Data Analysis of Storj's Short-Term Funding Situation: Capital Flows and On-Chain Activity

TechFlow Selected TechFlow Selected

Data Analysis of Storj's Short-Term Funding Situation: Capital Flows and On-Chain Activity

From a funding perspective, the team began a large-scale unlock in the second half of 2022, and the currently unlocked holdings should exceed 30%.

Author: Jaden, LD Capital

1. Project Overview

Storj is an open-source decentralized cloud storage network primarily aiming to provide censorship-resistant, secure, and affordable storage services targeted at enterprise clients. A key feature of the Storj network is the introduction of "satellites" that act as coordinators connecting users with storage nodes. The technical architecture of Storj centers around data storage, retrieval, and repair, while also incorporating mechanisms for data auditing and reputation management for both satellites and storage nodes. For data integrity, Storj employs erasure coding and uses satellites to manage and track data locations and audits. Storage services can be paid for using its native token.

Project Milestones

-

2014: Storj founded;

-

2014–2016: Released test version v1;

-

2017: Launched v2;

-

2020: Officially released v3;

-

February 2023: Adopted Storj Next, introducing features such as permanent storage and token-based storage rewards.

2. Token Supply and Distribution

The total supply of STORJ tokens is 425 million, with a circulating supply of approximately 394 million, representing 93% of the total. The remaining non-circulating portion is held by the official team. The circulating supply underwent significant changes in the second half of 2022, primarily due to adjustments made by the team regarding long-term locked tokens.

Following the 2017 token sale, the team held 245 million STORJ tokens. Starting December 2018, these 245 million tokens were divided into eight portions of 30.625 million each, with one portion being unlocked and re-locked every quarter until 2020, maintaining a stable circulating supply. However, due to the pandemic, the team began adjusting the long-term locked portion starting in 2020, entering a period of frequent adjustments by 2022, during which most tokens were transferred into wallets designated for operational reserves.

According to the latest announcement, all tokens scheduled for unlocking from Q3 2022 through Q3 2023 will be transferred into operational reserve wallets, leaving only two portions yet to be unlocked. (Whether the remaining portions will be unlocked will be announced by the team 45 days in advance.)

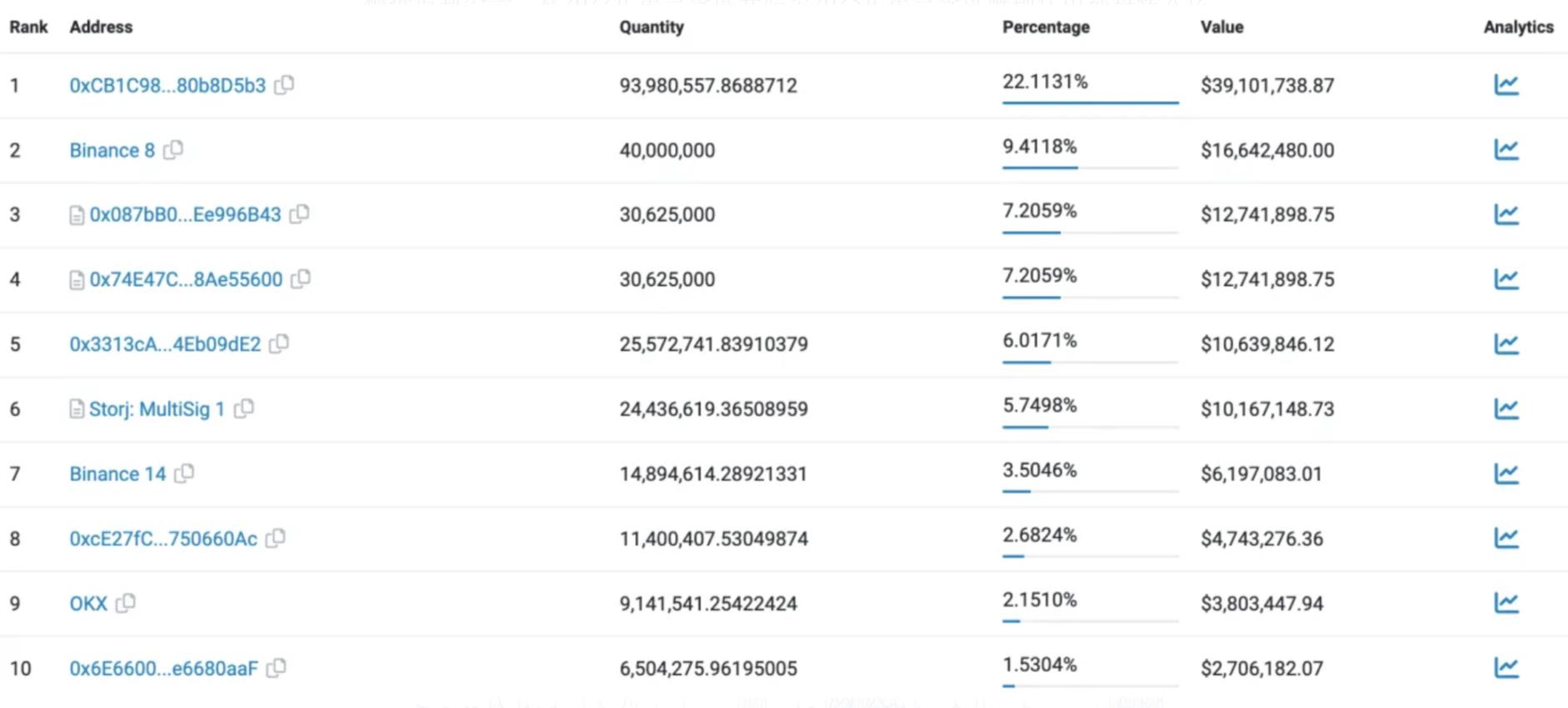

Currently, among the top 10 addresses, 20.1% of tokens are held in locked and team multisig wallets, 15.4% are held on centralized exchanges, and the remaining addresses hold 32.3%.

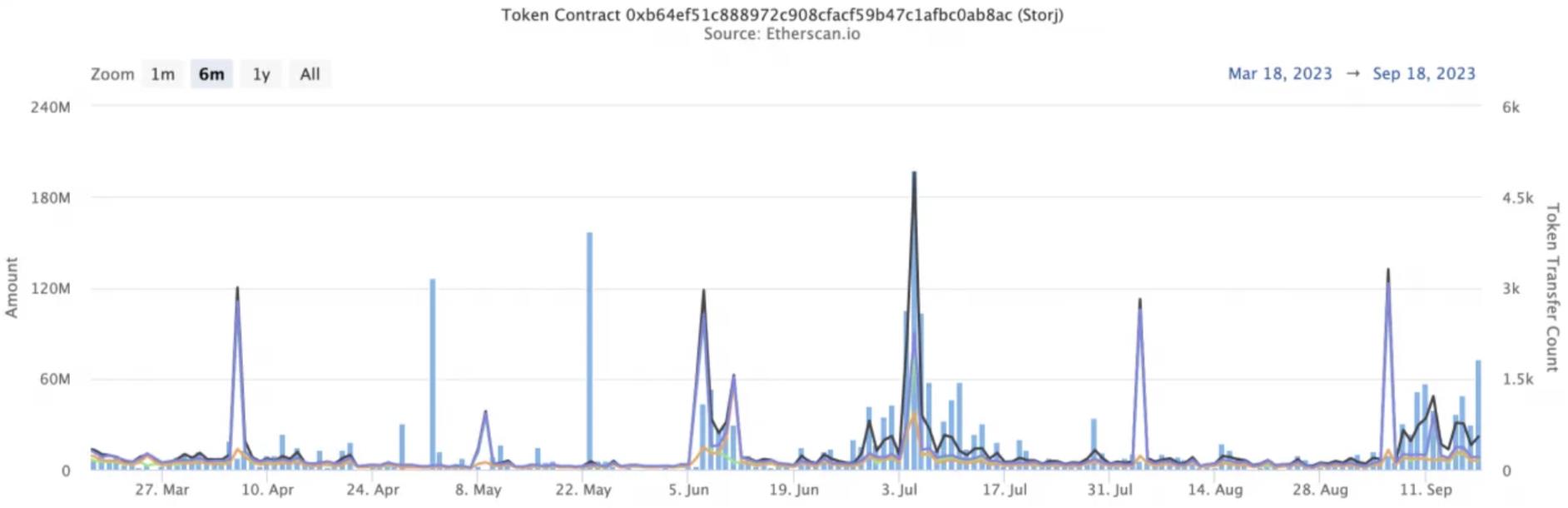

Looking at on-chain address activity over the past six months, there have been two active periods—July and September—with a high correlation between price movements and on-chain activity. Whether high on-chain activity indicates accumulation by large holders requires comprehensive analysis including changes in holding addresses and the extent of price fluctuations.

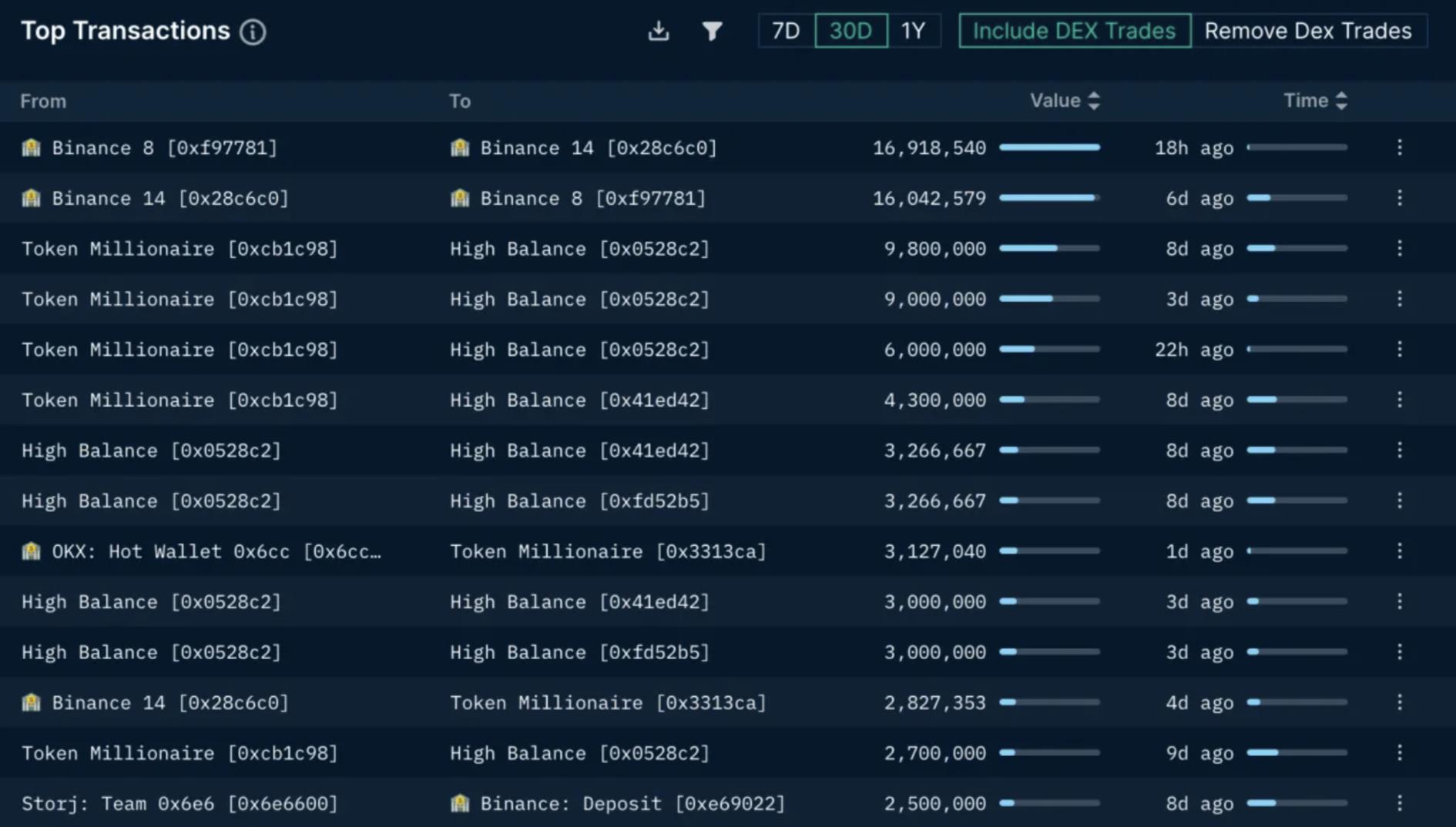

Based on analysis of large transactions over the past 30 days, the main active addresses include (calculations below use approximate values for simplicity):

1) Address 0x3313: Activity began on September 15, consistently withdrawing from Binance and OKX. This address has cumulatively withdrawn 25.572 million STORJ tokens from centralized exchanges, accounting for 6.07% of the total supply—16.26 million from Binance and 9.31 million from OKX.

2) 0x0528c2 / 0xfd52b5 / 0x41ed42 / 0xcb1c98:

Highly correlated addresses; some began small outflows to exchanges starting June 2023, likely originating from previously long-term locked tokens. Since September 1, these highly correlated addresses have transferred a total of 15.8 million tokens to Binance via 0xe6026. Transfers to OKX via other addresses involved too many addresses to calculate here.

3) Storj team: Transferred 2.5 million tokens to Binance, with 6.5 million STORJ remaining in their wallet.

3. Conclusion

The project's major fundamental update occurred in February this year. From a funding perspective, the team began large-scale unlocks in the second half of 2022. To date, the unlocked holdings should exceed 30%, warranting attention to potential selling by the team. The large withdrawals by address 0x3313 from exchanges raise the possibility that this address may be associated with the team.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News