The Role and Limitations of OKX Pay in the PayFi Ecosystem

TechFlow Selected TechFlow Selected

The Role and Limitations of OKX Pay in the PayFi Ecosystem

The actions of big companies go far beyond simple "jumping on trends."

Authors: Mia, Zhao Qirui

"PayFi appears to be the ideal of a decentralized protocol, but in practice—especially within CEX ecosystems like OKX Pay—it functions more as a sophisticated SocialFi marketing tool. OKX Pay leverages the PayFi concept to attract users, strengthens the integration between social interaction and payment behavior, enhances user stickiness and ecosystem activity, demonstrating the critical role major players have in advancing Web3 payment adoption."

1: The Origins of PayFi: Redefining Web3 Payments

Since its inception, the internet has evolved from the "read-only" era of Web1.0 to the interactive "read + write" landscape of Web2.0, and is now gradually transitioning into Web3.0—a new era based on blockchain technology, centered around users, decentralized, and enabling self-ownership of value. This evolution is not merely technological progress; it represents a profound transformation in network philosophy, value distribution, and user rights. Within this broader narrative, payments—the foundational mechanism underpinning economic activity—are undergoing their own redefinition driven by underlying technologies and ideologies.

(1) The Evolution of PayFi: An Inevitable Step Toward Value Interconnection

Traditional payment systems are rooted in centralized trust models. Institutions such as banks and credit card companies act as gatekeepers for value transfer. While this model significantly facilitated commerce in its time, it also exposes inherent pain points: high transaction costs, especially in cross-border payments with complex processes and layered fees; slow settlement speeds, where international wire transfers can take days; lack of transparency, leaving users with limited visibility into fund flows; and heavy reliance on infrastructure that still excludes billions globally from basic financial services. The dominance of Web2 platforms further centralizes control over user data and content, raising concerns about censorship and abuse of power.

Bitcoin, the first widely recognized cryptocurrency, was defined in its whitepaper as a peer-to-peer (P2P) electronic cash system designed to enable online payments without third-party intermediaries. This marked the emergence of decentralized payment concepts. However, Bitcoin's extreme price volatility severely limits its utility as a medium for everyday transactions.

The subsequent emergence of stablecoins greatly mitigated the issue of price volatility in crypto assets, making them one of the primary means of payment in the blockchain space. Stablecoins like USDC and USDT serve as "digital dollars" on-chain, widely used in payments, trading, and DeFi applications, becoming essential tools in the digital economy.

It is against this backdrop that the concept of PayFi (Payment Finance) emerged. Lily Liu of the Solana Foundation is credited with coining the term, defining it as "the process of creating new financial markets around the time value of money." PayFi is not an entirely standalone concept but rather an innovative application integrating Web3 crypto payments, decentralized finance (DeFi), and real-world assets (RWA). It aims to leverage blockchain technology to revolutionize payment systems, enabling faster, lower-cost transactions while combining financial services with payment functionality to deliver novel financial experiences and use cases.

The evolutionary trajectory of PayFi clearly reflects the progression of Web3 payments—from theoretical ideals to practical implementation, from isolated functions to integrated ecosystems. Starting from Bitcoin’s vision of P2P payments, stabilized by stablecoins to solve volatility issues, and further enhanced by incorporating DeFi’s strengths in liquidity, programmability, and yield generation, PayFi also brings real-world assets on-chain via RWA. Its core objective is to promote the application of digital assets in real-world scenarios and improve financial efficiency by unlocking the time value of money (TVM). PayFi goes beyond simple transactions, aiming to integrate payments, financing, and investment into a unified decentralized framework.

From a technical architecture perspective, PayFi is typically understood as comprising multiple layers: a settlement layer built on high-performance blockchains (e.g., Solana, Stellar, or Layer2 solutions); an asset issuance layer responsible for issuing payment instruments (such as stablecoins); a currency exchange layer connecting fiat and crypto assets; and a front-end application layer面向users. Additionally, there are supporting layers handling custody, compliance, and financing. This layered structure provides a solid technical foundation for the robust development of PayFi.

(2) Web3 vs. Web2: Reshaping Power and Value

The fundamental difference between Web2 and Web3 payments lies in their underlying trust mechanisms and methods of value transfer—not just a technical distinction, but a redefinition of user rights and system architecture.

At a deeper level, Web3 payments build a network of "machine trust" through blockchain technology. Transaction rules are encoded in smart contracts and executed automatically, replacing manual processes. User identity (via DID) and assets (via tokens) truly belong to the users themselves, stored in their blockchain addresses rather than hosted on centralized platforms. This model fundamentally challenges the Web2 paradigm where platforms monopolize data and value distribution, granting users greater autonomy and value capture capabilities.

PayFi takes this further by pushing the programmability of Web3 payments and deep integration with DeFi/RWA to the extreme. It is not merely a tool for low-cost, fast transfers, but an ecosystem capable of delivering complex financial services such as real-time financing, yield generation, and asset management directly atop payment workflows. This fusion transforms "payment" from an isolated step into a bridge connecting real-world assets and on-chain financial services, unlocking the time value of capital. This marks a paradigm shift—from simple accounting and settlement—to a value transfer infrastructure enriched with advanced financial attributes.

(3) Big Tech Moves: Giants Enter and Confirm the Paradigm

Web3 payments, particularly the "payments-as-finance" vision painted by PayFi, are attracting significant attention from industry giants. This includes not only deepening efforts by native crypto players but, more notably, increasing involvement from traditional payment providers, financial institutions, and internet tech companies. Their entry serves both as strong validation of the sector’s potential and signals an acceleration from early exploration toward mainstream adoption.

1. Traditional Payment & Financial Giants: “Defense and Evolution”

-

Visa & Mastercard: These two credit network giants are not passive observers. They’ve begun experimenting with using stablecoins (e.g., USDC) for settlements and exploring ways to connect their vast global merchant networks with blockchain-based payments. For example, Visa has partnered with multiple crypto platforms to issue cards supporting cryptocurrency spending and has tested USDC settlements on its network—significantly reducing complexity and cost in cross-border transactions. This is a classic strategy of “embracing innovation to avoid disruption.”

-

PayPal: As a pioneer in online payments, PayPal launched its own stablecoin PYUSD and allows users to buy, sell, hold, and transfer select cryptocurrencies on its platform—even using them for payments at certain merchants. This marks a strategic expansion from its Web2 stronghold into Web3, aiming to bring the advantages of crypto payments into its existing ecosystem within a compliant and user-friendly framework.

-

SWIFT: Even SWIFT, the backbone of traditional interbank communication and payment instructions, is actively exploring interoperability with central bank digital currencies (CBDCs) and tokenized assets, seeking its place in the emerging financial infrastructure.

2. Internet Tech Giants: “Crossing Boundaries and Empowerment”

-

China’s Internet Giants: With the domestic payment market already consolidated, cross-border e-commerce and overseas expansion have become new growth frontiers. The pain points of traditional cross-border payments—high costs, slow speed, and exchange rate risks—are particularly acute for these firms. Therefore, leveraging policy windows in places like Hong Kong to explore Web3 payment tools such as stablecoins for optimizing international settlements has become a strategic move. JD.com’s positioning through its Hong Kong subsidiary reflects its recognition of stablecoins’ disruptive potential in improving cross-border efficiency and lowering operational costs, aiming to leapfrog competitors in the global payment race.

-

Overseas Tech Giants: Meta (formerly Facebook) once ambitiously pursued the Diem (originally Libra) stablecoin project, aiming to build a global, low-cost payment network, especially for the unbanked. Although derailed by regulatory pressure, the attempt revealed the strong desire of tech giants with massive user bases and social ecosystems to enter payments and finance—and highlighted the potential of Web3 technology in realizing this vision.

3. Native Crypto Exchanges: “Ecosystem Closure”

-

Coinbase & OKX, etc.: These large centralized exchanges naturally possess users, assets, and transaction scenarios. They are actively expanding into payments—Coinbase Commerce enables merchants to accept crypto payments, while OKX launched OKX Pay. Their logic is to create a closed-loop ecosystem encompassing on-ramping, trading, storage, and payment consumption by integrating fiat on/off ramps, stablecoins, custodial wallets, and payment solutions. Obtaining payment licenses serves not only exchange compliance but also lays the groundwork for expanding their payment offerings.

(4) Strategic Implications Behind Big Tech Moves: From “Testing the Waters” to “Strategic Positioning”

The actions of big tech go far beyond mere trend-chasing. They recognize the strategic value embedded in Web3 payments, particularly the PayFi concept:

-

Efficiency Revolution: The near-instantaneous, low-cost nature of blockchain payments represents a game-changing advantage over existing systems.

-

New Financial Paradigm: The integration of payments with DeFi and RWA opens vast possibilities for financial innovation—such as instant clearing, programmatic financing, and automated market-making.

-

User Sovereignty Trend: While some giants still adopt centralized or semi-centralized models, the Web3 principle of returning ownership of data and assets to users is an irreversible trend they must adapt to.

-

Globalization Accelerator: For enterprises with global ambitions, Web3 payments offer a way to bypass traditional financial intermediaries and achieve more efficient global capital flows.

These giants’ explorations and investments bring not only capital, technology, and users to Web3 payments, but more importantly, they are educating the market, helping mature regulatory frameworks, and accelerating the transition of Web3 payments from “niche geek tools” to “mainstream infrastructure.” Every move they make in the PayFi space contributes to shaping this payment revolution, collectively validating the immense potential of Web3 to reshape the global financial landscape.

2: The Product Architecture of OKX Pay: Old Wine in a New Bottle

"The industry’s first truly non-custodial and compliant integrated payment app"—this is how OKX founder Star Xu positions OKX Pay, meaning providing decentralized payment pathways through a centralized exchange ecosystem. Users enjoy the convenience of OKX’s account system while completing on-chain payments via non-custodial wallets, creating a hybrid experience of “self-sovereignty + platform endorsement.” Let’s break down the underlying product logic:

(1) Multisig + ZK Email + AA: OKX Pay’s Winning Combo of “Security + Usability”

Multisignature (Multisig), standardized since the 2012 Bitcoin protocol, is one of today’s mainstream security strategies for non-custodial assets. By splitting transaction authorization among multiple signers (i.e., multiple private keys or recovery authorities), it reduces systemic risk from single-point key loss or theft. Simply put, a single account can be jointly controlled by multiple parties, requiring collective “signatures” to access funds. OKX Pay uses dual signatures—one from the user’s Passkey, and another from OKX acting as the “account guardian.”

Passkey authentication builds on asymmetric cryptography with added device and biometric verification, enabling users to access on-chain services without seed phrases—an extremely user-friendly experience. The OKX signature integrates ZK Email and Account Abstraction (AA) into the product architecture to enhance identity privacy and transaction flexibility, aiming to address high entry barriers, difficult key management, and fragmented payment experiences.

-

ZK Email (Zero-Knowledge Email): Using zero-knowledge proofs (ZKP), it encrypts and protects user identity verification data, allowing users to perform on-chain identity operations without revealing their actual email address—making it one of the friendlier entry points into Web3. It simplifies access control for on-chain identities and lowers the barrier posed by traditional seed phrases. In short, with encrypted email, a friend can send you money by entering your email. You receive an encrypted email and click to complete the receipt. Technical details like wallet addresses and private keys are all handled automatically in the background, eliminating the risk of sending funds to the wrong address.

-

Account Abstraction (AA): By abstracting Ethereum’s account model, it allows wallets to implement smart contract-controlled permissions, custom transaction logic, multi-factor authentication, and more—greatly enhancing transaction flexibility and programmability, without requiring users to directly sign complex transaction data. In simple terms, it turns the “wallet into a customizable smart account.”

In summary: ZK Email makes using a wallet as easy as using an email; AA makes your wallet as smart and secure as an app. OKX Pay packages all this together, making on-chain payments truly accessible to ordinary users.

(2) Compliance Integration: Balancing On-Chain Payments and Regulation

Although OKX Pay uses self-custodial wallets and on-chain settlement, it incorporates embedded compliance mechanisms—such as KYC and AML—at key stages including user onboarding, transaction analysis, and merchant vetting. This may seem contradictory, but in reality, OKX Pay adopts a “connectable = regulatable” strategy: the platform does not directly control user assets, but can impose restrictions on high-risk behaviors in the ecosystem through “service access,” “ecosystem admission,” “account binding,” and “limit controls.”

This manifests in several ways:

-

User identification via OKX login or account linking effectively creates centralized user profiles;

-

High-frequency transfers, merchant payouts, and community creation require identity binding or pass risk review;

-

The platform retains the ability to “block access” to malicious addresses, sensitive regions, or illegal goods payments;

-

Even though fund flows occur on-chain, the platform can still suspend aggregator services or remove recommendations from traffic feeds.

This mechanism is known as “platform-level compliance enforcement”—performing partial regulatory functions based on ecosystem access and API permissions, without accessing user private keys. It represents a pragmatic middle ground—a hybrid model of “Web2 legal logic + Web3 technical architecture”. Truly decentralized products with centralized compliance management.

3: SocialFi in a PayFi Disguise

Currently, OKX Pay’s PayFi functionality is limited to internal transfers among OKX users and does not support third-party merchants. It relies heavily on subsidies from OKX, such as zero transaction fees on the X Layer chain and passive staking rewards. Its real value lies in being an ecosystem enhancer—specifically, “payment + red packet virality”—using socialized payments to deepen engagement between OKX users and communities.

During transfers, OKX Pay requests access to the user’s contact list. If a phone number in your contacts matches an existing OKX account, you can complete the transfer with one click, avoiding the hassle of finding wallet addresses. If the recipient hasn’t registered yet, the system automatically initiates a 48-hour “cooling-off period,” temporarily holding the transfer while prompting you to invite your friend to register for OKX, set up OKX Pay, and activate their account.

This design is actually a smarter user acquisition tactic. Compared to traditional “referral codes + bonuses” or various headhunting campaigns (which can cost up to $20 per new user), OKX Pay’s transfer invitations inherently carry social trust, making them more natural and cheaper—a true “zero-cost social user acquisition” aligned with Web3 growth logic.

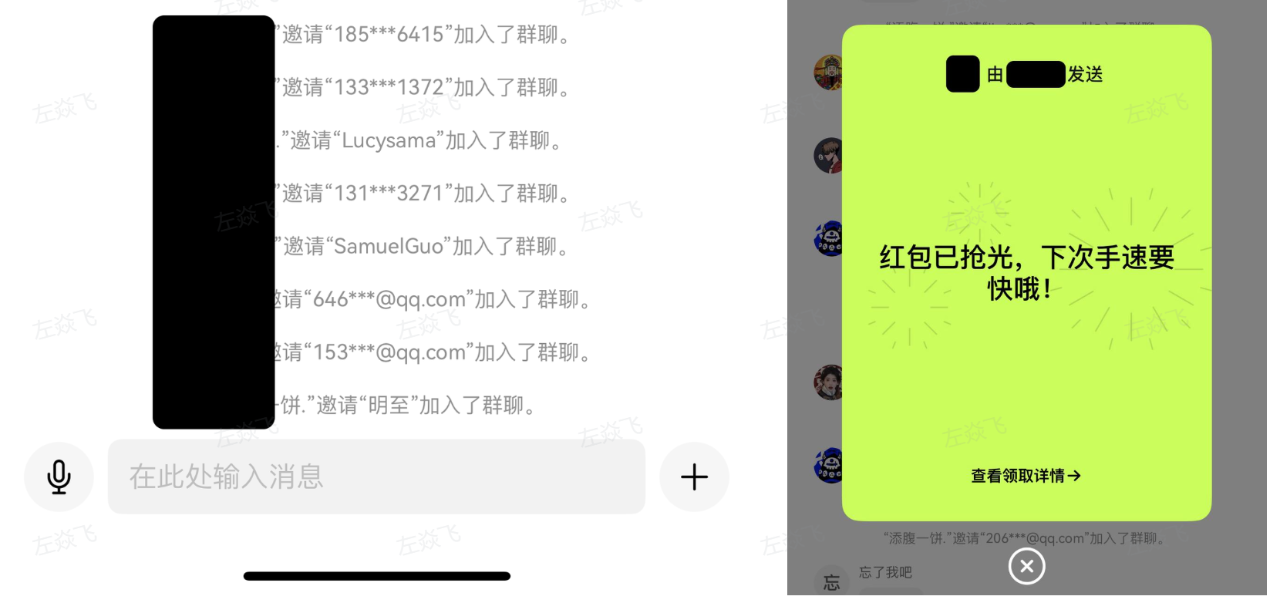

OKX’s masterstroke, however, is the KOL community built on Pay group chats, mimicking WeChat group dynamics. KOLs can create chat groups and share QR codes, allowing users to join with a single scan. Within these groups, KOLs can send red packets, discuss crypto markets, and communicate freely—bypassing keyword censorship common in traditional messaging apps—creating a more authentic Web3 atmosphere.

Insiders reveal that OKX even recruited a product manager from the established SocialFi project DeBox specifically to tailor this system after WeChat’s community mechanics. This approach is deeply “understanding of Chinese users”—low barrier, high engagement, boosting retention with minimal operational cost. Compared to Western markets dominated by Twitter, this “close-circle viral” design better fits Chinese-speaking communities and effectively supports the growth needs of integrating payments with social interactions.

4: Between Structural Advantages and Regulatory Gray Zones

Despite OKX Pay’s success in launching with a “Web3 payments + social asset network” combo, its long-term development faces multiple challenges from compliance, user behavior, business models, and geopolitical policies. Beneath its structural advantages lie unresolved systemic issues in on-chain payments.

(1) Business Competition: Closed Ecosystem, Limited Pathways

While OKX Pay claims to build a Web3 payment tool, its current use cases remain largely confined within the exchange—functioning more like a localized plugin than a standalone payment network serving broader ecosystems. Compared to native payment protocols or traditional payment companies, it lacks independent value and scalable pathways.

-

Limited Use Cases: Currently, OKX Pay is mainly used for intra-platform asset transfers, red packets, and tips. These features represent only minor adjustments to existing capital flow paths, not genuine innovations in payment experience.

-

Lack of External Integration: Unlike native Web3 payment protocols (e.g., PayFi) that can be integrated by DApps or off-chain merchants, OKX Pay does not offer open SDKs or system integration interfaces, nor has it progressed to support real-world off-chain payment scenarios.

-

No Established User Habits: Products like Binance Pay are also attempting to expand payment features, but overall, CEX payment services have yet to become users’ primary choice. Breaking through in this area remains a significant challenge for OKX Pay.

-

Ecosystems Cannot Interoperate: Different exchanges operate in silos, with incompatible payment systems. User demand for payments often depends on trust in individual platforms, lacking interoperability and network effects.

(2) Legal Compliance: Blurred Boundaries, Significant Risks

Although OKX Pay adheres to basic KYC/AML requirements, entering the on-chain payment space introduces more complex regulatory challenges. Compliance is not merely a technical process but involves defining platform responsibilities and managing legal risks.

Inadequate Identity Verification: OKX’s KYC may satisfy exchange compliance standards, but whether it meets higher thresholds for cross-border payments and anti-money laundering remains uncertain. Especially when users transfer assets off-platform for on-chain payments, the effectiveness of identity tracking diminishes.

On-chain Transparency vs. Privacy Conflicts: On-chain payments are publicly traceable. While real names aren't shown, combining on-chain data with off-chain information can reconstruct user profiles. Laws like the EU’s GDPR strictly limit such “identifiability.” Future adoption of mixers or zero-knowledge technologies for privacy could trigger regulatory concerns over facilitating money laundering.

Unclear Platform Liability:

If a payment fails, a transfer is incorrect, or fraud occurs, should OKX bear arbitration or compensation responsibilities?

In the absence of clear liability definitions like those for third-party payment providers, can users hold the platform accountable? Should the platform assume functions like freezing funds or resolving disputes?

No Unified Regulatory Definition:

Whether OKX Pay qualifies as an MSB (Money Services Business) or VASP (Virtual Asset Service Provider) depends on local interpretations of its payment function. Some jurisdictions may classify it as a wallet tool, others as a payment institution.

Large Global Policy Variations:

The EU’s MiCA regulation is establishing a unified framework, but requires national-level implementation;

U.S. regulation is fragmented, with agencies like SEC and FinCEN still unclear on boundaries between trading, payments, and securities;

Southeast Asia and the Middle East have looser regulations, but many countries can retroactively charge entities with “terrorist financing” or “illegal fund transfers.” The lack of clear compliance pathways increases uncontrollable risks.

5: Conclusion: Is OKX Pay a Protocol—or a Tool for Big-Tech Ecosystem Building?

PayFi appears to be the ideal of a decentralized protocol, but in practice—especially within CEX ecosystems like OKX Pay—it functions more as a sophisticated SocialFi marketing tool. OKX Pay leverages the PayFi concept to attract users, strengthens the integration between social interaction and payment behavior, enhances user stickiness and ecosystem activity, demonstrating the critical role major players have in advancing Web3 payment adoption.

For the industry, PayFi is both an innovative force driving Web3 payment adoption and carries the risk of centralization driven by corporate capital. Meanwhile, as legal regulations gradually mature, the PayFi ecosystem must find a balance between compliance and openness—a challenge that is also a necessary path toward healthy industry development.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News