OKX Ventures Latest Research Report: Ton Ecosystem and Investment Analysis

TechFlow Selected TechFlow Selected

OKX Ventures Latest Research Report: Ton Ecosystem and Investment Analysis

TON's asynchronous design also makes it more difficult to maintain broad consistency and atomicity between smart contract calls, complicating application development and maintenance.

KeyTakeaways

1. History and Development of Ton

TON has undergone a turbulent development path: Created in 2018, its ICO was halted by the SEC in 2020. It relaunched as New TON, and in 2022 the TON Foundation restarted ecosystem development. With vibrant Telegram bot activity and expectations for full-scale launches of Telegram Wallet and TON Space in November, TON's market cap has surged from $3B to $7B (+292%), though valuation remains high (mcap / TVL = 654). Token distribution is concentrated, with the foundation actively promoting OTC trading. The network has transitioned to POS with a 0.6% annual inflation rate; current staking yields approximately 3.73% APY.

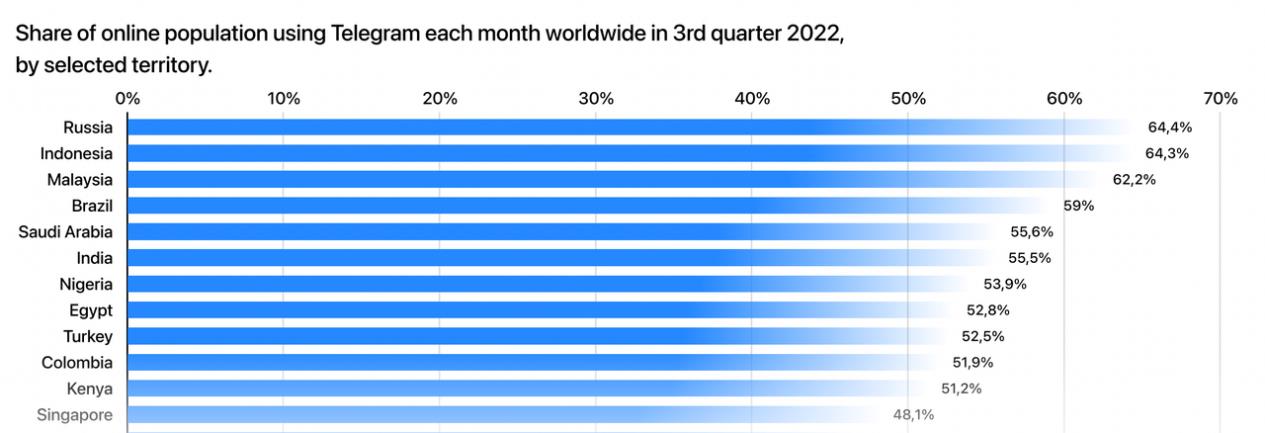

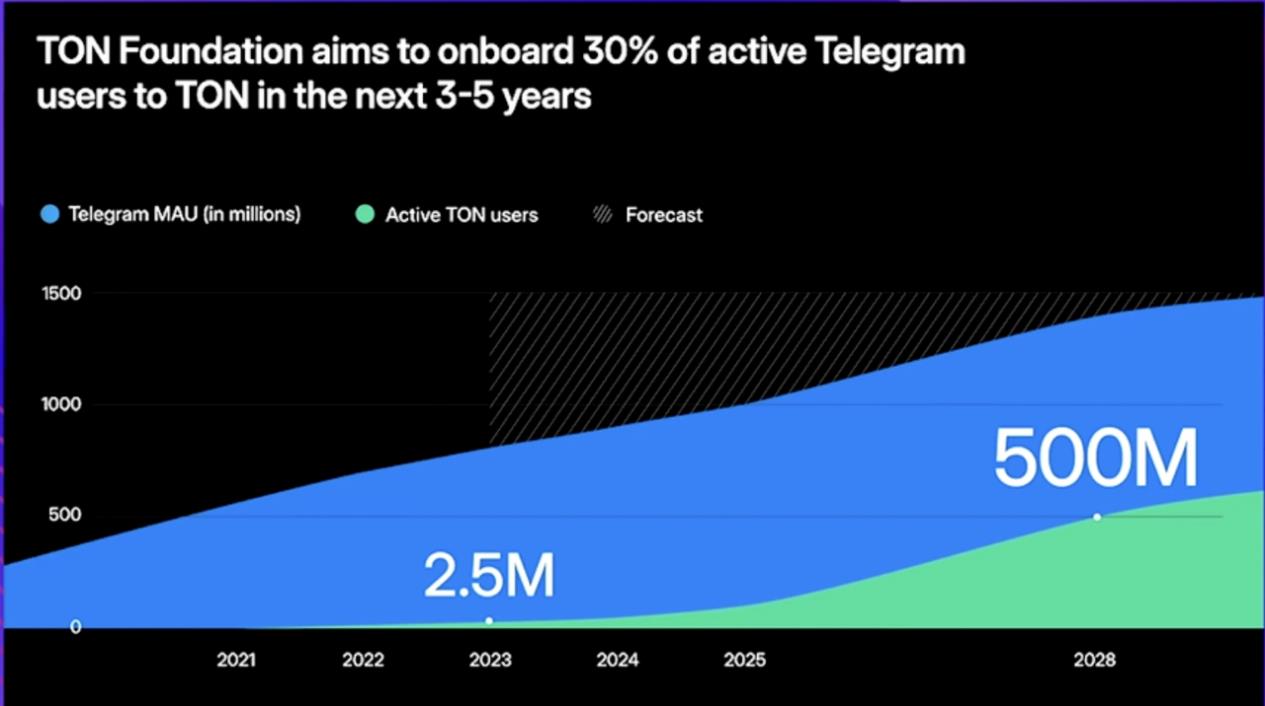

Telegram user landscape: 800 million MAUs; TON active users at 3.5M, targeting coverage of 30% of Telegram users and aiming for 500M users by 2028. Users are primarily non-Chinese and non-American (India has 100M DAU and 300M MAU; Russia, Indonesia, and Malaysia each exceed 60% market share). Telegram users focus on news, entertainment, and education, closely coupled with Twitter (59.5% also use Twitter), and exhibit strong engagement (average daily usage of 4 hours).

Infrastructure opportunities on TON: The core development language is FUNC (difficult, similar to C++). Recently, the official team introduced TACT—a scripting-language-compatible compiler—though it incurs efficiency trade-offs. Early ecosystem developers were former employees of VKontakte founded by Durov; currently, key application-layer developers come from South Korea and Russia.

2. TON Framework and Technology

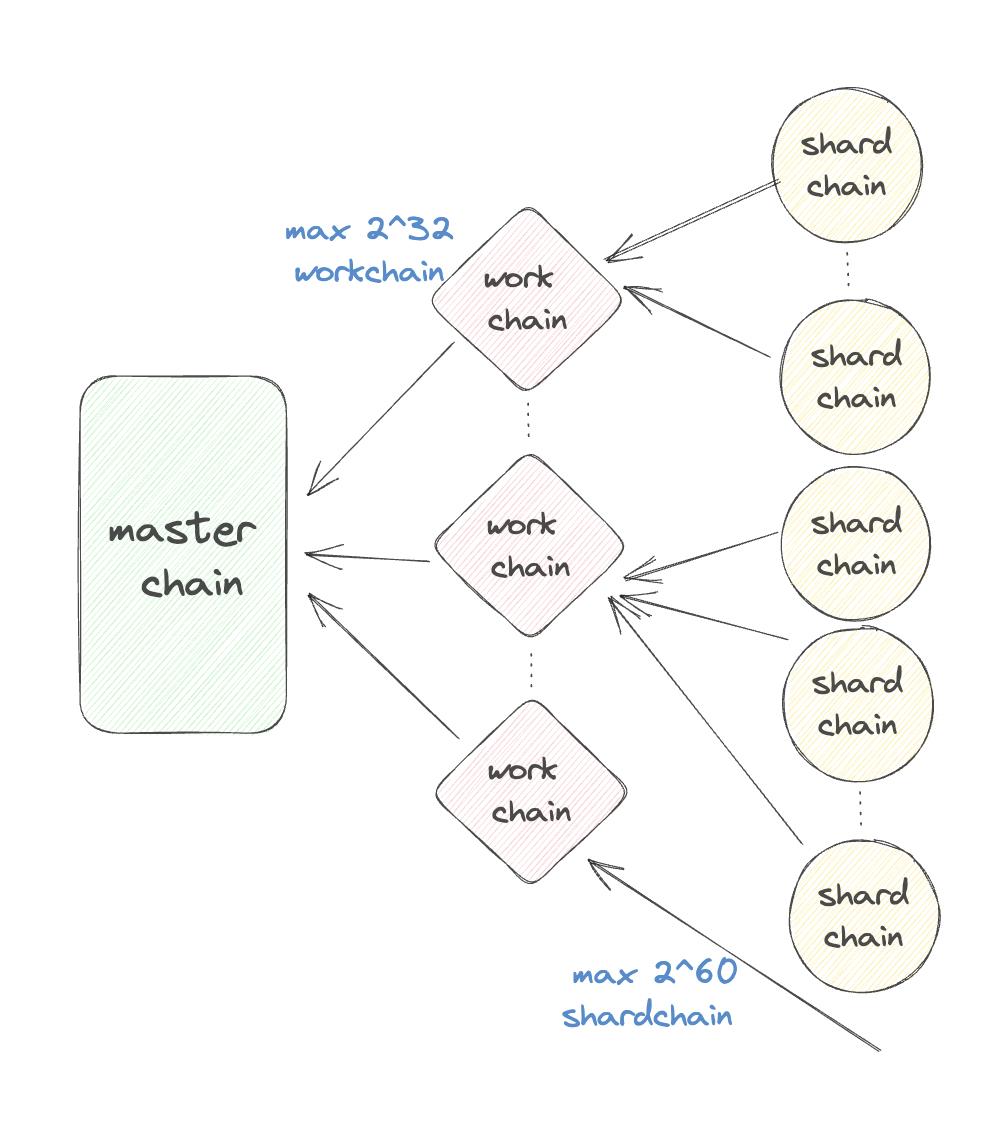

TON Architecture: Employs an adaptive infinite sharding multi-chain architecture comprising masterchain (coordinating core chain), workchains (collections of shardchains), and shardchains (further subdivisions of workchains to improve processing efficiency). Each account operates as a shardchain that can dynamically merge into larger shardchains based on transaction demand. Through adaptive infinite sharding, asynchronous message passing, and unique consensus mechanisms, TON builds a highly efficient and secure blockchain network.

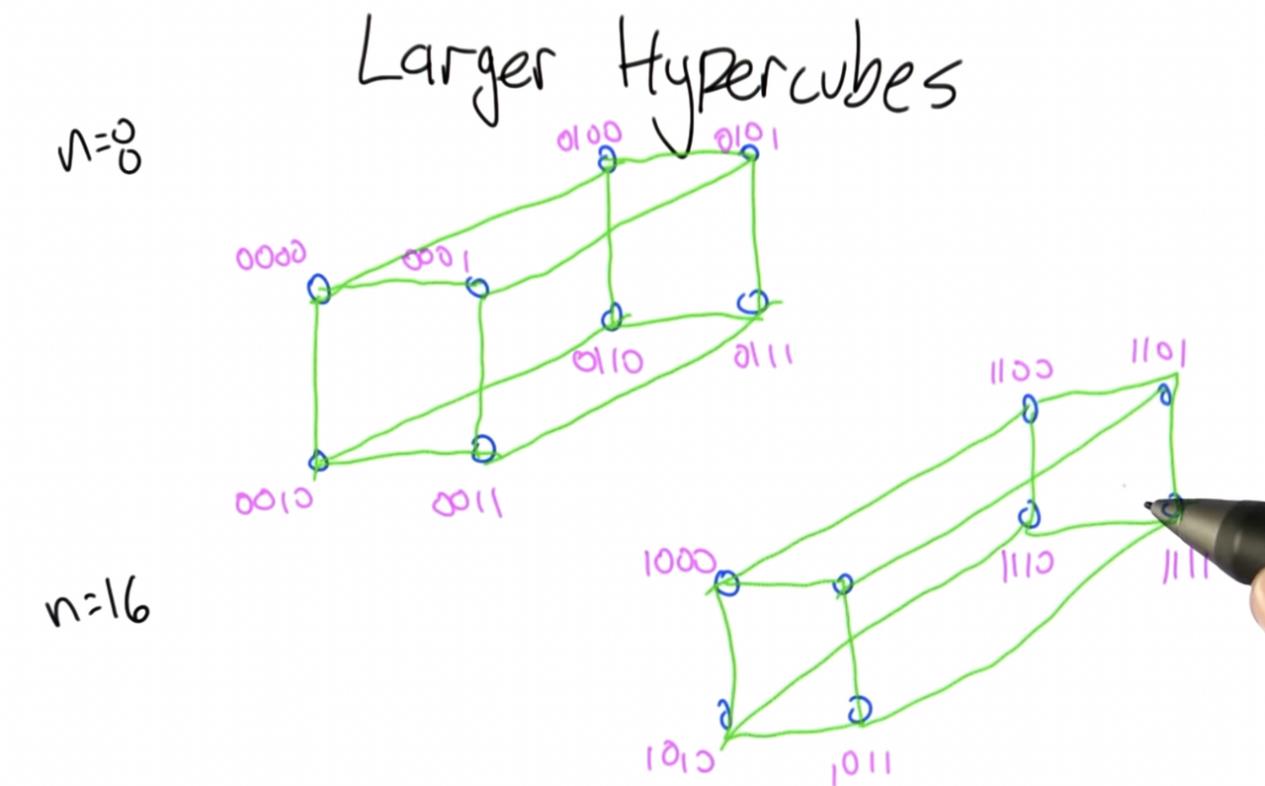

Asynchronous message passing and hypercube routing mechanism implemented: Each transaction executes within a single smart contract, communicating via asynchronous messages. Messages travel between shardchains through hypercube routing, which enables rapid delivery. Fast routing allows pre-processing and streamlined message transmission during routing.

TON Consensus Mechanism: Combines PoS and BFT. The network includes validators, fishermen, and auditors. Validators participate by staking tokens and are elected monthly. Fishermen detect validator misconduct, while auditors recommend new candidates for validation roles.

MEV and flash loan attacks have not yet emerged. Information propagates among nodes through adjacent peers using diverse paths without a mempool structure. The “fast routing” mechanism removes transactions already relayed by neighboring shardchains from output queues, preventing double-spending.

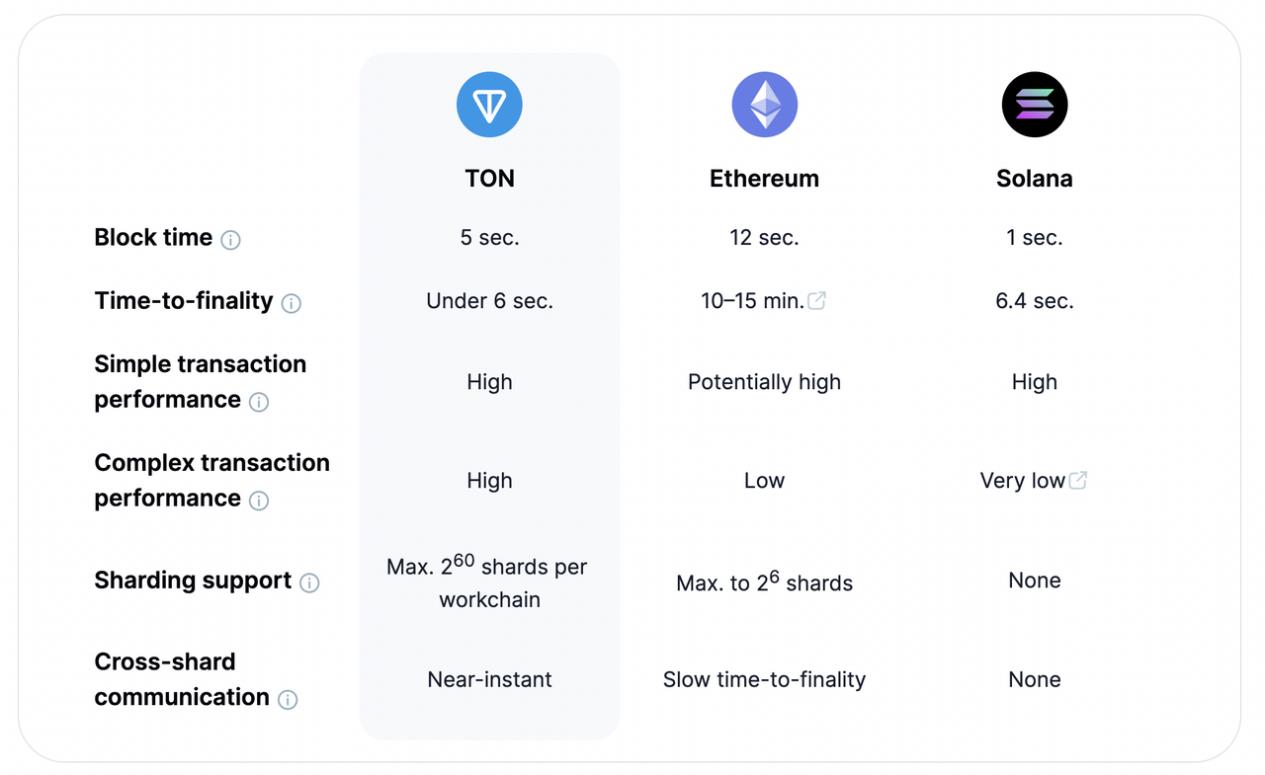

Advantages and Challenges of TON: Compared to Solana and Ethereum, TON offers fast block confirmation times, short transaction durations, a large maximum number of shards, and faster inter-shard communication. Each smart contract pays for its own resource costs—computation, storage, and network transmission. Notably, when a contract’s balance is depleted, it is automatically deleted, mitigating blockchain data bloat. However, TON’s asynchronous design complicates maintaining consistency and atomicity across contracts, increasing complexity for app development and maintenance.

3. Native Components of TON

TON P2P Network: A network protocol combining DHT-based discovery with ADNL communication;

TON DNS: A decentralized domain name system usable by both users and developers, albeit at a high price point;

TON Storage: A Dropbox-like storage solution leveraging BitTorrent technology, dubbed the "decentralized Amazon S3"; developers can deploy contracts on storage, but user-side complexity remains high;

TON Proxy: A network anonymity layer hiding TON node IP addresses, currently functional;

TON Payments: Two directions exist—@Wallet targets Web2 users with basic send/receive functionality, while the Web3-oriented TON Space aggregates payments, social features, and other ecosystem services;

Telegram Apps Center: Enables seamless development and integration of dApps onto the chain;

4. Telegram Ecosystem and TON Ecosystem

Current Telegram ecosystem model is "Bots + API + wallet custody", showing strong data metrics but offering no real support for the TON public chain;

Why should projects join the TON ecosystem? Benefits include traffic referral from Telegram’s Apps Center, native TON payments, community promotion via Telegram groups, foundation grants and investments, and lifted API restrictions—all contributing to project growth. Corresponding user experiences include instant launch, user-friendly interfaces, push notifications, social and gaming mechanics, and seamless Web3 integration.

Why does Telegram support TON? Telegram needs monetization avenues given uncertain IPO prospects and limited revenue streams. TON may represent one of the best commercialization pathways available;

Current TON ecosystem applications mostly follow the format of "Bots + API + wallet custody + TON token mapping". Fully developed FUNC-native apps remain rare, and infrastructure usability is suboptimal, leading to rising demand for developer tools and middleware like TONfura;

Officially listed applications total 551, spanning staking, wallets, utilities, NFTs, social platforms, games, and decentralized exchanges. DEXs, lending protocols, and games dominate numerically, indicating a rich and growing ecosystem;

5. Investment Strategy Considerations

Promising Infrastructure Backed by Official Support: While TON components exist, user experience requires improvement. Opportunities lie in bundling and optimizing infrastructure—such as one-stop deployment infrastructures, dynamic site search engines, dashboards, and aggregators;

Mini-program Applications: Emphasis lies on diversity and breadth of mini-programs, aligning more with mass-adoption web 2.5 than pure crypto orthodoxy. User experience and security outweigh ideological purity. TON Space and Telegram entry points attract substantial Web2 traffic. Application-side demands revolve around traffic sources, use cases, social graphs, payment gateways, and user reach—five areas where technically or ecologically strong teams could thrive;

Cautious Optimism Toward DeFi, MEV, and ZK: Current ecosystem needs lean toward stable-yield pools and foundational trading infrastructure rather than complex DeFi innovations. In traditional crypto domains, MEV, ZK, and bridges are premature focuses—the priority now is generating more assets and building stable product pipelines. Layer2 and zk-focused initiatives are not recommended in the near term;

Other Sector Directions: Dev Tools require high technical thresholds and close coordination with official teams and components, making them challenging. Social Payment and game-social graph integrations offer potential—especially small games tied to tokenomics or social platforms solving creator-user interaction problems.

1. History and Development of Ton

Team Overview

TON and Telegram are legally separate entities but have signed business agreements. TON’s development is primarily driven by the TON Foundation.

More than half of the TON Foundation team comes from countries such as Russia and Ukraine. Many members, including founders and staff, have prior experience at VK and Telegram.

Token Status

(Early October 2023 data)

Token Utility: Covers smart contract transaction fees, platform service payments, staking, cross-chain transactions, governance, and storage services on TON. Future use cases may include paying for TON proxy services.

Token Price: Currently priced at $2.04, up 292% from its September 2021 low of $0.51. Over the past year, the price has fluctuated between $1.5 and $2.5. From late 2022 to mid-2023, TON ecosystem construction led to steady price appreciation. Between May and August 2023, Telegram bot hype influenced broader TON narratives, causing temporary price declines. Since August 2023, as bot enthusiasm cooled, prices have gradually recovered.

Market Performance: FDV and TVL

(Early October 2023 data)

Market Cap: Currently $7B, stable around $3B from November 2022 to July 2023, then rising to ~$7B. Milestone developments in July–August 2023 included integration of a built-in wallet, partnership with bit.com, and launch of the TAPP App Center. Full rollout of Telegram Wallet and TON Space expected in November 2023.

TVL $10.86M; FDV $10B. mcap / TVL = 654. Compared to benchmarks like Ethereum (9.33), Solana (29.6), and Polygon (6.5), TON appears overvalued.

Tokenomics

Token Supply: Initial supply was 5 billion TON, with no hard cap and annual growth of ~0.6% (~30 million tokens). Tokens reward validators, and misbehaving validators face slashing. Staking currently yields ~3.73% APY.

Token Utility: Users can buy TON directly via credit card in Telegram Wallet, then purchase virtual goods like anonymous accounts. Future Telegram promotions may also consume TON.

Token Distribution: The team holds 1.45% of tokens; the remaining 98.55% were mined early under POW. This results in significant concentration among early miners. To address this, the foundation passed the “TON Token Economic Model Optimization Proposal” in February 2023, freezing 171 inactive wallets holding over 1.081 billion TON (21% of total supply) for 48 months. Additionally, discounted bulk sales of TON have been conducted.

Holding Distribution: 85.53% of users hold less than $1K worth of TON, 14.05% hold between $1K and $100K, and only 0.42% are whales holding over $100K. Approximately 18.08% of holders have held their tokens for over a year, while about 12.20% are short-term holders (~one month).

Revenue Streams

Transaction Fees: Average Gas fee per transaction on TON ranges from $0.1 to $0.5, significantly lower than Tron ($1–2) and Ethereum (~$7).

Service Fees: Developers pay fees for smart contracts; users can also spend TON on premium subscriptions for certain services.

Telegram / TON Domain Services: Over 34,000 DNS domains sold (compared to 2.574 million ENS domains minted on Ethereum), generating 6.26 million TON in sales (~$12 million at current rates), averaging $375 per domain—relatively expensive.

Whale Club NFT: Grants holders access to exclusive perks such as private staking pools, whale accelerator programs, and member discounts.

2. User and Developer Insights

User Information

Rapid Growth of Telegram Users: Telegram was the fastest-growing app in 2022 and is now the world’s fourth-largest instant messaging platform. Monthly active users exceed 800 million—1.4x Twitter’s 556 million, 0.61x WeChat’s 1.309 billion, 0.86x Facebook Messenger’s 931 million, and surpassing TikTok’s 715 million. Over 2.5 million new users register daily (data as of January 2023).

Rich Internal Ecosystem Expands Blockchain Use Cases: Telegram functions as an e-commerce platform, benefiting Chinese foreign trade companies significantly (exports via Telegram reached $1.2M in 2020).

Large User Base, Especially Outside China and the US:

-

Popular in Russia, India, and Brazil: In 2022, Telegram saw 34.91 million downloads in Russia, exceeding AliExpress (29.29 million). This popularity is reflected in many TON apps supporting only English and Russian. India leads in total users with 86.6 million, followed by Brazil (15.8 million), and the US (10.89 million).

-

Highest Market Share in Russia, Indonesia, Malaysia: As of Q3 2022, Telegram’s market penetration exceeded 60% in Russia, Indonesia, and Malaysia. Other countries above 50% include Brazil, Saudi Arabia, India, Nigeria, Egypt, Turkey, and Cambodia.

Primary Content Interests Are News and Entertainment, Deeply Linked with Twitter: News content dominates Telegram channels (85% share), and 59.5% of Telegram users also use Twitter.

High User Stickiness: According to Statista data, global internet users spent an average of 151 minutes daily on social media in 2023. In contrast, the average Telegram user spends four hours per month on the app, demonstrating higher-than-average engagement.

Inefficient Advertising Recommendation System: Due to Telegram’s anonymity and lack of precise ad targeting, promised traffic support from the TON ecosystem currently delivers low efficiency.

Expected Increase in TON Penetration: Based on official statistics

-

Stable Account Growth: TON has over 3.5 million on-chain accounts, up 176% in the past six months. Daily active users stand at 810,000, a 154% increase over the same period. Since January 2022, daily new user additions have averaged around 1,500, reflecting consistent growth. TON aims to cover 30% of Telegram users, targeting 500 million users by 2028.

-

349 validators spread across 25 countries, collectively staking nearly 500 million TON—about 10% of total supply and 14% of circulating supply.

Developer Landscape

Development Languages

Core Languages: Two options: FUNC, akin to C++, which is very difficult; and Fift, a lower-level language involving TVM and Fift assembly instructions, even harder to master.

Optimized Compilation Language: The recently launched high-level language TACT reduces development difficulty by ~40%. Developers familiar with TypeScript can adapt quickly—senior engineers from major tech firms can onboard rapidly. Key features:

-

User-Friendly Syntax: Inspired by JavaScript, Rust, and Swift, TACT offers friendly support for algebraic data types and compile-time execution.

-

Actor-Oriented: Designed specifically for TON’s actor model, TACT enforces strict communication contracts between strongly-typed actors, compatible with TL-B schema and algebraic data types.

-

Gas Control: TACT verifies gas costs via Gas commit and compiler checks—either static limits or explicit runtime verification.

Key Development Considerations (from Beosin Security Team):

-

Both FunC and Tact are statically typed—developers must clearly understand variable data types in their code.

-

The TON blockchain lacks revert messages—developers must carefully plan all possible execution termination paths.

-

TON has multiple transaction phases (computational phase, actions phase, bounce phase)—developers must be aware of which phase their test transactions are executing in.

-

Due to TON’s asynchronous nature, developers must handle failed call messages appropriately.

-

For external messages, replay attack risks must be considered. Implement counters or identifiers to prevent such attacks.

Development Metrics

Developers: Many originate from Telegram; core devs mainly from South Korea and Russia, known for strong technical skills but weaker product sense. According to Developer Report data, as of October 2023, there are 28 full-time developers (daily code changes >10 lines), 77 part-timers, and 124 monthly active developers. Activity peaked from early 2022 to May 2023, recently declining slightly. Overall developer count remains low compared to other ecosystems.

For comparison: Ethereum has 1,900 full-time developers; Polkadot, Cosmos, and Solana each have 300–500; top ten chains all exceed 130.

Documentation and Channels:

-

Documentation: Official developer docs are minimal, covering only smart contracts, DApp development, and TON integration. TheQ&A section allows technical discussions (currently 496 posts, ~40–50/month), but response rates are low. According toDeveloper Report, there are over 1,750 TON-related code repositories online.

-

Channels: All are Telegram-based, highly active with 50–100 messages daily.

English Developer Channel has 5,667 members, ~100 daily messages, mostly about coding and deployment issues.

Chinese Developer Channel has 1,596 members, ~50 daily messages.

Official TACT Telegram Group hosts 1,287 developers, with 50–100 daily messages—high activity.

Jetto Wallet Addresses: Despite over 3.5 million total addresses, only 143,000 hold Jetto wallets—indicating only a minority deeply engage with the TON ecosystem.

Jetton is TON’s fungible token standard. Jetton wallet contracts enable sending, receiving, and burning tokens. This tool allows developers to instantly deploy their Jettons to mainnet.

3. TON Framework and Technology

Adaptive Infinite Sharding Multi-Chain Architecture

TON’s sharding is bottom-up: accounts are first grouped into shardchains, which then interact. Unlike other blockchains, TON enables parallel transaction processing across multiple chains, earning it the nickname “blockchain of blockchains.”

TON’s architecture comprises three key parts: Masterchain, Workchain, and Shardchain. The Masterchain acts as the coordination hub, storing protocol parameters, validator sets and shares, and tracking active Workchains and their subordinate Shardchains. Lower-layer chains submit their latest block hashes to the Masterchain to ensure state finality.

-

Masterchain: Only one exists. It contains protocol parameters, validator sets and shares, and records all active Workchains and their Shardchains. Lower chains submit their latest block hashes here so that inter-chain message reads can determine the most recent state.

-

Workchain: A virtual concept representing a collection of Shardchains. Up to 2^32 Workchains can coexist. Each Workchain can customize rules (address formats, transaction types, native tokens, VMs) as long as interoperability standards are met.

-

Shardchain: To enhance processing efficiency, each Workchain splits further into Shardchains—up to 2^60 possible. Shardchains adhere to Workchain rules, distributing workload horizontally. Each serves only a subset of all accounts, splitting under heavy load and merging when idle.

Message Passing Mechanism – Asynchronous Message Passing + Hypercube Routing

Message Overview: Nodes communicate via “messages,” linked to the development language (e.g., FunC’s send_raw_message function). The basic logic involves participants processing incoming messages, updating internal states, and generating outbound messages.

Hypercube Routing Overview: Enables messages created in one shardchain block to be swiftly delivered and processed in the next block of the target shardchain, regardless of total shard count.

Asynchronous Message Passing

In asynchronous systems like TON, each transaction runs on a single smart contract and communicates via messages—unlike synchronous blockchains like Ethereum, where a single transaction can alter multiple contract states.

To achieve this, TON uses logical time (Lamport time) to sequence events. Every message carries a logical timestamp determining event order, enabling validators to prioritize processing. Execution logic ensures messages are handled strictly in timestamp order, with lower timestamps processed earlier.

Message Hypercube Routing Mechanism

Traditional hypercube routing handles three types of inter-chain messaging: between shardchains in the same workchain, different workchains, and between masterchain and workchains. Each chain connects only to those differing by one hexadecimal digit in shard ID, forming a “hypercube” topology. This network supports millions of shardchains with just log16(N) routing steps, scalable even with only four nodes.

TON employs both slow and fast message routing. Fast routing uses Merkle proofs to directly relay messages without intermediate shard involvement, reducing latency. However, if receipts are lost, validators aren’t penalized, so both modes operate in parallel.

Features include: nodes need only know neighbor info, not others’ errors; input messages collected based on rules rather than purely asynchronously; and special transactions explicitly delete output queue messages once relayed by adjacent shardchains, preventing duplication.

Global State of Shardchains – Bag of Cells and Vertical Block Repair:

“Bag of cells” refers to a set of cells forming a directed acyclic graph (DAG). Updating it involves representing the new state as another “bag of cells” rooted separately, removing old cells, then merging and deleting the old root.

In TON’s mainchain, each block in a shardchain is itself a mini-blockchain, known as a “vertical blockchain.” If a faulty shard block needs correction, a new block is submitted in the vertical chain to either replace the invalid horizontal block or describe differences from a prior version. When the vertical chain grows faster than the original, it becomes the new canonical version.

Consensus Mechanism – Combined PoS and BFT

PoS – Three Roles in the Network:

-

Validators: Participate in securing the network by staking TON tokens.

Requirements: Must stake 300,000 TON and meet hardware requirements.

Mechanism: Blocks are produced by 100–1,000 selected nodes, re-elected monthly. During their term, nodes are divided into working groups tasked with creating new blocks on designated chains. A new block is valid upon receiving signatures from over 2/3 of the group’s stake. Malicious behavior results in slashed funds and disqualification.

-

Fisherman: Earn rewards by detecting validator failures—submitting invalid proofs. If a validator accepts an invalid proof, they are penalized.

-

Auditor: Recommends new candidate blocks to validators. By verifying shard state against data from neighboring shards and submitting appropriate Merkle proofs, auditors help maintain integrity—and earn rewards if their recommendations are accepted.

BFT: Although DPoS is faster, BFT provides stronger trust guarantees, hence TON’s choice.

Comparison with Other Public Chains

TON stands out with rapid block finality, fast transactions, numerous shards, and faster inter-shard communication than Ethereum: Ethereum requires all users to interact with one smart contract, executing transactions sequentially. TON can assign a dedicated chain per user wallet. Parallel computation across shards, instant cross-shard communication, and TVM support for asynchronous computing form the theoretical basis for high TPS.

TON stands out with rapid block finality, fast transactions, numerous shards, and faster inter-shard communication than Ethereum: Ethereum requires all users to interact with one smart contract, executing transactions sequentially. TON can assign a dedicated chain per user wallet. Parallel computation across shards, instant cross-shard communication, and TVM support for asynchronous computing form the theoretical basis for high TPS.

Core Differences Between TON, Solana, and Ethereum Lie in Resource Payment and Asynchronicity—offering greater scalability and flexibility at the cost of increased application development and maintenance complexity..

-

Resource Payment: On TON, each smart contract must pay for its own resources—computation, storage, and bandwidth. Contracts must hold TON tokens to cover these costs.

This shields end-users from direct fees but means contracts must maintain sufficient balances. If a contract’s TON balance runs out, it is automatically deleted—an anti-bloat mechanism preventing unbounded blockchain growth.

-

Asynchronicity: Smart contract calls on TON are asynchronous, not atomic. When one contract invokes another, execution doesn’t happen immediately—it’s scheduled for a future block after the current transaction ends.

4. Native Components of TON

TON P2P Network

Overview: A P2P transfer protocol similar to IPFS, allowing access to the TON blockchain, transaction submission, and receipt of client account or smart contract information.

Network Structure: TON uses Kademlia Distributed Hash Table (DHT) to locate nodes. Communication occurs via Abstract Datagram Network Layer (ADNL). Each Shardchain gets a specific Overlay subnetwork for efficient communication.

-

DHT: Locates other nodes. When a client wants to send a transaction to a Validator on a Shardchain, it looks up the Validator’s location in the DHT using a key.

-

ADNL: Abstracts the traditional TCP/IP network layer. Instead of relying on IP addresses, nodes communicate using abstract network addresses—256-bit integers derived from ECC public keys and other parameters—facilitating identity recognition and enabling clean separation between Shardchains.

-

Overlay: Different Shardchains cannot and should not process transactions from other Shardchains. Therefore, each Shardchain has its own Overlay subnetwork inside the TON Network, communicating internally via ADNL-based gossip protocols.

TON DNS

Overview: A distributed, scalable naming system on TON, similar to ENS. TNS resolves human-readable names (e.g., “alice.ton”) into machine-readable identifiers. Domains are auctioned/sold on https://fragment.com/ (the priciest sale being .news for 994,000 TON, ~$2 million).

Launch Date: July 2022.

Availability: Fully operational. Users can buy domains as nicknames or wallet addresses; developers can replace smart contract addresses with .ton domains in code.

Ecosystem Support: Integrated into services like Tonkeeper, TON Web Wallet, and Tonscan. Available for resale on NFT markets like Getgems or Disintar. Owners pay an annual renewal fee of 0.015 TON.

TON Storage

Overview: A P2P file sharing and storage solution using BT (torrent) technology, comparable to Dropbox. Used to store TON blockchain blocks and snapshots. Officially branded as the “decentralized Amazon S3.”

Launch Date: January 2023.

Availability: Users can store files under 50MB via the demo interface, but must manually create Bags (file collections distributed via TON Storage), obtain BagIDs, and deploy contracts—complex for average users. Developers can host any-sized files or static TON sites by deploying contracts on TON Storage.

Roadmap: Future versions will allow users to find suitable storage nodes via a registry, improve UX, and launch TON Torrents (Dropbox-like app) and TON Storage API.

TON Proxy

Overview: A special network service allowing indirect connections between endpoints, providing network anonymity. TON Proxy hides TON node IP addresses. Users can run entry proxies directly

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News