Why RWA Became the Key Narrative in 2025

TechFlow Selected TechFlow Selected

Why RWA Became the Key Narrative in 2025

In-depth analysis of the RWA sector landscape.

Author: OKX Research Institute

RWA (Real World Assets) is becoming the new darling of global capital.

In simple terms, RWA refers to moving valuable, ownership-based assets from the real world—such as houses, bonds, stocks, and other traditional financial instruments, even assets like art, private loans, or carbon credits that are typically hard to trade directly—onto blockchains, transforming them into tradable, programmable crypto assets. This enables anyone, anywhere, to trade these assets on-chain 24/7 at lower cost.

OKX Research Institute believes RWA is not a fleeting crypto trend but a crucial bridge between Web3 and the multi-trillion-dollar traditional financial market. From asset securitization in the 1970s to today’s RWA transformation, the core objective has always been enhancing liquidity, reducing transaction costs, and expanding the user base. This report aims to deeply analyze the RWA landscape and explore its future potential.

1. RWA Market Overview: Development History, Scale, and Institutional Drivers

Take rental housing as an example: RWA is reshaping traditional models. Without intermediaries or "one-month deposit plus three months' rent," users can simply pay for one month via mobile app to move in automatically; upon check-out, security deposits are instantly refunded with one click; during temporary relocation, remaining lease periods can be transferred on-chain—entirely transparent and tamper-proof. Landlords use RWA to verify property rights on-chain, with rent automatically distributed via smart contracts, and even monetize future lease income or rental revenue rights in advance. RWA transforms real estate into flexible, circulating crypto assets, significantly improving efficiency.

RWA represents the inevitable machine-readable evolution of traditional financial assets on-chain—not creating new assets, but building a new, efficient operating environment for existing ones.

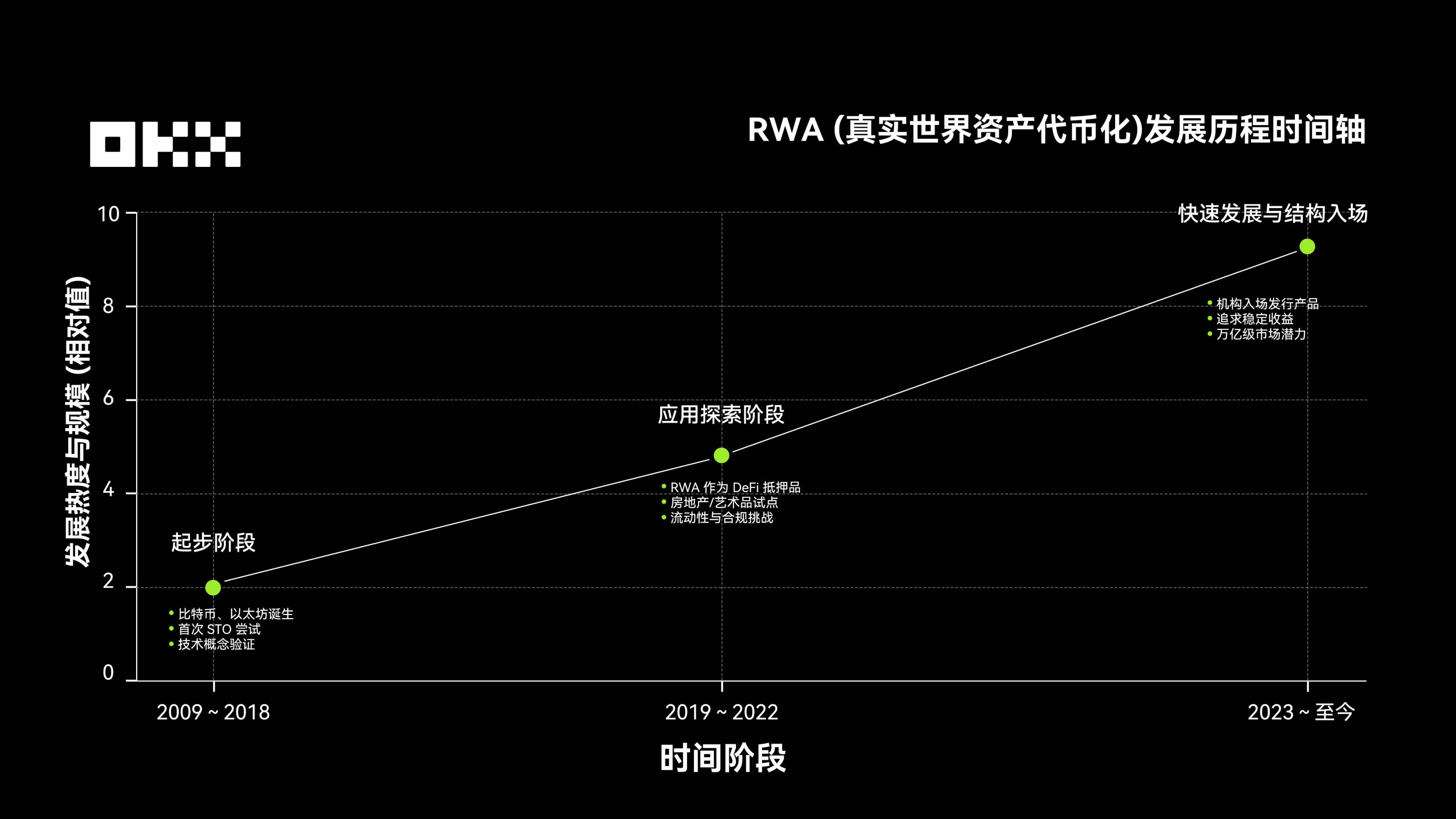

RWA development has gone through roughly three phases: 2009–2018 was the initial stage, marked by the emergence of Bitcoin and Ethereum, initiating early exploration of asset tokenization and STO; 2019–2022 saw application experimentation, with RWA introduced into DeFi as collateral and pilot projects for real estate and art assets going on-chain, though still facing challenges in liquidity and compliance; since 2023, driven by investor demand for stable returns and active institutional issuance of tokenized products, the RWA market has entered a rapid growth phase, continuously expanding toward a trillion-dollar new financial market.

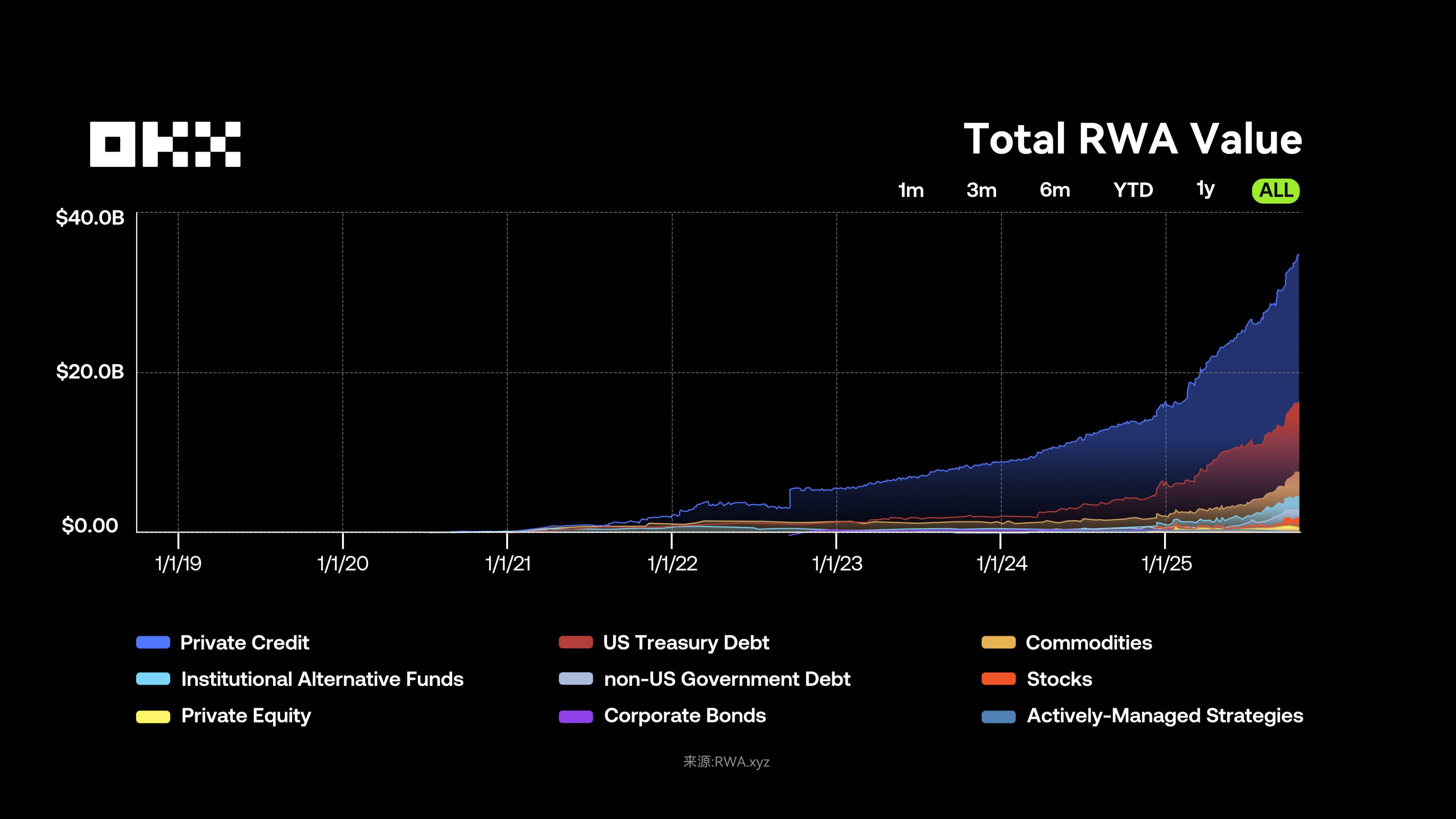

From a macro perspective, RWA first enhances payment and collateral efficiency, then expands into credit, and may eventually support AI wallet transactions—potentially reshaping capital markets over the next five to ten years. Since reaching $50 million in 2019, the RWA market has grown exponentially, with particularly significant acceleration between 2024 and 2025. As of November 3, 2025, the total value of on-chain RWA (excluding stablecoins) reached $35 billion, up more than 150% year-on-year; stablecoin market cap surpassed $295 billion, with over 199 million holders, indicating the tokenization narrative is shifting from concept to mass adoption.

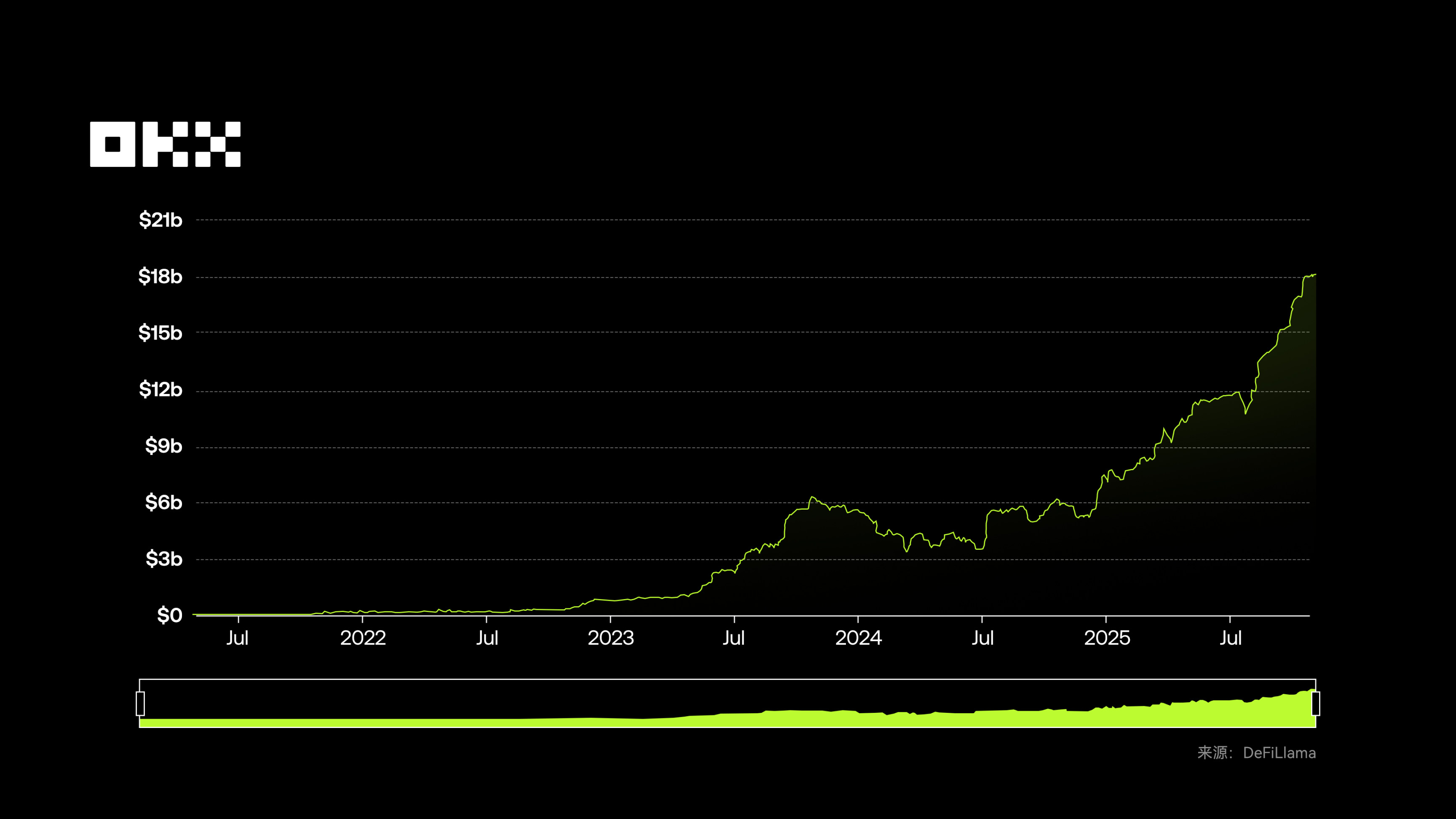

According to DeFiLlama data, global RWA total value locked (TVL) stands at $18.117 billion, continuing an upward trend. (Note: On-chain RWA total value refers to the aggregate market value of all issued tokens across chains; TVL specifically measures the value of RWA deposited in DeFi protocols as collateral or yield-bearing assets. A large portion of RWA—such as BlackRock's BUIDL—is held directly in user wallets rather than deposited in DeFi protocols, hence TVL is much smaller than total issuance.)

This growth stems from the synchronized advancement of institutional participation, regulatory clarity, and technological maturity: uncertain global interest rate environments have made tokenized U.S. Treasuries (offering ~4% yield) the low-risk asset of choice for DeFi users and institutions; regulatory frameworks like the EU’s MiCA provide legal blueprints; financial giants such as BlackRock and Franklin Templeton launching products validate RWA’s compliance and feasibility. Meanwhile, DeFi protocols adopt RWA as collateral and yield benchmarks to hedge volatility, with platforms like MakerDAO accepting RWA-backed stablecoin issuance, creating resonance between on-chain and off-chain capital flows.

2. RWA Sector Deep Dive: User Profiles, Structure, and Six Key Asset Classes

As of November 3, 2025, according to RWA.xyz, the number of RWA asset holders exceeded 520,000. Institutional investors dominate (about 50–60%), participating through platforms like BlackRock BUIDL and JPMorgan TCN; qualified/high-net-worth individuals account for 10–20%, primarily using Ondo and Paxos; retail investor participation remains low but is gradually increasing through new models like fractional ownership.

While the current RWA market appears vibrant, institutional capital mainly chases a few safe assets—U.S. Treasuries and top-tier private credit—which are already saturated. Real growth lies in whether non-liquid long-tail assets (e.g., SME invoices, carbon credits, consumer credit) can be scaled on-chain. However, fundamental conflicts exist between DeFi composability and traditional finance risk isolation. Without proper disclosure and constraint mechanisms, RWA will remain merely an on-chain mirror of traditional finance, not a more efficient capital market.

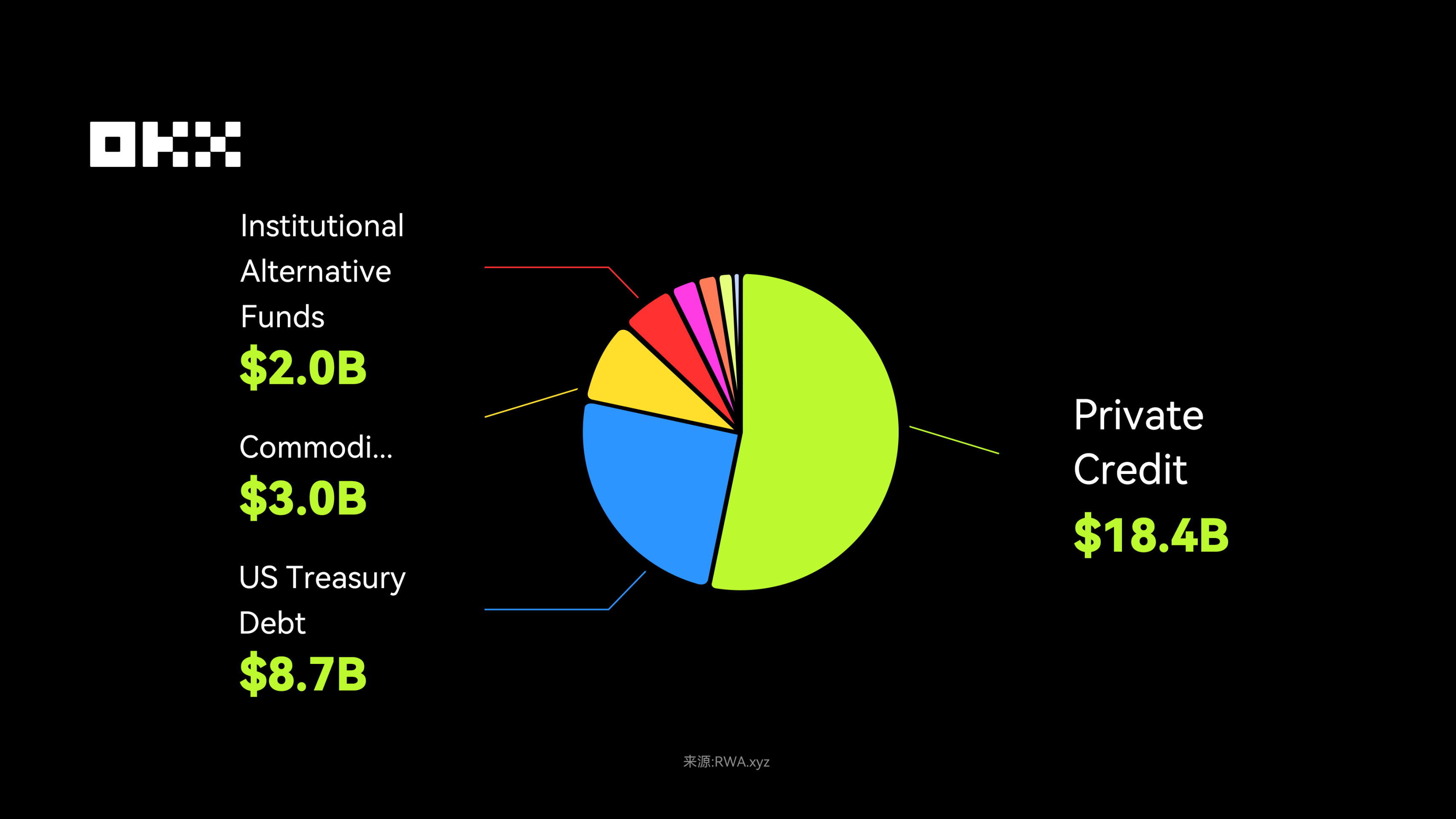

On-chain RWA asset structure reveals market preferences: private credit and U.S. Treasuries are core holdings—private credit dominates due to high yields, while Treasuries serve as the "entry-level" product for institutions; commodities and institutional alternative funds stand around $3 billion and $2 billion respectively. Non-U.S. government bonds ($1 billion), public equities ($690 million), and private equity ($580 million) form the long tail, offering greater growth potential. In the long run, the tokenization opportunity far exceeds current scale. BCG estimates that by 2030, the global tokenized asset market could reach $16.1 trillion, about 10% of global GDP.

Notably, not all assets are suitable for tokenization. True growth often comes from stable-yield, cash-flow-positive assets—such as short-term Treasuries, HELOCs, and consumer credit—that are predictable and cash-rich, making them ideal candidates for on-chain packaging. Illiquid assets (e.g., certain real estate), even if tokenized, remain trapped in liquidity constraints.

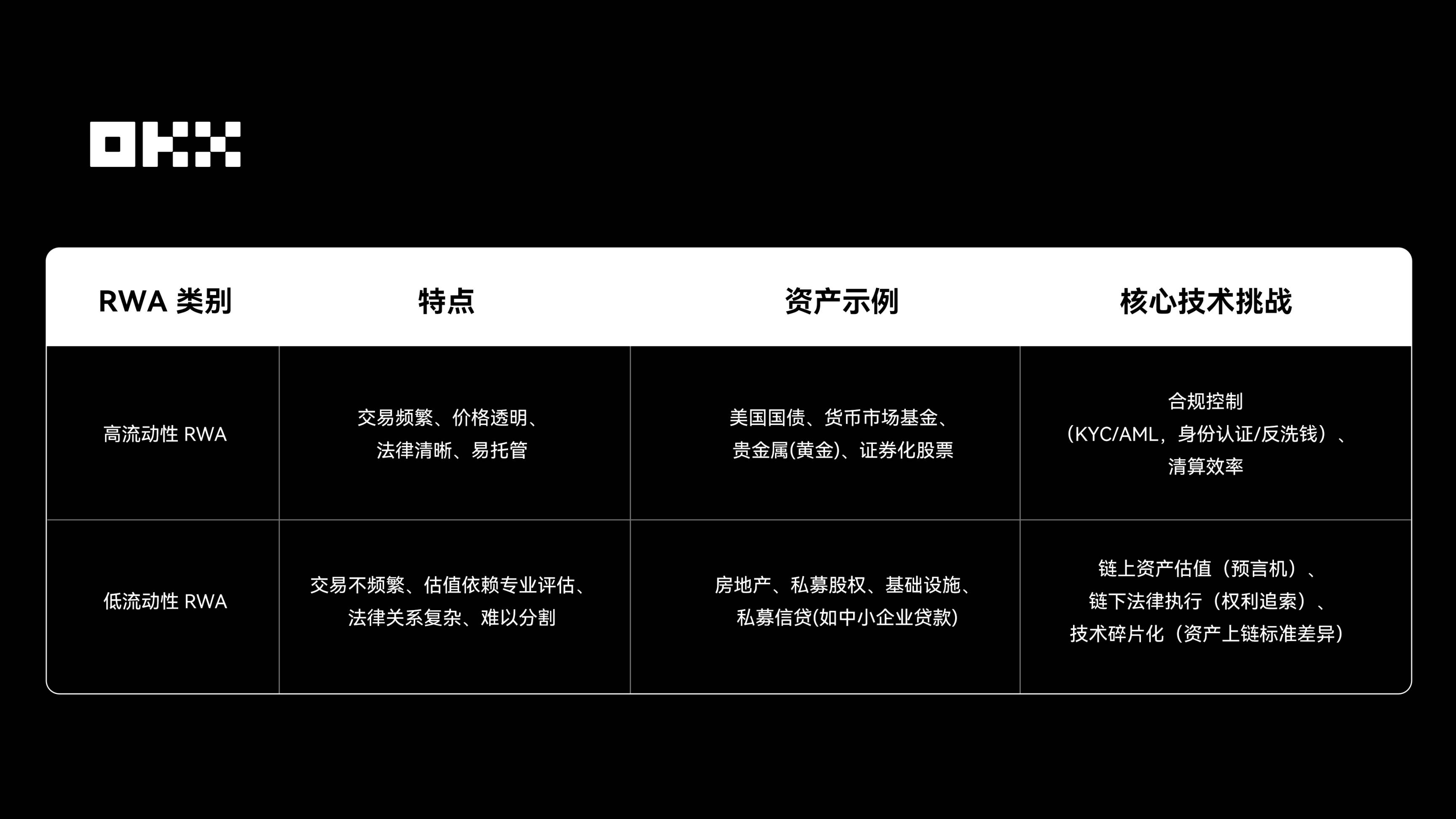

A common but misleading belief is: “Tokenization creates liquidity.” In reality, tokenization doesn’t generate liquidity—it only exposes and amplifies inherent liquidity characteristics. For highly liquid assets (e.g., U.S. Treasuries, blue-chip stocks), tokenization optimizes and extends liquidity, enabling 24/7, global, programmable access—a clear enhancement. For illiquid assets (e.g., individual properties, specific private equity), tokenization only changes ownership registration without solving core issues: information asymmetry, valuation difficulty, complex legal transfers, and shallow markets. An on-chain property NFT with no buyers still has zero liquidity.

The core logic is: liquidity stems from robust market-making networks, clear price discovery mechanisms, and market confidence—not from token standards themselves. Blockchain improves settlement and custody efficiency, not asset appeal. The lesson for the market: successful RWA projects (like tokenized U.S. Treasuries) don’t create new assets but offer better pipelines for high-demand, inefficiently traded cash-flow assets. Moreover, slow-growing RWA areas (e.g., real estate) face problems not in technology, but in the inherently non-standardized and infrequent nature of the underlying assets. Tokenization’s primary value lies in transparency and process automation, with liquidity improvement being secondary.

RWA distribution across public blockchains varies significantly. Aside from private, permissioned chains like Canton developed by Digital Asset, most RWA assets remain concentrated on Ethereum. Other networks such as Polygon, Solana, and Arbitrum also host varying scales of RWA activity.

When analyzing from yield-generating or investment-potential perspectives, focus remains on private credit, U.S. Treasuries, and commodities—though smaller in scale, they represent true “yield-driven” RWA. Therefore, understanding the RWA market requires distinguishing between total-market-cap dominance and yield-asset leadership.

(1) Private Credit: Core High-Yield RWA Asset

Private credit, valued at $1.6 trillion in traditional finance, is currently the largest non-stablecoin RWA category. It involves wrapping private debt instruments—such as corporate loans, invoice financing, and real estate mortgages—into tradable tokens via blockchain smart contracts.

Private credit grows due to high yields and relative stability, offering DeFi users 5–15% annual returns independent of crypto market volatility. Tokenization fragments illiquid assets, attracting global crypto capital, boosting liquidity, and empowering traditional borrowers. Importantly, it does not redefine credit but provides a more efficient receipt mechanism. Once on-chain, these assets can be plugged into lending markets, used as collateral, or packaged into asset-backed securities like other crypto assets.

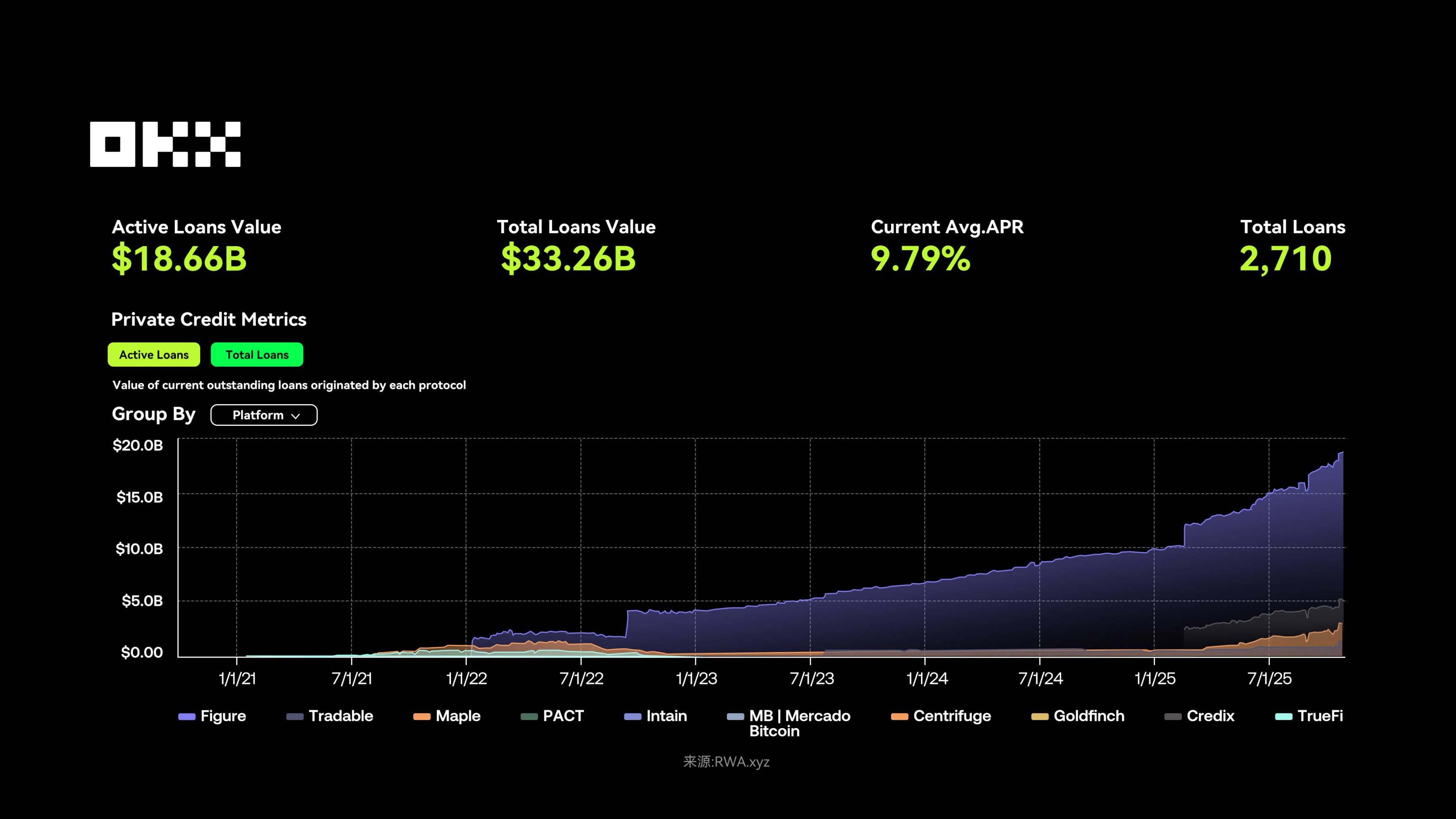

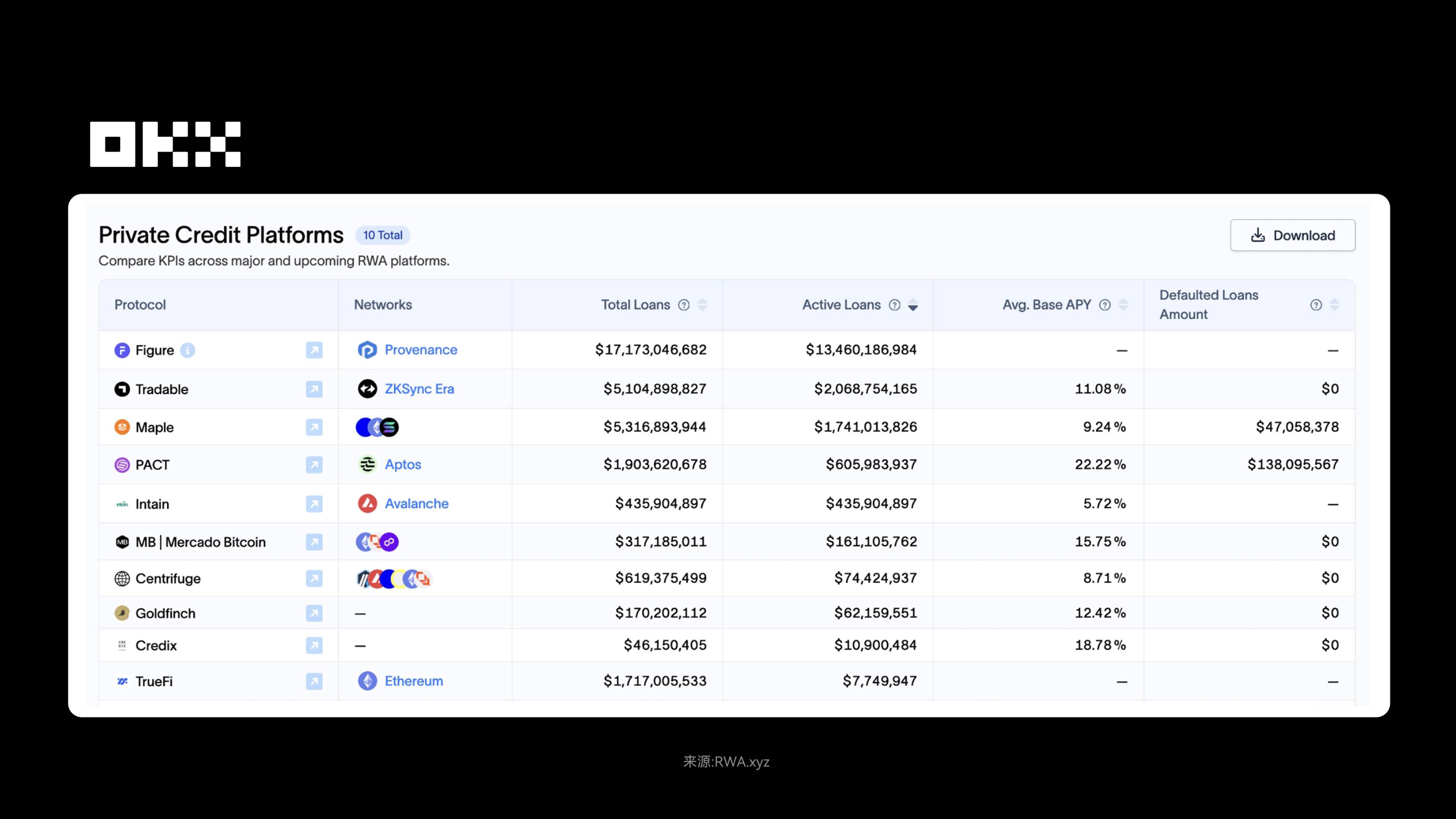

As of November 7, 2025, active private credit loans in the RWA space totaled approximately $18.66 billion, with an average annual interest rate of 9.79% and 2,710 loan transactions. Figure holds about 92% market share, with total loans reaching $17.2 billion; Centrifuge, leveraging a multi-chain architecture interoperable with DeFi protocols, grew its TVL from $350 million to over $1.3 billion, delivering historical annual yields of 8–15%.

The on-chain boom in private credit mirrors traditional credit cycles: starting with high-quality loans, then expanding to lower-quality collateral. The collapse of some yield-focused stablecoins may signal entry into the "junk bond" phase—these products essentially lend user funds to opaque on/off-chain hedge funds, bearing massive counterparty risk behind high yields. The Stream Finance incident revealed that the real threat in modular lending markets is liquidity freeze: even if protocol solvency is intact, a run triggered by collapsing poor-quality assets can drain shared liquidity layers, causing temporary paralysis—not just a technical risk, but a collapse of reputation and trust.

Figure follows a high-compliance U.S.-centric model. It solves pain points in traditional lending: too many intermediaries, slow approvals, poor asset liquidity. Using its proprietary Provenance blockchain, the platform tokenizes the entire home equity line of credit (HELOC) process, enabling fast on-chain settlement and custody. Borrowers experience ultra-fast service—from application to disbursement in minutes. This high-efficiency model satisfies borrower needs and attracts institutional investors. With cumulative HELOC loans exceeding $16 billion and over 50% active market share, Figure dominates the HELOC market and successfully listed on Nasdaq in September 2025.

Centrifuge takes a different approach, positioning itself as DeFi infrastructure focused on cross-chain interoperability. It tackles the challenge of bringing traditionally illiquid assets (e.g., corporate invoices, receivables) on-chain. Its flagship product, Tinlake, splits assets into tranches of different risk levels (Senior/Junior), offering DeFi users ~8–15% annual yields. Centrifuge’s key advantage is deep integration with the DeFi ecosystem—platforms like Aave and MakerDAO can directly use its assets as collateral. As a result, its TVL has surpassed $1 billion, providing SMEs and asset originators with an efficient on-chain financing channel.

(2) U.S. Treasuries: Institutional Capital’s “Entry-Level” RWA

By the end of October 2025, the total size of U.S. Treasuries exceeded $38 trillion. Treasury tokenization originated during the 2020–2022 DeFi bear market when users sought stable, moderately returning assets amid low yields. U.S. Treasuries fit perfectly: government-backed, nearly risk-free, yielding 4–5% annually—significantly higher than bank deposits (1–2%) and some DeFi lending products. But limitations were clear: limited liquidity (requiring brokers or brokerage accounts), high entry barriers (KYC required), and geographic restrictions (non-U.S. users struggled to invest directly). By 2023, rising Fed rates pushed Treasury yields above 5%, coupled with stablecoin market expansion, driving rapid demand for tokenized Treasuries.

Early projects like Ondo Finance’s OUSG (2023) and Franklin Templeton’s FOBXX led the way. In 2024, BlackRock joined, pushing the market size from $85 million in 2020 to $4–5 billion in Q1 2025 via its BUIDL fund, with the overall market surpassing $8 billion. Yield-wise, BlackRock’s BUIDL offers 4–5% annually, while Ondo’s USDY exceeds 5%, and both can serve as collateral in DeFi for “sustainable yield farming,” further amplifying returns.

Technically, Treasury tokenization relies on ERC-20/ERC-721 for on-chain ownership transfer; BUIDL and USDY are essentially programmable wrappers for ultra-conservative debt instruments. They don’t redefine Treasuries but provide an on-chain interface. Once on-chain, these assets can act as DeFi collateral, participate in yield farming, or circulate across chains. This “Wrap as a Service” model is key to scaling RWA from pilot to mainstream. Regulatory support from EU MiCA and U.S. SEC approval accelerated adoption.

In terms of stability, U.S. Treasuries are virtually default-proof (AAA-rated), inflation-resistant, and market-volatility resilient. On-chain tokenization further enhances transparency and security via smart contracts and audits. More importantly, their liquidity and accessibility improve dramatically—24/7 trading, minimum $1 investment, global access—and they can serve as collateral to borrow USDC in DeFi. As institutions continue joining, with improved KYC support and diversified offerings (short-term, long-term), tokenized Treasuries are becoming increasingly compliant and universal.

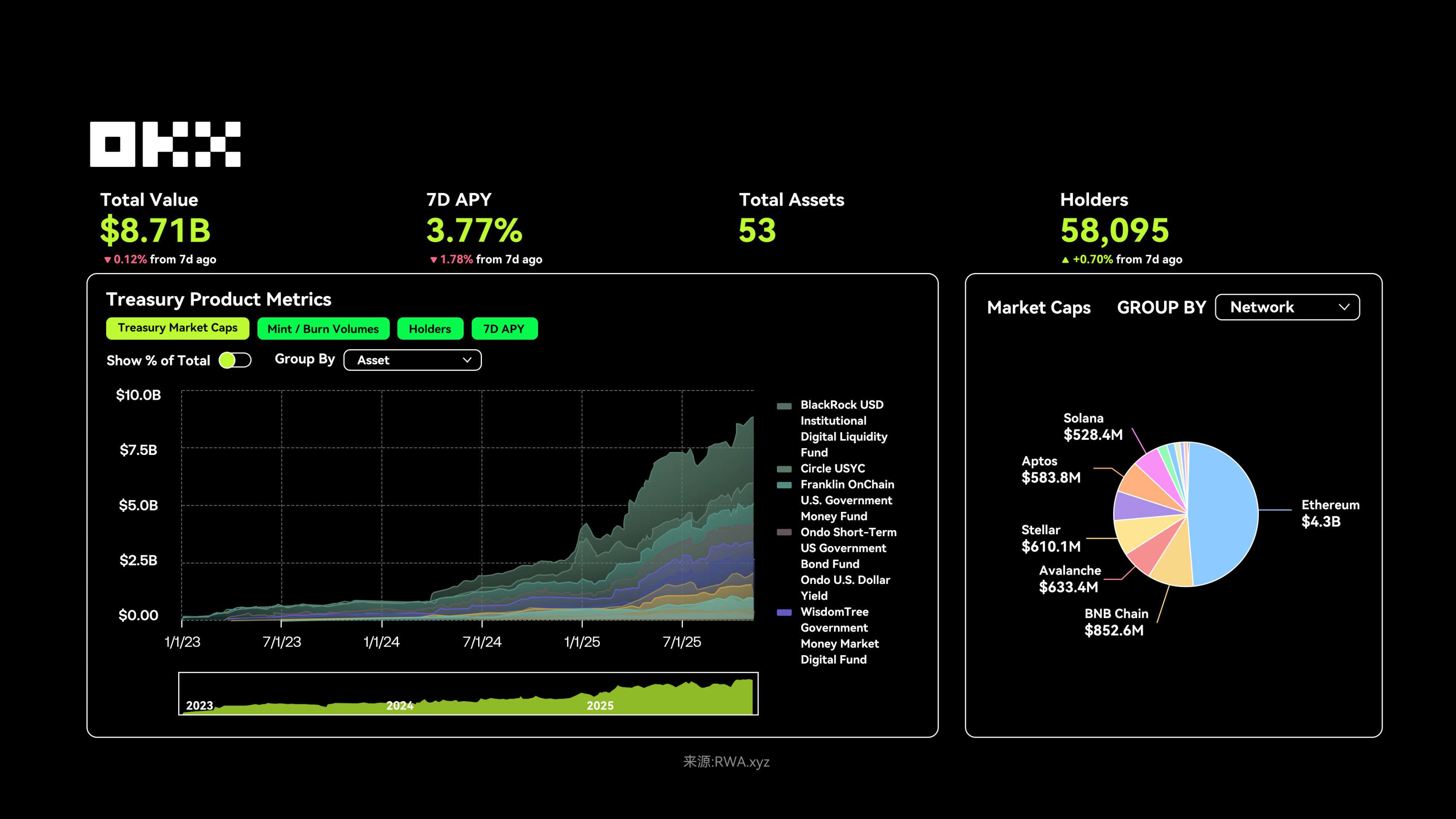

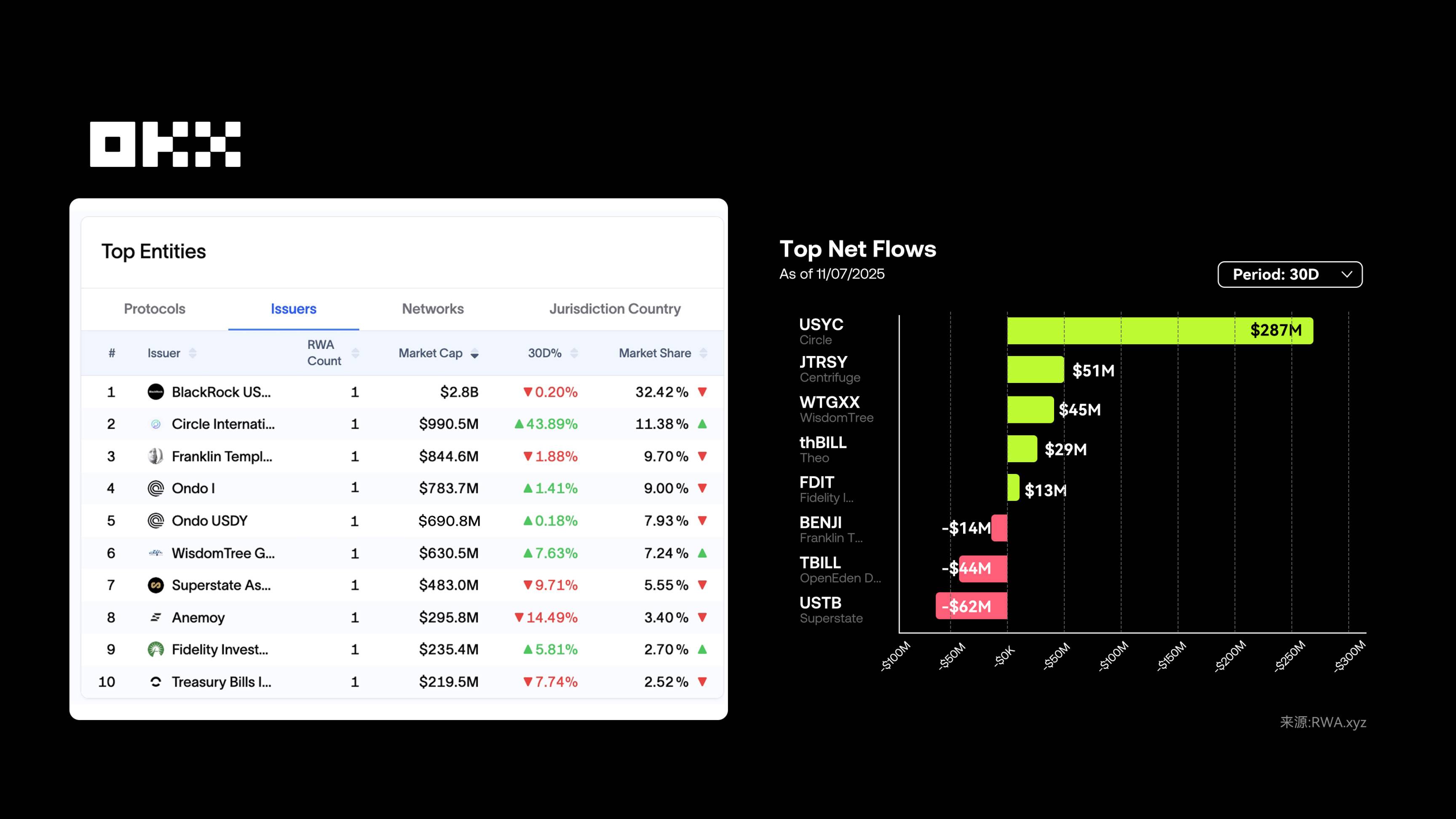

As of November 7, 2025, the total locked value of tokenized U.S. Treasuries reached approximately $8.7 billion, with over 58,000 holders, and a 7-day average annual yield (APY) of 3.77%, slightly down due to changing interest rate conditions. On-chain distribution shows Ethereum holding over $4.3 billion, with clear multi-chain trends, such as VanEck’s VBILL fund expanding across multiple ecosystems.

The tokenized U.S. Treasury market is currently led by institutions like BlackRock BUIDL, Circle USYC, and Ondo Finance. In 2025, as interest rates normalized and stablecoin regulation clarified, this sector heated up rapidly. The goal is straightforward: bring U.S. Treasuries onto blockchains so users can earn stable, readily accessible returns. These products clearly distinguish between U.S. accredited investors and global non-U.S. investors, with thresholds ranging from retail (e.g., USDY/USYC) to high-net-worth (e.g., OUSG/BUIDL), allowing users to diversify based on geography, risk tolerance, yield, and fees.

BlackRock BUIDL leads institutional-grade U.S. Treasury tokenization. It addresses high entry barriers and poor liquidity in traditional investing. Backed by BlackRock’s brand and Securitize’s compliance framework, BUIDL has a market cap of ~$2.8 billion, about one-third of the market. With a high threshold (minimum $5 million), it targets only U.S. accredited institutions. Yields are based on SOFR (Secured Overnight Financing Rate)—the overnight lending rate using Treasuries as collateral—minus management fees, at ~3.85% annually. Transparent on-chain audits make it the highest compliance benchmark bridging traditional finance and Web3.

Circle USYC primarily serves non-U.S. users and qualified institutions, solving their difficulties in accessing U.S. Treasuries, with a current scale of ~$990 million. Integrated closely with USDC and backed by Bermuda regulation, it offers a 7-day APY of ~3.53%, with daily NAV updates requiring no manual claims. The fund charges no management fee, only a 10% performance fee—moderately high. USYC supports T+0 instant redemption, multi-chain circulation, moderate thresholds ($100,000 + KYC/AML), and accelerates global deployment through partnerships with traditional institutions like DBS Bank.

Ondo Finance takes a mass-market approach, using two products—OUSG and USDY—to serve different user groups, addressing high KYC barriers and poor liquidity in Treasury investing. OUSG (~$783 million) targets U.S. accredited institutions, investing in short-term Treasury ETFs, requiring strict verification (net worth ≥$5 million, minimum $100k USDC investment); USDY (~$690 million, over 16,000 holders) serves global non-U.S. investors, requiring no strict verification—simply deposit USDC to earn yield, greatly simplifying retail access. Advantages include low fees (0.15%), multi-chain compatibility (Ethereum, Solana), DeFi collateral usability, and turning Treasury yields (~3.7% APY) into “liquid money.” Strategically, Ondo is acquiring firms like Strangelove to build full-stack RWA infrastructure—issuance, secondary markets, custody, compliance tools—preparing for institutional-grade RWA solutions.

The success of tokenized Treasuries lies not in disrupting Treasuries themselves, but in acting as compliant, low-risk “Trojan horses” that bring institutional capital and trust on-chain. BUIDL and USDY are programmable wrappers for conservative debt instruments, making old financial products portable, composable, and always online. This is the true PMF (product-market fit) of RWA’s first stage: serving machines, not humans—providing a risk-free yield curve for on-chain finance and paving the way for more complex RWA financial engineering. The next phase will reward whoever builds the killer application for on-chain money market funds.

(3) Commodities: Gold Tokenization Leads Growth

Commodities in the RWA space refer to traditional goods like oil, gold, silver, and agricultural products being tokenized via blockchain, granting digital ownership and enabling on-chain trading.

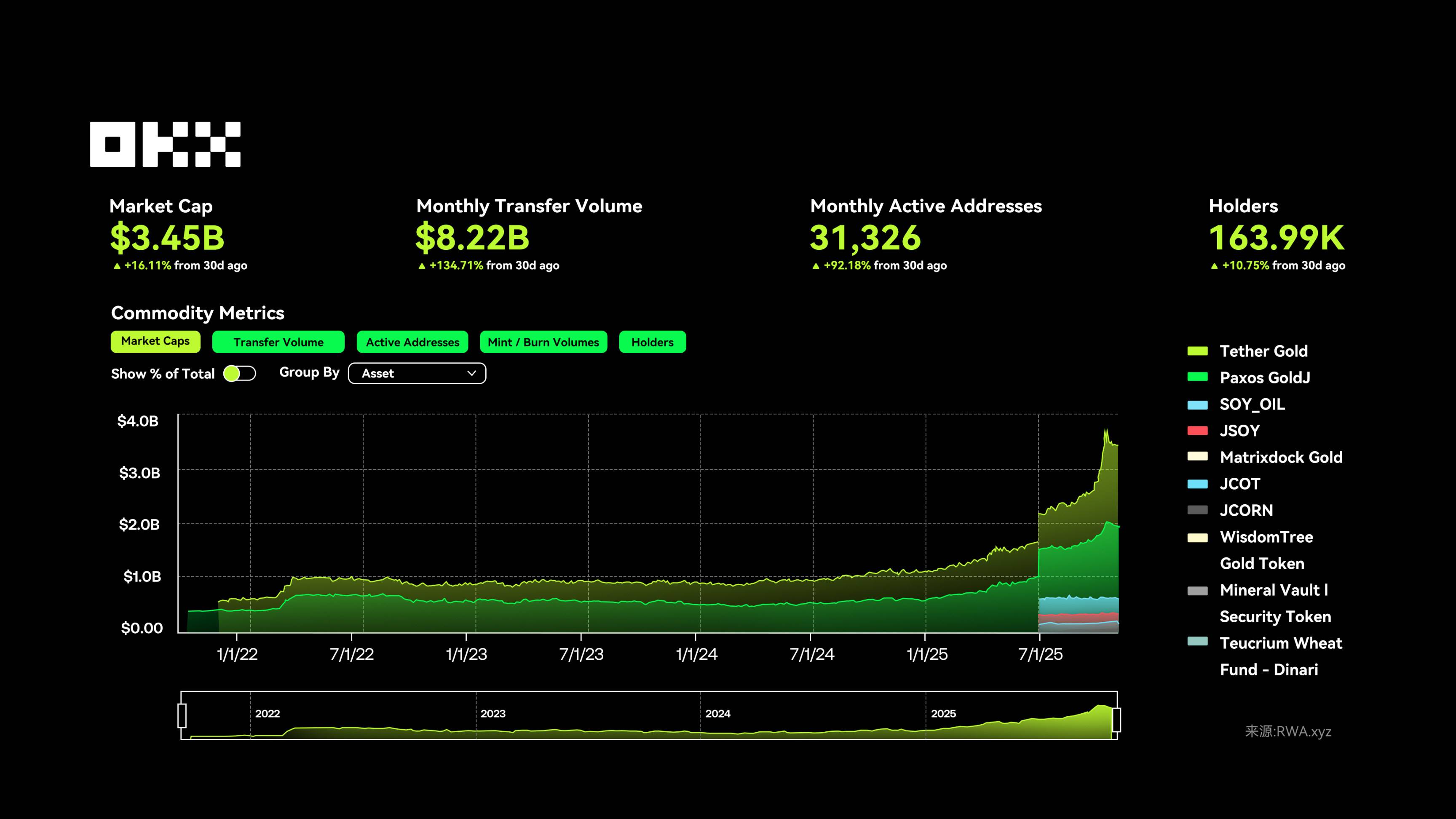

As of November 10, commodity tokens in the RWA sector show strong growth, expanding from less than $10 in early days to ~$3.5 billion in total size, $8.22 billion monthly trading volume, 31,326 monthly active addresses, and 164,000 holders. Gold tokens especially stand out, while oil and soybean tokenizations are accelerating, reflecting rapid expansion in market activity and scale.

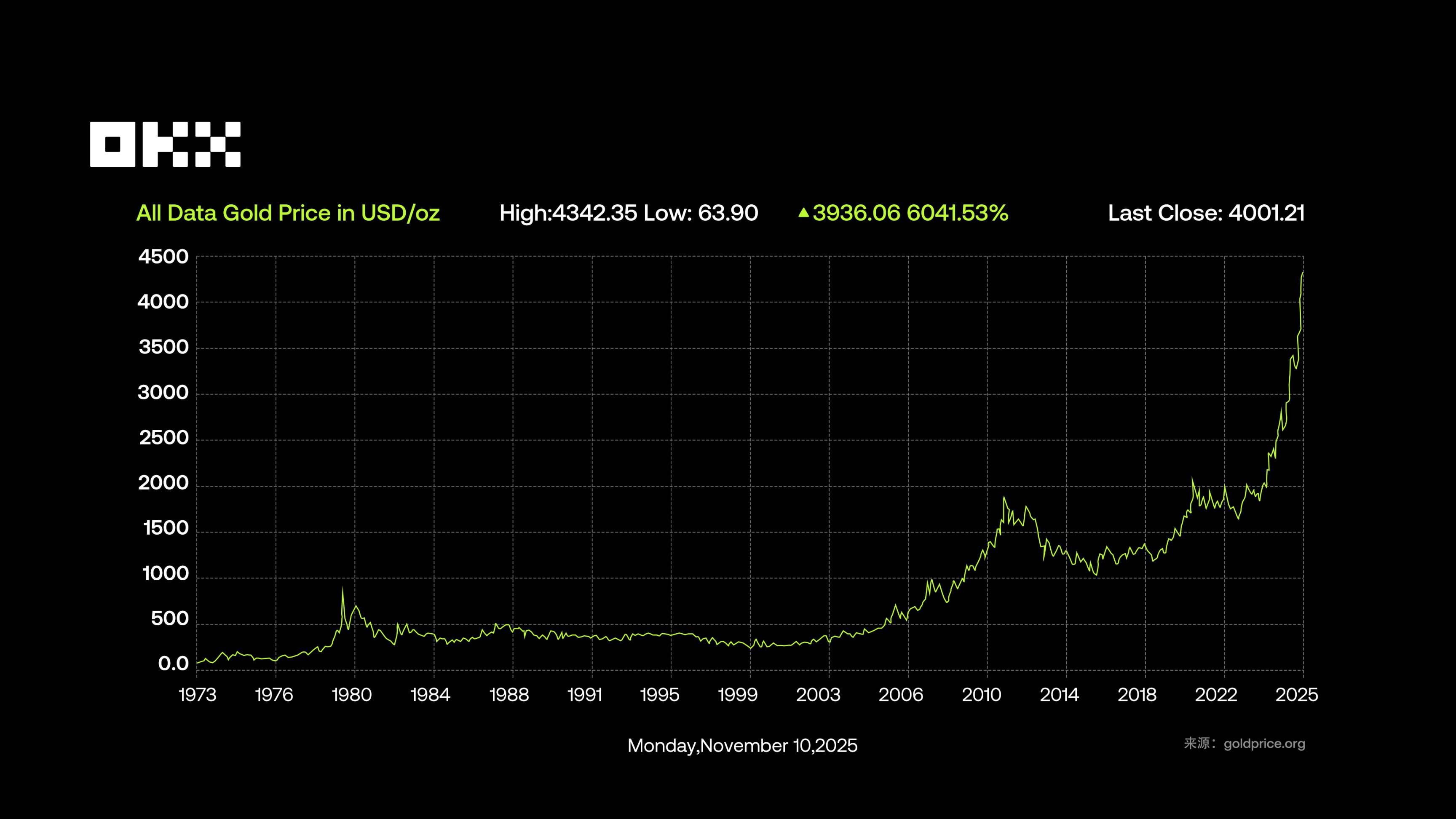

As of November 10, 2025, spot gold prices rose to ~$4,075 per ounce, up 55.3% year-to-date, hitting record highs. Price increases are driven by geopolitical tensions, inflation expectations, and sustained central bank buying—global central banks net-purchased over 600 tons in the first three quarters of 2025. Globally, total gold reserves stand at 21.6–28.2 thousand tons (including mines, central bank reserves, jewelry), valued at ~$27 trillion at current prices. Annual demand is ~4,500–5,000 tons; Q2 2025 demand hit 1,249 tons (~$132 billion, +45% YoY), with full-year demand expected to exceed 5,000 tons.

RWA commodity assets are relatively concentrated. Gold tokens, benefiting from their traditional safe-haven status and mature on-chain issuance mechanisms, have become the preferred choice for RWA commodity exposure. This growth reflects rising demand for on-chain commodity assets and gold’s pioneering breakthrough as a “digital-native” physical asset in RWA. Gold tokens like Tether Gold and Paxos Gold dominate the sector, with market caps far exceeding other commodities (e.g., oil, agriculture). Particularly after July 2025, gold-based RWA tokens experienced explosive growth, becoming the main driver of sector expansion.

The tokenized gold market is currently led by products like Tether Gold (XAUt) and Paxos Gold (PAXG). Though both are 1:1 backed by physical gold, they differ significantly in strategic focus and user services—one favors trading convenience and yield opportunities, the other prioritizes security and long-term allocation.

Tether Gold (XAUt), issued by Tether, is the largest tokenized gold product, with each token representing one troy ounce of physical gold stored in professional vaults. As of November 2025, its market cap is ~$2.1 billion, capturing 56.8% of the market—clearly dominant. XAUt is tradable on exchanges like OKX, supports fractional ownership, allows redemption of physical gold (with 0.1–0.5% fees), and is accepted as collateral or yield-bearing assets in some DeFi protocols. Technically, it operates across multiple chains including Ethereum, Solana, and Algorand. According to Tether, its gold reserves exceed 7.7 tons. However, due to centralized custody and past transparency controversies surrounding Tether, users should remain cautious about custody and audit risks.

Paxos Gold (PAXG) emphasizes compliance, targeting institutions and conservative users. Issued by Paxos Trust Company, regulated by the New York State Department of Financial Services, each token corresponds to one ounce of physical gold stored in London vaults. Its advantages lie in compliance and traceability—users can verify the bar number and storage location of their gold on-chain. As of November 2025, PAXG has a market cap of ~$1.12 billion (30.3% share) and over 41,000 holders. It supports purchases from 0.01 ounces, tradable on OKX or Paxos’ website, and redeemable for physical bars, unallocated gold, or fiat. Settlement completes within one day, total cost 19–40 bps, no custody fees, audited by KPMG, with monthly reserve reports—leading in industry transparency.

(4) Listed Stocks: Tech Stocks and ETFs Dominate Tokenization

Stocks in the RWA context refer to traditional listed company shares tokenized via blockchain. Each token represents partial ownership, entitling holders to dividends and voting rights. Through tokenization, stocks achieve 24/7 trading, high liquidity, and cross-border settlement on-chain while maintaining compliance and transparency.

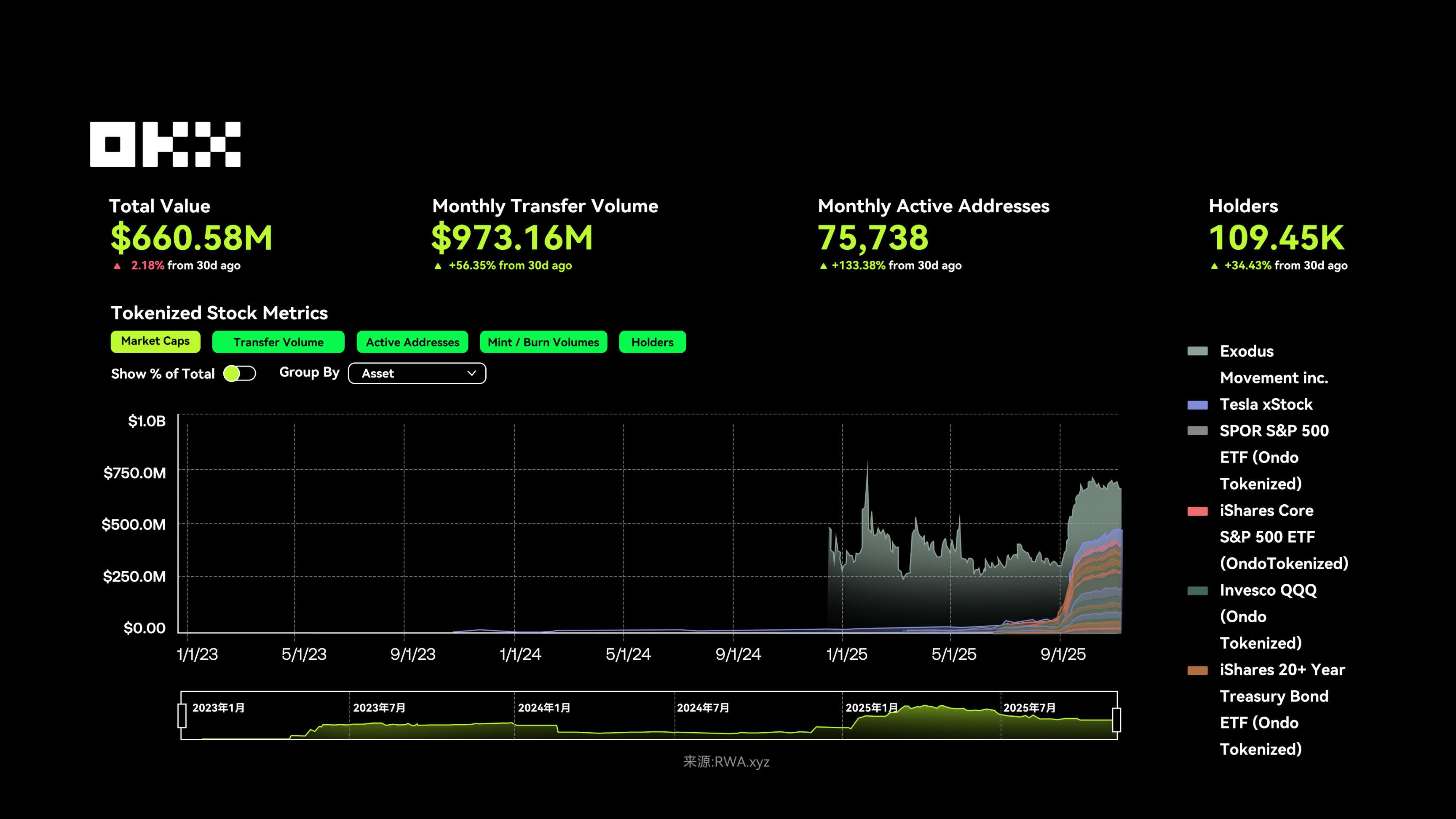

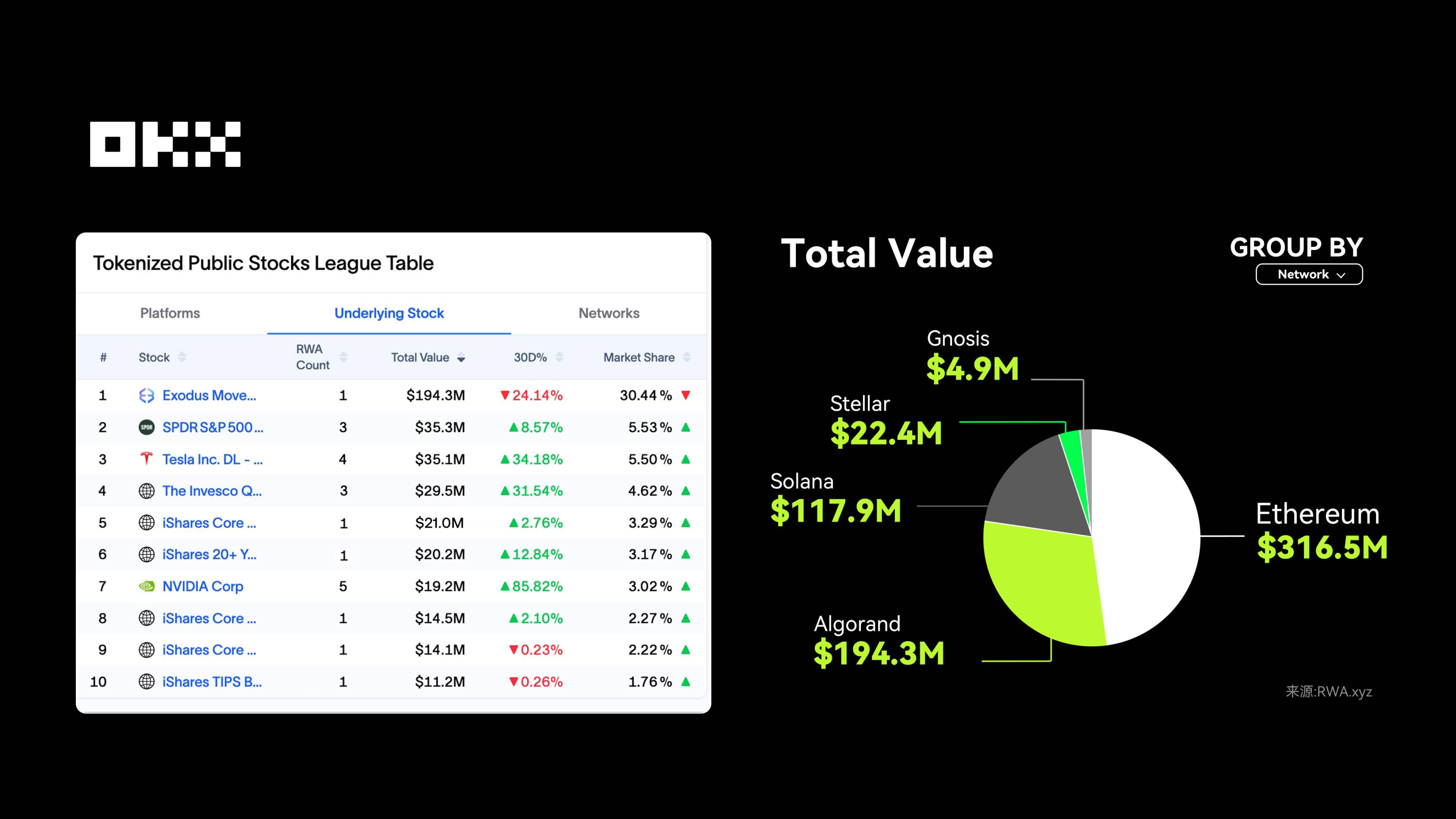

As of November 10, 2025, the total locked value of listed stocks is ~$661 million, monthly trading volume ~$973 million (+56.35% MoM), 75,738 active addresses (+133.38% MoM), and over 109,000 holders (+34.43% MoM). Overall, user engagement and trading热度 are steadily recovering, signaling a new growth cycle.

Tokenized stocks face a “triple test” of structure, liquidity, and regulation. The dominant SPV-based model is criticized for failing to grant users full shareholder rights, though proponents argue it's a necessary step from 0 to 1. The most critical issue is liquidity: market makers hesitate to hold positions over weekends, leading to wide spreads and shallow depth. A black swan event like a late-night Elon Musk tweet can instantly crash on-chain prices; when spot markets rebound Monday, retail traders are left permanently disadvantaged. If DeFi lending protocols use these prices for liquidations, cascading margin calls may follow. The real opportunity may not lie in the next Robinhood, but in the “water sellers” building the infrastructure.

Asset-wise, tokenized stocks remain centered on tech stocks and ETFs, with market concentration in a few leading projects. For instance, Exodus Movement Inc. (EXOD) leads with a total value of $194 million. On October 20, 2025, Exodus announced expanding its common stock tokens to Solana via Superstate’s issuance platform (previously on Algorand), becoming a representative case of “natively on-chain stocks,” indicating compliant equity tokenization is moving from concept to reality.

Popularity of tech leaders carries over on-chain. Tesla xStock (TSLAx), issued by Backed Finance on Solana, has a total value of ~$29.44 million and over 17,000 holders, showing tech stocks retain strong appeal in crypto markets. Additionally, tokenized ETFs SPDR S&P 500 ETF (SPYon) and iShares Core S&P 500 ETF (IVVon), issued by Ondo Finance, together exceed $45 million in market cap, reinforcing ETF tokenization’s strategic role in providing broad market exposure.

On the issuance side, growth is dominated by a few platforms. Most use 1:1 real-world asset backing and on-chain infrastructure for asset mapping and yield distribution. Ondo Finance ($ONDO), with ~47.8% market share ($316 million), leads, focusing on ETF tokenization (SPYon, IVVon, QQQon, etc.), running on its proprietary Ondo Chain and Nexus framework—the core engine of tokenized ETFs.

Securitize, though currently issuing only EXOD, captures nearly 30% market share with $194 million in value. As an SEC-regulated compliant platform, Securitize focuses on institutional-grade equity tokenization, having processed over $10 billion in assets cumulatively by 2025. Backed Finance (BackedFi), with ~18.6% market share ($123 million), specializes in tech stock tokenization (TSLAx, NVDAx, etc.), using Chainlink oracles for precise price synchronization and actively expanding on Solana. WisdomTree, representing traditional finance, holds ~3.4% share with its WisdomTree 500 Digital Fund (SPXUX), emphasizing digital ETF issuance and leveraging TradFi experience to accelerate compliant adoption.

Overall, the top four platforms collectively control over 90% of the market. With major exchanges like Robinhood and Kraken opening tokenized stock trading in mid-2025, and maturing cross-chain settlement and regulatory recognition, tokenized stocks are transitioning from niche experiments to mainstream asset classes.

However, centralized custody and fragmented regulation remain ongoing risks.

While tokenized public stocks offer convenience, they fail to solve core pain points, as traditional broker experiences are already solid. The next wave of growth is more likely to emerge from a central contradiction: providing efficiency premiums for traditionally inefficient assets.

The main battleground will shift from transparent, efficient public markets (listed stocks, Treasuries) to private markets (private credit, private equity). These markets suffer from difficult exits, vague valuations, and slow settlements—e.g., selling a private equity stake may take months, relying on emails and manual matching. Tokenization, via on-chain clearing and fractional ownership, can reduce settlement time from months to minutes, unlocking liquidity for non-standard assets. True PMF lies in tokenizing private credit and Pre-IPO equities (e.g., SpaceX), lowering investment barriers and solving systemic issues of capital lock-up and price discovery.

(5) Real Estate: Fractional Ownership Lowers Investment Barriers

The RWA real estate sector involves tokenizing traditional real estate assets via blockchain, enabling on-chain trading and management of ownership or income shares. Market growth is largely driven by fractional ownership, allowing global users to invest in high-value properties with as little as $50 (e.g., Lofty AI), enjoying rental income and instant settlement efficiency.

Although private credit and U.S. Treasuries dominate, real estate tokenization is experiencing rapid growth with significant long-term potential. However, structural challenges don’t vanish just by “going on-chain”: lack of transparent pricing benchmarks, complex title transfers, and high cash flow costs persist. Even with property tokens or NFTs, legal ownership still depends on off-chain contracts and registries—this explains why RWA focuses on standardized assets like Treasuries while real estate remains largely in pilot stages.

Players in the real estate space focus intensely on solving compliance and liquidity, falling into two main categories: equity tokenization and transaction/settlement platforms:

RealT pioneered fractional real estate ownership. As of November 2025, it manages over $500 million in assets. Its core model uses equity tokens, where each token represents an ownership share in an LLC holding U.S. residential properties. Token holders receive rental dividends and benefit from potential property appreciation. With low entry—often just hundreds of dollars—and automatic yield distribution to compatible wallets, it enables easy retail participation in U.S. real estate.

Propy focuses on real estate transaction processes, having handled over $1 billion in transactions. Its model uses NFT-backed deeds—mapping property titles to NFTs—for automated sales and ownership transfers. Users complete tokenized property buying, payments, and compliance checks within the app, greatly improving efficiency and resolving complex legal and custody procedures in traditional transactions.

Lofty is an emerging fast-growing player, with TVL growing 200%. Its model uses AI-driven fractional rental properties, tokenizing income-generating real estate. Entry is extremely low—starting at $50—with all investment management (rent collection, exit mechanisms) handled in real-time via app, making real estate accessible to everyday investors.

(6) Stablecoins: Dominant Position

When including stablecoins, re-ranking RWA by market cap clearly shows stablecoins dwarfing all other RWA categories combined—over tenfold larger—placing them firmly at number one. This means stablecoins form the liquidity foundation and backbone of the entire on-chain RWA ecosystem. The future growth and innovation potential of the RWA sector hinges on leveraging this foundational tool to bring trillions of dollars in non-monetary real-world assets (bonds, credit, stocks) on-chain.

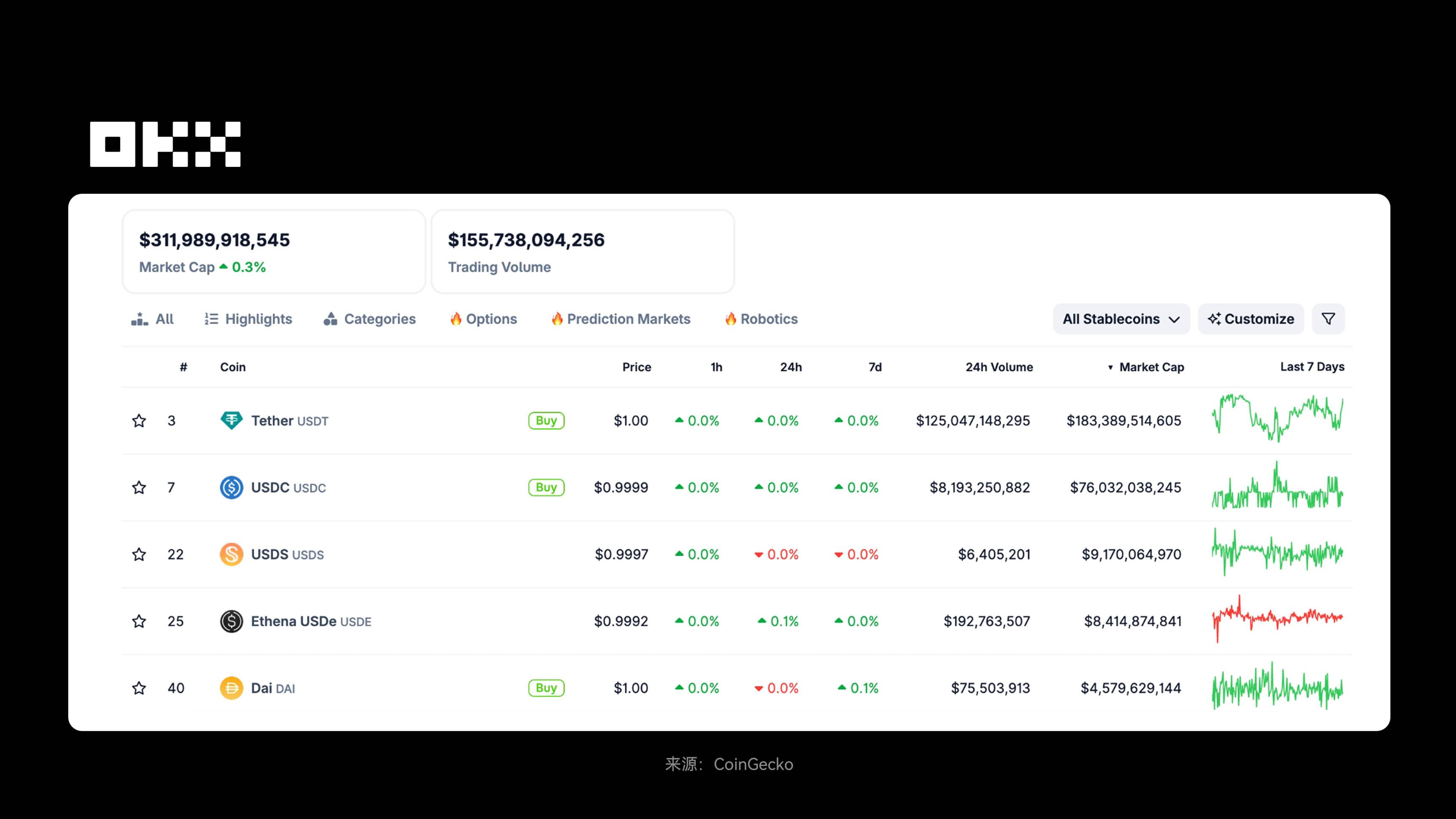

Stablecoins are cryptocurrencies pegged to fiat currencies, commodities, or other financial assets to maintain price stability on-chain. According to CoinGecko, as of November 11, stablecoin total market cap reached $311.99 billion. By issuance network, Ethereum leads in stablecoin market cap, followed by TRON, with Solana, Arbitrum, and others holding notable shares—reflecting differences in stablecoin distribution across multi-chain ecosystems.

The stablecoin market is highly concentrated: USDT and USDC together account for over 80% of market cap, backed primarily by fiat reserves, cash, and U.S. Treasuries, highly centralized, mainly used in cross-border payments, trading settlements, and corporate payroll. Smaller stablecoins like DAI, USDe, sDAI use yield-bearing or over-collateralized models, partially decentralized, relying on on-chain monitoring and smart contracts, serving DeFi, on-chain lending, and asset tokenization, carrying higher risk and volatility. Overall, centralized fiat-backed stablecoins offer low risk and transparency, while innovative stablecoins emphasize on-chain financial functionality and automated yield.

Centralization stems from the intrinsic need for fiat backing: issuance and management require regulated financial institutions. While decentralization is technically feasible, it's complex and costly—most transactions occur on L2s. Users may pay a premium for decentralization in core settlement layers, but prioritize speed and low cost, accepting centralization at higher layers.

Issuers have incentives to keep activity within their controlled networks (e.g., Circle’s Arc, Tether’s Stable and Plasma), while crypto and fintech players want transactions on their own controllable chains (e.g., Base, Robinhood Chain). This competition will shape the future stablecoin ecosystem.

The table below provides an overview of major global stablecoins (as of November 11, 2025):

As the most mature and strategically central liquidity infrastructure in RWA, stablecoins play three key roles: first, top centralized stablecoins (e.g., USDT, USDC) integrate high-liquidity RWAs like U.S. Treasuries to bring stable off-chain value and low-risk yields on-chain, reconstructing the trust basis of 1:1 fiat pegs; second, yield-bearing stablecoins (e.g., USDe, USDM) use derivatives or tokenized Treasuries to convert off-chain asset yields into native on-chain returns, enabling stablecoins to offer low-volatility investment income beyond payments; third, as unified pricing and settlement tools, stablecoins enable cross-scenario interoperability across RWA projects, enhancing asset liquidity and capital efficiency—making them the core value bridge of the on-chain RWA ecosystem.

Notably, stablecoins and tokenized Treasuries are forming a complementary relationship: the former acts as on-chain cash for payments, the latter as on-chain savings for yield and collateral, jointly building a two-tier monetary structure for on-chain finance.

3. Why Has RWA Become a Key Narrative in 2025?

In 2025, the RWA narrative peaks—but may ultimately be led not by crypto-native companies. Platforms like Robinhood aggregate traffic through unified interfaces (stocks, crypto, future private credit), earning distribution fees; while traditional financial giants controlling trillions in assets (e.g., BlackRock, Fidelity) hold the top of the value chain, capable of launching their own L2s or private chains to fully integrate assets, tokenization services, trading, and settlement into closed loops.

The long-term story of RWA is not crypto displacing traditional finance, but traditional finance going on-chain. Crypto firms may retreat into infrastructure providers, finding opportunities in serving long-tail assets that traditional giants cannot efficiently cover, or establishing irreplaceable advantages in cross-chain settlement, privacy computing, dynamic risk pricing, and other critical areas. Its core value lies in unlocking liquidity for illiquid assets and providing investment access to ~1.7 billion unbanked people globally—achieving true financial inclusion.

Despite vast potential, RWA faces multiple challenges: fragmented regulation increases cross-border issuance costs and compliance pressure, with the SEC possibly classifying some RWA as securities; legal complexity, oracle vulnerabilities, and centralized custody introduce counterparty risks; market volatility and privacy compliance slow adoption. During credit expansion cycles, underwriting standards may loosen, collateral quality may quietly deteriorate, planting seeds for the next downturn. DeFi protocols must achieve deep, transparent understanding of the credit risk behind RWA used as collateral.

Strategically, a hybrid CeFi-DeFi model is needed to sustain momentum. Users should opt for diversified portfolios via audited platforms; issuers should embed compliance standards like ERC-3643 from inception; regulators need unified frameworks to avoid fragmentation. Overall, RWA is not a bubble but a cornerstone of crypto finance, projected to support about 30% of global financial assets by 2030.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News