Can Radpie replicate or even surpass Penpie's returns?

TechFlow Selected TechFlow Selected

Can Radpie replicate or even surpass Penpie's returns?

This article will introduce you to the Radpie mechanism, product advantages and disadvantages, narrative tags, and how to participate in Magpie ecosystem IDOs.

Penpie $PNP IDO opened with a surge of up to 5x.

Riding the momentum, Magpie has announced it will continue launching Radiant $RDNT's "Convex"—Radpie—under its subDAO model.

With multiple compelling narratives in play, can Radpie replicate—or even surpass—the returns seen with PNP? This thread will walk you through Radpie’s mechanism, product strengths and weaknesses, narrative tags, and how to participate in Magpie ecosystem IDOs.

A. Radpie Mechanism

Simply put, Radpie is to RDNT what Convex is to Curve. Let's dive deeper.

Radiant Capital, a cross-chain lending protocol and LayerZero-themed project, imposes restrictions on liquidity incentives—meaning users must indirectly lock up RDNT to earn mining rewards.

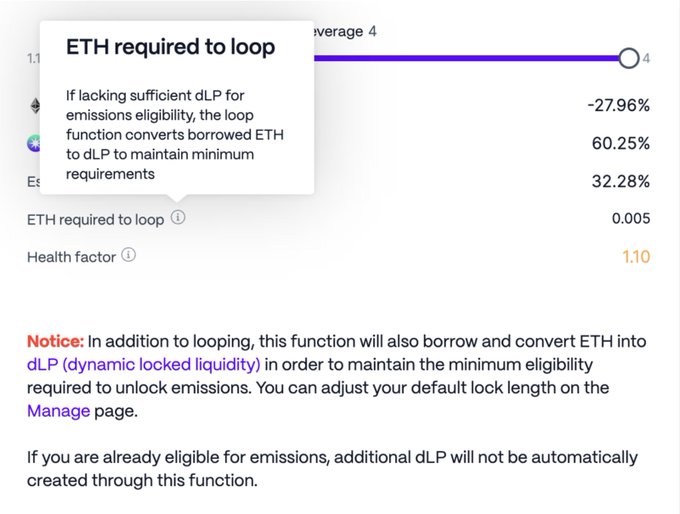

Specifically, users need dLP equivalent to 5% of their deposit amount. dLP refers to LP tokens from an 80% RDNT / 20% ETH Balancer pool. If your dLP ratio falls below 5%, you lose eligibility for RDNT emissions. If you use RDNT’s one-click loop feature, the system will automatically borrow funds to buy more dLP once your stake drops under 5%.

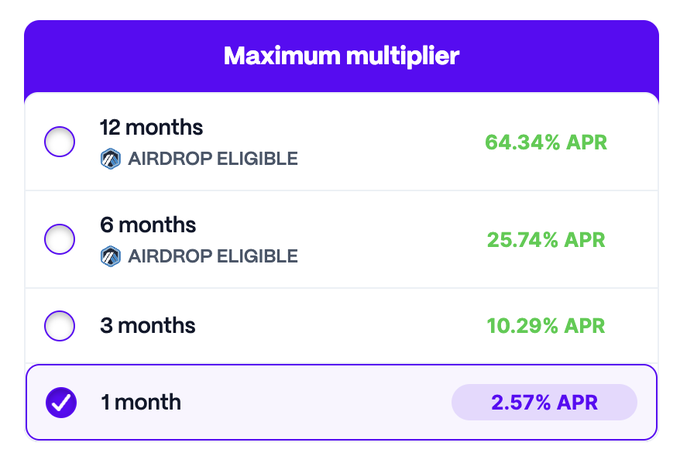

This creates strong long-term sustainability for RDNT, as mining RDNT inherently contributes long-term liquidity. After all, dLP comes with a lock-up requirement, and longer locks yield higher APRs.

Radpie’s role is to pool dLP and share it with DeFi miners, enabling them to farm without directly holding RDNT—similar to how Convex shares veCRV. The pooled dLP will be represented by mDLP tokens, just as CRV becomes cvxCRV via Convex.

For RDNT holders, they can form dLP and convert it into mDLP through Radpie, earning high yields while maintaining exposure to RDNT. The logic mirrors that of cvxCRV, since dLP contains 80% RDNT and closely tracks RDNT’s price movements.

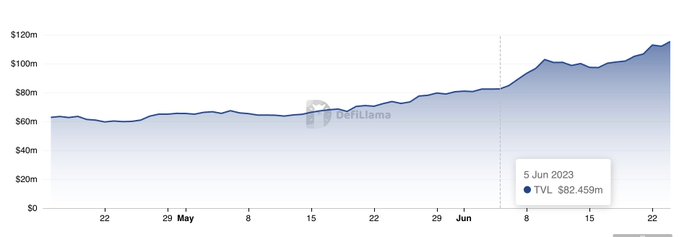

From Radiant’s perspective, this is beneficial too. Once converted to mDLP, the dLP is effectively locked in perpetuity, sending part of the RDNT supply into a black hole and strengthening long-term liquidity. It also helps attract lighter-weight users. As shown below, Pendle saw accelerated growth after launching its Pendle-ecosystem “Convex” product—Radiant is expected to benefit similarly.

One drawback is that unlike Pendle or Curve, Radiant does not allocate incentives via governance voting, so there’s no bribe revenue stream. However, Radiant has committed to ongoing DAO development, meaning governance rights may gain value over time—and Radpie, holding massive governance power (via dLP), stands to benefit significantly.

B. Product Strengths and Weaknesses

Like Penpie, Radpie is a project built on the shoulders of giants—such projects tend to have well-defined ceilings and floors. For comparison, Aura’s FDV is 35% of Balancer’s, while Convex is 14% of Curve’s. Given that RDNT is a $300M FDV project listed on Binance, Radpie’s valuation has reasonable comparables.

Following Magpie’s typical subDAO approach, Radpie’s IDO FDV should be under $10M, offering meaningful profit potential for early participants. The downside is that Radpie lacks the horizontal scalability of its parent DAO, Magpie. However, it will benefit from Magpie’s internal and external looping ecosystem across subDAOs—more on this in the next section.

C. Narrative Tags

LayerZero / ARB Airdrop / Sovereign Leverage Governance / Dual Internal-External Loop / subDAO will be Radpie’s core narrative pillars.

LayerZero: RDNT is a well-known LayerZero-themed token, and Radpie will naturally leverage LayerZero for cross-chain interoperability.

ARB Airdrop: The RDNT DAO has decided to distribute 40% of received ARB tokens to newly locked dLPs during an upcoming period, and 30% evenly to existing dLPs over the next year. Radpie happens to launch right at this opportune moment, positioning it well to capture a share of the 2M+ ARB distribution—a major boost for project traction.

Sovereign Leverage Governance: As per standard practice, a large portion of RDP tokens will be allocated to the Magpie treasury. These tokens generate yield shared with MGP holders, and when decisions are made in the Radiant DAO, MGP holders can influence outcomes through their controlled RDP stakes.

Given that MGP controls RDP, which in turn controls dLP tied to RDNT, this setup inherently creates leverage. If MGP votes for a proposal and holds a majority of RDP shares, it will likely pass unless others collectively oppose. In RDNT voting, 100% of dLP controlled by Radpie will vote accordingly—this is the essence of sovereign leverage governance.

Dual Internal-External Loop: This is a unique system emerging from Magpie’s expansion strategy using the subDAO model. For example, the mdLP/dLP trading pair will likely be deployed on Wombat, where vlMGP holders can bribe for increased WOM emissions. If mDLP later integrates with Pendle, Radpie would then bribe Penpie.

These emitted tokens remain within the Magpie ecosystem—this is the “internal loop,” keeping value within the system and minimizing net outflows. The “external loop” refers to resource sharing between projects to reduce costs and improve efficiency. For instance, Ankr used Penpie Bribe to claim Pendle incentives—once Radiant opens bribe opportunities, similar collaborations become feasible.

subDAO: As evident, both sovereign leverage governance and the dual-loop system stem from Magpie’s expansion via the subDAO model.

Beyond these two aspects, the subDAO model offers additional benefits: First, in today’s environment full of rug pulls, credibility is paramount—subDAO inherits the parent DAO’s reputation. Second, issuing independent tokens (vs. direct integration) unlocks powerful tokenomics-driven growth. Third, it provides more speculative instruments for the market, ensuring the parent project stays aligned with prevailing narratives.

D. How to Participate in Magpie Ecosystem IDOsIn Penpie’s case, IDO allocations were distributed as follows:

35% – xGRAIL holders;

30% – mPENDLE holders;

25% – vlMGP holders;

10% – Penpie LP providers.

By extension, participation in future Magpie ecosystem IDOs can follow two paths:

Long-term approach: Buy and hold vlMGP, which is expected to grant access to all future subDAO IDOs. However, this method is highly sensitive to MGP price volatility—please do your own research thoroughly.

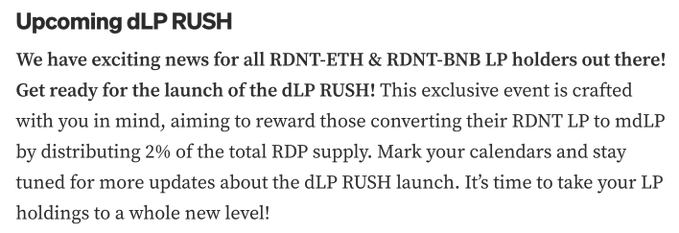

Short-term arbitrage approach: Borrow RDNT via Binance or hedge via short contracts, then join the mDLP Rush event to convert dLP into mDLP—earning both RDP airdrops and IDO allocation. If you’re bullish on the base asset (RDNT), you can simply buy RDNT and participate directly in the mDLP Rush.

Note: Like cvxCRV/CRV, mDLP/DLP are softly pegged rather than rigidly fixed—there’s no guarantee of a 1:1 redemption upon exit. DYOR, DYOR!

Launchpad platforms may also receive some allocation, but frankly, low-valuation projects gaining funding through launchpads offer limited strategic value. PNP likely chose Camelot to tap traffic and engage the ARB community, helping Magpie establish presence on Arbitrum. But Radpie may not need such a move.

Pancake/Camelot remain possible candidates (though Camelot isn’t particularly strong anymore), but unless favorable terms exist, there’s little reason to cede a portion of the pie. Thus, this aspect remains highly uncertain. Additionally, Cake and Grail are large pools—arbitrage gains could be small, and uncertainty remains high.

Summary

Radpie is essentially RDNT’s Convex—the biggest advantages being low valuation and standing on the shoulders of giants. Radpie carries five narrative layers: LayerZero, ARB airdrop, sovereign leverage governance, dual internal-external loop, and subDAO. Participation in its IDO offers diverse options, suitable for both long-term holders and short-term speculators.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News