A Brief Analysis of DWF's Business Logic: How to Use Relevant Information to Guide Secondary Market Trading?

TechFlow Selected TechFlow Selected

A Brief Analysis of DWF's Business Logic: How to Use Relevant Information to Guide Secondary Market Trading?

DWF initially created a wealth effect through early price manipulation to build its brand image; it is inherently a product born out of weak regulation during a bear market, capitalizing on project teams' difficulties in development and retail investors' psychology to profit from both sides.

This year, DWF has risen to prominence with continuous large-scale investments, causing related tokens to double in value overnight. How has DWF managed this amid the current deep bear market in crypto? And how should secondary market investors approach these associated assets?

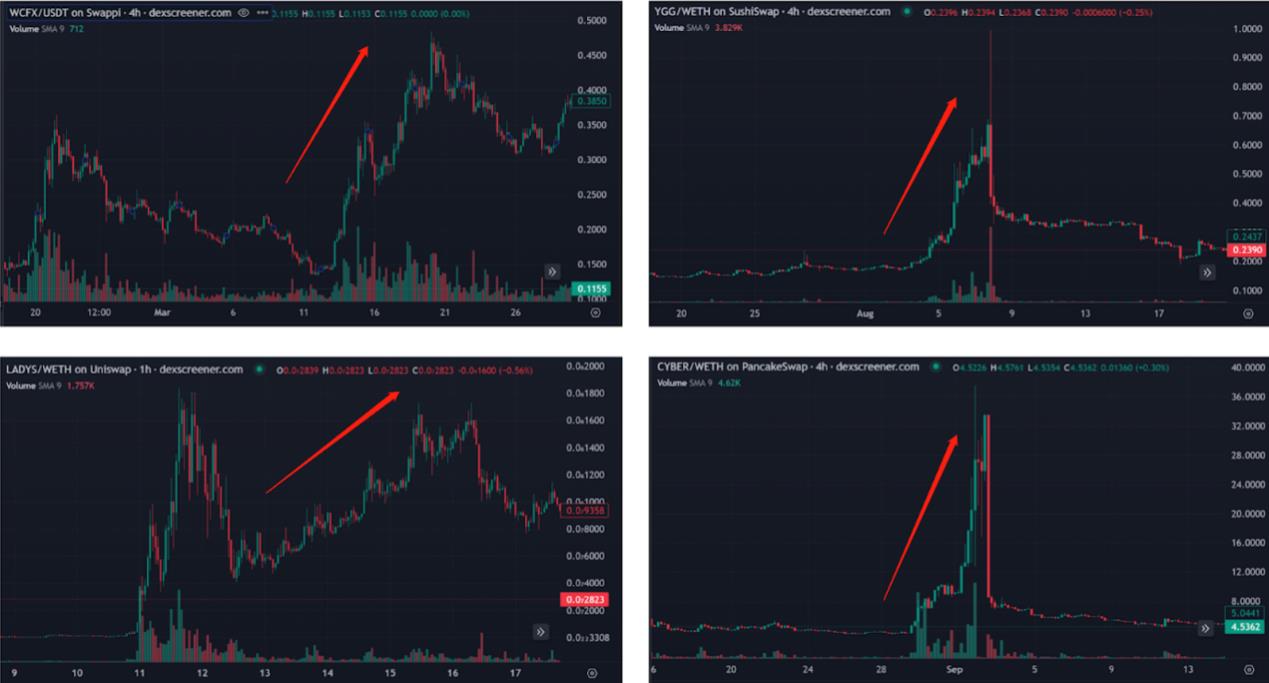

DWF Labs is a subsidiary of Digital Wave Finance (DWF), a global high-frequency cryptocurrency trading firm that has been active since 2018, conducting spot and derivatives trading across more than 40 top-tier exchanges. Initially entering the crypto market as a market maker, DWF began attracting widespread attention in Q1 with sharp rallies in Hong Kong-themed tokens like CFX and ACH. This continued into Q2 with meme coins such as PEPE and LADYS surging tens of times in value, followed more recently by listed tokens like YGG and CYBER gaining multiple-fold increases. Among these, CFX, ACH, and YGG were acquired via OTC deals, while coins like PEPE (MEME), LADYS (MEME), and CYBER (Binance Launchpool) had favorable token distributions, allowing DWF to directly purchase and influence prices on the secondary market.

Several DWF-related tokens have surged multiple times, drawing market attention

Beyond the significant price volatility of tokens handled by DWF, another reason for its notoriety is its strained relationships with peers. Prominent market makers like Wintermute and GSR have publicly criticized DWF, labeling it a low-quality market maker and a bad actor in the ecosystem.

Breaking down DWF’s business scope:

In the crypto market, investing and market making are typically two distinct activities. Investing usually refers to providing capital to project teams before token issuance to support development, operations, and marketing, in exchange for locked tokens upon launch. Market making, on the other hand, aims to provide liquidity for already-issued tokens, reduce trading costs, and attract more traders. Investment returns come from token appreciation, while market making generates revenue through fees paid by projects and bid-ask spreads. Well-known investment firms in crypto include a16z and Paradigm, while established market makers include Wintermute and GSR.

DWF has drawn criticism from market participants for blurring the lines between investing and market making. On its official website, DWF positions itself as a Web3 venture capital firm and market maker, dividing its services into three categories: investment, OTC, and market making.

Judging from past performance of DWF-associated tokens, their selection criteria are primarily driven by sentiment and thematic trends. Tokens they’ve provided liquidity for include CFX, MASK, YGG, C98, WAVES, etc. However, reviewing their historical cases reveals little evidence of long-term project support. Instead, DWF typically injects capital into already-token-issued “distressed” projects at a discount via OTC deals, then sells the tokens on the secondary market for profit. During this process, they often aggressively pump the price of their so-called “investments,” selling at high prices while simultaneously building a public image of generating profits—thereby turning this image into a sellable product for future project partnerships. For example, by jointly disclosing large investment news with projects, they create bullish sentiment, attract liquidity, and facilitate better exit opportunities.

Surface-Level Businesses: Investment, Market Making, OTC, Marketing

Core Business Model: Inject capital into “distressed” projects, acquire discounted tokens via OTC, then sell on the secondary market for profit; aggressively pump prices to build brand image and monetize that image with future project clients. Specific examples below:

1. YGG & C98: Buy via OTC, Pump and Dump on Secondary Markets

On February 17, 2023, gaming guild Yield Guild Games (YGG) announced raising $13.8 million through token sales, led by DWF Labs and a16z (YGG had already launched its token back in 2021).

Notably, DWF Labs received 8 million YGG tokens from YGG’s treasury on February 10 and transferred 700,000 to Binance on February 14. On February 17, media reported the investment news, after which DWF made two further transfers: 3.65 million YGG on June 19 and another 3.65 million on August 6. In terms of price action: On February 17, YGG surged up to 50% intraday (+33% close) on the news, followed by a five-and-a-half-month downtrend. The rally resumed in early August, lifting YGG over 7x from its lows. The run ended as DWF transferred its final batch of YGG tokens to Binance.

For secondary market investors, abnormal futures data can signal the start of a YGG rally. Early signs include a sharp rise in open interest with stable funding rates. Mid-phase shows slowing growth in open interest and declining funding rates. Late phase features declining positions due to long liquidations.

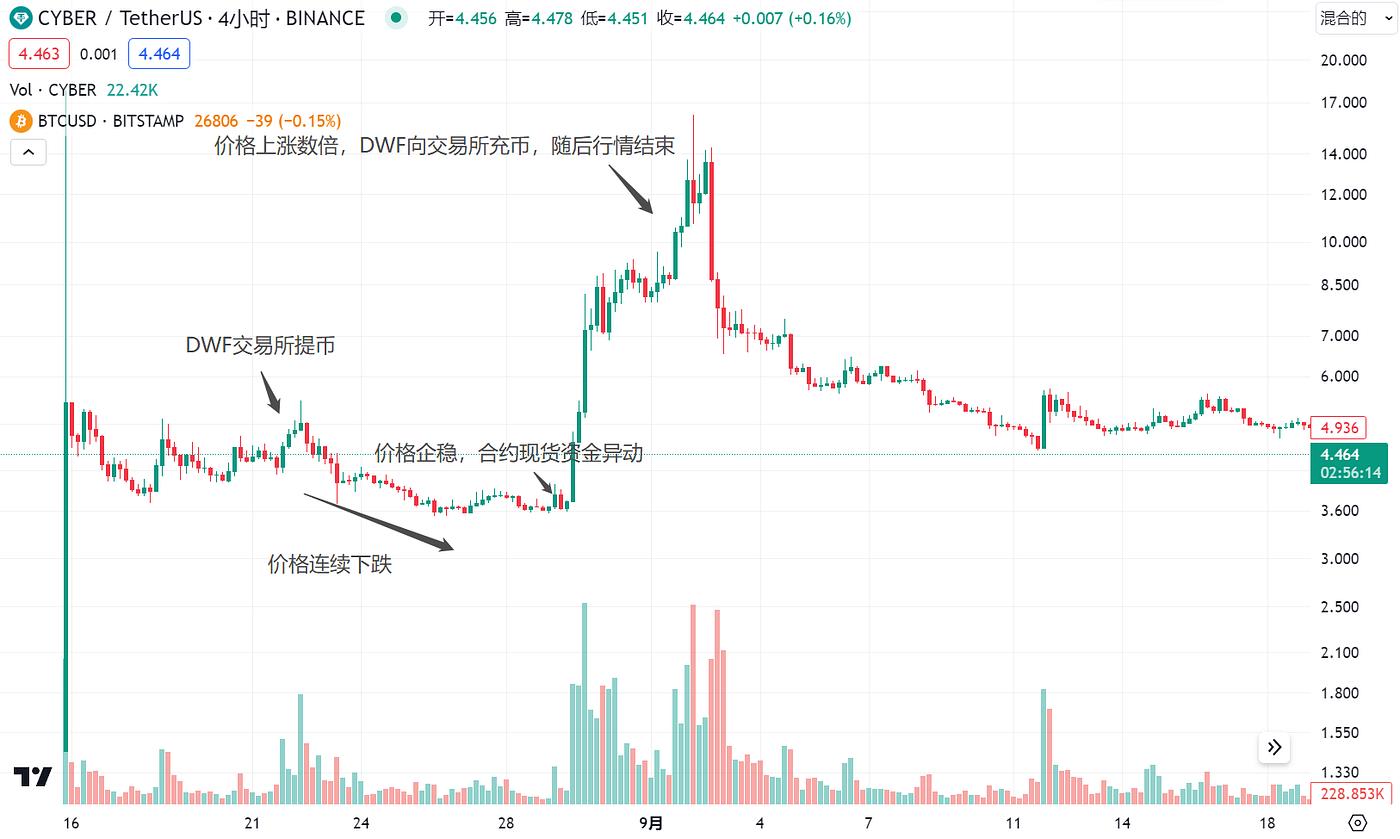

A similar playbook can be observed in CYBER and other tokens: On August 22, DWF withdrew 170,000 CYBER from Binance when the price was around $4.5, followed by a drop to $3.5. Seven days later, the price surged to a high of $16.2—up ~3.6x from DWF’s withdrawal price and ~4.6x from the bottom. As a Binance Launchpool project, CYBER had a clean token distribution and low secondary market sell pressure early on. DWF’s involvement appears limited to secondary market buying and pumping, with minimal direct coordination with the project team (similar to their Q2 participation in PEPE and LADYS memecoins).

At the capital flow level, CYBER mirrored YGG: early surge in open interest with stable funding rates; mid-phase slowdown in position growth and declining rates; late-stage decline in positions due to long unwinding.

On February 2, 2023, a DWF on-chain address received approximately 4.12 million C98 tokens from Coin98’s official address, worth about $1.11 million at the time (~$0.27 per token), and immediately transferred them to Binance. On August 8, Coin98 announced a seven-figure investment from DWF Labs to promote mass Web3 adoption. On October 12, media reported that DWF transferred $1 million USDT to C98. Looking at C98’s price action: After DWF received and deposited the tokens, C98 briefly rallied before entering a five-month downtrend. On August 8, media coverage triggered a 58% rally from lows within two days, followed by a swift reversal. Reviewing this event, it likely reflects DWF acquiring C98 tokens at a 10% discount before dumping them on the secondary market.

Before the C98 pump, data showed a sharp increase in open interest. The end of the rally was marked by declining positions from long liquidations and normalization of funding rates.

Other tokens with similar pump patterns include LEVER, WAVES, CFX, MASK, and ARPA.

These represent recent typical DWF-manipulated assets. It's clear that DWF often operates in both futures and spot markets. At the beginning of a rally, large inflows into futures markets are visible. Since the main capital is long early on, rising open interest doesn’t affect funding rates. Mid-phase usually involves spot market pumps while futures longs begin to unwind—this stage often sees explosive spot price gains, deeply negative funding rates, and stagnant or falling open interest. Some tokens experience a final pump to generate liquidity for better exit pricing. In others, the rally ends immediately after futures longs cash out. The key is assessing whether, for the dominant player, the marginal gain from pushing the spot price further outweighs the cost (e.g., resistance levels, heavy sell-side orders).

2. "Marketing-Driven" Investments, On-Chain Transfers: Leveraging Brand Image to Mask Distribution

As a new entrant VC, DWF has been highly active during the bear market, partnering with over 260 projects. Media reports suggest DWF has invested in more than 100 projects, including several large-ticket items. Projects receiving over $5 million in investment include:

DWF co-founder Grachev stated that DWF Labs has no external investors. Yet, such frequent and large-scale investments raise questions about the source of their funds. Most of their portfolio projects aren't trendsetters but rather older projects with weak fundamentals (e.g., EOS, ALGO). Post-investment, there's little observable improvement in product development, marketing, or community engagement. This suggests DWF’s actions may amount to "marketing-driven" investments—creating artificial bullishness to attract retail investors and repeatedly炒作 (hype) token prices to offload holdings. (FET announced a $40 million investment from DWF, but to date DWF has only received ~$3 million worth of tokens.)

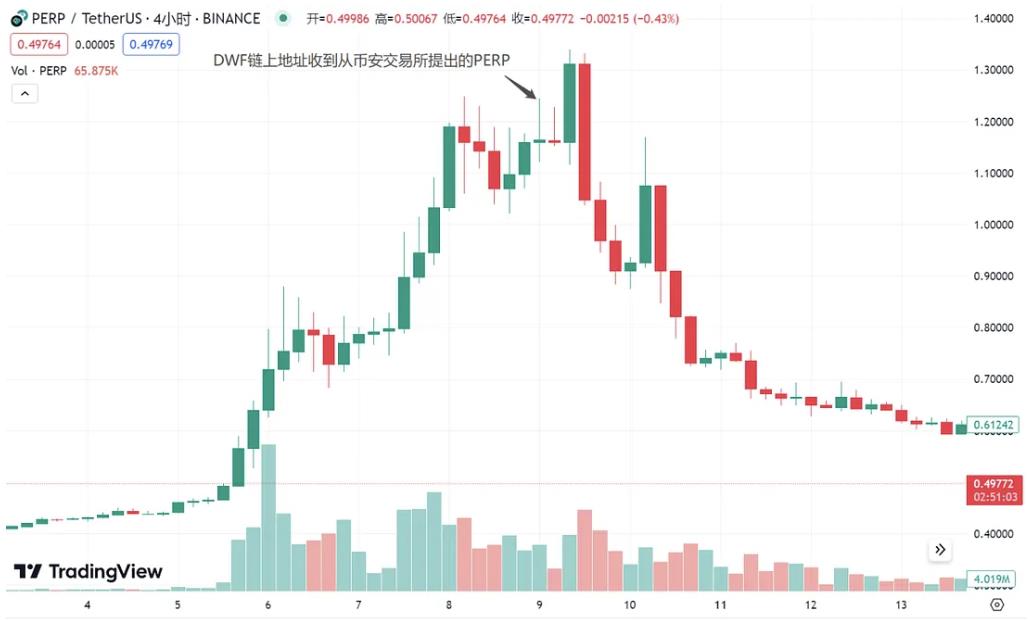

Additionally, on September 8, a DWF on-chain address received PERP tokens from Binance, following a multi-fold price surge. After DWF’s deposit activity, buy-side volume spiked temporarily, followed by a major dump and downward trend—marking the end of the rally.

On October 17, BNX announced a strategic partnership with DWF. Prior to the announcement, BNX had seen a sharp week-long rally. Immediately afterward, the price crashed—strongly suggesting insider trading and leveraging DWF’s brand to create liquidity for an exit.

Instances of projects using DWF’s brand influence to fabricate bullish news and distribute tokens are common. Secondary market participants must carefully scrutinize any DWF-related announcements. Many DWF-linked tokens continue to decline, such as EOS, CELO, FLOW, and BICO.

3. Targeting "Distressed" Projects: Exploiting Bear Market Funding Challenges to Maximize Profit Margins

Abracadabra (SPELL) is a stablecoin project that uses interest-bearing assets (e.g., Curve LP tokens, Yearn deposits) as collateral. After UST’s collapse—UST being a major underlying asset for Abracadabra—the protocol accumulated massive bad debt. Combined with prolonged bear market pressures, its TVL, token price, and overall momentum have remained depressed, making sustainable development difficult. On September 14, it passed AIP#28, introducing DWF as a market maker under the following terms:

1. Abracadabra provides DWF with an $1.8 million SPELL loan over 24 months;

2. DWF purchases $1 million worth of tokens from the DAO at a 15% discount to market price, with a 24-month lock-up;

3. Abracadabra grants DWF a European call option, exercisable at the end of the loan term, as a market-making fee.

These terms are significantly more costly for Abracadabra compared to standard market-making arrangements, especially given the discounted token purchase and embedded call option. Because the deal includes a discount based on market price, DWF benefits from a lower token price in the short term. Reflecting this, SPELL’s price declined steadily after DWF’s involvement:

The proposal went live for voting on September 11 and passed on September 14. During this period, SPELL rose from a low of $0.0003716 on September 11 to a high of $0.0006390 on September 19—a 72% gain (driven by speculative retail flows).

On September 19, Abracadabra transferred 3.3 million SPELL to DWF, who promptly sent them to Binance. SPELL then entered a downtrend and currently trades at $0.0004416—down 31% from its peak.

From a capital flow perspective, the short-lived rally showed poor consensus: 70% of the move involved fragmented, relay-style buying, indicating high uncertainty.

In summary: DWF initially built its brand by creating wealth effects through aggressive pumps. It emerged as a product of the unregulated bear market, profiting from both struggling projects and retail investor psychology. Project teams in bear markets commonly face difficulties in fundraising and exiting positions. Direct token sales would undermine fragile market confidence and harm token prices and ecosystems.

In this context, DWF acts as an intermediary for projects to offload tokens, using OTC deals or marketing tactics. They frame OTC acquisitions as “strategic investments,” despite showing no real commitment to long-term project development, only to turn around and dump the tokens. Through promotional packaging, they conceal the true nature of indirect token distribution by project teams. In doing so, DWF profits from both project teams and retail users.

For secondary market investors, upon seeing news of a project partnering with DWF, it's crucial to first determine which type of DWF service is involved (secondary market investment, OTC, market making, or marketing). Based on past market behavior:

1. Tokens where DWF directly invests on the secondary market warrant close attention—these are typically newly listed tokens with strong tokenomics or memecoins;

2. Tokens where DWF buys via OTC (marketed as strategic investments) often first enter a months-long downtrend, followed by a sharp pump. The rally typically ends shortly after DWF deposits tokens to exchanges (the pump usually lasts less than one week);

3. Genuine market-making projects by DWF rarely see doubling moves but may attract speculative flows, offering brief entry windows for early movers;

4. Rallies triggered by DWF-related marketing news tend to have low win rates and poor risk-reward ratios, as insiders leverage DWF’s current market influence to attract liquidity before dumping.

Once DWF’s intent to pump is detected, a surge in futures open interest and spot trading volume signals the start of a rally. Interactions between DWF’s on-chain and exchange addresses (especially at high prices), declining positions, and extremely negative funding rates typically mark the end of the move.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News