2023 H1 Crypto Funding Report: Mapping Top VCs' Investment Preferences and the Top Ten Most Popular Projects

TechFlow Selected TechFlow Selected

2023 H1 Crypto Funding Report: Mapping Top VCs' Investment Preferences and the Top Ten Most Popular Projects

Bear Market as the Right Time to Build Positions? Crypto Funding Halved in First Half of 2023, Yet a "Dark Horse" Investor Emerges.

By: Zelda

Recently, the venture capital team at Sequoia Capital has experienced turbulence, with two cryptocurrency investors departing. These individuals had previously invested in the now-collapsed crypto exchange FTX, resulting in a $214 million loss for Sequoia. This internal upheaval reflects the broader state of crypto market investments in the first half of this year. Data shows that overall funding in the primary market has been dismal, with investment volumes nearly halved quarter-on-quarter.

However, not all news is negative. Market volatility is often seen as an ideal time to make strategic investments. In the first half of this year, one standout player emerged in the VC space—DWF Labs. It made 32 investments during this period, far surpassing other firms, and publicly claims to invest in an average of five projects per month "regardless of market conditions."

On another front, the crypto secondary market has shaken off the deep bearish sentiment from last year. Bitcoin’s price climbed from a low of 16,477.6 USDT to a high of 31,550 USDT, marking a gain of over 90%. This rally has provided some relief to investors. Perhaps, as the secondary market exits the bear phase, primary market fundraising could improve in the second half of the year.

1. Overall Downturn: Funding Amounts Nearly Halved Quarter-on-Quarter

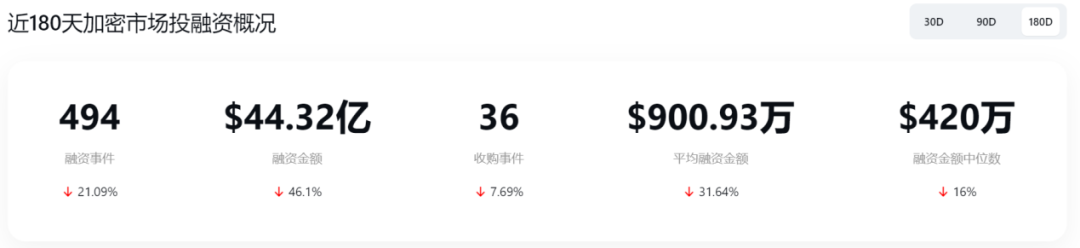

Let’s first examine the overall investment landscape over the past six months. Since the collapses of LUNA and FTX last year, the global crypto market has entered a deep bear cycle. Whether it's Bitcoin or NFTs, or activity in the primary versus secondary markets, the situation has been bleak across the board. Data reveals sharp declines in both funding amounts and deal counts compared to the second half of last year, with funding volume dropping by 46.1%—nearly cut in half.

2. Declining Investment Volume and Count; Infrastructure Remains the Hottest Sector

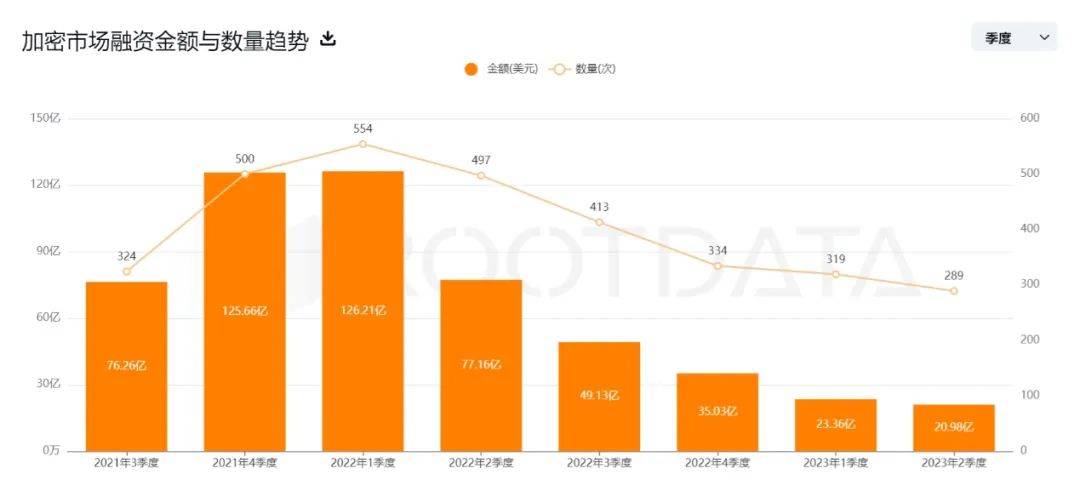

In terms of trends, both investment volume and count have declined for five consecutive quarters since Q1 last year. At present, institutions remain cautious, and there are no signs yet that the "investment winter" has bottomed out.

Source: ROOTDATA

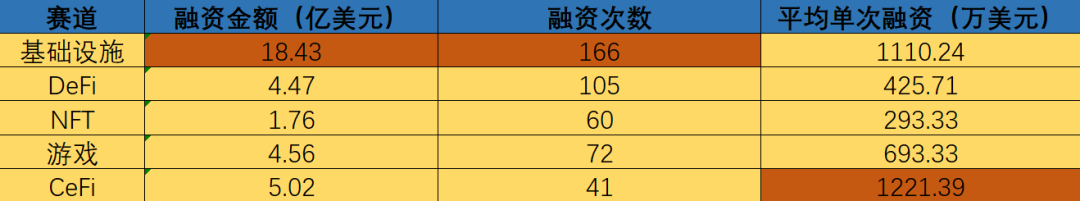

By sector, infrastructure remains the most favored by institutional investors, leading in both funding amount and number of deals. However, when comparing average funding per round, CeFi leads, indicating that while CeFi raises fewer times, each round tends to secure substantial capital.

Source: ROOTDATA

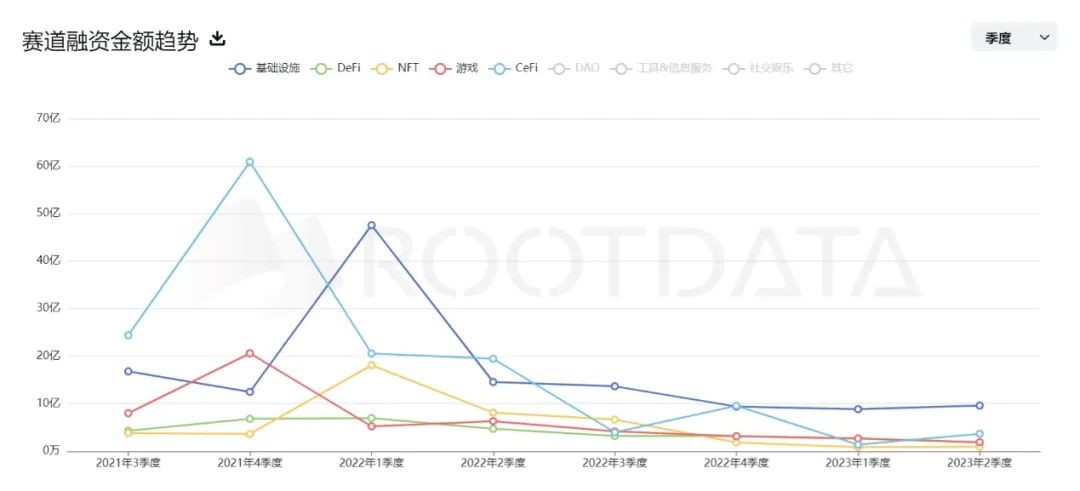

From a longitudinal perspective, funding amounts across all sectors show a downward trend.

Source: ROOTDATA

Unit: billion USD. Source: ROOTDATA

Deal counts saw a slight rebound this year but still remain far below previous highs.

Source: ROOTDATA

Funding rounds by sector. Source: ROOTDATA

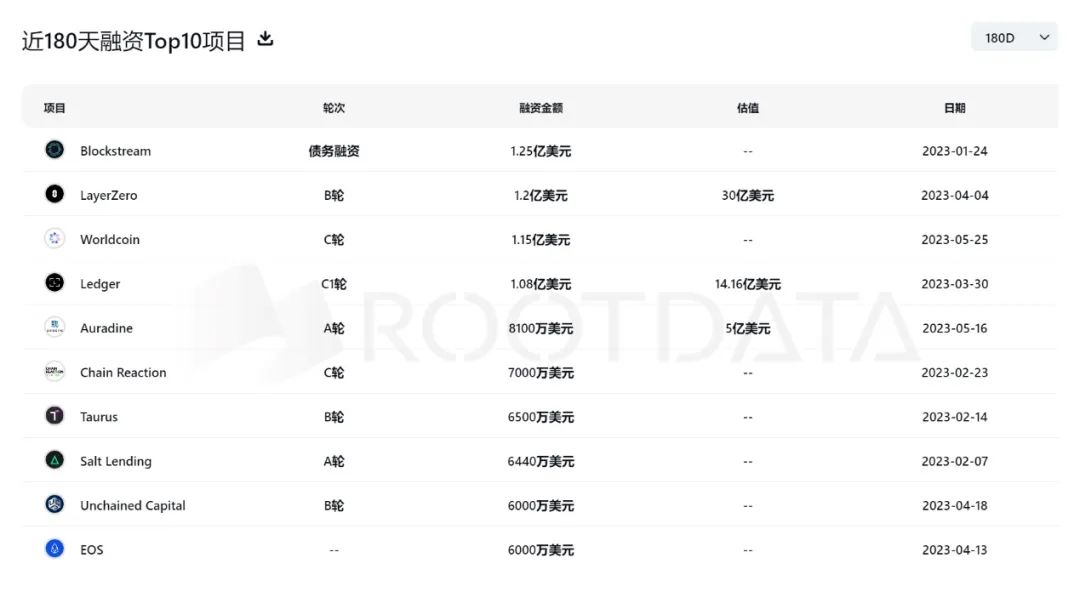

Among the top ten highest-funded projects were Blockstream (infrastructure), LayerZero (infrastructure), Worldcoin (digital currency), Ledger (infrastructure), Auradine (infrastructure), Chain Reaction (infrastructure), Taurus (infrastructure), Salt Lending (CeFi), Unchained Capital (CeFi), and EOS (infrastructure).

Source: ROOTDATA

Surprisingly, infrastructure accounted for seven of the top ten funded projects, CeFi for two, and digital currency for one. Infrastructure clearly remains the most favored sector among investors. A robust and mature infrastructure is essential for Web3 application growth, and in uncertain market conditions, investing in "shovels" often proves to be the optimal strategy.

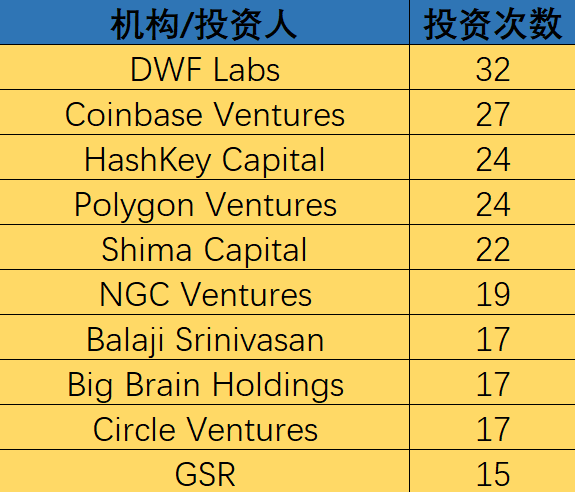

3. A "Dark Horse" Emerges: DWF Labs Invests in 32 Projects in Six Months

According to our incomplete statistics, DWF Labs ranked first in investment frequency during the first half of this year, making 32 investments—truly a "dark horse" in the VC scene.

Investment counts by investor. Source: ROOTDATA

DWF Labs is not a traditional heavyweight but a new entrant founded in 2022. It operates as a Web3 venture capital firm and market maker, offering liquidity provision, secondary market investments, early-stage funding, OTC services, token listing, and advisory services to Web3 companies.

DWF Labs holds a notably aggressive investment philosophy, stating on its website: "Regardless of market conditions, we invest in an average of five projects per month." Andrei Grachev, Managing Partner at DWF Labs, stated in an interview that the current volatile market presents the best opportunity to enter, and they have accumulated sufficient capital from profits to fund these initiatives. Most of the time, DWF Labs invests by directly purchasing tokens.

Additionally, DWF Labs is part of Digital Wave Finance (DWF), one of the world’s top cryptocurrency trading firms, actively trading spot and derivatives across more than 40 major exchanges. This strong backing may be a key reason why this "newcomer" feels confident enough to aggressively deploy capital during a bear market.

Notably, the prominent VC firm a16z did not appear in the top ten list. During the first half of 2023, a16z made only 14 investments, significantly fewer than the 25 deals in the second half of 2022. This reduction further reflects the ongoing bearish sentiment in the crypto market.

Next, let’s examine the investment preferences of several well-known VC firms:

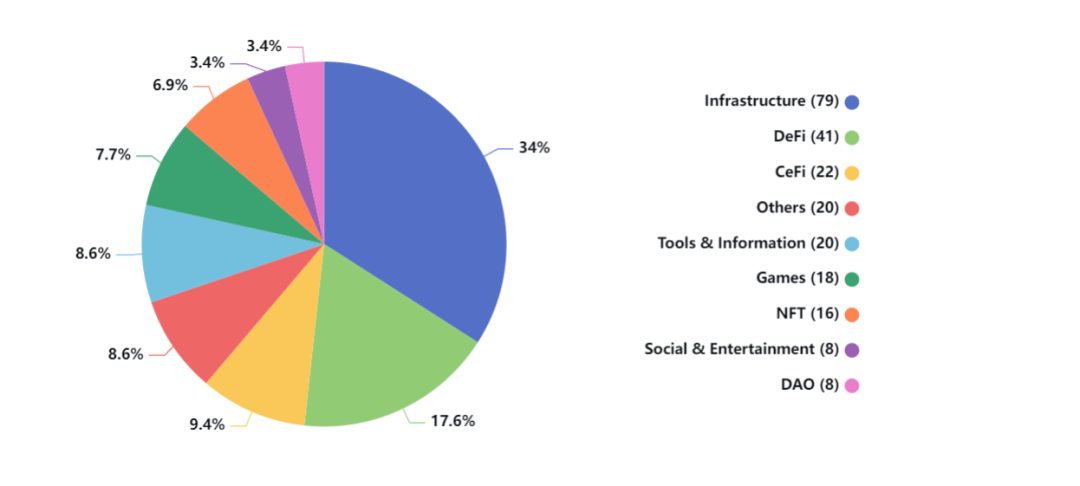

HashKey Capital Investment Portfolio. Source: ROOTDATA

HashKey shows a clear preference for infrastructure, which accounts for over one-third (34%) of its total investments. DeFi (17.6%) and CeFi (9.4%) rank second and third, respectively.

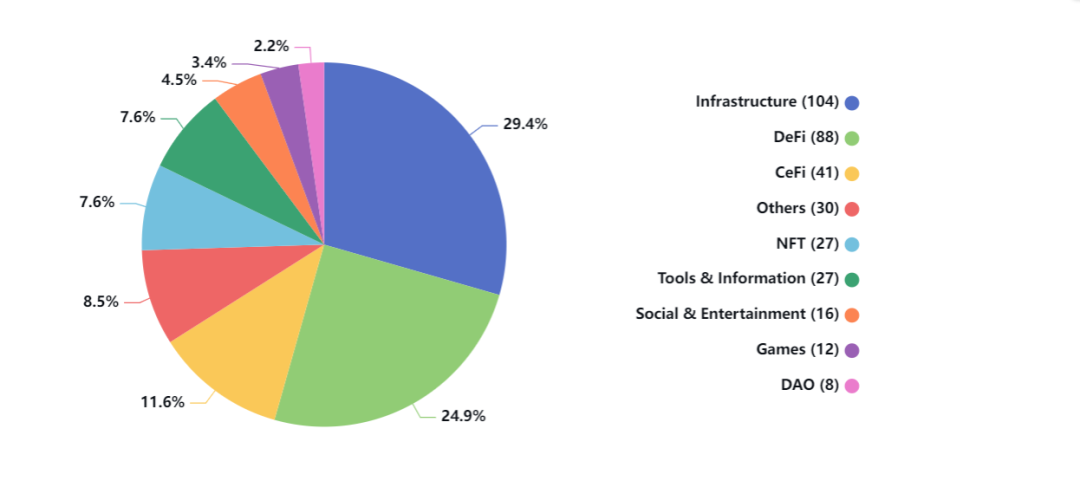

Coinbase Ventures Investment Portfolio. Source: ROOTDATA

Coinbase Ventures also favors infrastructure (29.4%), though its investments are more evenly distributed. Its second-largest category is DeFi (24.9%), followed by CeFi (11.6%), both higher than HashKey’s proportions.

Circle Ventures Investment Portfolio. Source: ROOTDATA

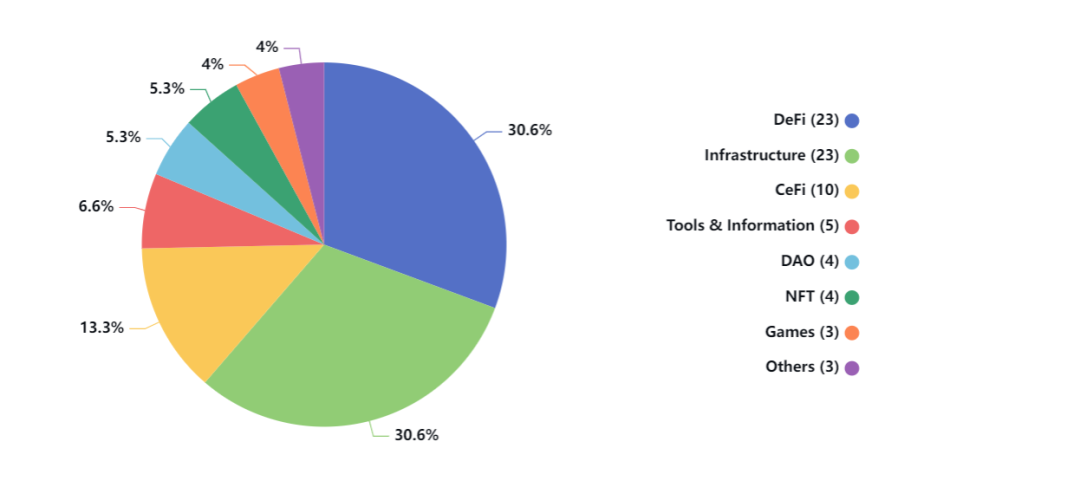

Circle Ventures shows equal preference for DeFi and infrastructure, each accounting for 30.6%. CeFi ranks third at 13.3%.

a16z Investment Portfolio. Source: ROOTDATA

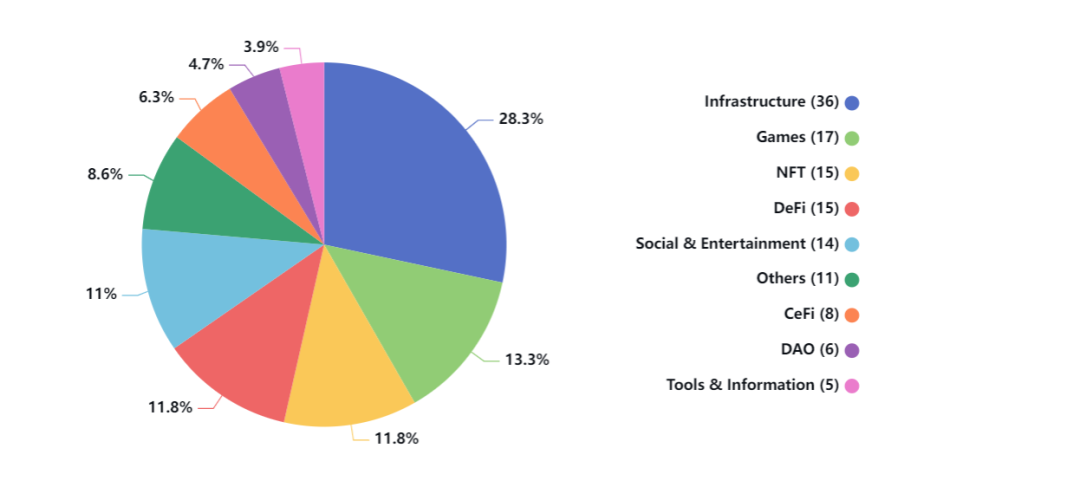

Unlike the first three firms, a16z has a distinct investment focus. While others prioritize infrastructure, DeFi, and CeFi, a16z ranks gaming and NFTs as its second and third largest categories. Its portfolio is more balanced: infrastructure leads (28.3%), followed closely by Games (13.3%), NFT (11.8%), DeFi (11.8%), and Social & Entertainment (11%).

4. Top Ten Most-Funded Projects in the First Half of 2023

The ten largest-funded projects in the first half of this year are listed below:

1. Blockstream

Blockstream is a leading blockchain development company founded in 2014. Its core mission is building new infrastructure for traditional financial systems, focusing on Bitcoin sidechains and other blockchain applications. Key technologies include its implementation of the Lightning Network and the Elements Project—a blockchain platform supporting open-source sidechains. Blockstream has launched multiple products such as Liquid (a Bitcoin-based inter-exchange settlement network), Blockstream Green (a secure Bitcoin wallet), real-time and historical crypto data tools, and custodial mining services.

Notable investors include Blockchain Capital and Ethereal Ventures.

2. LayerZero

LayerZero is a cross-chain interoperability protocol designed for lightweight message passing between blockchains. It enables trusted and guaranteed message delivery with configurable trustlessness.

Backers include Coinbase Ventures, Circle Ventures, Binance Labs, a16z Crypto, and FTX Ventures—an elite lineup signaling strong confidence in the project.

3. Worldcoin

Worldcoin is a new global cryptocurrency aiming to become the world’s largest and most inclusive crypto network by distributing free tokens to everyone. It developed a device called the Orb, which captures an image of a person’s eye and converts it into a short digital code to verify unique registration. If not already registered, users receive free Worldcoin tokens. The original biometric data is neither stored nor uploaded.

Investors include Coinbase Ventures, a16z Crypto, and Blockchain Capital.

4. Ledger

Ledger is a cryptocurrency hardware wallet provider that uses proprietary technology to develop secure infrastructure solutions and blockchain applications for individuals and enterprises.

Backers include Blockchain Capital.

5. Auradine

Auradine focuses on developing breakthrough solutions for scalability, sustainability, and security in future internet infrastructure, powered by revolutionary blockchain, security, zero-knowledge, and AI technologies.

Investors include DCVC and Mayfield.

6. Chain Reaction

Chain Reaction is shaping the future of disruptive blockchain and privacy technologies through accelerated computing performance. Collaborating with cloud providers and data centers, it uses custom ASICs and system modifications to optimize energy-efficient, high-performance computing. Its 3PU™ (Privacy-Preserving Processing Unit) dramatically accelerates real-time operations on encrypted data using privacy-enhancing technologies, transforming cloud environments into trusted zones. This enables vertical industries reliant on private big data—such as finance, healthcare, pharmaceuticals, defense, government, and energy—to securely leverage cloud computing.

Investors include Morgan Creek Digital and Hanaco Ventures.

7. Taurus

Taurus provides enterprise-grade infrastructure for issuing, custodying, and trading any digital asset—including staking, tokenized assets, and digital currencies. It also operates a regulated private market for tokenized securities.

Investors include Tezos and Credit Suisse.

8. Salt Lending

SALT Lending offers personal and commercial loans to members who use blockchain assets as collateral.

9. QuickNode

Unchained Capital is a Bitcoin-native financial services firm offering collaborative custody, trading desks, Bitcoin-backed loans, and Bitcoin retirement accounts.

Investors include Valor Equity Partners and NYDIG.

10. EOS

The EOS public blockchain is built on the open-source EOSIO software framework, enabling developers to build decentralized applications for real-world use cases.

Backers include DWF Labs.

Conclusion

Overall, the primary market investment landscape shows weak investor confidence, with both funding amounts and deal counts significantly lower than in previous years. Yet even in such a challenging environment, aggressive players like DWF Labs continue to boldly "buy the dip," embodying the classic investment principle: "Be fearful when others are greedy, and greedy when others are fearful."

R3PO believes it’s premature to be overly pessimistic about the primary market. The secondary market is already beginning to emerge from the bear market shadow. Typically, the performance of primary and secondary markets does not diverge for long—the profitability seen in the secondary market will eventually spill over into the primary market.

Therefore, even during a deep bear market, it's crucial to stay alert to investment trends. Tracking the projects and sectors favored by top investors may reveal the spark that ignites the next bull cycle in crypto.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News