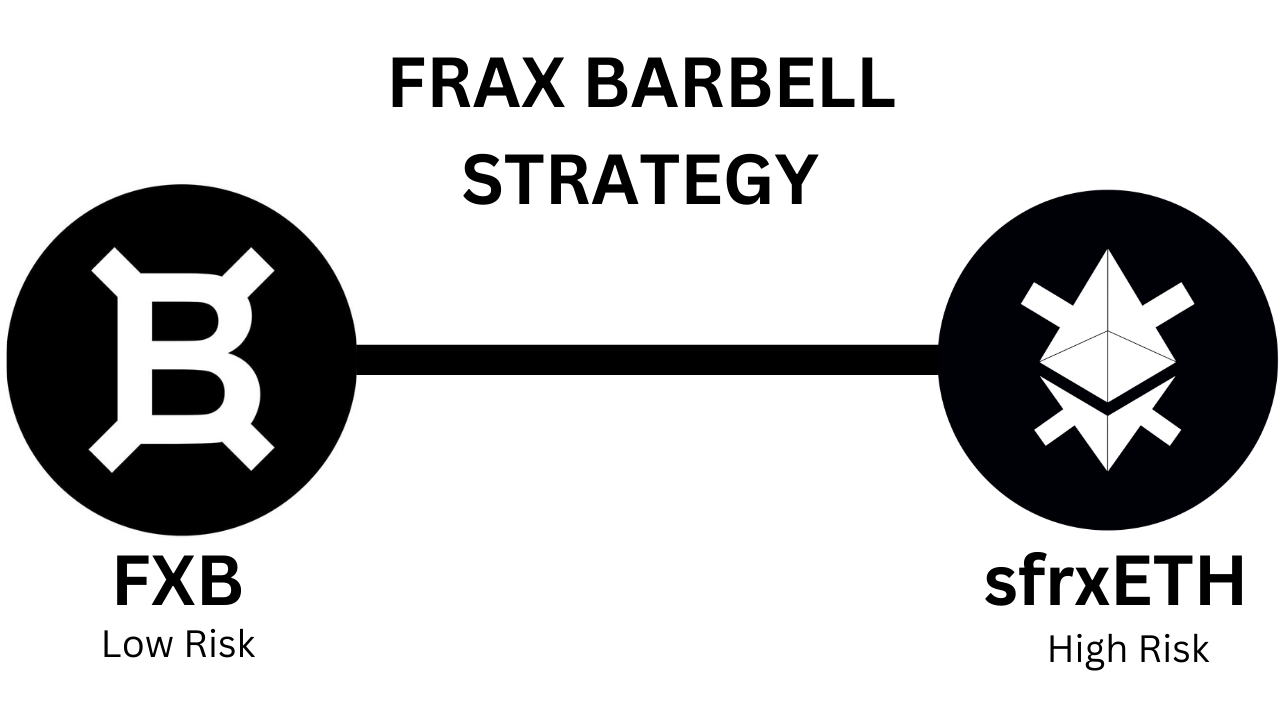

Fraxbonds and sfrxETH: Is the barbell strategy of combining high- and low-risk assets viable?

TechFlow Selected TechFlow Selected

Fraxbonds and sfrxETH: Is the barbell strategy of combining high- and low-risk assets viable?

Frax is creating a "fully vertical, on-chain liquidity stack" for investors, enabling them to seamlessly mix and match the yields and risks of sfrxETH and Fraxbonds (FXB) according to their risk preferences.

Written by: Samuel McCulloch

Compiled by: TechFlow

The barbell investment strategy is an approach where investors divide their portfolio into two extremes: low-risk, predictable assets such as government bonds, and high-risk, high-return assets such as speculative ETH. The method intentionally avoids medium-risk investments, aiming to leverage both the safety of low-risk assets and the potential for substantial returns from high-risk assets.

Asset allocation isn't always 50/50; it's adjusted according to individual risk tolerance and financial goals. This strategy holds that the low-risk side provides stability, while the high-risk side offers growth potential that can offset the modest returns of safer assets. As market dynamics shift, investors can rebalance their portfolios, moving gains from one end to the other.

Until now, if you wanted to execute this strategy, there was no effective way to do so entirely on-chain. While crypto offers abundant high-risk assets, safe and reliable yield has had no real place. Just consider how investors were drawn in by Luna/Anchor’s 20% yield—only for UST’s price to collapse nearly overnight and go to zero.

Other avenues for yield-seeking in DeFi also carry risks—just one motivated developer manipulating liquidity internally, or a North Korean hacking group targeting exploitable code, and your hard-earned cash could vanish instantly. Hackers stole over $3.8 billion in 2022 alone, underscoring the inherent risks of cryptocurrency investing.

Yet despite all these hacks, many people still want to keep all their assets fully on-chain, avoiding any centralized third-party services where they don’t have full control over their funds.

This post was inspired by a comment made by Naly in a chat discussion.

Naly pointed out that Frax is building a "fully vertical, on-chain liquidity stack" enabling investors to seamlessly mix and match the yields and risks of sfrxETH and Fraxbonds (FXB) based on their risk preferences.

As Naly wrote: “In high-interest-rate environments, investors typically favor low-risk, high-yield investments like U.S. Treasuries. FRAX and FRAX BONDS aim to offer similar types of on-chain exposure.”

Fraxbonds will offer FRAX at a discounted price, similar to off-chain short-term Treasury yields. By selecting one of four annual maturity dates, FRAX holders can lock up their FRAX and secure a fixed return over that period.

Alright, but why would investors buy bonds? In some cases, bonds act like cash—and they pay interest, i.e., yield.

When interest rates rise, newly issued bonds offer higher periodic interest payments, making them more attractive. Additionally, during times of economic uncertainty—which often coincide with high interest rates—the low-risk nature of bonds, especially those issued by governments, becomes appealing for capital preservation.

All risk asset prices are benchmarked against bond yields. If you're investing in real estate yielding 7%, while short-term bond yields sit at 5.5%, that might not be a compelling choice.

Fraxbonds will simulate the same kind of exposure to real bonds—but fully on-chain. When markets turn negative, FXB will serve as a safe haven for investors seeking security and stable returns. FXB doesn’t pay interest; instead, it represents the right to purchase future FRAX at a discount.

Conversely, in low-interest-rate environments, Naly writes: “Investors move up the risk curve.” As yields fall, the expected overall return from risk assets decreases, pushing up their asset prices.

Naly continues: “People believe Ethereum (ETH) could become the preferred low-rate internet bond.” ETH offers both yield and upside potential. If you know ETH will accumulate returns and may experience significant upward volatility, it makes sense to position yourself accordingly.

There’s also the possibility of hedging the price sensitivity of sfrxETH—that is, adjusting the rate at which the position’s value changes per 1% increase or decrease—so that when interest rates rise, the impact of price volatility is offset.

In this new paradigm, investors can find yield in either low-risk FXB or high-risk sfrxETH—a true barbell strategy.

Naly also mentioned that transitions between barbell strategies could be managed via an AMM governed by external interest rate data, acting as an on-chain asset manager.

“Balancer technology allows weighted pools, but it also supports liquidity pools whose weights change over time. There’s even a model that can adjust token weights based on external data sources. So for example, you could have an 80/20 FXB/sfrxETH weighted pool when the U.S. 10-year Treasury yield is above ...%, then switch to a 20/80 FXB/sfrxETH pool when Treasury yields fall below ...%.”

The idea Naly presents here is revolutionary. Imagine a pool that automatically adjusts its strategy based on current market conditions, offering both the safety of bonds and rich staking yields. If executed properly, this could redefine how passive investing works in DeFi, bringing traditional finance sophistication into the decentralized world.

This AMM could also receive FXS gauges, further enhancing rewards within the barbell strategy. Thus, in addition to yield from FXB and sfrxETH, rewards from CVX, AURA, and BAL gauges could be added through Balancer integration.

Naly’s exploration of a Frax barbell investment strategy via on-chain solutions is a compelling proposal. Combining the safety of bonds with the volatility of ETH—especially through an auto-adjusting pool—is an ambitious endeavor. It would require new oracles to feed in data, but in theory, it’s entirely buildable.

It also marks a new chapter in Frax’s evolution as a vertical infrastructure supporting a dollar-plus-ETH future, where yield generation is central to its growth. In the coming months, we’ll see the launch of Frax v3, FXB, and frxETH v2—and how this new system ties all these components together.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News