Deep Dive into RWA: Underlying Assets, Business Structures, Development Pathways, and Potential Opportunities

TechFlow Selected TechFlow Selected

Deep Dive into RWA: Underlying Assets, Business Structures, Development Pathways, and Potential Opportunities

RWA is one of the bridges connecting traditional markets and crypto markets, with the potential to attract incremental users from traditional markets and inject new liquidity, which is beneficial for the development of the blockchain industry.

Author: Colin Lee

Since the beginning of the year, discussions around RWA (real-world assets) have become increasingly frequent in the market. Some believe that RWAs could trigger the next bull market. Several entrepreneurs have also shifted their focus toward RWA-related sectors, hoping to accelerate business growth under this rising narrative.

RWA refers to mapping traditional financial assets onto blockchain through tokenization, allowing Web3 users to trade and invest. These tokens represent rights to the underlying asset's returns. While STOs several years ago were primarily limited to corporate bond financing, today’s RWA scope is much broader—not confined only to primary markets but extending to any asset circulating in both primary and secondary markets. This allows Web3 users to participate via tokenized instruments. Thus, the RWA narrative encompasses a diverse range of asset types and yield profiles.

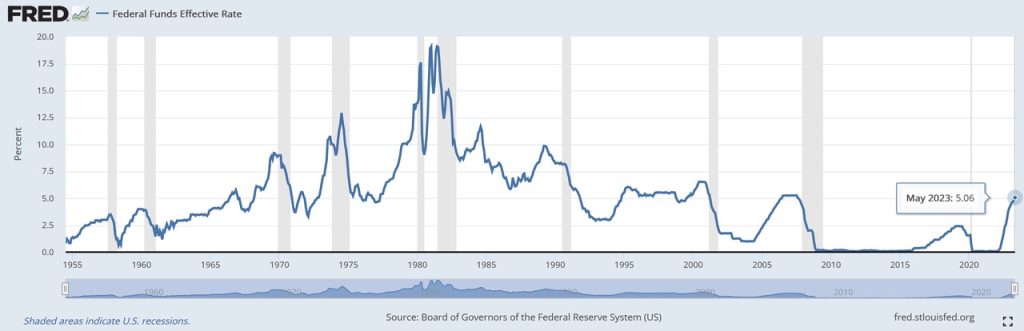

There are several reasons why RWA has gradually drawn market attention: First, the crypto market currently lacks low-risk, USD-denominated assets. Meanwhile, with global interest rate hikes, major economies now offer risk-free rates as high as 4% or more—levels attractive enough for native crypto investors. This mirrors trends during the 2020–2021 bull run when traditional capital entered crypto markets seeking low-risk arbitrage opportunities. Introducing traditional-market products with relatively low risk and higher yields via RWA may appeal to certain investor segments. Second, the crypto market is not currently bullish, and even within native crypto ecosystems, compelling narratives are scarce. RWA stands out as one of the few sectors backed by tangible yield potential, possibly enabling explosive business growth. Finally, RWA serves as a bridge between traditional finance and crypto, potentially attracting new users from traditional markets and injecting fresh liquidity—an undoubtedly positive development for the blockchain industry.

However, judging from current RWA projects, key metrics such as TVL (Total Value Locked) haven’t grown rapidly, suggesting the market might have overly optimistic short-term expectations. For any RWA project, the following dimensions must be carefully considered:

-

Underlying Assets: This is the most critical aspect of the RWA space. Selecting appropriate underlying assets significantly benefits subsequent management processes.

-

Standardization of Underlying Assets: Due to varying degrees of "heterogeneity" across different assets, standardizing them presents differing levels of difficulty. The greater the heterogeneity, the higher the standardization requirements and complexity involved.

-

Off-chain Partnerships and Collaboration Models: High-quality off-chain partners can not only fulfill their obligations smoothly but also help fully unlock the value of the underlying assets.

-

Risk Management: Risk factors arise throughout the lifecycle—from asset maintenance and onboarding to yield distribution. In cases involving debt-based assets, additional risks include collateral liquidation and collections following borrower default.

1. Underlying Assets

The underlying asset is the most crucial element.

Currently, RWA projects mainly involve the following categories of underlying assets:

-

Bond-type assets, primarily short-term U.S. Treasuries or bond ETFs. Notable examples include stablecoins like USDT and USDC. Some lending platforms, such as Aave and Maple Finance, have also joined this category. Treasury bonds/Treasury ETFs currently dominate the RWA landscape;

-

Gold, exemplified by PAX Gold. Still operating under the broader “stablecoin” narrative, its development remains slow due to weak market demand;

-

Real estate RWAs, represented by RealT and LABS Group. Similar to packaging real estate into REITs before tokenizing them. These projects source properties widely, often focusing on cities where the founding team is based;

-

Loan-based assets, including projects like USDT and Polytrade. Asset types vary widely—ranging from residential mortgages and corporate loans to structured finance instruments and auto loans;

-

Equity-based assets, typical examples being Backed Finance and Sologenic. These require actual ownership verification but face significant legal constraints. Crypto-native “synthetic assets,” particularly those tracking publicly traded stocks, overlap heavily with this domain;

-

Others, including farms and artworks—large-scale (high individual asset value) yet poorly standardized asset classes.

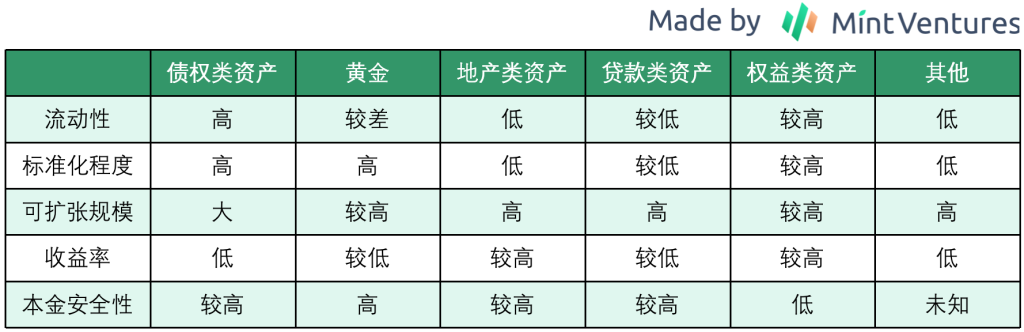

Selecting an appropriate underlying asset requires evaluating five key dimensions: liquidity, degree of standardization, principal safety, scalability, and yield. Using these criteria, we can roughly categorize the characteristics of the above-mentioned assets.

From the perspective of underlying assets, debt-based assets currently appear to be the most promising category. Based on their positioning, they can pursue differentiated strategies such as fiat-collateralized stablecoins or "crypto money market funds." Although the fiat-backed stablecoin sector is already dominated by a few large players with extensive ecosystem integrations, the niche of "crypto余额宝 (money market fund)" remains largely untapped.

For real estate assets, although the REIT model is mature, if project teams choose to directly manage diversified regional portfolios themselves, costs will rise substantially—for instance, managing geographically dispersed properties increases staffing needs, procurement expenses for repairs, and travel overhead. During my evaluation of projects, I encountered one aiming to cap individual property values below $100,000 while spreading holdings across five countries and multiple property types beyond just residential and commercial. While such diversification seems ideal, it introduces significant challenges in disclosure and property management, making rapid expansion difficult in the future.

At present, I do not recommend excessive focus on the “other” category of underlying assets, primarily due to poor liquidity and lack of standardization. Agricultural assets, for example, suffer from high non-standardization, complicating quality assessment. Even at the level of a single farm, crop quality varies significantly, and storage, transportation, and sales involve specialized operations. Delivering returns reliably to investors would require deep industry experience over many years. Economic crops are further affected by unpredictable production cycles and weather conditions, making final monetization highly challenging.

Projects that source and package assets independently face severe limitations in scalability, making rapid growth extremely difficult.

In terms of underlying assets, focusing on bond-type assets as core holdings, supplemented by REIT-like assets to enhance yield, appears to be a more practical and implementable approach.

2. Business Architecture

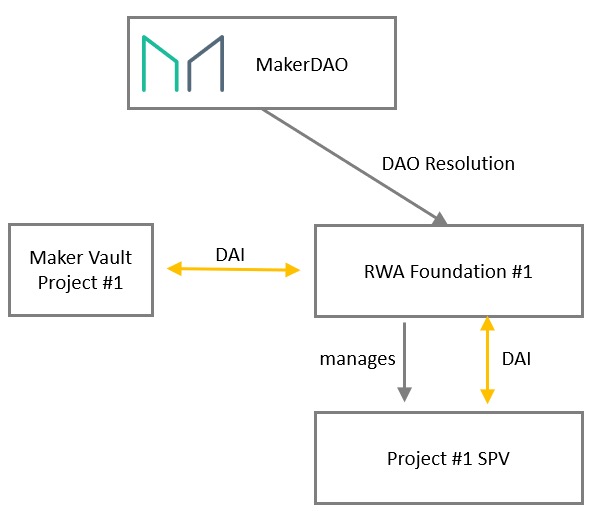

If in previous years there were substantial hurdles to bringing RWAs on-chain, today, thanks to exploratory efforts by leading projects like MakerDAO, clearer pathways have emerged.

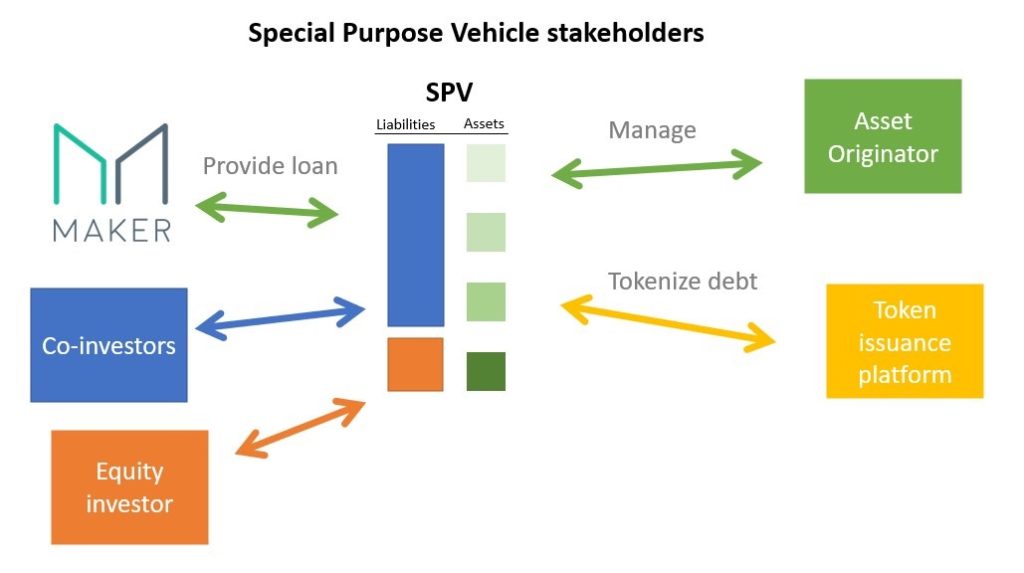

First, to facilitate ease of onboarding RWAs, an RWA Foundation structure can be established. Under this framework, MakerDAO manages multiple RWAs, and new assets can be onboarded simply by launching a Special Purpose Vehicle (SPV) through the foundation.

Second, each SPV can adopt a management model similar to ABS (Asset-Backed Securitization), using asset-backed securities financing structures:

To ensure capital security, MakerDAO invests in senior tranches, while other investors may take junior positions. Other projects can tailor their risk exposure based on target user risk preferences.

Unlike traditional securitization, MakerDAO’s SPVs omit roles such as settlement and custody but introduce token issuance platforms. As regulatory clarity improves, however, settlement and custodial services may eventually become essential components of RWA infrastructure.

3. Risk Management

RWA risk management involves three main dimensions:

1. Underlying Asset Risk Management: The lower the standardization of an asset, the higher the required risk management capability. Compared to forests or farms, government bonds are highly standardized, more liquid, and better priced. Therefore, managing Treasuries is easier. However, even within the same asset class, management difficulty varies by region and country. For example, in some developing nations with low digitization, debt instruments may still exist in paper form. This necessitates secure physical storage during holding periods to prevent damage. Paper-based assets also carry a significant risk of fraud ("bait-and-switch"), which has led to major incidents globally.

In summary, effective underlying asset risk management must first ensure the authenticity and validity of the asset throughout the project lifecycle. Second, it must protect against human-induced devaluation. Third, it should guarantee the ability to sell the asset at fair market value. Lastly, it must ensure safe and smooth delivery of returns and principal to investors. These risks closely resemble those in traditional finance, allowing for adaptation of existing risk mitigation practices.

2. On-chain Risk Management: Since data is brought on-chain, inadequate oversight of off-chain entities may lead to falsified reporting. Such negative cases frequently occur in traditional finance—commercial paper, supply chain finance, and commodities have all seen large-scale fraud. Even with real-time sensor monitoring and fixed delivery points, risks cannot be eliminated entirely.

Given that the RWA industry is still nascent, I expect similar issues to emerge. With no clear regulatory guidelines yet and low penalties for misconduct, the risk of fraudulent data on-chain is significant.

3. Counterparty Risk Management: This type of risk aligns more with traditional finance, but the absence of specific RWA regulations creates uncertainty. For example: What kind of custodian qualifies as compliant? Can current accounting standards accurately reflect the unique features of RWAs? If risks materialize during operations, what resolution mechanisms best protect investors? Clear answers to these questions remain elusive, leaving room for malicious behavior by partners.

4. Current User Structure and Demand

As previously discussed in "Outlook on the On-chain Bond Market in Crypto", due to the extreme volatility and cyclical nature of crypto markets, relatively low-risk, conservative investors struggle to achieve consistent returns. In such an environment, many users exhibit strong risk appetites:

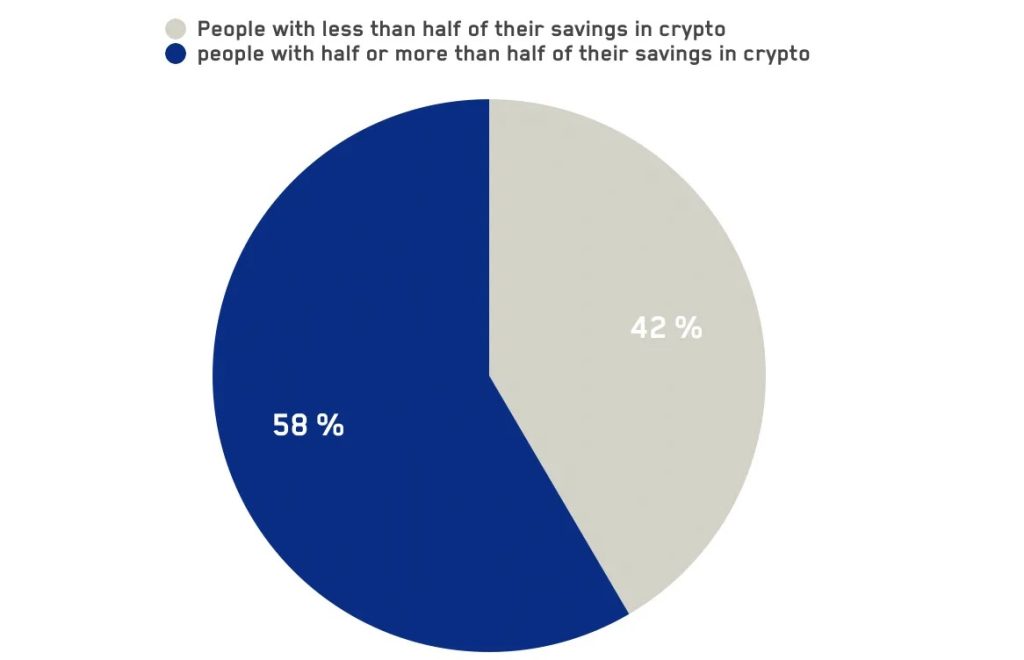

According to a report published in 2020 by dex.blue and others, half of surveyed crypto users had invested 50% or more of their total savings into crypto. Surveys by Pew Research and Binance indicate that younger demographics make up a significant portion of the crypto user base. Given this structure, crypto investors tend to have higher risk tolerance than traditional market participants.

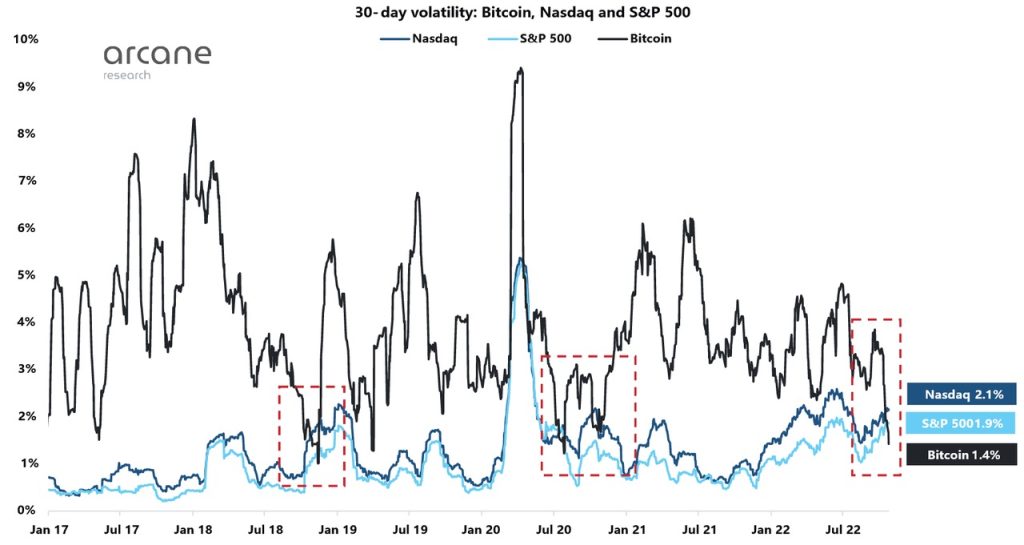

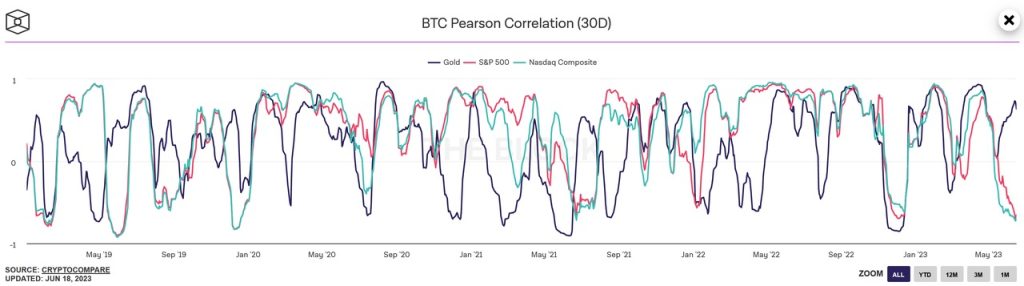

In a market dominated by "arbitrageurs and ultra-high-risk investors," volatility reflects similar patterns: Research from K33 shows that from early 2017 to October 2022, Bitcoin’s volatility was generally higher than that of Nasdaq and S&P 500 indices, with U.S. equities surpassing Bitcoin only during periods of extreme market apathy.

The two main investor groups in crypto likely have different return expectations: For arbitrageurs, “low-risk” opportunities are accessible—for instance, perpetual futures funding rates on Bitcoin have yielded annualized returns of 15%-20% since inception, far exceeding the long-term average of ~5% in global equity markets, and vastly outperforming long-term bond yields. High-risk investors naturally expect even higher returns.

Therefore, even tokenized stocks may struggle to meet current market demands and expected return levels. In the short term, the risk-return profile of many RWA products finds itself in an awkward position.

5. Regulation: A Potential Opportunity

In early June, the U.S. SEC announced that tokens including BNB, BUSD, MATIC would be classified as securities, sparking regulatory concerns and causing noticeable price declines in affected assets.

If the SEC's approach gains recognition among G20 nations or other jurisdictions—and more tokens are categorized as securities under traditional frameworks—future on-chain token issuance may fall under regulatory purview. Early signs point in this direction: whether in the U.S., Japan, or EU countries, stablecoin regulations are increasingly aligning with traditional banking norms. It’s plausible that future token regulation will draw inspiration from securities laws.

Should this scenario unfold, traditional finance professionals may feel more confident bringing assets on-chain: local assets gaining access to global liquidity. This concept has already gained traction among some RWA entrepreneurs who, despite geographic constraints, leverage blockchain to attract global investors. For these practitioners, regulated on-chain asset deployment offers two advantages: 1) Access to global liquidity pools, freeing fundraising from geographical limits and potentially lowering capital costs; 2) Ability to find investors with lower yield expectations than local ones, expanding project feasibility.

Simultaneously, user-side regulations are advancing—particularly KYC (Know Your Customer). Native crypto projects typically require only a wallet, but early-stage startups conducting private fundraising increasingly rely on KYC to verify accredited investor status. Projects integrating RWA, such as Maple Finance, treat KYC as an essential part of customer acquisition. If KYC becomes standard across new projects, a clearer regulatory landscape combined with identity verification could bring an added benefit: increasing confidence among mainstream investors entering the market.

Such users prefer familiar assets while maintaining curiosity about emerging crypto-native instruments. At this juncture, RWA can serve as a key investment avenue for these more conventional investors.

6. Possible Development Paths for RWA

In the short term, RWA brings three main benefits to crypto investors:

1. Low-risk, fiat-denominated investment options: Major economies led by the U.S. now offer risk-free rates above 3%, clearly outpacing borrowing yields across various USD-denominated lending protocols in crypto. Without requiring leveraged compounding, these provide very low-risk investment opportunities. Projects like Ondo Finance, Maple Finance, and MakerDAO have launched U.S. Treasury yield-based investment products, highly appealing to fiat-settled investors. This segment could give rise to a “crypto余额宝 (money market fund)” equivalent.

2. Portfolio Diversification: Take Bitcoin as an example—its correlation with gold and U.S. equities fluctuates across market cycles.

Even during macro-driven bull runs post-2020, different asset classes continue offering diversification benefits.

For portfolio-oriented investors, combining native crypto assets with various RWAs enables greater risk diversification.

3. A tool for investors in developing countries to hedge against domestic currency volatility: Nations like Argentina and Turkey face persistently high inflation. RWA can help investors in these regions partially hedge against local currency depreciation and achieve global asset allocation.

From these three perspectives, RWAs most likely to gain widespread adoption in the near-to-medium term are sovereign debt instruments from major economies—high-yield, low-risk assets made attractive by recent rate hikes.

Looking ahead, as regulatory frameworks become clearer, more mainstream investors enter the crypto space, and user interfaces improve, RWA has the potential to mirror the explosive growth seen in China’s fintech sector a decade ago:

1. Blockchain-based RWA assets offer unprecedented accessibility to global retail investors: As the most familiar asset class for everyday people, RWA could become the primary on-chain investment vehicle for non-native Web3 users. For them, the borderless, permissionless nature of on-chain assets opens access to a wider range of global investments. Conversely, for entrepreneurs, this offers unparalleled user reach, scale, and ultra-low customer acquisition costs. The rapid rise and broad adoption of USDT and USDC as “on-chain dollars” have already begun validating this trend.

2. RWA assets may spawn new DeFi business models: LSD (Liquid Staking Derivatives) acted as a novel underlying asset that catalyzed the rapid growth of LSD-Fi. Beyond revitalizing established models like asset management, spot trading, and stablecoins, it spotlighted underappreciated areas such as yield volatility. If RWA becomes a major category of underlying assets, introducing vast external yield streams could foster entirely new DeFi business models. In the future, RWA could combine with native crypto assets and strategies to create hybrid products, helping adventurous users explore unfamiliar territory through familiar entry points. From this angle, the next ultra-high-TVL RWA+DeFi project could well be a “on-chain余额宝” (money market fund).

3. The ongoing tension between industry innovation and regulation will eventually resolve, enabling compliant customer acquisition: Whether in Western nations or Hong Kong, regulatory clarity is inevitable. As the crypto industry grows toward a $10 trillion valuation, regulators won't stand idle. As policies clarify, previously unfeasible businesses can launch—such as issuing stablecoins through compliant channels in Hong Kong, or exploring integration between blockchain and traditional industries in the Middle East.

Long-term, one of the key drivers of vibrant crypto growth is abundant liquidity. With regulatory frameworks in place, RWA—especially fiat-collateralized stablecoins—is poised for rapid expansion. Especially under the next wave of global monetary easing, new entrants supported by strong ecosystems and distribution channels could see compliant fiat-backed stablecoins replicate the meteoric growth path of USDT.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News