New POW Projects Overview: Dynex, Microvision Chain, Neurai

TechFlow Selected TechFlow Selected

New POW Projects Overview: Dynex, Microvision Chain, Neurai

This article introduces several recent POW projects that have shown decent market performance.

Author: Duoduo, LD Capital

Since Ethereum transitioned to POS mode, most public chains attracting market attention have also adopted the POS model. However, POW-based chains continue to evolve as well. A notable example is KAS, which introduced a new POW blockchain model. With KAS consistently rising in value, emerging POW projects are gradually drawing interest from investors and communities. This article introduces several recent POW projects that have shown promising market performance.

1. Market Performance

Source: CoinGecko, LD Capital

Note: All data in this article is accurate as of August 1, 2023.

From the table above, we can see that these projects launched less than a year ago, with market caps below $50 million, and have achieved solid price increases over the past two months.

Additionally, the teams behind Dynex and Neurai remain anonymous and have not disclosed any information. The co-founder of Microvision Chain (Twitter: @Jason_K0001) is Chinese, but the official website does not provide detailed background or experience.

2. Narratives

New POW projects have each developed narratives aligned with current market trends and hot topics.

Dynex

Dynex is a neuromorphic supercomputing blockchain based on the DynexSolve chip algorithm, proposing a Proof-of-Useful-Work (PoUW) mechanism to enhance speed and efficiency in decentralized networks.

DynexSolve enables the operation of "neuromorphic chips," which outperform traditional computing methods across various computational tasks. Neuromorphic computers serve as natural platforms for many AI and machine learning applications today. Dynex aims to leverage this foundation to provide computing power for artificial intelligence, machine learning, fintech, biomedicine, and other fields.

Dynex primarily utilizes GPU computing power. According to statistics from hiveon.com, DNX currently accounts for 14% of the platform's total hash rate, making it the largest POW token by GPU hash rate within the platform’s monitoring scope.

Microvision Chain

Microvision Chain aims to build a highly scalable POW public chain serving as a Bitcoin Layer 2 solution—improving efficiency and reducing transaction fees. The protocol proposes three key improvements:

1) Smart contracts based on UTXO accounts, enabling application development;

2) Built-in decentralized identity protocol supporting cross-chain interoperability, where all chain data belongs to a single ID;

3) Enabling users to access Web3 applications without needing to purchase or hold cryptocurrency, lowering entry barriers for new users.

According to its official website, core team members published research on UTXO model scalability in November 2021 and filed a patent titled “Method and system for hierarchically cutting data in blockchain transaction, and storage medium.” The testnet launched in May 2022 and was validated by the High-Performance Computing Center at the University of Science and Technology of China, achieving smart contract execution speeds exceeding 5,000 TPS.

Neurai

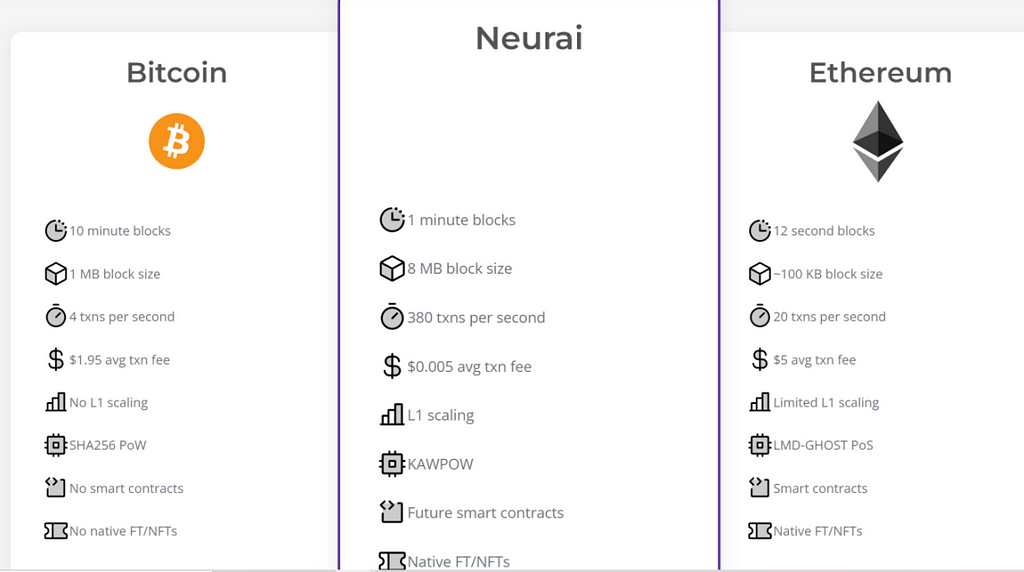

Neurai aims to become an integrated platform leveraging AI algorithms to perform data analysis, predictive modeling, decision-making, and connect blockchain assets with IoT devices. Compared to Bitcoin and Ethereum, Neurai’s main technical parameters are as follows:

Source:Neurai Official Website

As shown, Neurai aims to increase transactions per second, reduce transaction fees, and eventually support smart contract functionality.

3. Hash Rate

Based on data from Mining Pool Stats, the hash rates of each project are as follows:

Source:Mining Pool Stats, LD Capital

Note: Hash rate unit: H/s is the smallest unit. One random hash computation per second equals one Hash/s (H/s).

1 KH/s = 1,000 H/s, 1 MH/s = 1,000 KH/s, 1 GH/s = 1,000 MH/s, 1 TH/s = 1,000 GH/s, 1 PH/s = 1,000 TH/s, 1 EH/s = 1,000 PH/s.

Comparing with top-ranking and well-known POW blockchains: BTC ranks first in hash rate, BCH seventh, BSV twelfth, KAS twenty-ninth, DASH thirty-first, LTC and DOGE rank thirty-eighth and thirty-ninth respectively. Thus, Microvision Chain has a relatively high hash rate ranking.

It should be noted that according to hiveon.com, DNX currently holds 14% of the GPU hash rate, making it the largest POW token by GPU hash rate within the platform’s monitored range—surpassing even KAS. This differs significantly from MiningPoolStats’ figures, likely due to different measurement methodologies.

Source:Hiveon

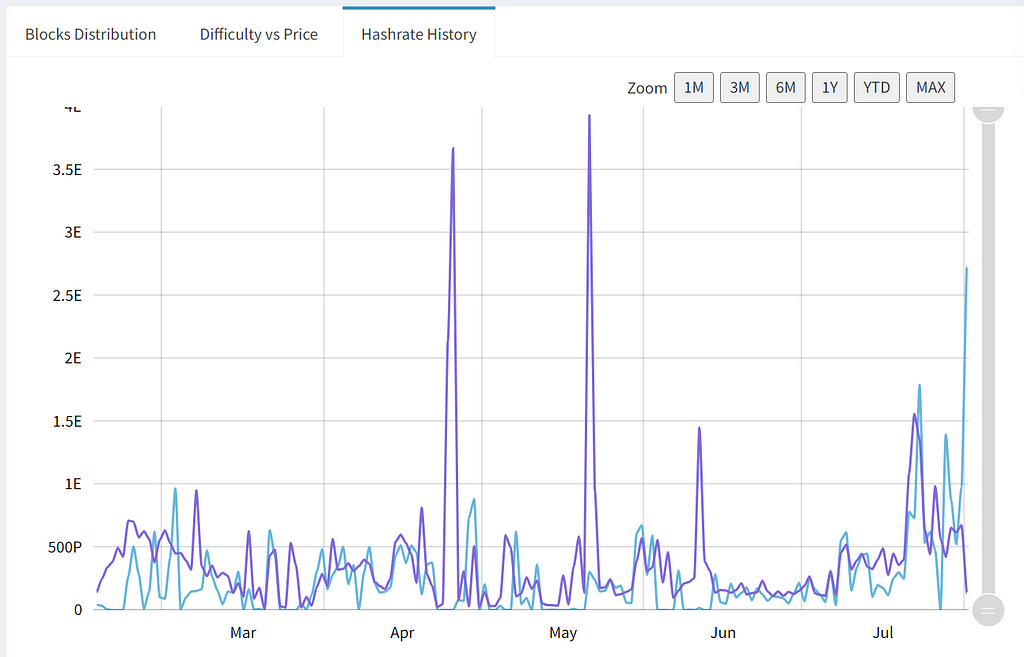

Below are charts from MiningPoolStats showing hash rate trends for each protocol:

Dynex: Overall upward trend. Recently, due to an algorithm upgrade, the hash rate dropped temporarily.

Microvision Chain: Hash rate fluctuates without significant growth or decline.

Neurai: Recently experiencing growing hash rate, primarily driven by retail miners; known pools show declining hash contributions.

Overall, Dynex dominates in GPU hash rate with a generally rising trend, though recently dipped due to an algorithm update expected to recover soon. Additionally, as KAS shifts toward ASIC mining, former GPU capacity is migrating to DNX mining, further boosting DNX's hash rate. Microvision Chain ranks highly in overall hash rate but suffers from high centralization and ongoing volatility. Neurai sees broad participation from individual miners, indicating higher decentralization, with hash rate on an upward trajectory.

4. Economic Models

Dynex

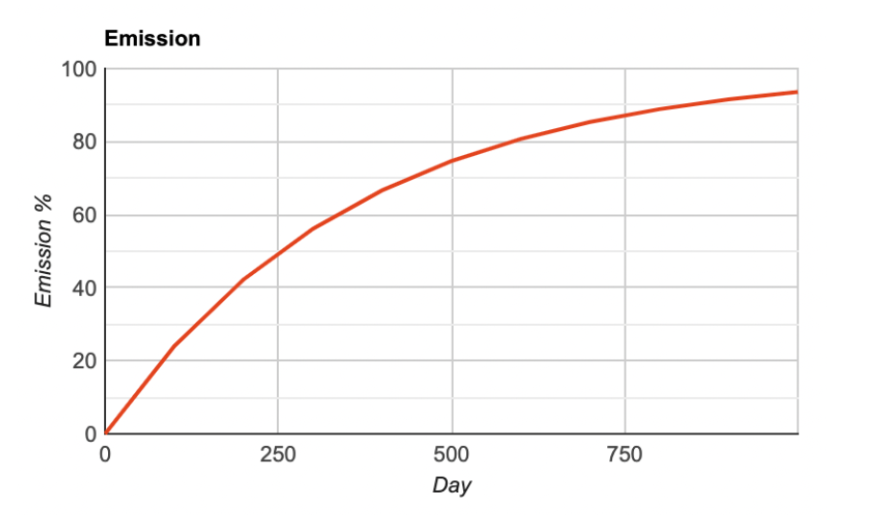

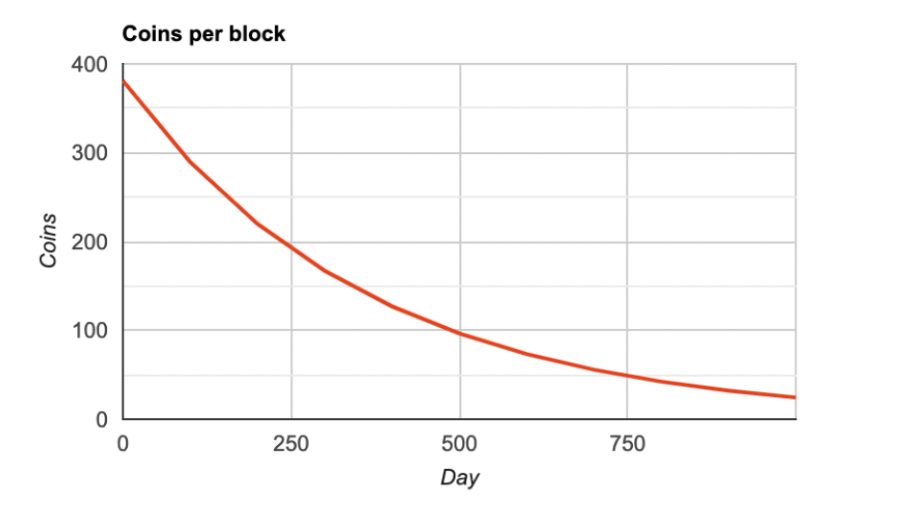

No ICO, no pre-mine, no team allocation. Total supply is 100 million tokens, with 64.61 million already released (64% in circulation). The release schedule is aggressive—around 80% will be in circulation within two years. The charts below illustrate the token emission timeline and per-block reward reductions over time. Block rewards decrease gradually according to a specific formula, forming a smooth decay curve.

Currently, each block rewards approximately 173 DNX tokens, with a new block generated roughly every 2 minutes. Based on this, monthly token emissions amount to about 2.67 million DNX. At a price of $0.60 per token, this translates to around $2.2 million worth of tokens released monthly.

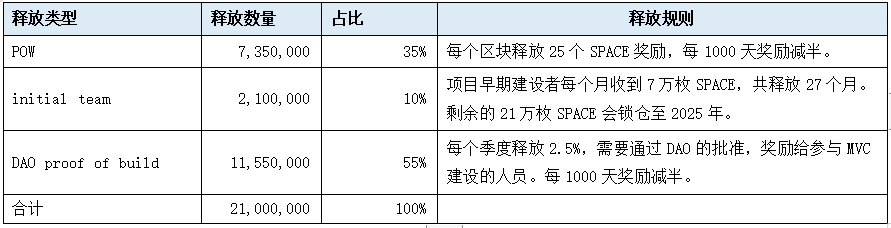

Microvision Chain

Microvision Chain’s token distribution is not purely POW-based. It includes allocations for the founding team and DAO builders, resembling a hybrid of POW and POS models.

Under this emission schedule, monthly issuance during the first 1,000 days averages about 274,000 tokens—approximately 3.28 million annually. Over three years, 9.86 million tokens will be released, reaching 47% circulation after three years. At a price of $12 per token, this equates to roughly $3.28 million in monthly value issuance and $39 million annually.

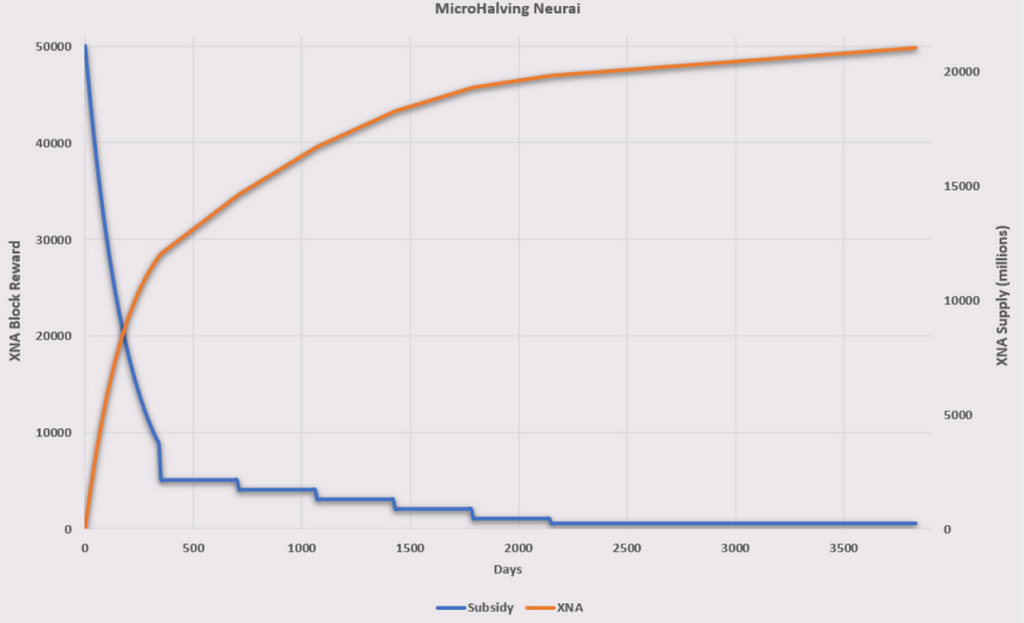

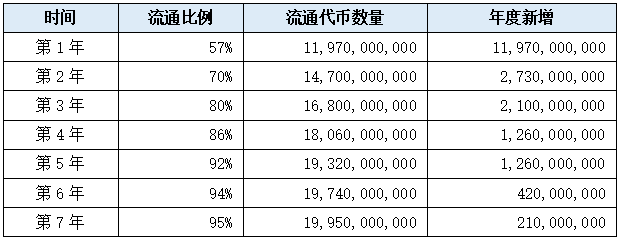

Neurai

Total supply is 21 billion tokens, with 5,873,595,098 currently in circulation (28%).

At a unit price of $0.00081, newly issued tokens add approximately $810,000 in value monthly—about 17% of the current market cap.

In summary, Dynex and Neurai follow fully POW-based token distributions. In contrast, 65% of Microvision Chain’s tokens are distributed outside POW mechanisms, giving the project team substantial control. All three projects feature high early-stage token releases, meaning early miners hold large quantities. These holdings represent both potential selling pressure and possible upward momentum drivers.

5. Risks and Concerns

The most common criticisms directed at these three projects concern their team credibility and technical feasibility. In both the Dynex and Microvision Chain communities, FUD occasionally emerges—accusing the teams of merely stitching together existing academic papers and arguing that demo videos do not demonstrate novel technology, but rather vague conceptual presentations.

These projects require strong scientific research capabilities and advanced technical development skills. Yet Dynex and Neurai operate with anonymous teams and no disclosed member information. While Microvision Chain has a semi-public co-founder (active on Twitter and interviews), there is still no notable industry reputation or prior involvement in recognized projects.

Currently, many investors participating in these projects are those who previously profited from KAS investments, resulting in partial community overlap.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News