Web3 "land-grab movement" — no one can afford to ignore it

TechFlow Selected TechFlow Selected

Web3 "land-grab movement" — no one can afford to ignore it

Silkworms don't think of autumn threads, summer cicadas never see winter snow. Whether you see it or not, Web3 is right before your eyes.

Author: Kang Shuiyue, Founder of Fox Tech and Way Network, Chairman of Danyang Investment

Preface: Spring silkworms don't think of autumn silk, summer cicadas never see winter snow. Whether you notice it or not, Web3 is right in front of you.

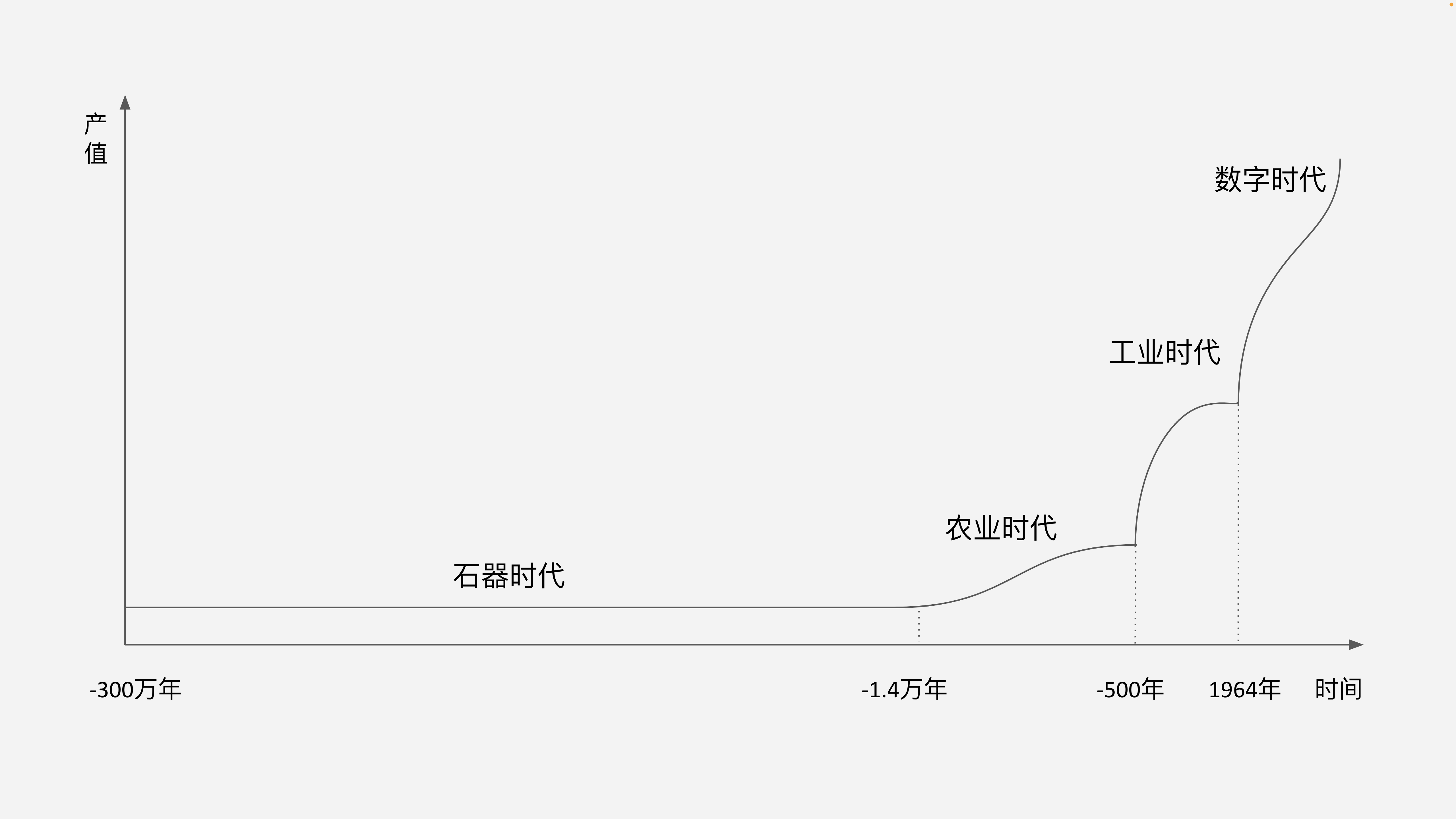

Three million years ago, the Paleolithic era began when early hominids crafted the first stone tools, using them to hunt animals and cut meat for cooking. Twenty thousand years ago, the Mesolithic era emerged—humans created more diverse stone tools for hunting, and also began producing stone carvings and ornaments to satisfy spiritual needs. Fourteen thousand years ago, the Neolithic era began, marked by polished stone tools; humans learned to sow plant seeds and domesticate wild animals, giving rise to agriculture and animal husbandry—the so-called "First Agricultural Revolution." Ten thousand years ago, humans mastered bronze tools such as bronze hoes, enabling settled life and hoe-based farming—the "Second Agricultural Revolution." Five thousand years ago, humans began crafting iron plows and using domesticated oxen for plowing, while employing irrigation techniques to boost yields—the "Third Agricultural Revolution." These three "Agricultural Revolutions," unfolding over vast stretches of time, now seem mundane.

Fast forward nine centuries to the 12th century. At that time, Europe began experiencing the "Enclosure Movement"—a seemingly brutal but productivity-liberating process that lasted until the 19th century. As humanity ventured into maritime trade and explored new lands, the East India Company, the highest market cap company in human history at the time, was born. The shipping, textile, and sheep-farming industries formed a chain underpinning the Enclosure Movement: nobles evicted tenant farmers, demolished their homes, and repurposed the land for more profitable sheep farming. Land consolidation led to larger, more efficient farms and pastures; displaced peasants flooded into cities, providing abundant cheap labor for the First Industrial Revolution between 1830 and 1840.

Figure 1: Transitions Across Human Eras

In fact, just before the First Industrial Revolution erupted, the First Financial Revolution had already taken place in Europe. Though people rarely discuss the "Financial Revolution" today, its impact may have surpassed even the Industrial Revolution. The world’s first stock exchange, the Amsterdam Stock Exchange, was founded in 1602; the Bank of England, the first central bank, in 1694; the London Stock Exchange in 1773; and the New York Stock Exchange in 1792. From then on, financial instruments like stocks, bonds, foreign exchange, and commodities flourished. The First Financial Revolution supplied the capital fuel for the three industrial revolutions over the next 500 years, financing technological R&D and large-scale industrial production. Finance nurtured technology, which in turn reshaped society and the economy. Today, humanity stands once again at a shining moment where technology and finance converge—FinTech.

It took humanity 3 million years to move from the Stone Age to the Agricultural Age, 14,000 years to advance from the Agricultural Age to the Industrial Age, but only 500 years to transition from the Industrial Age to the Digital Age. During these 500 years, though equity, debt, forex, and commodities evolved in form, they remained essentially the same old wine in new bottles—until 2009, when Bitcoin emerged, introducing an unprecedented asset class: programmable assets, commonly known as "crypto." Blockchain descended upon Earth like a golden-horned beast from outer space, with crypto as its horn, sending shockwaves through traditional financial markets. Future generations may call this the "Second Financial Revolution."

The economic value generated during the 14,000-year Agricultural Age far exceeded that of the 3-million-year Stone Age; the value produced during the 500-year Industrial Age dwarfed that of the Agricultural Age. And so far, the 60-year Digital Age has already generated vastly more economic value than the entire 300-year Industrial Age. Humanity is in the very early stage of a technological explosion, and the global emergence of programmable tools is the core hallmark of this explosion. It took 3 million years for humanity's primary tools to evolve from stones to hoes, and then from hoes to programmable tools—an astonishingly long journey. The starting point of all digital transformation lies in the invention of the "computer."

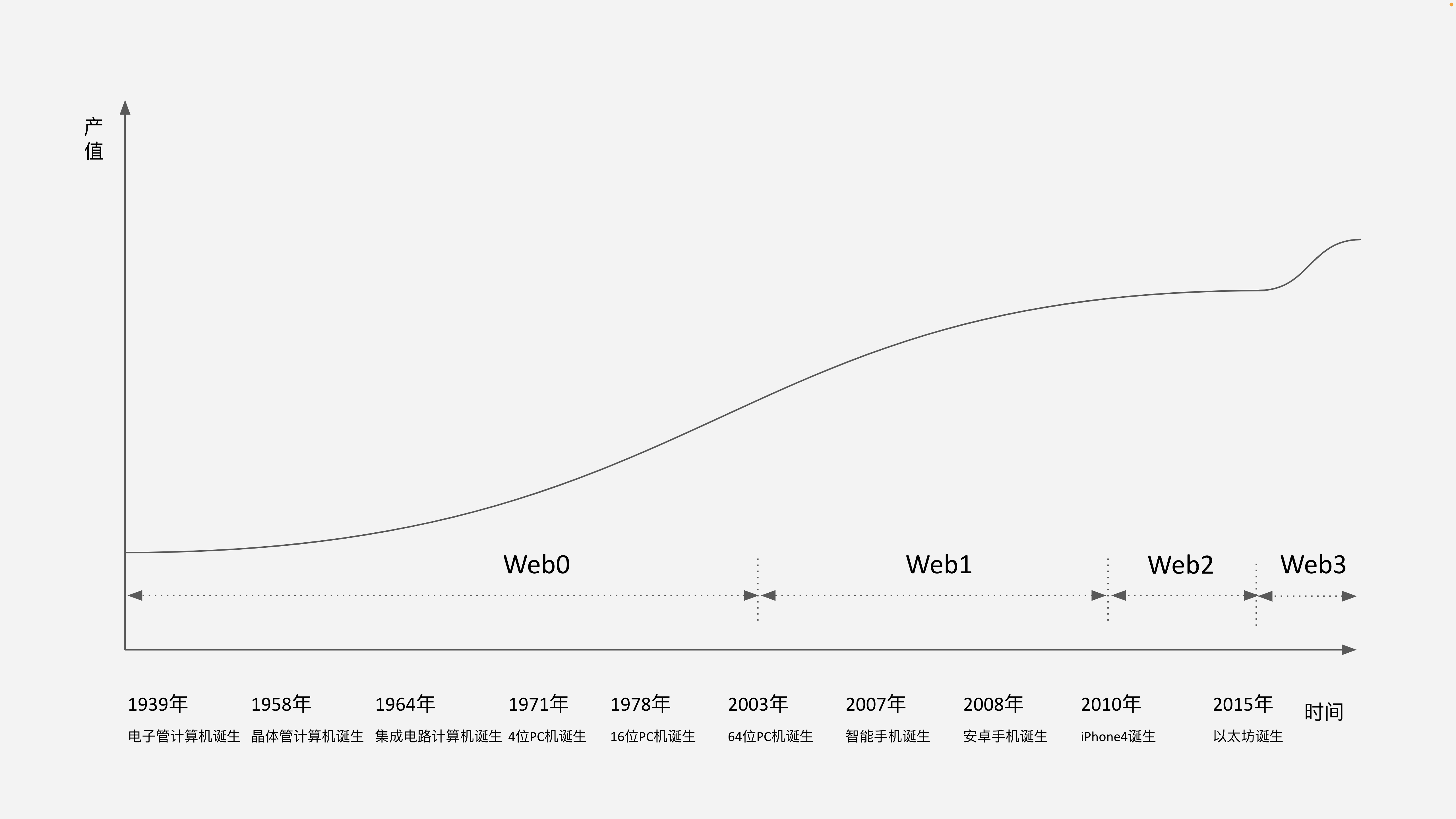

Figure 2: Evolution of the Digital Age

The advent of integrated circuit computers in 1964 marked humanity’s entry into the Digital Age, laying the physical foundation for large-scale programming. The defining feature of the Digital Age is programmable tools. Using these tools, humans transform the physical world at speeds unimaginable to ancestors, fundamentally reshaping industrial structures across domains.

Digital platforms consist of frontend and backend components. The backend includes hardware and network infrastructure; the frontend includes devices and user interaction. Backend components include chips, operating systems, servers, data centers, and communication networks. From standalone machines and local networks (Web0), to Web1, Web2, and now Web3—this is the evolution of network architecture. Frontend devices include computers, smartphones, watches, glasses, headsets, cars, and smart home appliances; user interactions include text, images, voice, video, spatial interfaces, and brain-computer interfaces.

From the frontend perspective, the key difference between Web3 and Web2 is that Web3 users have greater data sovereignty. Why can Web3 establish ownership while Web2 struggles? A crucial technical factor is verifiability at the moment data is created. From the backend perspective, Web2’s hallmark is the cloud; Web3’s hallmark is blockchain. The cloud represents centralized capability delivery, while blockchain represents decentralized capability provisioning.

In Web2, user data is typically stored on central servers—though there may be backups, all are managed by service providers. While companies can issue ownership proofs, ultimate control rests entirely with these centralized entities. Blockchain changes this by enabling true ownership of assets and data. At the moment data is recorded on-chain, blockchain generates a verifiable time-stamped sequence, establishing ownership at the consensus level.

Yet, the development of new technologies is never smooth—some always exploit them for harm or illegal purposes. Programmable financial products, the core innovation of the Second Financial Revolution, were downgraded under relentless pressure from governments and traditional institutions into terms like "coins" or "virtual currencies," making "crypto" a taboo subject. Similarly, blockchain—the backbone of Web3—has faced a bumpy road. Some were forced to shut down projects; others chose to go offshore, becoming digital nomads.

Faced with unprecedented innovations, humans are thinking reeds. When steam trains, automobiles, and airplanes first appeared during the past 500 years of the Industrial Age, they sparked panic—only when ordinary people began using them did misunderstandings fade. Blockchain and digital currencies must inevitably pass through this same phase. After all, even great thinkers like Pythagoras, Plato, Aristotle, and Ptolemy mistakenly believed Earth was the center of the universe—how much more difficult for common folk?

Because Web3 isn’t purely technology-driven, its societal impact is amplified by the Second Financial Revolution, combining with programmable financial products like crypto. Programmable finance isn’t a monster—even "stablecoins" aren’t. Such financial products never existed in the 500-year Industrial Age, but become inevitable at certain stages of financial digitization. Governments clearly aren’t yet comfortable with this novelty, still in phases of surprise, confusion, learning, understanding, contemplation, and experimentation.

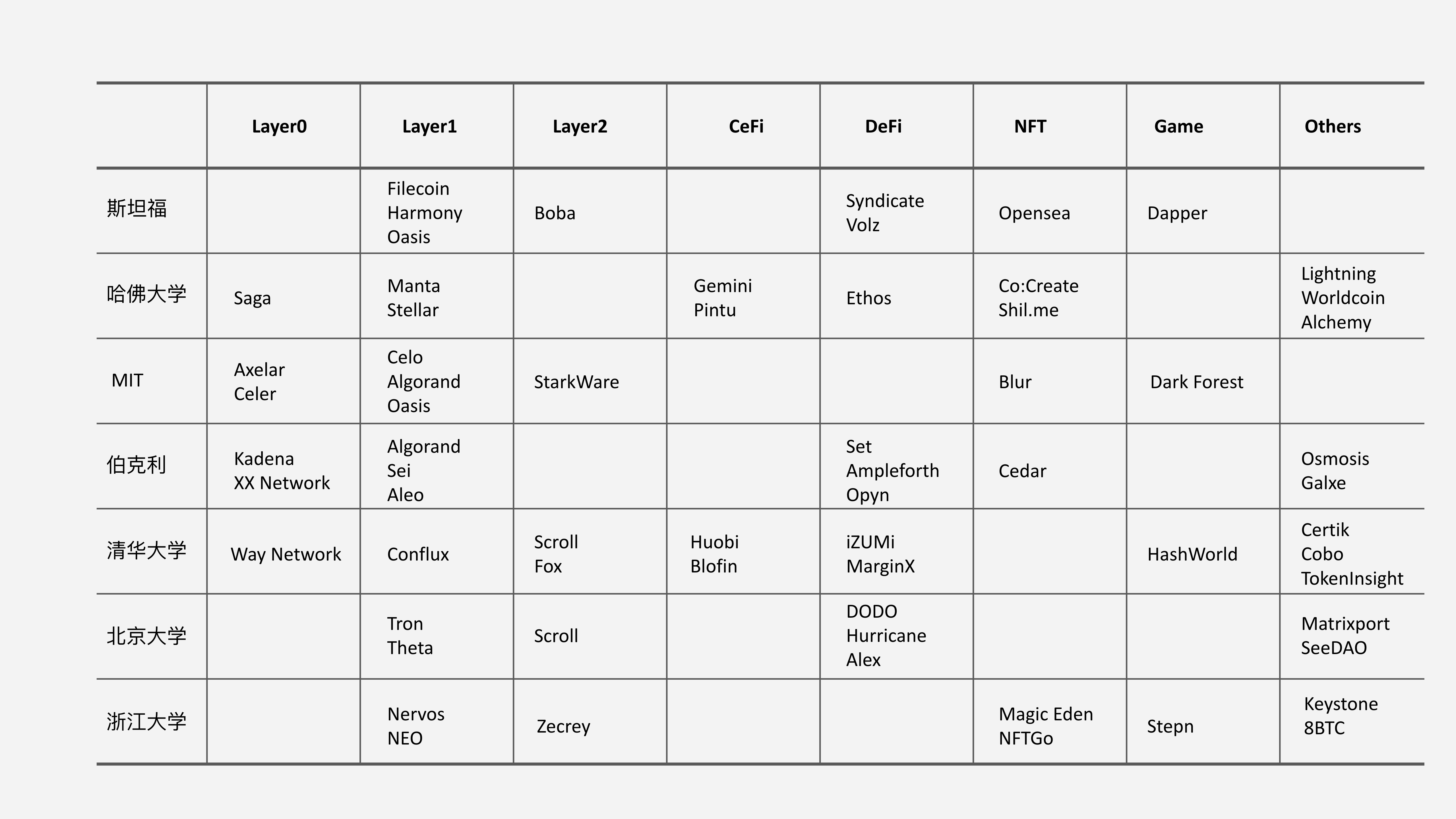

Yet some pioneers have already grasped this technological and financial shift and actively joined in. Notable examples include Aptos and Sui, founded by former Meta (Facebook) engineers; Solana, founded by ex-Qualcomm engineers; and investment firms like Sequoia Capital and a16z, which have poured $57.3 billion into Web3 since 2021. Top-tier university graduates worldwide have also entered this "land grab." Based on Rootdata’s database of Web3 projects founded by alumni from Harvard, Stanford, UC Berkeley, MIT, Tsinghua, Peking University, and Zhejiang University, I’ve compiled the following statistics by major sectors:

Figure 3: Universities Producing the Most Web3 Projects

Figure 3: Universities Producing the Most Web3 Projects

The U.S. occupies over half of the infrastructure sector; Chinese entrepreneurs dominate CeFi; nearly half of DeFi is operated by Chinese teams; NFT sees strong participation from China, the U.S., and Southeast Asia, though trends are still led by the U.S.; gaming thrives especially in Asia, accounting for an estimated two-thirds of global players.

Among all funded projects, the U.S. accounts for 386, or 35.12%; China, 109 (9.92%); Singapore, 105 (9.55%); India, 68 (6.19%); the UK, 62 (5.64%); South Korea, 35 (3.19%); Canada, 34 (3.09%); France, 34 (3.09%); Vietnam, 26 (2.37%). Chinese projects face significantly higher barriers to funding compared to U.S. counterparts, and Chinese Web3 capital holds considerably less influence than American Web3 capital.

Regarding Web3 policy, the stances of China and the U.S. are most critical. Current trends show the U.S. moving from loose to tight regulation, tightening further ahead; China, from strict to relaxed, gradually easing up. On February 20, 2023, the Hong Kong Securities and Futures Commission released a consultation paper on cryptocurrency trading, signaling Hong Kong’s opening of crypto trading under tacit approval from the central government. Could this mean China might reclaim leadership in Web3 over the next decade?

Conclusion: Regardless, Web3 already has 250 million global users, expanding beyond finance into gaming, social media, content creation, communications, transportation, healthcare, education, shopping, supply chains, manufacturing, finance, marketing, and corporate governance. At the current pace of this "land grab," Web3 could reach 1 billion users in less than five years, and possibly cover 60% of the world’s population within a decade. In other words, in just over ten years, Web3 could consume the world. Humanity is undergoing the steepest value growth curve since the Stone Age. The world changes within a generation—Are you ready?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News