L1s vs L2s: Who's Winning Based on Data Comparison?

TechFlow Selected TechFlow Selected

L1s vs L2s: Who's Winning Based on Data Comparison?

The battle between L1 and Ethereum L2 is not over yet.

Written by: Crypto Koryo

Compiled by: TechFlow

In the gap between L2 popularity surges, we are experiencing a new era—more and more projects are launching on Ethereum L2s, challenging traditional L1s and raising questions about the future of these once-dominant ecosystems. This article will use data to explore the competition between L1s and L2s, along with their respective advantages, disadvantages, and outlooks.

Which launches more new projects: L1 or L2?

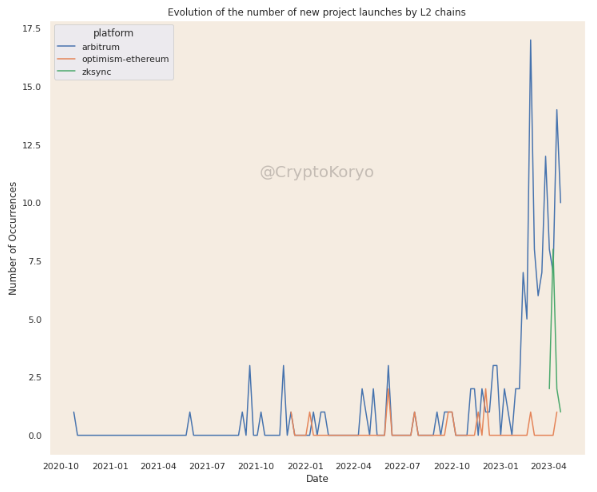

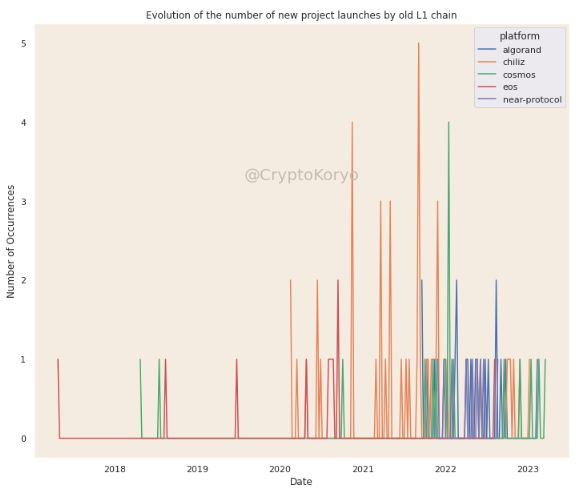

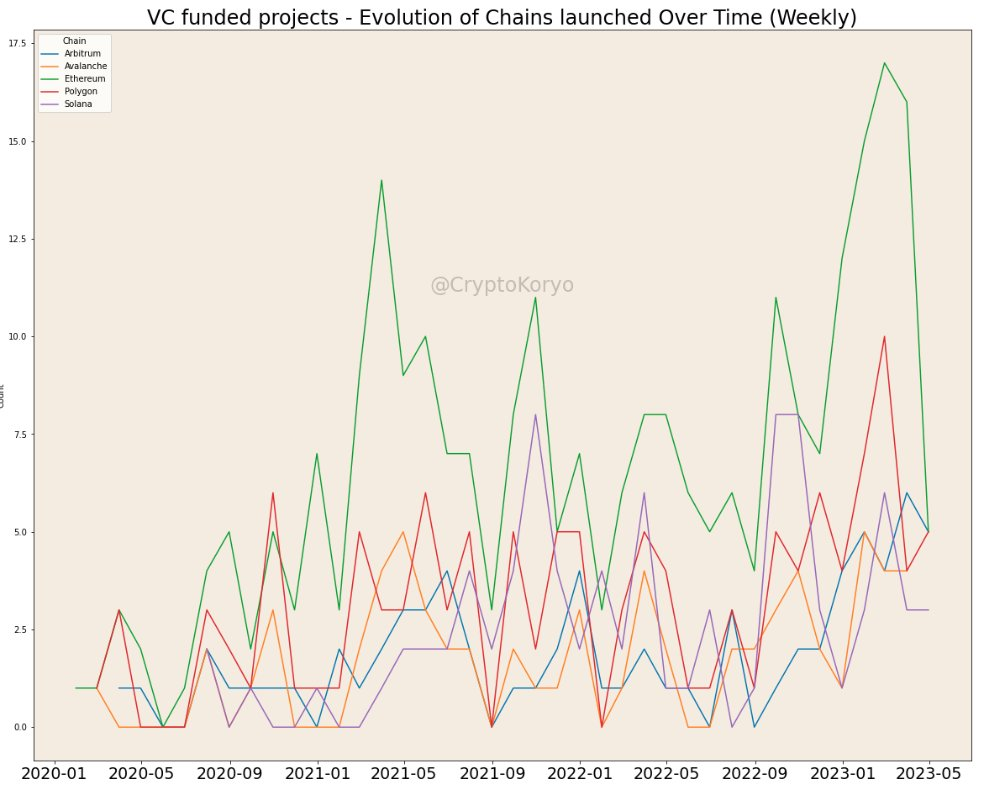

In the images below, you can see the number of new projects launching weekly on L2s. The other charts show some older L1 projects. I’ve also looked at projects launching on newer L1s like Aptos and Canto, but the numbers remain low for now.

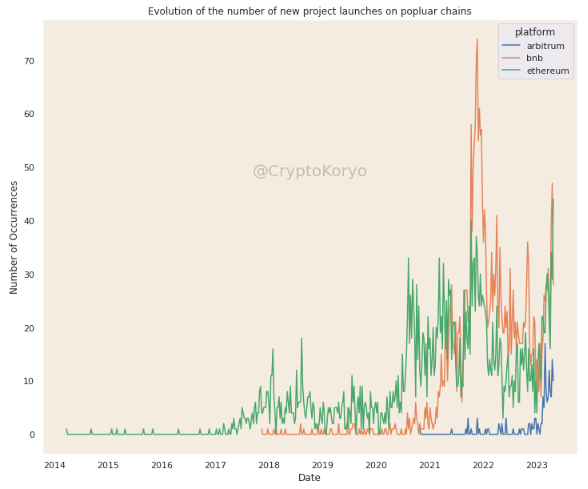

You can also observe the most popular blockchains—Ethereum, BNB, and Arbitrum. All three have seen solid growth in 2023.

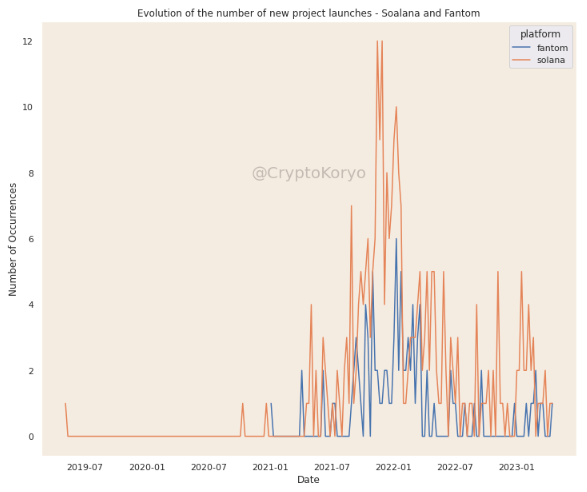

However, two major L1s, Solana and Fantom, haven’t seen many new project launches recently.

TVL

Where are people locking up their capital?

Recently, Arbitrum and Optimism have surpassed many popular L1s—including Fantom, Algorand, Avalanche, and Solana—in total value locked (TVL).

Data sourced from Defillama.

*TechFlow note: In the chart below, the blue line represents total TVL for L1s and the yellow line represents L2 TVL. As time progresses from left to right, L1 TVL sharply declines while L2 TVL steadily grows and eventually overtakes L1.

VC-Funded Projects

On which chains do VC-funded projects launch?

An increasing number of VC-backed projects are launching across multiple chains. When analyzing the data, we arrive at this chart.

While Arbitrum is rising, we haven't observed a dramatic shift overall.

Data sourced from Defillama.

However, if we look at certain L1s such as Algorand, Near, Fantom, and Cronos, we find far fewer new projects launching on them.

Social Metrics

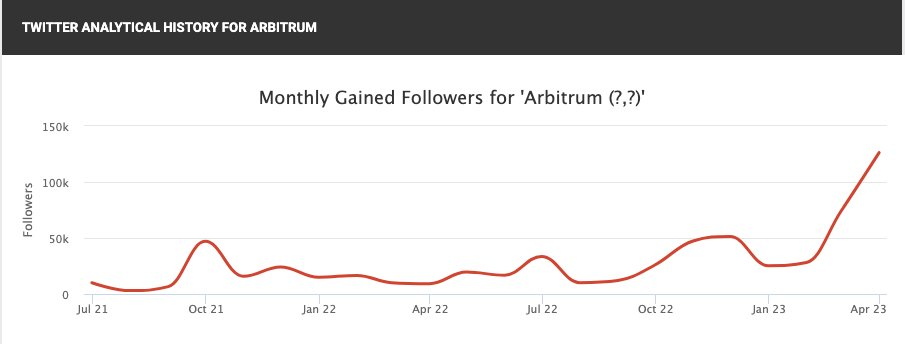

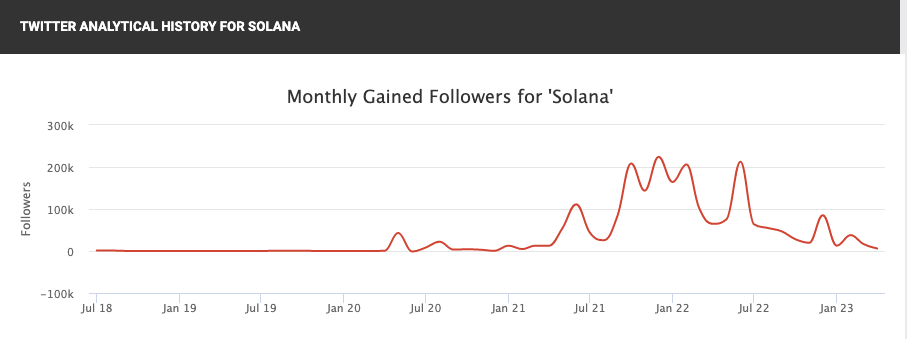

Measuring interest in an ecosystem is important. Has this interest grown over time? Are new accounts following these chains?

The first chart shows Arbitrum’s monthly net gain in followers—a strong upward trend.

The second chart shows Solana's follower count, trending downward.

Why are projects launching on Ethereum L2s?

A) Built on top of Ethereum;

B) Greater liquidity;

C) Richer ecosystem;

D) Stronger community;

E) Lower transaction fees;

F) L2 narrative;

G) Higher developer-friendliness.

Although other L1s may possess excellent technology (unproven), they lack alignment with all these factors.

Let’s draw a parallel with smartphones. In 2007, Apple launched the iPhone, completely disrupting the mobile communications industry and breaking the dominance of giants like Nokia, BlackBerry, and Motorola.

Despite efforts by these companies to release new phones and adapt to a rapidly changing market, they fell behind next-generation smartphones, unable to innovate or compete effectively.

Today, we may be witnessing a similar paradigm shift in blockchain. The growing prominence of L2s is diverting liquidity away from L1s, challenging the status quo and raising doubts about the future of these once-dominant L1 ecosystems.

Metcalfe’s Law states that a network’s value is proportional to the square of its number of users. This means that as a network grows, the value it provides to users increases exponentially.

To better understand this, consider social media. Established platforms like Twitter, Instagram, and TikTok already have massive user bases. Even if another platform is technically superior, users won’t easily switch. It must be 10x better. But if your competitor has 1,000x more resources, achieving a 10x improvement becomes extremely difficult.

Google+ (2011), Ello (2014), and Vero (2015) were all innovative social platforms offering something new. Yet ultimately, they failed to reach critical mass. L1s and L2s may be in a similar situation.

Have L1s already lost?

Clearly not.

Over recent months, major VCs like a16z and Jump have invested millions into new L1 projects such as Aptos, Sui, Sei, and Berachain.

Ethereum’s Layer 2 solutions aren’t perfect either—they come with their own technical and governance challenges. Remember the recent Arbitrum DAO "vote" incident?

Ethereum’s reliance on L2 scaling solutions with native tokens introduces friction and centralization risks. The venture capital-driven model hinders truly scalable solutions and may favor short-term gains over long-term improvements.

Final Thoughts

High throughput doesn’t matter if no one uses the chain. The blockchain trilemma suggests that high throughput comes at the cost of reduced security or decentralization. Data indicates that an increasing number of new projects are launching on L2s—and liquidity follows.

Ethereum L2s solve scalability issues, allowing Ethereum to focus on maintaining decentralization and security.

Promising new L1s have emerged. Despite strong technological potential, they face the daunting challenge of overcoming bottlenecks and attracting liquidity in the long run.

The battle between L1s and Ethereum L2s isn’t over. Perhaps the first round has ended—and (in my view) the winners are Ethereum L2s. But let’s wait for rounds two and three.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News