Folius Ventures: The Logic Behind Friend.Tech's Surge and Its Future Evolution

TechFlow Selected TechFlow Selected

Folius Ventures: The Logic Behind Friend.Tech's Surge and Its Future Evolution

At the intersection of social and crypto chaos, friend.tech sounds a rallying cry.

Author: Jason Kam, Partner & Investment Manager at Folius Ventures

A Review of Friend.Tech's Development Journey

Within a month, building on predecessors' work, solving industry pain points around content sharing, timely leveraging speculation for cold-start traction, and solidifying growth expectations through rapid iteration and strategic alignment with Paradigm.

• Well-Patched Product Design: The choice of PWA fits lightweight social products, giving legacy tech new use cases while bypassing Web3-hostile app stores—a critical advantage. Combined with Web2-style login to lower barriers, piggybacking Twitter accounts for initial traffic, bonding curve design enabling smooth liquidity entry/exit, Base/OP Stack offering optimal trade-offs between minimal security and ultra-low cost for social/small transactions, and the maturity of offshore USDC—this patchwork allows Friend.Tech to scale steadily within current Web3 infrastructure constraints, successfully realizing the "CT引流, FT变现" (Crypto Twitter drives traffic, Friend.Tech monetizes) business model.

• Partially Solving Real Pain Points: Whether it’s X (formerly Twitter), Discord, WeChat, or Telegram, the Web3 community lacks a clean mechanism akin to platforms like “Zhihu Live” or “Get” where high-value individuals can comfortably, one-directionally, and quietly monetize attention and knowledge based on cognitive value. Friend.Tech partially fills this gap, making direct payment to the most insightful and profitable figures in the industry possible.

• Speculative Effects and Early KOL Strategy Overcame Cold Start: Launching during a period of weak industry narratives, Friend.Tech gained massive early traction by directly gifting cash to Twitter KOLs and offering 5% revenue share from Key purchases to room owners. User expectations of KOL appreciation and wealth effects post-pump fueled the project’s first wave of adoption. Ongoing token airdrop expectations and breakout potential attracted a loyal base of contributors who kept DAU active.

• Paradigm as Core Secondary Rocket: As initial momentum slowed, news that Paradigm—the industry’s top-tier firm—led the investment laid a strong foundation for long-term development. This solidified future token launch and airdrop expectations, significantly raising valuation outlooks, which in turn boosted user willingness and capacity to invest. Given Paradigm’s strong reputation, users expect product flaws and legal issues will likely be resolved, greatly reducing scam risks and boosting confidence in usage and capital commitment.

• Rapid Iteration on the Right Track: While Friend.Tech would score poorly compared to Chinese/Asia-Pacific Web2 counterparts, it has fortunately continued iterating correctly along core principles: maximizing host monetization, ensuring user profits, and delivering a smooth experience—all executed pragmatically. From refresh speed, reply features, cross-chain capabilities, deposit functions, global comparison/ranking pages, and image support, the team’s 996-level execution promises ongoing improvements toward reaching basic Web2 standards.

Friend.Tech’s Point System and Airdrop Expectations Turn Holding Keys and Engagement into De Facto Pool2 Mining

Friend.Tech’s point system and anticipated airdrop have turned Key ownership and participation into de facto Pool2 mining—an exclusive way to gain exposure, currently offering high potential returns.

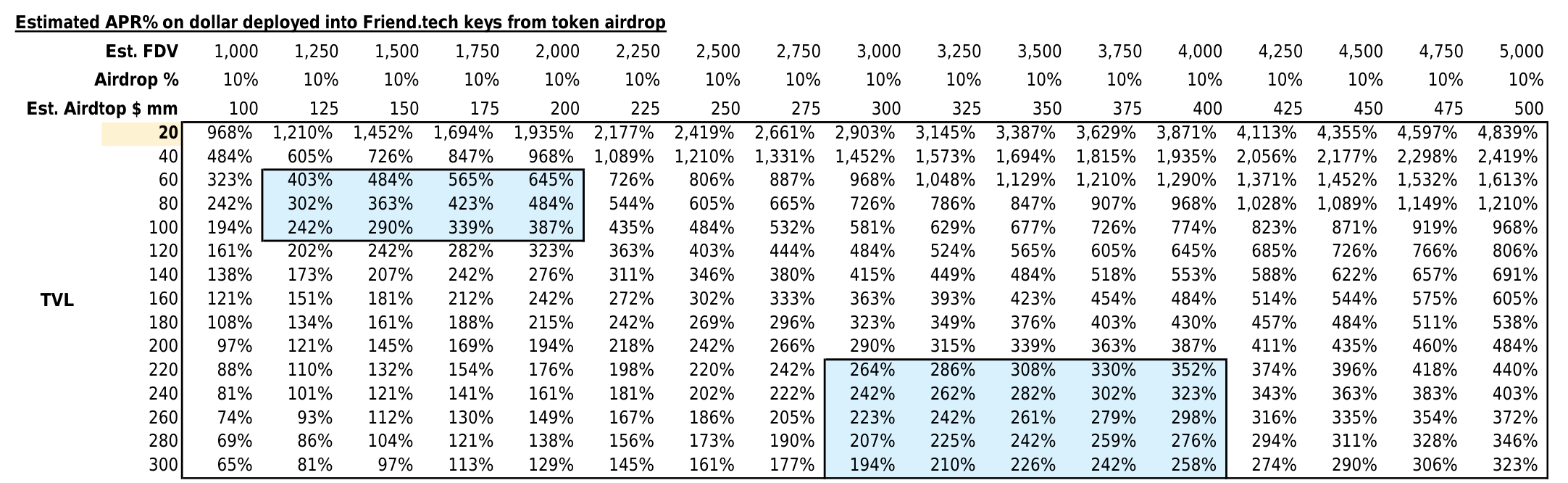

The platform’s current popularity largely stems from its expected token launch. For heavy participants, the mental model assumes each point may convert into $1–5 worth of token airdrops, equivalent to earning 200–500% APR or more in yield farming terms:

• Friend.Tech will distribute 100 million points over 25 weeks. There is broad consensus that these points represent eligibility for token airdrops, strongly correlated with total amount invested in Keys, holding duration, and in-app activity (opens, time spent, messages sent, etc.).

• As shown in the table below, if Friend.Tech eventually launches a token with a FDV of $1.5B, allocates 10% for airdrops, averages $80M TVL over 25 weeks, and distributes rewards proportionally to participation relative to TVL, the resulting annualized airdrop yield would be ~360%.

• Purchasing Keys and maintaining engagement creates friction that deters large-scale capital inflows. However, we believe that as awareness grows, product improves, financial infrastructure matures, and influencers from Silicon Valley, Asia-Pacific, and broader circles enter, both TVL and Key prices could rise substantially.

• Notably, Friend.Tech currently refuses engagement with any VCs other than Paradigm. Thus, we see this as an opportunity for retail investors and secondary-market funds, where mining may be the only path to gaining exposure.

On PMF: For Typical Professionals, Rapid Reputation Monetization Offers Short-Term Gains of $1,000–$10,000

• Subscription price = Sell price × 0.9 – Buy price × 1.1. In other words, once the price rises 22%, the user effectively gets a free subscription. By this formula, when Key holders increase by about 10% after purchase, the buyer essentially “free-rides.”

• Final pricing should converge near ~20% of the cost of repeated consultations (i.e., round-trip transaction). Based on current ETH prices and typical hedge fund consulting fees (~$500–$1,000/hour), top-tier experts should hold approximately 150–215 Keys, or a per-Key price of ~1.4–3.0 ETH. Interestingly, under the assumption that users can own multiple Keys, this number aligns closely with Dunbar’s Number (~150)—the cognitive limit for stable social relationships. We believe this S² / 16000 * 1 equation was intentionally designed, and the 1.5–3.0 ETH range represents what we expect to be the fair market price for industry experts once the hype fades.

• Public perception of reputation and expertise quickly pushes prices toward equilibrium. The thrill of early discovery and profit is addictive. High royalty rates give influencers immediate income satisfaction, further incentivizing platform promotion and accelerating network effects. An influencer earns royalties alone of at least ~$200 / $1,700 / $5,600 at 50 / 100 / 150 Keys. If they held three Keys cheaply early on, selling at those nodes could generate additional gains of ~$750 / $3,000 / $6,750. For most professionals, the prospect of quickly earning $1,000–$10,000 is enough motivation to participate daily and promote actively.

• Users may prefer to hold Keys due to desire for free access and status signaling. Moreover, we believe opportunities to access top-tier attention and cognition are extremely rare today, and the current cost to reach elite minds is surprisingly low. For those who need it, the price they’re willing to pay for attention and feedback could be uncapped, opening up Key price ceilings. However, sustaining long-term cash flow for influencers remains a challenge requiring solutions.

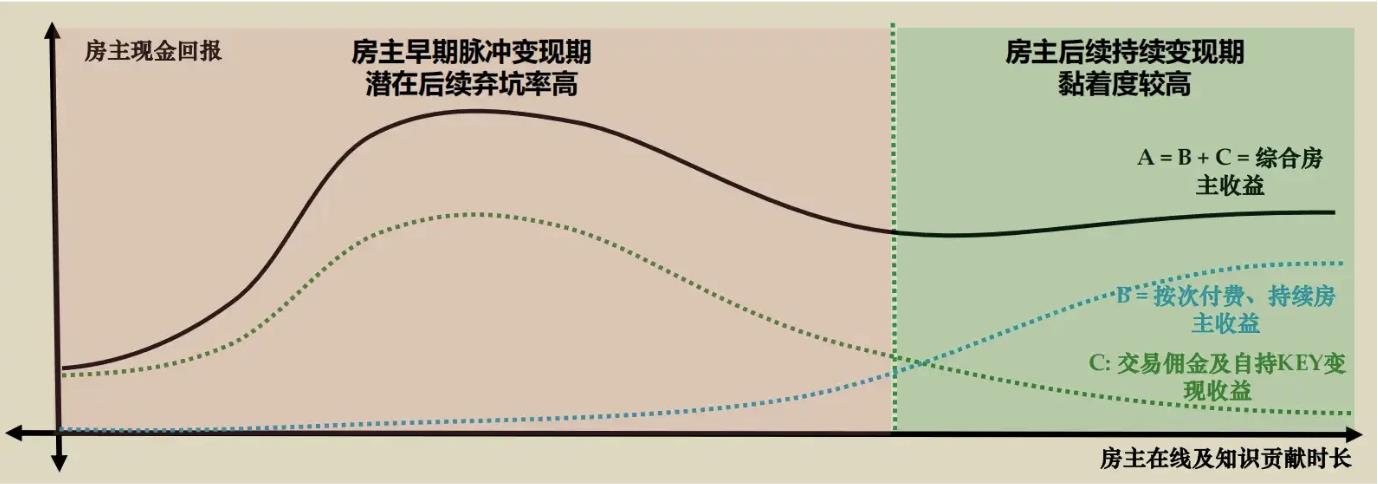

Early Revenue Surge vs. Long-Term Sustainability – Friend.Tech Must Introduce Recurring Payment Mechanisms

Declining KEY + token prices ↔ user churn may trigger a death spiral.

We believe Friend.Tech will inevitably face challenges later in its lifecycle: inflated host pricing, user saturation leading to reluctance to sell Keys, insufficient purchasing intent from new users due to capital constraints—resulting in inadequate recurring cash flow. After early windfalls via royalties and one-time Key sales, hosts will inevitably confront sustainability issues. To sustain engagement from Web2-centric and mid-to-high-end professionals, Friend.Tech must introduce external and internal pay-per-use models:

• Such designs should incorporate differentiated pricing for Key holders vs non-holders, referral links/commission mechanisms for Key holders, and appropriate free disclosures based on unlock timing or other criteria to enable effective ongoing monetization for hosts.

• Without achieving this, during post-saturation downturns, user attrition will spike sharply as Keys and tokens are dumped, further depressing prices and creating a two-way death spiral.

With Strong Execution, Friend.Tech Could Still See At Least Two More DAU Peaks

We anticipate that with sufficiently strong execution, Friend.Tech could still experience at least two more waves of DAU surges. Beyond that, the product must achieve sufficient network effects and quality to sustain itself.

Potential Future Participants:

• Silicon Valley VCs and founders: Spreading through Paradigm and existing Web3 networks

• Numerous VCs, founders, thought leaders, crypto traders, and tech professionals across Asia-Pacific: Expansion from West to East driven by wealth effect

• Non-Web3 professionals across industries, especially niche high-net-worth verticals: Driven by company-led business development and GTM spending. Attracting influencers with cash and tokens is crucial

• Native Web3 liquidity funds allocating directly to capture airdrop opportunities: We believe once general liquidity funds can easily buy ETF-like Key bundles and access potential airdrops, significant capital will flow in

• Continued wealth effects from new entrants and rising TVL will boost token valuations and attract more existing users’ capital. Strong airdrop expectations could keep the product hot until January–February 2024

Essential Feature Additions:

• Free previews: Increase purchase intent and discoverability

• Richer multimedia experiences: Especially video and live streaming

• Global feed: Help discover local content and drive influencer traffic; ads optional but not essential

• Referral rewards: Commission-sharing accelerates influencer monetization

• Additional encrypted or paid group content: Enable sustained influencer monetization

• Product details – Copy features from WeChat + Telegram: Polls, reactions to posts, pinned content, etc.

• Enhanced transaction scenarios: Send Keys, direct white-label orders, or facilitate token/NFT purchases

• Significantly lower barriers to entry and fiat on/off-ramps

• Greatly improved product fluidity

• Deepen thinking on bonding curves and introduce multiple curve types; consider ongoing incentives for active users and token holders post-launch

Bonding Curves Have Room to Improve – Team Made Smart Trade-Offs for Simplicity

Bonding curves still have room for improvement—the team made excellent simplicity-focused trade-offs. We look forward to deeper refinements potentially guided by Paradigm.

Currently, Friend.Tech’s product is pure and singular: simple bonding curves are easy to understand, ideal for high-value KOLs generating real revenue. But limitations exist—once user demographics expand, not every user fits this mold. Even KOLs need segmentation among their followers. Granting users a few choices (e.g., 3–4 curve types) implemented simply could significantly expand Friend.Tech’s TAM:

• Monetization-focused, fixed-price Keys: Fixed price instead of x², with majority (e.g., 90%) of revenue going to host instead of 5%. This allows Key holders to scale into thousands, similar to OnlyFans, adjusting utility to accelerate mass adoption.

• Knowledge-payment-focused, S-curve pricing Keys: Price converges after marginal users join (S-shaped rather than x²), stabilizing late-stage acquisition costs while preserving early speculative appeal—ideal for expert-type talents.

• Event-driven, multi-S-curve pricing Keys: Similar to above, but with renewed upward momentum when user count breaks through new thresholds—suited for celebrity hosts, possibly combined with referral links to drive organic promotion and break plateau phases.

Fortunately, Paradigm’s deep expertise in mechanism design and mathematics can greatly assist the Friend.Tech team.

Long-Term Holders of High-Traffic, High-Stickiness, High-Net-Worth Hosts Who Deeply Engage With the Product May Maximize Points Accumulation

If maximizing Points is the rationale for Key allocation, then long-term ownership of Keys from high-traffic, high-engagement, high-net-worth hosts who deeply commit to the product may be optimal.

Airdrop expectations add value beyond knowledge consultation and identity signaling. Assuming final token distribution correlates strongly with Points, the goal should be maximizing weekly Points accumulation. Although the team may adjust the formula weekly, we venture to predict the likely calculation method is:

In-app activity (self + others) × Key aggregate asset price (self + others) × Key holding duration

Given this, before adjustments occur, general strategies to maximize weekly Points might include:

• Keep the app open frequently and actively engage in your own and others’ communities. Held Keys should belong to active users.

• Prioritize hosts with ample follow-up capital—their ETH is more likely to be converted into Keys, increasing weight. Also favor users with high total asset values.

• Buying highly active KOLs at low prices early is difficult; thus, for well-capitalized users with built-in traffic, buying a substantial number of their own Keys upfront may be one of the best ways to boost parameters.

• Given holding duration is likely a weighting factor and round-trip transactions incur ~20% fees, the optimal strategy may involve early purchase and long-term holding of Keys from users genuinely committed to growing within the product—not frequent trading. Therefore, carefully selecting hosts who clearly cannot disengage or who show deep involvement, rather than trend-followers, may yield better results.

• Hence, from an allocation perspective, a host with high traffic, high stickiness, high net worth, and genuine motivation to build their brand within the product long-term should be the ideal candidate for sustained holding to maximize Points. Interestingly, such users likely already earned solid Points over the past four weeks, potentially serving as a screening criterion.

Folius’ Three Pillars of Web3 Integration for Consumer Products Are Well Reflected in Friend.Tech

Folius’ three pillars for consumer product Web3 integration—offshore fiat rails, low-cost incentive-based user acquisition, and reliance on external liquidity and economic depth for taxation—are all well demonstrated in Friend.Tech.

We believe Friend.Tech embodies several desirable traits we observe in successful Web3-native consumer products—i.e., leveraging the unique characteristics of Web3 value networks to achieve success:

Offshore Fiat Channels: Cross-border support (e.g., Russians buying Argentine president’s Key, Africans consulting Mexicans) and attention/knowledge/content payments in specific industries (often high-risk or controversial) are unlikely to work via traditional financial channels. However, seamless transactions using USDC on ETH/Base are easily achievable. Last-mile fiat on/off ramps remain friction points, but the ecosystem continues improving.

Low-Cost Incentive-Based Growth at Scale: Leveraging inherent speculation, wealth effects, and airdrop expectations, Friend.Tech can acquire highly loyal users at near-zero cost for a period. The possibility of token-derived cash flow multiples makes this acquisition intensity an order of magnitude stronger than traditional cash-based user acquisition. Of course, if the team fails to solidify fundamentals before these advantages fade, Web3-accelerated users will likely leave quickly. Yet for a social product needing rapid scale and tied to attention/knowledge monetization, this isn’t necessarily a bad trade-off.

Taxing External Liquidity and Economic Depth: Beyond airdrop-driven financial leverage, Keys also carry a multiplier on one-time payments. That is, today’s Keys represent a hybrid of quasi-equity in Friend.Tech and a multiplier on the host’s personal cash flow. On this basis, a 5% fee generates far greater revenue intensity than typical Web2 companies. Additionally, we can foresee future taxation on in-app financialization, pay-per-message tips, and even downstream revenue sharing once the platform scales—potentially becoming a traffic gateway with meaningful take rates.

Risks

As a financially intensive vertical social product, Friend.Tech faces numerous risks:

• Project may ultimately not launch a token, or airdrops may be unexpectedly small: Participants must therefore prioritize early entry and strictly manage ETH-denominated losses across cycles.

• Fails to break out and collapses prematurely: Current Web3 penetration is already high; failure to expand beyond this circle risks devaluing all assets.

• Excessively high fee rates: 10% fees on both buy and sell are steep and may provoke backlash as growth slows and user base expands.

• Significant regulatory risk of Keys being classified as securities: This risk cannot be eliminated and depends on Paradigm’s legal team and clever structural design.

• High execution risk: Due to strong financial ties, every feature update and iterative fix carries significant collapse risk during growth. The team must operate with extreme stability. Additionally, product quality remains below Web2 baseline with poor UX. Failure to improve will hurt retention once hype fades.

• Inevitable financial cycles due to DAU and price volatility: Keys will exhibit strong cyclicality and volatility driven by airdrop expectations, user inflow speed, and price swings—accompanied by significant impermanent loss risks. The team must carefully manage expectations and iterate through these cycles.

• Long-term retention risk: After the hype fades, Friend.Tech may become a niche product due to high Key prices for average users, failing to justify high FDV expectations. Clubhouse and other failed niche social apps serve as cautionary tales.

• Private key and Web3 asset security risks: Custodial wallet mechanisms and smart contracts inherently carry hacking risks that must be considered.

• Anonymous team risk: The team bears no formal accountability to users. While this is mitigated somewhat by Paradigm’s involvement, reputational risk from semi-anonymous founders persists.

• Content risk: Clearly, such a content platform faces high risks of hosting illegal content across jurisdictions. As the platform grows, it will inevitably face major moderation and regulatory challenges. The team must prepare with great patience and foresight.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News