Building a customer experience-focused tech stack centered around the wallet

TechFlow Selected TechFlow Selected

Building a customer experience-focused tech stack centered around the wallet

The wallet-centric customer experience stack represents the most significant and largest "mining" B2B infrastructure opportunity in today's crypto market.

Author: Superstructure

Translation: TechFlow

As Web3 matures, its infrastructure and tooling are evolving in parallel. One of the more interesting recent developments is the emergence of a new stack centered around embedded wallets. Dozens of companies and projects are racing to provide seamless, non-custodial onboarding experiences for global dApp developers. While merely improving the crypto user experience cannot solve the issue of mass adoption when value risk remains so high, tools that enable developers to deliver frictionless wallet interactions are critical. Therefore, the author believes there is significant opportunity in building a customer-centric technology stack centered on the wallet.

The Experience Stack

In B2B software across different technological paradigms, one of the biggest rewards is what I call the “experience stack.” It means different things in different contexts, and overlapping or coexisting experience stacks often exist. Nevertheless, we can identify platforms like Salesforce, later Intercom, Twilio, and Shopify as examples...

These companies started from different product strategies and target markets but converged into a privileged position as the “system of record” vendor, primarily managing end-to-end customer relationships. The “experience stack” isn’t the only component a company needs to integrate—it’s the piece around which everything else in the value chain revolves, granting immense strategic optionality, pricing power, and value capture. This typically aligns with an innovation in “customer record,” reflecting the centrality of the vendor’s full solution in managing customer relationships—such as cloud CRM, e-commerce order history, or more recently, “conversation history” as chat-based customer engagement grows increasingly important.

Since technology constantly changes and evolves—with old S-curves fading as new ones emerge—we see overlapping “experience stack” paradigms emerging from Web2. Salesforce’s major win in SaaS CRM laid the foundation for future battles over “conversational” CRM with companies like Intercom and Twilio, while Shopify’s e-commerce stack for building SMB merchant platforms is now seeing competitive pressure from the growing ecosystem of “Lego block” services offered by cloud providers.

While AI will emphasize the conversational aspects of this “experience stack,” in this corner of the Web3 world, we’re observing a very interesting category of competitors—one entirely oriented around wallets and the on-chain transactions they help users execute. This wallet-centric customer experience stack is being explored from multiple angles, yet we can see it converging around the same pain points to achieve the following:

-

Enable easy onboarding for users, whether existing Web3 users or newcomers, with seedless or equivalent experiences.

-

Manage wallet connections, transactions, and switching between them.

-

Allow users to transact without paying gas fees, pay gas using any token, and authorize operations via session keys.

-

Manage users, sessions, and all edge cases associated with wallets.

-

Let users easily move in and out of crypto using their preferred payment methods.

-

Empower users to perform more complex transactions and complete advanced wallet-aware workflows, such as depositing funds into DeFi yield vaults or gaining access to tokens.

While it involves more than just the wallet itself (e.g., linking Web2 credentials to Web3 wallets for simple login, pre/post-transaction session management), the wallet remains the primary and most important paradigm for customer relationships. In a Web3 world centered on wallets, the wallet serves as an inclusive self-sovereign identity and payment solution—users maintain some degree of control and natively express their preferences through blockchain transactions. Fundamentally, dApps or protocols communicate with customers—and engage in rich, ongoing “conversations”—using wallets (in any form), whose history (at least for now) is public and on-chain. WalletConnect 2.0 essentially enables dApps and wallets to communicate securely, initially transmitting value and data related to transactions, but soon including messages themselves.

Market Segmentation

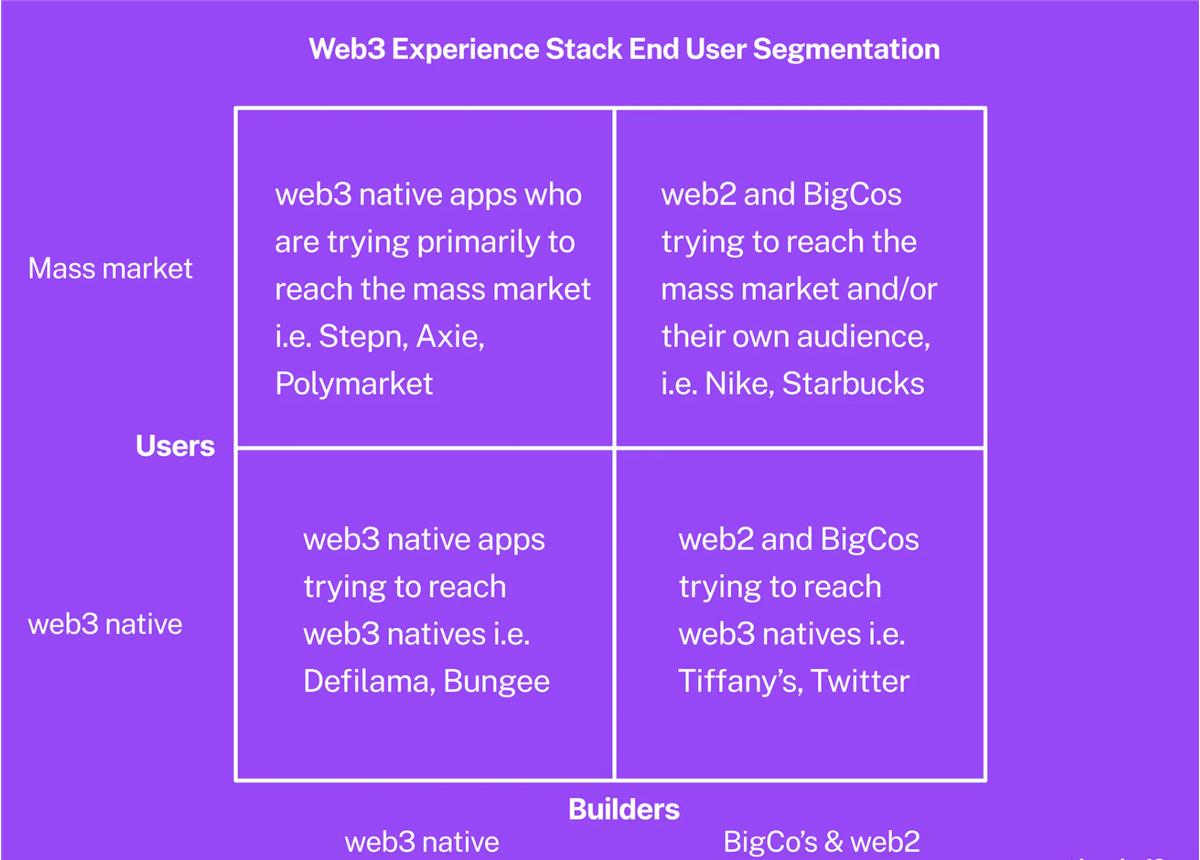

Crypto’s recent downturn highlights the need to be precise about who exactly we mean by “consumers.” So I’ll attempt to map out the potential buyer/integrator audience for this emerging experience stack category using a convenient 2x2 matrix.

First, we have Web3-native applications targeting Web3-native users—examples include Defilama and Bungie. These are builders native to crypto aiming at niche (but valuable on an ARPU basis) segments of existing Web3 users, whether NFT, DeFi, or technically inclined.

This segment certainly has growth potential, and I am highly optimistic about the long-term absolute growth prospects of on-chain Web3-native economies. But currently, it's arguably the most challenging segment, with active smart contract platform users likely numbering only 5 to 10 million MAU (monthly active users). Some of these companies may build their own stacks internally and prefer low-level technologies like wagmi and ethers. Since many interactions among Web3-native users are transaction-centric, free and open-source wallet connection libraries like Rainbow and WalletConnect may already suffice for many use cases. From what I understand, preferences in this segment are the hardest to pin down and most irregular, making competition here particularly tough for vendors.

Then there are Web3-native builders directly targeting the mass market. Think Stepin, Axie, Polymarket, OpenSea. These are application developers from the crypto world aiming their products squarely at mainstream audiences. They place heavy emphasis on user experience because their users are more likely to be beginners requiring full end-to-end customer experience and onboarding management platforms. However, these are startups—they likely want a highly product-led sales motion, offering free usage up to a point, enabling developers to try and evaluate before engaging with sales reps only when necessary. Another example in this category is what I call “non-custodial neobanks,” such as Turkey’s Cenoa, which leverages DeFi to offer differentiated financial services (in this case, inflation resistance and dollar-denominated savings yields) to the mass market.

On the side of large corporations and Web2 players, we have established participants experimenting or expanding outreach to tap into high-value, existing Web3 niches—specifically, the overlap between their most loyal, valuable customers and current Web3 users. Examples include Tiffany’s NFT drop and even Twitter’s PFP integration, both designed to appeal to existing Web3 users who already own NFTs and enhance their experience within the Crypto Twitter niche.

Finally, there are existing Web2 brands and large enterprises trying to reach the mass market. They may target their existing audiences—or sometimes new ones—but fundamentally aim to engage everyday people for various reasons using Web3 technology. Here, the UX advantage could be substantial, especially as companies shift from innovation labs toward more profit-driven business deployments (and thus stricter ROI scrutiny), increasing their exploratory forays into Web3. I also include influencers and celebrities going deeper into Web3 under this category, as they effectively function as “enterprises” themselves.

Convergence of Different Players

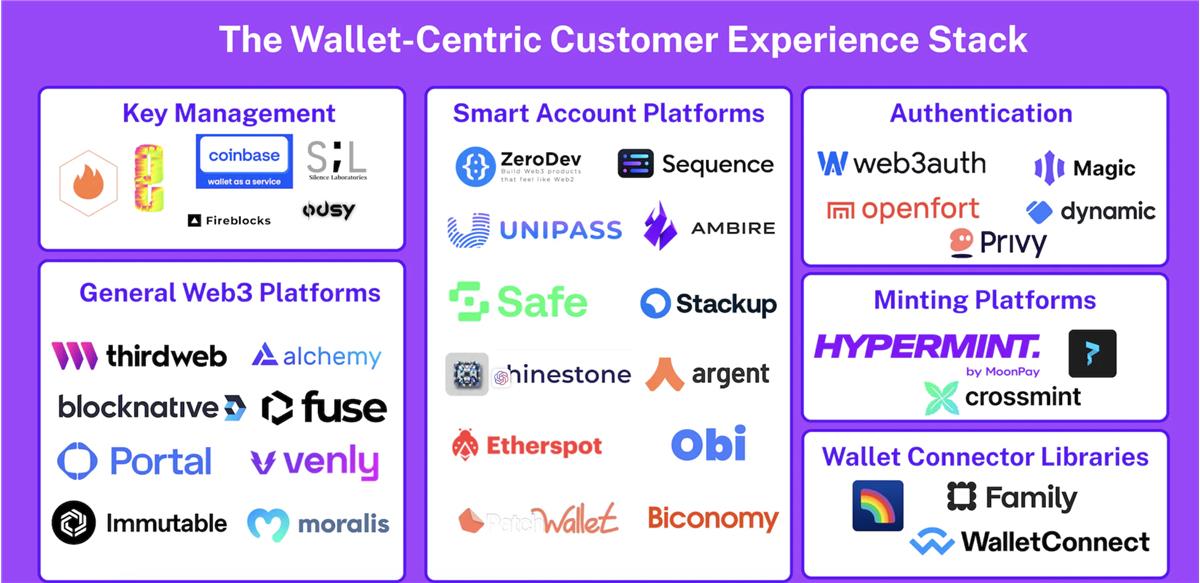

Some larger companies, like OpenSea, choose to cobble together their own solutions using low-level libraries. But an increasing number of startups and projects are emerging to address these challenges for dApp developers across all segments in repeatable ways. Their approaches, starting points, and strategies differ, yet they converge around the core needs of the end-to-end “experience stack” outlined above. Overall, competitors come from several directions:

-

Key management-centric (e.g., Lit Protocol), emphasizing security, programmable recovery options, and trustlessness.

-

General-purpose Web3 platforms (e.g., Thirdweb), offering various dApp building blocks unified under a single platform.

-

Smart account platforms (e.g., ZeroDev), focusing their services on smart accounts and placing features like gasless or sponsored transactions at the center. Some vendors focus on the account itself, others on the paymaster/bundler.

-

Authentication providers (e.g., Dynamic and Web3Auth), whose feature set revolves around managing the relationship between users and their wallets, including OAuth integration, session management, etc.

-

Minting platforms (e.g., Hypermint), focused on a specific common Web3 use case and providing brands with a complete turnkey solution.

-

Wallet connection libraries (e.g., RainbowKit), nearly exclusively focused on minimal wallet connectivity and functionality required for interacting on-chain.

These solutions are becoming increasingly competitive, directly or indirectly vying for the pivotal position typically occupied by the vendor/solution provider within the “experience stack.” They commonly appear as SDKs bundled with backend services, varying based on development standards.

Fog of War

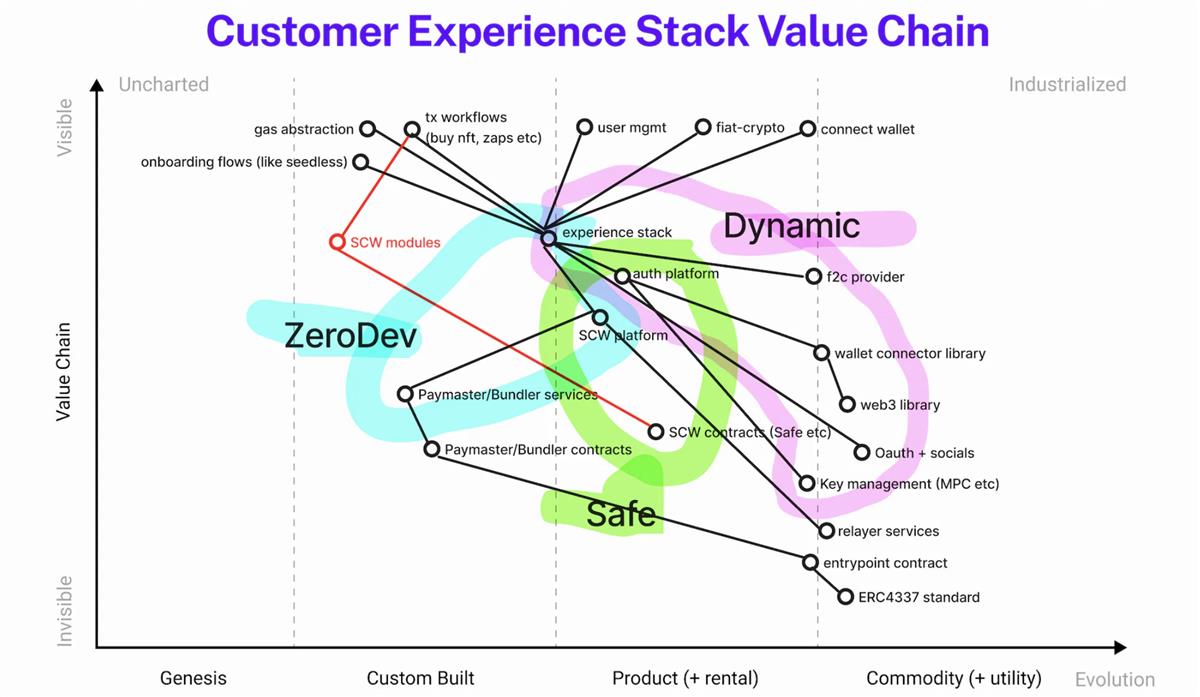

The fog here is thick, with multiple layers and differing perspectives among participants—distinctions between core and peripheral value, balance between proprietary differentiation and open standards. This leads to several instances of “friendly competition,” where one or more players compete for buyers’ limited attention and budget regarding their “Web3” needs, or act as value-added infrastructure components capable of extracting tolls without being disintermediated due to certain cumulative long-term advantages. What will ultimately be the winning focus? Which components within this space will be internalized and differentiated, and which will be outsourced or integrated? There are several competing theories, and I present here a high-level Wardley map of this emerging landscape—a broad view of the value chain supporting a wallet-centric experience stack:

Participants like ZeroDev focus on smart account services and integrate with arbitrary private key management providers, while Dynamic takes a broader, authentication-first approach covering embedded wallets to session management. Of course, Safe—the creator and maintainer of the Safe smart account protocol—has expanded its offerings beyond basic authorization suites to include transaction execution and relayer connectivity. Some components along the value chain are aggregating, and it’s unclear whether experience stack providers bundling MPC wallet providers or SCW implementations will win customers, or if selecting best-of-breed implementations for each major component would be better. For instance, ZeroDev, starting from the smart account SDK corner, already supports multiple hosted, semi-hosted, and non-custodial embedded wallets compatible with its smart accounts. Similarly, Thirdweb and Dynamic offer first-party and third-party options for these “instant wallets,” and as “account abstraction” continues driving the rise of smart contract wallets, players may attempt to integrate one or more smart account frameworks.

Such a complex network—though clearly forming this end-to-end experience stack—is not uncommon during the early stages of category creation. While a range of experiments are underway in this space, we can observe several potential winning strategies, though their exact details, configurations, and timing remain uncertain.

Many Unresolved Questions = Alpha

The process of creating this category is fluid, with various permutations of similar concepts, components, and messaging being tested. As customer development progresses and early PMF stabilizes, providers (and their customers) still need to navigate many unresolved issues within this maze. Solving these will unlock significant “alpha” in the space.

For example, we can expect this experience stack market to trend toward clear directions, as Web3 almost accelerates Web2’s historical trajectory—developing rich, competitive ecosystems of “integrations,” deeper emphasis on dApp<>user communication and embedded comms tools (possibly Web3-native tools like XMTP), and features managing customer journey stages such as retention management and marketing automation (again, possibly Web3-native tools). We can anticipate sales motions in this space increasingly focusing on traditional metrics like LTV or ARPU, albeit with distortions introduced by blockchain transactions. The Web3 “Salesforce” will contain many echoes of Web2 Salesforce.

But before this category fully unfolds, many thorny questions remain unanswered.

Non-custodianship spans a wide spectrum, and strong opinions exist around MPC and related methods for handling traditional EOAs from security and usability standpoints, raising numerous issues to resolve. Without diving into the specifics of the debate, there’s a fundamental difference between what the Lit Protocol aims to achieve and its attributes compared to more institutionalized, Web 2.5-style solutions like Fireblocks—yet developers are evaluating both to create and maintain easy-to-use, seedless accounts for users. We’re even seeing low-level experimentation from players like Odsy Network, which takes a completely different approach by decentralizing and making wallets themselves programmable within the Cosmos ecosystem, calling them “dWallets.”

Additionally, the coexistence of embedded wallets and existing standalone wallets, along with key portability and pluggability, remains a critical unresolved issue. If users of embedded wallets want to transition to a more independent, standalone wallet experience, the so-called “graduation problem” arises. As newly onboarded Web3 users “mature” in their Web3 journey, they may desire a more independent wallet, forcing dApps to consider how they want to handle this. Some experience stack providers, like Sequence, are leaning into solving this—their dedicated wallet app offers solutions for early onboarding and late-stage engagement, retention, and graduation to becoming full Web3 users across multiple dApps using the Sequence wallet. Other players like Coinbase WaaS are exploring low-level, flexible technical approaches allowing dApps to white-label starter wallets and let users “pop out” keys into standalone wallets. A natural tension exists between the “app wallet” argument and the “fat wallet” argument—where the latter intermediates Web3 on behalf of users. Yet even after embedded wallets succeed, users may naturally require re-integration since they might hold multiple embedded wallets across different apps, potentially giving mainstream Web2 platforms an opening to seize direct relationships with end users, pulling them away from both experience stack providers and standalone wallets.

Of course, we also have the question of MPC vs. smart account emphasis. Are these technologies substitutes or complements?

Some experience stack providers focus on one or the other, while others believe hybrid solutions offer value (e.g., Lit+Stackup or Safe and Web3Auth).

One observation is that despite many unresolved issues, key management may be commoditizing in terms of benefits that integrators can absorb, placing it near the boundary between commodity and utility status.

It appears pure key management providers/networks will compete to become drivers for these higher-level, full-featured SDKs, and typically won’t directly engage in customer relationship integration unless certain aspects of key management become sufficiently differentiating.

How key management is implemented will greatly influence the adoption speed of combining smart accounts with key management solutions, putting them on par with purely MPC-based alternatives.

Smart accounts also introduce the emerging concept of “modules,” extending wallet logic and programmability to external developers who can specialize in areas like different recovery schemes.

It remains unclear whether this becomes a key extensibility point in the experience stack, or whether something like a higher-level abstraction such as full-stack “workflows” captures broader developer interest.

Regardless, MPC and smart accounts both seem poised to play important roles in the evolution of the experience stack.

Another issue to watch is depth versus breadth across chains, tied to the smart account/account abstraction discussion.

One view holds that vendors in this space should support as many chains as possible to cater to customers’ long-tail chain demands—an advantage reflected in one of MPC’s strongest traits: inherent blockchain agnosticism.

Various factors may push experience stack providers toward more or less custodial implementations and choices between more or less decentralized chains, but one of the core value propositions of using Web3 technologies like NFTs for your product is the “composability return”—enabling your product to interoperate permissionlessly with native Web3 standards, liquidity, and existing primitives. How exactly this is resolved remains unclear, as different integrators may prioritize interoperability and composability differently than other concerns.

Whether experience stack providers should generalize or focus on specific verticals remains an open question. For example, Sequence focuses broadly on game developers, offering not only wallet and authentication infrastructure but also data indexing, NFT monetization solutions, fiat on-ramps, and Unity/Unreal SDKs. We may see other providers lean into the “non-custodial neobanking” space, selling to traditional banks and fintech clients seeking to bring on-chain advantages to users without exposing them to on-chain complexities. Others like Dynamic take a more generalized approach.

There will also be players betting on bottom-up distribution and mobilization of Web3-native developer communities—staking a claim on future innovation from the heart of Web3 (i.e., Web3 purists). Likely, several big winners will emerge across different focus areas, alongside foundational competition over universal infrastructure and standards in the smart contract wallet and key management ecosystem.

There’s also a fundamentally ambiguous “account” model. It’s unclear which authentication and login model will dominate—Are we talking about Waystar Royco dApp accounts, or AcmeCo’s embedded wallet account provided by the experience stack vendor?

Solutions vary in emphasis and in how inherently their designs and stack positions reflect one approach over another. Different customer segments may hold divergent views on who “owns” the customer via the wallet relationship, depending on how deeply their product integrates into the Web3 space.

Finally, what is the ultimate organizational structure and business model goal?Will we see a few massive centralized players consolidate dominance?

Possibly. But there may also be many open solutions that gradually erode the margins of more centralized service providers over time, forcing them to innovate higher up the stack to preserve their added value. Alternatively, winners might grow so large that the only way to relieve pressure is to decentralize or open-source their solutions in some form.

The most fundamental and important risk in Web3 remains value risk—we cannot apply blockchain to problems beyond early adopter speculation unless the technology uniquely enables their solution. In that sense, simply improving the Web3 user experience isn't enough to rescue it from the current use-case winter. But that doesn’t mean enhancing the dApp user experience—delivering Web2-like UX with Web3 guarantees—isn’t a necessary condition for reducing value risk over time. A wallet-centric customer experience stack represents the most important and largest “pick-and-shovel” B2B infrastructure opportunity in today’s crypto market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News