Taking ZkSync as an example, decoding the three-pronged approach to discovering opportunities in new public blockchains

TechFlow Selected TechFlow Selected

Taking ZkSync as an example, decoding the three-pronged approach to discovering opportunities in new public blockchains

In this article, crypto researcher 2Lambroz.eth uses zksync as an example to explain the three aspects he values when looking for a new chain.

Written by: 2Lambroz.eth

Translated by: TechFlow

When entering a new public blockchain, what aspects should we pay attention to? In this article, crypto researcher 2Lambroz.eth uses zkSync as an example to explain the three key factors he considers when evaluating new chains.

New blockchains typically offer three key opportunities:

-

Early liquidity mining;

-

Early bets on tokens with favorable risk-reward profiles;

-

Ecosystem incentives.

Early Liquidity Mining

There are several types of early-stage mining, including issuance rewards and real yield. Of course, these opportunities exist only if you enter early enough, when pool sizes are still small.

Issuance Rewards

DEXs compete for liquidity by increasing mining rewards.

Real Yield

In early ecosystems, cross-chain bridges are often limited—sometimes only ETH can be bridged. Users typically use swap functions to convert ETH into USDC/USDT/DAI, generating real yield. Additionally, you can benefit from users repeatedly trading volume in pursuit of potential airdrops.

Genuine Trading Volume

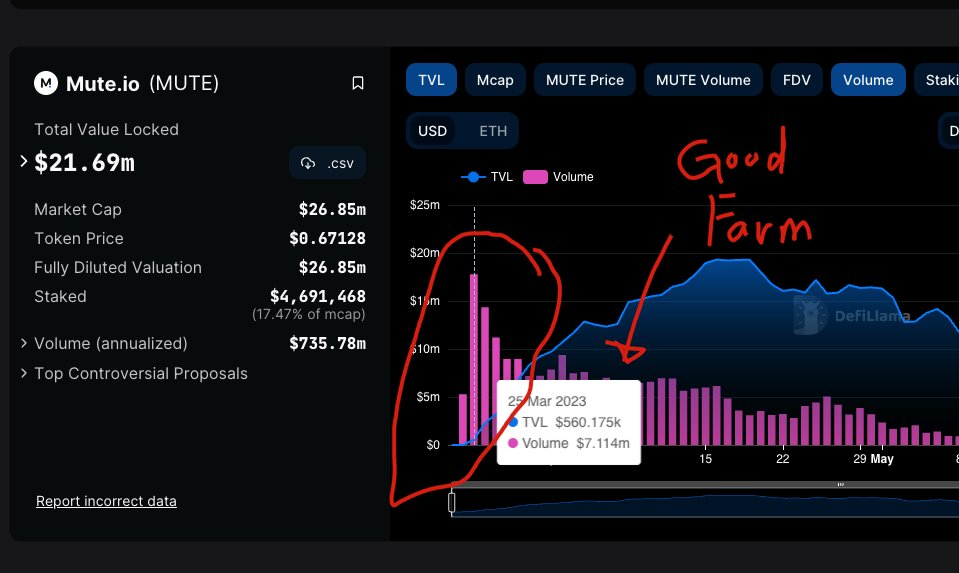

Take Mute.io as an example: trading volume exceeding total value locked (TVL) is usually a good sign of a promising mining opportunity. Whether driven by the above reasons or market volatility, returns tend to be strong!

Early Tokens with Favorable Risk-Reward Profiles

Every ecosystem needs infrastructure such as decentralized exchanges, lending platforms, aggregators, and perpetual contracts. You always have the chance to bet on the "first" or "leading" protocols.

I believe these represent leveraged bets on the ecosystem itself. If the ecosystem truly takes off, Dapp tokens could outperform the chain's native token like $OP or $ARB. Of course, you still need to evaluate their valuation and tokenomics.

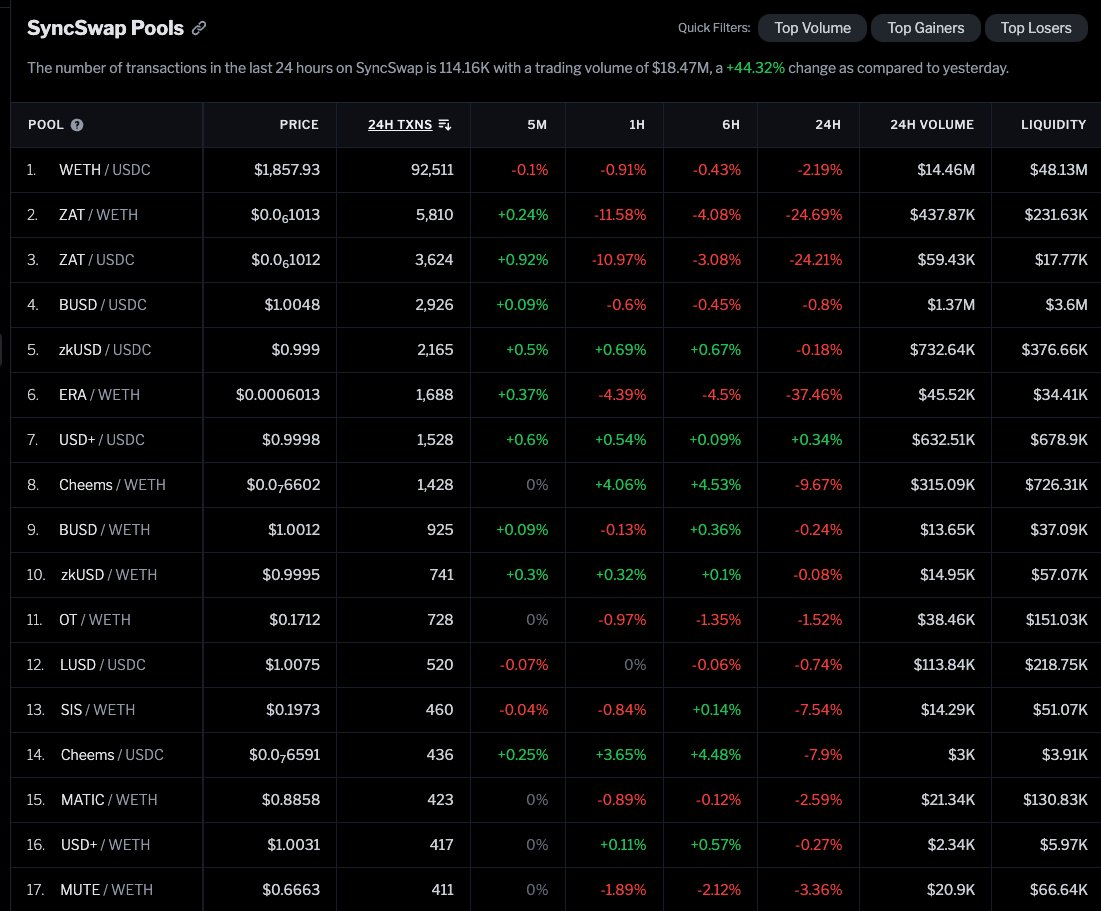

For instance, if Syncswap raises funds via an IDO at a valuation below $20–30 million FDV, then the top TVL “go-to” DEX on zkSync would be worth considering. (This valuation is purely hypothetical—they haven’t announced anything yet.)

Ecosystem Incentives

Currently there aren't incentive programs like those on Optimism, only potential airdrops. However, generally speaking, the best mining opportunities come from solid protocols backed by chain-level incentives. These are typically vetted by the chain team and supported by deep liquidity incentives.

Updates and overview on zkSync:

-

TVL is growing;

-

Trading volume is increasing, but dominated mainly by ETH;

-

No major innovation—mostly derivative projects from other ecosystems;

-

Fewer scam tokens now, though fraud attempts have also decreased.

Things to do:

-

Take advantage of small-scale mining opportunities;

-

Look for incentivized trading/mining;

-

Seek out potential airdrop opportunities.

Mining Yields

Syncswap:

-

ETH/USDC 22.6% APY; TVL $48 million;

-

BUSD/USDC 6.4% APY; TVL $3.2 million.

Mute.io:

-

ETH/USDC 22%-53% APY; TVL $13 million;

(Their yield boost applies to all trading pairs—mining across multiple pairs may be more effective)

-

ETH/USDC 17.44% APR;

(Stable yield, but current rate isn't very high)

-

ETH/USDC 38% APR with 7-day lock-up, of which 26% is on xSpace;

(xSpace requires 30 days to unlock; immediate withdrawal incurs a 50% discount)

-

ETH/USDC APR 28%.

Currently, yields on zkSync mainly come from USDC/USD+ LPs across different exchanges.

Decentralized Lending Markets

EraLend:

$3.2 million TVL; supply and borrowing rates are not high; only ETH and USDC available for borrowing.

Perpetual Contracts

OnchainTrade:

Synthetic asset futures + swaps. I don’t fully understand it yet, but it appears to combine different pools, sharing fees between perpetual contracts and swaps. I’ve asked some questions in their Discord, but since I don’t fully grasp it yet, I won’t comment further.

A few projects I’m watching:

-

Derivio;

-

eZKalibur;

-

MESprotocol;

-

Meson;

-

Derp DEX.

Derivio looks like a relatively credible project, though still on testnet. It will allow trading of perpetual contracts and options. The perps part resembles the GMX model, with GLP-like staking features they call bonds—unclear whether one can trade the “interest rate” on their GLP yield.

eZKalibur is like Camelot on zkSync. As a fan of Camelot, I’ll keep an eye on it. An IDO is coming soon.

MESprotocol has made significant progress since my last check—they didn’t even have a Gitbook back then. Now they have a functional orderbook DApp plus a full Gitbook.

Derp DEX is a V2/V3 decentralized exchange—why am I paying attention? I really like their memes:

Meson’s cross-chain swap offers a unique marketing strategy—they leverage OKX wallet integration and “task” rewards to attract users. However, you must register somehow and provide LP; documentation doesn’t suggest a token launch will happen soon.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News