From Gaming GPUs to Data Centers: How NVIDIA is Responding to the Ethereum PoS Transition and the AI Boom?

TechFlow Selected TechFlow Selected

From Gaming GPUs to Data Centers: How NVIDIA is Responding to the Ethereum PoS Transition and the AI Boom?

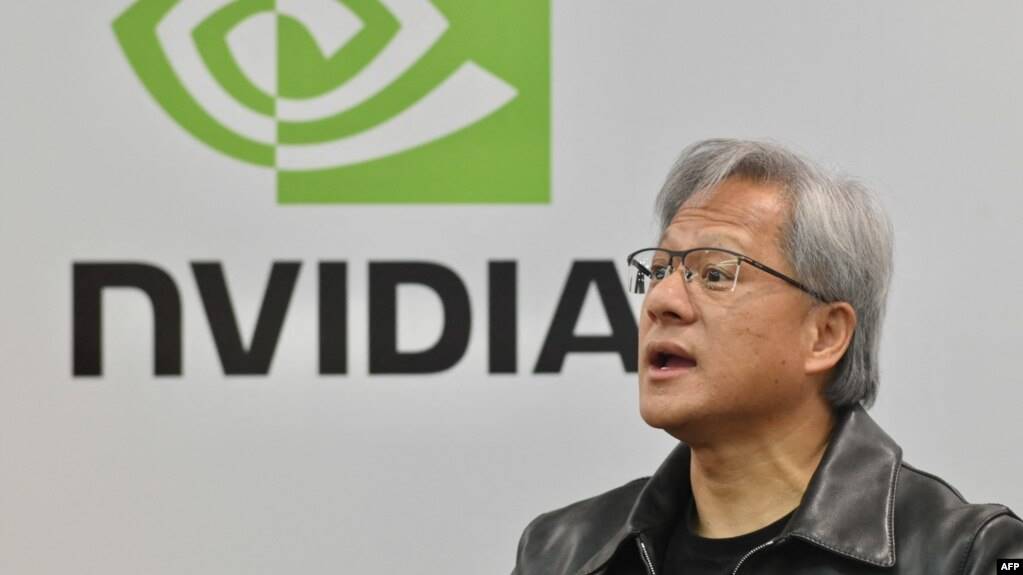

As ETH transitioned from POW to POS and amid the AI boom, NVIDIA's primary business shifted from gaming GPUs to data centers.

By CapitalismLab

NVIDIA, the leading AI stock in U.S. markets, has recently surged past a $1 trillion market capitalization—nearly equal to the entire cryptocurrency market, or twice the market cap of Bitcoin. Why is NVIDIA rising? How does it differ from peer AMD? And what is its position within the AI field?

This article will help you clearly understand NVIDIA through data and analysis.

NVIDIA's business is primarily divided into five segments:

-

Data Center – this includes AI & cloud computing

-

Gaming GPUs – which also include cards used for cryptocurrency mining

-

Professional visualization (e.g., 3D design)

-

Automotive chips

-

OEM and others

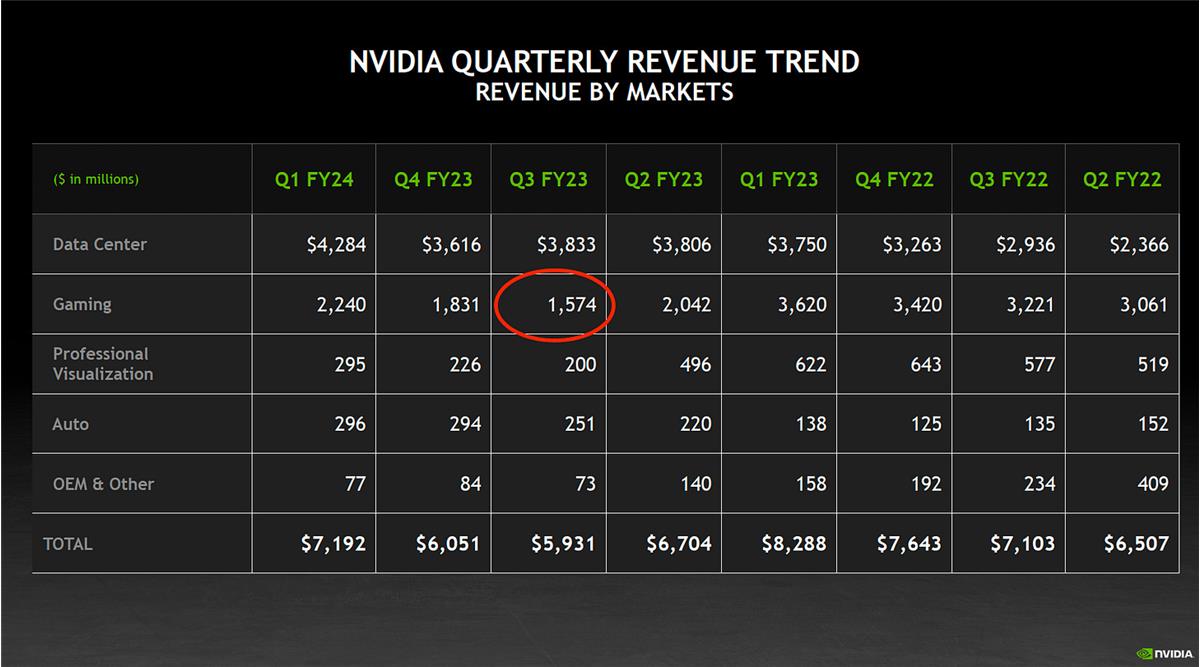

As shown in the chart above, NVIDIA’s core business has shifted from gaming GPUs to data center operations.

Analyzing quarterly trends, we can see that in Q3 of NVIDIA’s fiscal year 2023 (July–September 2022), gaming GPU revenue hit a low point. This coincided with the Ethereum Merge in September 2022, when ETH transitioned from Proof-of-Work (PoW) to Proof-of-Stake (PoS), rendering many GPU-based mining rigs obsolete. To date, NVIDIA’s gaming GPU revenue has only recovered to about 60% of its pre-Merge level.

Although overall revenue has not yet returned to previous highs, the data center segment—home to cloud computing and AI—has maintained steady growth. While the numbers may appear modest (up 14% year-over-year and 18% quarter-over-quarter), more importantly, amid the ChatGPT boom, companies are aggressively purchasing GPUs to develop large-scale general-purpose models, creating strong growth expectations for this business line.

Stock and crypto investing are similar—in particular for growth stocks, prices are heavily influenced by expectations and narratives. As seen in the chart below, since the launch of ChatGPT last year, NVIDIA’s valuation relative to AMD has steadily climbed, now reaching nearly three times that of AMD.

Note: EV/EBITDA is a common metric used to value tech stocks.

Why hasn’t AMD benefited similarly?

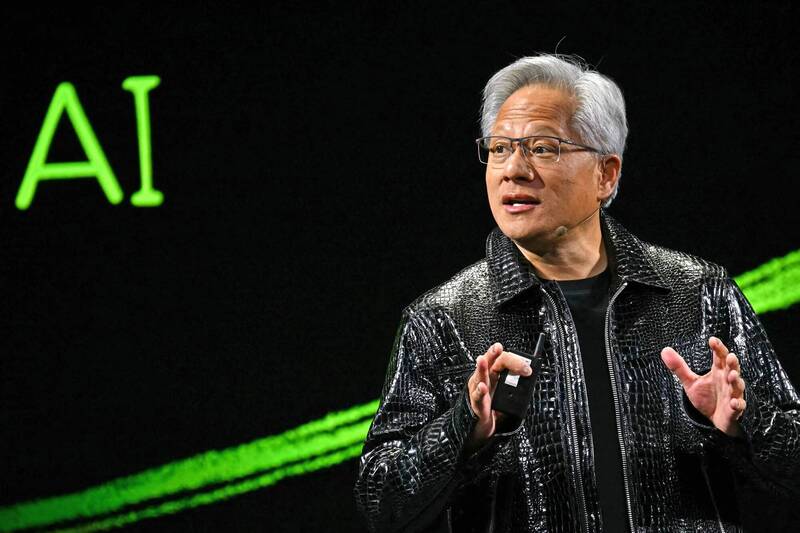

After all, AMD boasts “CPUs beat Intel, GPUs beat NVIDIA.” But NVIDIA isn’t just a hardware company—it dominates the software ecosystem in accelerated computing. Its CUDA platform has seen 40 million downloads and attracted 4 million developers. In other words, AI development relies not only on NVIDIA’s hardware but also on its software—a key advantage AMD cannot match.

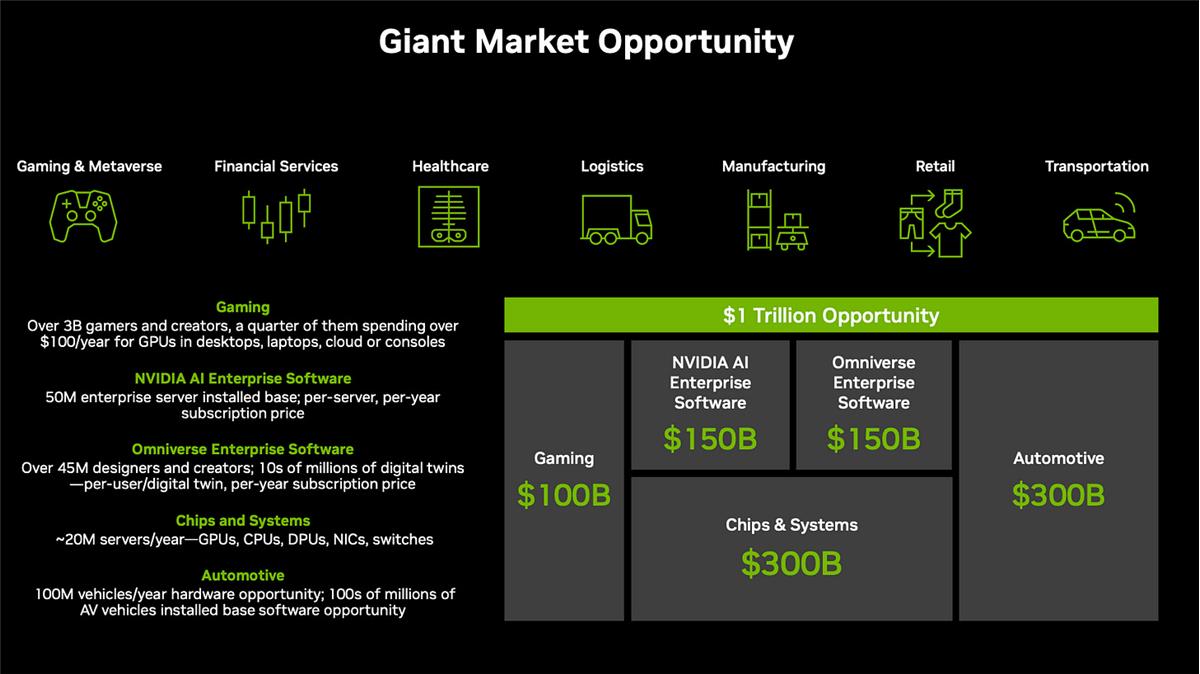

Simply put, in AI computing, NVIDIA is like Intel + Microsoft in the PC era. AMD has recently gained ground on Intel thanks to TSMC’s advanced process nodes. But what if Intel and Microsoft were the same company? Or more simply, NVIDIA is like Apple in the AI era. As illustrated in NVIDIA’s long-term vision below, the company sees an equally massive $300 billion opportunity in software as it does in hardware within the data center space.

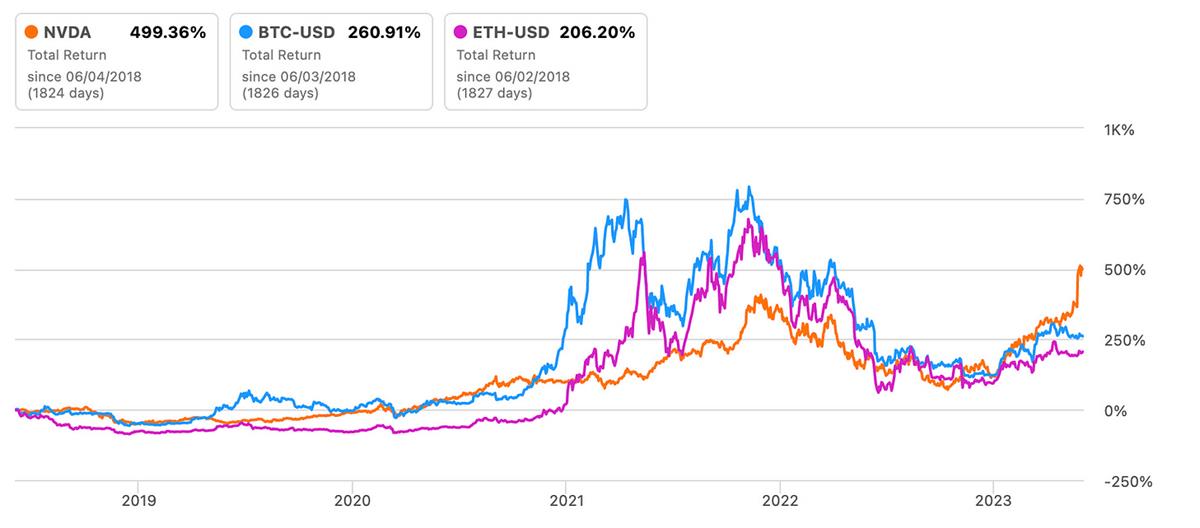

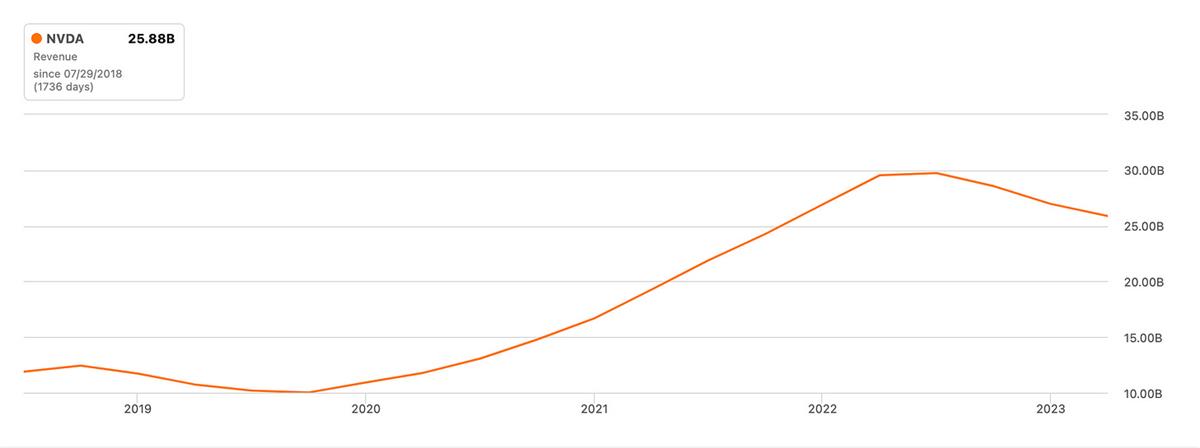

Comparing five-year returns, NVIDIA’s ~5x return far exceeds those of BTC and ETH. Considering its revenue has grown slightly over 2x, we can roughly estimate that about half of the price increase stems from fundamentals, while the larger half comes from valuation expansion—especially recent gains, which are almost entirely driven by rising valuations.

Summary

Following Ethereum’s transition from PoW to PoS and amid the AI boom, NVIDIA has successfully shifted its primary business from gaming GPUs to data centers. NVIDIA excels in both hardware and software in the AI domain—akin to Apple—and its recent surge is largely driven by strong growth expectations and narrative-driven valuation increases in the AI sector.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News