What Information About SUI Is Revealed in the 123-Page Court Document Between Mysten Labs and FTX Debtors?

TechFlow Selected TechFlow Selected

What Information About SUI Is Revealed in the 123-Page Court Document Between Mysten Labs and FTX Debtors?

On March 22, Mysten Labs reached an agreement with FTX debtors to repurchase FTX's equity investment in Mysten Labs and SUI token warrants for $96.3 million in cash.

By: Julian

Recently, according to disclosed court documents, Mysten Labs reached an agreement with FTX debtors on March 22 to repurchase FTX's equity investment in Mysten Labs and its SUI token warrants for $96.3 million in cash.

The 123-page document details the circumstances of FTX’s investment in Mysten Labs back in August 2022. Combining these court filings with Sui’s recent developments, Sui World offers the following summary and analysis:

1. Mysten Labs completed a B-round financing of over $300 million at a valuation of approximately $2 billion

This fundraising information was publicly known last year. FTX and other B-round investors obtained Sui Token warrants through their investment in preferred shares of Mysten Labs.

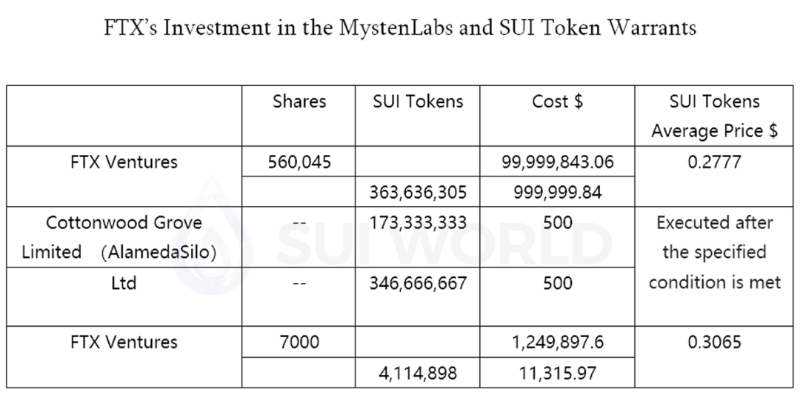

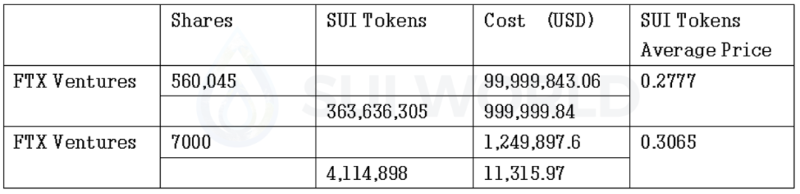

2. FTX acquired approximately 890 million Sui Tokens for around $102 million

FTX invested a total of $102 million in Mysten Labs’ B round, acquiring about 570,000 preferred shares and warrants to purchase approximately 890 million Sui Tokens. As the lead investor, FTX secured an extremely low average cost per Sui Token—approximately $0.114.

Two warrant acquisitions by FTX are particularly significant: Cottonwood Grove Limited (Alameda) and FTX Trading each acquired warrants for approximately 173 million and 346 million Sui Tokens respectively—at a price of $500 each—totaling 519 million Sui Token warrants.

These 519 million Sui Tokens were intended to be used for market-making trading on the FTX platform upon the launch of the Sui Network mainnet and the Sui Token. (*Sui World Note: Cottonwood Grove Limited is a wholly-owned subsidiary of Alameda Research.)

As a former top-tier exchange and market maker, one of the key conditions for FTX’s over $100 million lead investment in Sui was that its affiliated market makers, Alameda and FTX Trading, would nearly obtain 519 million Sui Tokens for free to provide liquidity on FTX.com. However, since FTX collapsed before Sui launched, this warrant agreement became void.

3. The Sui Token cost basis for some B-round investors was approximately $0.28–$0.31

Excluding FTX’s market-making portion, the cost basis for Sui Token warrants held by other B-round investors can still be referenced from FTX Ventures, averaging between $0.28 and $0.31.

4. Sui will reclaim a large amount of low-cost institutional holdings

In addition to the Sui Token investments at around $0.28–$0.31, the lead investor FTX also received an additional 519 million Sui Tokens for market making.

Now, Mysten Labs is repurchasing FTX’s equity stake and SUI token warrants for $96.3 million in cash, effectively reclaiming a substantial amount of low-cost investment and market-making tokens previously held by FTX. This is positive news for the future launch of the Sui Token.

It's worth noting that FTX similarly led a funding round in another Move-based chain, Aptos, at a comparable valuation and investment size. FTX’s investment structure in Aptos likely mirrored that of Sui—holding a large quantity (over one-third of circulating supply) of low-cost investment and market-making tokens. This means that for Aptos, which launched before FTX’s collapse, some of these low-cost tokens have already entered the market, while unsold holdings await resolution under FTX creditors’ proceedings.

5. FTX debtors may continue “seeking higher offers from third parties”

The documents also disclose that FTX debtors may continue “seeking higher offers from third parties” until the court finalizes the sale date. Mysten Labs’ equity stake and Sui token warrants remain attractive to many institutions.

6. SUI mainnet launch clears its biggest external hurdle

Resolving issues with FTX debtors removes the single largest external obstacle to the SUI mainnet launch. The rollout of the SUI mainnet and the release of the Sui Token no longer need to account for the handling of FTX’s prior investment holdings.

7. The $96.3 million buyback corresponds to a $100 million fund

Once the $96.3 million cash buyback is completed, it will have no short-term financial impact on Mysten Labs, which raised over $300 million last year. The long-term implications may primarily relate to Mysten Labs’ strategic initiatives in Web3, such as investing in or acquiring Web3 projects.

This aligns with previous reports that Mysten Labs CEO Evan Cheng is seeking to raise over $100 million for a new Web3 fund, which will not be limited to the Sui ecosystem. Alex Shin, co-founder of Hashed, and seasoned hedge fund investor Sandeep Ramesh will join as general partners in this newly established Web3 venture fund.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News