CFTC Wins Lawsuit Against Ooki DAO, Setting Precedent for DAOs Bearing Legal Liability

TechFlow Selected TechFlow Selected

CFTC Wins Lawsuit Against Ooki DAO, Setting Precedent for DAOs Bearing Legal Liability

On-chain DAOs are no longer a lawless frontier.

Executive Summary

-

In the case of CFTC v. Ooki DAO, due to Ooki DAO's failure to respond, the CFTC achieved a sweeping victory, with the court ordering Ooki DAO to cease operations in the U.S., shut down its website and remove content, and pay a $643,542 fine.

-

The judge agreed with the CFTC’s definition of a DAO as an unincorporated association, thereby allowing a DAO to be named as a defendant and held legally liable.

-

Once DAOs are recognized as legal defendants, on-chain activities are no longer beyond the reach of law—regulatory agencies can use this precedent to regulate on-chain DAOs, DeFi platforms, and DEX projects.

-

On-chain DAO = Unincorporated Association = All governance participants may bear joint liability for the DAO's actions.

I. The CFTC’s Victory

On June 9, 2023, the U.S. Commodity Futures Trading Commission (CFTC) announced a “sweeping victory” against Ooki DAO in a judicial ruling, setting an unprecedented precedent by establishing that a DAO can be a legally liable defendant.

In the case of CFTC v. Ooki DAO, a California federal judge issued a default judgment in favor of the CFTC on June 8, 2023, finding Ooki DAO civilly liable for operating an illegal trading platform and unlawfully acting as a Futures Commission Merchant (FCM). The judgment imposed a $643,542 penalty and ordered the permanent shutdown of Ooki DAO’s website and the removal of all its online content.

Critically, in this landmark ruling, the court recognized Ooki DAO as a "person" under the U.S. Commodity Exchange Act, making it subject to legal liability as a defendant. A CFTC official stated: “This judgment should serve as a wake-up call to those who believe they can evade the law by adopting a DAO structure, avoid regulatory oversight, and ultimately endanger the public.”

This judgment is pivotal for DAOs and DeFi projects: (1) The court has defined a DAO as a legally actionable "person," meaning on-chain activities are no longer beyond the law—regulators can now use this precedent to oversee on-chain DAOs, DeFi platforms, and DEXs; (2) The CFTC’s classification of an on-chain DAO as an "unincorporated association," accepted by the court, implies that DAO governance participants may face joint legal liability for the DAO’s actions.

II. Details of the Ooki Case

bZx is a blockchain-based decentralized DeFi protocol that allows users to provide digital assets as collateral to create leveraged positions for trading. The value of these trades is determined by the price difference between two digital assets, without involving the actual sale of digital assets.

Initially developed and maintained by bZeroX LLC and its founders, around August 23, 2021, bZeroX LLC transferred control of the bZx protocol to bZx DAO—which was later renamed Ooki DAO on November 18, 2021. From that point onward, Ooki DAO could only be governed through voting by holders of OOKI tokens. The CFTC cited a statement from one of the bZx protocol’s founders at the time: “Transitioning to a DAO will make the bZx protocol immune to legal regulation and accountability.” Clearly, the CFTC disagrees.

On September 22, 2022, the CFTC initiated two enforcement actions against Ooki DAO: (1) penalizing bZeroX LLC and the bZx protocol’s founders, which was settled; and (2) filing a lawsuit against Ooki DAO, alleging that it (i) illegally offered retail off-exchange leveraged and margined commodity transactions; (ii) operated as an unregistered futures commission merchant (FCM); and (iii) failed to implement KYC verification and customer identification procedures (CIP) as required under the Bank Secrecy Act for FCMs. The court subsequently approved service of process via forum chatbots and public forum announcements directed at Ooki DAO and its members.

Subsequently, four Web3 organizations—Paradigm, a16z, the DeFi Education Fund (supported by Uniswap), and LeXpunK_Army (supported by Yearn, Curve, and Lido)—submitted amicus briefs to the court in support of Ooki DAO, arguing that it was unreasonable for the CFTC to hold DAO members or token holders liable solely based on governance voting. Miles Jennings, General Counsel at a16z, further argued that enforcement should focus only on those DAO members who participated in governance votes related to illegal activities, rather than holding all members liable.

After Ooki DAO missed its January 2023 deadline to respond, the CFTC moved for a default judgment, meaning Ooki DAO failed to defend itself in court—possibly a strategic decision, as no member appeared willing to face CFTC liability.

On June 8, 2023, a California federal judge issued the default judgment in favor of the CFTC, meaning the CFTC did not need to substantiate its allegations against Ooki DAO. Despite widespread support, Ooki DAO’s failure to appear set a troubling precedent for regulatory oversight of DAOs.

CFTC Chair Rostin Behnam described Ooki DAO as a clear case of fraud, with organizers attempting to evade CFTC regulation by illegally offering leveraged and margined digital asset derivatives to U.S. retail customers. He emphasized that while DAOs represent innovative technology, they do not exempt entities from state or federal regulatory frameworks.

III. Implications and Consequences of the CFTC’s Victory

Because Ooki DAO did not respond, the California judge essentially accepted all of the CFTC’s demands without requiring any justification from the agency. As the U.S. operates under a common law system, this ruling will have significant ripple effects across the crypto industry: defining DAOs as legally actionable entities means on-chain activities are no longer beyond the law—regulators can now target DAOs, DeFi platforms, and DEXs using this case as precedent. Additionally, DAO governance participants may now face personal joint liability for the DAO’s actions.

3.1 On-Chain DAOs Are No Longer Lawless Zones

On the CFTC’s official Digital Assets webpage, all virtual assets—including all cryptocurrencies—are classified as “commodities.” This gives the CFTC authority to regulate derivative transactions in the virtual asset futures market and combat fraud and market manipulation in the spot market. However, the CFTC lacks jurisdiction over spot market transactions that do not involve margin, leverage, or financing.

Prior to transitioning into a DAO, bZeroX LLC and its founders were clearly liable for any violations. Notably, the California judge accepted the CFTC’s argument that Ooki DAO constitutes an “unincorporated association” under the Commodity Exchange Act—a legally actionable “person” capable of being sued and held liable.

This means that going forward, the CFTC has the authority to regulate and sue DAOs and DeFi projects involved in virtual asset futures and derivatives markets. Should dYdX, Synthetix, and other decentralized derivatives exchanges be concerned? Even more alarming: could the SEC leverage this ruling to directly pursue enforcement actions against projects—and even decentralized exchanges (DEXs)—it deems to be issuing or selling unregistered securities?

(https://www.bitstamp.net/learn/web3/what-is-a-decentralized-exchange-dex/)

3.2 DAO Members May Bear Joint Legal Liability

Although the court’s penalties were directed solely at Ooki DAO, the CFTC relied on federal law and various state partnership law precedents to assert that members of a for-profit unincorporated association may be personally liable for the organization’s actions. This exposes Ooki DAO governance participants to potential personal liability. It remains unclear how the CFTC will enforce the financial penalty.

This is devastating for DAOs, especially compared to legal structures like LLCs or corporations, which shield individuals from organizational liabilities. The CFTC drew a parallel between bZeroX LLC and Ooki DAO—both controlled the bZx protocol and governed it through member votes. Therefore, the CFTC argues: any OOKI token holder who participates in governance voting to influence proposals effectively volunteers to join Ooki DAO and may be held personally liable for its actions.

3.3 New Regulatory Pathways for DeFi

Following the U.S. government’s sanctions in August 2022 against the DeFi mixing protocol Tornado Cash, this case represents another expansion of regulatory reach over on-chain DeFi projects. In the case of Tornado Cash, the U.S. government sanctioned it for allegedly facilitating money laundering for terrorists, adding it to the SDN list and prohibiting all U.S. persons or entities from transacting with Tornado Cash or associated wallet addresses. The Ooki DAO case goes further: U.S. regulators have now directly ordered servers to shut down the Ooki DAO website, delete online content, and ban Ooki DAO from conducting any business in the United States.

On April 6, 2023, the U.S. Department of the Treasury released its 2023 Assessment of Illicit Finance Risks Related to Decentralized Finance—the first-ever global assessment of illicit financial risks tied to DeFi. The report recommends strengthening U.S. AML/CFT regulations and enhancing enforcement over virtual asset activities, including DeFi services, to improve compliance with Bank Secrecy Act (BSA) obligations among virtual asset service providers. It’s evident that U.S. regulators are following a dual-track strategy: regulating fiat on/off ramps through AML/CFT controls at the entry points, and overseeing project-level compliance from an investor protection standpoint.

IV. Solution—Legal Wrappers for DAOs

The CFTC has clearly used this case to break through the notion of on-chain immunity. On-chain activities are no longer beyond the law. Implementing a legal wrapper for decentralized DAOs and DeFi projects is no longer optional—it is essential to protect members’ limited liability.

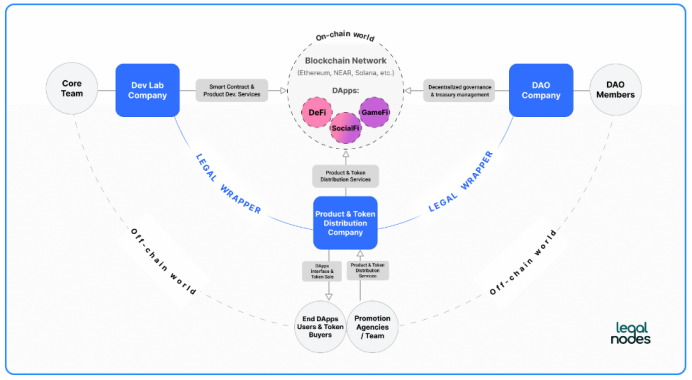

A legal wrapper for a DAO refers to a legal framework or formal corporate entity designed specifically for DAOs, granting them recognized legal status within a given jurisdiction. Its core function is to “wrap” the DAO within a legal structure, enabling it to interface with traditional legal systems—ensuring regulatory compliance, protecting members’ limited liability, and bridging the DAO to the real world.

Founders and members of unregistered DAOs face significant legal risks, particularly:

A. Legal Liability Risk. Like Ooki DAO, an unregistered DAO may be treated as a general partnership. If classified as such, every member could be personally liable for all of the DAO’s debts and obligations. In contrast, a registered DAO can exist as a separate legal entity, complying with local and international regulations and providing members with limited liability similar to traditional corporate structures.

B. Tax Risk. DAO members who fail to pay income taxes may face fines or penalties. A registered DAO can conduct proper tax reporting and meet tax compliance requirements in relevant jurisdictions based on its legal structure.

C. Financial Compliance Risk. Accepting funds or engaging in economic activity in the anonymous blockchain environment without proper KYC/AML/CFT checks may lead to administrative or criminal investigations related to securities, AML/CFT, or financial crimes.

DAO legal entities can be registered in various forms: foundations, associations, nonprofit LLCs, or for-profit LLCs.

The choice of legal form and jurisdiction depends on the DAO’s type (community/protocol, service, investment), business model, token utility, and other factors.

When deciding where to establish a DAO, three key criteria typically guide the decision:

(1) Does the DAO intend to generate profits and distribute them to members?

(2) What is the level of decentralization of the DAO?

(3) Will the DAO issue tokens in the future?

V. Final Thoughts

After regaining momentum following the FTX collapse, U.S. regulators launched enforcement actions in Q1 2023 against major players in the crypto space, including Coinbase, Kraken, Paxos, Silvergate Bank, Signature Bank, Justin Sun, and Binance. Most recently, the SEC has directly challenged the two largest crypto giants—Coinbase and Binance—by classifying certain listed tokens as “securities,” while the CFTC has already breached the defenses of the crypto world, exposing approximately 12,745 DAOs and $20 billion in digital assets to CFTC enforcement.

DAOs, DeFi platforms, and DEX projects must proceed with extreme caution!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News