Interpreting the K33 Cryptocurrency Index Report: Finding Definite Beta Returns Amidst the Market Noise

TechFlow Selected TechFlow Selected

Interpreting the K33 Cryptocurrency Index Report: Finding Definite Beta Returns Amidst the Market Noise

Which beta assets in the crypto market are worth investing in?

While we are keen on hunting for alpha returns in the crypto market, beta returns also deserve attention.

So, which beta assets in the crypto market are worth investing in? Everyone may have their own evaluation criteria. Among these standards, the KVQ (K33 Vinter Quality) quality index released by K33 has caught our attention:

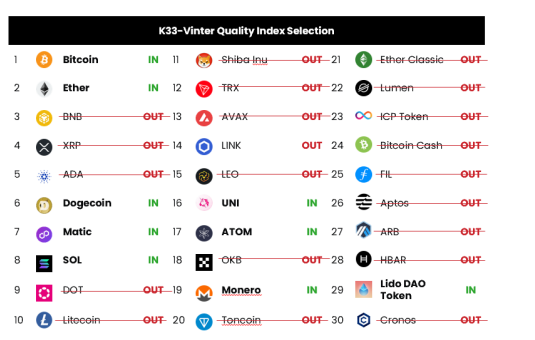

This index is a Smart Beta index for crypto assets, consisting of an equal-weighted portfolio of the most promising tokens among the top 30 largest cryptocurrencies. For assessing token quality, K33 sets multiple evaluation criteria to conduct detailed and objective assessments.

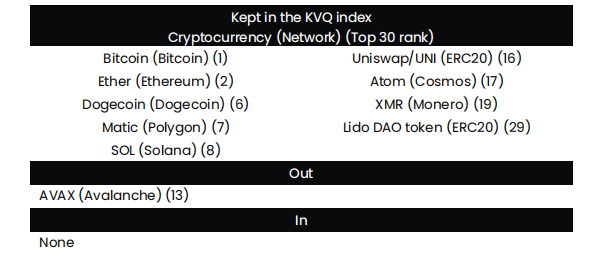

The latest report shows that among the top 30 tokens by market cap, only BTC, ETH, DOGE, MATIC, SOL, UNI, ATOM, XMR, and LDO—nine tokens—made the cut, while AVAX was excluded due to factors such as token inflation and concentrated holdings.

Moreover, many tokens commonly perceived as valuable were surprisingly excluded from the list.

Every standard has its limitations, but critically referencing a given framework can provide insights and guidance for investment decisions.

Therefore, TechFlow Research has analyzed and summarized the report’s key contents for your reference.

Background: About K33 and the Construction Criteria of the KVQ Index

About K33:

K33, formerly known as Arcane, is a research-driven digital asset brokerage firm wholly owned by Arcario AB (formerly Arcane Crypto AB), which is listed on Nasdaq First North.

The company provides investment services to help clients across Europe, the Middle East, and Africa make informed decisions, enter markets, and invest in relevant funds supported by digital asset research.

KVQ Index Calculation Methodology:

The K33 Vinter Quality Index is a cryptocurrency index based on market capitalization, updated quarterly.

Overview of calculation process:

-

Pre-selection: Select the top 30 tokens by market cap;

-

Categorization: Group the top 30 tokens by sector;

-

Exclusion: Tokens with flawed economic models or lacking information and transparency are removed;

-

Evaluation: Comprehensive assessment across five dimensions—enduring network effects, utility, regulatory risk, ecosystem vitality, and token inflation/concentration;

-

Ranking: Rank tokens based on evaluation scores and select qualifying cryptocurrencies.

Key Conclusions:

-

The nine tokens selected—BTC, ETH, DOGE, MATIC, SOL, UNI, ATOM, XMR, and LDO—are considered high-quality beta assets by K33 for this period.

-

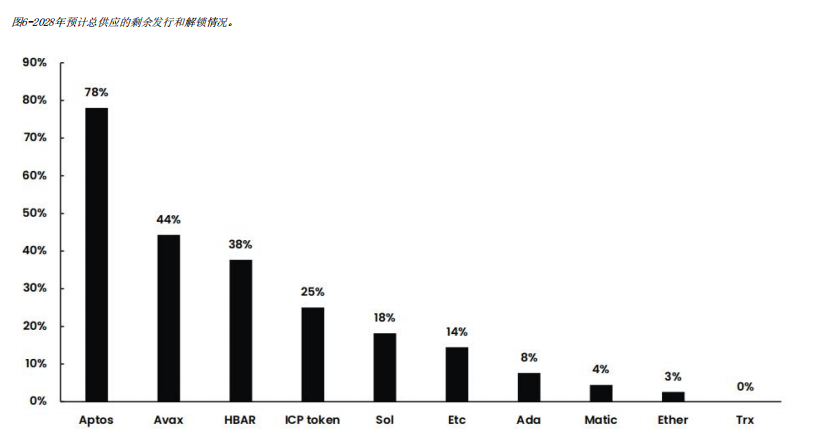

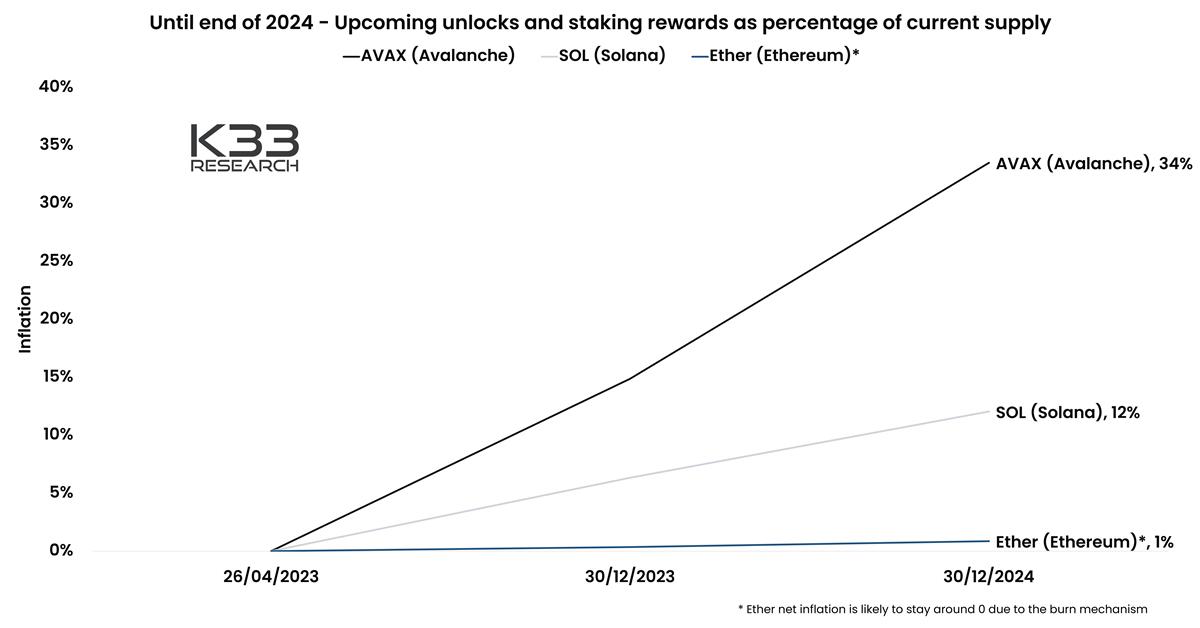

AVAX was excluded due to concerns about future token inflation and large upcoming unlocks.

Overview of Other Top 30 Market Cap Tokens That Did Not Qualify:

*Note: The Top 30 market cap data was calculated as of 9:30 AM on April 24.

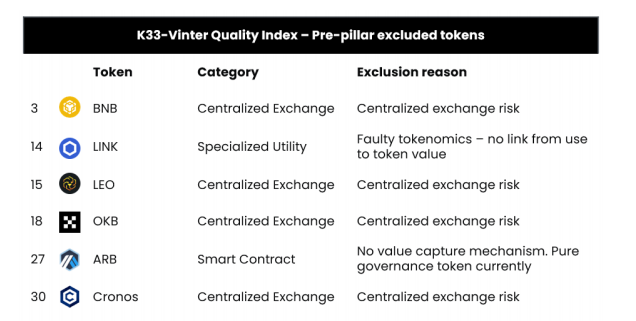

Pre-excluded Tokens: Six tokens from the Top 30 were prioritized for exclusion: BNB, LINK, LEO, OKB, ARB, and CRONOS.

Reasons:

-

BNB & OKB: Centralized exchange (CEX) tokens were excluded because their value propositions largely depend on trust in the exchange. Given the recent FTT (FTX) collapse, K33 decided to remove all exchange tokens from the index—for now. This stance could change in the future.

-

LINK: Oracle data is easily provided and not particularly advanced; oracle services are highly substitutable. Additionally, there's no direct link between users and subscribers of price feeds. K33 believes LINK is overvalued.

-

ARB: Arbitrum operated for over a year without the ARB token, with transaction fees paid in ETH. K33 considers ARB an unnecessary token without a value capture mechanism.

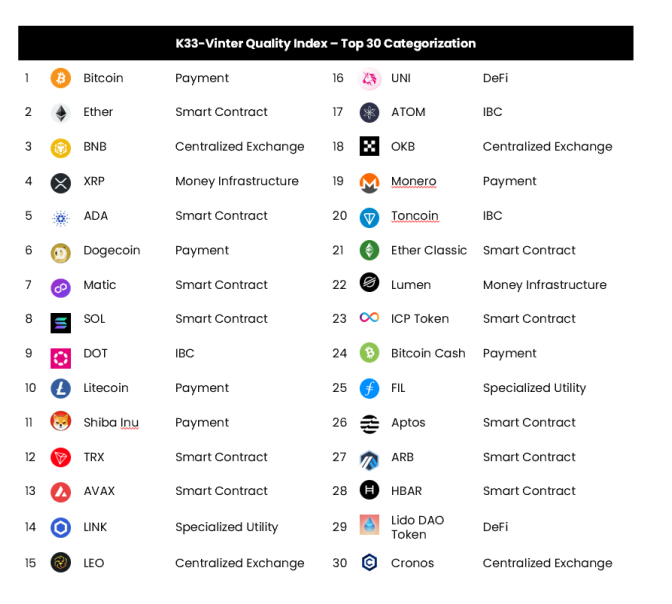

Sector Classification of Top 30 Tokens:

Tokens are categorized into sectors such as payments, smart contracts, CEX, monetary infrastructure, cross-chain communication protocols, special utility, DeFi, etc.

Payments Sector: BTC, XMR, and Doge Emerge Victorious

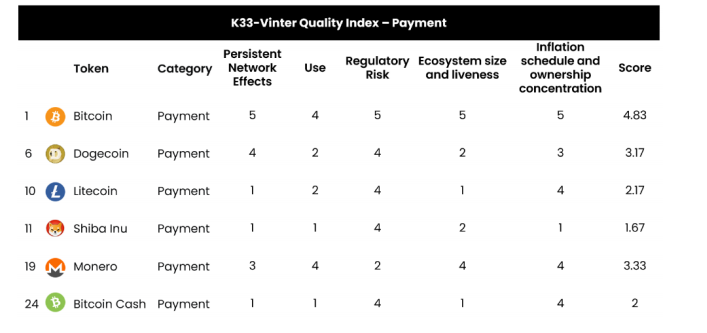

Composite score table after evaluation across enduring network effects, utility, regulatory risk, ecosystem vitality, and token inflation/concentration:

-

Enduring Network Effects: BTC has the longest-standing consensus; XMR meets demand for private transactions; Doge benefits from meme appeal. BCH and LTC are seen as BTC clones, while Shiba is viewed as a Doge copycat—both offering limited added value according to K33.

-

Utility: Most tokens are primarily speculative, but BTC and XMR clearly serve additional functions beyond trading.

-

Regulatory Risk: BTC is uniquely classified as a commodity, and its PoW mechanism makes it harder to regulate. XMR faces heightened scrutiny due to its privacy features.

-

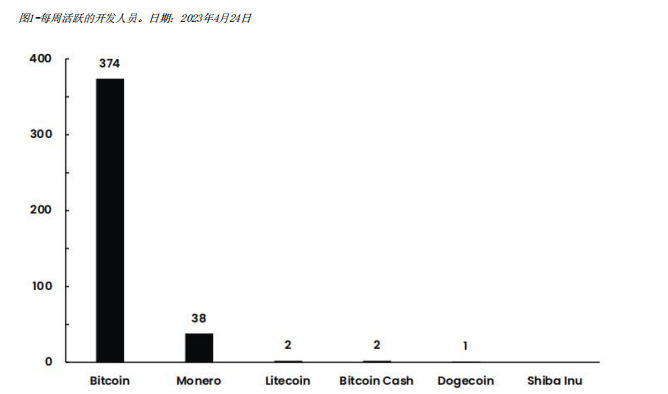

Ecosystem Vitality: Developers for BTC and XMR remain relatively active. Doge, despite low development activity, demonstrates unique ecosystem energy through its strong meme culture.

-

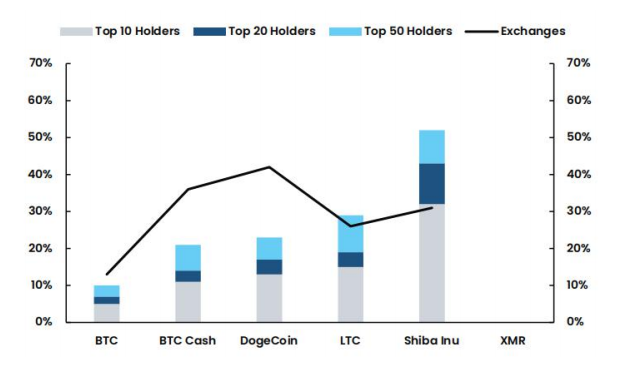

Inflation and Token Concentration: BTC has the lowest concentration. BCH, LTC, and Doge show similar distribution patterns. Shiba is highly centralized. XMR’s distribution is hard to track due to privacy, but K33 assumes it is widely distributed given its use as a medium of exchange.

Smart Contract Sector: ETH, MATIC, and SOL Prevail; AVAX Falls Short

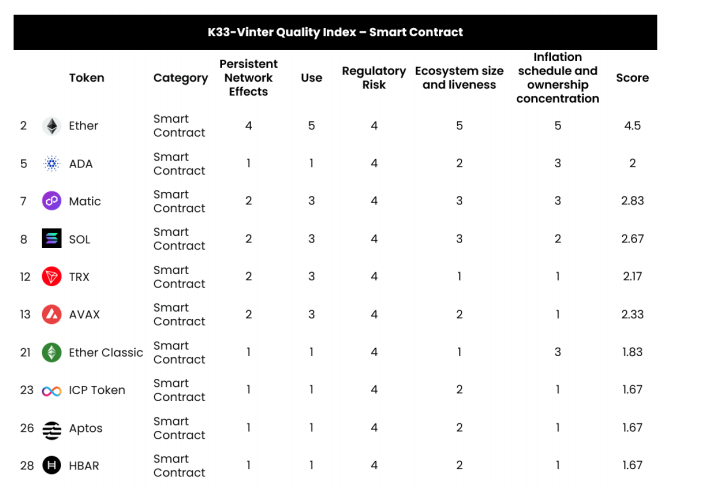

Composite score table after evaluation across enduring network effects, utility, regulatory risk, ecosystem vitality, and token inflation/concentration:

-

Enduring Network Effects: While the idea of a “new Ethereum” is appealing, K33 finds little evidence of sustained demand for Ethereum alternatives as market conditions weaken. Most Ethereum competitors likely fall short in network effects compared to Ethereum itself.

-

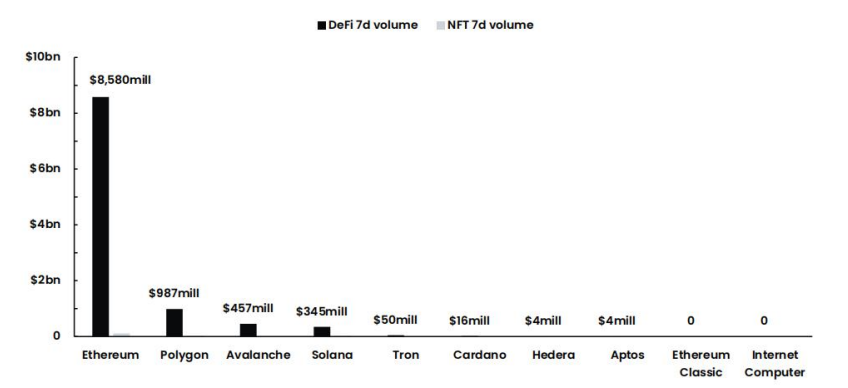

Utility: Considering usage and transaction volume in applications like DeFi and NFTs, the ranking is shown below:

-

Regulatory Risk: Differences among smart contract blockchains are minimal, with ongoing debate about whether they should be classified as securities.

-

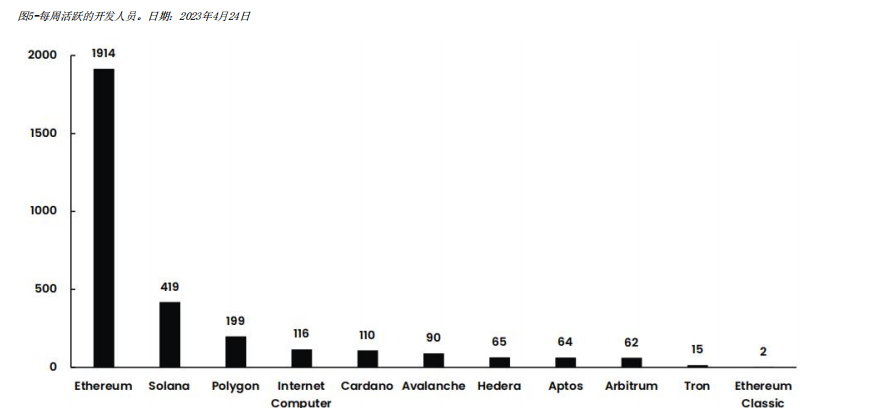

Ecosystem Vitality: ETH leads by far; SOL ranks second-tier; MATIC and others are at a similar level of developer activity.

-

Inflation and Token Concentration: Ethereum offers the best combination of predictable inflation and decentralized ownership; SOL stands out with a few major holders, posing a significant risk, though remaining issuance is lower than peers; TRX has no inflation due to fixed supply, but extreme concentration of ownership is seen as a major drawback, resulting in the lowest score.

AVAX faces more pronounced challenges regarding unlock schedules and staking reward emissions.

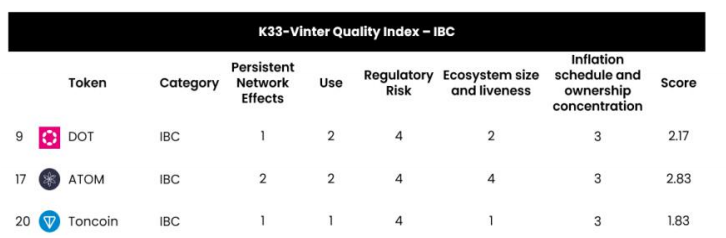

Inter-Blockchain Communication (IBC): ATOM Emerges as Winner

Composite score table after evaluation across enduring network effects, utility, regulatory risk, ecosystem vitality, and token inflation/concentration:

-

Enduring Network Effects: Evaluating these tokens differs from evaluating their ecosystems. For DOT, both align, but for ATOM, even if ATOM fails, the Cosmos ecosystem might still succeed. Overall, K33 believes Cosmos has a higher survival rate than Polkadot.

-

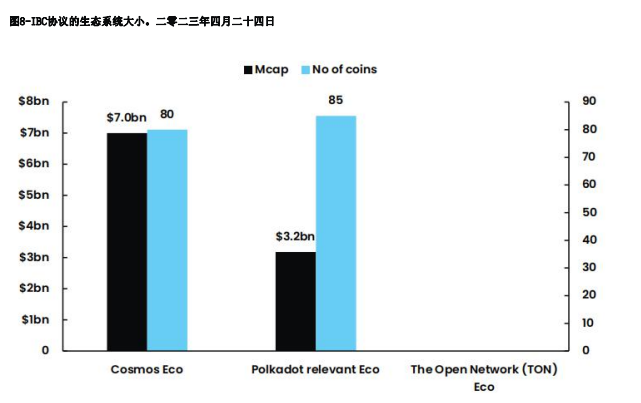

Ecosystem Vitality: A natural starting point for comparing IBC protocol ecosystems is examining the number and market cap of tokens within each. Results show Cosmos tokens’ market cap remains three times that of Polkadot (excluding ATOM and DOT).

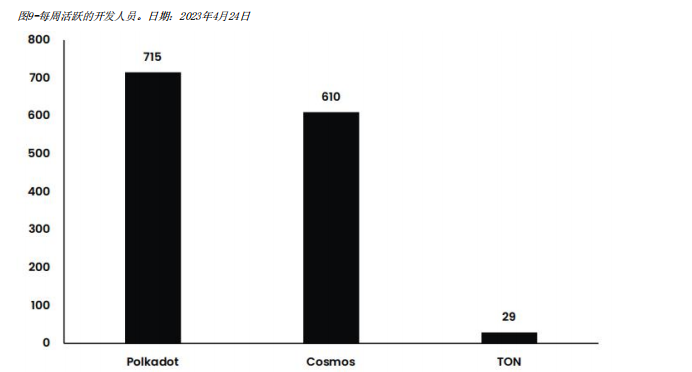

Considering developer activity, however, Polkadot appears stronger:

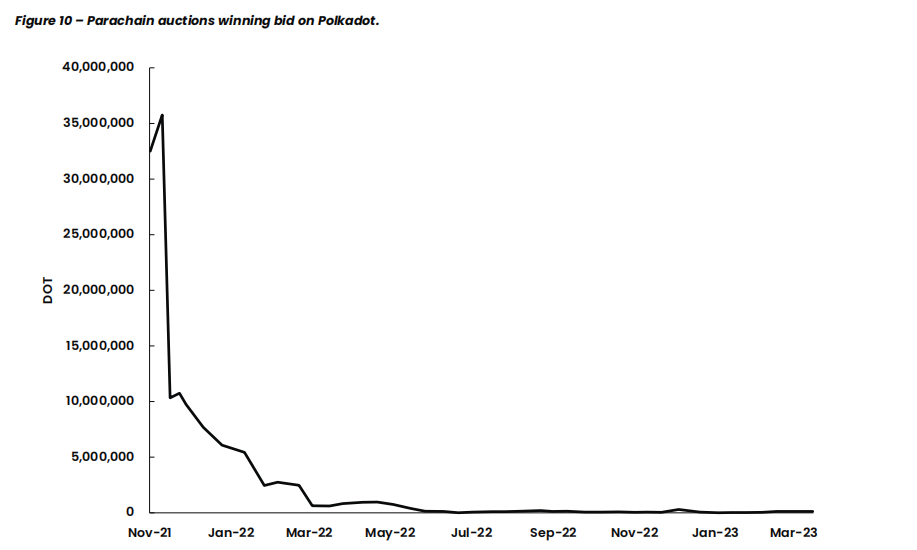

Yet, the hype around Polkadot seems to have vanished. The following chart on Polkadot’s parachain auctions illustrates this more vividly: a year ago, securing a slot required hundreds of millions of dollars in DOT; today, slots are practically free. In a capital-driven world, people are unwilling to lock up large amounts of capital on Polkadot.

-

Regulatory Risk: Minimal differences among IBC protocols; K33 assigns them consistent scores.

-

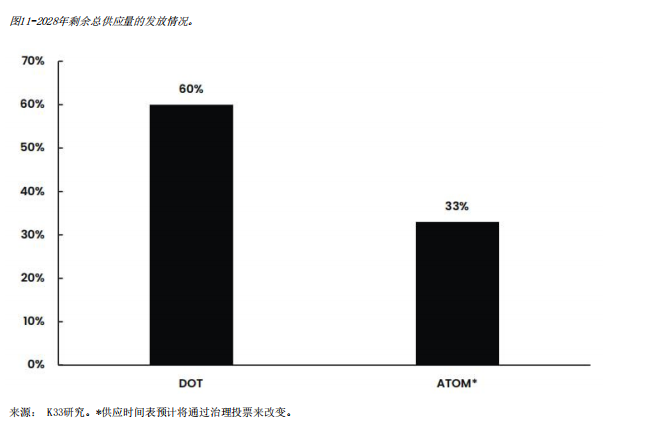

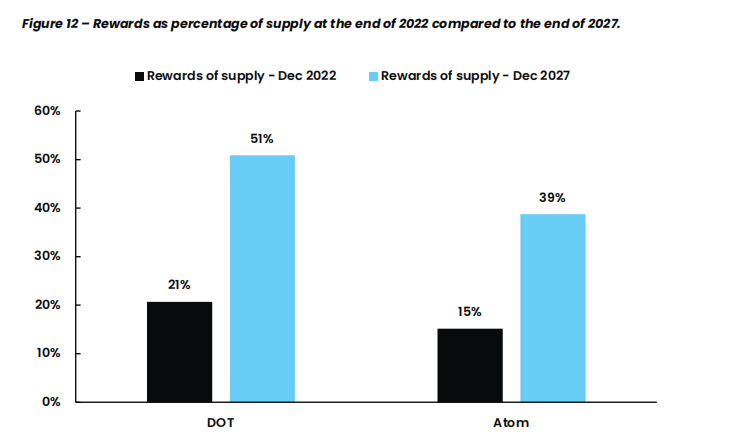

Inflation and Token Concentration: ATOM and DOT are broadly comparable, though current rules suggest DOT will emit more tokens.

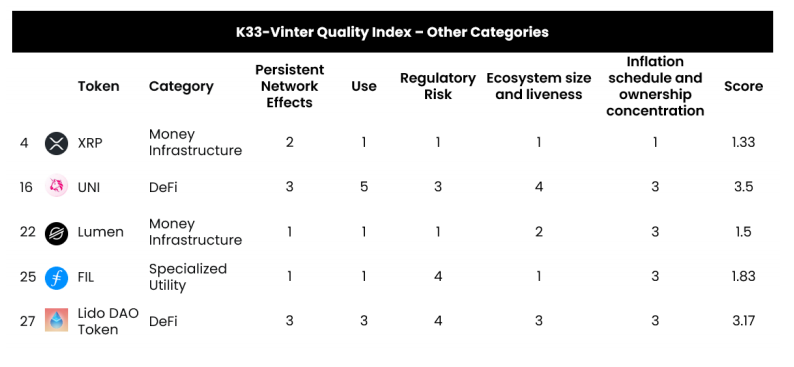

Other Categories: UNI and LDO Stand Out

Composite score table after evaluation across enduring network effects, utility, regulatory risk, ecosystem vitality, and token inflation/concentration:

-

Why LUMEN, FIL, and XRP Were Excluded:

XRP and Lumen act as bridges between traditional financial institutions but have been operational for years without significant real-world adoption.

FIL has existed for a long time without evidence of meaningful storage usage or growing demand.

-

Why UNI and LDO Were Selected:

These are easier to evaluate than general payment or smart contract tokens, resembling classic equities. K33 prefers to assess their actual revenue and business fundamentals.

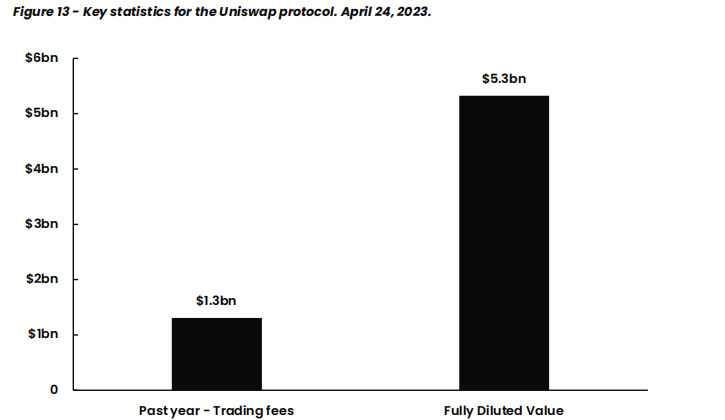

UNI: Generated $1.8 billion in total trading fees in 2022, with FDV near $5.3 billion. It’s plausible that future cash flows from the UNI token could match or exceed its current market value.

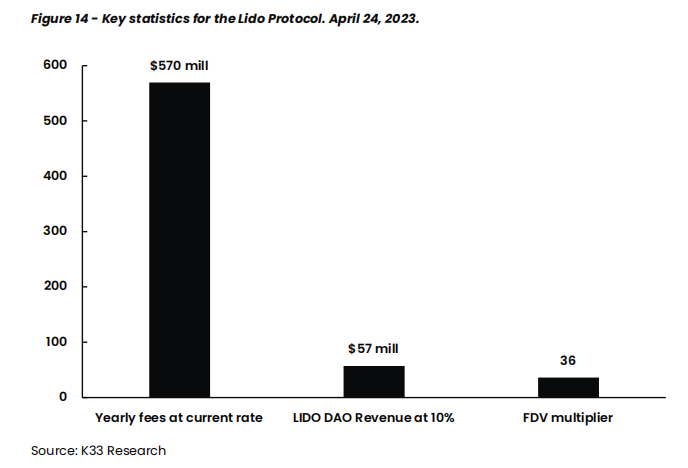

LDO: 10% of protocol revenue flows to Lido DAO token holders. Based on current total value locked and staking rates, plus the DAO’s 10% share, the FDV-to-annual-revenue ratio is slightly above 50—a figure comparable to stock P/E ratios. In equities, a P/E of 50 would typically be considered very high (bearish).

This implies that either staking within the protocol must grow significantly, or the DAO’s revenue share must increase.Given growth potential, K33 sees LDO as having low permanent financial loss risk and thus does not warrant exclusion from the index.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News