RWA Real-World Implementation: Ondo Finance's On-Chain Bond Experiment and Institutional Innovation

TechFlow Selected TechFlow Selected

RWA Real-World Implementation: Ondo Finance's On-Chain Bond Experiment and Institutional Innovation

In the process of integrating DeFi with traditional finance, the RWA sector has undergone three evolutionary phases: from initial STO attempts, to yield-bearing tokens centered on U.S. Treasuries, and finally to high-performance public chains combined with structured credit products from 2023 to 2025. Fixed-income RWAs, especially U.S. Treasuries, are at the forefront of this transformation. Taking Ondo Finance as an example, this article analyzes its product logic, technical implementation, and risk control mechanisms, comparing it with projects such as Maple and Centrifuge. Key insights: compliance, transparency, and liquidity are critical to the success of fixed-income RWAs; token architecture (accrual vs. rebase) plays a pivotal role

The Paradigm Evolution and Real-World Structure of RWA

1.1 Three-Stage Evolution of RWA

The evolution of RWA is a slow transformation driven by the joint forces of blockchain capability stacks, financial market demand, and regulatory environments. A brief review of three stages:

- Phase One: STO Experimentation (2015–2020) Before Ethereum's rise, many early attempts involved "tokenizing" assets such as stocks, bonds, and real estate rights into security tokens (STOs). Traditional securities were mapped onto blockchains via legal contracts. Unfortunately, this phase struggled due to immature on-chain liquidity infrastructure, weak Oracle awareness, lack of cross-chain mechanisms, and mismatched secondary markets. Most assets ultimately continued trading in traditional markets, with blockchain serving only as a formal representation.

- Phase Two: Interest-Bearing Stablecoins / Tokenized Treasury Bonds (2020–2023) As DeFi ecosystems matured, stablecoins became the primary gateway for capital entering blockchains. With growing exposure to credit crises in crypto, more capital sought stable, low-risk returns. U.S. Treasury and government bonds, seen as foundational credit assets, gradually became tokenized and integrated into stablecoin reserves or issued as standalone interest-bearing tokens. In this phase, RWA’s dominant form shifted from direct equity STO mapping to bringing low-risk yields on-chain through Treasury-backed stablecoins or specialized tokens.

- Phase Three (Current and Future): Structured Credit + High-Performance Chains and Cross-Chain Liquidity By 2023–2025, driven by multiple factors, RWA entered a more complex stage. The scale of tokenized U.S. Treasuries rapidly expanded, while new challenges emerged: how to support credit-based assets, enable efficient circulation across multiple chains, reduce cross-chain friction, and leverage high-performance public chains as infrastructure. At this stage, RWA is no longer just asset tokenization but a combination of “liquid assets + structured products + composable financial primitives.”

This paradigm shift implies that blockchain may evolve beyond a simple ledger carrier to become mainstream financial infrastructure.

1.2 Current Asset Distribution Landscape of RWA

As of October 2025, according to CoinGecko’s “RWA Report 2024” and data from RWA.xyz, RWA assets are concentrated in a few standardized, highly liquid asset types. Key categories include:

- Private Credit / Private Debt: This is currently the largest segment in the RWA ecosystem, totaling approximately $17.4 billion, over 50% of total RWA value. It includes institutional credit pools, corporate accounts receivable, and structured debt products, offering typical on-chain yields between 8–15% [1].

- U.S. Treasury / Government Bond Tokenization / Interest-Bearing Stablecoins: Government bonds remain the most trusted and compliant RWA asset class, valued at around $8.3 billion. The core logic is “using Treasuries to back on-chain interest rates.” Notable examples include Ondo’s OUSG and USDY [2], Franklin Templeton’s BENJI fund, and BlackRock’s BUIDL fund.

- Commodities / Gold Tokenization: Worth about $3.1 billion, primarily represented by gold tokens like PAXG and XAUT, used as non-correlated hedges within crypto portfolios. Given gold’s inherent value anchoring and global pricing system, these assets perform steadily during market downturns.

- Institutional Alternative Funds / Private Equity Fund Tokenization: Approximately $2.8 billion in size, where traditional funds use SPV structures for on-chain issuance—examples include Janus Henderson’s JAAA fund and Blockchain Capital’s BCAP fund. These products enhance transparency and liquidity for private funds, acting as a bridge for traditional asset managers entering DeFi.

- Non-U.S. Government Debt: Around $1 billion, mainly involving short-term government bills from Europe and emerging markets being tokenized. Still in pilot stages, these products are typically issued by TradFi funds through qualified investor channels.

- Traditional Stocks / ETF Tokenization: About $680 million, still exploratory. Companies like Ondo, Securitize, and Backed Finance have launched tokenized U.S. stock or ETF products, opening new “equity asset” pathways into on-chain capital markets. However, limited by compliance, liquidity, and valuation synchronization, volumes remain small.

American Fixed-Income RWA Case Study: Deep Dive into Ondo Finance

Within the U.S. Treasury-based RWA sector, Ondo Finance stands out as one of the most representative and fully implemented cases.

2.1 Product Logic: How to Bring Treasuries Alive On-Chain

First, examine how Ondo builds a Treasury tokenization product combining low risk with liquidity.

2.1.1 Asset Allocation and Portfolio Strategy

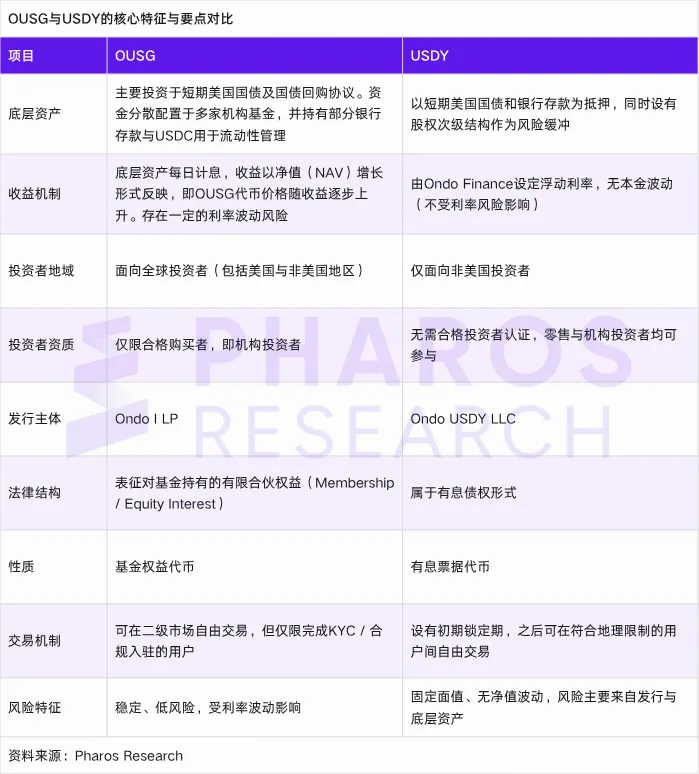

Ondo’s current tokenized financial products include the Short-Term US Government Treasuries fund ($OUSG) and the interest-bearing stablecoin Ondo US Dollar Yield Token ($USDY).

Unlike USDY, OUSG allocates its portfolio across multiple institutionally managed Treasury/money market funds such as BlackRock’s BUIDL, Franklin’s FOBXX, WisdomTree’s WTGXX, FundBridge’s ULTRA, Fidelity’s FYHXX, along with some cash/USDC as a liquidity buffer. This diversified allocation reduces reliance on any single fund or manager. This strategy means OUSG does not directly hold native Treasuries but invests in institutional funds based on them.

USDY’s underlying assets consist mainly of short-term U.S. Treasuries and bank deposits. Its Treasury portion is held via on-chain instruments, while bank deposits reside in regulated financial institutions, backed by an equity subordination structure as a risk buffer. Unlike OUSG’s indirect exposure through fund shares, USDY directly links to income-generating claims, with Ondo Finance dynamically adjusting yields based on market rates.

2.1.2 Token Architecture Design: Accruing + Rebasing + Instant Minting and Redemption

In token design, both OUSG and USDY offer two versions:

- Accruing OUSG/USDY: Each token’s net asset value (NAV) increases over time as earnings accumulate;

- Rebasing rOUSG/rUSDY: Price fixed at $1.00, with the system minting additional tokens daily to distribute yield to holders.

This dual-version design offers greater flexibility, especially for institutional users, and official documentation confirms 1:1 convertibility between versions.

These fixed-income notes also support 24/7 instant minting and redemption using USDC or PYUSD. However, there are daily caps; amounts exceeding limits or large redemptions may trigger non-instant processing.

2.1.3 Multi-Chain Deployment + Cross-Chain Bridging Strategy

To circulate OUSG across multiple ecosystems (e.g., Ethereum, Solana, Polygon, XRPL), Ondo has developed a cross-chain deployment and bridging solution. For example, earlier this year, Ondo partnered with Ripple to deploy OUSG on XRPL, enabling RLUSD stablecoin as settlement currency for minting/redeeming operations [3][4]. This cross-chain strategy enhances liquidity and user reach while offering low-friction access for capital on different chains.

2.1.4 Fee Model and Yield Distribution

Ondo charges a management fee of 0.15% annually—a conservative rate. Yield distribution (whether accruing or rebasing) is based on net interest from the underlying portfolio minus costs. There may be minimal transaction fees or slippage compensation for minting/redeeming, though certain operations are advertised as zero-cost.

In summary, Ondo’s key product insight lies in transforming the safest traditional assets into usable on-chain tools through a stable, verifiable Treasury portfolio, flexible token architecture, cross-chain availability, and low-fee design.

2.1.5 Current Performance

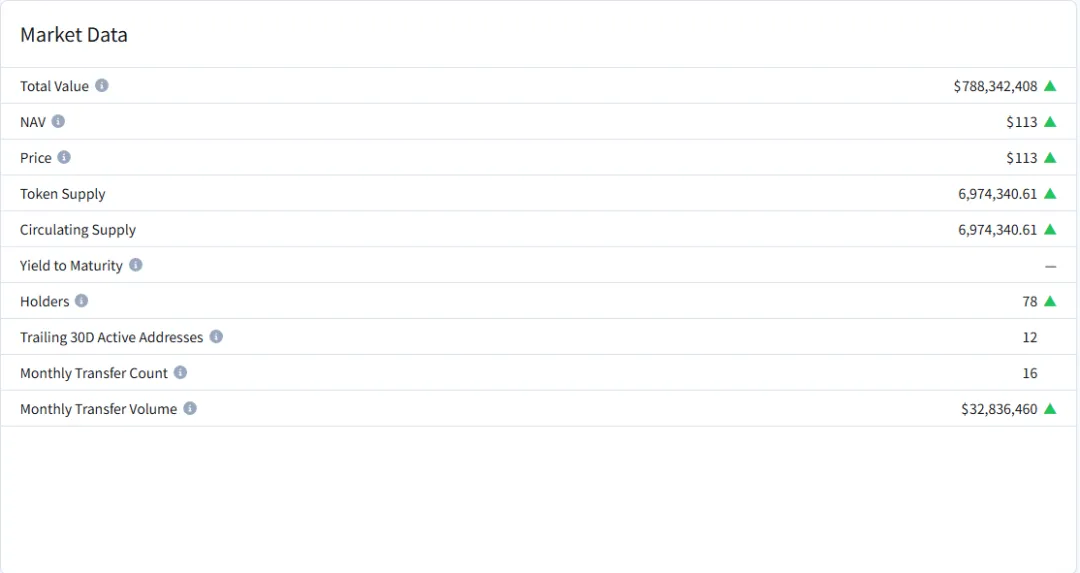

As of October 2025, OUSG’s total asset value was approximately $792 million, with a token NAV of around $113 per unit. Over the past 30 days, secondary market transfer volume reached about $32.85 million, with a circulating supply of roughly 7,011,494 tokens, held by only about 79 individuals and 12 active addresses. These figures indicate OUSG has achieved scale and compliance structure, yet its secondary market activity remains low, with concentration among a few large holders or institutions.

In contrast, USDY shows stronger expansion in user reach and on-chain engagement. Its total asset value is about $691 million, with a token NAV of approximately $1.11 and an APY of around 4.00%. More importantly, it has about 15,959 holders, 1,124 monthly active addresses, and a monthly transfer volume of ~$22.66 million. These numbers clearly show broader adoption and higher on-chain activity.

2.2 Technical Architecture: On-Chain Systems and Trusted Interfaces

Product logic forms the foundation, but successful implementation depends on reliably connecting off-chain assets, cross-chain mechanisms, and on-chain contracts.

2.2.1 Contract System and Permission Controls

OUSG deploys standard ERC-20 or security-token-compatible contracts on mainnets (e.g., Ethereum), supporting minting, redemption, price queries, and rebasing. Contracts incorporate permission controls (admin roles, pause functions, minting whitelists, redemption limits) to prevent misuse. To mitigate risks, contracts undergo rigorous audits including static analysis and fuzz testing. Public records confirm Ondo’s contracts have audit backing.

2.2.2 Net Asset Value / Valuation Oracle and Transparency Mechanisms

To synchronize on-chain token values with off-chain assets, reliable, tamper-resistant NAV oracles are essential. Ondo engages third-party fund administrators to access underlying accounts, calculate daily NAV and portfolio composition, then feed this data on-chain via off-chain–on-chain interfaces using oracles (primarily Pyth Network and Chainlink).

For transparency, Ondo provides investors with detailed portfolio breakdowns, daily reports, audit results, and custodian disclosures. Platforms like RWA.xyz clearly display key metrics such as asset composition, holder count, and NAV for OUSG and USDY.

2.2.3 Cross-Chain Bridging and Arbitrage Synchronization

Market cap trends of Treasury-based RWA products across different public chains

Source: RWA.xyz

Ondo’s cross-chain design ensures price consistency and redeemability of OUSG and USDY across chains through bridging mechanisms (lock/mint and unlock/burn) combined with arbitrage incentives. When OUSG prices deviate from NAV on a chain, arbitrageurs can exploit cross-chain redemption, transfer, and minting/redemption loops to correct spreads.

Cross-chain bridges are high-risk zones. Therefore, Ondo employs multi-signature controls, withdrawal buffers, and asset isolation as protective measures. The XRPL deployment exemplifies this approach—OUSG is hosted on XRPL with RLUSD as the settlement channel for cross-chain minting/redemption. Such collaborations are central to Ondo’s ecosystem expansion strategy.

2.2.4 Enabling Composability / Lending Integration

To make OUSG and USDY genuinely useful in DeFi, Ondo introduced companion protocols like Flux, allowing OUSG to be used as collateral for borrowing and participation in liquidity mining or portfolio strategies (similar to treating OUSG as a base asset in DeFi). This composability transforms OUSG from a passive “yield-holding tool” into an active participant in complex financial operations.

Additionally, in February 2025, Ondo announced its own base layer chain (Ondo Chain) tailored for large-scale RWA operations.

2.3 Risk Management: From Trust Building to Exception Handling

Even with solid product and technical foundations, institutional capital will hesitate without robust risk controls. Ondo’s approach to risk deserves close examination.

2.3.1 Compliance, Legal Structure, and Asset Segregation

Ondo places OUSG under regulated trust/SPV structures, treating its tokens as products compliant with U.S. securities law, offered to accredited investors under Regulation D. By setting investor qualification thresholds, conducting KYC/AML checks, and maintaining address whitelists, Ondo implements compliance access control on-chain. Underlying assets (such as Treasuries and fund shares) are held by independent custodians, with contracts and fund agreements clearly defining ownership and legal rights—ensuring investors can legally claim their assets even if technical or operational risks arise.

In contrast, traditional DeFi protocols rely solely on smart contracts for fund management and yield distribution, often lacking clear legal entities or defined asset ownership, leaving users with extremely limited recourse in case of bugs, liquidations, or hacks. This combination of “legal + compliance + custody” is Ondo’s key differentiator from pure DeFi projects.

2.3.2 Transparency / Audits / Disclosure Mechanisms

Ondo hires third-party fund administrators to compute daily NAV and disclose portfolio details and reports. Annual audits are conducted by external firms covering custodied assets, cash flows, and reporting processes.

At the on-chain level, contract logs allow public viewing of mint/redeem records, token circulation data, and holder address distributions. Platforms like RWA.xyz also display key OUSG metrics such as AUM, holder count, and NAV changes. This “dual on-chain + off-chain” transparency model forms the basis of trust [5].

OUSG Current Market Data Overview

Source: RWA.xyz

2.3.3 Redemption / Liquidity Risk Control

To avoid runs, Ondo Finance implements a three-tier hybrid redemption mechanism for its on-chain Treasury products: “instant redemption limits + buffer cash pool + queued redemption.” Users within limits can redeem instantly; those exceeding limits enter a non-instant process [6].

Specifically, the buffer pool consists of cash and highly liquid assets to meet daily redemptions and sudden liquidity needs, avoiding forced Treasury sales during volatility. Combined with this is the “instant redemption limit,” capping the amount eligible for immediate processing per day or transaction. Requests within the cap are fulfilled directly from the buffer or operating liquidity. Exceeding the cap triggers entry into a “non-instant redemption” process, potentially requiring queue-based execution, asset liquidation, or waiting for pool replenishment. The queuing mechanism activates when redemption volume surpasses thresholds, balancing user experience with asset safety through periodic funding resets. This layered redemption system balances liquidity and stability, preserving 24/7 mint/redeem functionality while mitigating systemic risks from mass redemptions.

2.4 Institutional Participation Pathways: Who, How, Why

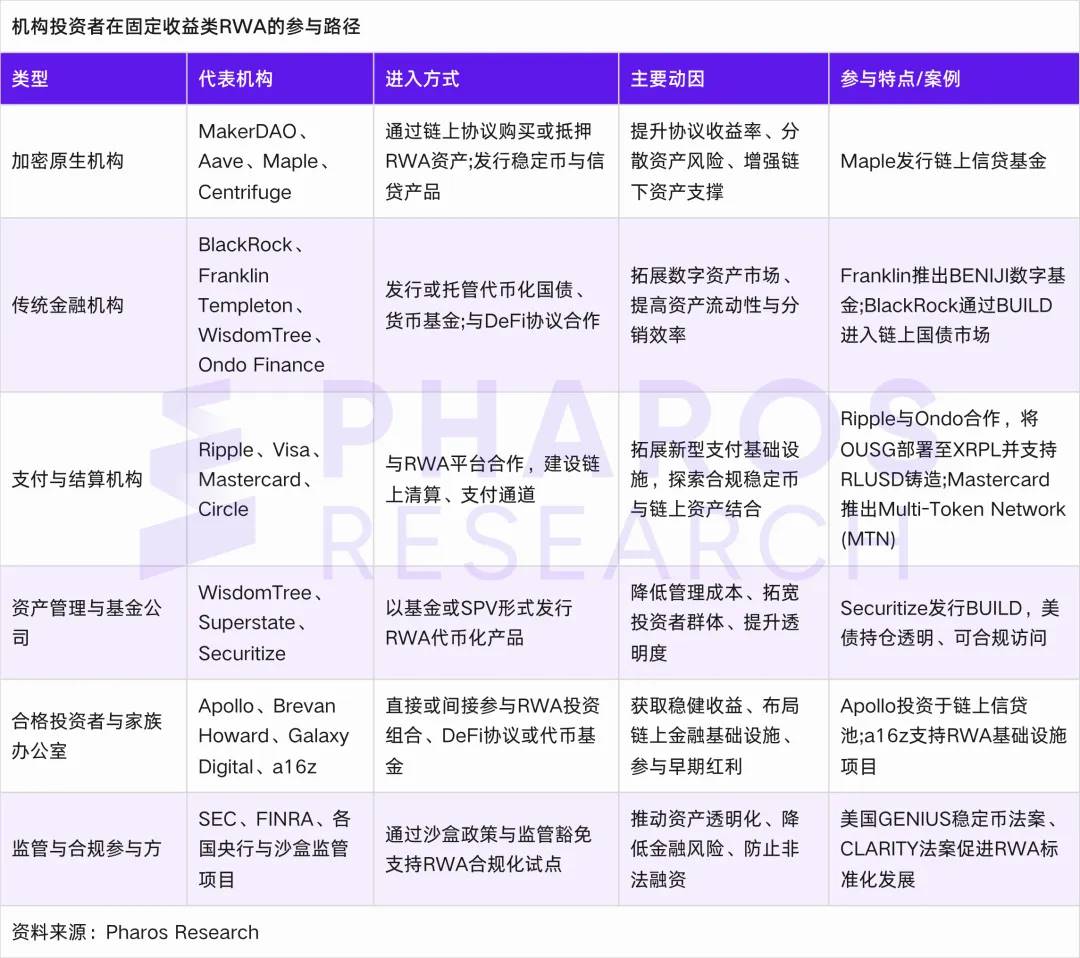

After building the product and technology, the critical next step is attracting institutional capital. The table below summarizes institutional investor pathways in fixed-income RWA for reference.

2.4.1 Crypto-Native Institutions / DAOs / Protocols

This group are often early adopters, holding large stablecoin balances but lacking safe yield options. Through OUSG and USDY, they earn ~4–5% annualized compound yield (APY), comparable to short-term U.S. Treasury returns.

DAOs, projects, and crypto funds are comfortable with on-chain systems and smart contract risks, making them natural first users for Ondo.

2.4.2 Traditional Financial / Asset Management Firms / Banks

These institutions demand high standards in legal structure, compliance, asset custody, and operational efficiency. Ondo’s strategy includes:

- Reducing legal and trust barriers via auditable, lawful SPV/trust structures, KYC/compliance gates, and transparent disclosures;

- Providing professional interfaces such as APIs, custody integration, and batch operations for familiar onboarding;

- Offering competitive fees, liquidity, and arbitrage cost advantages to ensure capital efficiency.

In April 2025, Ondo partnered with Copper Markets for custody services, enabling institutional users to securely hold OUSG and USDY. While specific institutional clients remain undisclosed, securing even a few early adopters creates demonstration effects, lowering psychological barriers for others.

2.4.3 Family Offices / High-Net-Worth Individuals / Trusts / Foundations

Though smaller in scale than major institutions, these users value flexibility, low risk tolerance, and stable returns. Once sufficient trust is established, they are willing to allocate partial capital to OUSG or USDY for secure yields [7].

For them, ease of use, transparent reporting, customer support, and legal safeguards are crucial experiential factors. If Ondo excels here, it can attract long-term holders from this segment.

2.4.4 Market Makers / Liquidity Providers / Arbitrageurs / DeFi Protocols

These players act as market lubricants.

- Market makers and arbitrageurs maintain OUSG’s price peg by trading spreads across chains and pairs;

- Liquidity providers offer OUSG/USDC (or other) pairs on DEXs to earn fees;

- DeFi protocols integrate OUSG into collateral, lending, and strategy modules, expanding its utility.

To attract these participants, Ondo must ensure ample liquidity, strong contract compatibility, and low cross-chain costs. These actors significantly enhance OUSG’s composability and ecosystem influence.

2.4.5 Results and Scale Achievements

By mid-2025, Ondo’s OUSG and USDY were widely reported as among the top three tokenized U.S. Treasury products, with total assets reaching the billion-dollar tier. Its deployment on XRPL further boosted market activity through Ripple’s liquidity commitments [8].

Ondo was also integrated into Mastercard’s Multi-Token Network (MTN), becoming the first RWA provider on the network to promote token usage in traditional payment/financial systems. These moves signal Ondo’s transition from DeFi fringe to mainstream financial infrastructure [9].

Comparison and Trend Outlook: Maple, Centrifuge, and Future Directions

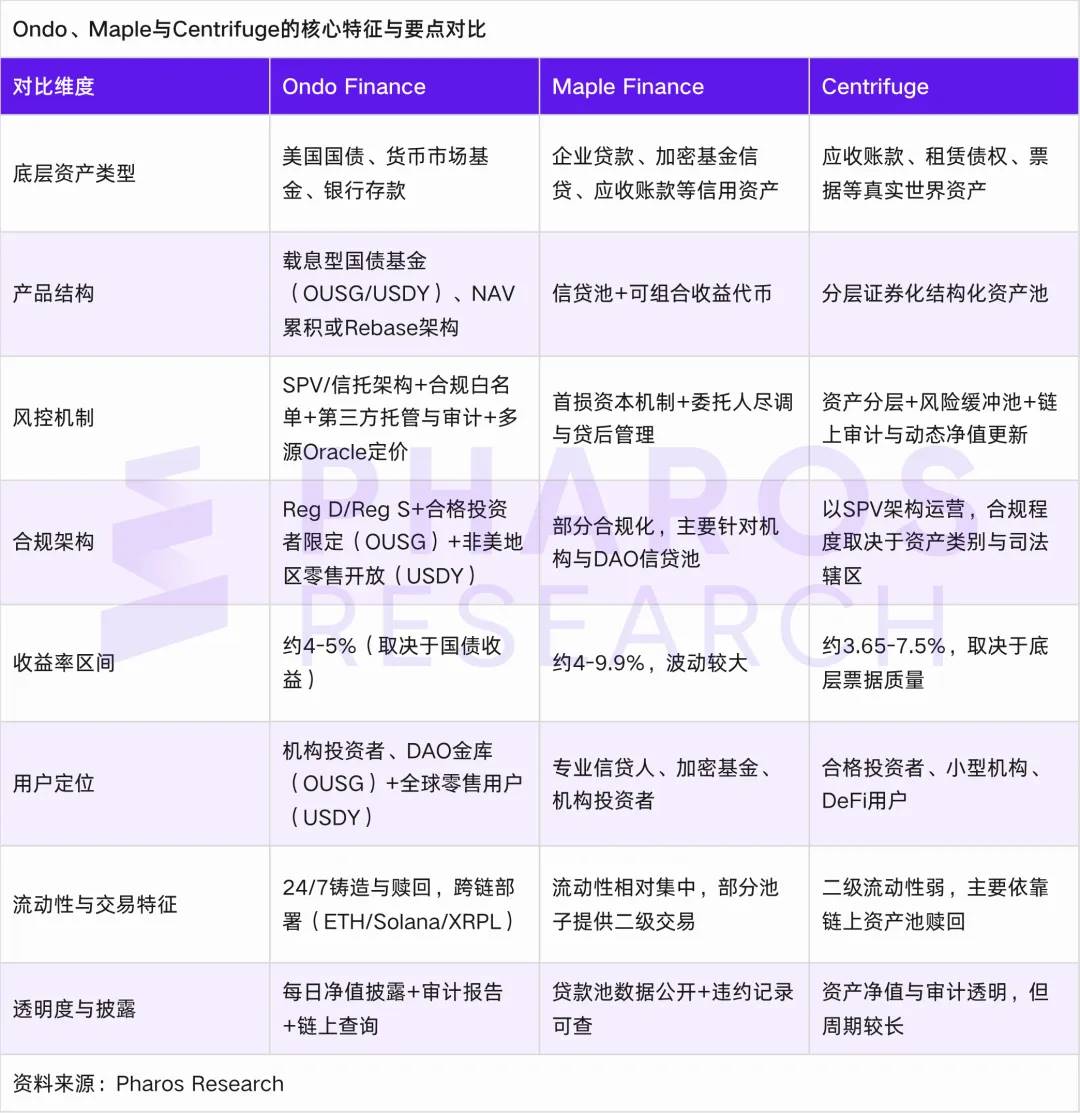

Having understood Ondo’s success path, we now broaden our view to compare strategies and risks of credit/structured RWA projects like Maple and Centrifuge, identifying potential paths Ondo could follow and future industry trends.

3.1 Credit Buffering and Structuring: Ondo’s Next Step?

Ondo Finance marks the arrival of fixed-income RWA into a “standardized and institutionalized” phase.

However, for RWA to become true mainstream financial infrastructure, Treasury-only assets cannot sustain market depth and diversity. To advance credit extension and yield layering, Ondo must draw lessons from mature RWA projects—most notably Maple Finance and Centrifuge. The former offers insights into on-chain credit lending and risk buffering; the latter demonstrates structured securitization and tiered yield distribution [12][14].

From Maple’s development logic, Ondo can learn the core concept of “institutionalized risk buffering under credit expansion.” Maple’s business centers on institutional credit loans, featuring three key roles: borrowers, lenders, and Pool Delegates. Borrowers are typically crypto-native entities like market makers or hedge funds, receiving undercollateralized loans (0–50% collateral ratios). Lenders deposit capital into liquidity pools for interest, with principal redeemable only after loan maturity. Pool Delegates act as fund managers, assessing borrower creditworthiness and setting loan terms, while staking significant capital (typically ≥$100k in USDC-MPL LP position) to compensate lenders in case of default. This design establishes an on-chain “skin-in-the-game + risk-sharing” credit guarantee model, dynamically balancing loan safety and incentive alignment.

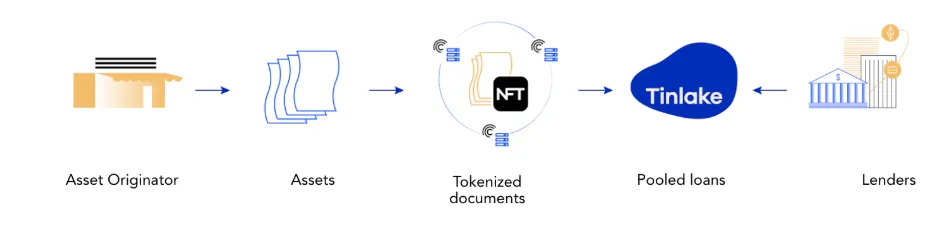

Centrifuge’s experience offers Ondo a framework for structured and composable asset securitization. Centrifuge’s Tinlake system uses real-world assets like accounts receivable as collateral, issuing tiered yield tokens with varying risk profiles, allowing investors to choose based on appetite. This tranching mechanism enhances RWA risk management flexibility and enables modular participation in different risk-level pools [11][13]. If Ondo adopts this model, it could build structured modules atop the low-risk OUSG/USDY layers. For instance, future “OND Yield+” or “OND Structured” products might use OUSG as a safe base layer, adding credit bonds or high-yield bond tiers to create multi-layer risk-return matching. This would satisfy diverse institutional and retail demands while unlocking higher yield potential without compromising base-layer stability [15].

Schematic illustration of Tinlake’s asset securitization and tokenization process.

Source: Centrifuge

3.2 Trend Observations and Future Paths

Basing on the above comparisons and case studies, here are likely development paths and trends for fixed-income RWA over the next 2–3 years:

- Treasury tokenization matures: Over the next 1–2 years, U.S. Treasury RWA will continue expanding, deeply integrating with stablecoin and institutional cash management, becoming a mainstream asset class.

- Gradual credit expansion: Credit assets (high-quality bills, investment-grade corporate bonds, SME loans, receivables) will progressively join the RWA ecosystem, supported by credit buffers, insurance, credit scoring/data integration, and enhanced legal contracts.

- High-performance and cross-chain chains become infrastructure focus: As RWA scales, demands for performance, cost-efficiency, and cross-chain speed grow. High-performance L1/L2 chains (supporting fast finality, state parallelism, lightweight execution) will emerge as the next infrastructure frontier.

- Bridge and cross-chain security evolves: Cross-chain bridging is essential for RWA growth, but security remains paramount. Safer multi-sig/exit mechanisms, buffers, and cross-chain insurance will become standard.

- Standardized compliance and industry infrastructure: Standardized token specs (security token standards, KYC-compliant whitelist APIs), custodial platforms, audit/reporting/credit rating services, and legal frameworks will become essential public utilities.

- Capital tranching + modular architecture: Future platforms will likely offer “multi-risk/multi-yield” modules (safe layer, credit layer, leveraged layer), enabling capital of all risk appetites to participate—not just single-point exposure.

- Regulatory policy and financial infrastructure convergence: Regulatory shifts in the U.S., EU, Hong Kong will be decisive. Policies such as U.S. stablecoin bills, securities law reforms, and custody regulations will directly shape RWA’s implementation boundaries.

Conclusion

The significance of fixed-income RWA extends far beyond simply moving traditional assets “onto the chain.” Ondo Finance’s practice proves that on-chain assetization gains systemic relevance only when financial soundness in product design, secure and controllable smart contracts, transparent and robust risk frameworks, and institutional trust converge into a closed loop.

Yet, Ondo’s success is merely a starting point. As Treasury tokenization matures, the core competition in RWA will shift from “can it go on-chain” to “can it build new liquidity structures and capital orders once on-chain?” Credit expansion, structured securitization, cross-chain interoperability, asset pooling, and regulatory collaboration will define the next era. Projects that balance technological efficiency, financial innovation, and institutional trust will have the opportunity to truly shape the future of financial infrastructure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News