Taking Magpie as an Example: Analyzing Best Practices for subDAOs

TechFlow Selected TechFlow Selected

Taking Magpie as an Example: Analyzing Best Practices for subDAOs

Magpie focuses on the governance sector, making it a perfect match for the subDAO model.

Growth is crucial for investment returns, yet in web3, very few projects successfully expand into new ventures. Established projects often struggle to compete with newer ones when launching new business lines. subDAO + execution capability might be the answer to this challenge.

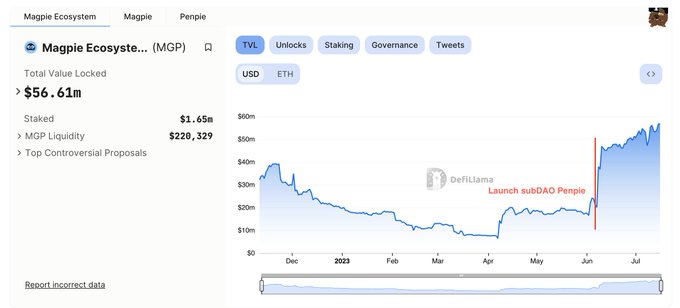

From Penpie to Radpie, Magpie is rapidly expanding through the subDAO model. This article uses that case to unpack best practices for subDAOs.

What is a subDAO?

Today there are examples of unsuccessful subDAOs such as MakerDAO's Spark, but those without independent tokens offer limited reference value. We believe a qualified subDAO should have the following characteristics:

1. The subDAO has its own independent token and capacity for independent expansion;

2. The parent DAO holds a significant portion of the subDAO’s equity;

3. There is mutual benefit between the parent DAO and the subDAO.

Take Radpie—the yield booster for Radiant Capital—as an example of Magpie’s subDAO.

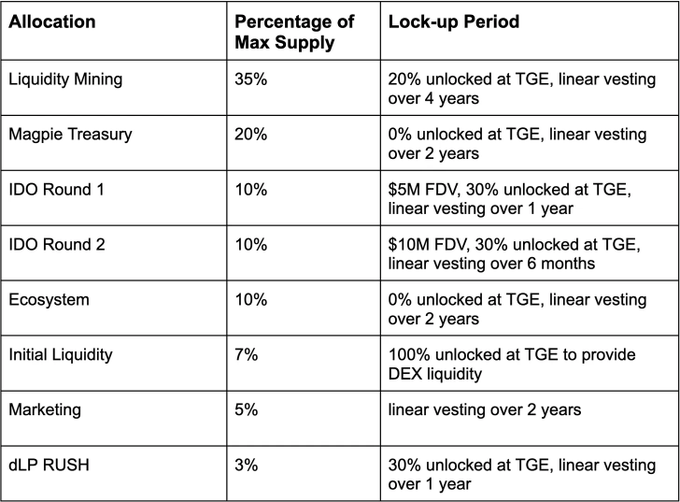

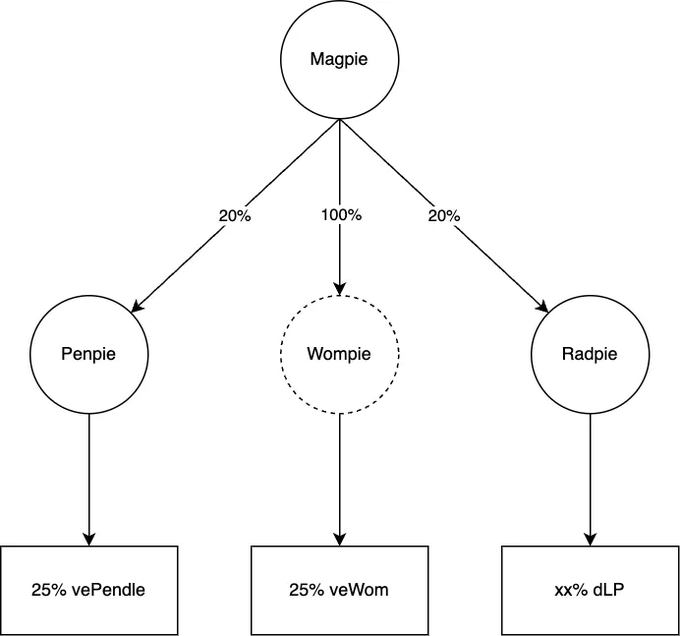

Radpie will issue $RDP, with 20% held by Magpie’s treasury. Additionally, 30% of the IDO allocation will go to MGP holders, meaning:

1. MGP holders can share in IDO proceeds;

2. MGP holders will gain access to future “dividends” from $RDP.

3. Magpie retains strong control over Radpie, thereby gaining substantial governance influence over Radiant;

4. Radpie will leverage Magpie’s team resources for rapid launch.

What are the advantages of the subDAO model?

1. Reputation – The subDAO inherits the parent DAO’s credibility, easing launch;

2. Growth – An independent token enables ample incentive budgets for growth;

3. Narrative – The subDAO token aligns with emerging narratives, allowing the parent DAO to stay relevant;

4. Loop – Integration within the parent DAO’s ecosystem enables resource sharing and efficiency gains;

5. Leverage – Amplifies the parent DAO’s overall influence.

Reputation

In crypto, new projects face fears of rug pulls, leading liquidity providers (LPs) to heavily discount risk. However, a subDAO inherits the parent DAO’s reputation, significantly reducing such concerns. Partnerships with KOLs and other projects also become much smoother. Moreover, reputation is an intangible asset that compounds—each successful project makes it easier to launch subsequent subDAOs.

Growth & Narrative

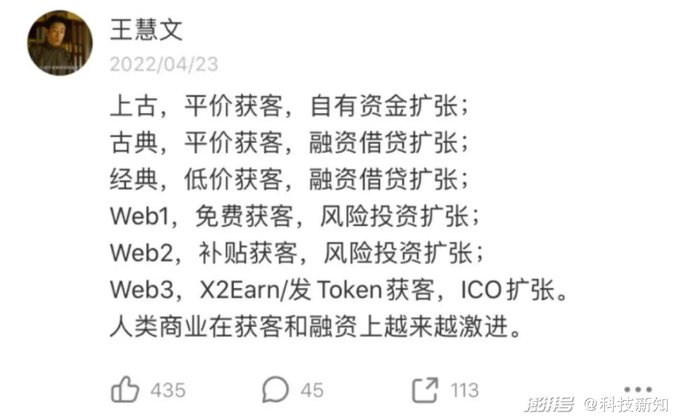

Meituan co-founder Wang Huilong once sharply observed that web3 employs more aggressive user acquisition and fundraising models, with tokens serving as the key instrument. Legacy projects venturing into new businesses often face a dilemma: if they heavily inflate token supply to incentivize growth, price drops follow; but without such incentives, winning competitive battles becomes difficult.

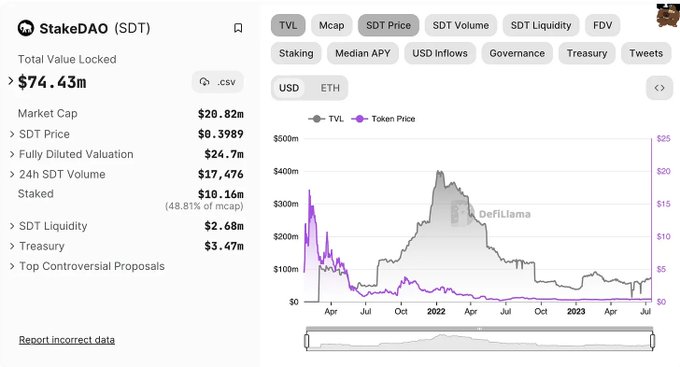

Even worse, large legacy tokens are hard to pump due to their size and unclear positioning. When markets chase new narratives, these tokens are rarely included in core discussions. For instance, StakeDAO spent a year building Convex-like governance services, integrating ten projects with limited success. Despite integrating Pendle, it captured little of Pendle’s momentum.

The subDAO model avoids this. Take Penpie/$PNP as an example—an independent project that issued no new $MGP tokens while tightly anchoring itself to Pendle’s narrative. While $MGP’s price may appear stagnant, recall that MGP originated from Wombat. A comparable project, $WMX, recently dropped 70%. Without Penpie, it’s easy to imagine $MGP suffering a similar fate.

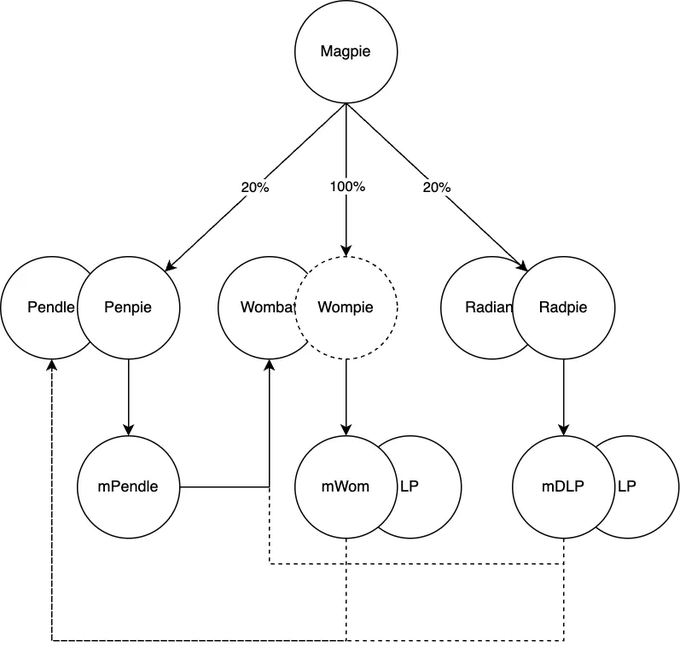

Loop

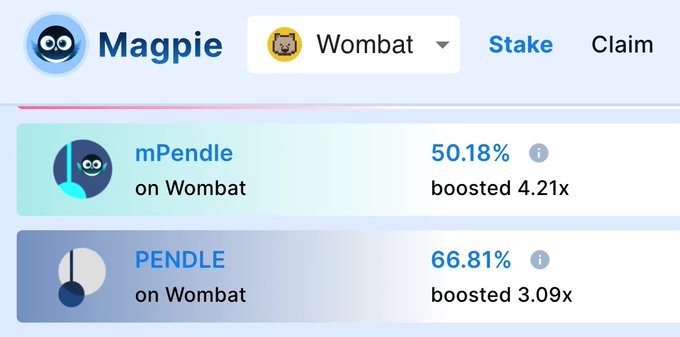

For example, mPendle/Pendle trading pools were recently added to Wombat, seeking bribe support via MGP. As a result, PNP’s incentive spending flows directly into MGP holders’ pockets. Next, could mWOM/mDLP and both sides’ LP tokens be listed on Pendle, using $MGP and $RDP to participate in Penpie’s bribery market? Logically, this seems highly plausible.

Newly emitted tokens circulate back into the Magpie ecosystem through bribes—this is the so-called internal loop. In essence, “the meat rots in the pot,” minimizing net outflows. Naturally, external loops exist too: cross-project resource sharing reduces costs and increases efficiency. For instance, Ankr obtained Wom incentives via Magpie bribes, enabling smooth BD collaboration with Penpie.

Magpie’s endgame should be to never directly distribute incentive tokens, instead optimizing efficiency internally via bribes, creating mutual benefits, and building a more competitive bribery market through shared BD resources.

Moreover, Magpie focuses on the governance rights sector—a perfect match for the subDAO model. Unlike perpetual sectors requiring deep continuous development, once governance infrastructure is built, ongoing work is minimal and highly standardized, allowing new projects to reuse prior efforts extensively.

For example, Penpie quickly launched its bribery market—a product nearly identical to the one Magpie previously built for Wom—demonstrating effective resource reuse.

Leverage

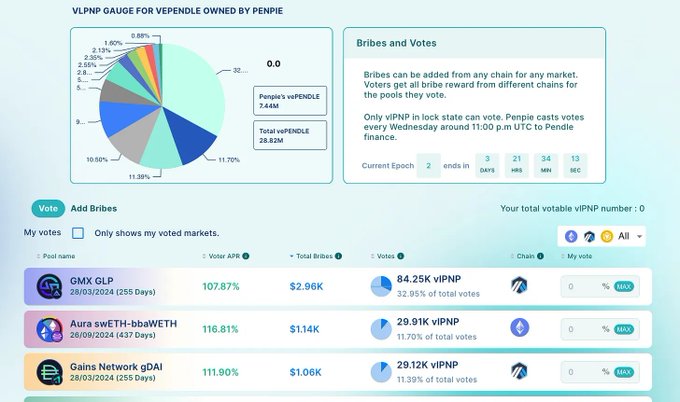

Take Magpie as an example: nominally, Magpie controls 20% of Penpie’s governance power, while Penpie controls 25% of Pendle’s governance. On one hand, Magpie enjoys 20% × 25% = 5% of vePendle’s revenue. On the other hand, regarding protocol-level votes (yes/no), Magpie’s 20% vote effectively determines Penpie’s stance—meaning it indirectly controls nearly 25% of Pendle’s voting power.

This is leverage: although subDAOs dilute economic ownership, governance control remains largely intact. In effect, Penpie acts as a coordinated actor with Magpie—delivering a 1 / 20% = 5x leverage effect.

Execution

The subDAO concept sounds promising, but ultimately depends on execution. MakerDAO’s Spark has been live for six months with little progress—merely a fork of AAVE, followed by no major updates or clear tokenomics. It currently doesn’t qualify as a true subDAO. This underscores the importance of team execution. That said, MakerDAO isn’t necessarily underperforming; its focus is likely prioritized on RWA initiatives.

Conclusion

subDAOs open up growth pathways for web3 projects. Rapid expansion via subDAOs enables sufficient budget for new ventures, alignment with emerging narratives, ecosystem integration, and resource sharing—all contingent on having a team with strong execution capabilities.

Historically, DeFi has mostly functioned as modular components, unable to compete with the vast systems of large centralized exchanges (CEX). But if DeFi can rapidly scale horizontally and evolve into a full-fledged system, perhaps the singularity is near.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News