Are tokens really important in Web3 games?

TechFlow Selected TechFlow Selected

Are tokens really important in Web3 games?

In this article, Vader Research explores the role and design of tokens in Web3 gaming, as well as the differences between game tokens and stocks.

Author: Vader Research

Compiled by: TechFlow

For Web3 games, tokens can make it easier for creators to raise funds and plan next steps. However, token design has always been a challenge, and most founders focus too heavily on tokens while neglecting gameplay, ultimately leading to project failure. In this article, token economics advisor Vader Research explores the role and design of tokens in Web3 gaming, as well as how game tokens differ from stocks.

Why do games launch tokens?

There are several reasons: fundraising, player incentives, and payment currency.

Fundraising

Issuing a token is better than going bankrupt; during bull markets, launching a token is actually pragmatic—you can tap into ample FOMO-driven capital from retail investors and VCs.

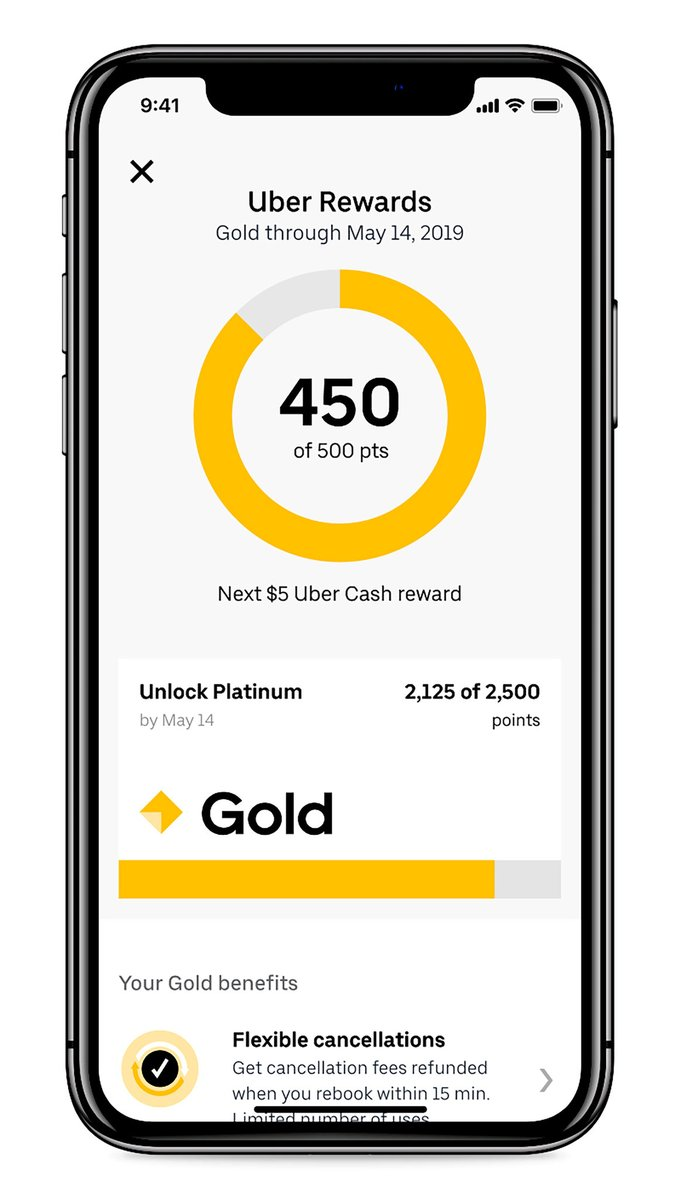

Player Incentives

If Uber had given me $10 worth of stock every time I used it starting in 2013, I would have sold my car and become an Uber fanatic. Rewarding players with tokens increases user engagement, retention, and spending.

Value Capture Problem

However, all tokens face one fundamental problem: Why would anyone buy your token? Why would holders keep holding instead of selling? What drives your token’s value?

People buy your token because they expect the game will succeed—and that success will be captured through the token—just like stocks, which capture value by distributing dividends or conducting share buybacks.

A game can become highly successful—but how does the token capture that value?

-

Buybacks → Use revenue to repurchase tokens;

-

Staking → Distribute revenue to stakers (i.e., dividends);

-

Payment currency → Require players to pay using the token;

-

Regulatory risk → Buybacks and staking may classify your token as a “security”;

-

Product/user experience risk → Forcing players to leave the platform and purchase tokens via CEX/DEX could lead to high churn rates.

Token vs. Stock Comparison

Your game becomes extremely successful and gets acquired by a company like Activision Blizzard—but the token price fails to capture this value. Token holders are understandably angry, yet powerless—they lack shareholder rights unlike traditional equity holders.

Utility Tokens

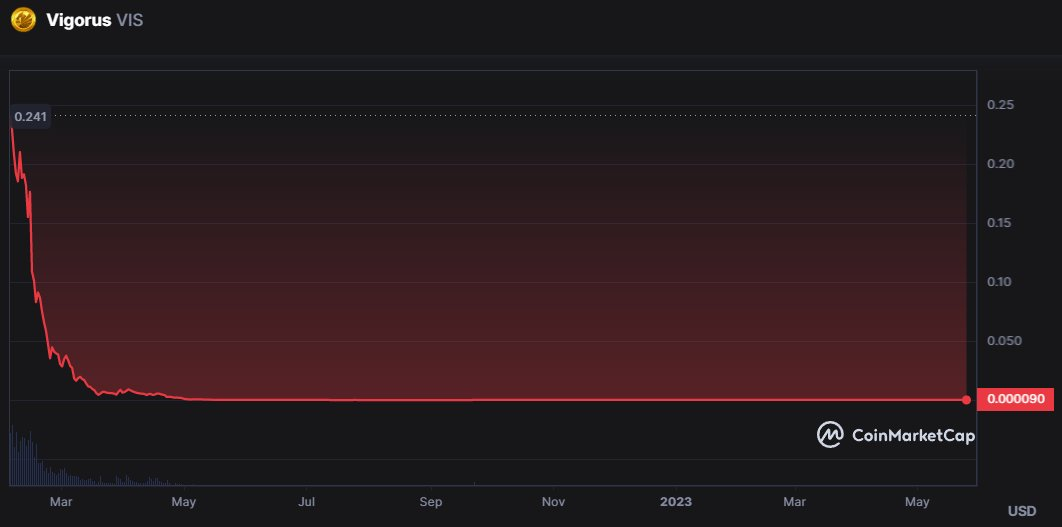

The biggest mistake with utility tokens is creating “low-volatility utility tokens with variable supply.” What happens when a token cannot capture value and is continuously issued?

It inevitably collapses due to constant inflation causing sustained sell pressure.

You can attempt to capture some value for utility tokens using the methods mentioned earlier, but you’ll only end up diluting the value of the primary token, NFTs, or equity—like slowing down blood loss without curing the underlying wound.

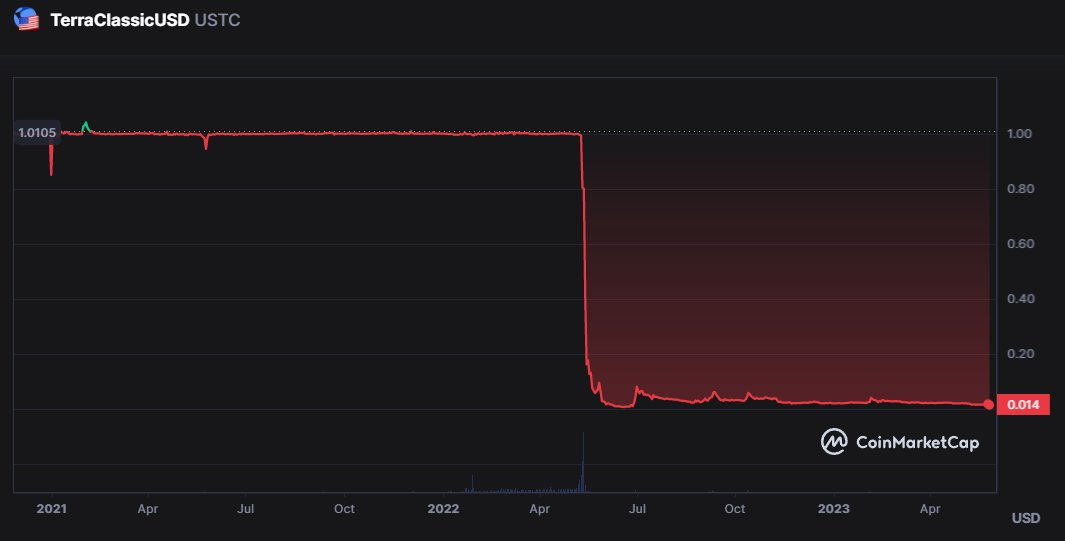

Semi-Stable Tokens

The concept of semi-stable tokens is problematic. Let’s examine pegging a token to $1: if the token exceeds $1, mint more tokens and sell them to build up USD reserves. If the token falls below $1, use USD reserves to buy back the token.

When people sell and the token drops below $1, you’re finished once your USD reserves run out. UST collapsed despite being backed by LUNA; Lebanon’s currency became unpegged due to exhausted dollar reserves. Pegs only work for net exporters like Saudi Arabia.

Payment Currency

A tradable payment currency is needed to allow players to trade in-game NFTs. It should have deep liquidity, be listed on most exchanges, and exhibit low volatility. Using USD-pegged stablecoins or L1 native coins (ETH, AVAX) is the ideal solution.

There's no need to reinvent the wheel here—every semi-stable or utility token eventually collapses. Moreover, you should include non-tradable soft and hard currencies within the game, just like in F2P games, to maintain economic flexibility.

Monetary Control

Anything you can do with a token—you can also do with NFTs. In real-world economies, having your own currency allows control over inflation. In Web3 games, you already have full control over inflation—you can regulate the supply of every in-game item produced and traded.

Who Wants You to Launch a Token?

-

Venture capitalists → Early exit liquidity (dumping on market) + they still demand equity;

-

Market makers and exchanges → Earn fees;

-

Token economy consultants → Charge fees;

-

Lawyers → Charge fees;

-

Speculators → Farm and sell airdrops.

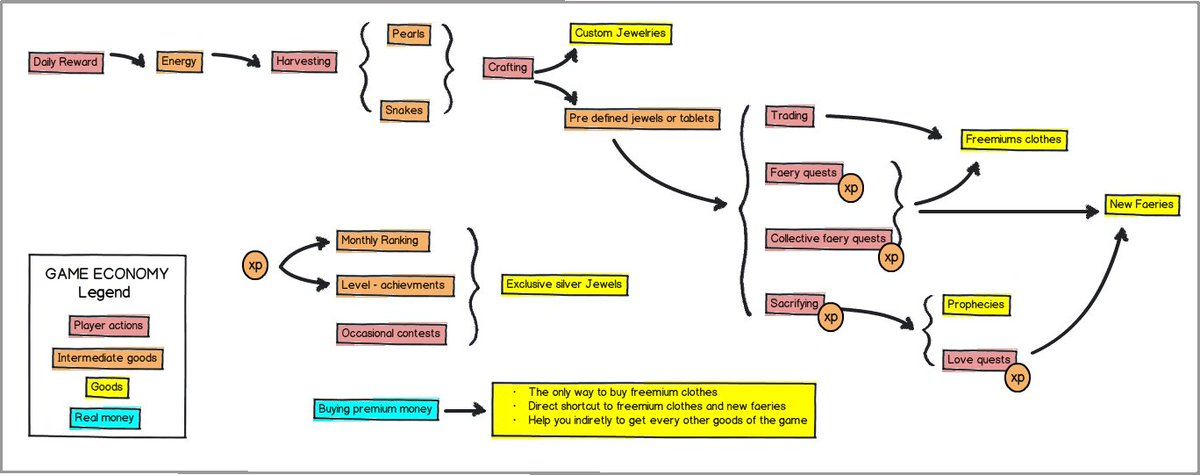

Web3 game developers should not overly focus on tokens. Instead, they should prioritize holistic economic design:

-

Tradable vs. non-tradable items;

-

Progression systems;

-

Reward distribution (skill, time, spending, opportunity);

-

Item pricing and supply planning;

-

Player personas, etc.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News