Pear Protocol: An on-chain one-stop options spread trading protocol

TechFlow Selected TechFlow Selected

Pear Protocol: An on-chain one-stop options spread trading protocol

This article will explain what spread trading is and how the Pear Protocol provides users with greater value and opportunities.

Written by: DeFi Made Here

Translated by: TechFlow

Spread trading is an investment strategy that generates returns by taking opposite positions in one asset relative to another. While common in traditional markets, it is not yet popular in the DeFi space.

The pain point lies in the fact that there currently isn't a seamless way to short one token and long another (with leverage) on-chain.

Pear Protocol offers a solution. Below, a crypto KOL explains what spread trading is and how Pear Protocol provides users with greater value and opportunities.

The concept of spread trading or relative value trading isn't very popular in DeFi but is quite common in traditional markets.

What is spread trading, and how to identify pairs trading opportunities?

Relative value trading is an investment strategy where one or more assets are traded against another. For example, going long $ETH and shorting $BTC. Spread trading also aims to minimize market risk and profit even when the market lacks direction or is volatile.

The goal of relative value funds is to identify mispriced assets relative to each other. For instance, you may not be able to predict overall market movements, but you notice one asset is overvalued or undervalued compared to its peers within the same sector. In this case, smart investors can go long the undervalued asset and short the overvalued one. Regardless of market direction, the overvalued asset is likely to underperform or lose more than the undervalued one.

You can think of it as hedging market volatility while still profiting when the spread between assets narrows. However, these trades are not without risk. If your analysis is wrong, or if the market remains irrational longer than expected—you will lose money.

How to identify such trading opportunities in DeFi?

Two common approaches are:

• Fundamentals;

• Technicals.

Using the fundamental approach, you should compare:

• Market cap;

• FDV;

• TVL;

• Fees;

• Revenue;

• Price-to-fee ratios, etc.

One of the best websites to find fundamental data for DeFi projects is Token Terminal.

The technical approach relies on chart analysis. For example, if in 2021 you spotted a divergence in the BNB/ETH pair, going short $ETH and long $BNB could have yielded a 10x return.

One of the most famous examples of spread trading in crypto is shorting $BTC and going long $ETH. Many people effectively execute this trade by supplying ETH on lending platforms, borrowing BTC, and selling it—though they may not realize they're engaging in "spread trading."

Currently, there is no seamless way to short one token and go long another (with leverage) on-chain. This is where Pear Protocol comes in—it's the first all-in-one protocol enabling on-chain spread trading.

Users can deposit USDC as collateral, set up leveraged long/short pair trades, and execute them in a single transaction. Positions on the platform are represented as ERC-721 tokens (NFT-represented receipts). The composability of ERC-721 allows open positions to be utilized in various ways:

• Lending;

• Trading on secondary markets;

• Creating derivatives, etc.

Pear is liquidity-agnostic. It leverages existing decentralized perpetual exchanges and market makers. This allows Pear to offer a stronger, better-diversified, and more liquid platform without needing to bootstrap its own liquidity pools.

Trade execution flow:

• Users initiate a trade by depositing collateral and receive an ERC-721 receipt;

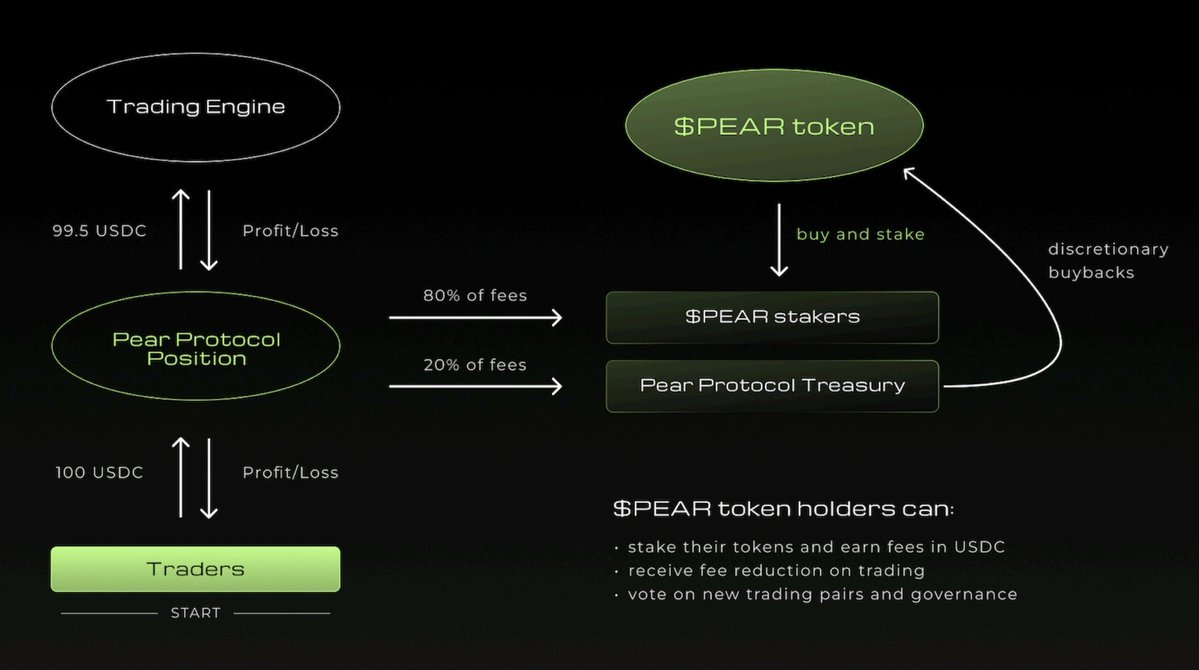

• Pear collects fees and distributes them to the treasury and $PEAR stakers;

• The trading engine routes collateral to the deepest liquidity markets to open long and short positions.

Pear’s contract acts as a “wallet” opening trades on external liquidity platforms. User position NFT receipts are updated in real-time to reflect current holdings.

Pear is conducting a token sale, ending on April 24.

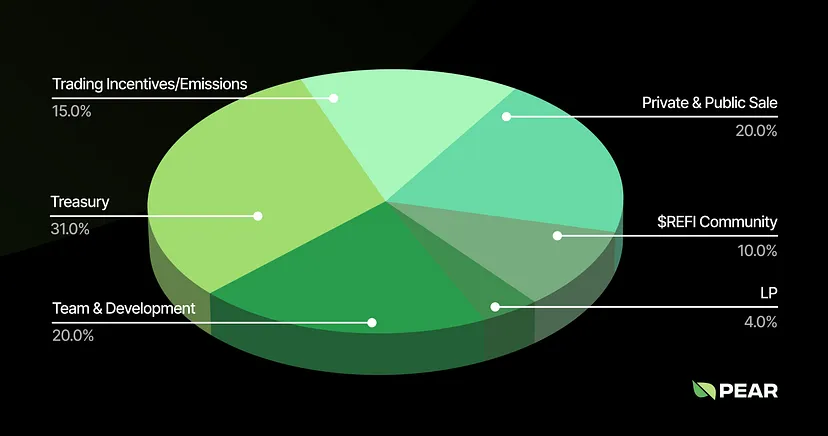

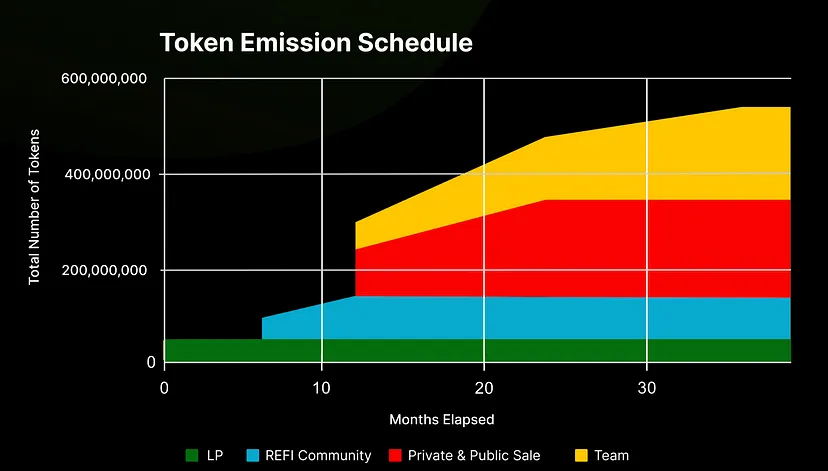

20% of the total token supply (200 million tokens) is allocated to private and public sale participants. Of this, 84 million were sold in the private round, and the remaining 100 million will be offered in the public sale at $0.025 per token (FDV of $25 million).

Note that the token will have a 1-year linear vesting schedule. Qualified members of the $refi community will receive a 10% airdrop, which will be fully vested before the release for token sale participants begins.

Token Utility

$PEAR holders will enjoy benefits such as USDC yield, fee discounts/waivers, and more. Additionally, token holders will be able to participate in governance.

Pear has become the first all-in-one on-chain spread trading protocol, allowing users to execute leveraged long/short pair trades in a single transaction. Furthermore, the protocol is liquidity-agnostic and leverages existing decentralized perpetual exchanges and market makers to deliver a more robust, risk-diversified, and liquid platform.

In summary, the launch of Pear Protocol will bring revolutionary changes to the cryptocurrency market, offering users greater value and opportunities.

*Disclaimer: This article does not constitute financial advice and reflects only the author’s personal views.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News