Ryze Labs 10,000-Word Research Report: In-Depth Analysis of DePIN's Economic Model, Industry Landscape, Advantages, and Challenges

TechFlow Selected TechFlow Selected

Ryze Labs 10,000-Word Research Report: In-Depth Analysis of DePIN's Economic Model, Industry Landscape, Advantages, and Challenges

The market transformation brought by DePIN will impact the evolution of supply chains, industrial landscapes, and the entire economic ecosystem.

Author: Fred

1. Introduction: What is DePIN?

DePIN stands for Decentralized Physical Infrastructure Networks. It incentivizes users through tokens to share personal resources in building infrastructure networks, covering areas such as storage space, communication bandwidth, cloud computing, and energy.

Simply put, DePIN adopts a crowdsourced model that distributes infrastructure services—traditionally provided by centralized corporations—to numerous individuals worldwide.

According to CoinGecko data, the current market capitalization of the DePIN sector has reached $5.2 billion, surpassing Oracle's $5 billion and showing an upward trend. Projects ranging from early pioneers like Arweave and Filecoin, to Helium which surged during the last bull market, and recently prominent ones like Render Network—all fall under this category.

Some readers might wonder: these projects have existed before; Helium attracted significant attention during the previous bull run—why is DePIN gaining renewed interest and momentum now?

The reasons can be broadly summarized into three aspects:

-

Infrastructure development has become significantly more mature compared to a few years ago, paving the way and empowering the DePIN sector;

-

On the other hand, Messari first introduced the concept of DePIN at the end of 2022, calling it “one of the most important fields in crypto investment over the next decade.” This new definition and expectation reignited narrative enthusiasm around the sector;

-

Additionally, people once pinned hopes on social and gaming sectors as breakout narratives for Web3, but with the onset of the bear market, exploration has shifted toward alternative possibilities. The DePIN sector, closely linked to real-world user needs just like Web2, has naturally emerged as a key choice for Web3 builders.

So is the DePIN sector merely old wine in a new bottle, or a genuine breakthrough opportunity for Web3? This article will provide an in-depth analysis of DePIN from five perspectives: its necessity, token economics, industry status quo, representative projects, advantages, limitations, and challenges.

2. Why Do We Need DePIN?

Why do we need DePIN? What problems does it solve compared to traditional ICT infrastructure?

2.1 Current State of Traditional ICT Industry

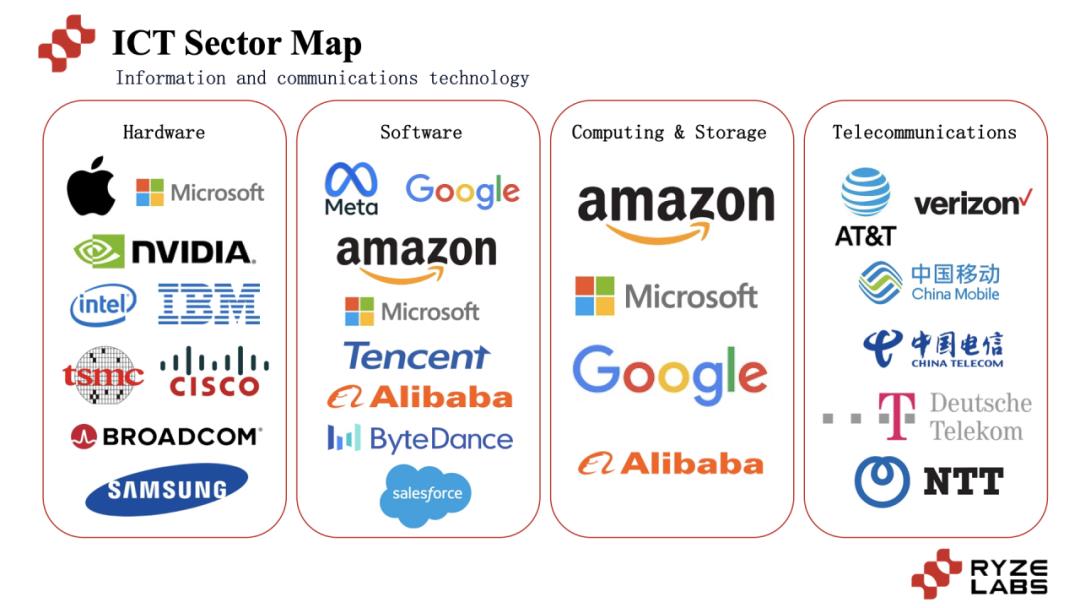

In the traditional ICT industry, infrastructure can primarily be categorized into hardware, software, cloud computing & data storage, and communication technologies.

Among the top ten companies globally by market cap, six belong to the ICT industry (Apple, Microsoft, Google, Amazon, NVIDIA, Meta), accounting for half of the list.

According to Gartner, the global ICT market size reached $4.39 trillion in 2022, with data centers and software showing growth trends in recent years, impacting our lives in every aspect.

2.2 Challenges Facing Traditional ICT Industry

However, the current ICT industry faces two major challenges:

1) High entry barriers restrict full competition, leading to pricing monopolies by giants.

In fields like data storage and communication services, companies must invest heavily in hardware purchases, land leasing for deployment, and hiring maintenance personnel. These high costs allow only large enterprises to participate. For example, AWS, Microsoft Azure, Google Cloud, and Alibaba Cloud collectively hold nearly 70% market share in cloud computing and data storage. This results in price monopolization, with high costs ultimately passed on to consumers.

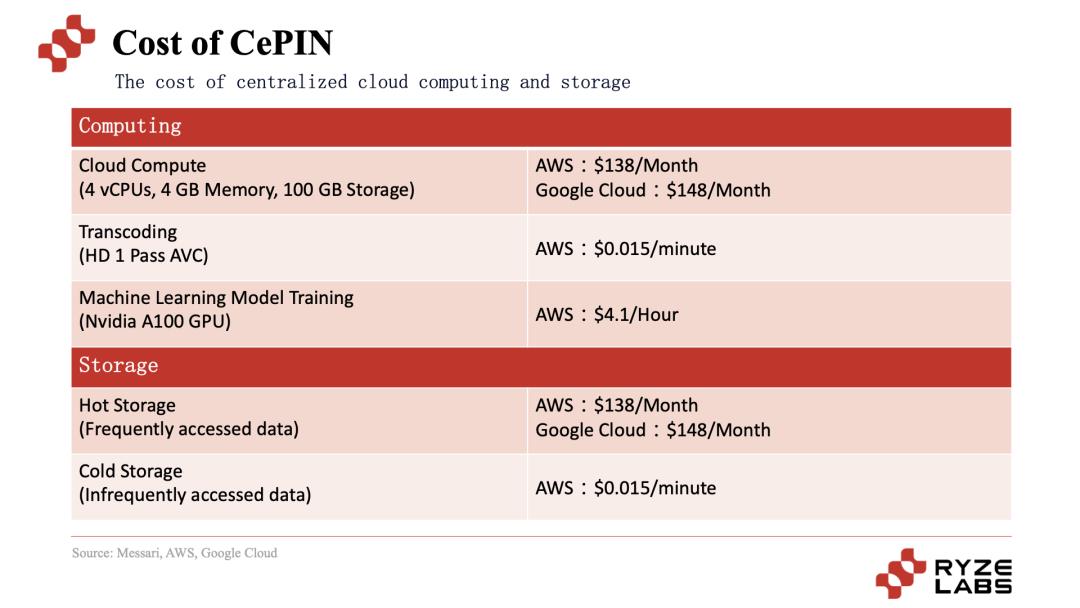

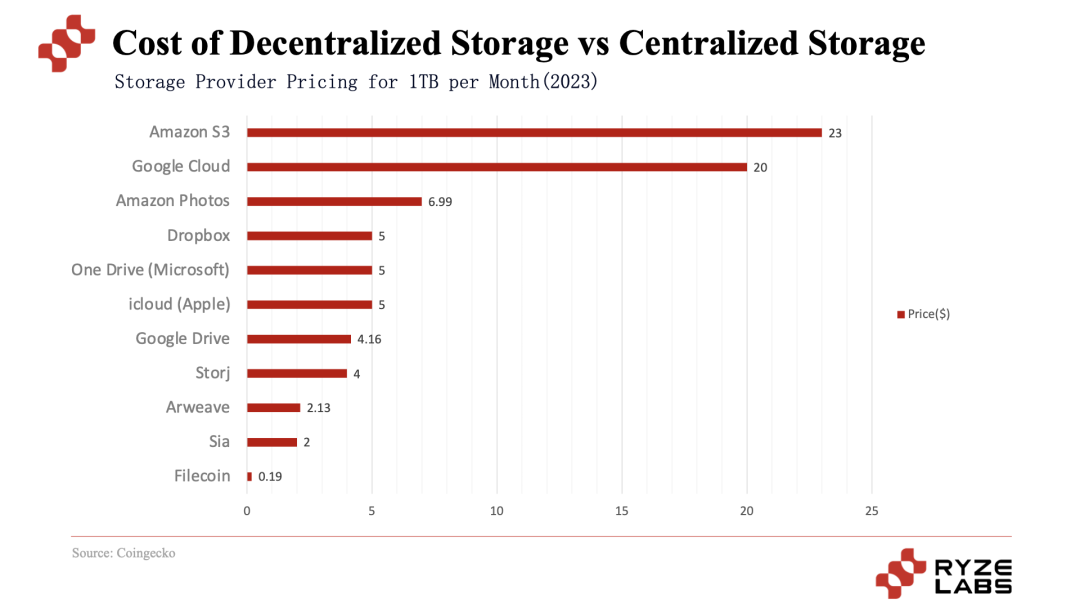

Take cloud computing and data storage prices as examples—the costs are extremely high:

According to Gartner, global enterprise and individual spending on cloud services reached $490 billion in 2022, expected to continue growing and exceed $720 billion by 2024. RightScale data shows that 31% of large enterprises spend over $12 million annually on cloud services, while 54% of SMEs spend over $1.2 million. As businesses increase investment in cloud services, 60% report their cloud costs exceed expectations.

Just looking at expenditures related to cloud computing and data storage, it’s clear that when prices are monopolized by giants, both users and enterprises face increasing financial pressure. Moreover, the capital-intensive nature limits market competition and hinders innovation and development in the field.

2) Low utilization rates of centralized infrastructure resources.

Low resource utilization in centralized infrastructure is a major challenge in today’s business operations, especially pronounced in cloud computing environments where companies allocate substantial budgets.

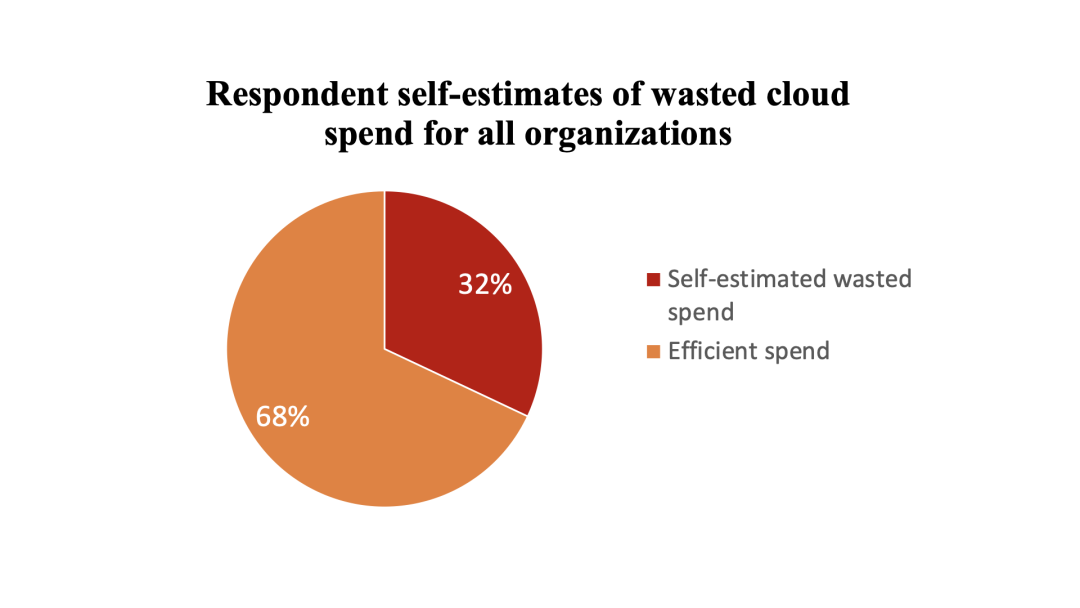

According to Flexera's recent 2022 report, there is a concerning trend: on average, 32% of company cloud budgets are wasted, meaning one-third of allocated resources sit idle after expenditure, resulting in significant financial losses.

This misallocation stems from various factors. For instance, companies often overestimate demand to ensure continuous service availability. Additionally, Anodot data indicates that over half of cloud waste results from lack of understanding about cloud costs, getting lost amid complex pricing models and diverse packages.

On one hand, monopoly leads to high prices; on the other, a significant portion of corporate cloud spending goes to waste, placing IT costs and IT utilization in a dual dilemma detrimental to healthy commercial development. However, every challenge presents an opportunity—and this creates fertile ground for DePIN’s emergence.

Faced with high prices and wastefulness in cloud computing and storage, the DePIN sector offers effective solutions. On pricing, decentralized storage (e.g., Filecoin, Arweave) is several times cheaper than centralized alternatives. Regarding inefficiency, some decentralized infrastructures adopt tiered pricing to differentiate demands—Render Network in the decentralized computing space uses multi-layer pricing strategies to efficiently match GPU supply and demand. Later sections analyzing specific projects will detail how DePIN addresses these two core issues.

3. DePIN Token Economic Models

Before diving into the current state of the DePIN sector, let’s understand its operational logic. The central question: why would users contribute their own resources to join a DePIN project?

As mentioned earlier, the core mechanism of DePIN lies in using token incentives to encourage users to provide resources—such as GPU power, hotspot deployments, or storage space—to contribute to the network.

Since tokens typically lack real value in the early stages of DePIN projects, user participation resembles venture investing. Contributors select promising projects among many DePIN options and invest their resources as “risk miners,” profiting from increased token holdings and potential price appreciation.

Unlike traditional mining, these contributors offer resources involving hardware, bandwidth, and computational capacity. Their income in tokens correlates with network usage, market demand, and other variables. For example, low network activity may reduce rewards, or network attacks/stability issues could lead to resource waste. Therefore, DePIN “risk miners” must accept such risks and play a crucial role in ensuring network stability and project growth.

This incentive model creates a flywheel effect—positive feedback loops during growth phases, but also risk of cascading exits during downturns.

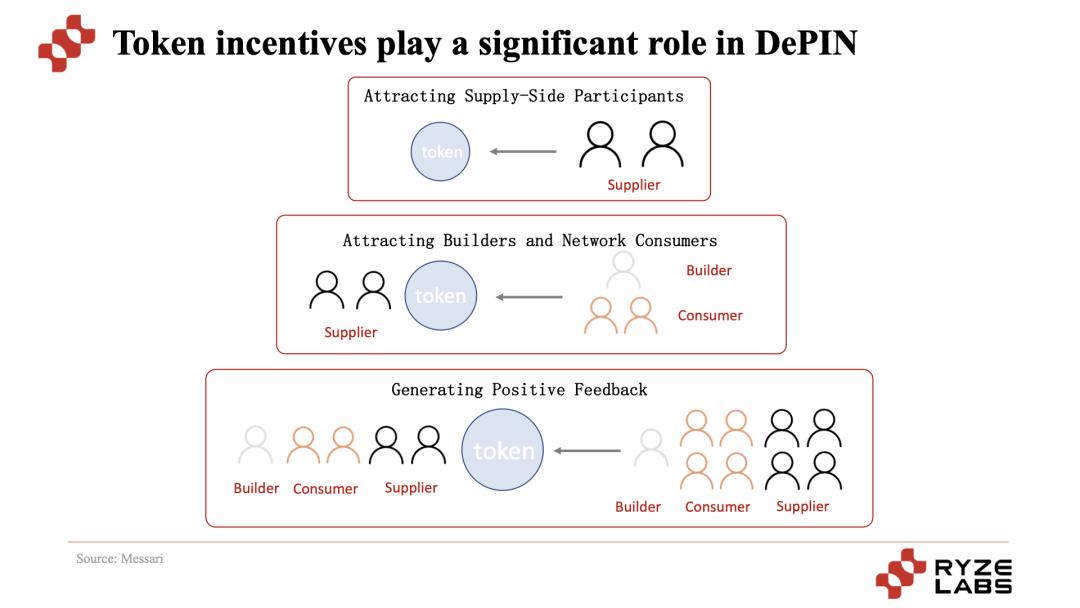

1. Attract Supply-Side Participants via Tokens: Through well-designed tokenomics, attract early participants to build the network and contribute resources, rewarding them with tokens.

2. Attract Builders and Consumers: As more resource providers join, developers begin building applications within the ecosystem. Once sufficient supply exists, lower prices compared to centralized infrastructure start attracting consumer users.

3. Create Positive Feedback Loop: With growing user demand, supply-side participants earn higher incomes, reinforcing positive feedback and attracting even more participants on both sides.

In this cycle, suppliers receive increasingly valuable token rewards, while consumers enjoy cheaper, higher-value services. Project token value grows alongside participant numbers. Rising token prices attract more contributors and speculators, enabling effective value capture.

Through token incentives, DePIN first attracts suppliers, then draws in users—enabling cold starts and core operations, allowing further expansion and development.

4. Current State of the DePIN Industry

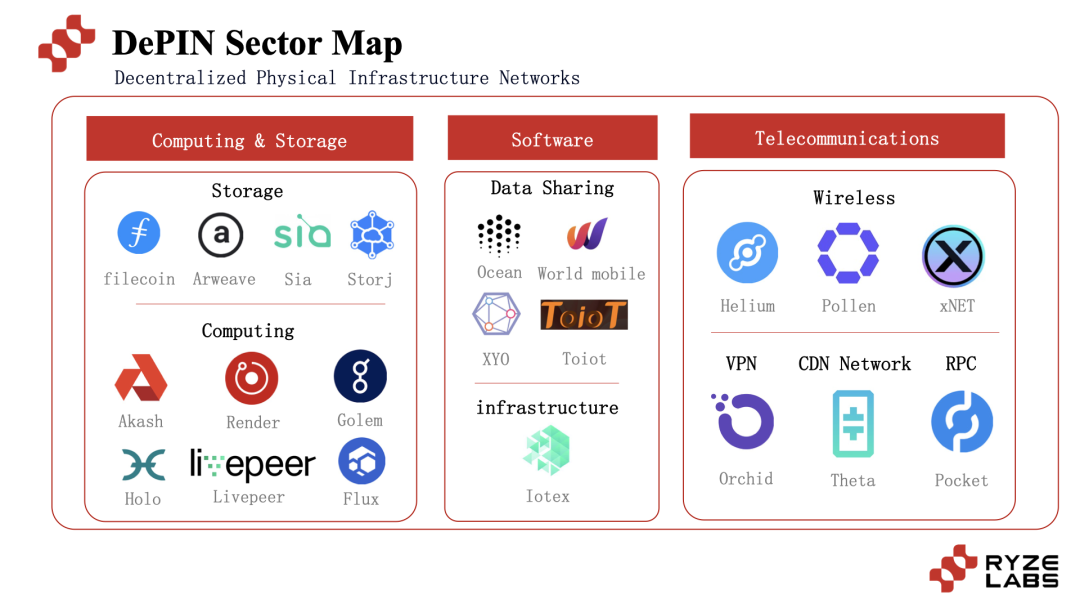

Looking at early projects like Helium (2013), Storj (2014), and Sia (2015)—all focused mainly on storage and communication technologies—we see that initial DePIN efforts were concentrated in those domains.

However, with the evolution of internet, IoT, and AI, demands for innovative infrastructure have grown. Today, DePIN projects span computing, storage, communications, and data collection/sharing.

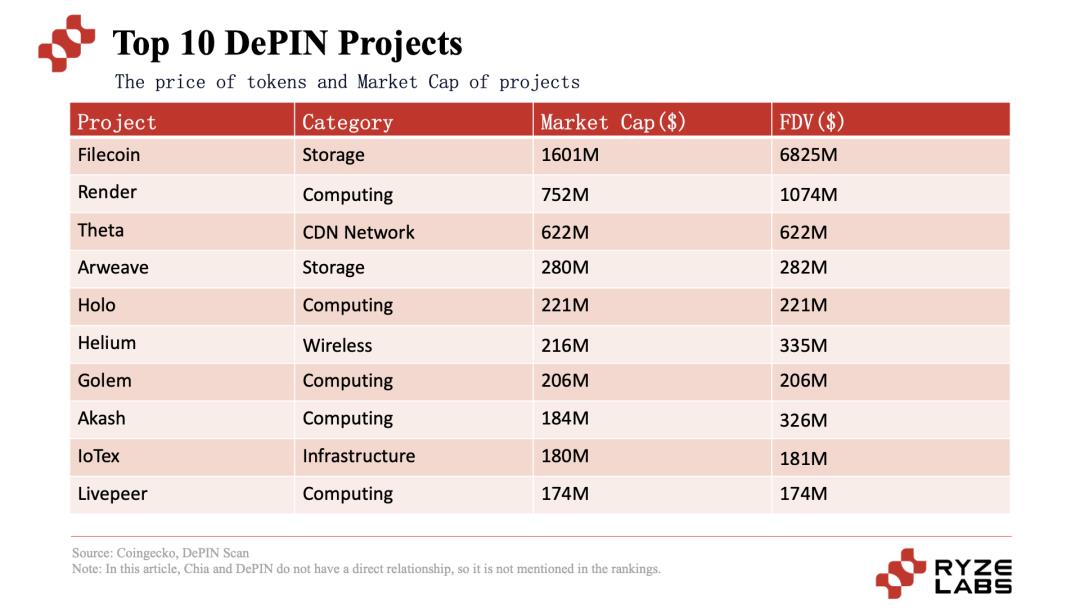

Among the top 10 DePIN projects by market cap today, most belong to Storage and Computing sectors. There are also notable projects in telecommunications—including pioneer Helium and rising star Theta—which we’ll analyze later.

5. Representative DePIN Projects

Based on Coingecko’s DePIN market cap rankings, this article focuses on the top five: Filecoin, Render, Theta, Helium, and Arweave.

First, let’s examine Filecoin and Arweave—two well-known players in the decentralized storage space.

5.1 Filecoin & Arweave – Decentralized Storage Sector

As highlighted earlier in the discussion of traditional ICT challenges, centralized cloud storage suffers from high pricing on the supply side and low resource utilization on the consumption side—posing difficulties for users and enterprises alike. Risks like data breaches add to the concerns. To address this, Filecoin and Arweave offer decentralized storage alternatives with significantly lower prices, delivering different kinds of value.

Let’s start with Filecoin. From the supply side, Filecoin is a decentralized distributed storage network that incentivizes users to provide storage space via token rewards (with direct correlation between allocated storage and block rewards). Within about one month of launching its testnet, storage capacity reached 4PB, with Chinese miners (storage providers) playing a significant role. Today, total storage has reached 24EiB.

Notably, Filecoin builds upon the IPFS protocol—a widely recognized distributed file system. By storing user data across nodes in the network, Filecoin achieves decentralized and secure data storage. Leveraging IPFS gives Filecoin strong technical advantages in decentralized storage, and support for smart contracts enables developers to build diverse storage-based applications.

In terms of consensus mechanisms, Filecoin employs Proof of Storage, including advanced algorithms like Proof of Replication (PoRep) and Proof of Spacetime (PoSt), ensuring data security and reliability. In simple terms, PoRep verifies that nodes have replicated client data, while PoSt ensures they continuously maintain storage space.

Filecoin has partnered with many renowned blockchain projects and enterprises. For instance, NFT.Storage leverages Filecoin to offer simple, decentralized storage solutions for NFT content and metadata. Shoah Foundation and Internet Archive use Filecoin for content backup. Notably, OpenSea—the world’s largest NFT marketplace—uses Filecoin for NFT metadata storage, further accelerating ecosystem growth.

Now let’s turn to Arweave, which shares similarities with Filecoin in incentivizing supply-side participation—offering token rewards based on stored data volume and access frequency.

The key difference is that Arweave is a decentralized permanent storage network—once data is uploaded, it remains stored on-chain forever.

How does Arweave incentivize users to provide storage? It uses a mechanism called "Proof of Access," designed to prove data accessibility within the network. Simply put, miners must present a randomly selected previously stored data block during block creation—as proof of access.

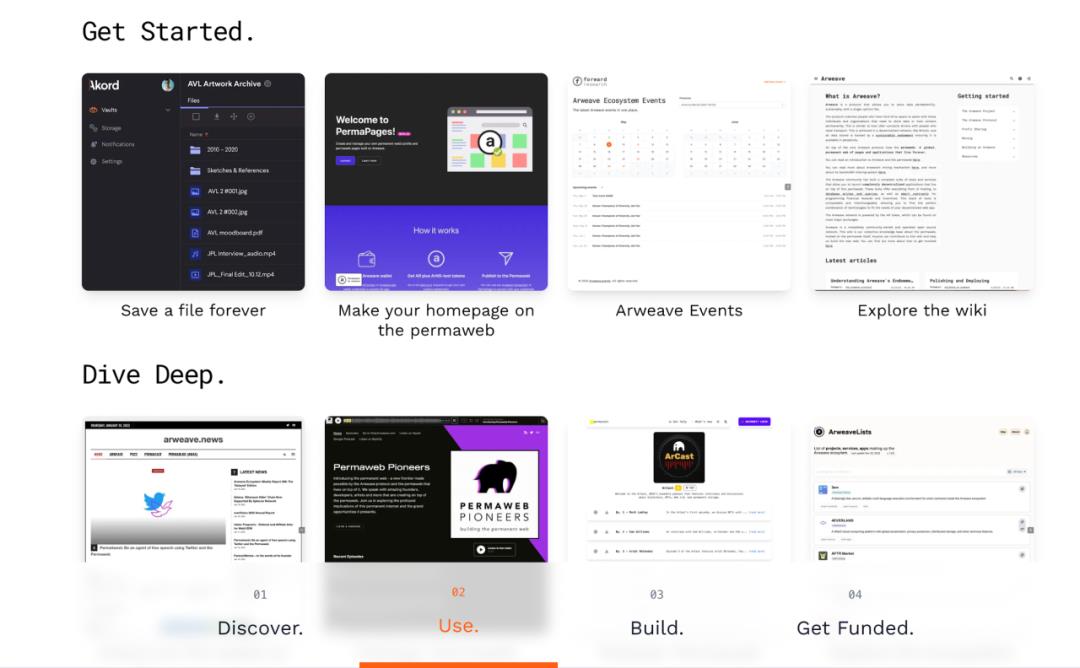

Officially, Arweave offers multiple solutions, including permanently storing files, creating permanent profiles, and hosting persistent web pages.

(Source: Arweave official Website)

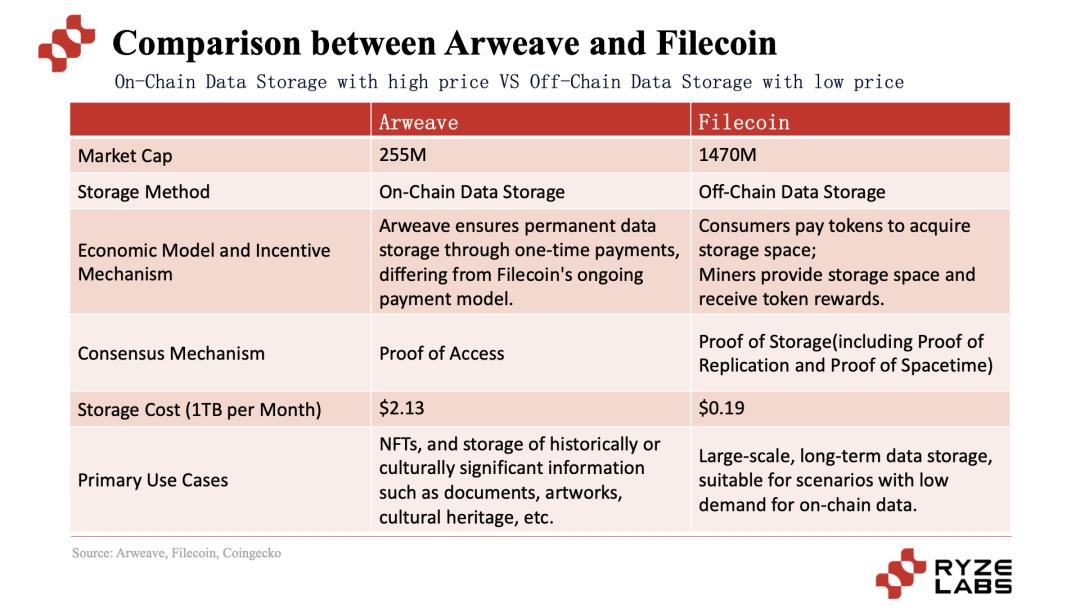

To help readers quickly grasp differences between Arweave and Filecoin, here’s a comparison table:

From the table above, Filecoin and Arweave differ significantly in storage methods, economic models, and consensus mechanisms—giving each unique strengths in different application scenarios. Due to lower storage prices, Filecoin currently holds a dominant market position.

Overall, with the proliferation of big data and AI applications, data generation is growing exponentially, increasing demand for storage. Against the backdrop of high pricing in centralized storage, demand for decentralized alternatives continues to rise. The chart below clearly illustrates the price gap between decentralized and centralized storage.

Under identical conditions—storing 1TB for one month—decentralized storage costs less than half of Google Drive and only one-tenth of Amazon S3.

Beyond cost advantages, decentralized storage offers enhanced security—data distributed across multiple nodes reduces single points of failure and improves censorship resistance.

Regarding data privacy, users retain absolute ownership and control over their data in decentralized storage. They can access, modify, or delete their data anytime. In contrast, centralized storage requires entrusting data to service providers who may exert partial control, subjecting users to provider-specific terms and privacy policies.

On the downside, decentralized storage faces technical hurdles such as efficiency in data storage/retrieval and node reliability. Compared to centralized storage’s high availability and performance guarantees, decentralized systems may experience fluctuations due to participant behavior, potentially affecting user experience.

5.2 Helium – Decentralized Wireless Network

After exploring decentralized storage, let’s look at Helium—one of the most talked-about decentralized wireless network projects. Founded in 2013, Helium is a veteran and pioneer in the DePIN space.

Why is decentralized wireless networking important? In traditional IoT industries, infrastructure costs often outweigh revenue, preventing any dominant player from emerging and leaving no consolidated market. Unmet demand and undersupply created ideal conditions for Helium’s growth in IoT.

Since infrastructure cost is the biggest bottleneck, leveraging crowd-sourced participation on the supply side becomes a natural advantage for DePIN in this domain. Using token incentives, Helium attracts global users to purchase and deploy network devices, forming a distributed network. Its technological strength gives it a clear edge in IoT—last August, hotspot count surpassed 900,000, with 600,000 monthly active hotspots, 20x more than The Things Network’s 30,000. (Even though active hotspots have since dropped to 370,000, Helium still maintains a significant lead.)

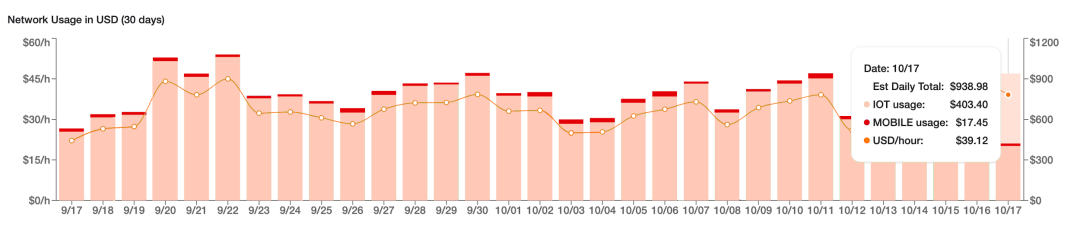

After making progress in IoT, Helium sought to expand into 5G and Wi-Fi markets. However, as shown in the chart below, Helium excels in IoT but performs modestly in 5G.

Why does Helium perform strongly in IoT but weakly in 5G? Let’s analyze from market and regulatory angles.

In IoT, Helium uses LoRaWAN technology—a low-power wide-area network known for low energy consumption, long transmission range, and excellent indoor penetration. This type of network usually doesn’t require special licensing, making it a cost-effective option for large-scale IoT deployments.

For example, in agriculture, farmers only need to monitor soil moisture or temperature thresholds to enable smart irrigation and crop management. Similarly, smart lampposts, trash bins, parking sensors, and other smart city applications show great promise.

Moreover, the IoT network market generates vast coverage but limited data traffic, making profitability difficult and preventing giant players from emerging. Helium seized this opportunity by combining Web3 technology with IoT networks, cleverly solving the high-capital barrier via DePIN. By distributing heavy upfront infrastructure costs across individual users, Helium achieved lightweight launch. Devices like indoor/outdoor trackers and smart farms (e.g., Abeeway, Agulus) now use Helium—reaching over 900,000 hotspots by last August.

On the other hand, Helium’s entry into the 5G market a year ago hasn’t yielded satisfactory results. The root cause lies in dual challenges: compliance and market ceiling.

On compliance: Frequency allocation and licensing in the U.S. are strictly regulated by the FCC. Low bands (600MHz, 700MHz), mid-bands (2.5GHz, 3.5GHz), and high bands (28GHz, 39GHz) all require rigorous approval. T-Mobile, for example, uses 600MHz for 5G deployment, Verizon uses 700MHz. As a latecomer, Helium chose unlicensed CBRS GAA band to reduce deployment costs and ease compliance burdens. But compared to licensed mid-band frequencies used by carriers, CBRS offers slightly smaller coverage and no clear competitive advantage.

On market ceiling: 5G is a highly regulated sector tied to national policy. In most countries, telecom operators are state-owned, and even private ones maintain close government ties. Thus, from a global perspective, Helium struggles to replicate its U.S. 5G model overseas.

Another issue is opacity in partner hardware—an experiential problem on the supply side. Since Helium’s devices are open-source, performance, pricing, and installation processes vary widely across manufacturers. This lack of transparency frustrates contributors and allows some vendors to pass off second-hand equipment as new. Improving supplier experience and balancing openness with transparent, user-friendly device specs remains a key challenge for Helium.

Notably, on March 27 this year, Helium began migrating from its Layer1 blockchain to Solana. The migration rationale includes:

-

Helium’s core team wants to focus on network building. After evaluating the importance of maintaining a Layer1 chain, they decided to delegate blockchain maintenance to experts, freeing up internal resources for network development;

-

Solana was chosen for its rich ecosystem. Many high-quality projects and developers exist on Solana. Native compatibility between HNT and Solana-native innovations expands utility for token holders;

-

Furthermore, Solana’s latest state compression feature enables massive NFT minting at ultra-low cost. Minting nearly 1 million NFTs for Helium on Solana cost only $113, saving enormous fees. These NFTs serve as network credentials verifying hotspots, integrating ecosystem features like token-gated access and owner privileges—highly efficient and convenient;

-

Looking ahead, synergies exist between Solana Mobile Stack, Solana’s planned Saga phone, and Helium—mutually beneficial collaborations for Solana aiming to enter mobile and Helium expanding into 5G services.

Long-term, Helium’s exploration in IoT represents a groundbreaking 0-to-1 innovation with immense value in addressing IoT connectivity needs. Despite ongoing challenges, as IoT devices proliferate and application scenarios expand, Helium’s decentralized network solution may gain broader adoption. In future domains like smart agriculture and smart cities, it holds tremendous potential.

5.3 Render Network – Decentralized Computing

Render Network is a decentralized GPU rendering platform. Rendering refers to converting 2D or 3D computer models into realistic images and scenes. It sparked discussions during Apple Vision Pro’s launch and amid metaverse and AR/VR booms.

Some readers may wonder: why aren’t personal computers sufficient for video editing and animation production, necessitating Render Network? The answer lies in scale. Small projects like short videos or microfilms require relatively low compute power. But large-scale productions demand massive computational resources, typically relying on centralized cloud providers like AWS, Google Cloud, or Microsoft Azure—whose prices are often prohibitively expensive.

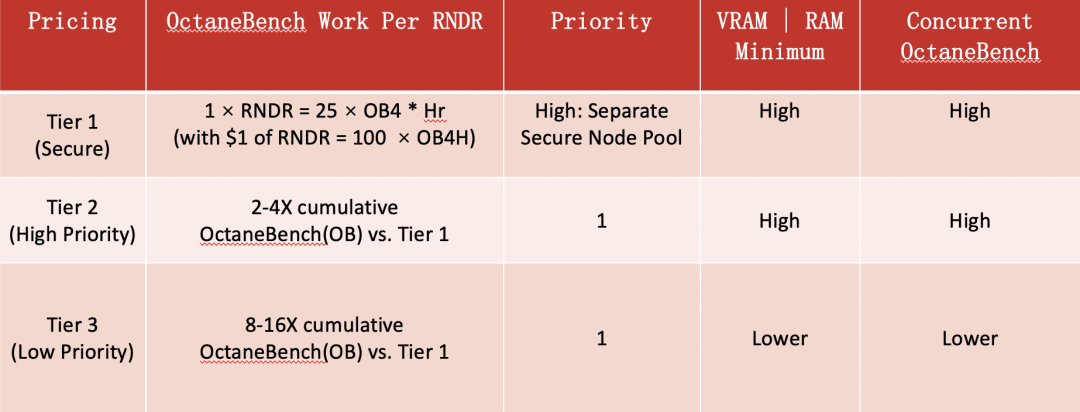

On pricing—the top concern for clients—Render Network implements multi-tier pricing to optimally match GPU supply and demand.

Render Network focuses on client-centric pricing, adopting a multi-layer strategy to efficiently align GPU supply and demand.

Rendering services are quantified in OctaneBench units over time, adjusted according to OctaneBench4 and standardized to €1. This pricing model reflects current costs of GPU cloud rendering services on centralized platforms like Amazon Web Services (AWS). Specifically, €1 worth of RNDR equals 100 OctaneBench4 points per hour.

Compared to Tier1, Tier2 offers 2–4 times the total OctaneBench workload and 200–400% more computing power. Tier2 rendering jobs have higher queue priority than Tier3, enabling accelerated parallel rendering. Tier3 provides 8–16 times the OctaneBench workload, but ranks lowest in queue priority and isn't recommended for time-sensitive tasks.

(Source: Render Network Knowledge Base)

In short, each tier has a fixed pricing formula, but the OctaneBench unit floats based on market dynamics. Tier1 matches AWS-level cost and performance. Tier2 and Tier3 achieve lower prices by accepting slower processing speeds. Price-sensitive users can choose Tier3; efficiency-focused users prefer Tier1; moderate users opt for Tier2.

Moreover, Render Network emphasizes full utilization of idle GPU resources. Most GPUs remain underused locally. Meanwhile, artists and developers strive to scale up cloud rendering and computation workloads. A decentralized rendering network creates an efficient two-way market for global GPU computing supply and demand—an exceptionally effective resource-matching model.

5.4 Theta Network – Decentralized Video Network

Theta Network’s co-founder Steve Chen was formerly a co-founder of YouTube, bringing strong industry credentials. The project’s core function leverages blockchain-optimized content delivery networks (CDNs) to significantly reduce video transmission costs and improve distribution efficiency.

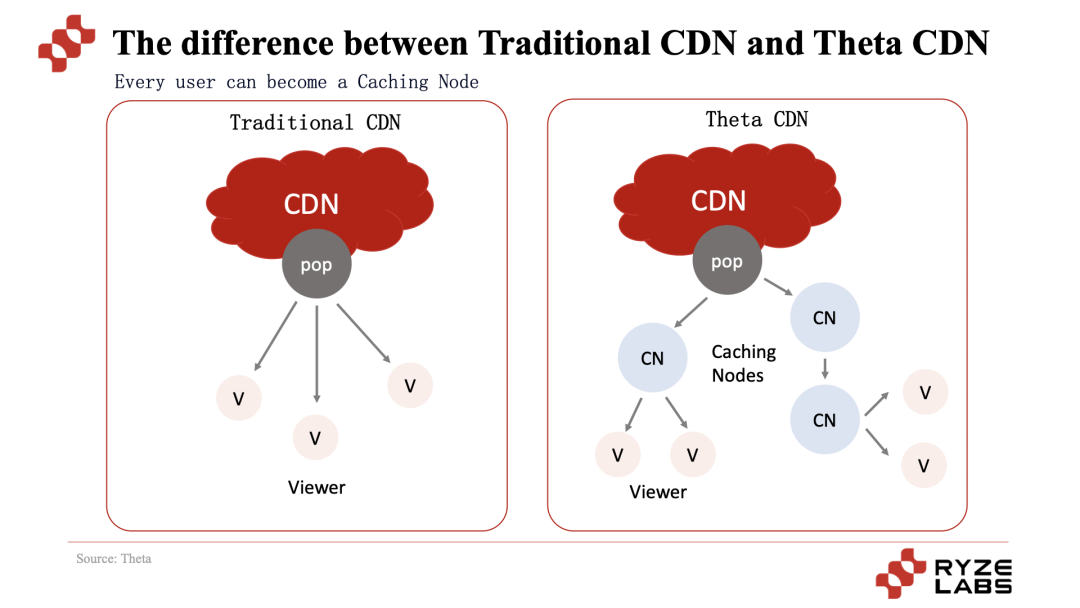

To better understand, let’s compare it with traditional CDNs:

In traditional CDNs, all viewers connect directly to Points of Presence (POP) servers—network nodes deployed globally—for video playback. Most platforms like Netflix and Facebook rely on centralized CDNs. However, viewers far from POP servers often suffer degraded streaming quality. Theta Network instead allows users to contribute bandwidth and compute power as caching nodes, distributing video closer to end-users.

This delivers superior viewing experiences, rewards contributors with tokens, and lowers platform costs. With continued growth in video consumption and rising popularity of live streaming and game streaming, Theta Network holds promise across diverse use cases. Currently, in decentralized video streaming, Theta faces competition from projects like Livepeer and VideoCoin.

Of course, beyond the top five market-cap projects analyzed above, many others deserve mention—IoTeX providing foundational infrastructure for IoT projects, offering SDKs for DePIN developers, and recently launching Beta version of DePINscan, a data platform helping analyze DePIN sector metrics.

Additionally, Ketchup Republic—the winning project at this year’s Wanxiang Blockchain Week Hackathon—aims to create a Web3 version of Yelp, redirecting merchant marketing fees directly to users, enhancing traffic and experience for both merchants and consumers...

These noteworthy projects emerging from the DePIN space are sprouting like bamboo shoots after rain. The long-desired mainstream breakthrough might bloom into a new summer within DePIN—though slowed by hardware-software integration costs, this summer may arrive gradually. But a delayed spring is still spring.

6. Advantages of DePIN

Surveying the mechanisms across various DePIN projects, the fundamental essence is resource integration: Using token incentives to encourage users to share resources, enabling efficient flow from suppliers to demanders. Compared to traditional centralized infrastructure, DePIN functions much like DeFi versus CeFi—reducing intermediary roles and enabling freer flow between supply and demand.

6.1 Transition from Capital-Intensive to P2P/P2B Model

The mechanism behind DePIN projects represents a revolutionary market transformation. Its decentralized nature drastically lowers barriers to enterprise participation, breaking free from monopolies held by a few centralized giants. This breakthrough empowers small and medium-sized enterprises and startups with greater involvement and equal footing against industry leaders.

In infrastructure development, oligopolistic dominance in centralized markets has long been evident—especially in traditional storage and computing, where capital-intensive industries are dominated by AWS, Azure, Google Cloud, etc., setting prices unchecked. Users often lack bargaining power, forced to accept high prices without meaningful alternatives.

Yet DePIN injects new vitality into this landscape. Whether Filecoin, Arweave, or Render Network, by incentivizing users with tokens to contribute resources and form networks, they shift from capital-intensive models to P2P or P2B paradigms. This dramatically lowers entry barriers, breaks price monopolies, and gives users more affordable choices. Through incentivized resource sharing and fostering free competition, DePIN makes markets more open, transparent, and dynamic.

6.2 Reuse of Idle Resources, Promoting Better Societal Development

In traditional economic models, many resources lie idle, failing to realize their potential value. This waste negatively impacts economies and exerts undue environmental and social pressures—including unused compute power, storage, and energy. Take cloud computing: according to Flexera’s report, enterprises effectively utilized only 68% of purchased cloud resources in 2022, implying 32% wastage. Considering Gartner’s estimate of nearly $500 billion in cloud spending in 2022, roughly $160 billion was wasted.

DePIN offers a fresh solution to this dilemma. Many users possess idle resources—storage, compute, or data—but the challenge lies in mobilizing them. Through incentive mechanisms, DePIN encourages users to share and utilize these resources, maximizing utilization. This applies not only to digital assets like storage and computing, but also to physical ones like energy. For example, React Protocol connects batteries to electricity markets, forming community grids that stabilize power supply by sharing excess user-generated electricity—contributing to clean energy while offering limited-resource users new monetization avenues. Truly a win-win. Such initiatives reduce waste and promote more sustainable societal development.

6.3 Eliminating Middlemen, Enabling More Efficient Money Flow

Beyond shifts in decentralized storage, computing, and networking, and reuse of idle resources, recent emerging DePIN projects reveal ambitions akin to Web3 versions of Meituan, Yelp, or Didi—O2O-style platforms.

For instance, Ketchup Republic aims to help merchants attract offline foot traffic using Bluetooth-based location relationships. Merchants can customize token reward schemes, adjusting parameters like location, frequency, and distance. Compared to Web2 models (merchant-platform-user), where marketing budgets go through intermediaries, Ketchup Republic sends promotional funds directly to users’ pockets—reducing friction and leakage.

These emerging DePIN projects aim to replace Web2 infrastructure, allowing data-providing users to receive direct payments from merchants—cutting out middlemen.

This means DePIN establishes a decentralized ecosystem directly connecting suppliers and demanders, enabling direct value transfer. Funds and resources flow faster, improving transaction efficiency and transparency. This mechanism not only reduces transaction costs but also brings more opportunities and flexibility to market participants.

7. Limitations and Challenges of DePIN

The DePIN sector spans diverse categories—storage, computing, data collection/sharing, communication technologies—each facing varying degrees of competition. DePIN’s development confronts numerous limitations and challenges:

7.1 User Experience: Lack of Standards in Early Stage, Poor Developer and User Experience

The DePIN industry remains in its early stages, lacking complete infrastructure—each project must develop independently. Additionally, understanding and onboarding requirements for users remain relatively high: learning about tokens, purchasing and configuring hardware. These factors result in generally subpar user experiences, limiting breakout potential. Companies must aggregate and simplify participation processes to enhance usability and scalability.

Notably, some firms are building DePIN infrastructure. For example, Filecoin announced Filecoin Data Tools—a suite built on its network offering computing and storage tech—to improve developer experience and deliver comprehensive data service solutions. At the infrastructure level, IoTeX develops move-to-earn SDKs and toolkits, aiming to establish standards and consensus within DePIN to drive healthier industry growth.

7.2 Competition: Lack of Competitive Moats

A lack of defensible moats poses challenges to long-term network stability. Supply-side users may easily switch to competing networks if better options emerge. For example, Pollen has entered the 5G space, and some Helium community miners have started deploying Pollen devices. As fellow decentralized mobile network providers, establishing irreplaceability and competitive barriers remains a long-term endeavor.

Moreover, preventing cheating is critical for sustained growth. Issues like cluster-mining fraud in Helium or GPS spoofing in geolocation-data projects must be addressed. For instance, Helium’s monthly active hotspots dropped from a peak of 600,000 to 370,000—how to reverse this decline and improve service quality is urgent.

Current projects mainly rely on token incentives—adjusting reward amounts based on coverage, uptime, and other metrics. Yet no consistently effective solution has emerged. How to sustain user engagement and foster a positive flywheel effect remains a journey of exploration.

7.3 Expansion: Regulatory Compliance Constraints

Given DePIN’s involvement in infrastructure and impact on Web2 users, regulatory compliance is unavoidable. In communications, 5G technology faces strict regulations. In many countries, telecom operators are state-run, and even private ones maintain tight government links—making authorization difficult. Even where certain bands are opened (like CBRS GAA in the U.S.), spectrum limitations prevent clear advantages over established carriers.

Conversely, in IoT, the absence of dominant solutions leaves room for Helium to innovate. The DePIN sector remains early-stage: in areas unresolved by Web2—like IoT networks—it can experiment freely; but in domains with mature Web2 solutions—like 5G or data security—it must grow alongside evolving regulations, whose pace remains uncertain and volatile.

7.4 Development: Talent Barrier

Discussions with various DePIN project teams reveal a shared pain point: talent scarcity.

The DePIN field requires multidisciplinary talent—understanding both IoT and Web3 market dynamics. Such professionals are currently rare.

In a sense, the steady, methodical nature of IoT contrasts sharply with Web3’s aggressive innovation ethos—qualities rarely found together in one individual. Most experienced IoT professionals lean toward traditional industries, while those skilled in both IoT and Web3 operations are even rarer. This gap makes team recruitment and collaboration particularly challenging.

Overall, the DePIN sector faces immediate challenges in product experience, moat-building, regulatory compliance, and talent shortages. Yet in the long run, whether through lowering barriers, driving innovation, reusing idle resources, or enabling more efficient money flows, DePIN’s emergence will profoundly reshape markets. Its transformative impact will influence supply chains, industrial structures, and the broader economic ecosystem. As DePIN continues to evolve and mature, we have good reason to believe it will become a pivotal force delivering real change for society, enterprises, and individuals.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News