TProtocol: How to Achieve High-Yield Treasury Returns for Ordinary Users?

TechFlow Selected TechFlow Selected

TProtocol: How to Achieve High-Yield Treasury Returns for Ordinary Users?

This article will analyze the current pain points of RWA treasury tokenization and the problems addressed by Tprotocol.

Author: CapitalismLab

MakerDAO offers high interest but with complex mechanisms—beyond buying Treasuries, it also lends small loans. Ondo is purely focused on Treasuries but isn't accessible due to KYC hurdles, high barriers, and poor liquidity. The market still lacks a clean, Treasury-backed token available to the general public. TProtocol V2 was built precisely to fill this gap. This article analyzes current pain points of RWA-based Treasury tokens and how TProtocol addresses them.

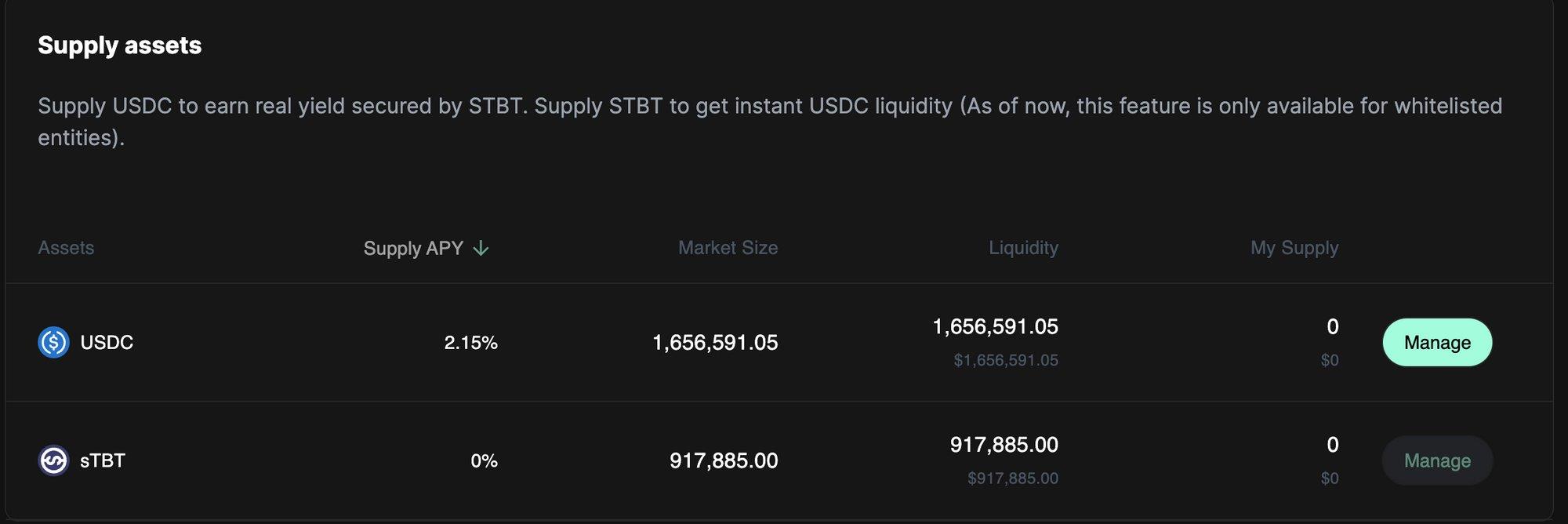

On the surface, TProtocol is a lending product. For example, its first supported pool, Matrixdock, allows users to deposit Treasury-backed tokens (STBT) issued by Matrixdock—one of the top three RWA protocols by TVL—to borrow USDC. USDC depositors receive rUSDP, a yield-bearing token similar to Aave’s aUSDC.

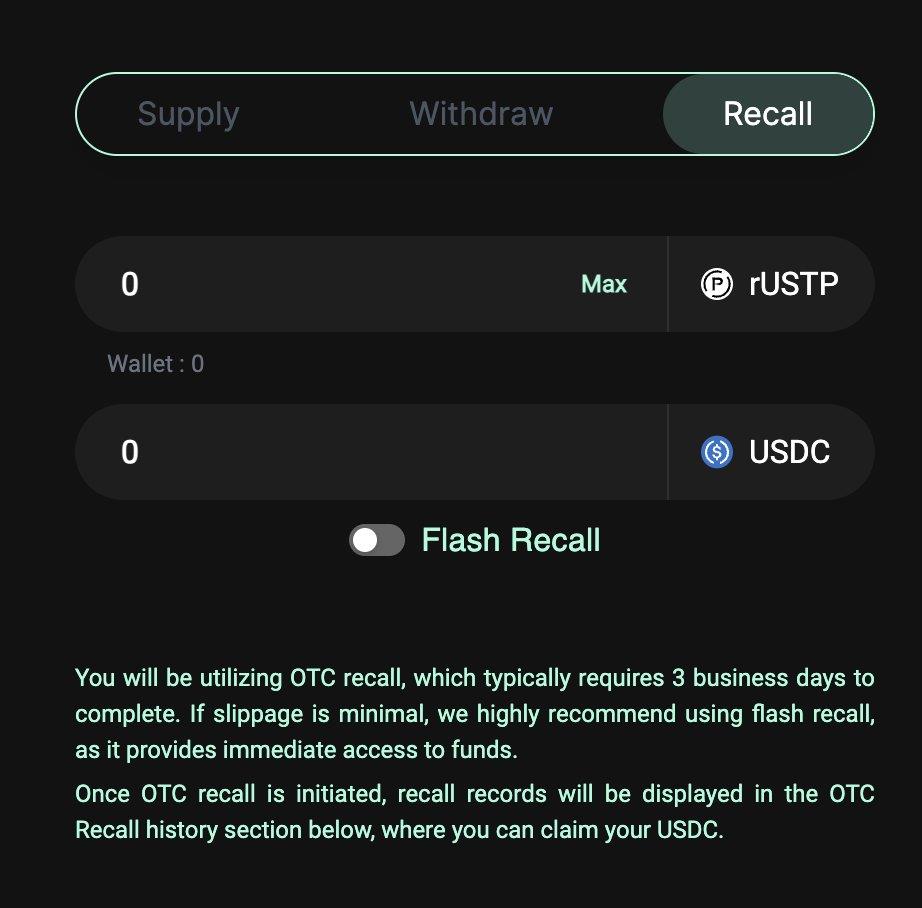

The key highlight: STBT borrowing has an LTV as high as 100.5%. This means utilization can reach up to 99.5%, allowing nearly all Treasury yield to be passed on to rUSDP holders. But how does it handle large withdrawals? It uses an OTC settlement model—giving Matrixdock time to sell Treasuries and repay the loan. Small withdrawals are processed normally or via DEX sales of USDP.

Due to compliance requirements, tokens like Ondo-OUSG and Matrixdock-STBT are only available to accredited investors. Even Ondo's recently launched USDY, which has slightly relaxed conditions, still requires KYC and a minting period of up to two months. The value TProtocol delivers is using institutional collateralized lending to maximize Treasury yield distribution to USDC depositors—enabling regular users to access Treasury returns without restrictions.

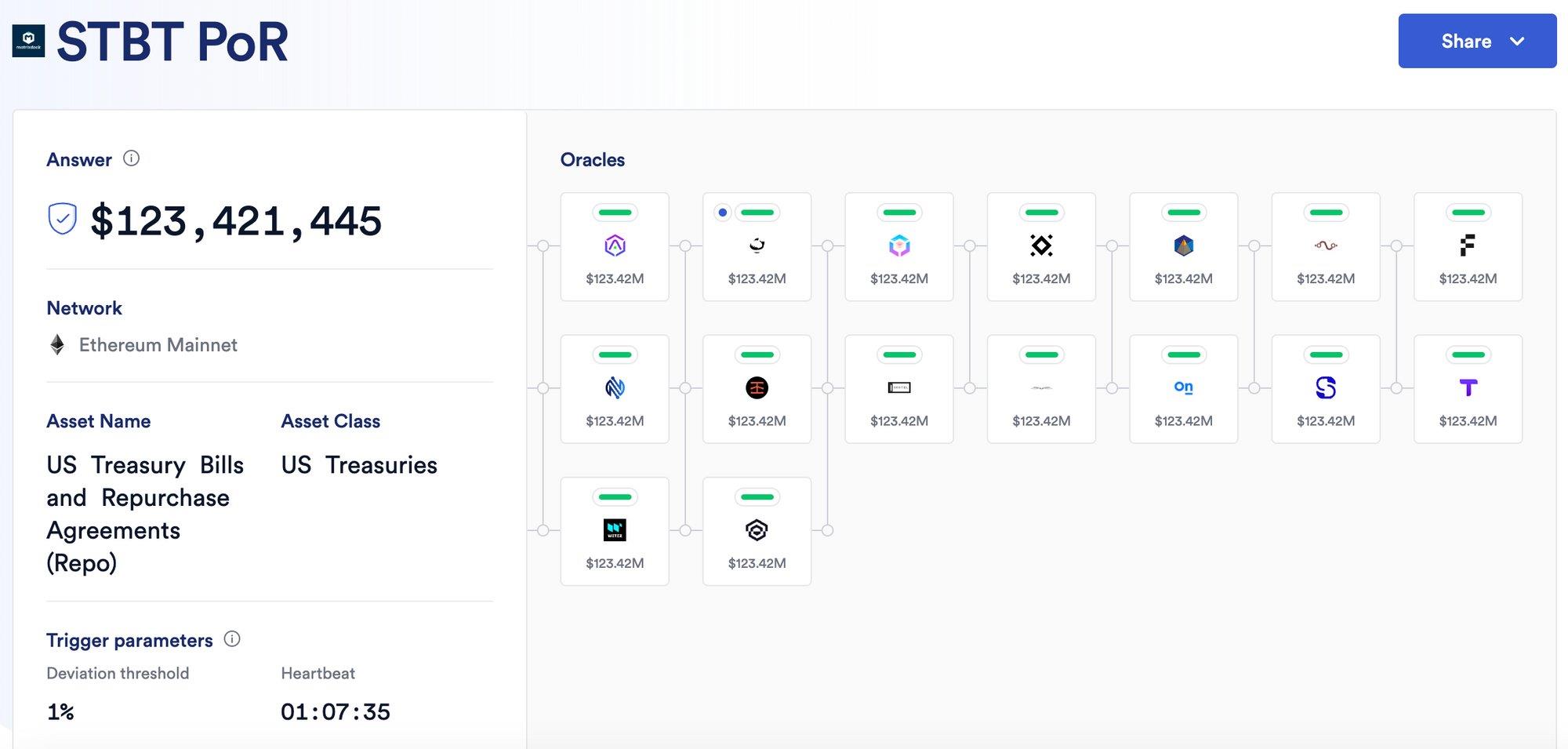

Unlike frequently collapsing institutional credit loans, TProtocol focuses on purpose-specific products. For instance, STBT explicitly targets short-term Treasuries and reverse repurchase agreements, regularly publishes asset reports, and partners with Chainlink for proof of reserves.

Of course, despite these proofs, the system still largely relies on trust in underlying Treasury custodians. To mitigate risk, TProtocol launches separate pools for different RWA assets. For example, if it partners with Ondo in the future, a new Ondo Pool will be created, issuing a new token like rUSDP-Ondo to isolate risks.

Other aspects of TProtocol’s design cater to degens—for example, its governance token TPS/esTPS works similarly to GMX, where longer staking leads to higher dividends. It also features a two-tier structure: iUSDP/USDP, akin to sfrxETH/frxETH. iUSDP is the auto-compounding version of rUSDP, while USDP carries no yield and is used for providing liquidity on DEXs.

This model enables TProtocol to enhance capital efficiency and boost iUSDP yields through bribing other protocols—similar to how sfrxETH increases returns—potentially making iUSDP yields exceed standard Treasury yields.

Currently, competition in the RWA sector is intense. MakerDAO holds a dominant position, but as an over-collateralized stablecoin protocol, the proportion of its underlying assets that can be allocated to Treasuries is limited. Previously, MakerDAO used USDC within its PSM module to purchase Treasuries, but this capacity is now constrained. If too many users deposit DAI for yield, the rate could even fall below Treasury yields.

Summary

Through an institutional collateralized lending model, TProtocol channels pure Treasury token yields to everyday users who don’t need KYC. By adopting a design similar to sfrxETH/frxETH, it creates potential for yields to exceed base Treasury returns.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News