How to Decompose ETH Volatility? Deconstructing F(X)'s New Stable Asset and Leverage Scheme

TechFlow Selected TechFlow Selected

How to Decompose ETH Volatility? Deconstructing F(X)'s New Stable Asset and Leverage Scheme

The positions and future development trajectories of fETH and xETH within the Ethereum ecosystem are not isolated, but closely influenced by market demand and trader behavior.

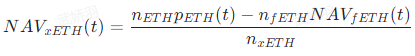

As the latest project from AladdinDAO, the f(x) protocol splits ETH into two new derivative tokens: fETH and xETH. fETH is a low-β quasi-stablecoin with minimal price volatility that does not rely on centralized collateral, effectively meeting the needs of decentralized finance (DeFi).

xETH is a high-β leveraged long-term perpetual ETH contract, serving as a powerful decentralized on-chain trading instrument. Both tokens are fully backed and redeemable using ETH as collateral, preserving decentralization and Ethereum-native characteristics.

In simple terms, the f(x) protocol allows users to deposit ETH to mint fETH and xETH, enabling exposure to different levels of ETH price movements. The price of fETH follows only 10% of ETH’s price changes—meaning it has a β coefficient of 0.1. In contrast, xETH captures all price movements not reflected in fETH, giving it a β greater than 1. Thus, fETH acts like a floating stablecoin, while xETH functions as a leveraged long-term investment vehicle.

AladdinDAO

AladdinDAO is a DAO composed of DeFi experts dedicated to identifying high-quality DeFi projects and providing community members with high-yield investment opportunities. During the Curve War—a battle for CRV voting power—AladdinDAO launched two new tools: Concentrator and Clever—to help users maximize profits and influence.

These tools not only offer users a simple path to high yields but also provide the DAO with a treasury management solution that eliminates the need for multi-signature processes. Additionally, they strengthen Convex’s influence in the Curve War, thereby shaping the development trajectory of the Curve ecosystem.

Following the USDC crisis, core members of AladdinDAO reevaluated the shortcomings of existing stablecoins and proposed a new solution: the f(x) protocol.

Stablecoins

Before discussing the f(x) protocol, let's first revisit the definition of a stablecoin:

A stablecoin is a digital currency whose value is pegged to another currency, commodity, or financial instrument to reduce price volatility compared to more volatile cryptocurrencies such as Bitcoin.

The primary role of stablecoins is to serve as a store of value and medium of exchange, providing liquidity and stability within the cryptocurrency market. Most stablecoins are pegged to the U.S. dollar or other fiat currencies, enabling seamless interaction and conversion with traditional financial systems. However, from a crypto-native perspective, as the crypto world grows, stablecoins may relatively lose value due to ongoing fiat inflation, since they fail to capture the appreciation of crypto assets against fiat. As a result, stablecoins may lose appeal and competitiveness, prompting demand for assets that track crypto market growth.

Currently, stablecoins fall into three main categories: fiat-backed, partially algorithmic, and CDP-based algorithmic stablecoins.

Purely algorithmic (unsecured or undercollateralized) stablecoins, such as Terra’s UST, represent the most apparent risk category due to their difficulty in ensuring safety and reliability, making them unsuitable for long-term use. Existing stablecoins can be divided into three types:

1. Fiat-backed stablecoins (e.g., USDC, USDT), which rely on third-party institutions to maintain fiat reserves but face centralization risks.

2. Algorithmic stablecoins partially or fully backed by fiat (e.g., DAI, FRAX), which inherit the centralization risks of fiat-backed stablecoins.

3. Fully decentralized CDP-based algorithmic stablecoins (e.g., LUSD), which accept only decentralized collateral but still face challenges in scalability and capital efficiency.

Therefore, the goal of the protocol is to create stable assets that maintain low volatility while significantly improving capital efficiency and scalability, introducing the two assets fETH and xETH. In traditional finance, β measures the volatility of a given security or portfolio relative to the market. Since fiat currencies serve as the denominator in these measurements, cash has β = 0, while a portfolio with β = 1 perfectly tracks market returns (e.g., an S&P 500 ETF). A portfolio moving in the same direction as the market but with smaller magnitude has β < 1, while one with larger magnitude has β > 1.

In the f(x) protocol, ETH price is defined as the market, and β measures the volatility of a given cryptocurrency relative to ETH. ETH itself has β = 1, while a perfect stablecoin would have β = 0. An asset X with a target β of 0.5 reflects only 50% of ETH’s price changes.

How the Protocol Works

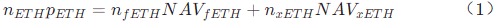

The protocol maintains the f(x) invariant by adjusting the NAV (Net Asset Value) of fETH and xETH:

Then, the protocol calculates the new NAV of xETH based on the f(x) invariant:

This way, xETH captures all ETH price movements filtered out by fETH, delivering leveraged returns.

Fractional ETH—Low Volatility Asset / "Floating" Stablecoin

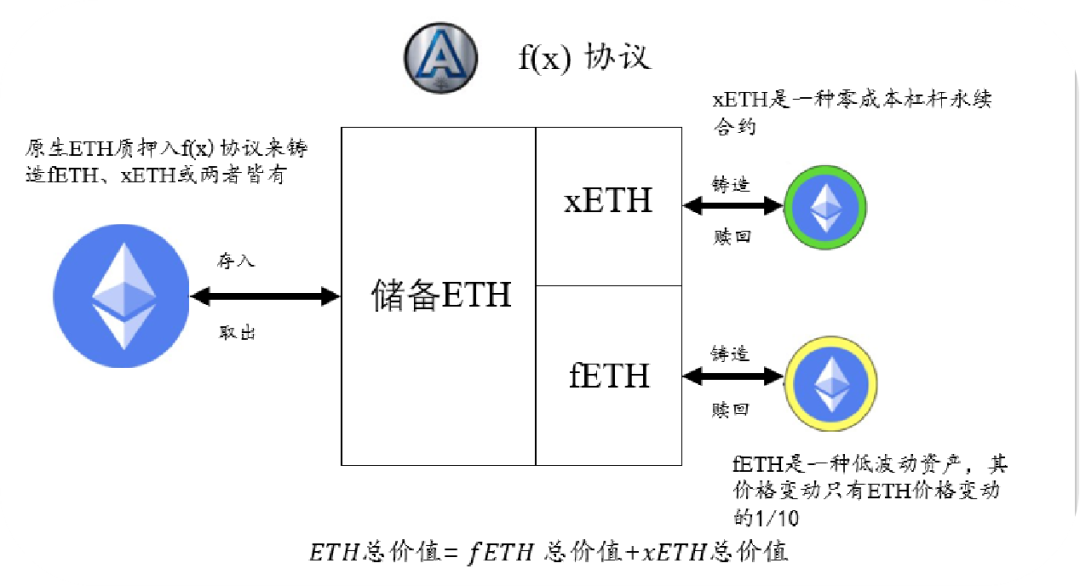

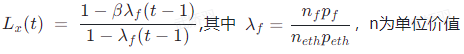

At launch, fETH is priced at $1. The protocol controls its volatility by adjusting fETH’s NAV so that it reflects only 10% of ETH’s price changes (i.e., β_f = 0.1). When ETH prices change, fETH’s NAV is updated according to the following formula:

where rETH is the return rate of ETH between time t and t-1.

The advantages of stablecoins lie in low price volatility, low intrinsic risk, and deep liquidity. fETH is a low-volatility asset with β = 0.1, meaning its price moves only one-tenth as much as ETH. Thus, fETH avoids centralization risks while capturing a portion of ETH market gains or losses.

Compared to traditional stablecoins, fETH issuance responds to direct market demand rather than CDP borrowing demand, limited only by xETH supply (xETH absorbs fETH’s volatility and provides leveraged returns), resulting in higher scalability and capital efficiency. fETH can be seen as pegged to ETH, but unlike traditional fixed-ratio pegs, it adjusts dynamically based on β = 0.1.

Overall, fETH serves as a store of value and medium of exchange, offering liquidity and stability in the crypto market while retaining some market growth potential.

Leveraged ETH

Leveraged ETH, known as xETH, is a decentralized, composable leveraged long ETH futures contract with low liquidation risk and zero funding costs (in extreme cases, xETH minter can even earn fees), designed as a companion asset to fETH. xETH holders collectively absorb most of the volatility from fETH supply. Traders can adjust their positions freely via the f(x) minting and redemption module or readily available on-chain AMM liquidity pools.

fETH can be minted and redeemed based on direct demand, provided sufficient xETH supply exists to absorb fETH’s volatility. The leverage of xETH is variable, allowing a relatively small amount of xETH to support a large volume of fETH.

Calculating xETH Leverage

Determined by the following formula:

If no fETH is minted, then $$\lambda_f=0,L_x=1$$, making xETH a 1x long perpetual ETH contract.

The actual effective leverage of xETH varies over time as xETH and fETH are minted and redeemed, depending on their relative supplies. The higher the xETH supply relative to fETH, the lower the effective leverage of xETH, as fETH’s excess volatility is distributed across more tokens. Conversely, a larger fETH supply concentrates volatility on fewer xETH tokens, increasing effective leverage.

System Stability

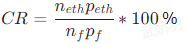

Since xETH acts as a hedge against fETH, the system becomes more stable as xETH supply increases. If we treat total ETH reserves as collateral in a CDP system and total fETH supply as borrowed amount, we can use a metric similar to the Collateral Ratio (CR) to monitor system health. For the f(x) protocol, CR is defined as:

Any minting or redemption of fETH or xETH, or adjustments to their NAVs, affects the CR. If the system’s CR drops to 100%, xETH’s value reaches zero, and fETH’s β becomes 1—meaning it is fully exposed to ETH price volatility and no longer functions as a low-volatility asset. To prevent this, f(x) implements a four-tier risk management module.

Risk Control

The f(x) risk control system consists of four modules designed to maintain fETH’s low volatility and xETH’s positive net asset value when the system’s collateral ratio (CR) falls below certain thresholds, thereby increasing CR. These measures include:

Stability Mode: When CR falls below 130%, fETH minting is disabled, fETH redemption fees are waived, xETH redemption fees are increased, and additional rewards are given to xETH minters.

User Balancing Mode: When CR falls below 120%, users are incentivized to redeem fETH to increase the system’s collateral ratio, with extra rewards provided to redeemers.

Protocol Balancing Mode: When CR falls below 114%, the protocol automatically uses its ETH reserves to buy and burn fETH on the open market, boosting the collateral ratio.

Recapitalization: In the most extreme case, the protocol can issue governance tokens to raise ETH for recapitalization, either by minting xETH or purchasing and redeeming fETH.

Revenue

The f(x) protocol generates revenue by charging fees on the minting and redemption of fETH and xETH. These fees are operational parameters set at launch. Additionally, when risk management modules activate, fETH holders must pay stability fees, which are distributed to users or the protocol helping rebalance the system.

β—The Key Parameter for Volatility Control

To better understand β’s impact on assets, we analyze the shift in β from 0 to 1 across three perspectives: store of value, medium of exchange, and crypto-native nature. These dimensions cover the primary functions and roles of assets within the cryptocurrency market.

Store of Value

From a store-of-value perspective, as β increases from 0 to 1, asset price stability decreases due to growing exposure to market volatility. Stablecoins (β = 0) maintain purchasing power equivalent to fiat, while ETH (β = 1) fluctuates directly with market movements. fETH (β = 0.1) sits in between—it retains some market upside while limiting volatility.

Medium of Exchange

From a medium-of-exchange perspective, as β increases from 0 to 1, asset liquidity and scalability improve, aligning more closely with the needs and characteristics of the crypto market. Stablecoins (β = 0) enable easy fiat conversion but carry centralization risks and trust issues. ETH (β = 1) is fully decentralized and native to Ethereum, yet suffers from high volatility and price uncertainty. fETH (β = 0.1) strikes a balance—avoiding centralization risks while maintaining low volatility and high liquidity.

Crypto-Native

From a crypto-native perspective, as β increases from 0 to 1, decentralization and innovation grow stronger, reflecting the spirit and values of cryptocurrency. Stablecoins (β = 0) are pegged to fiat and depend on traditional financial institutions and regulatory oversight. ETH (β = 1) is the native asset of the Ethereum network and a leader in innovation. fETH (β = 0.1) is a novel asset created through the f(x) protocol—a low-volatility, decentralized, scalable, Ethereum-native asset paired with xETH, a high-volatility, leveraged perpetual contract token.

Hypothetical Scenarios in Extreme Market Conditions

Under extreme market conditions, let's examine how fETH performs compared to the centralized stablecoin USDT. If seeking a short-term hedging tool with low volatility, USDT might be more suitable due to its fixed fiat peg. However, for long-term value storage, fETH may be preferable. fETH maintains a relatively stable relationship with ETH, tracking crypto market growth without being affected by fiat depreciation. Crucially, fETH has built-in resilience—through its risk management modules, it maintains low volatility and achieves its target β = 0.1 even during sharp ETH price swings.

Consider a practical example: suppose ETH is priced at $2,000 and fETH at $1 (i.e., fETH’s NAV equals $1). If ETH drops to $900, fETH declines by approximately 10% to $0.90. Though depreciated against fiat, fETH maintains its low-volatility property. If ETH is expected to rebound long-term, or if fiat continues to devalue, fETH can act as a mildly deflationary store of value. In contrast, while USDT maintains a fixed fiat peg, it cannot hedge against fiat devaluation and carries centralization risks such as banking crises or regulatory intervention. Therefore, fETH and USDT each have strengths and weaknesses, and the choice depends on individual needs and expectations.

Conclusion

Overall, the position and future trajectory of fETH and xETH within the Ethereum ecosystem are not isolated but are closely shaped by market demand and trader behavior. Market demand is influenced by multiple factors, including ETH price trends and broader crypto market conditions. Trader behavior, in turn, depends on expectations of market movement, risk tolerance, and understanding of the value of decentralization and composability. These interwoven factors collectively shape the roles and prospects of fETH and xETH in the Ethereum ecosystem. Therefore, predicting and understanding their development requires a deep analysis of shifts in market demand and trader behavior, and how these forces interact to influence the standing and evolution of these two assets.

Disclaimer: This article is for research purposes only and does not constitute any investment advice or recommendation. The project mechanisms described herein represent solely the author's personal views and are not affiliated with the author or this platform. Blockchain and cryptocurrency investments involve extremely high market, policy, technical, and other uncertainties. Token prices in secondary markets are highly volatile. Investors should make cautious decisions and bear investment risks independently. Neither the author nor the platform shall be held liable for any losses incurred by investors relying on the information provided herein.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News