In-Depth Analysis of Kaspa: A POW Public Chain Based on the GHOSTDAG Protocol

TechFlow Selected TechFlow Selected

In-Depth Analysis of Kaspa: A POW Public Chain Based on the GHOSTDAG Protocol

Kaspa aims to implement smart contracts, DeFi, and Layer 2 applications on its public blockchain, building the corresponding ecosystem.

Author: duoduo, LD Capital

Kaspa is a PoW public blockchain built on the GHOSTDAG protocol. Compared to Bitcoin, Kaspa primarily changes the structural model of the blockchain. While Bitcoin adopts a single-chain structure, GHOSTDAG uses a directed acyclic graph (DAG) structure in which one block can reference multiple blocks.

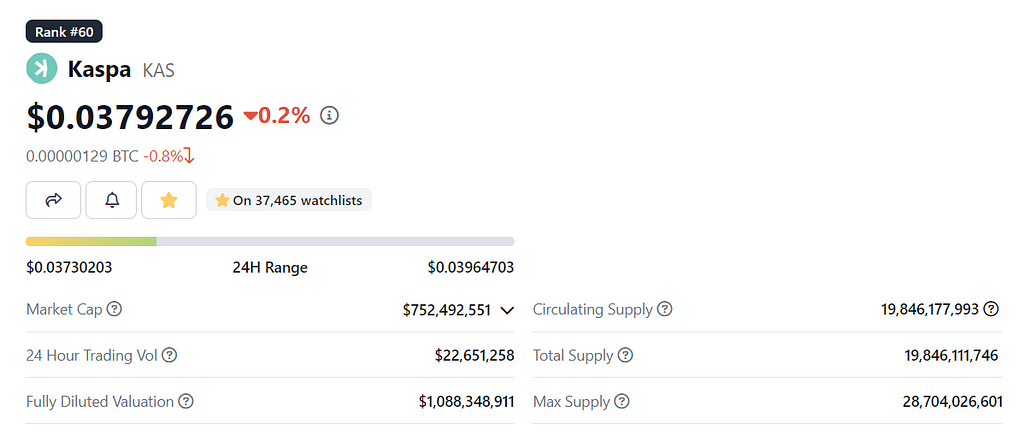

The KAS token launched in November 2021 with a total supply of 28.7 billion, a current circulating supply of 19.8 billion (69% circulation rate), a market cap of $750 million, and an FDV of $1.08 billion. Since its launch, the token has appreciated over 100x.

1. Team

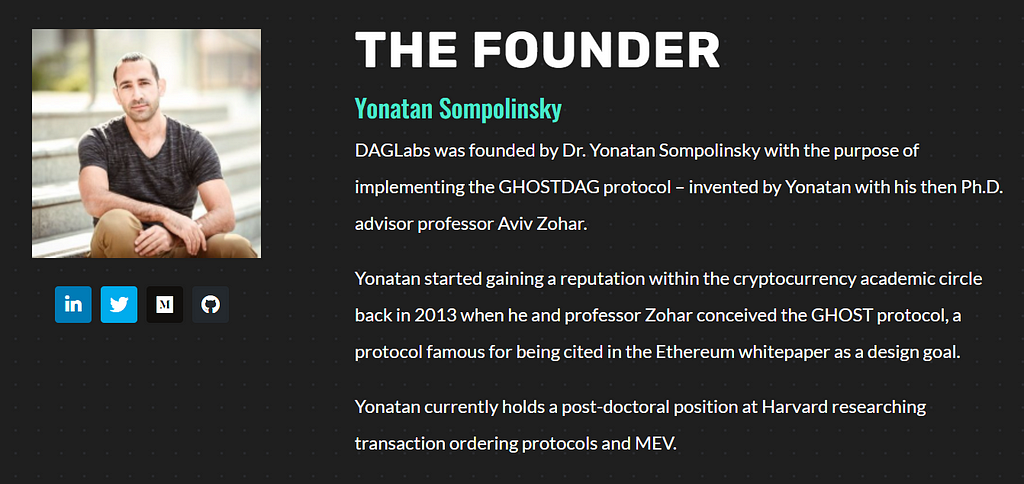

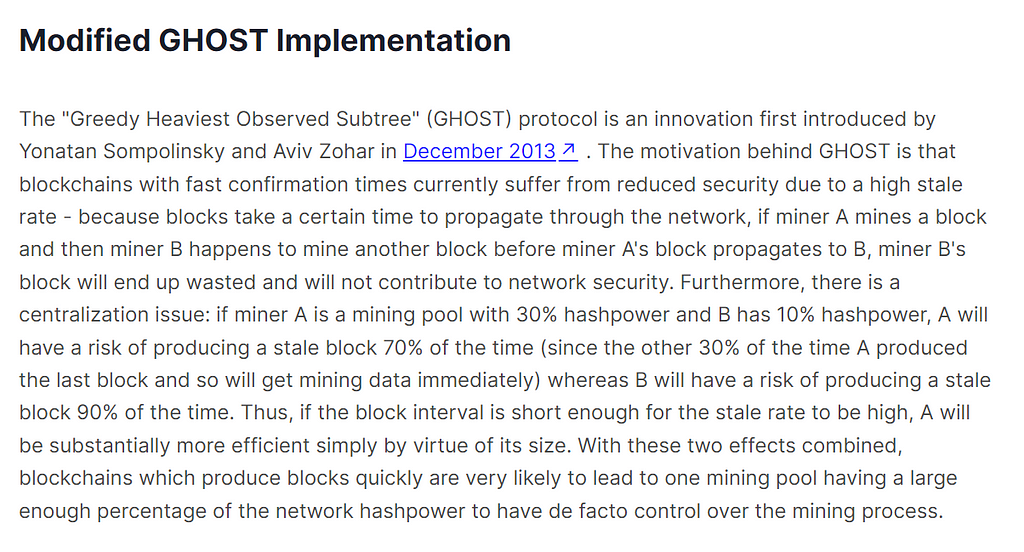

Kaspa's team is relatively well-known. Founder Yonatan Sompolinsky is currently a postdoctoral researcher at Harvard University, focusing on transaction ordering and MEV. As early as 2013, he co-conceived the GHOST protocol with his doctoral advisor, and related papers were cited in Ethereum’s whitepaper.

Source: Kaspa Official Website

Below is the excerpt from the Ethereum whitepaper:

Source:Ethereum Whitepaper

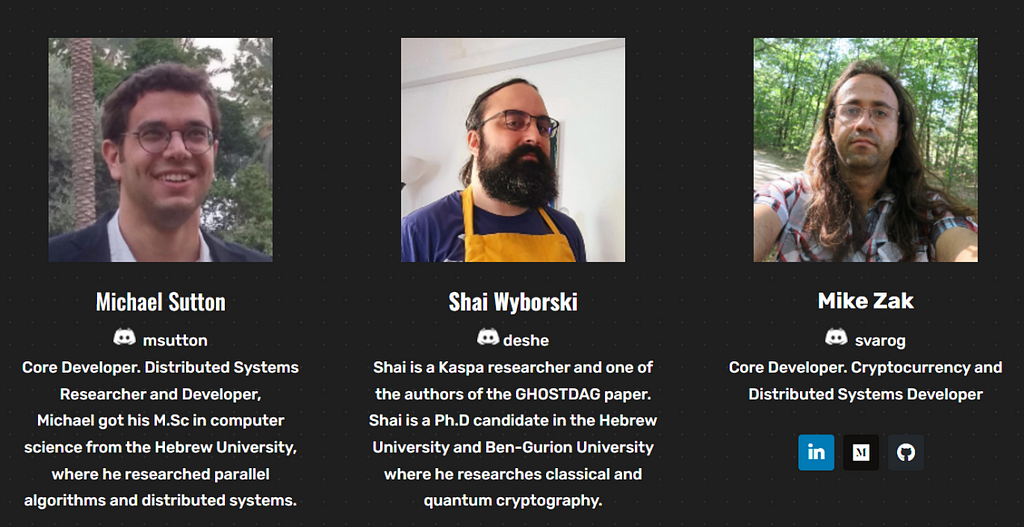

In addition to the founder, there are five core developers. Michael Sutton focuses on parallel algorithms and distributed systems. Shai Wyborski is one of the authors of the GHOSTDAG paper and studies classical and quantum cryptography. Mike Zak and Ori Newman focus on distributed systems development. Elichai Turkel is an applied cryptographer and high-performance blockchain developer.

Source: Kaspa Official Website

2. Technical Principles

Kaspa's technical principles are mainly described in its 2021 paper titled "PHANTOM GHOSTDAG: A Scalable Generalization of Nakamoto Consensus."

Bitcoin is essentially an open and anonymous network of nodes that jointly maintain a public ledger. The ledger follows the "longest chain" rule, enabling honest blocks to link together and secure the network. This design artificially limits network throughput and results in low protocol scalability. Currently, Bitcoin generates one block every 10 minutes, supporting 3–7 transactions per second.

Structural Model: Directed Acyclic Graph (DAG)

Kaspa introduced the PHANTOM protocol, a permissionless ledger protocol based on Proof-of-Work that generalizes Satoshi's blockchain concept into a blockDAG (directed acyclic graph). PHANTOM allows referencing multiple previous blocks, provides total ordering for all blocks and transactions, and outputs a consistent set of accepted transactions.

PHANTOM includes a parameter k that controls the protocol’s tolerance for concurrently created blocks, allowing adjustment for higher throughput. When k=0, no forks exist—this corresponds to Bitcoin’s single-chain, longest-chain structure.

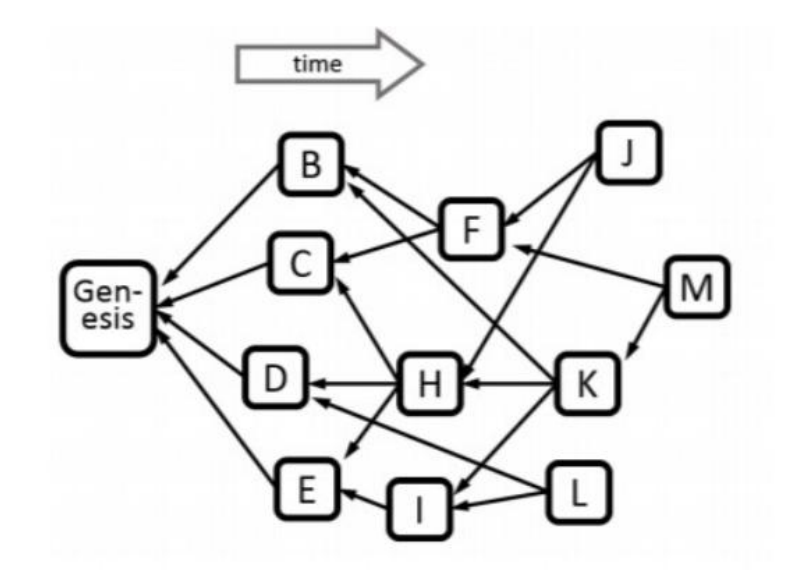

Source:"PHANTOM GHOSTDAG: A Scalable Generalization of Nakamoto Consensus"

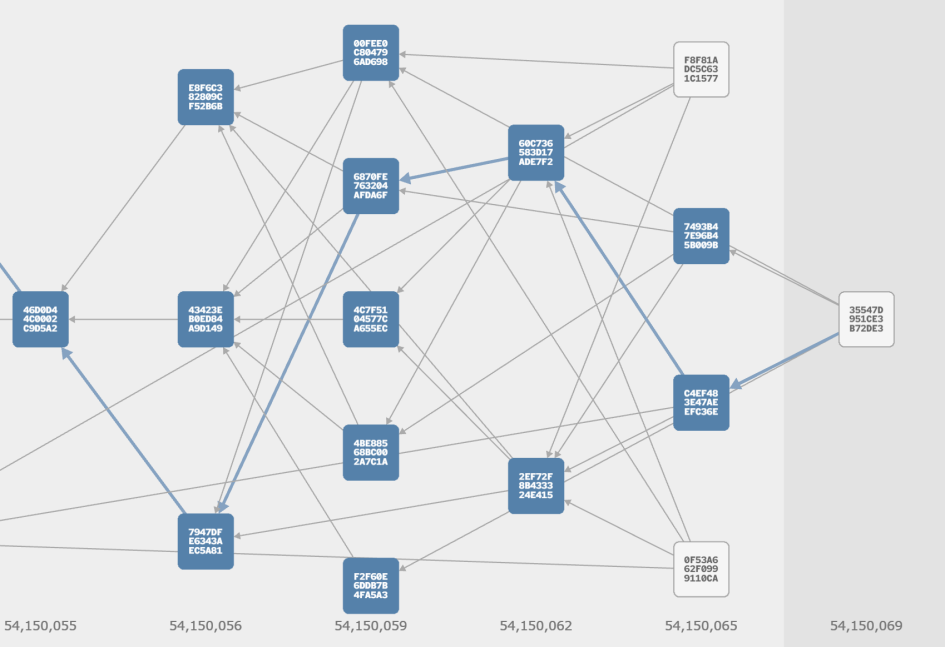

Let us first understand different types of blocks within DAG, as these concepts will be used in examples below. In the figure above, taking block H as an example:

-

past(H)={Genesis, C, D, E} — past blocks that directly or indirectly point to H before it was created;

-

future(H)={J,K,M} — future blocks that directly or indirectly point to H after it was created;

-

anticone(H)={B,F,I,L} — blocks unrelated (neither past nor future) to H;

-

tips(G)={J,L,M} — leaf or tip blocks that may serve as references for new blocks.

Identifying Honest and Malicious Blocks

PHANTOM addresses the identification of honest versus malicious blocks. A characteristic of malicious attacks is that blocks generated by malicious nodes have lower connectivity with those from honest nodes, whereas honest blocks exhibit higher mutual connectivity.

The criterion is the aforementioned parameter k. For a specific block X, if the intersection between anticone(X) and honest blocks exceeds k, then X has low connectivity with honest blocks and is classified as an attack block; otherwise, X is considered an honest block due to high connectivity.

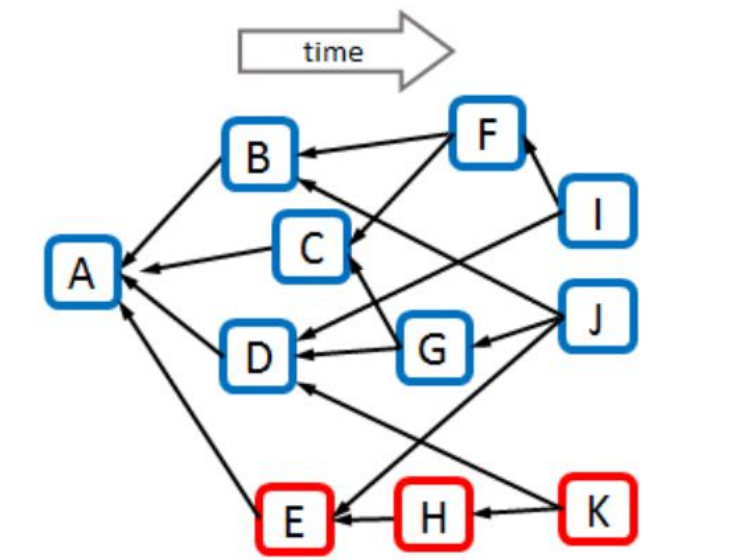

The diagram below illustrates such classification. With k=3, blue blocks are identified as honest, red ones as attack blocks.

Source:"PHANTOM GHOSTDAG: A Scalable Generalization of Nakamoto Consensus"

Linear Ordering

To solve the double-spending problem, the team applies the GHOSTDAG protocol. It scores each block based on its connectivity (number of elements in its past set), selects the highest-scoring blocks to form the main chain (initial subset), and then the remaining blocks vote sequentially according to this order. Thus, the entire network votes in descending order of connectivity.

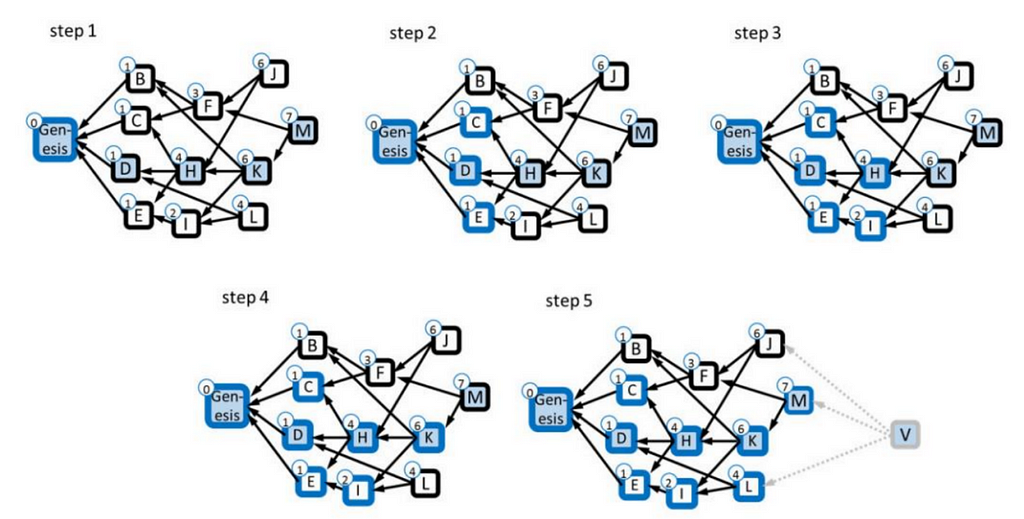

The figure below shows how GHOSTDAG performs sorting when k=3. Small circles next to each block X represent its score—the number of blue blocks in its past DAG.

Step 1: Starting from block M (highest score), successively select K, H, D, and Genesis, marked with blue fill and black borders—forming the initial subset. Accessing block D, whose only past block is Genesis.

Step 2: Access block H, whose past blocks are C, D, E. After applying the honest/malicious identification method described earlier, C, D, E are confirmed as honest and added to the subset, outlined in blue.

Step 3: Access block K, whose past blocks include H and I—both identified as honest and marked with blue borders.

Step 4: Access block M, whose past blocks include K and F. K is honest and added to the subset with a blue border.

Step 5: Block V is a virtual block whose past equals the entire current DAG.

Source:"PHANTOM GHOSTDAG: A Scalable Generalization of Nakamoto Consensus"

Thus far, Kaspa has completed the explanation of its new consensus architecture and implemented it in practice. The official website visualizes the DAG production process:

Source:Kaspa Official Website

3. Hashrate Overview

KAS uses the kHeavyHash mining algorithm, supporting GPU solo mining or dual mining with ETHW and ETC, and compatible with certain FPGA and ASIC miners.

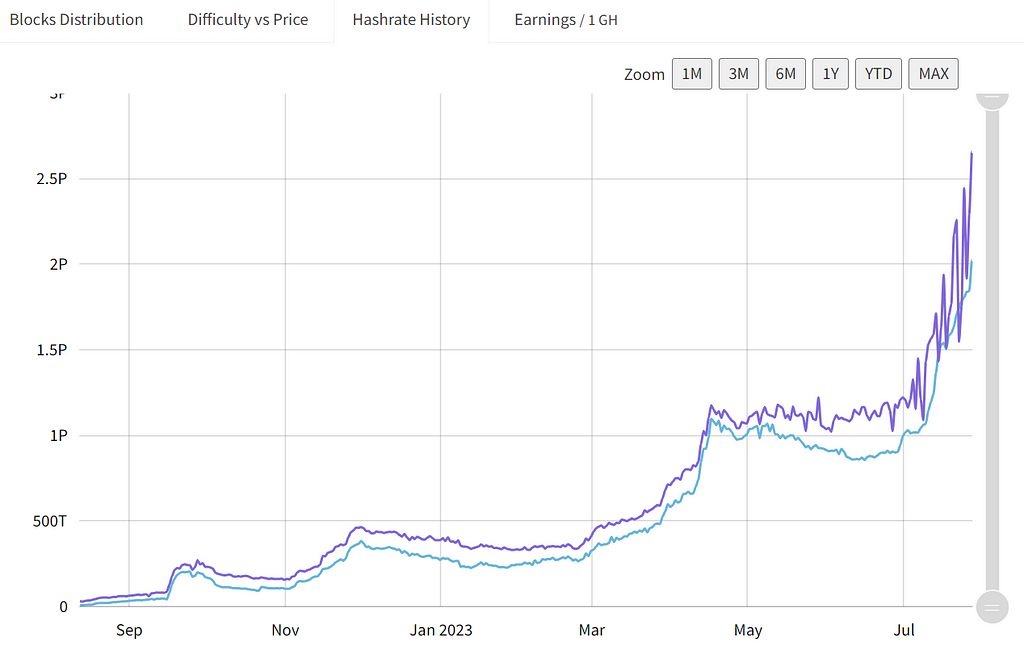

According to the official blockchain explorer, Kaspa's hashrate ranges between 2.6–2.7 PH/s. Based on Mining Pool data, Kaspa ranks around 30th globally, behind BCH, BSV, and DASH but ahead of DOGE and LTC.

Kaspa’s hashrate shows a continuous upward trend. It experienced four notable increases in October 2022, December 2022, February 2023, and July 2023. In March this year, mining hardware manufacturers released specialized machines to improve mining efficiency.

Source:miningpoolstats

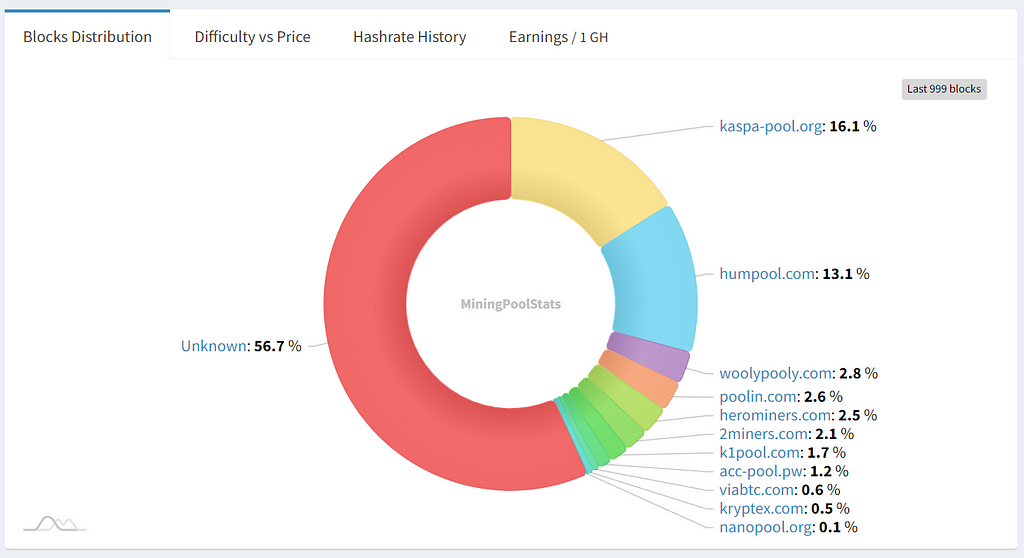

In terms of hashrate distribution, centralization is moderate. Among the latest 999 blocks, the top five mining pools accounted for 37.1%; over 56.7% of blocks were mined by untagged addresses.

Source:miningpoolstats

4. Tokenomics

Token Distribution

KAS launched in November 2021 with no pre-mine, zero presale, and no initial token allocation. Total supply is 28.7 billion tokens, with 19.8 billion currently in circulation (69%), a market cap of $750 million, and an FDV of $1.08 billion.

Token Emission

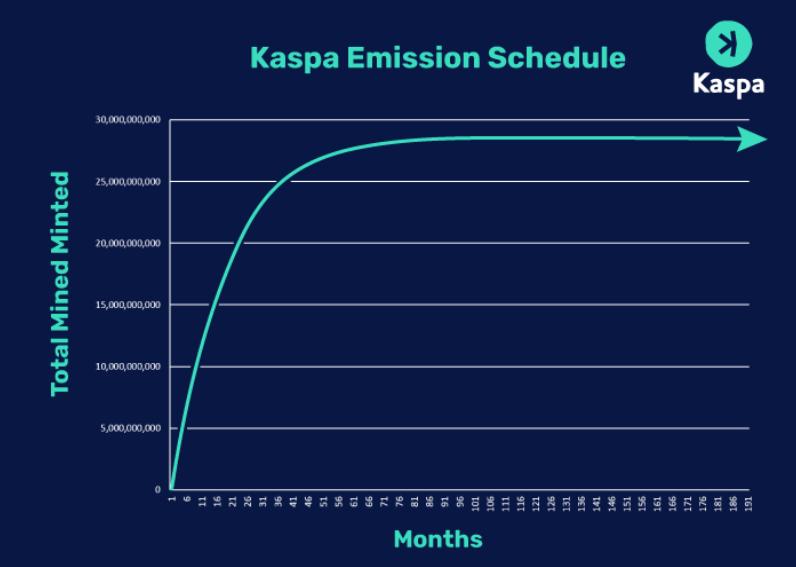

According to the emission schedule, KAS reduces monthly output in a way that halves annual issuance. The diagram below illustrates emissions, showing high early release rates, enabling early miners to accumulate significant holdings. The full emission schedule is available on the official website (https://kaspa.org/wp-content/uploads/2022/09/KASPA-EMISSION-SCHEDULE.pdf).

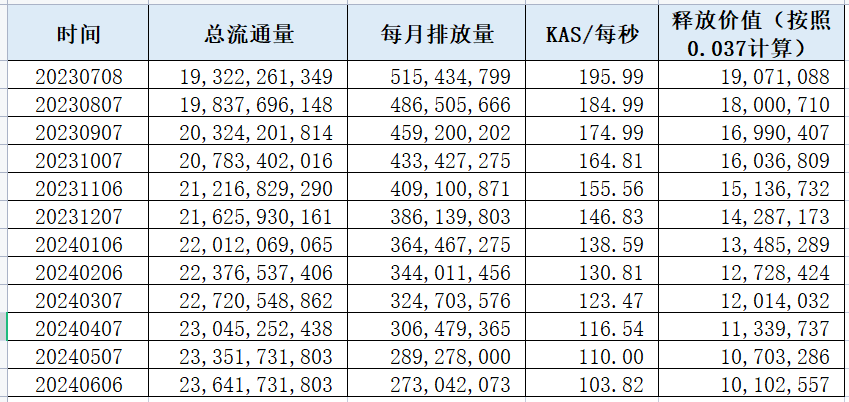

Based on the emission table, we calculated monthly KAS emissions and their value from July 2023 to June 2024. At a price of $0.037, KAS emitted tokens worth $19 million in July 2023, gradually decreasing thereafter. By June 2024, monthly emissions will be worth approximately $10 million.

Source:Kaspa Official Website, LD Capital

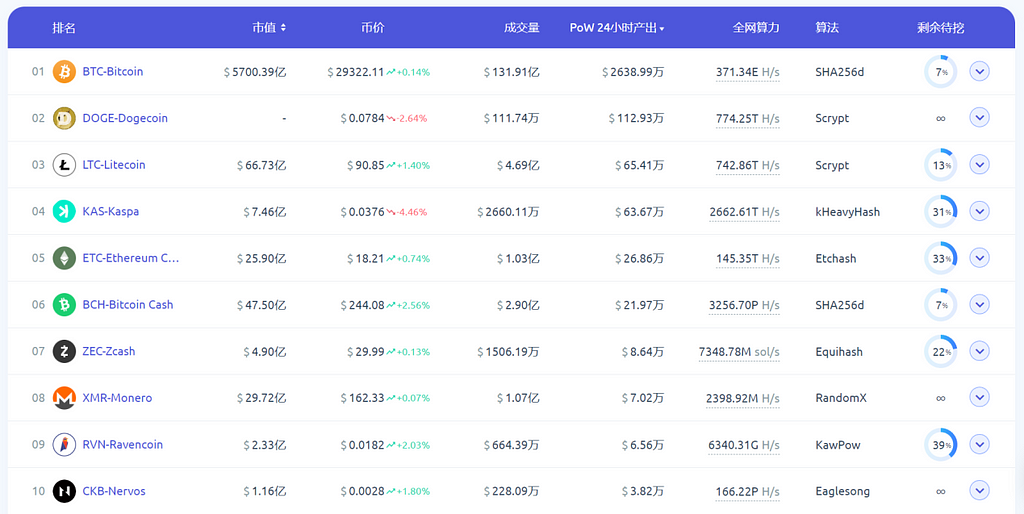

According to f2pool data, Kaspa ranks fourth in daily mining revenue, behind Bitcoin, Dogecoin, and Litecoin, but ahead of ETC and BCH.

Source:f2pool

Holding Distribution

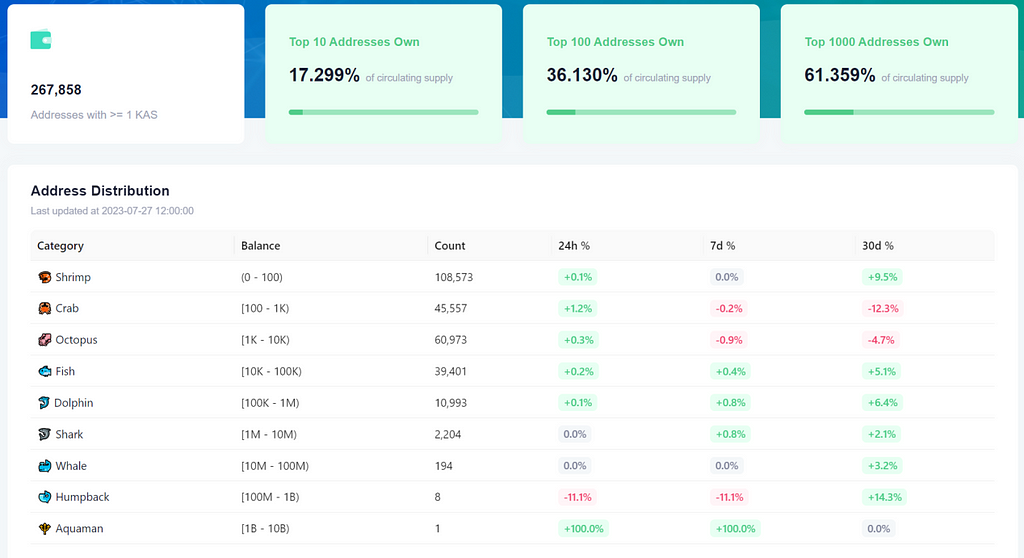

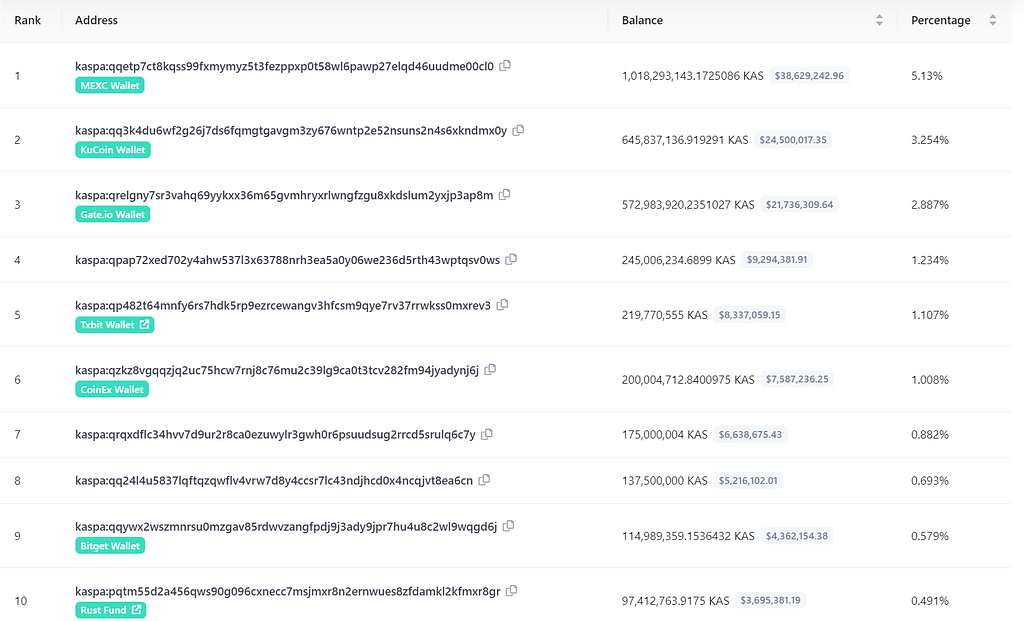

There are 267,000 addresses holding 1 or more KAS tokens. Token concentration is relatively high: the top 10 addresses hold 17.299% (mainly exchange wallets), the top 100 hold 26.13%, and the top 1,000 hold 61.35%.

In terms of token flow, over the past 30 days, addresses holding 100–10K tokens showed outflows, while those with 0–100 and over 10K tokens showed inflows. Over the past 7 days, addresses holding 100–10K tokens and “Humpback” addresses (100M–1B) showed outflows, while others showed inflows.

Source:Kaspa Blockchain Explorer

5. Current Progress and Development Roadmap

The official website disclosed key progress since 2023 and upcoming development plans.

Completed

In February 2023, core developer Michael Sutton published a paper on DagKnight Consensus—a successor to GHOSTDAG that theoretically enables faster transactions and confirmation times.

In Testing

Rewriting code in Rust:

Currently, Kaspa is written in GoLang. Michael Sutton is rewriting the codebase in Rust to enhance performance and transaction speed.

Mobile wallet development:

High demand exists for high-performance mobile wallets, with an estimated development time of 3–4 months.

Ledger integration:

Users will be able to send and receive KAS using Ledger hardware wallets.

Under Research and Development

Upgrade consensus mechanism based on DagKnight Consensus,further increasing blocks-per-second and transactions-per-second:

Currently, Kaspa produces 1 block per second, aiming to increase to 32 blocks per second. The testnet already achieves 10 blocks per second.

Release project whitepaper:

While several research papers describe Kaspa’s technology, the official project whitepaper has not yet been released and is currently being compiled.

Improve archival nodes:

Currently, standard nodes can only access transactions from three days ago. Improving archival nodes will enable retrieval of more historical data.

Development Roadmap

Implement smart contracts and build an ecosystem:

Kaspa aims to support smart contracts, DeFi, and Layer 2 applications on its public chain to establish a vibrant ecosystem.

Smart contract deployment is the most critical factor for future growth. If smart contracts are successfully deployed and an active ecosystem emerges, Kaspa’s market cap has further upside potential. However, failure to deploy smart contracts or build an ecosystem would create clear development bottlenecks.

6. Summary

The team has strong technical expertise and solid development foundations. They proposed a novel blockchain model and pursued innovative directions. Early adoption attracted hashpower diverted from Ethereum, and hashrate continues to grow.

Market cap is relatively high, having increased over 100x. Currently valued at $750 million (rank ~60), the market has largely priced in the team’s technical achievements and hashrate growth. Future appreciation requires stronger catalysts.

Significant downward pressure from token supply. Early miners hold large amounts of low-cost tokens, and daily emissions continue. Any sell-off could significantly impact price.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News