Parallax Finance: How to Maximize Your LSD Yields?

TechFlow Selected TechFlow Selected

Parallax Finance: How to Maximize Your LSD Yields?

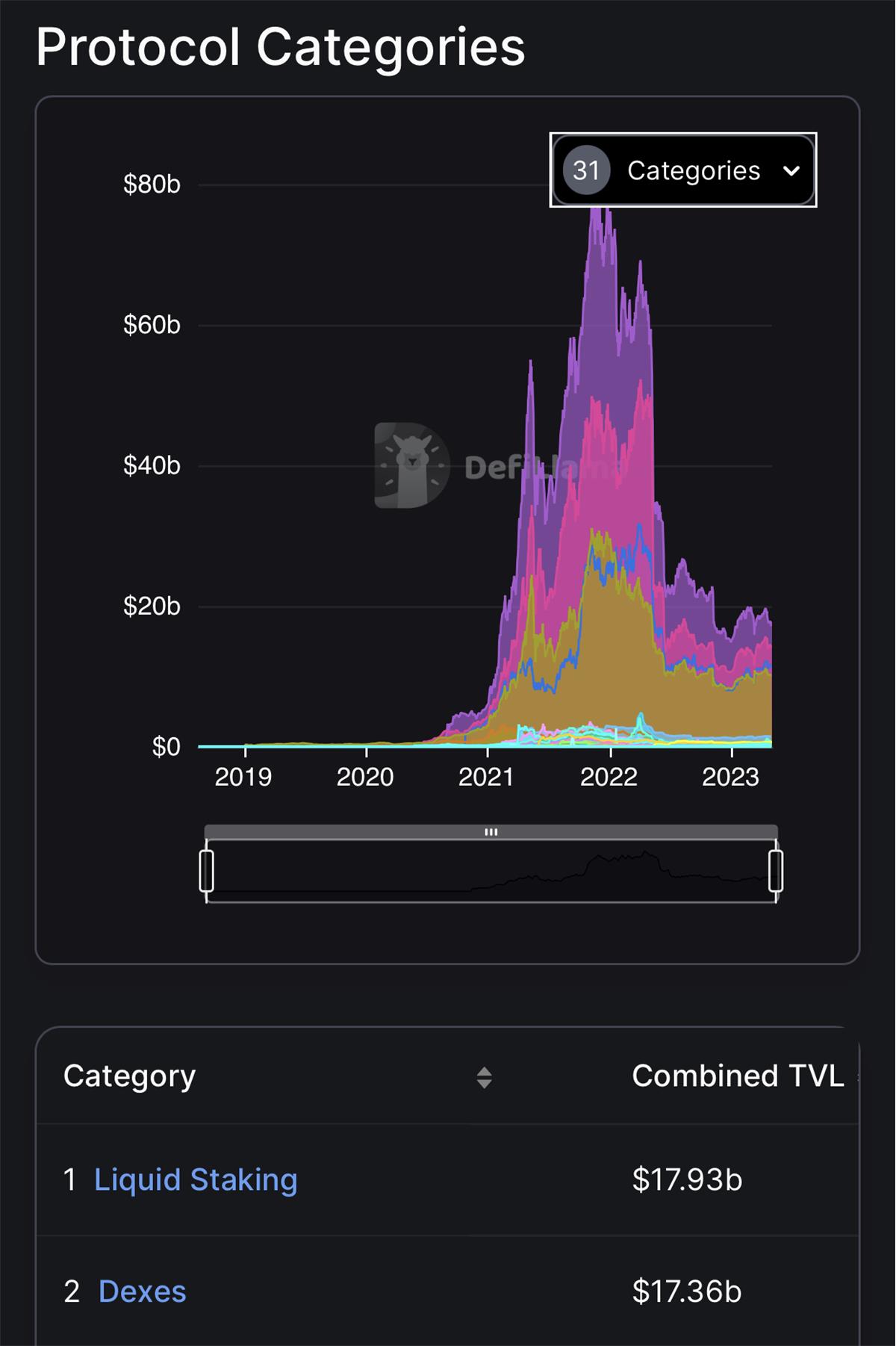

Recently, LSDs have surpassed Dexes to hold the highest TVL in DeFi.

Written by: Salazar.eth

Translated by: TechFlow

Recently, LSDs have surpassed Dexes to claim the highest TVL in DeFi. Want to capture investment opportunities in the LSD sector? In this article, researcher Salazar highlights Parallax Finance's work in the LSD space and how it helps users generate higher yields.

Parallax Finance is a community-driven DeFi protocol built by DeFi developers for DeFi users—without involvement from venture capital firms or institutions.

What are the core features of Parallax Fi?

Parallax Finance is a liquidity layer infrastructure empowering DeFi participants, DAOs, and protocols with greater capabilities.

It consists of four main components: Orbital, Andromeda, Supernova, and Black Hole:

-

Orbital – Yield Optimizer: This strategy enhances returns on LP positions and stablecoins through automated compounding.

-

Andromeda – Multi-Variable Yields: DeFi users can choose from any vault or create their own customized vaults.

-

Supernova – Powering LSDfi: Maximizes yield on LSD derivatives by leveraging asset lending.

-

Black Hole – Liquidity Market: Users can build assets similar to Olympus Bonds on any Arbitrum token pair via Parallax’s owned liquidity market.

In this article, we will focus primarily on using Parallax for LSDfi.

Currently, there are two LSD market segments:

-

Base-layer LSDs – Protocols that help you maximize ETH utilization: Lido, Rocket Pool, StakeWise;

-

L2 LSDs – DeFi protocols built atop base-layer LSDs to generate additional yield, such as unshETH, fraxETH.

Parallax Fi focuses on maximizing LSD yields through an index system combining a basket of yield strategies. The Parallax Meta-LSD strategy incorporates the following elements:

• Diversified income sources;

• Automated compounding;

• Risk diversification;

• Additional yield generated from platform revenue;

• $PLX token incentives + partner token incentives.

This approach is known as the Meta-LSD strategy, which is simple to use and secure. The system comprises various strategies within vaults, applying an index-based methodology across a basket of strategies, allowing users to customize percentage allocations in their portfolios.

You can gain exposure to multiple LSDs at once and earn additional rewards through PLX.

For example: Maxwell wants his ETH yield to exceed the 4% he sees on Lido. While he knows higher returns are available on other LSD platforms, he's unsure which one to pick. By using Parallax, Maxwell can access all these yields at once—automated hourly compounding deposits, PLX rewards, L2 LSD tokens, and platform fee earnings—thereby boosting his overall returns.

Finally, let’s talk about airdrops.

Users will receive airdrops through Alpha test vaults, and the team is considering increasing the airdrop allocation for testers.

The vaults have been audited by Hacken and received a perfect 10/10 score. Additionally, the project team places strong emphasis on security, with vaults having undergone at least three audits.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News