The Evolution of LSD: Development Path, Market Landscape, and Yield Analysis

TechFlow Selected TechFlow Selected

The Evolution of LSD: Development Path, Market Landscape, and Yield Analysis

The more tokens that are staked, the harder it becomes to alter the blockchain's consensus mechanism, as token holders who stake have an incentive to maintain the status quo.

Written by: SAURABH

Translated by: TechFlow

Humans have long explored the concept of "truth." We categorize it into different types to help our thinking reach harmony—absolute truth, objective truth, personal truth, and so on. Truth can take many forms, if you will. In the financial world, the order of transactions determines the ultimate truth, and blockchains facilitate the establishment of these truths.

Satoshi's genius lay in finding a way for geographically distributed computers to independently agree on the same transaction order. The word "independently" is crucial here because relying on other nodes means the system is trust-based—no different from what already happens in traditional finance. Using blocks as building blocks allows nodes to arrive at the "correct" order. At their core, blockchain networks are often differentiated by who has the right to propose new blocks.

Basics

In Bitcoin, a new block can be proposed through Proof-of-Work (PoW). This ensures that the block proposer has done sufficient work, indicating they've consumed resources such as electricity or mining hardware. This makes spamming the network a losing proposition.

Multiple block producers (miners in this case) compete to produce a block, but only one is accepted. This means the work done by others is wasted. Given Bitcoin’s age and the incentive structure of its network participants, changing Bitcoin’s consensus model is now difficult. But newer networks can adopt alternative approaches.

Proof-of-Stake (PoS) systems avoid competition among block producers by electing them. These networks don’t require miners to set up complex machines and consume electricity to compete for mining rights. Instead, block producers are selected based on the amount of native tokens staked by participants.

The earliest version of staking resembled fixed deposits. Tokens were locked for a specific period, which could be as short as a week. Banks typically offer higher returns on fixed deposits than regular savings accounts to encourage individuals to lock capital for longer periods. While banks use these funds for commercial activities like lending, staked assets generate (and vote on) new blocks and protect old ones.

The more tokens are staked, the harder it becomes to alter the blockchain’s consensus mechanism, because stakers holding tokens have an incentive to maintain the status quo. In most staking networks, participants securing the network receive a small portion of tokens as rewards. This serves as their baseline yield.

Opportunities

With the emergence of PoS networks like Solana, an entire industry has matured to help users stake. There are two main reasons:

-

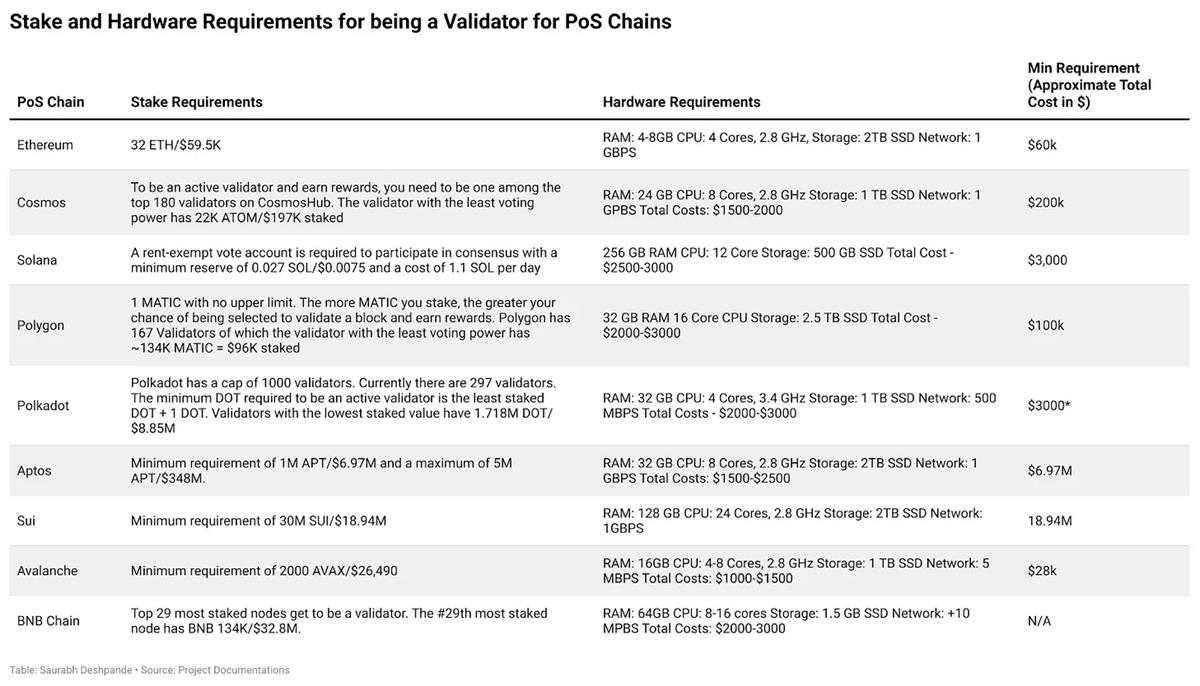

As shown in the table above, validators typically require sophisticated computers costing thousands of dollars. Ordinary users may lack this equipment or prefer not to manage it themselves.

-

It helps monetize idle crypto assets. Exchanges like Coinbase and Binance allow users to stake via their products and earn a small spread between the rewards provided by the network and those passed on to staking users.

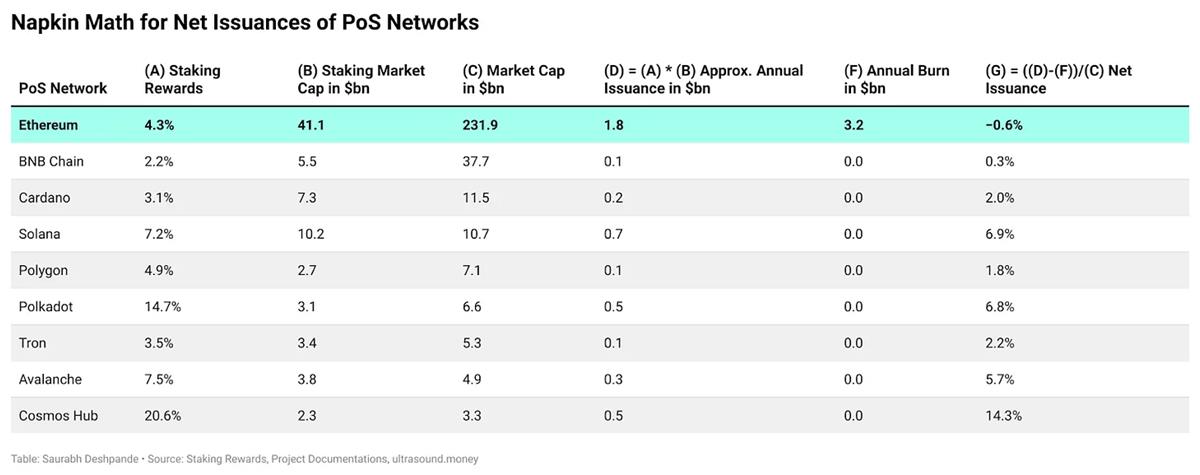

One way to measure the size of the staking market is to sum the market caps of all PoS-based chains. That number is approximately 318 billion USD. Of this, 72% is Ethereum. The “staking ratio” mentioned below measures what percentage of a network’s native tokens are being staked.

Ethereum has one of the lowest staking ratios across networks. Yet in dollar terms, it is an absolute giant.

Ethereum attracts so much capital in staking because the yields offered by the network are more sustainable. Why is that? Among all proof-of-stake networks, Ethereum is the only one that offsets daily issuance by burning part of transaction fees. The amount of fees burned on Ethereum scales with network usage.

As long as people use the network, any tokens issued as staking rewards are balanced out by tokens burned as part of the fee model. This is why the yield generated by Ethereum validators is more sustainable than on other PoS networks. Let me illustrate with numbers.

According to Ultrasound.money, Ethereum will issue about 775,000 ETH this year for stakers. Meanwhile, Ethereum will burn around 791,000 ETH in transaction fees. This means that even after distributing staking rewards, Ethereum’s supply is still shrinking (by about 16,000 ETH).

Think of Ethereum’s fee-burning mechanism similarly to stock buybacks. When founders of public companies sell shares, investors get nervous. But when companies consistently buy back shares from the open market, it's usually seen as a healthy sign. Stock prices rise, and everyone feels a bit happier. Typically, cash-rich companies confident in their future opt for buybacks over purchasing other instruments like government bonds—especially in low-interest environments.

Ethereum’s burning is analogous to share buybacks. It removes Ether from circulation. And the more people use Ethereum, the more Ether gets removed from the market. Since EIP-1559 launched about two years ago, Ethereum has effectively “bought back” over $10 billion worth of Ether. However, there’s one key difference between stock buybacks and burning tokens as part of a PoS network’s fee model: public companies don't issue new shares every quarter.

Suppose buybacks remove shares from circulation. In Ethereum’s case, newly issued tokens (as staking rewards) balance out the tokens burned (as fees). This equilibrium between issuance and burning may explain why Ethereum didn’t surge immediately after The Merge earlier this year.

We did a simple calculation to compare this with other networks. In the chart below, staked market cap refers to the value of assets flowing into the network. The difference between issuance and burning (via fees) gives net issuance. ETH is the only network we can verify that had a slightly negative rate over the past year. This explains why so many startups are building around it.

Staking Landscape Overview

Despite Ethereum (ETH) investments performing well economically, some fundamental issues make it hard for retail users to participate. First, you need 32 ETH to become a validator. At current prices, that’s about $60,000—equivalent to the cost of a Master’s in Finance at LSE or buying a Bored Ape NFT.

That’s quite a high barrier if you want to stake. Another challenge was that until recently, staking on Ethereum was one-way. Once you committed as a validator, you couldn’t reliably withdraw your funds. This meant that if you needed urgent access to your ETH, you were out of luck.

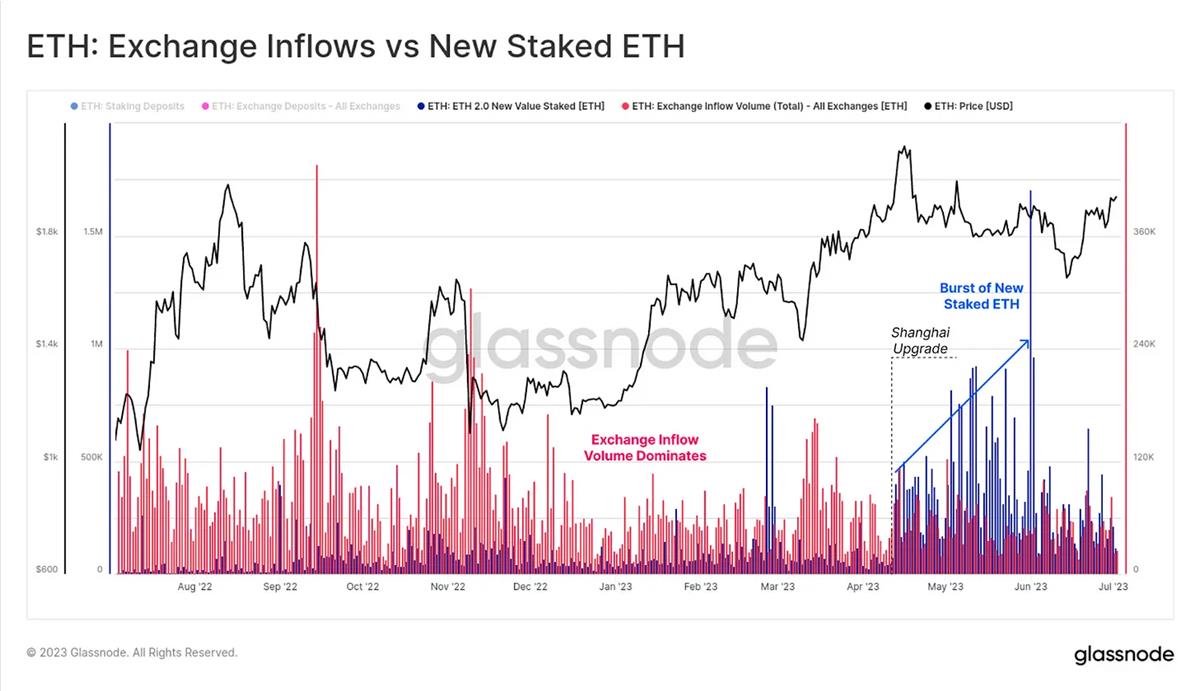

The following chart from Glassnode shows new ETH being staked at an accelerating pace post-Shanghai upgrade.

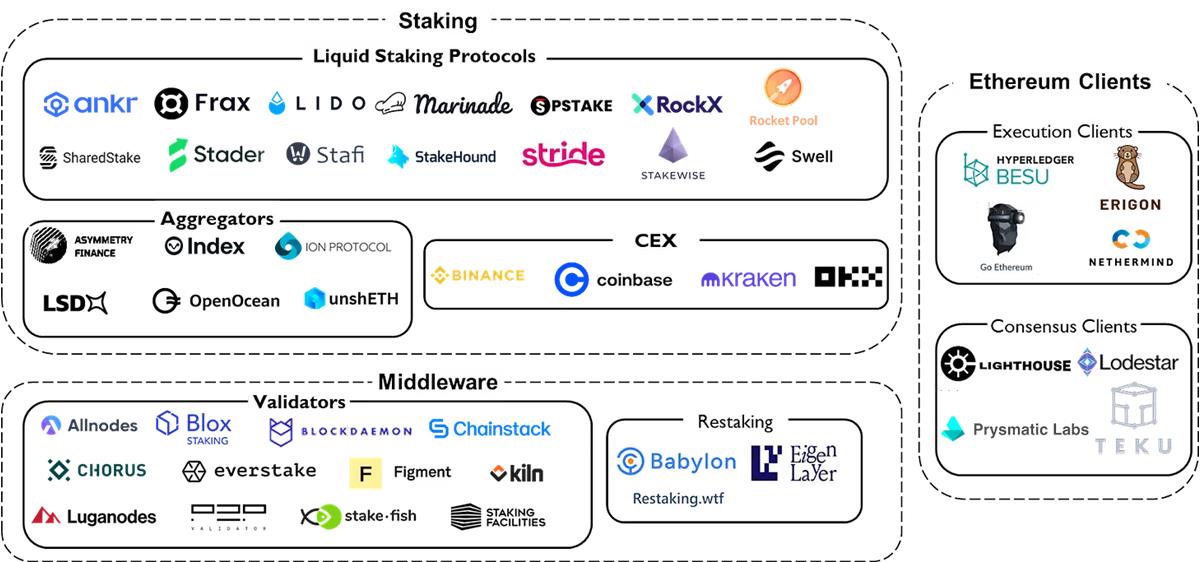

Soon, Liquid Staking Derivatives (LSDs) emerged to solve these problems. First, they allow retail participants to stake without losing access to their staked assets. Users can withdraw their earned rewards anytime. Second, people can stake even with smaller amounts of ETH. But how does this work? The model relies on the following:

-

Issuing receipt-like tokens to stakers, confirming their ETH deposit in a staking contract.

-

Creating ETH pools and depositing in batches of 32 ETH, allowing investors to stake with lower denominations of ETH.

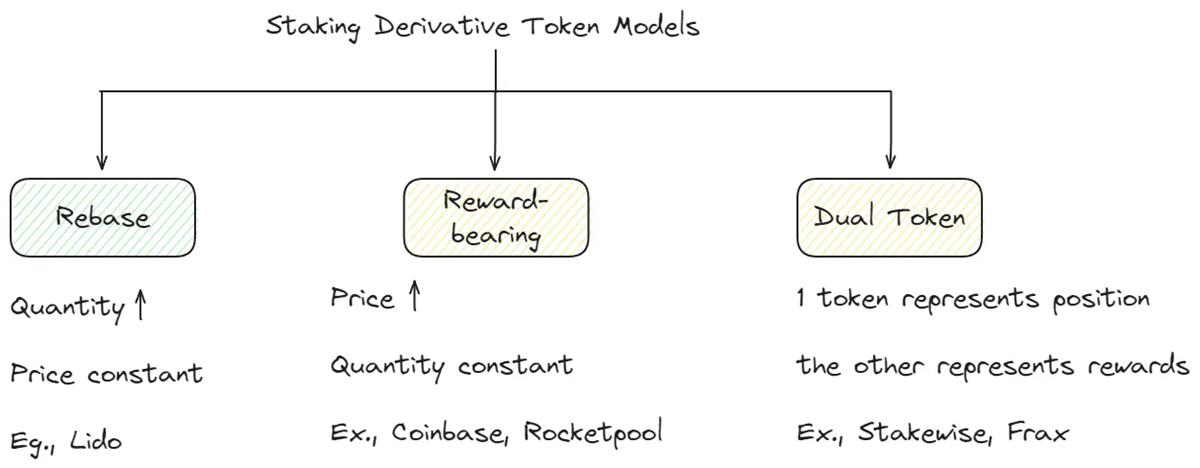

Imagine pooling money with friends for a college trip. LSDs offer a similar mechanism for crypto enthusiasts wanting to stake. Three emerging LSD models have appeared in the market.

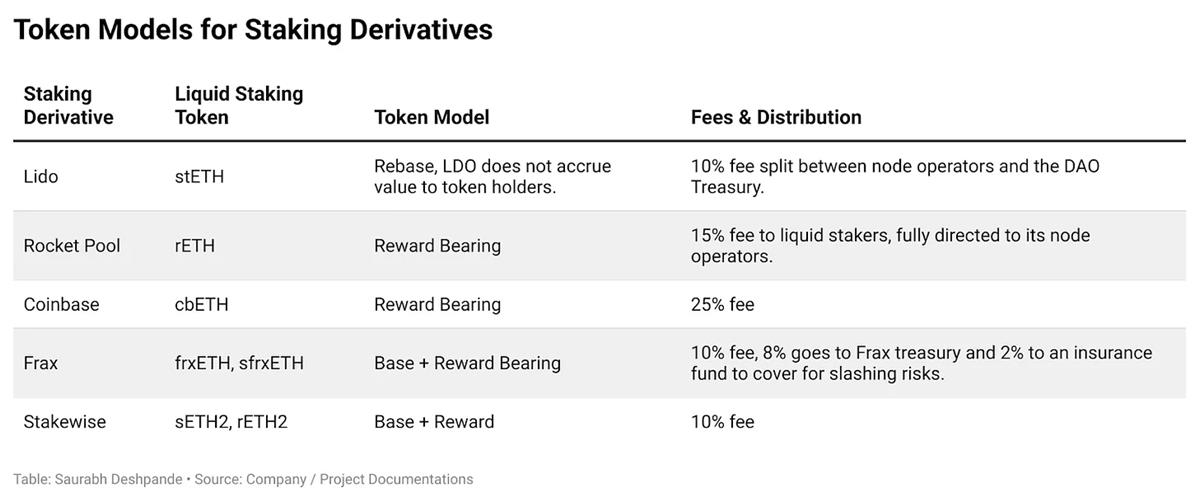

In the Rebase model, users receive tokens equal in quantity to the ETH they’ve locked via the protocol. For example, if you lock 2 ETH via Lido, you get 2 stETH. As you earn staking rewards, the amount of stETH increases daily. While simple, this changing balance poses composability challenges across DeFi protocols. Depending on your jurisdiction, each increase in token count could be a taxable event.

For reward-bearing tokens like Coinbase’s cbETH and Rocket Pool’s rETH, it’s the token value that adjusts, not the quantity.

Frax uses a dual-token model where ETH and accumulated rewards are split. These are called frxETH and sfrxETH, with frxETH pegged 1:1 to ETH, while sfrxETH is a vault designed to accumulate staking yields for Frax ETH validators. The exchange rate of frxETH to sfrxETH increases over time as more rewards are added to the vault. This resembles Compound’s c-tokens, which continuously accrue interest.

Of course, liquid staking providers aren’t offering these options to retail users out of charity. Profit motives are involved. Liquid staking firms charge a fixed fee from the network’s yield. So if ETH offers 5% staking yield annually, Lido takes 50 basis points from stakers.

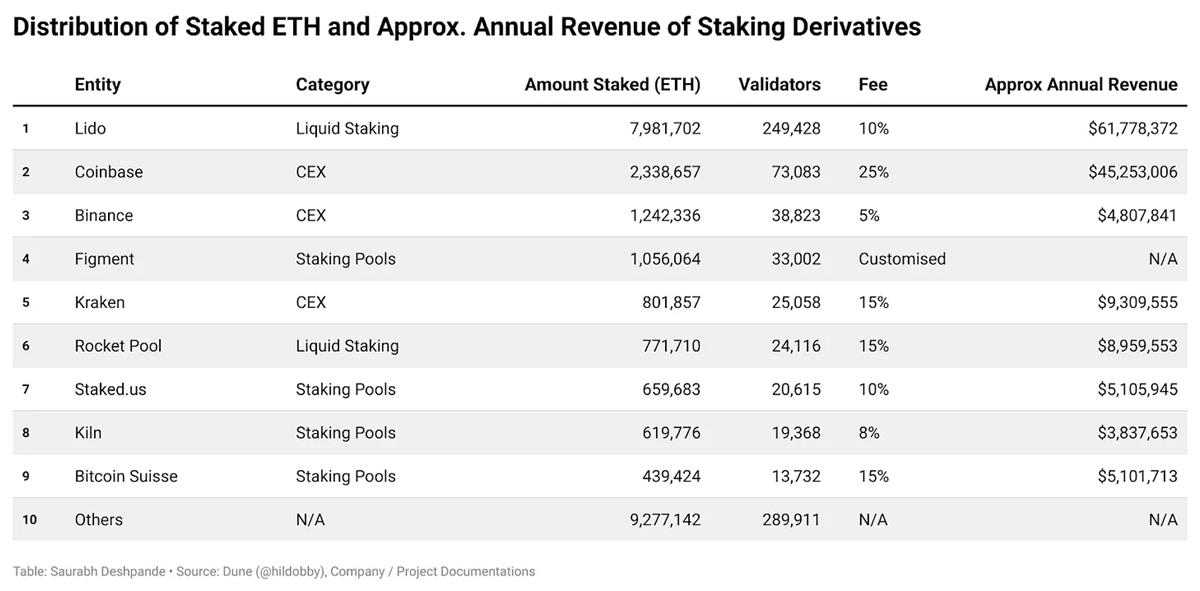

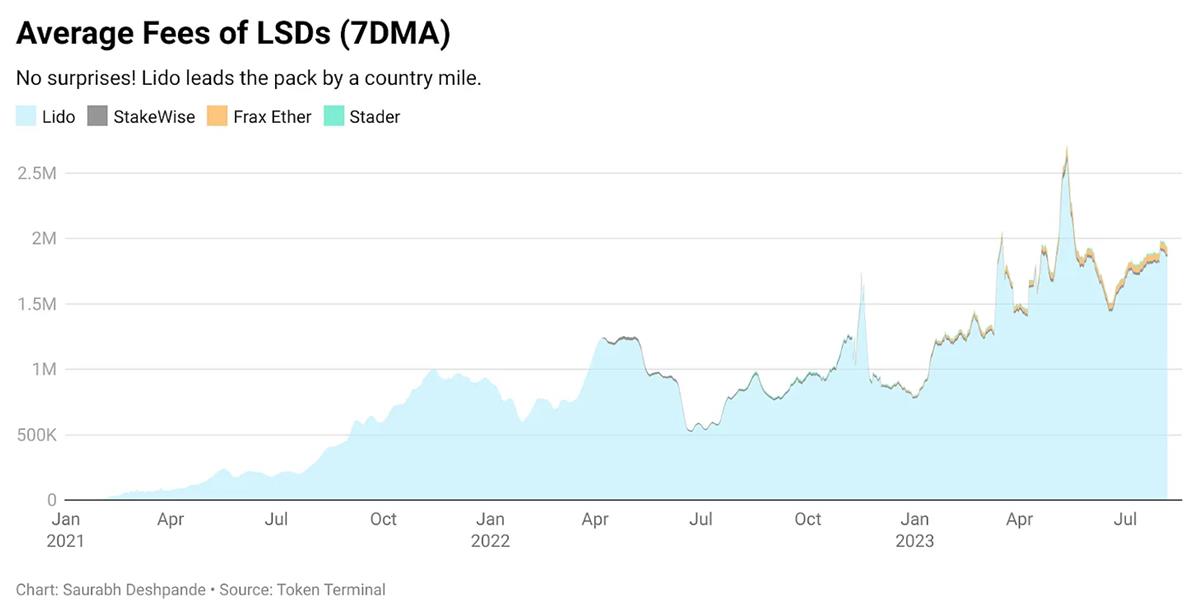

Based on this calculation, Lido earns nearly $1 million in fees daily from its stakers. Of this, 10% goes to node operators and the DAO. It faces little competition from its tokenized peers. While we can’t access data on other major derivatives like Rocket Pool or Coinbase ETH, we can roughly estimate their fee generation.

For instance, Coinbase stakes 2.3 million ETH and charges 25% of staking rewards. Assuming a 4.3% staking yield and ETH price of $1,800, Coinbase earns about $45 million just from ETH. SEC filings show Coinbase earns nearly $70 million per quarter from staking across all supported assets.

Over the past year, Lido’s treasury has been one of the few departments accumulating significant value from operating revenue. As I write this, $279 million has flowed into Lido’s DAO treasury. In just the past 30 days, the protocol generated $5.4 million in revenue, compared to $1.7 million for Aave and $400,000 for Compound. Comparing fees from other liquid staking derivative projects against Lido highlights its dominance in the LSD market.

As the staking market evolves, new entrants may erode Lido’s profit margins, and stakers might shift elsewhere for lower fees. But for now, what I know is that Lido is one of the few crypto projects capable of monetizing idle assets at scale. About $15 billion worth of ETH is staked on Lido. As long as ETH generates yield and funds don’t exit, liquid staking businesses remain in good shape.

Moreover, unlike Uniswap or Aave, Lido is less affected by market volatility. Lido profits from human laziness.

Risk-Free Rate

The risk-free rate is the return on an investment with zero default risk. Hence the term “risk-free.” Typically, this refers to bonds issued by financially and politically stable governments. Wait, why are we discussing the risk-free rate?

In investing, a good or bad investment is judged against the cost of capital. Every investor asks a basic question before investing: Is the expected return greater than the cost of capital?

If yes, it’s investable; otherwise, it’s not. The cost of capital includes both cost of equity and cost of debt.

The cost of debt is straightforward—it’s the interest rate you pay. The cost of equity depends on three factors: the risk-free rate, the investment’s risk relative to the risk-free asset, and the risk premium.

Without a defined risk-free rate, it’s hard to determine the cost of capital—and thus evaluate any investment’s foundation.

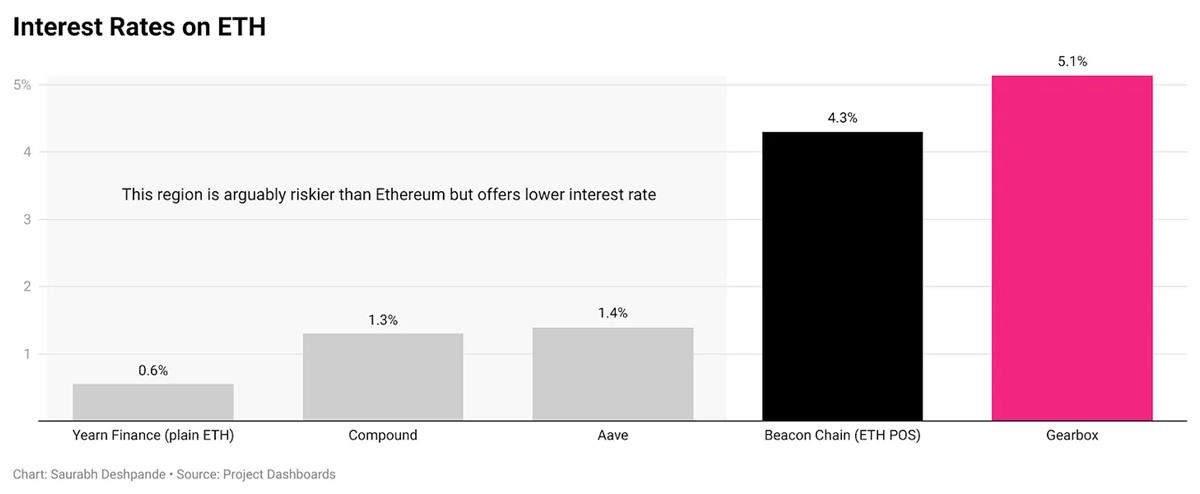

Take LIBOR (London Interbank Offered Rate) as an example. It served as a benchmark for setting rates on everything from floating-rate bonds to derivative pricing. The rate earned by Ethereum validators may be the closest equivalent standard for determining other rates within DeFi.

Current DeFi interest calculations have flaws. For example, lending ETH on Compound offers an APR of about 2%, while the Ethereum Foundation reports a validator yield of 4.3%. Ideally, ETH lending rates should be slightly higher than validator yields because:

-

Applications carry more risk than protocols themselves. Smart contract risk is mispriced in lending markets.

-

If liquid staking alternatives offer both liquidity and competitive yields, investors have little incentive to lend funds to smart contracts. And that’s exactly the current situation.

As previously mentioned, Ethereum’s staking ratio is among the lowest. With withdrawals enabled, the amount of assets entering staking continues to grow. As assets increase, each validator’s yield declines because more capital chases limited rewards. The amount of ETH issued does not scale proportionally with the number of staked tokens.

Profit motives drive everything around us. If validators notice opportunity costs, they’ll move staked assets elsewhere. For example, if ETH lending rates or liquidity provision yields on Uniswap are significantly higher than validator yields, there’s no incentive to run validator nodes. In such cases, finding alternative yield sources for validators becomes critical to maintaining Ethereum’s security.

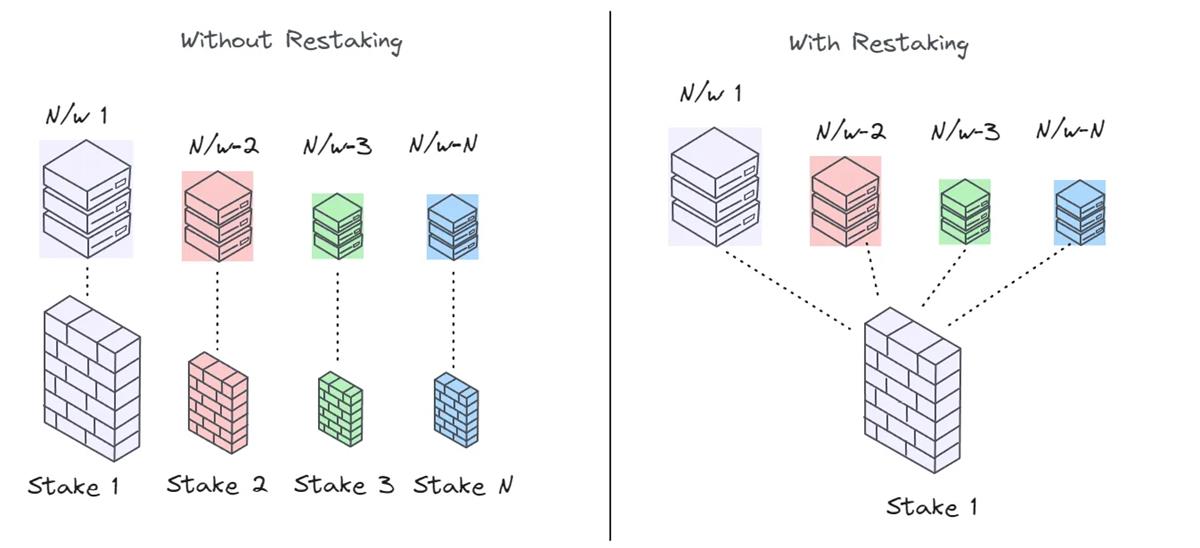

Restaking is emerging as another avenue for validators to boost yields.

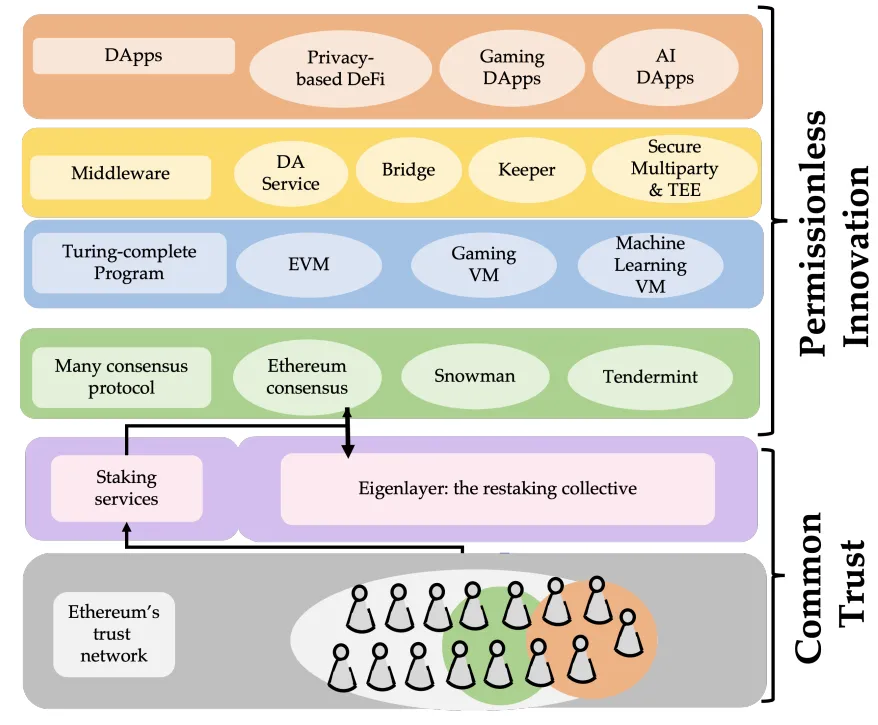

EigenLayer is one of the leading middleware platforms enabling restaking. Let’s break it down. When you use blockchains like Bitcoin or Ethereum, you pay for block space so your transaction can be permanently stored in a block. This fee varies across networks. Consider transacting on Bitcoin, Ethereum, Solana, and Polygon to observe differences in these fees.

Why is that? EigenLayer’s whitepaper elegantly explains: block space is a product of decentralized trust provided by underlying nodes or validators. The greater the value of this decentralized trust, the higher the price of block space.

Restaking enables us to go deeper into the decentralization stack and create a market for decentralized trust. EigenLayer allows Ethereum validators to reuse their trust, enabling new blockchains to benefit from the same trust.

It applies one network’s security to other applications, such as rollups, cross-chain bridges, or oracles.

Key Questions

This all sounds great, but you might wonder who’s actually using these tools. We can analyze from supply and demand perspectives. On the supply side, there are three sources:

-

Native ETH stakers (those staking ETH directly),

-

LST restakers (those staking their LSTs like stETH or cbETH), and

-

ETH liquidity providers (those staking LP tokens containing ETH as one of the assets), who can also choose to validate other chains.

On the demand side, there are typically emerging applications or new chains seeking to bootstrap security. You might want to build an oracle network that fetches on-chain data and delivers it to DeFi apps.

A few years ago, when Ethereum and several other Layer 1s were emerging, we weren’t sure if one chain would dominate. By 2023, we see multiple layers running simultaneously. The idea of application-specific chains seems plausible.

But the question is: Should all these upcoming chains build security from scratch?

Let’s not rush to say no. Look at how Web2 evolved to form a view. In the early days of the internet, much like today’s Web3 startups, founders had to solve problems around payments, identity verification, and logistics. A few years later, companies like Stripe, Twilio, and Jumio emerged to address these challenges. Part of eBay’s rationale for acquiring PayPal in the early 2000s was to solve its payment problem.

Do you see a pattern? Internet applications scaled best when they outsourced functions unrelated to their core competencies.

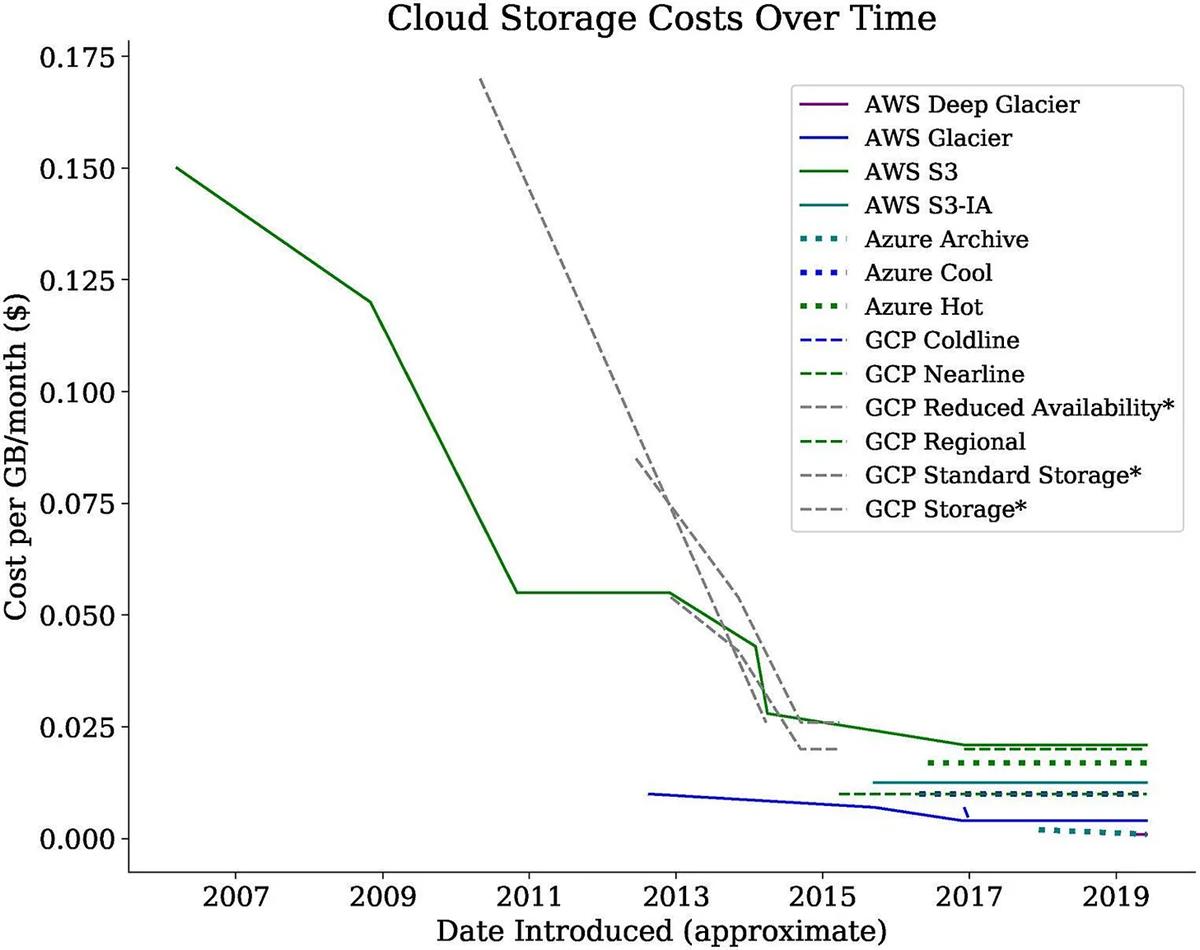

By 2006, AWS drastically reduced hardware costs. A seminal Harvard Business Review paper in 2018 claimed AWS reshaped the venture capital landscape as we know it due to its impact on experimentation costs. Suddenly, you could offer unlimited streaming (Netflix), storage (Dropbox), or social media (Facebook) without worrying about buying servers.

Restaking plays the same role for blockchain networks that AWS did for servers. You can outsource one of the most expensive aspects of network security. Resources saved this way can be better spent focusing on the applications you’re building.

Let’s return to our earlier question. Should every chain build its own security? The answer is no. Not every chain aims to become a global settlement network like Ethereum, Bitcoin, or SWIFT. Absolute security doesn’t exist in public blockchains. Blocks are probabilistic (rolling back one or two blocks isn’t uncommon), and security exists on a spectrum. When you're focused on building applications, you should probably focus on users.

Achieving security levels competitive with chains having massive network effects is slow and painful. And if you’re an application-specific chain, your users don’t care about security—as long as it’s sufficient for your app.

The staking landscape keeps evolving. If institutional interest in digital assets surges due to ETF approvals, this will be one of the few industries poised for exponential growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News