Shanghai Upgrade Withdrawal Effect: Data Reveals Performance of LSD Projects

TechFlow Selected TechFlow Selected

Shanghai Upgrade Withdrawal Effect: Data Reveals Performance of LSD Projects

This article will provide an overview of ETH staking data and the LSD market following the ETH Shanghai upgrade.

Author: DefiNapkin

Translation: TechFlow

This article provides an overview of ETH staking data and the LSD market following the Shanghai upgrade. The total amount of staked ETH has declined by 8%, with more validators exiting the chain. It also details various metrics and trends across top LSD protocols and how these protocols are influencing the DeFi ecosystem and users.

ETH Statistics

At the time of the Shanghai upgrade, 15.67% of the ETH supply was staked, with 584,529 validators active.

The top three exchanges for staking ETH were:

- Coinbase (12.63%);

- Kraken (6.67%);

- Binance (5.53%).

LidoFinance dominates the LSD market with a 74.22% share:

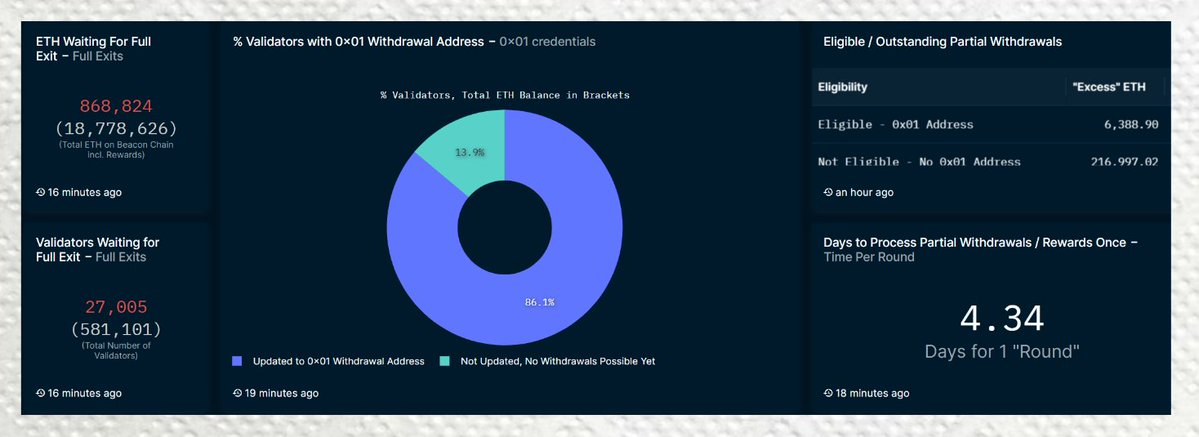

Currently, an increasing number of validators are exiting the chain, and the total amount of staked ETH has decreased by 8% (from 18.7 million to 17.3 million).

There are two main types of ETH withdrawals:

-

Partial withdrawals – withdrawing staking rewards only.

-

Full withdrawals – withdrawing the entire balance and exiting as a validator.

Partial and full withdrawals are processed in the same queue, but partial withdrawals are prioritized to ensure network stability. Partial withdrawals take approximately 4.34 days to complete. 868,000 ETH from 27,000 fully exited validators remain in the withdrawal queue.

Overview of Top LSDs

1. LidoFinance is the leader in the LSD space, accounting for 30.6% of total ETH staked—Lido offers a 5% annual percentage yield (APY).

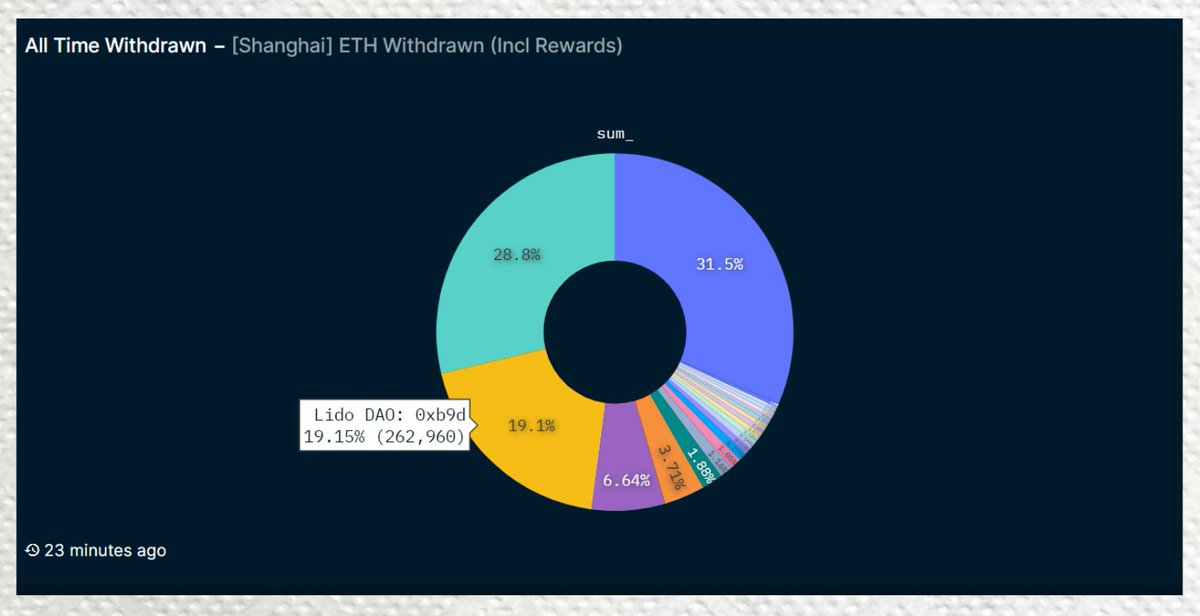

19.1% of ETH withdrawals originated from Lido.

2. Rocket Pool (RPL) holds a 2.4% market share.

Rocket Pool offers Smart Node Operators (SNOs) a base APY of 7.01% and individual stakers a 5% APY.

ETH withdrawals on RPL are negligible.

3. Frax Finance holds a 0.7% market share.

Frax’s staked sfrxETH offers a 5.48% APY. ETH withdrawals on Frax are also negligible.

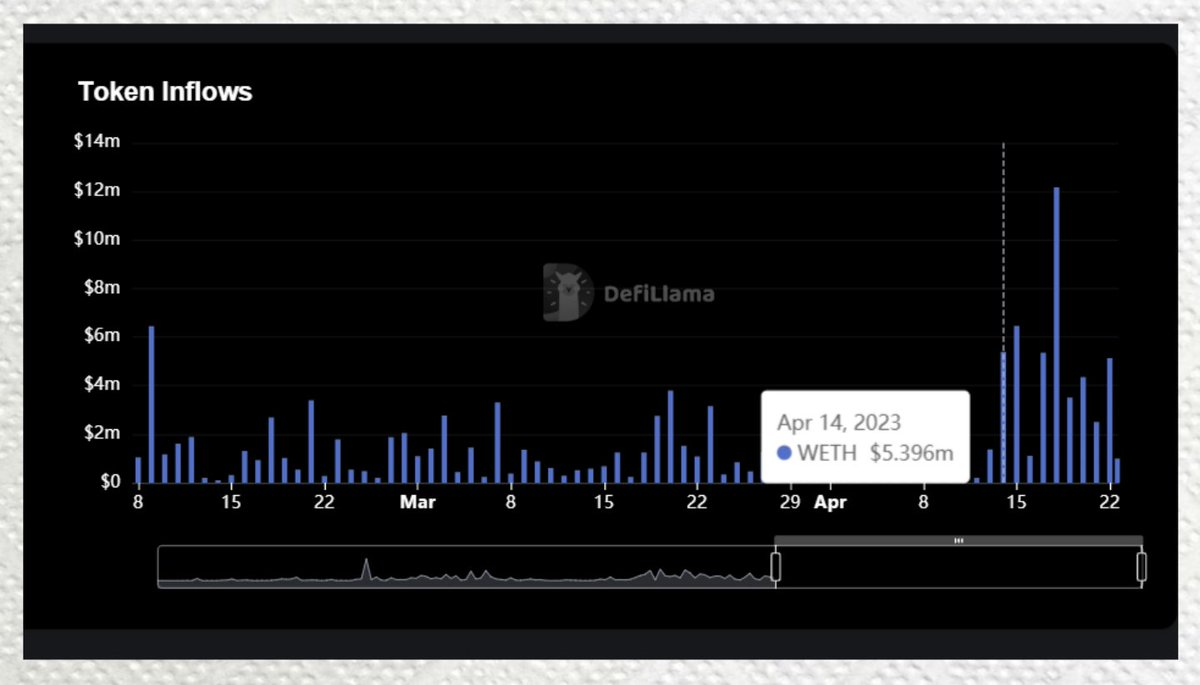

In fact, after the Shanghai upgrade, Frax saw a surge in ETH deposits:

Among the following LSD protocols, since the start of Shanghai, Lido has increased its staked ETH by 200,000, while other protocols have remained stable or declined.

Impact on Other dApps

The Shanghai upgrade has positively impacted dApps like Pendle, as more users are staking their assets and seeking secure yield opportunities.

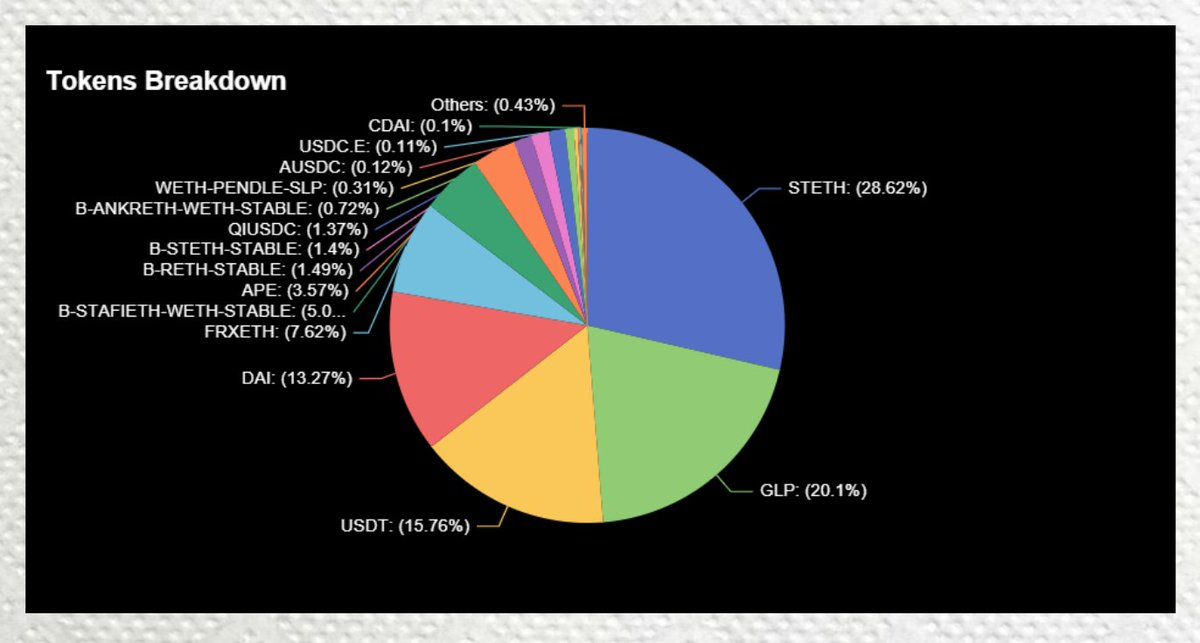

As ETH in Lido increases, so does the yield on stETH. Users are now depositing their stETH into Pendle for long-term yield.

Now, 29% of Pendle’s total value locked (TVL) consists of stETH.

Summary

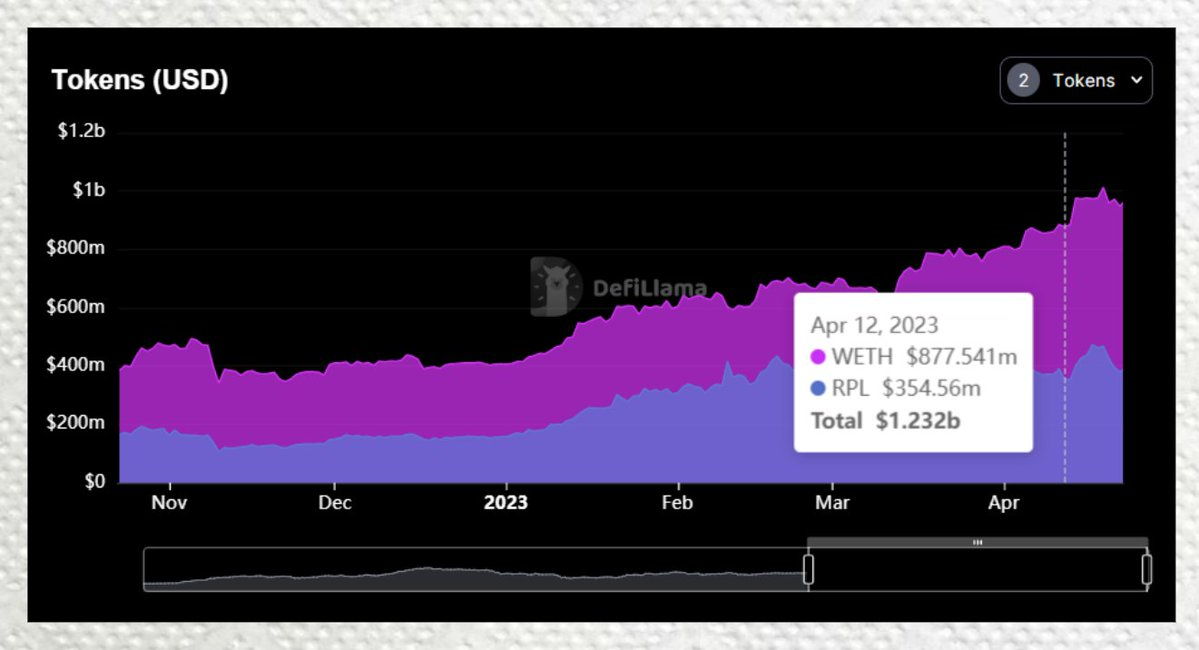

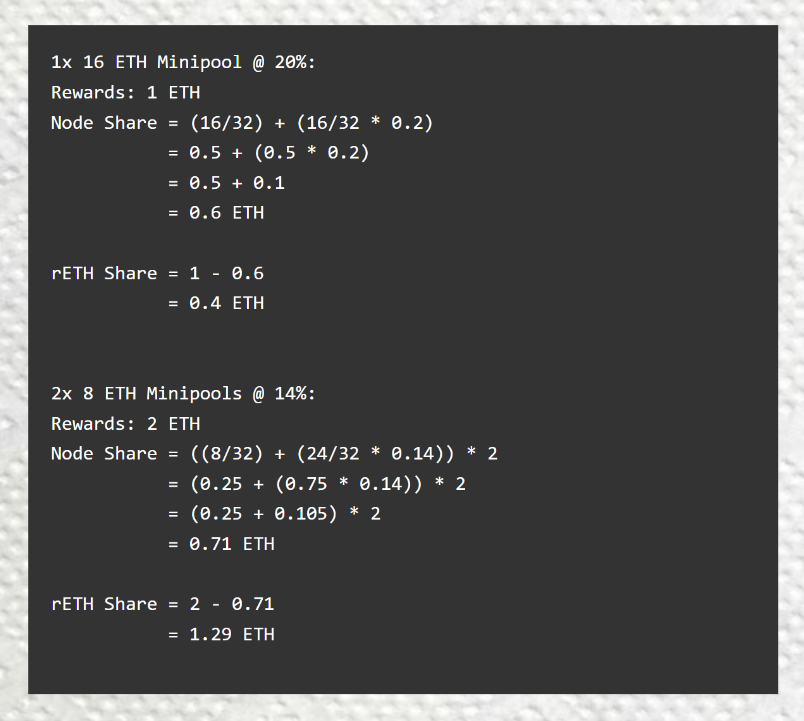

Following the Shanghai upgrade, Rocket Pool reduced the ETH requirement for their mini-pools, allowing users to become validators with just 8 ETH instead of the previous 16 ETH.

This trend is evident from the $200 million increase in WETH TVL on Rocket Pool since Shanghai:

Compared to direct protocol staking, running multiple 8-ETH pools offers significantly higher APR. Even Rocket Pool’s base yield of 5.07% APY exceeds Lido’s current 5% APY.

Rocket Pool’s update has clearly positioned it at the forefront of the LSD race. For investors seeking passive income, RPL is a notably better option offering higher yields, despite rETH having less DeFi integration compared to Lido’s stETH.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News