A Multidimensional Analysis of LSD MAP 2.0: A Guide to Thinking and Action

TechFlow Selected TechFlow Selected

A Multidimensional Analysis of LSD MAP 2.0: A Guide to Thinking and Action

This article will compile most of the available LSD-related projects, raise questions, and provide a guide for reflection and action.

After the previousLSDFi Map was released, most of the products we predicted have emerged—such as stablecoins backed by LSTs (R, TAI, USDL, etc.) and governance wars sparked by veTokens (e.g., Pendle War). However, there were also many unexpected findings. This article compiles most of the verifiable LSD-related projects, raises questions, and provides reflections and action guidelines.

First is the updated LSD Map 2.0, shown in the image below. For detailed data and subjective evaluations, please refer to my personal compilation onGoogle Sheet.

Landscape

The LSD sector has formed an initial landscape. If categorized by layers, DVT technology providers such as SSV Network and Obol Labs can be considered L0. DVT technology enhances validator stability and security in fulfilling their signing responsibilities. As the first project in this layer to launch a token, SSV Network holds a first-mover advantage in brand recognition.

Lido, Ankr, Coinbase, and other LST issuers constitute L1. The primary business model at L1 is commission-based, with users mainly benefiting from ETH staking rewards via Proof-of-Stake (PoS). After the Shanghai upgrade, statistics revealed that the number of L1 projects far exceeded those in subsequent layers—contrary to our first MAP forecast. However, investigation showed over 20% are still in testnet phase. According toDefiLlama data, Lido dominates liquid staking with a 74.45% market share. Together, Lido and Rocket Pool hold around 82.5%, while centralized exchanges like Coinbase account for over 12% of liquid staking volume. This leaves little room for other decentralized staking platforms. Some participants in this tier are multi-chain LST issuers trying to capture market share, but in practice, Ethereum’s LSD mechanics differ significantly from other public chains. Aside from Ankr, which benefited from early entry, no other cross-chain projects have achieved notable success.

TVL Share Chart (Source: DefiLlama, Date: 2023.6.23)

L3 consists of fixed-income products, stablecoins, yield aggregators, and structured strategies built upon LSTs—commonly known as LSDFi. At this level, LST-backed stablecoins dominate, using LSTs as collateral and typically supporting other stablecoins and ETH/WETH. There are fewer lending or leveraged projects, directly limiting the number of yield aggregators and structured strategy protocols. Products like Yearn-style yield vaults, Shield’s options-based structured products, and Pendle’s fixed-income offerings will further catalyze growth in yield aggregation and structured strategies. Projects relying on token subsidies to boost staking yields have seen both token prices and TVL decline sharply after the Shanghai upgrade.

Price chart of a project with APY exceeding 1000% post-Shanghai upgrade

The L2 layer highlights the importance of teams, with some projects entering the LSD space mid-way and achieving strong results. The success of certain protocols in fixed-income, options, yield aggregation, stablecoins, and synthetic assets prompts reflection on their potential expansion into LSDFi. Amid insufficient market liquidity, ETH—as a top-two cryptocurrency—delivered strong liquidity even during bear markets. How many teams truly capitalized on this opportunity? With a new cycle approaching and bull market expectations rising, enhanced liquidity may enable other yield-bearing assets to follow ETH’s path and develop similar products.

A fixed-income protocol leveraging LSD products achieved a 10x token price increase

This article defines L3 as products built on L2. StakeDAO, Equilibria, and Penpie—projects behind the Pendle War—fit this definition. Other examples include AcidTrip, which automates compounding for 0xAcid; and gUSHer, which simplifies unshETH operations and boosts returns. The dominant trend remains governance battles driven by veTokens. This layer holds vast potential beyond just L2 tools and governance aggregation—such as multi-L2 product aggregators or front-ends offering combined strategies.

In EigenLayer, individual ETH holders stake ETH or stETH with operators who then allocate node operators within EigenLayer, allow validators to participate directly, or delegate management to others. Various middleware and data availability layers pay fees (project tokens, transaction fees, etc.) to earn rewards. While it uses ETH staking principles, it does not generate LSTs. Instead, it accepts LSTs (currently rETH, stETH, cbETH) as stake—thus classified under L2.

Index products are primarily led by Index Coop’s three LST indices, though these contain relatively few LST types.

Overall:

[1] L0 has the highest technical barrier, but attention must be paid to the actual utility of its token

[2] Leaders have emerged in L1. Barring internal or systemic risks, time and space no longer allow new entrants into the top three, though new players will appear

[3] Much of L2 lacks moats, making team strength and business development key. The more foundational DeFi strategies based on LSTs, the more vibrant L2 becomes

[4] L3's market cap and liquidity depend heavily on L2 development, yet offer significant potential requiring time to mature

Data & Trends

Staking Rate

Before the Shanghai upgrade, we predicted a rebound followed by a second wave of staking rate decline. But reality diverged: after Shanghai, the largest unstaking waves came from collecting staking rewards and continuing to stake, and from principal withdrawals (mainly via CEXs). Staking volumes then began steadily rising, surpassing 20 million ETH by mid-May and exceeding 16% by June.

ETH Staking and Unstaking / Total Staked Chart (Source: Nansen, Date: 2023.06.23)

Regarding comparisons between ETH staking rates and other blockchains, I strongly oppose such views. In MAP 1.0, I predicted stabilization around 25%, based on the following reasoning:

Reason One: ETH’s Decentralization

ETH’s distribution differs from high-staking-rate “VC chains” or “consortium chains,” where tokens are often forced to stake due to concentrated holdings and limited participants—selling could trigger collapse.

Chart of large ETH holder distribution (including exchanges and bridge addresses) and address count changes (Source: Feixiaohao, Date: 2023.06.23)

Reason Two: Utility

As the most active public chain, ETH acts as the "golden shovel" of Ethereum—used across DeFi, GameFi, and NFTs. It’s involved in ETH-denominated transactions and gas fees, making it unrivaled in on-chain activity frequency and use cases.

Reason Three: External Scalability

The rise of L2s and the multi-chain era mean ETH serves as a core asset across multiple ecosystems, further dispersing holdings and reducing centralization pressure toward Ethereum staking. Of course, in the next section we’ll analyze cross-chain staking protocols to explore their impact on the LSD ecosystem.

Reason Four: Compliance

As crypto remains a focal point for traditional finance and regulators, ETH ranks second only to BTC in ETF allocations and is typically among the top five holdings in crypto hedge funds. With growing adoption of crypto ETFs and secondary funds, some suggest these funds might directly stake tokens. However, compliance challenges remain significant. Even if they seek staking yield, opting for services like StakeFish offers greater legal safety and lower regulatory risk.

Price dynamics may also influence staking rates. When the halving-driven bull cycle arrives in a year, amid altcoin rallies, will many ETH stakers sell to capture profits and rotate into new trending assets? This remains to be observed.

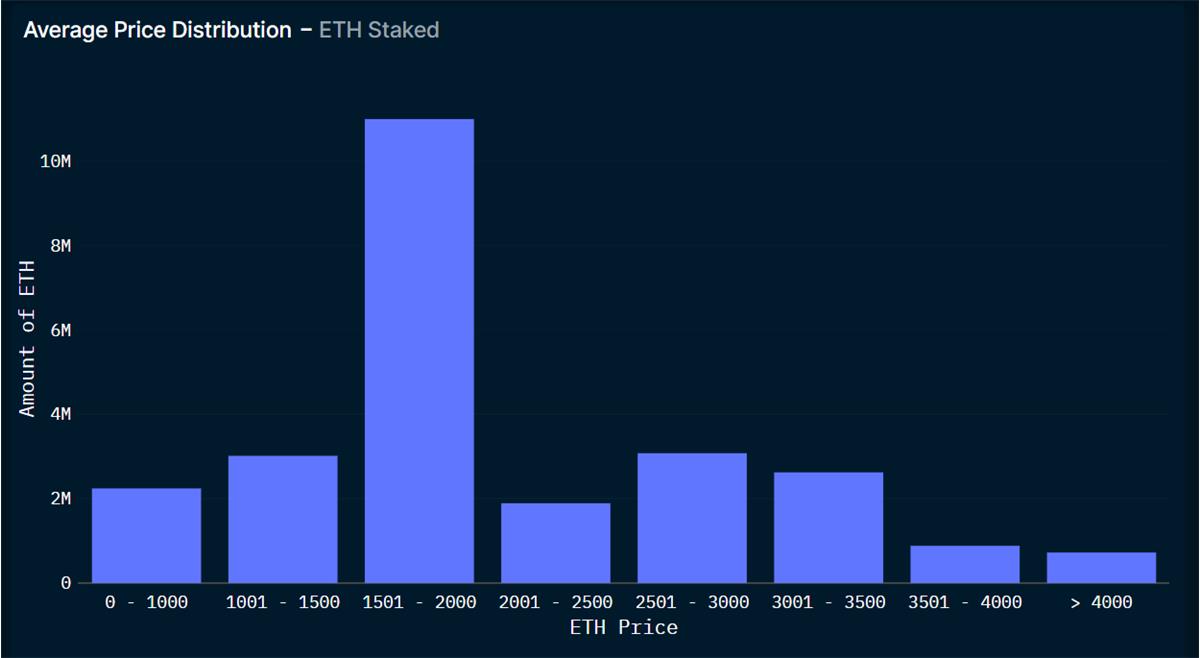

ETH staking purchase price distribution chart (Source: Nansen, Date: 2023.06.23)

Undoubtedly, LSDFi will boost staking rates. LSTs generated from staking can enter various protocols to earn multiple yields, reducing opportunity costs—or even generating excess returns. Currently, however, no L2 project exists capable of absorbing large amounts of ETH, and many L1-issued LSTs aren’t being utilized in L2. Therefore, I believe L2 still presents major investment opportunities.

Centralized vs. Decentralized Staking

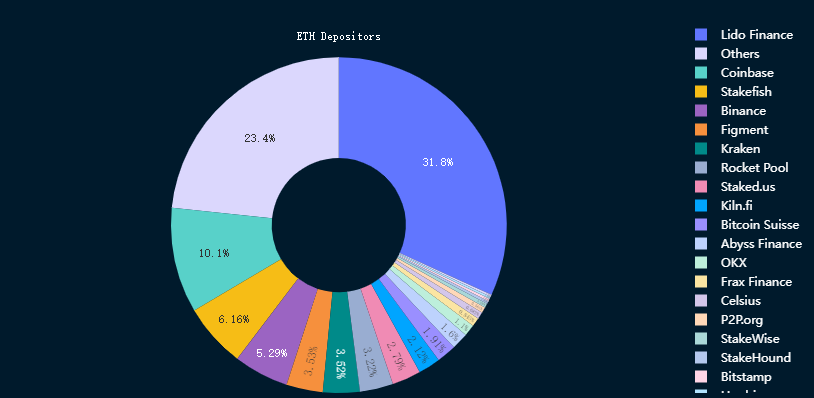

Based on rough calculations fromNansen data, less than 40% of staked ETH comes through decentralized platforms, about 20% via CEXs, and the majority through solo staking or direct node operation. After Shanghai, CEXs accounted for 57.74% of principal withdrawals. Given Lido controls 31.8% of total staked ETH, concerns arise about decentralization becoming centralized. To counter this, some L2 projects now balance LST allocations by distributing rewards proportionally, incentivizing participation in smaller platforms’ LSTs.

ETH staking breakdown (Source: Nansen, Date: 2023.06.23)

Many L1 platforms employ DVT and other technologies to enhance decentralization. Yet rationally, stakers prioritize security first, then yield. Lido and Rocket Pool’s LSTs are nearly universally compatible with all LSDFi projects at L2 and have had no security incidents. Lido leverages its leadership in ETH staking to gain revenue and market share. As a major beneficiary, centralization would harm both Ethereum and its own core interests. Nonetheless, internal risks and external threats like regulation remain critical concerns for every L1 platform.

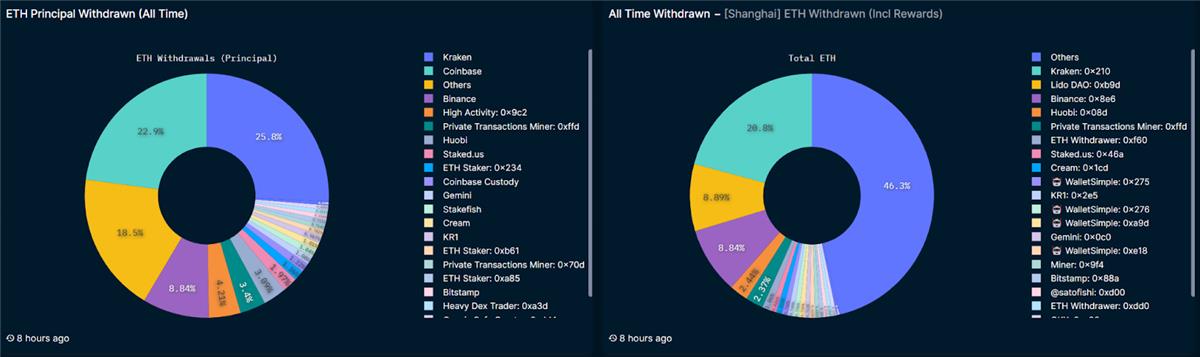

Post-Shanghai upgrade ETH principal/reward unstaking chart (Source: Nansen, Date: 2023.06.23)

Thus, I remain bullish on the dominance of the top three leaders, but believe decentralization—a native trait of crypto—makes diversification in L1 inevitable. Several L1 products now balance decentralization, security, and low entry barriers. Still, even quality projects struggle with token utility issues.

Yield

Ignoring security considerations, high yield and sustainability are the two most important factors in LSD-related projects. High yields require users to assess their own risk tolerance. During early stages of many L2 projects, direct LST staking yields—boosted by token incentives—reached triple digits, while LP yields hit quadruple digits. But extreme price volatility made “mine-and-dump” behavior unavoidable. Currently, some projects adopt point systems or staking-for-airdrop models, which minimally impact user retention and token prices.

Stakers looking to boost yields can apply common DeFi Lego strategies:

1. Choose LSTs with broad use cases and many partners

2. Increase capital efficiency through leverage

3. Participate in L2 products (some L2s support multi-layer nesting with L3)

4. Join IDOs or reward programs of new projects (lower security, but higher returns)

Using two-layer nesting can generally push staking yields above 10%. Readers should design strategies according to their own risk profiles.

After research, I found sustainable projects share one trait: modest yields. Many rely on their own tokens or partner tokens (e.g., Frax using Curve) for partial subsidies. If ETH → LST yield is foundational—derived from Ethereum staking rewards—where do L2 and L3 yields based on LSTs come from?

Summarized as:

[1] Token Incentives: Self-token subsidies or third-party token subsidies

[2] Lending Fees: From certain stablecoins

[3] LP Liquidity Pool Fees

[4] Derivatives Hedging

[5] EigenLayer pays service providers to subsidize staking nodes

[6] Product trading fees/commissions

From income source stability, we can judge the sustainability of L2/L3 yields. Only [1], [4], and [6] align with high-yield characteristics. However, [4] and [6] involve high operational uncertainty, so [1] remains the dominant method for now and likely for the long term—though practical implementation varies greatly. For long-term survival, projects using [1] must implement sound tokenomics.

In my view, quality projects combine real yield, practical applications, and strong tokenomics. At L2, PENDLE-led projects combining real yield and veToken models already meet these criteria.

L2’s LSD

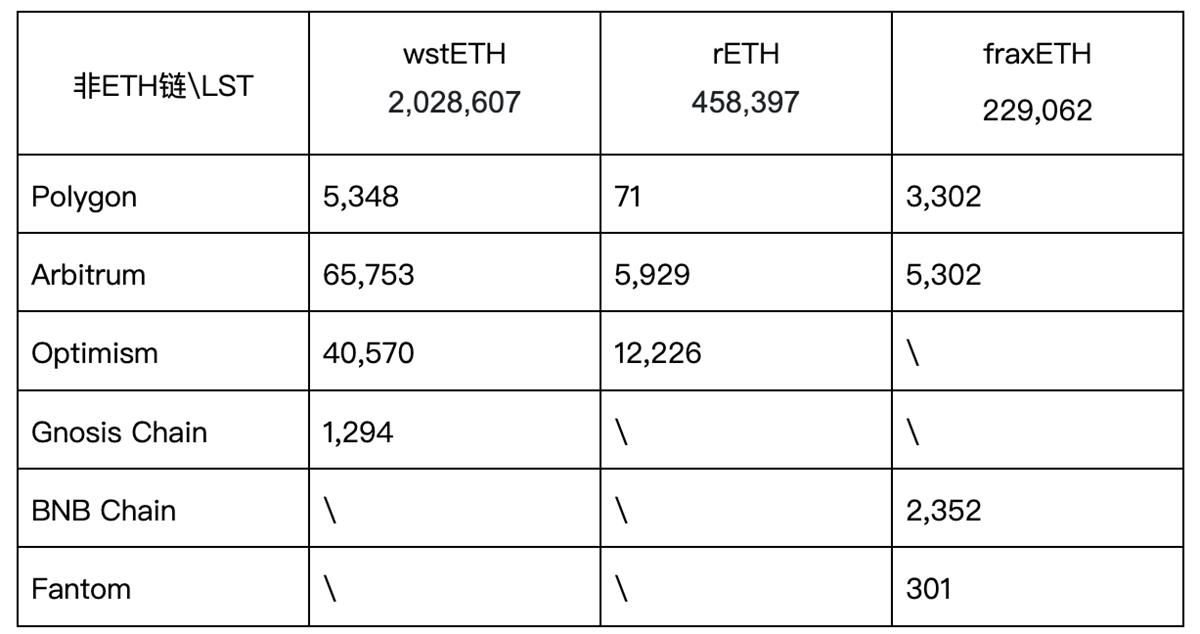

From the table, we see many projects deployed at L2, using the top three decentralized staked LSTs—wstETH, rETH, fraxETH—for analysis.

Quantities of top 3 decentralized staked LSTs across different chains (Source: blockchain explorers via CoinGecko)

In total quantity, Arbitrum leads. Our research also shows the highest concentration of L2-layer products built on Arbitrum. Optimism hosts substantial LST volumes, but dedicated LST projects are far outnumbered by general DeFi liquidity pools. Lower transaction fees and faster execution on L2s, along with growing holder counts, make L2-based L2 development promising. Early deployment offers better chances to capture L2 LST liquidity.

User Segmentation

Different users have varying staking needs, but common factors include security, yield, degree of decentralization, tokenomics, UI/UX, and ease of use.

Currently, L0 has few projects due to late token launches, high technical barriers, and heavy VC involvement. In L1, leaders have emerged, and whales/major holders mostly stake ETH at L1 and participate in L2. L2 attracts various opportunistic players. Yet comparing L1 and L2 TVL—take Lido’s stETH as example: total supply is7.383M, while statistically trackable staking in LSDFi is only around150K—indicating vast untapped market potential in L2.

(Recommend more granular data tracking; current data complexity necessitated simplification in analysis)

Each factor appeals differently to users of varying capital sizes. I believe future L1 and L2 newcomers will fully leverage these dimensions.

[1] Security: Team background, internal management, audits, fund custody, etc.

[2] Yield: Level, persistence, diversity of yield sources

[3] Decentralization: Custody methods, DVT tech, token concentration

[4] Tokenomics: Ability to ensure utility while balancing supply-demand, ideally creating scarcity

[5] UI/UX: Clear, clean interface and low user threshold

[6] Usability: Clarity in communicating product purpose to users

Project Recommendations

Basic project information is available in theGoogle Sheet—please allocate based on your own risk appetite.

As a personal example, with limited capital, I pursue high returns—participating in only one L1 leader or rising star, allocating the rest to L2 real-yield and L3 projects, plus small positions in new launches.

Conclusion

Many LSD projects use “LSD Summer” as a slogan, drawing parallels to DeFi Summer. Based on the above analysis, such a comparison is unlikely—but a summer is possible. Tracing back, the entire LSD ecosystem is rooted in PoS-native tokens, meaning LSDFi users must understand Web3 and are mostly engaged in on-chain projects. Most tokens aren’t listed on exchanges, and returns are denominated in crypto—implying LSD participants are a niche subset within the already small Web3 community. External user inflow remains extremely limited.

Bear market liquidity has been persistently scarce. Unlike DeFi Summer—which lacked NFTs, GameFi, or BRC20—today’s crypto liquidity is fragmented across numerous sectors. Though LSD is a hot sub-sector within DeFi, it cannot capture most of DeFi’s liquidity. Beyond hype cycles, a true summer may only arrive alongside the bull market.

Due to length constraints, I didn’t cover several standout projects—some excelled through strong partnerships, others pivoted mid-way anticipating LSD hype and delivered impressive results. This underscores team importance. In homogenized L1 and L2 spaces, both technological innovation and team effort are essential. With the upcoming Cancun upgrade and approaching bull cycle, designing new products or tailoring them for different assets may be key considerations for many teams.

Cross-layer products are emerging across tiers—possibly a future trend. Capturing share in one’s own layer and leveraging advantages to expand into adjacent layers represents viable business growth. Expanding to Layer 2 remains a solid choice, with many projects already planning developments—worth anticipating.

As stakers and investors facing a rich array of products, I recommend first understanding your risk profile, then building strategies around higher-security products (those with broader attention and no past security issues). Recently, scam and rug-pull projects have emerged—heightened vigilance is required.

Disclaimer: All projects mentioned in this article do not constitute investment advice. I hold tokens in some of these projects, creating potential conflicts of interest. Analysis contains subjective elements.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News