In the multi-chain era, why is chain abstraction the most值得关注 area after account abstraction?

TechFlow Selected TechFlow Selected

In the multi-chain era, why is chain abstraction the most值得关注 area after account abstraction?

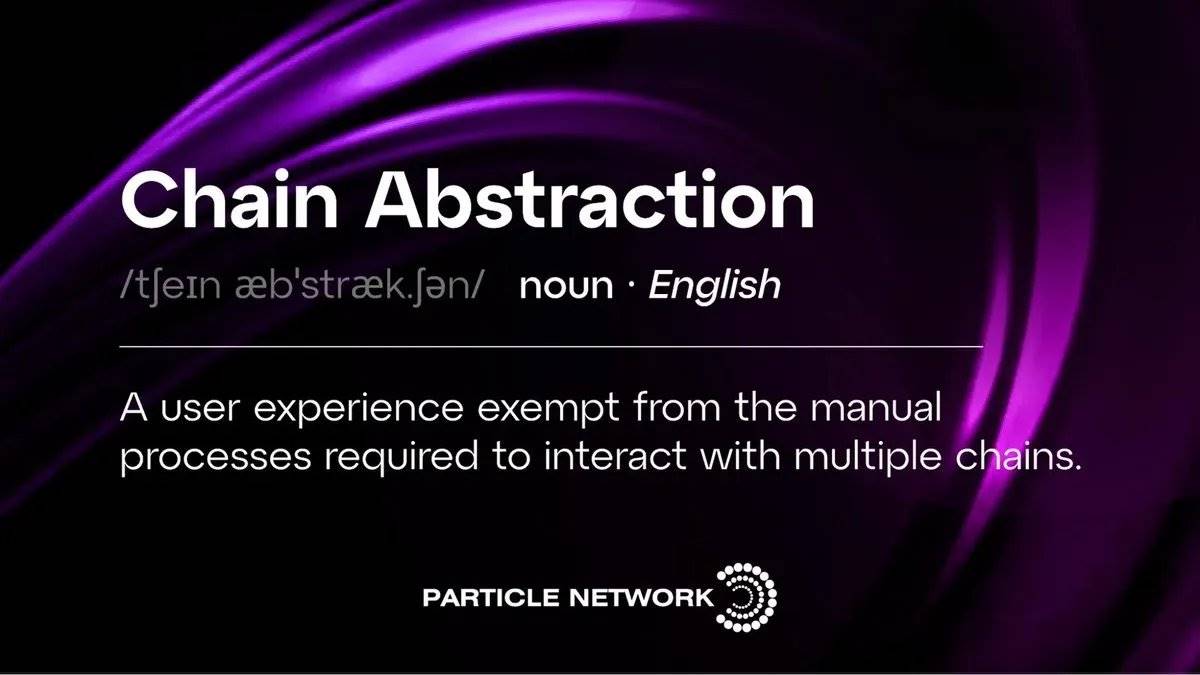

Chain abstraction hides internal details such as individual chains, gas fees, and native tokens from users, enabling a seamless, imperceptible experience across chains.

Author: Jason Chen

In previous articles, I've frequently discussed the explosion of app-specific chains and the awkwardness of underutilization. In "Do We Really Need So Many Layer 2s? Where Is the Inflection Point for Web3 Mass Adoption?", as Layer 1s and Layer 2s proliferate, following account abstraction, I believe chain abstraction is another critically important area to watch.

Many friends often ask what "abstraction" means in account abstraction—and why such a strange name? In software engineering, abstraction specifically refers to exposing only surface-level interfaces while hiding internal implementation details, thereby reducing complexity and enabling high cohesion with loose coupling. The concept of abstraction aligns closely with modularity. Thus, account abstraction hides internal blockchain account information—such as addresses, private keys, and seed phrases—making accounts effectively invisible to users. Similarly, chain abstraction hides underlying chain specifics—including gas fees and native tokens—from users, rendering chains themselves imperceptible.

Why is chain abstraction so important? Two key reasons:

1. User experience;

2. Liquidity aggregation.

User experience speaks for itself. Currently, users must understand the concept of blockchains, constantly switch between and manually add networks when using applications, and even bridge assets across chains just to obtain the correct gas token. Chains are like Web2 servers—when scrolling TikTok, users shouldn't need to know which data center stores a given video, let alone switch data centers or purchase region-specific bandwidth just to view it. That would be absurd.

If usability issues merely raise barriers to entry, liquidity fragmentation is far more fatal.

Polygon recently announced its Polygon 2.0 plan, focusing precisely on solving unified liquidity. I previously explained this 2.0 initiative and its features on Twitter. As one-click chain deployment becomes increasingly mature, the proliferation of chains severely fragments liquidity—not only financial capital but also broader user engagement and traffic. How can we understand this? Let's again use Web2 as an analogy.

In Web2, there may be dozens of data centers housing servers. A video you upload might reside in one specific center, yet you can still browse videos “across data centers.” Your Beijing-based phone number doesn’t restrict you to viewing only videos from northern China’s data centers. But if that were true? Content would fragment into isolated silos, drastically reducing liquidity. A high-quality video that could reach 100,000 people might now only reach 10,000 covered by its host server.

Similarly, remember many online games from 15 years ago—like Audition (Dance Dance) or QQ Speed? Upon logging in, you first had to select a server: North China Zone 1, North China Zone 2, etc. You could only play with others on the same server. User liquidity was severely fragmented, interactivity greatly diminished. Some games even isolated user data and accounts per zone—meaning if I leveled up my character to max in North China, I’d have to start over from scratch in South China.

In Web3—which is inherently financial, especially DeFi—liquidity is even more critical. Capital efficiency directly determines how effectively funds circulate. Many believe Uniswap’s unshakable position stems from its deep liquidity pools. If a DeFi project spreads its liquidity across multiple chains, that’s extremely risky. Likewise, Web3 applications like social platforms or games already struggle with low user counts; further fragmenting liquidity makes them virtually unplayable.

Account abstraction lowers the barrier to understanding and operating blockchain applications—users can interact almost as easily as in Web2, using just an email-like interface without grappling with complex backend concepts. Similarly, we urgently need chain abstraction: erasing all notions of individual chains. Users should only need to know that they’re interacting with something called blockchain—just like drivers only need to know the left pedal is brake and the right is accelerator, without needing to understand engines, rotors, or regulators.

Beyond lowering barriers, chain abstraction’s greater value lies in unifying liquidity. Users should simply know they're engaging with blockchain—while the system automatically and dynamically routes their interactions across underlying chains and assets. Cross-chain functionality is thus a crucial step toward chain abstraction—but not the entirety. What's needed is a comprehensive, automated solution spanning wallets, assets, and messaging, built on cross-chain interoperability and grounded in security—a substantial engineering challenge.

Projects in the chain abstraction space include Connect, DappOS, and others. Some companies focused on account abstraction are also beginning to extend downward into chain abstraction.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News