Bull Market Loading? A Roundup of Notable Narratives and Projects to Watch Recently

TechFlow Selected TechFlow Selected

Bull Market Loading? A Roundup of Notable Narratives and Projects to Watch Recently

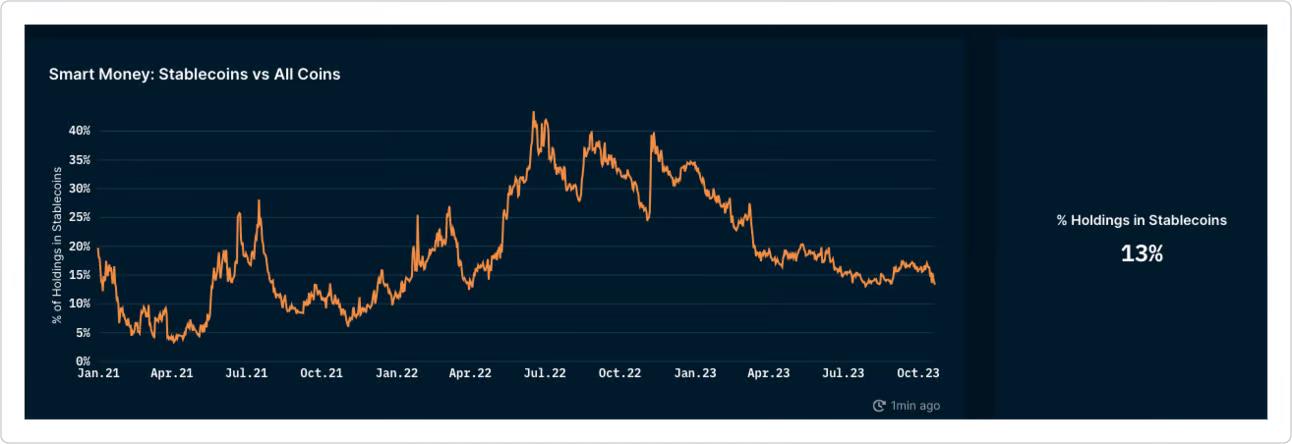

Liquidity is flowing into the market, and smart money is actively building positions and implementing strategies to maximize their returns.

Author: Aurelian

Translation: TechFlow

It seems a Cointelegraph intern's mistaken post has triggered the next bull market. After months of market stagnation and widespread predictions of further declines, this single tweet sparked a sudden market recovery, making many realize they were completely unprepared for the ETF rollout.

This Week’s Narrative: Where Do We Stand?

Recently, Bitcoin surged past $35,000 due to a misleading tweet and subsequent speculation about potential U.S. approval of a spot Bitcoin ETF—highlighting persistent bullish sentiment in the crypto market despite underlying caution caused by speculative trading and regulatory uncertainty.

-

The market responded positively to news of a court ruling in favor of Grayscale Investments’ ETF application and the SEC's decision not to appeal, along with progress on BlackRock’s ETF filing, underscoring growing anticipation and its impact on investor sentiment.

-

Despite the rebound, Bitcoin blockchain transaction activity has noticeably declined over the past month, while derivatives trading has dominated over spot trading—indicating that the rally is more driven by speculation than fundamental economic activity within the Bitcoin network.

-

A significant shift of capital from stablecoins into Bitcoin suggests strong risk appetite among market participants, signaling an early stage of a potential bull market.

DeFi, L1, and L2

-

$HAY, created five years ago by a Uniswap founder, saw its market cap surge to nearly $4 million after the founder burned 99.99% of the supply, leaving only 56 tokens in circulation.

-

Evidence shows founders of 3AC and CoinFlex misused creditors' assets for personal benefit.

-

Celestia airdrop recipients will receive significantly increased allocations following the reallocation of unclaimed tokens.

-

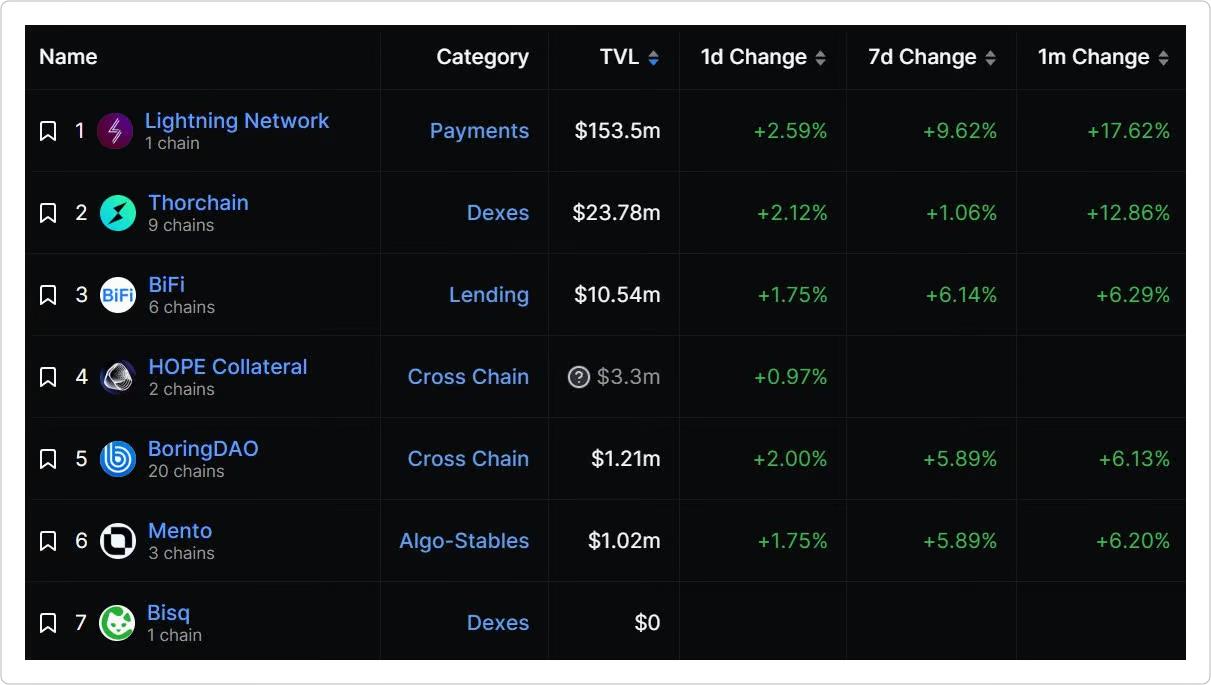

Lightning Labs has launched its Taproot Assets protocol on mainnet.

-

Maestro bots were attacked.

-

Cipher Core, Friendtech’s Arbitrum competitor, faces a soft rug as developers have left the project.

-

Vitalik invested in Nocturne Labs, a project aiming to introduce private accounts to Ethereum.

Project Spotlight: Celestia

Celestia’s genesis block will launch on October 31, and they recently introduced Blobstream. Why is the crypto community so excited about Celestia, and how could it redefine the space? Let’s dive in.

-

Modular Design: Unlike traditional blockchains, Celestia uses a different architecture that separates tasks into distinct components. This approach helps address common issues like slow transaction speeds, high security costs, and maintaining decentralization.

-

Investor Backing: With strong support from major investors and significant funding raised, Celestia has solid financial backing to pursue its goals and continue development.

In summary, Celestia matters because it tackles core challenges in the blockchain space. It offers solutions to improve how data is handled and accessed, enabling faster and more efficient blockchain operations.

Blue-Chip and Major Coins

-

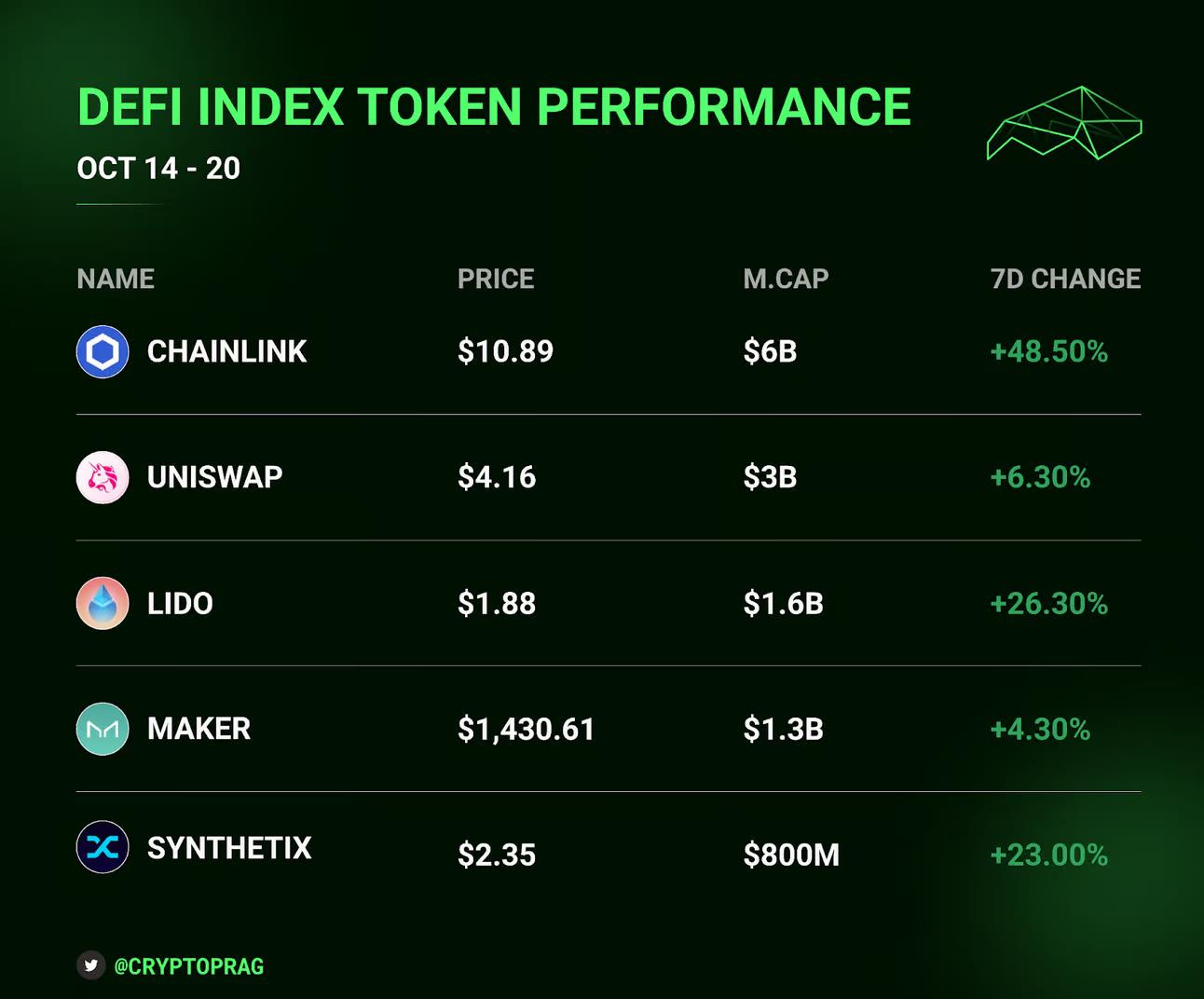

Maker achieved a record annualized revenue of $203 million, primarily driven by users depositing tokenized real-world assets to mint its stablecoin DAI.

-

Solana has been one of the top-performing major cryptocurrencies in recent days, rising nearly 40%. However, despite the sharp price increase, key fundamentals such as DeFi TVL have not seen a corresponding rise, leading to notably elevated relative valuations.

-

Capital inflows into Scroll have slowed. Compared to previous L2 launches, its TVL has been disappointing. This may be an ideal time to position via bridges using Scroll-based protocols ahead of potential future airdrops.

-

$LINK experienced a recent rebound, with its market cap surging to $6 billion and the token price climbing approximately 48%.

Degen Watchlist

Liquidity is flowing back into the market, and smart money is actively building positions and deploying strategies to maximize returns. By studying these strategies and understanding how DeFi mechanisms work—including tools and bots used by traders—valuable insights can be gained.

-

Patrick detailed JitoSOL’s excellent yield strategy on Solana—a simple yet effective DeFi strategy for Sol holders.

-

Pendle interns outlined a useful strategy: holding assets like wstETH, WBTC, and tBTC while still earning yield through Pendle and crvUSD.

-

Tokens such as SPX, JOE, and Starlink have seen substantial market cap growth over the past few weeks. Smart money has already established positions of varying sizes in these tokens.

-

Fan.tech, built on Mantle, currently has only $100,000 in TVL. If Mantle gains significant traction, this protocol is worth monitoring.

-

Canto continues to hit new highs, up 48.9% over the past two weeks. The ecosystem is drawing significant attention with the introduction of RWAs.

-

As Emperor Osmo pointed out, Bitcoin DeFi protocols are experiencing notable growth, reaching $190 million in TVL. Researching the ecosystem and its protocols before the chaos of a bull market may prove worthwhile.

NFTs and Gaming

-

Royal is redefining its mission of bringing artists and fans closer together through shared music ownership. They plan to explore new technologies and decentralization to strengthen this connection.

-

Night Run is now available for free on the Epic Games Store.

-

AI World Fair hosted by Verse Digital took place in Decentraland from October 25–27, bringing together experts from Web3, gaming, fashion, art, and robotics to discuss AI-related ideas and opportunities.

-

Y00ts’s Ethereum bridge is now live.

-

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News

Add to FavoritesShare to Social Media