CFTC launches new phase of "Crypto Sprint," opening compliance pathway for instant digital asset trading

TechFlow Selected TechFlow Selected

CFTC launches new phase of "Crypto Sprint," opening compliance pathway for instant digital asset trading

From gray areas to regulatory compliance, the U.S. crypto market is迎来a structural turning point.

Author: kkk, BlockBeats

Under strong impetus from the Trump administration, the U.S. is accelerating the integration of digital assets into the mainstream financial system. On August 1, the Commodity Futures Trading Commission (CFTC) officially launched a regulatory initiative called "Crypto Sprint," proposing on August 5 to allow spot crypto assets to be traded compliantly on CFTC-registered Designated Contract Markets (DCMs). Subsequently, on August 21, the CFTC advanced the next phase of the Crypto Sprint, prioritizing the achievement of real-time digital asset transactions at the federal level, with a focus on issues related to leveraged, margined, or financed retail trading by stakeholders on CFTC-registered exchanges. This move not only breaks the long-standing regulatory gray area for spot markets but also signals a clear and viable compliance pathway ahead for the Web3 industry.

CFTC Acting Chair Caroline Pham publicly stated: "Under President Trump's strong leadership, the CFTC is fully advancing federal-level spot trading of digital assets and coordinating closely with the SEC's 'Project Crypto.'" This statement sends a powerful signal: U.S. regulation is shifting from "defensive suppression" to "institutional acceptance," providing unprecedented compliance opportunities for Web3 infrastructure such as DeFi, stablecoins, and on-chain derivatives.

Spot Contracts Legalization: The Institutional Starting Point for Crypto Markets

For years, the U.S. regulatory framework has lacked unified oversight over crypto spot trading. Trading of assets like BTC and ETH has largely been concentrated on overseas platforms or unlicensed domestic exchanges. Regulatory gaps have not only undermined investor protection but also kept significant institutional capital on the sidelines.

The CFTC’s "Crypto Sprint" aims precisely to address this pain point. One of its core components is enabling spot contracts for non-security crypto assets to be legally listed on CFTC-registered futures exchanges (DCMs). By authorizing these platforms to host spot crypto trading, the CFTC offers a compliant alternative to the previously dominant unlicensed or offshore platforms—platforms that have gradually lost institutional trust following the FTX collapse (2021) and Binance's ongoing regulatory challenges. For institutional investors, this policy means a more legal, transparent, and fair entry path into crypto assets, removing key barriers to large-scale digital asset allocation.

According to the CFTC, Section 2(c)(2)(D) of the Commodity Exchange Act explicitly requires any commodity transaction involving leverage, margin, or financing to occur on a registered DCM. This provision provides a solid legal foundation for the listing of crypto spot contracts and brings much-needed regulatory certainty to the market. Under this framework, we may soon see centralized trading platforms akin to Coinbase—or on-chain derivatives protocols such as dYdX—obtaining compliance licenses through DCM registration.

Meanwhile, the policy opens a compliant gateway for traditional financial institutions to access crypto assets. CME, a representative DCM, already possesses full infrastructure for BTC and ETH futures markets. Once spot contracts are approved, it could offer institutional investors a one-stop gateway for both futures and spot crypto trading, accelerating the inflow of traditional capital.

The new phase of the Crypto Sprint launched on August 21 focuses on filling gaps in digital asset market structure, custody arrangements, stablecoin regulation, and anti-money laundering standards. Andrew Rossow, CEO of AR Media Consulting, noted in an interview with Decrypt that the CFTC is attempting to establish a unified federal-level spot market for crypto assets to lay a regulatory foundation, addressing long-standing interstate fragmentation and regulatory gray zones. He views these moves as part of a "federal legitimacy strategy" aimed at driving foundational reforms. Once the so-called "federal handcuffs" are removed, retail investors could regain trust under stronger protections, helping repair a market environment damaged by regulatory neglect.

The remaining "Sprint" initiatives are expected to tackle unresolved issues such as DeFi oversight, banking access, tax clarity, and inter-agency coordination.

SEC and CFTC Join Forces: Regulatory Coordination Brings Certainty

In recent years, one of the biggest regulatory challenges in the U.S. crypto market has been the overlapping and ambiguous jurisdictions between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Projects often face simultaneous compliance demands from both agencies, caught in a "regulatory squeeze" or subject to "duplicate enforcement," consuming resources and increasing uncertainty.

The current "Crypto Sprint" marks the first clear signal that the CFTC will establish close cooperation with the SEC to jointly clarify the legal classification of crypto assets (security vs. commodity), custody standards, and trading compliance requirements—providing market participants with a unified and predictable compliance pathway.

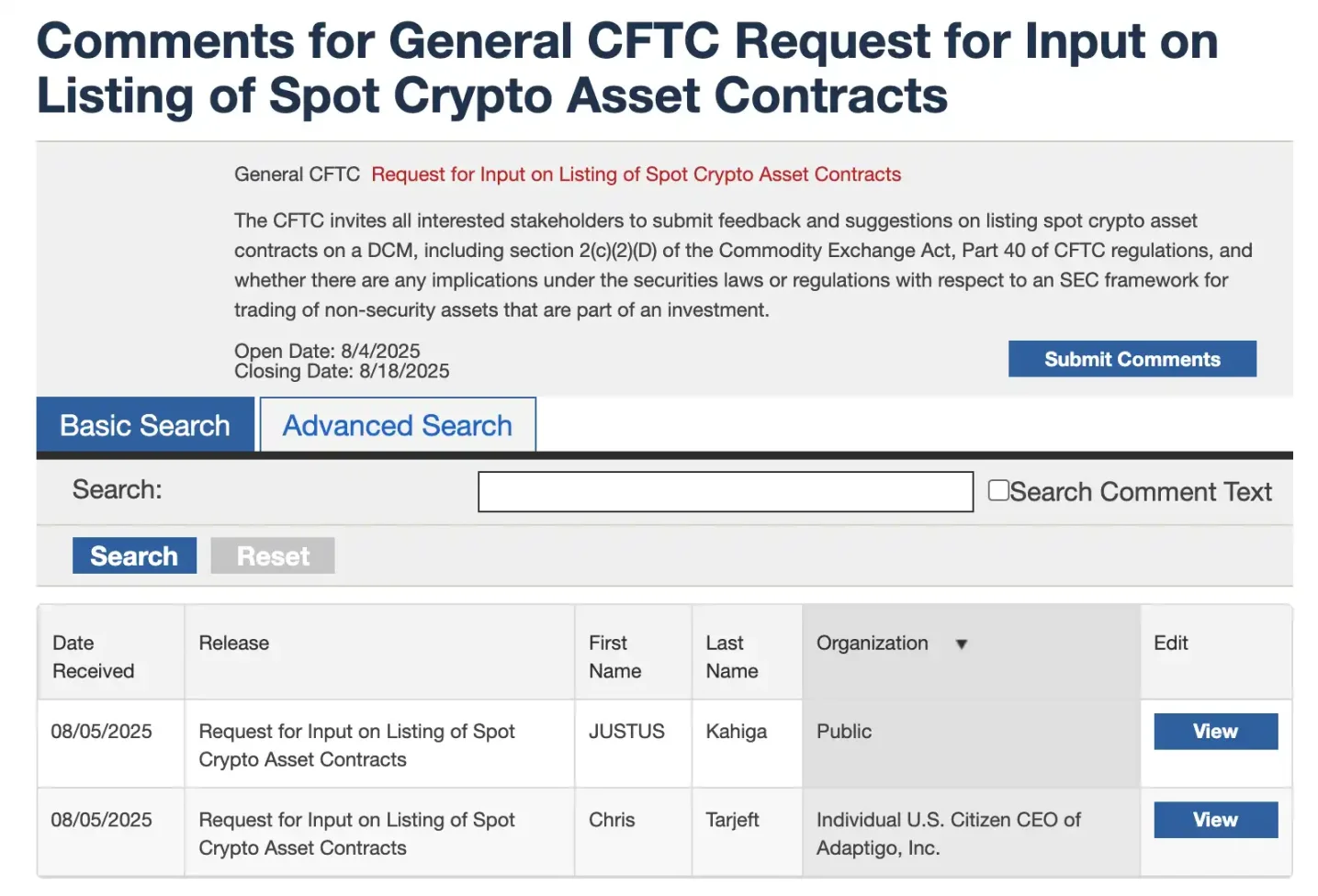

The "Sprint" signifies not just an acceleration in regulatory pace but a fundamental shift in mindset—from passive defense to proactive collaboration. For Web3 projects, this is no longer merely a "regulatory observation period," but an unprecedented window for institutional co-creation. The CFTC has opened public consultation on its proposal to list spot crypto asset contracts on registered DCMs, with feedback due by August 18. Participants who submit timely comments may not only avoid future regulatory blind spots but also influence the specific direction of upcoming rules.

At the same time, the SEC’s "Project Crypto" is closely aligned with the "Crypto Sprint," aiming to build a unified federal regulatory framework that clearly distinguishes between security-type and commodity-type crypto assets, and to promote the development of a "super app" structure capable of trading multiple asset classes. If realized, future platforms could legally offer a one-stop suite of crypto financial services—including stocks, Bitcoin, stablecoins, and staking—under a single license.

SEC Chair Paul Atkins and Commissioner Hester Peirce have publicly expressed support, calling it a "historic turning point toward on-chain financial systems," and pledged to accelerate rulemaking in key areas such as stablecoin regulation, crypto asset custody, and compliant token issuance.

This dual-track regulatory advancement could finally end the long-standing U.S. confusion over whether crypto assets are "securities" or "commodities," setting a clear and replicable compliance model for the world.

More importantly, it means Web3 projects can now move beyond the fear of accidental violations, instead integrating into the mainstream financial system through clear registration processes, compliant custody, and audit frameworks—bridging on-chain assets with real-world finance.

Summary

In the past week, the U.S. government has sent unprecedented strong signals in the digital asset space: the White House formally released the "Digital Asset Strategy Report," the SEC launched "Project Crypto," and the CFTC initiated the next phase of "Crypto Sprint," making real-time digital asset transactions at the federal level its top priority and opening public consultation on compliant spot contract listings. Meanwhile, the White House made the rare declaration banning banks from discriminating against crypto firms—this is not just a "thaw," but a full policy reversal.

Once the main source of regulatory shadow for crypto projects, the SEC is now partnering with the CFTC to build a unified regulatory framework for Web3. What we are witnessing is a visible, historic structural transformation: from ambiguity to clarity, from suppression to support, from gray zones to federal legislation.

This time, it's not just regulators who are sprinting—it's every Crypto Builder.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News