The Story Behind RDNT's 50% APR: The "I Mine Myself" Ve(3.3) Game

TechFlow Selected TechFlow Selected

The Story Behind RDNT's 50% APR: The "I Mine Myself" Ve(3.3) Game

Will RDNT experience a death spiral?

Author: Loki

1. Leveraged TVL

First, RDNT's TVL contains significant inflation. RDNT has heavily skewed its mining incentives—allocating five times more RDNT rewards to borrowers than to depositors—creating ample room for circular lending.

On this basis, RDNT legitimizes circular lending. Essentially, such lending acts as "trade-to-earn," using high mining subsidies to stimulate artificial borrowing demand. While past lending platforms used circular loans to extract users’ real funds in exchange for their own worthless tokens, RDNT primarily leverages its own TVL and APY.

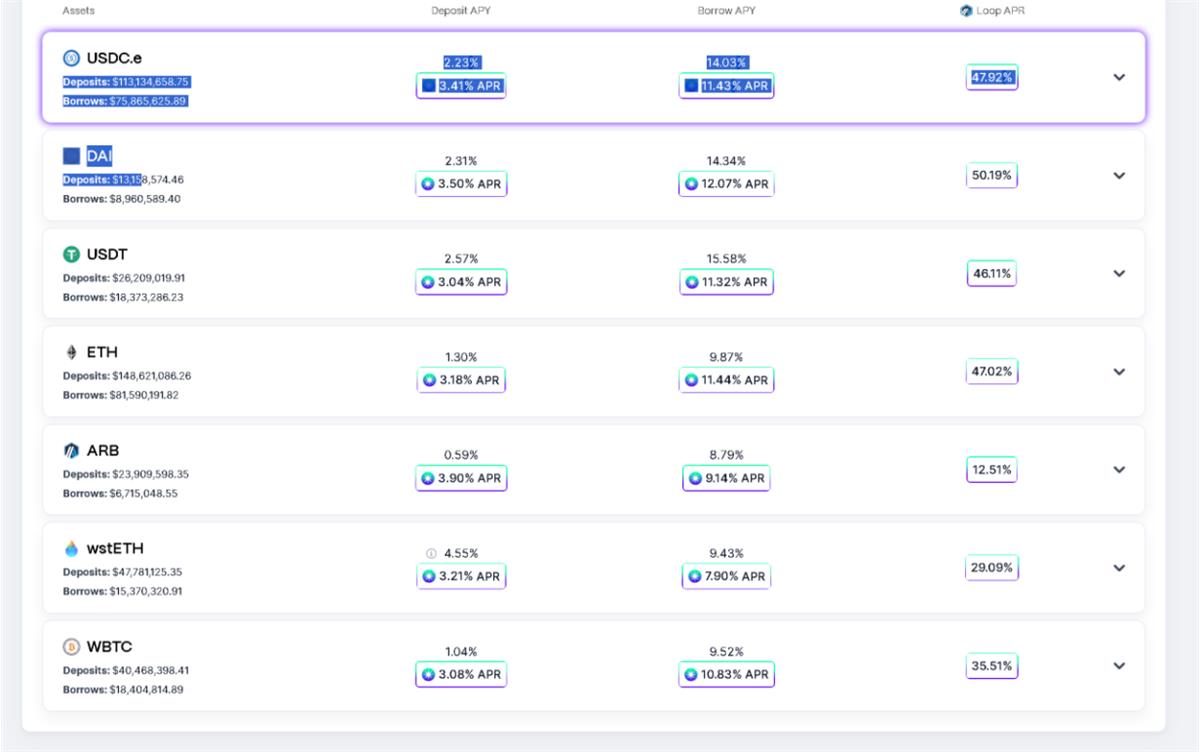

Data shows that utilization rates for most tokens exceed 60%. Assuming a 4x leverage for stablecoins and 3.3x for non-stablecoins, only about $76 million in genuine TVL is required to achieve the current $280 million TVL (on Arbitrum). The actual figure may be slightly higher than $76 million, but not by much—the reason being simple: which real borrower would borrow USDC at 14.03%?

If you pick ten RDNT borrowers, all ten are likely arbitrageurs running circular loans. There might be some false positives, but assuming only nine are involved probably means missing one.

2. The APY Protocol Shows You vs. The APY You Actually Earn

"Secondly, RDNT’s nominal APY also has issues." Promising up to 50% USDT interest via circular lending? Sounds tempting—but if you’re tempted, you’ve already been fooled. That rate shown is merely the deposit yield, excluding borrowing costs.

Suppose you deposit 100 USDC and use 4x leverage, effectively making it 400 USDC deposited and 300 USDC borrowed. Your total return = deposit interest + deposit mining rewards - borrowing interest + borrowing mining rewards. Plugging in the numbers:

APR = 4×2.23% + 4×3.41% - 3×14.03% - 3×11.43% = 14.76%

At this point, someone might think: Fine, 14.76% APR isn’t bad.

Then congratulations—you’ve been fooled again. Two problems remain:

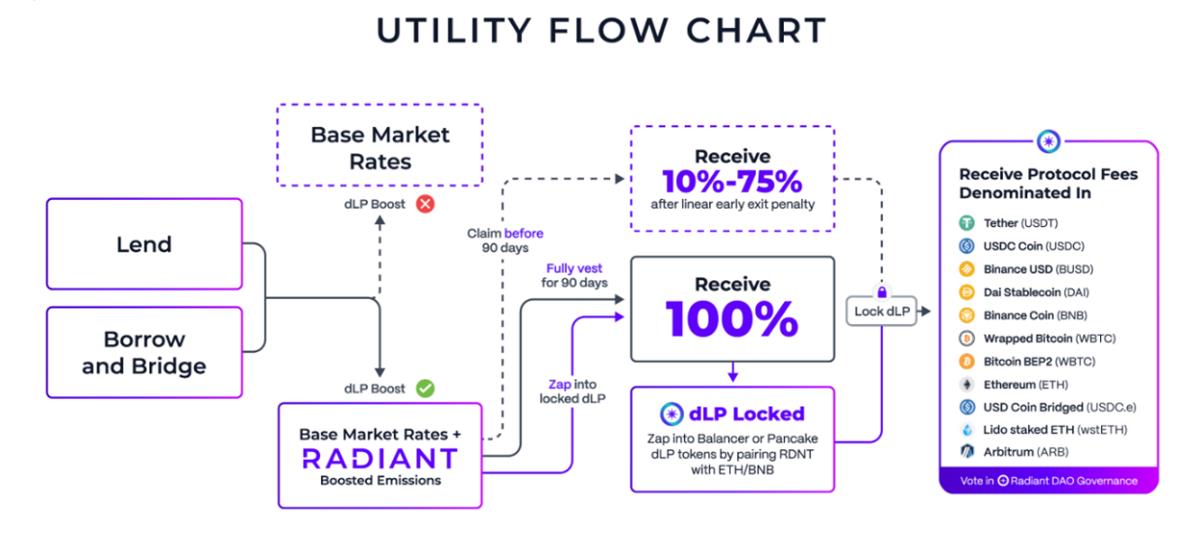

(1) To claim RDNT mining rewards, you must hold DLP equal to 5% of your leveraged position. This “5%” is actually conservative since it's calculated based on leveraged amounts. If you deposit $100, with 4x leverage, you need $100 × 4 × 5% = $20 worth of LP—or 20% of your principal in LP. With such a high requirement and extremely long lock-up periods, can your farming gains possibly offset impermanent loss?

(2) The second issue requires analyzing net returns from a cost-benefit perspective, where both costs and benefits are denominated in different assets. Take depositing 100 USDC for one year: you’d earn 4×3.43% + 3×14.03% = 55.81 units of RDNT. But the interest paid is real USDC—specifically 11.3%×3 - 4×2.23% = 24.98 USDC. Worse, USDC interest is paid immediately, while RDNT rewards are vested. If your average selling price of RDNT drops below 44.75% of the current market price, you’ll end up losing money after covering impermanent loss—essentially getting drained twice.

3. The Missing Reserve Factor

As mentioned earlier, inflated APYs and disguised token sales through circular lending are common in DeFi, especially in lending protocols. However, another key point is that standard lending models follow this equation:

Deposit Rate = Borrow Rate × Utilization × (1 - Reserve Factor)

This implies that borrowing interest is split into two parts: one distributed to depositors, and the other retained by the protocol as fees (higher Reserve Factor = higher protocol cut). Consequently, when both utilization and borrowing rates are high, deposit rates should also rise. Yet this rule does not apply to RDNT.

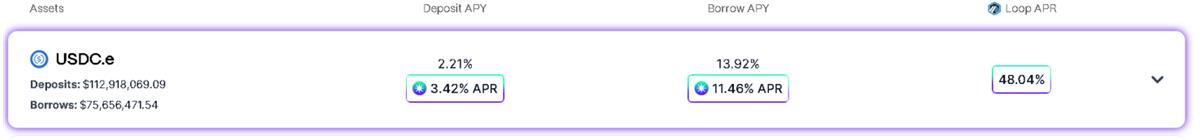

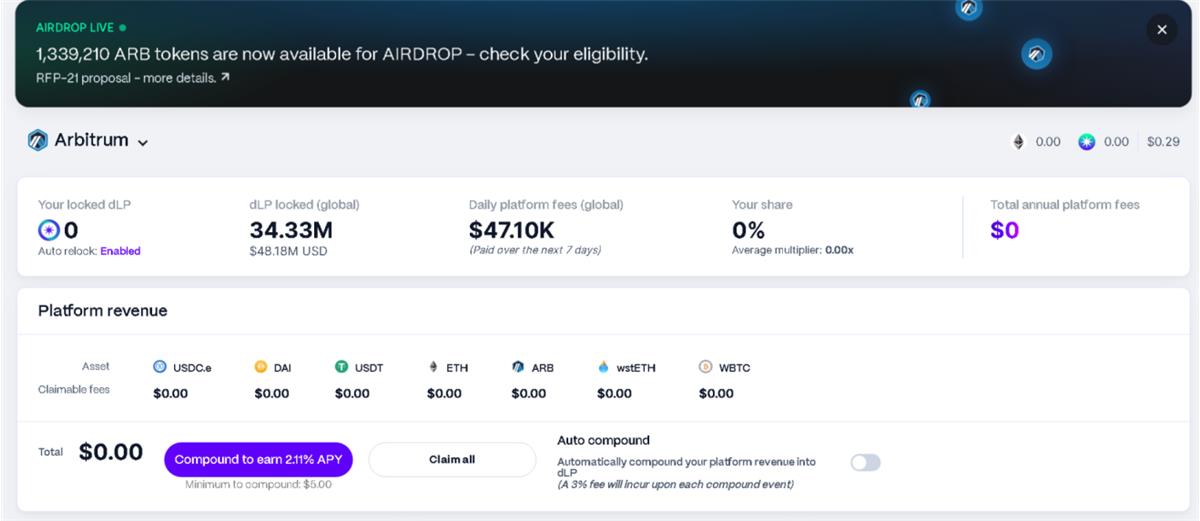

We see that 2.21 / (13.92 × 67%) = 23.7%, meaning only 23.7% of loan income goes to depositors, while 76.3% is allocated to DLP providers. Over the past seven days, the protocol generated approximately $47,000 daily, amounting to an annualized revenue of $17.155 million—all paid out in real assets like USDC, ETH, ARB, and BTC.

Now we reach an ironic twist: if I deposit 100 USDC with 4x leverage to farm RDNT, although the protocol charges me ~$24.98 in borrowing fees annually, these fees are redistributed to DLP pools. So here’s what happens: I farm RDNT, RDNT farms my USDC, DLP farms RDNT’s USDC, and I farm DLP—resulting in: Am I farming myself?

Lending income comes from borrowers. Therefore, if the following condition holds, a borrower could fully reclaim all fees they've paid, achieving true “self-farming”:

Borrower’s Loan Amount / Total Platform Loans = Borrower’s DLP Amount / Total Platform DLP

Let’s look at the data: On Arbitrum, total deposits stand at $280 million, with total DLP at $48.38 million. As previously noted, due to leveraged circular lending, users need DLP equal to 5% × leverage factor. Estimating at 20%, $48.38 million in DLP supports $242 million in farming subsidies—meaning at least $38 million in deposits receive no RDNT rewards (though they may simply be passive depositors who won't get drained).

4. The Largest DeFi 2nd-Tier Pool

Clearly, this mechanism has created an enormous LP pool for RDNT—$48.4 million just on Arbitrum. Since the end of new-chain narratives and the Luna collapse, I haven’t seen such a massive secondary liquidity pool. What implications does this have?

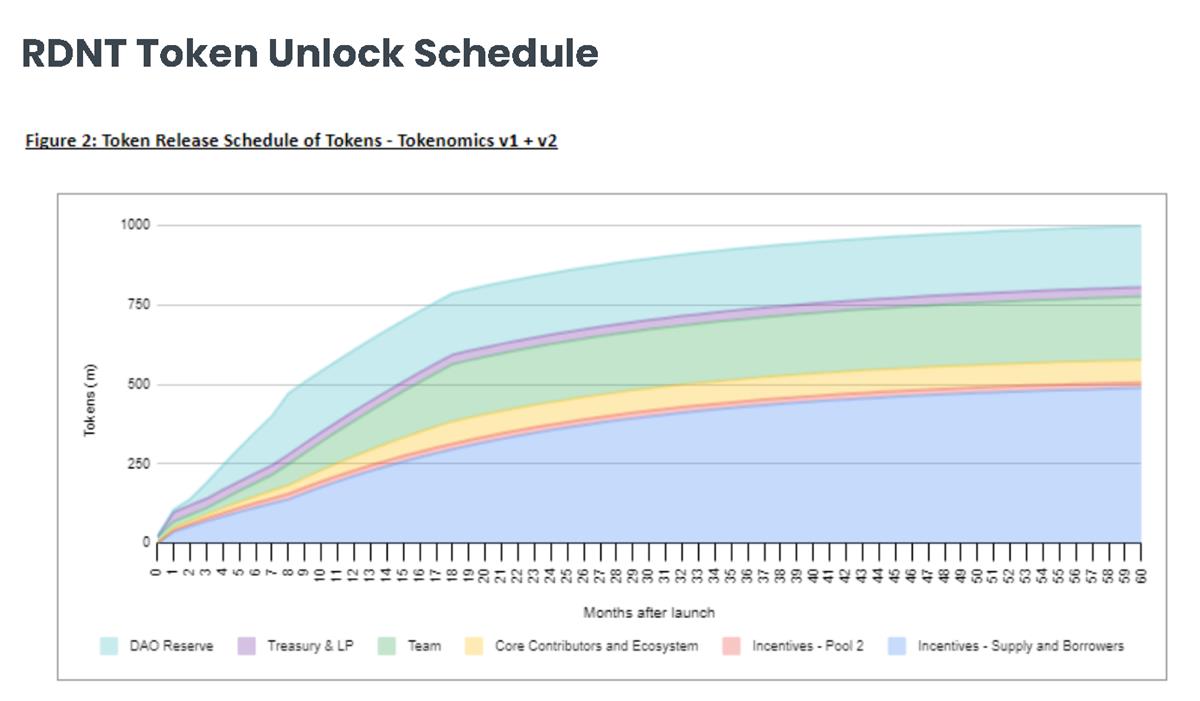

(1) Absorbing selling pressure from mining emissions. The biggest downside of circular lending is excessive token generation. Based on earlier estimates (44% ratio of interest cost to mining output), while DLP earns $47,000 daily, it simultaneously creates around $100,000 in sell pressure. However, RDNT’s vesting mechanism slows this down. Combined with the massive pool size, the death spiral of mined tokens is significantly delayed.

(2) Exit liquidity for large holders. We must also consider that the team and core contributors hold large unlockable token balances. Strong liquidity presents a major opportunity for them. Let’s hope they don’t exploit it.

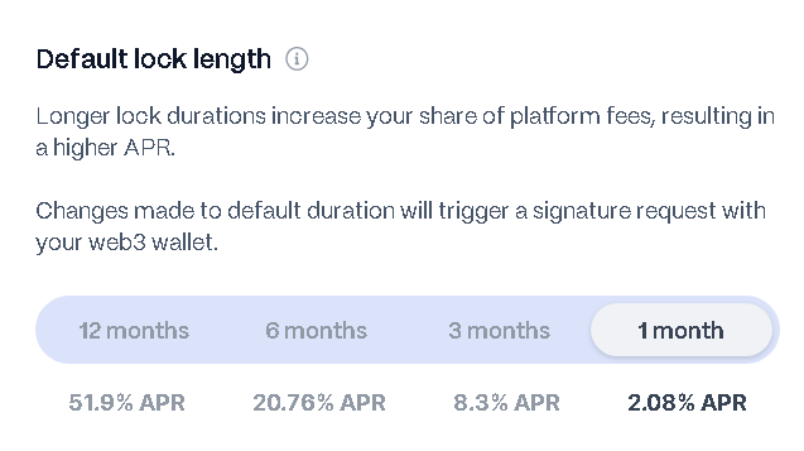

Another consideration: rather than directly selling tokens, it’s far more advantageous for the team and core contributors to deposit their RDNT into DLP. After all, a 50% APR and $17.155 million in annual income are highly attractive—and this income is paid in highly liquid assets, fully compliant with legal and on-chain norms. Note that DLP yields depend on lock duration: locking for 12 months yields 51.9% APR, whereas 1-month locks yield only 2.08% APR.

This brings us back to the previous question—“Can I farm myself?”—and flips the answer once more: now it becomes “I cannot farm myself.” Because the team and core contributors inject oversized DLP, diluting user rewards. Objectively speaking, some dilution is acceptable—after all, Compound and Aave retain around 20% as Reserve Factor. The sole concern is that if the team and core contributors deploy excessive DLP with maximum lock durations, they could capture 50%, 60%, or even higher shares of DLP rewards.

5. The Invisible Ve(3,3) Game

When the team and core contributors participate in DLP farming, they collect what amounts to a “tax,” while also muddying the waters. Imagine if arbitrageurs coordinated perfectly, all choosing 1-month locks—they could enjoy high yields while minimizing impermanent loss. But if the team and core contributors flood the system with 1-year locked DLP, the yields for 1-month lockers will plummet. Of course, even without them, there’s likely to be a “traitor” among the arbitrageurs.

The outcome is clear: opting for a 1-month lock was never a viable strategy from the start. Data shows that with $57,000 in daily income and $48 million in TVL, the average annualized APY is 35.3%, yet 1-year locked DLP achieves 51.9%. While exact proportions can’t be pinpointed, many clearly chose the 1-year option. This means if you don’t lock for a full year, your borrowing costs will be absorbed by those who do.

Of course, it remains a strategic choice: longer locks let you capture others’ yields but expose you to greater impermanent loss. One-month lockers may still find justification, but 3- or 6-month options offer diminishing returns.

6. Final Question: Will RDNT Enter a Death Spiral?

Theoretically, yes. The current mining model operates like lifting oneself by one’s bootstraps—amplifying APR and TVL by 3–4x, then using miners’ costs to subsidize their rewards, enticing them to keep farming, while DLP and vesting mechanisms lock in liquidity. That’s why RDNT hasn’t collapsed over recent months.

However, RDNT’s APR has now dropped low enough—14.76%, long unlocking periods, and exposure to DLP impermanent loss—that RDNT no longer looks appealing. If fewer users engage in circular farming, DLP yields will sharply decline. Higher impermanent risk will demand even higher APRs, reducing reinvestment into DLP. This triggers one-sided dumping, further depressing RDNT prices and mining yields—accelerating the death spiral…

Of course, this is just one possibility. Currently, the secondary pool still holds tens of millions in capacity, while RDNT’s daily trading volume on Binance is only a few million dollars. Its FDV stands at just $300 million, with circulating market cap under $100 million. Besides the death spiral, an “inverse death spiral” is equally possible: rising RDNT price → higher farming APR → attracting more leveraged capital → increased DLP rewards → growing reinvestment demand → stronger buy pressure → continued price rise. Combined with narratives around Binance investment and Arbitrum, the outlook isn’t entirely bleak.

At present, the cost-efficiency of participating in circular farming seems poor. If you’re bearish on RDNT, using the interest generated from circular loans to directly buy and hold RDNT—or stake in DLP—might yield better capital efficiency. And if you lack confidence in RDNT, the best choice remains non-participation. (As always, not investment advice.) Regardless of whether RDNT eventually spirals down, the DLP mechanism itself offers a meaningful economic design framework worth deeper exploration.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News