

Signature Aggregator: Since ERC4337 supports non-ECDSA signature schemes, UserOperations using different algorithms must first be grouped. The Bundler then uses a Signature Aggregator to generate a single aggregated signature for each group, enabling verification of multiple signatures in one step—significantly lowering gas costs.

In summary, users begin by sending a UserOperation containing custom parameters to a Bundler. If paymasterAndData is specified, the associated Paymaster covers gas fees. If initCode is present, a new smart contract wallet is created according to the provided logic. To minimize verification costs, ERC4337 employs batched transaction processing:同类 UserOperations are grouped together using a Signature Aggregator to produce a single aggregated signature, verified only once. Only after both off-chain simulation by the Bundler and on-chain validation succeed does the Wallet Contract fully execute the requested actions and refund unused gas to the Bundler as compensation.

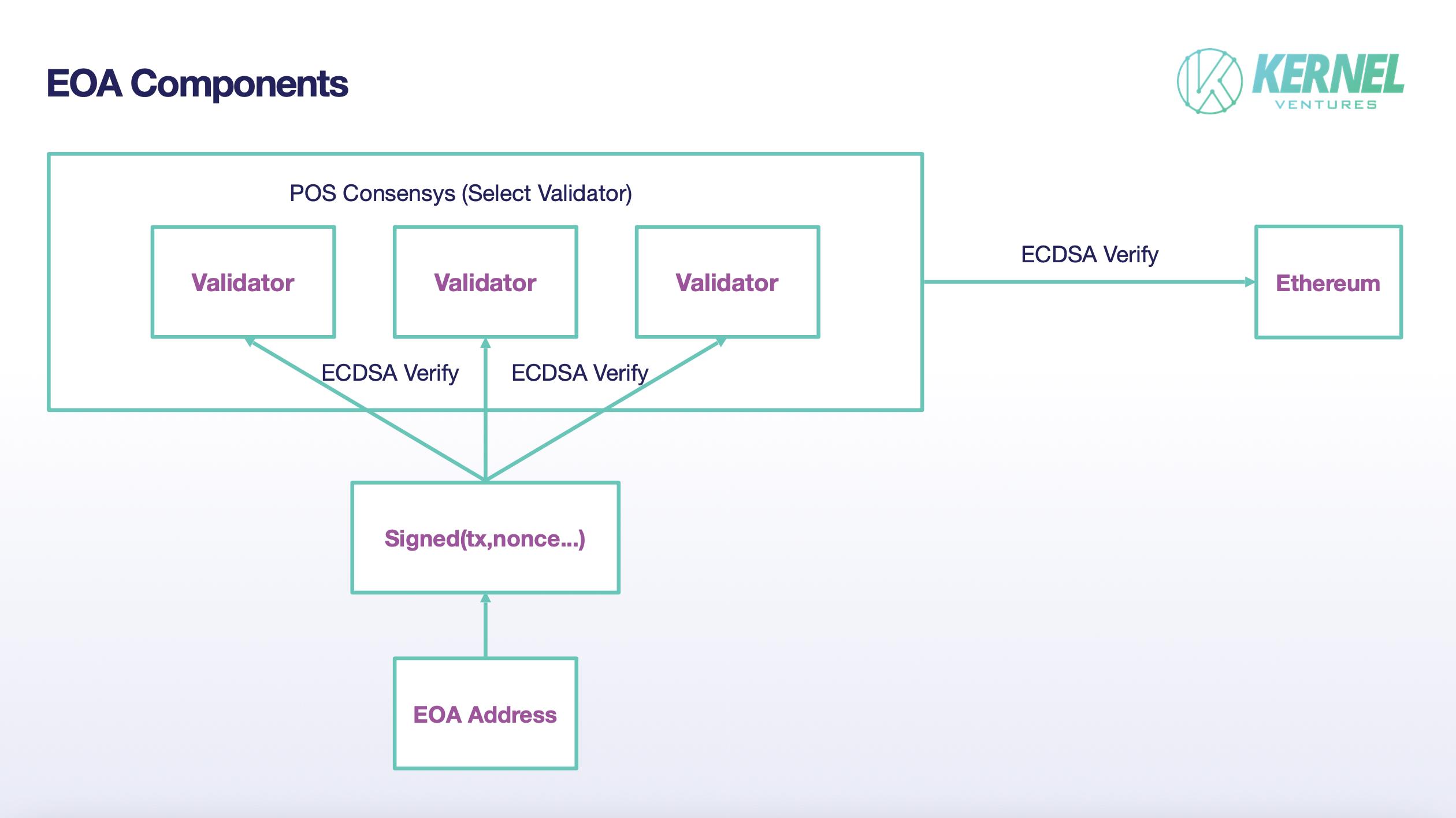

By contrast, initiating a transaction via an EOA is extremely simple: an EOA signs the transaction data and broadcasts it across the network. Validated transactions enter a pending queue and are eventually included in a block by a validator selected via PoS. This process is straightforward—no intermediaries like Bundlers or Entry Point contracts—and results in lower gas usage. Security relies solely on the ECDSA algorithm, avoiding the inherent risks of complex contract logic. However, private keys are permanently tied to account control, cannot be changed, and every transaction requires individual signing, preventing automation.

In short, ERC4337 enables separation of private keys from account ownership, reduces gas costs through batch processing, eliminates ETH balance requirements via Paymaster contracts, and allows customizable signature methods and functionalities through smart contract wallets—major advancements toward making web3 accounts more user-friendly and feature-rich.

3. Current Types of Ethereum Wallets and Their Pros and Cons

-

EOA (Externally Owned Account): Ethereum EOAs are controlled via private key signatures derived from a 12-word mnemonic phrase. While EOAs allow proactive transactions, maintaining ownership requires securely storing either a 64-character hexadecimal string or the 12-word recovery phrase—an inconvenient burden for users. Furthermore, identity-authenticated transactions require individual signatures, making repeated confirmations tedious—equivalent to separately confirming every state change behind a single action. Lastly, EOA users must pre-fund their wallets with ETH, raising the entry barrier.

-

SCW (Smart Contract Wallet): Compared to EOAs, smart contract wallets offer greater convenience and automation. Built-in contract logic enables transaction batching and automatic execution of complex operations. However, SCWs lack the authority to trigger transactions independently—their execution depends on being called by an EOA.

-

MPC (Multi-Party Computation Wallet): MPC wallets split a private key into fragments stored across multiple parties, reconstructing it only when needed for signing. While similar to multisig wallets, there are key differences: MPC uses a single private key (sharded), whereas multisig involves multiple distinct keys. Also, threshold settings and signature generation occur off-chain in MPC, unlike on-chain verification in multisig. MPC effectively mitigates single points of failure, eliminating the risk of losing access due to lost keys. However, off-chain signature generation introduces centralization risks requiring strict oversight. Most MPC solutions today are proprietary and closed-source, limiting modular integration and increasing development costs. Importantly, MPC and AA wallets serve different purposes—MPC focuses on secure key management, while AA improves transaction flexibility—and they can complement each other in future designs.

-

AA (Account Abstraction): The idea of account abstraction dates back to EIP-86 in 2017, proposing that all accounts become contracts so users could define their own security models. However, this required changes at the Ethereum consensus layer, posing high implementation difficulty and potential security risks, leading to indefinite postponement. Later, EIP-2938 reduced the required底层 modifications and addressed security concerns via mempool rule adjustments, shifting the focus toward achieving account abstraction purely at the smart contract layer. In 2021, ERC4337 was introduced, fully realizing account abstraction without altering the base protocol. In March this year, the Entry Point contract deployed on Ethereum, marking the beginning of the ERC4337 era.

4. Challenges and Responses

4.1 No Standard Yet Established

-

Consensus-Layer Account Abstraction: ERC4337 is not the only path for L1 account abstraction on Ethereum. Proposals like EIP-2938, aiming for consensus-layer abstraction, were merely suspended—not rejected. Currently, the benefits of account abstraction may not justify deep protocol changes. But as ERC4337 reaches technical limits, demand for better UX may revive interest in consensus-layer solutions that enable contract accounts to initiate transactions directly, eliminate Bundlers, and reduce complexity and costs.

-

Unfinalized EIP Proposals: ERC4337 has been live for less than a year and continues to evolve as new issues emerge. Because the Entry Point contract cannot be modified, current optimization proposals mostly target Bundler improvements or opcode enhancements—for example, EIP-5189 introduces an endorser contract to mitigate MEV attacks, and EIP-3974 proposes opcodes allowing EOAs to delegate control to smart contract accounts. Whether these will gain community approval remains to be seen.

-

Native Account Abstraction on Layer2: There are also native account abstraction implementations on Layer2 platforms like Starknet and zkSync Era. Starknet uses a non-ECDSA signature scheme that drastically reduces signing and verification costs, cutting gas fees. Moreover, Starknet only supports contract accounts by default, treating them as top-level accounts, allowing direct transaction initiation without complex workarounds—offering developers a more flexible and powerful application environment.

In sum, although ERC4337 is currently the most widely accepted option for account abstraction on Ethereum, it is not the only one.

4.2 Inherent Limitations of ERC4337

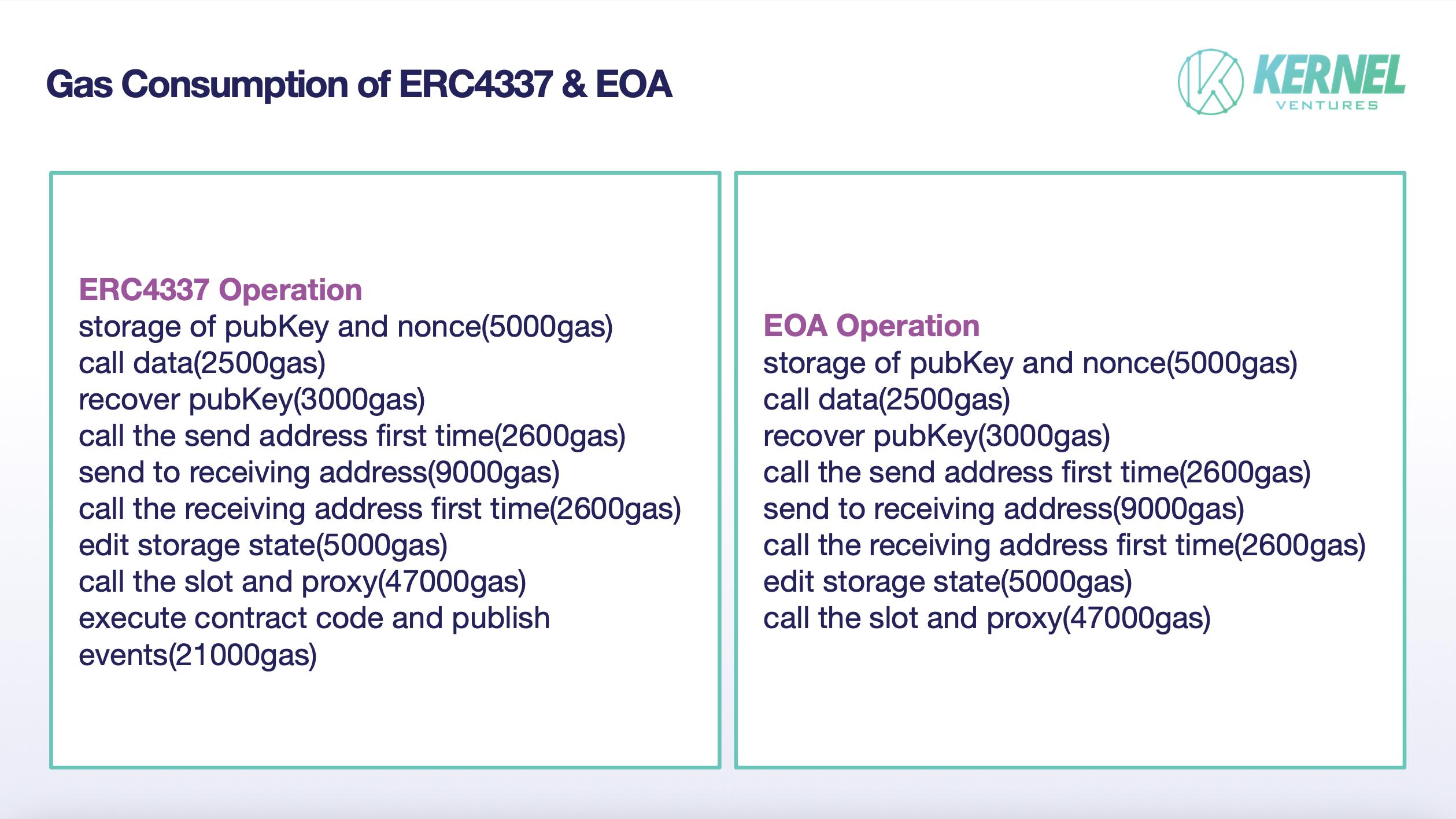

- Higher Fixed Gas Costs: Basic operations in ERC4337 wallets consume around 42,000 gas—twice that of typical EOA transactions. Key reasons include:

As shown, introducing smart contracts leads to substantial gas overhead during business logic execution (unpacking UserOperations, condition validation, on-chain hashing) and event logging. Additionally, the promised cost savings from transaction batching have proven impractical in real-world usage—most users don’t need to bundle many transactions in one call, except in rare cases like airdrops. Worse, failed UserOperations result in higher losses for either the wallet or the Bundler compared to EOA failures.

-

High Upgrade Cost: The Wallet Contract uses the entryPoint() function to obtain an IEntryPoint-compliant address and verify whether incoming calls originate from the legitimate Entry Point. However, this requires hardcoding the Entry Point address into every deployed wallet contract. Upgrading the Entry Point would thus require universal agreement among all wallet contracts—an increasingly difficult task as adoption grows, nearly equivalent in difficulty to changing the consensus layer. Hence, deployment must be done carefully with thorough audits. Future performance optimizations will also face severe constraints.

-

Smart Contract Security Risks: Traditional EOA transactions rely on cryptographic guarantees and consensus mechanisms—both well-tested and academically validated, with minimal vulnerability risk. In contrast, ERC4337 moves many previously consensus-enforced checks into contract-based validations, placing immense pressure on contract security. As transaction logic becomes more complex, so do the associated risks.

4.3 Update Costs for ERC4337

Hesitation from Major Wallet Providers

According to ChainCatcher, MetaMask product lead Alex Jupiter stated in an interview with Decrypt that despite frequent discussions about account abstraction and EOA improvements at EthCC, MetaMask will adopt such technologies cautiously.

As a traditional wallet provider, MetaMask enables easy EOA creation and earns revenue through decentralized swap fees. For established players relying on stable income streams, adopting unproven technologies carries too much risk. Most remain观望, actively exploring but proceeding with caution.

DApp Update Burden

Existing Ethereum DApps—including OpenSea, Uniswap, MetaMask Swap—are built assuming EOA accounts as primary users. Achieving full compatibility with ERC4337 wallets would require changes to how DApps validate wallet interactions and manage token staking. Updating mainstream DApps would involve rewriting core contract logic, entailing unpredictable security risks and high development costs. Additionally, given previous backlash against contract accounts following the Tornado Cash sanctions, the upgrade effort becomes even more daunting.

4.4 ERC4337 and Cross-Chain Compatibility

Most cross-chain bridges between Ethereum and Layer2 networks assume the recipient address on the destination chain matches the sender on the source chain. This works fine for EOAs since the same private key controls both addresses. However, in ERC4337 wallets, the sender is a contract address not directly controlled by a private key, making it impossible to set the recipient address identically. Consequently, ERC4337 wallets are incompatible with nearly all current cross-chain bridges connecting Ethereum L1 and L2.

4.5 Improvements to ERC4337

-

EIP-Based Enhancements: Although the core ERC4337 standard is hard to modify, supplementary EIPs can enhance functionality. For instance, EIP-5189 (proposed June 2022) introduces an endorser contract to reduce Bundler selection risks and defend against MEV bots. Other relevant proposals include EIP-3074 and EIP-5003, though their adoption awaits broader community review.

-

Cross-Chain Protocol Add-ons: The fundamental fix for cross-chain issues lies in modifying bridge protocols to allow users to freely set recipient addresses. However, this requires redeploying bridge contracts and addressing new security concerns. A practical interim solution involves using a trusted third-party EOA as intermediary—holding sufficient ETH or L2 tokens as collateral, facilitating cross-chain transfers, and reclaiming collateral upon confirmation, earning rewards in return.

-

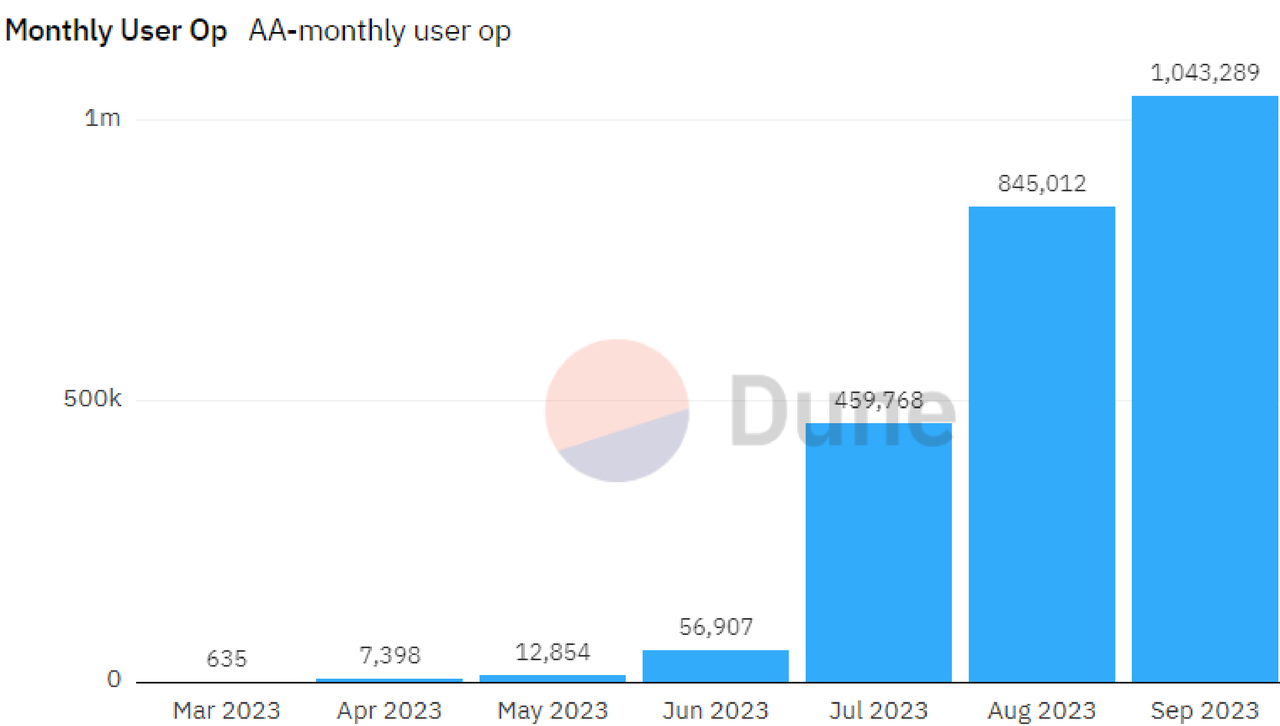

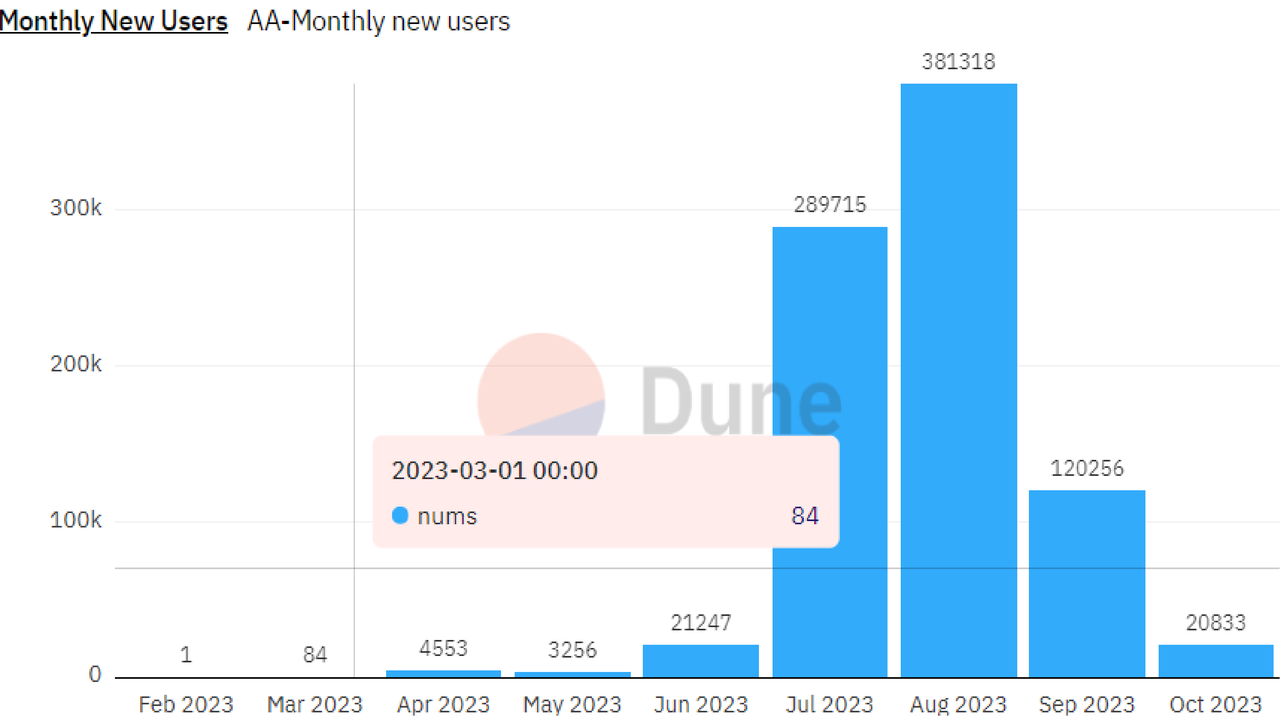

Building Native ERC4337 DApps: Since the Entry Point deployment in March, numerous ERC4337-native wallet projects have launched on Ethereum, inherently compatible with the standard. Examples include ZeroDev Kernel, a highly extensible smart contract wallet, and MynaWallet, a government-backed account abstraction initiative in Japan. Together, they form a growing ecosystem. Despite hesitation from legacy providers, monthly UserOperation volume on Ethereum has steadily increased since March, indicating rapid expansion.

5. Opportunities Created by ERC4337

5.1 Bundler: A New Type of Miner Under ERC4337

ERC4337 introduces the Bundler to decouple account control from ownership. Any EOA holding some ETH can act as a Bundler. Compared to traditional PoW mining, this new model requires near-zero upfront investment and poses no legal risks.

Compared to PoS staking, becoming a Bundler has extremely low barriers—no need to stake 32 ETH—only enough gas to interact with the Entry Point contract once.

This difference stems from the fact that Bundlers have far less incentive and opportunity to misbehave compared to validators, so large-scale staking isn't necessary to maintain incentive alignment.

Finally, compared to liquidity pool staking, Bundlers enjoy shorter lock-up periods, enhancing capital efficiency. During market downturns, users can quickly withdraw assets to limit losses.

Given these advantages, Bundler operations could become a popular new investment avenue on Ethereum, potentially evolving into pooled services akin to Bitcoin mining pools or Ethereum staking pools—offering low cost, stable returns, and high liquidity.

5.2 Intent-Centric Applications Under ERC4337

Intent-centric refers to systems where users express intentions rather than specifying exact steps—the underlying system automatically executes modular actions. For newcomers to web3, tasks like signing transactions and setting gas prices are intimidating. Even interested users often resort to CEXs instead of engaging directly with web3. This stems from a fundamental difference in intent modeling between DEXs and CEXs.

For example, suppose someone wants to swap USDT for ETH in the most profitable way via a DEX. They must manually choose the best pool, sign authorization, deposit USDT, and finally withdraw ETH—each step corresponds to a discrete on-chain action. In contrast, on a CEX, fulfilling the same intent requires only placing a market order—users don’t need to understand pricing mechanics.

Some argue manual execution offers better understanding and avoids pitfalls of automation. But such users are a minority. Most simply want reliable, modular workflows without needing to grasp underlying mechanics. Manual processes also carry higher error risks compared to battle-tested automated flows.

Before ERC4337, EOA inefficiencies—requiring individual transaction confirmations—slowed the development of intent-centric apps on Ethereum. With ERC4337, users send UserOperations to auxiliary mempools, where Bundlers batch them and submit collectively to the Entry Point for validation and execution.

In this model, users merely declare or sign their intent. Execution follows predefined consensus or contract rules, handled entirely by Bundlers without further user involvement. DApps can embed intent-centric logic: users sign their goals once, rather than selecting actions and signing repeatedly. As ERC4337 adoption grows, intent-centric DApps are poised to proliferate, dramatically lowering the barrier to web3.

5.3 ERC4337 and DeFi

During the last bull run, DeFi tightly integrated with EOA accounts, expanding on-chain interaction options and enabling staking, market-making, lending, and other financial services—culminating in “DeFi Summer.” However, complex transaction flows and high gas costs created significant barriers for average users, hindering wider adoption. Integrating ERC4337 wallets with DeFi enables intent-centric interfaces, delivering CEX-like ease of use. Paymaster support allows gasless or low-cost transactions, letting operators lower entry barriers and attract more users. However, unlike SocialFi or GameFi, DeFi involves substantial token transfers and staking, demanding extremely high security. The added complexity of account abstraction increases vulnerability risks. Additionally, following U.S. sanctions on Tornado Cash and similar privacy tools, many DeFi protocols strictly scrutinize or block interactions with contract accounts. This creates widespread incompatibility, and ERC4337 wallets risk being mistakenly blacklisted—posing major obstacles to DeFi integration.

5.4 Full-Chain Gaming Under ERC4337

Unlike early GameFi games that only placed assets and items on-chain (“semi-chain”), full-chain games encode core game logic and economic models as on-chain smart contracts, enabling fully decentralized and secure gameplay. However, going fully on-chain comes at a steep price—especially skyrocketing gas fees. Every interaction—characters, items, scenes—must be recorded on-chain, inflating operational costs.

To cope, current full-chain games keep interaction logic extremely simple, limiting user experience. Using traditional EOA accounts exacerbates this—players endure cumbersome signature prompts for every move, severely degrading playability. With account abstraction, transaction costs drop significantly—confirmation requires only a BLS aggregate signature and single verification, slashing cryptographic overhead.

Moreover, batched transactions eliminate repetitive confirmations. Customizable smart contract accounts also simplify modular game construction, boosting development speed. So far, most such integrations appear on L2s with native account abstraction—like Loot Realms and Cartridge on StarkNet.

This isn’t because Ethereum is unsuitable, but because the Entry Point contract only went live in March—many Ethereum-based ERC4337 full-chain games are still in development.

Soon, we expect many ERC4337-powered full-chain games to launch on Ethereum, greatly improving interactivity and reducing costs. Existing major titles like Dark Forest and Wolf Games may also consider updating their contracts to support ERC4337.

5.5 ERC4337 and SocialFi

Due to rigid private-key binding and limited EOA functionality, SocialFi has long struggled with high entry barriers and poor account management. Poor UX has capped project growth. Account abstraction promises to revolutionize this landscape—but balancing convenience, recoverability, and security depends on the perceived value of individual web3 identities.

First, separating private keys from account control frees users from managing chaotic hex strings or mnemonics. Dynamic password updates become possible. For example, Ambire, launched in late 2021, enables web3 account creation and key recovery via email.

Second, ERC4337’s batch transaction capability solves the very usability gap mentioned at the start: actions requiring one click in web2 can now be achieved with one click in web3.

Third, customizable contract logic brings web3 closer to web2 personalization—allowing SocialFi users to tailor account features based on preferences, much like choosing whether to enable channels in QQ.

6. Outlook

At the time of writing, web3 user count stands at roughly 300 million—about 4% of the global population and far below the 6 billion internet users worldwide. To catch up with web2 and surpass the 1-billion-user milestone, web3 needs lower entry barriers and richer customization. Among current approaches, ERC4337 offers relatively lower risk, a mature framework, and strong backing from the Ethereum Foundation and core developers. Since the deployment of the Entry Point contract, the number of account-abstraction users has grown explosively.

While ERC4337 enjoys broad recognition and community momentum, practical rollout faces hurdles.

First, the standard itself remains unsettled. Many supplementary EIPs are still under review, leaving the final shape of ERC4337 unclear—impeding ecosystem development.

Second, update costs are high. Changing the Entry Point requires near-universal coordination among wallet contracts—a prohibitively expensive endeavor.

Third, incompatibility with existing DApps and bridges persists. Widespread adoption would necessitate massive upgrades across the ecosystem, carrying high security and financial costs.

Nonetheless, active responses are underway: external contracts improve Bundler efficiency, new opcodes enhance contract account privileges, and supplementary EIPs aim to overcome upgrade limitations.

Additionally, to bypass DApp incompatibility, the ERC4337 community is building its own ecosystem, accelerating adoption. Full deployment of ERC4337 wallets could enable EVM-level intent-centric execution, abstracting DApp interactions to match the simplicity of web2—where user intent drives everything.

If intent-centric design becomes ubiquitous in Ethereum DApps, sectors like DeFi, GameFi, and others demanding simplicity and automation will see dramatic UX improvements, attracting mainstream users. However, DeFi’s exposure to token transfers makes adoption likely conservative due to stricter security demands. In contrast, SocialFi and GameFi prioritize UX over absolute security—but were previously constrained by EOA limitations, unable to implement rich interactions.

With ERC4337, these sectors can overcome high entry barriers and poor UX, potentially driving mass adoption and serving as key catalysts in the next bull cycle.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News